Key Insights

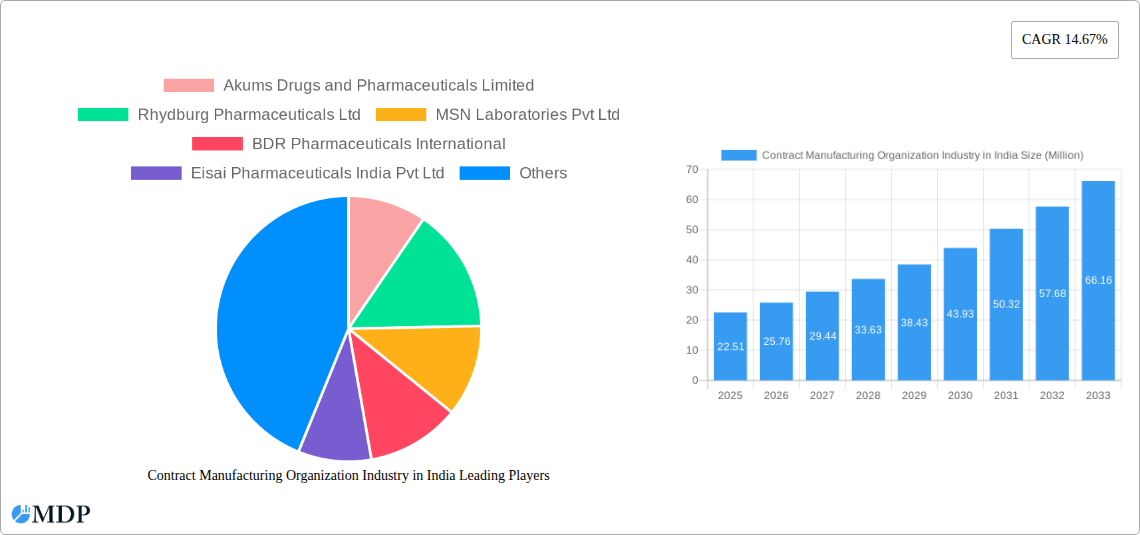

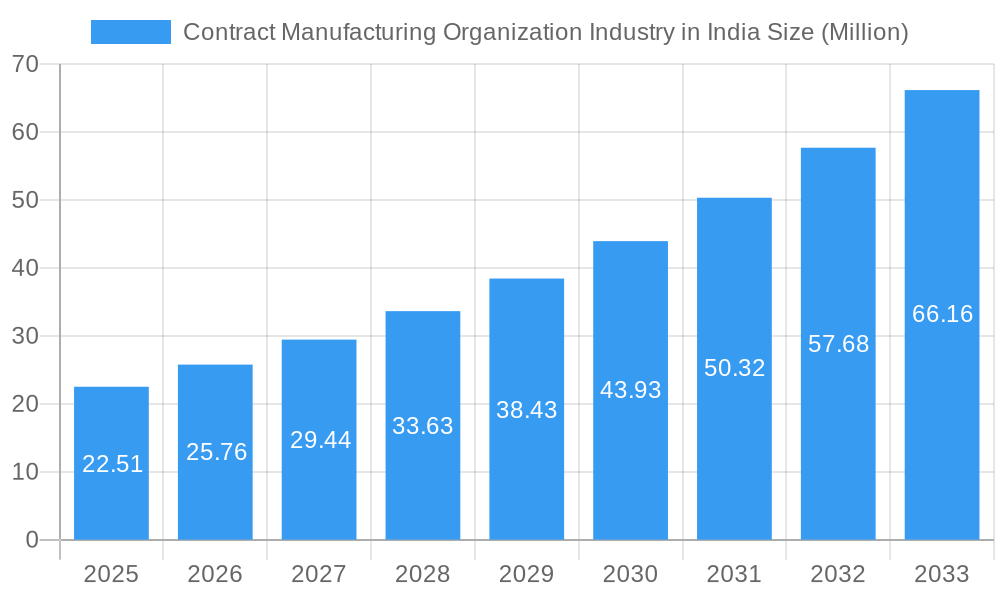

The Indian Contract Manufacturing Organization (CMO) industry is experiencing robust growth, projected to reach \$22.51 million in 2025 and expand significantly over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 14.67% indicates a substantial market expansion driven by several factors. The increasing demand for pharmaceutical products, both domestically and globally, coupled with the rising adoption of outsourcing strategies by pharmaceutical companies, fuels this growth. Furthermore, India's cost-effective manufacturing capabilities, skilled workforce, and favorable regulatory environment attract international pharmaceutical companies to leverage Indian CMOs. The industry's segmentation into API and Intermediates and Finished Dose services further contributes to its diversification and growth potential. Prominent players like Cipla, Dr. Reddy's Laboratories, and Sun Pharmaceuticals (inferred based on industry prominence) contribute significantly to the market share, although a fragmented landscape with many smaller players also exists. Regional variations exist; however, specific regional data requires further detailed analysis to give definitive insights into regional market dominance. The focus on quality and regulatory compliance will continue to be a key driver of growth, with companies investing in advanced technologies and stringent quality control measures.

