Key Insights

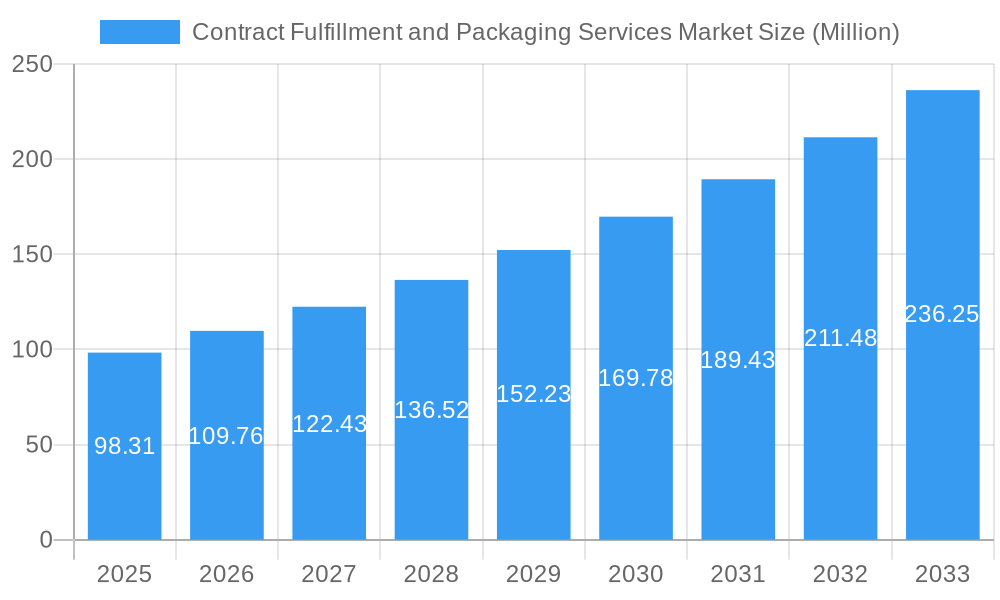

The contract fulfillment and packaging services market, valued at $98.31 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.43% from 2025 to 2033. This significant expansion is driven by several key factors. The increasing e-commerce penetration necessitates efficient and reliable fulfillment solutions, boosting demand for contract packaging and warehousing services. Furthermore, the rising focus on brand experience and product presentation fuels the need for sophisticated packaging design and prototyping services. The pharmaceutical and food & beverage sectors are major contributors, demanding stringent quality control and specialized handling throughout the supply chain. Technological advancements, such as automated packaging systems and improved inventory management software, further enhance efficiency and drive market growth. However, challenges remain, including fluctuating raw material prices and the need for skilled labor to manage complex fulfillment operations. Competition is also intense, with numerous players vying for market share. Nevertheless, the overall market outlook remains positive, driven by sustained e-commerce growth and increasing consumer demand for convenient and high-quality products.

Contract Fulfillment and Packaging Services Market Market Size (In Million)

The market segmentation reveals a diverse landscape. Service types include packaging design & prototyping, contract packing (encompassing bottling, filling, labeling, and wrapping), package testing, warehousing and fulfillment, and other services. End-user segments are largely dominated by the food, beverage, pharmaceutical, and household & personal care industries. Geographically, North America and Europe are likely to maintain significant market share due to established e-commerce infrastructure and a high concentration of major players. However, the Asia-Pacific region is expected to witness the fastest growth, fueled by rapid economic expansion and rising consumer spending. This suggests considerable opportunities for expansion and strategic partnerships for companies operating in this dynamic market. The market's future will hinge on companies' ability to adapt to changing consumer preferences, technological advancements, and evolving regulatory landscapes.

Contract Fulfillment and Packaging Services Market Company Market Share

This in-depth report provides a comprehensive analysis of the Contract Fulfillment and Packaging Services market, offering invaluable insights for stakeholders across the industry value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Contract Fulfillment and Packaging Services Market Market Dynamics & Concentration

The contract fulfillment and packaging services market is characterized by a dynamic and evolving competitive landscape. Market concentration remains a key aspect, with a discernible influence from established players. In 2025, the top 5 players are projected to command an estimated xx% of the global market share, indicating a moderately concentrated structure. This concentration is often driven by the significant capital investments required for advanced automation and sophisticated logistics infrastructure. Innovation is a critical differentiator, spearheaded by advancements in industrial automation, the development and adoption of sustainable packaging materials, and the integration of cutting-edge supply chain management technologies. These innovations aim to enhance efficiency, reduce waste, and improve overall service delivery.

Regulatory influences, particularly stringent frameworks within the pharmaceutical and food & beverage sectors, play a pivotal role in shaping packaging and fulfillment practices. Compliance with these regulations necessitates specialized expertise and adherence to strict quality control measures. The market also navigates the presence of substitute packaging materials and services, compelling continuous innovation and adaptation to maintain competitive advantage. Furthermore, evolving end-user trends, most notably the exponential growth of e-commerce and a growing demand for personalized packaging solutions, are actively reshaping market demands and service offerings. Merger and acquisition (M&A) activities are a significant trend, with an estimated xx deals observed in the last five years. These strategic moves are crucial for consolidating market share, expanding service capabilities, and achieving economies of scale.

- Market Concentration: The top 5 industry leaders are expected to hold approximately xx% of the market share by 2025, highlighting a moderate level of market concentration.

- Key Innovation Drivers: Significant advancements in automation technologies, the increasing use of eco-friendly and sustainable packaging materials, and sophisticated supply chain optimization solutions are driving innovation.

- Regulatory Landscape: Stringent regulatory frameworks, especially within the pharmaceutical and food industries, significantly influence operational practices and packaging standards.

- Merger & Acquisition (M&A) Activity: The market has witnessed robust M&A activity, with approximately xx deals recorded over the past five years, indicating a trend towards consolidation and capability enhancement.

- End-User Trends: The burgeoning growth of e-commerce and an increasing demand for customized and personalized packaging solutions are key factors shaping market demand.

Contract Fulfillment and Packaging Services Market Industry Trends & Analysis

The Contract Fulfillment and Packaging Services market is experiencing robust growth fueled by several key factors. The increasing demand for outsourced logistics and packaging solutions, particularly from e-commerce businesses and companies seeking to streamline operations, is a significant driver. Technological advancements, such as automation and AI-powered solutions, are enhancing efficiency and reducing costs. Changing consumer preferences towards sustainable and convenient packaging options further contribute to market expansion. Competitive dynamics are characterized by intense competition among established players and emerging startups, leading to continuous innovation and service improvements. The market is experiencing a shift towards specialized services catering to specific end-user segments. The global market size is estimated at xx Million in 2025, exhibiting a CAGR of xx% during the historical period (2019-2024). Market penetration of automated packaging solutions is increasing steadily, reaching an estimated xx% in 2025.

Leading Markets & Segments in Contract Fulfillment and Packaging Services Market

The contract fulfillment and packaging services market is segmented by end-user industry and geography, each exhibiting distinct growth drivers and market dynamics. The Pharmaceutical segment currently stands as the dominant force within the end-user market. This dominance is primarily attributed to the highly stringent regulatory compliance requirements and the inherently complex nature of pharmaceutical product packaging, which often necessitates specialized handling, temperature control, and tamper-evident features. Geographically, North America commands the largest market share. This leadership is fueled by its robust and rapidly expanding e-commerce sector, coupled with a well-established and sophisticated logistics infrastructure that supports efficient order fulfillment and distribution.

Key Growth Drivers by Segment and Region:

- Pharmaceutical: Driven by the absolute necessity for strict regulatory compliance, meticulous quality control, and the specialized packaging needs of sensitive and high-value products.

- Food & Beverage: Characterized by a strong demand for specialized packaging that ensures product integrity, extends shelf life, and meets evolving consumer preferences for convenience and sustainability. Traceability requirements are also paramount in this sector.

- Household & Personal Care: Emphasis is placed on developing attractive and sustainable packaging solutions that resonate with consumer brand perception and environmental consciousness.

- North America: Benefits from a mature e-commerce ecosystem, a high level of consumer spending, and the presence of leading contract fulfillment and packaging service providers.

- Europe: Experiences a growing demand for innovative and sustainable packaging solutions, driven by strong environmental regulations and consumer awareness.

- Asia-Pacific: Witnessing rapid e-commerce expansion, a burgeoning middle class, and increasing manufacturing capabilities, making it a significant growth market.

Dominance Analysis: The overwhelming dominance of the Pharmaceutical segment in the contract fulfillment and packaging market is a direct consequence of its unwavering commitment to stringent quality standards and regulatory mandates, which inherently leads to a higher reliance on specialized outsourcing services. North America's continued leadership is underpinned by its advanced e-commerce infrastructure, a strong consumer base, and a well-developed network of specialized contract fulfillment and packaging companies adept at meeting diverse client needs.