Contract Manufacturing Organization Industry in India Market Size (In Million)

Looking ahead, the continued expansion of the Indian pharmaceutical sector, coupled with growing global demand for affordable medications, presents considerable opportunities for growth within the Indian CMO industry. However, challenges remain, including potential supply chain disruptions and the need for continuous regulatory compliance. The industry's ability to adapt to evolving global trends and maintain high quality standards will be crucial in sustaining its impressive growth trajectory. Strategic partnerships and investments in research and development will also play a vital role in shaping the future landscape of the Indian CMO market.

Contract Manufacturing Organization Industry in India Company Market Share

Contract Manufacturing Organization (CMO) Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Contract Manufacturing Organization (CMO) industry in India, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate current market dynamics and project future trends. The Indian CMO market, valued at XX Million in 2024, is poised for significant growth, reaching an estimated XX Million by 2033, exhibiting a CAGR of XX%.

Contract Manufacturing Organization Industry in India Market Dynamics & Concentration

The Indian CMO market is characterized by a moderately concentrated landscape with a few large players and numerous smaller firms. Market share is dynamic, with larger players continually seeking acquisitions and expansions to strengthen their market position. The industry's innovation is driven by the demand for cost-effective manufacturing, technological advancements in drug delivery systems, and increasing regulatory scrutiny. Stringent regulatory frameworks, including those set by the Central Drugs Standard Control Organization (CDSCO), significantly influence operational practices and product development. Generic drug manufacturing remains a prominent segment, with several companies specializing in producing lower-cost alternatives to branded drugs. Significant M&A activity has been observed in recent years, with approximately XX deals recorded between 2019 and 2024. This consolidation trend is expected to continue, fueled by the pursuit of economies of scale and broader product portfolios. End-user trends indicate a growing preference for specialized and high-quality services, pushing CMOs to enhance their capabilities and technological prowess.

Contract Manufacturing Organization Industry in India Industry Trends & Analysis

The Indian CMO sector is experiencing robust growth, propelled by several key factors. The rising prevalence of chronic diseases, increasing demand for affordable healthcare, and government initiatives promoting pharmaceutical manufacturing within the country contribute significantly to market expansion. Technological disruptions, such as automation and AI-driven process optimization, are driving efficiency gains and enabling CMOs to offer competitive pricing and faster turnaround times. Consumer preferences are increasingly leaning toward personalized medicine and customized drug delivery systems, creating opportunities for CMOs specializing in niche formulations. Competitive dynamics are intense, with companies vying for market share through strategic partnerships, technological innovation, and capacity expansions. The market exhibits strong growth across various segments, driven by factors including increased outsourcing by pharmaceutical companies, growing demand for generic drugs, and a favorable regulatory environment.

Leading Markets & Segments in Contract Manufacturing Organization Industry in India