Contract Fulfillment and Packaging Services Market Product Developments

Product development in the contract fulfillment and packaging services market is intensely focused on addressing key industry challenges and opportunities. A significant trend is the advancement of sustainable packaging materials, including biodegradable, compostable, and recycled options, to meet growing environmental concerns and regulatory pressures. Simultaneously, the market is witnessing the rapid adoption of automated packaging solutions, leveraging robotics, advanced conveyor systems, and intelligent sorting technology to enhance throughput, reduce labor costs, and improve accuracy. Furthermore, there's a growing emphasis on developing and integrating improved traceability systems, utilizing technologies like RFID and advanced barcode scanning to provide end-to-end visibility throughout the supply chain. The integration of artificial intelligence (AI) and machine learning is also playing a crucial role in optimizing packaging processes, predicting demand, and enhancing operational efficiency and precision.

These innovative developments are not only crucial for meeting evolving market demands but also provide significant competitive advantages. They enable service providers to offer substantial cost reductions through increased efficiency and reduced waste, deliver improved quality and consistency in packaging, and contribute to a reduced environmental impact, aligning perfectly with the current demands for corporate social responsibility and sustainable business practices.

Key Drivers of Contract Fulfillment and Packaging Services Market Growth

The contract fulfillment and packaging services market is experiencing robust growth, propelled by a confluence of powerful driving forces. The undeniable surge in e-commerce is a primary catalyst, creating an escalating demand for efficient, scalable, and cost-effective order fulfillment and packaging solutions to meet the needs of online retailers. Complementing this is the relentless pace of technological advancements, particularly in automation and artificial intelligence. These innovations are instrumental in boosting operational productivity, reducing manual labor dependency, and enhancing the overall cost-effectiveness of fulfillment processes.

The increasing stringency of regulatory requirements, especially within highly scrutinized sectors like pharmaceuticals and food & beverage, is another significant growth driver. These regulations necessitate specialized expertise and advanced packaging solutions that only dedicated contract service providers can consistently offer. Moreover, the global imperative for sustainability is profoundly influencing the market. This is driving a heightened demand for eco-friendly packaging materials, reusable packaging options, and optimized processes that minimize environmental footprint, thereby encouraging businesses to partner with specialized providers who can facilitate these sustainable transitions.

Challenges in the Contract Fulfillment and Packaging Services Market Market

The industry faces challenges such as fluctuating raw material prices impacting profitability. Meeting stringent regulatory compliance in diverse sectors adds complexity and cost. Intense competition necessitates continuous innovation and cost optimization. Supply chain disruptions, particularly experienced during recent global events, highlight the need for resilient and adaptable supply chain management strategies. These factors negatively impact market growth and profitability. Quantifiable impacts vary, but estimates suggest that supply chain disruptions alone caused a xx% reduction in market revenue in 2022.

Emerging Opportunities in Contract Fulfillment and Packaging Services Market

The contract fulfillment and packaging services market is ripe with emerging opportunities for forward-thinking companies. A significant area of growth lies in leveraging advanced technological advancements, such as the application of artificial intelligence (AI) and machine learning for sophisticated supply chain management. This includes predictive analytics for demand forecasting, route optimization, and warehouse management, leading to enhanced efficiency and reduced operational costs. Developing and implementing innovative, sustainable packaging solutions is another key opportunity, catering to the increasing consumer and regulatory demand for environmentally responsible practices. This can range from novel biodegradable materials to circular economy-focused packaging designs.

Strategic partnerships and collaborations across the entire value chain – from raw material suppliers and technology providers to logistics companies and end-clients – present substantial opportunities to enhance service offerings, expand capabilities, and create integrated solutions. Furthermore, there is significant potential in expanding into emerging markets that are experiencing rapid e-commerce growth and a burgeoning middle class, offering a vast untapped customer base. Finally, specializing in niche markets or offering highly customized fulfillment and packaging solutions for specific industries or product types can unlock significant growth and competitive advantage.

Leading Players in the Contract Fulfillment and Packaging Services Market Sector

- Budelpack Poortvliet B V

- Warren Industries Inc

- Aaron Thomas Company Inc

- Multi-Pac Solutions LLC

- AmeriPac Inc

- FW Logistics

- Assemblies Unlimited Inc

- ActionPak Inc

- Boughey Distribution Ltd

- Kane Logistics

- Sharp (UDG Healthcare plc)

- PAC Worldwide Inc

- Sonoco Products Company

- Wasdell Packaging Group

- Swan Packaging Fulfillment Inc

Key Milestones in Contract Fulfillment and Packaging Services Market Industry

- 2020: Increased adoption of automated packaging solutions due to labor shortages.

- 2021: Several key players invested heavily in sustainable packaging initiatives.

- 2022: Supply chain disruptions led to increased focus on supply chain diversification and resilience.

- 2023: Several mergers and acquisitions aimed at expanding market share and service offerings.

- 2024: Launch of several new packaging designs incorporating sustainable materials and improved functionality.

Strategic Outlook for Contract Fulfillment and Packaging Services Market Market

The Contract Fulfillment and Packaging Services market presents significant growth potential. Continued technological advancements, coupled with increasing demand for efficient and sustainable solutions, will drive long-term expansion. Strategic partnerships, market diversification, and investment in automation and digitalization will be key to success. Focusing on niche segments and specialized services is crucial for maintaining a competitive edge. The market's future trajectory hinges on adapting to evolving consumer demands, regulatory landscapes, and technological advancements.

Contract Fulfillment and Packaging Services Market Segmentation

-

1. Service Type

- 1.1. Packaging Design & Prototyping

- 1.2. Contract

- 1.3. Package Testing

- 1.4. Warehousing and Fulfilment

- 1.5. Other Service Types

-

2. End-user Type

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Household & Personal Care

- 2.5. Other End-user Segments

Contract Fulfillment and Packaging Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Contract Fulfillment and Packaging Services Market Regional Market Share

Geographic Coverage of Contract Fulfillment and Packaging Services Market

Contract Fulfillment and Packaging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Steady Demand from Key Verticals

- 3.2.2 such as the Food and Beverage Sector; Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation

- 3.3. Market Restrains

- 3.3.1. ; Stringent Government Regulations; Competition from In-house Packaging

- 3.4. Market Trends

- 3.4.1. Contract Packing is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Packaging Design & Prototyping

- 5.1.2. Contract

- 5.1.3. Package Testing

- 5.1.4. Warehousing and Fulfilment

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Type

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Household & Personal Care

- 5.2.5. Other End-user Segments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Packaging Design & Prototyping

- 6.1.2. Contract

- 6.1.3. Package Testing

- 6.1.4. Warehousing and Fulfilment

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Type

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Household & Personal Care

- 6.2.5. Other End-user Segments

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Packaging Design & Prototyping

- 7.1.2. Contract

- 7.1.3. Package Testing

- 7.1.4. Warehousing and Fulfilment

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Type

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Household & Personal Care

- 7.2.5. Other End-user Segments

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Packaging Design & Prototyping

- 8.1.2. Contract

- 8.1.3. Package Testing

- 8.1.4. Warehousing and Fulfilment

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Type

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Household & Personal Care

- 8.2.5. Other End-user Segments

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Packaging Design & Prototyping

- 9.1.2. Contract

- 9.1.3. Package Testing

- 9.1.4. Warehousing and Fulfilment

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Type

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Household & Personal Care

- 9.2.5. Other End-user Segments

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East Contract Fulfillment and Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Packaging Design & Prototyping

- 10.1.2. Contract

- 10.1.3. Package Testing

- 10.1.4. Warehousing and Fulfilment

- 10.1.5. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Type

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Household & Personal Care

- 10.2.5. Other End-user Segments

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Budelpack Poortvliet B V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Warren Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aaron Thomas Company Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Multi-Pac Solutions LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AmeriPac Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FW Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Assemblies Unlimited Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ActionPak Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boughey Distribution Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kane Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sharp (UDG Healthcare plc)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PAC Worldwide Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sonoco Products Company*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Wasdell Packaging Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Swan Packaging Fulfillment Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Budelpack Poortvliet B V

List of Figures

- Figure 1: Global Contract Fulfillment and Packaging Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 5: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 6: North America Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 11: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 12: Europe Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 17: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 18: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Latin America Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by End-user Type 2025 & 2033

- Figure 29: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by End-user Type 2025 & 2033

- Figure 30: Middle East Contract Fulfillment and Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Contract Fulfillment and Packaging Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 3: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 6: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 9: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 12: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 15: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 18: Global Contract Fulfillment and Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Fulfillment and Packaging Services Market?

The projected CAGR is approximately 11.43%.

2. Which companies are prominent players in the Contract Fulfillment and Packaging Services Market?

Key companies in the market include Budelpack