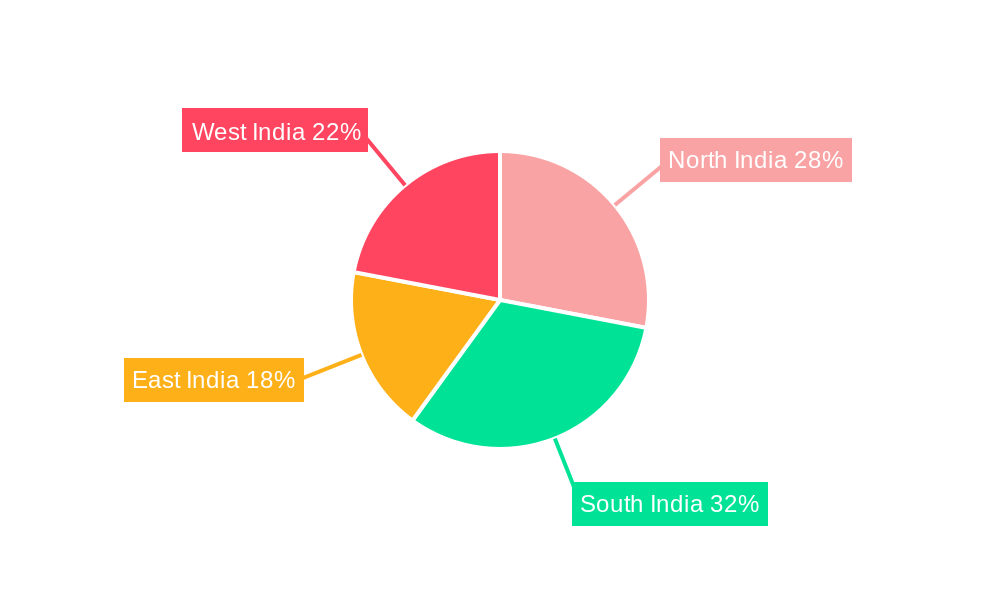

The Indian CMO market is geographically diverse, with major hubs concentrated in regions such as Gujarat, Maharashtra, Andhra Pradesh, and Telangana. These locations benefit from robust infrastructure, skilled labor, and proximity to key pharmaceutical markets.

By Service Type:

API and Intermediates: This segment enjoys significant demand, fueled by India's position as a major producer of Active Pharmaceutical Ingredients (APIs). Key drivers include cost advantages, government support for API manufacturing, and growing exports. The segment commands a larger market share, primarily due to the established manufacturing base and the considerable investment in API production facilities.

Finished Dose: This segment is witnessing rapid growth, driven by the increasing preference for outsourced manufacturing of finished dosage forms by pharmaceutical companies. Technological advancements in formulation development, rising demand for specialized drug delivery systems, and growing opportunities in export markets are key factors.

Key Drivers:

- Favorable government policies promoting domestic manufacturing and exports.

- Availability of skilled labor and cost-effective manufacturing capabilities.

- Well-established supply chains for raw materials and packaging.

- Growing demand for both generic and branded drugs.

Contract Manufacturing Organization Industry in India Product Developments

Recent product innovations in the Indian CMO sector are focused on advanced drug delivery systems, such as liposomes, nanoparticles, and sustained-release formulations. These developments aim to enhance drug efficacy, improve patient compliance, and reduce side effects. CMOs are also actively involved in developing specialized formulations for niche therapeutic areas, such as oncology and ophthalmology. The competitive advantage lies in offering specialized services, faster turnaround times, and cost-effective solutions tailored to individual client needs. Technological trends such as AI-powered process optimization and automation are improving efficiency and quality control.

Key Drivers of Contract Manufacturing Organization Industry in India Growth

Several factors drive the growth of the Indian CMO market. Technological advancements, including automation and sophisticated analytical techniques, improve efficiency and product quality. Government policies aimed at promoting domestic manufacturing and boosting pharmaceutical exports create a conducive business environment. The increasing demand for generic drugs and the rising prevalence of chronic diseases worldwide bolster market growth significantly. Furthermore, the strategic acquisitions and expansion plans of key industry players further fuel market expansion.

Challenges in the Contract Manufacturing Organization Industry in India Market

The Indian CMO sector faces several challenges. Regulatory hurdles, including complex approval processes and stringent quality standards, can impede timely product launches. Supply chain disruptions, particularly concerning raw materials and packaging components, can impact production efficiency. Intense competition from both domestic and international players puts pressure on pricing and profitability. Estimates suggest that regulatory delays alone account for an approximate XX% reduction in annual growth, significantly impacting overall industry performance.

Emerging Opportunities in Contract Manufacturing Organization Industry in India

The Indian CMO industry is poised for significant growth driven by several emerging opportunities. Technological breakthroughs, such as personalized medicine and advanced drug delivery systems, create new avenues for specialization and innovation. Strategic partnerships with international pharmaceutical companies can access wider markets and leverage expertise. Expansion into niche therapeutic areas, such as biologics and oncology, presents lucrative opportunities for CMOs.

Leading Players in the Contract Manufacturing Organization Industry in India Sector

- Akums Drugs and Pharmaceuticals Limited

- Rhydburg Pharmaceuticals Ltd

- MSN Laboratories Pvt Ltd

- BDR Pharmaceuticals International

- Eisai Pharmaceuticals India Pvt Ltd

- Ciron Drugs & Pharmaceuticals Pvt Ltd

- Wockhardt Limited

- Cipla Ltd

- Delwis Healthcare Pvt Ltd

- Unichem Laboratories Ltd

- Dr Reddy's Laboratories

- Theon Pharmaceuticals Limited

- Viatris Inc (Mylan Laboratories Ltd)

- Maxheal Pharmaceuticals India Ltd

- Medipaams India Pvt Ltd

- AMRI India Pvt Ltd

- Cadila Healthcare Limited

Key Milestones in Contract Manufacturing Organization Industry in India Industry

- June 2022: Glenmark Pharmaceuticals launched Indamet, a fixed-dose combination medication for uncontrolled asthma, marking a significant innovation in respiratory therapy.

- May 2022: Sun Pharma announced the launch of Brillo, a first-in-class oral drug for reducing LDL cholesterol, showcasing the commitment to novel therapeutic approaches.

- March 2022: Themis Medicare Ltd. received DCGI approval for VIRALEX, an antiviral medication for mild to moderate COVID-19, highlighting the rapid response to pandemic needs.

Strategic Outlook for Contract Manufacturing Organization Industry in India Market

The Indian CMO market exhibits strong growth potential. Future market expansion will be driven by increased outsourcing by pharmaceutical companies, technological advancements, and government initiatives supporting domestic manufacturing. Strategic partnerships, investments in capacity expansion, and diversification into niche therapeutic areas will be key to achieving long-term success for players in this dynamic and competitive landscape.

Contract Manufacturing Organization Industry in India Segmentation

-

1. Service Type

- 1.1. API and Intermediates

-

1.2. Finished Dose

- 1.2.1. Solids

- 1.2.2. Liquids

- 1.2.3. Semi-Solids and Injectables

Contract Manufacturing Organization Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Contract Manufacturing Organization Industry in India Regional Market Share

Geographic Coverage of Contract Manufacturing Organization Industry in India

Contract Manufacturing Organization Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. API and Intermediates

- 5.1.2. Finished Dose

- 5.1.2.1. Solids

- 5.1.2.2. Liquids

- 5.1.2.3. Semi-Solids and Injectables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. API and Intermediates

- 6.1.2. Finished Dose

- 6.1.2.1. Solids

- 6.1.2.2. Liquids

- 6.1.2.3. Semi-Solids and Injectables

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. API and Intermediates

- 7.1.2. Finished Dose

- 7.1.2.1. Solids

- 7.1.2.2. Liquids

- 7.1.2.3. Semi-Solids and Injectables

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. API and Intermediates

- 8.1.2. Finished Dose

- 8.1.2.1. Solids

- 8.1.2.2. Liquids

- 8.1.2.3. Semi-Solids and Injectables

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. API and Intermediates

- 9.1.2. Finished Dose

- 9.1.2.1. Solids

- 9.1.2.2. Liquids

- 9.1.2.3. Semi-Solids and Injectables

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. API and Intermediates

- 10.1.2. Finished Dose

- 10.1.2.1. Solids

- 10.1.2.2. Liquids

- 10.1.2.3. Semi-Solids and Injectables

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rhydburg Pharmaceuticals Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSN Laboratories Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BDR Pharmaceuticals International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eisai Pharmaceuticals India Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wockhardt Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delwis Healthcare Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unichem Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Reddy's Laboratories

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Theon Pharmaceuticals Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Viatris Inc (Mylan Laboratories Ltd)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxheal Pharmaceuticals India Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Medipaams India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AMRI India Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cadila Healthcare Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

List of Figures

- Figure 1: Global Contract Manufacturing Organization Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 7: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Organization Industry in India?

The projected CAGR is approximately 14.67%.

2. Which companies are prominent players in the Contract Manufacturing Organization Industry in India?

Key companies in the market include Akums Drugs and Pharmaceuticals Limited, Rhydburg Pharmaceuticals Ltd, MSN Laboratories Pvt Ltd, BDR Pharmaceuticals International, Eisai Pharmaceuticals India Pvt Ltd, Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive, Wockhardt Limited, Cipla Ltd, Delwis Healthcare Pvt Ltd, Unichem Laboratories Ltd, Dr Reddy's Laboratories, Theon Pharmaceuticals Limited, Viatris Inc (Mylan Laboratories Ltd), Maxheal Pharmaceuticals India Ltd, Medipaams India Pvt Ltd, AMRI India Pvt Ltd, Cadila Healthcare Limited.

3. What are the main segments of the Contract Manufacturing Organization Industry in India?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region.

6. What are the notable trends driving market growth?

Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

In June of 2022: Glenmark Pharmaceuticals introduced the cutting-edge fixed-dose combination (FDC) medication Indacaterol + Mometasone for patients with uncontrolled asthma in India. The business introduced this FDC under the name Indamet. Glenmark is the first business in India to commercialize the ground-breaking FDC of Indacaterol, a long-acting beta-agonist, and Mometasone Furoate, an inhaled corticosteroid that has been authorized by the Drug Controller General of India (DCGI),

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Organization Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Organization Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Organization Industry in India?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Organization Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence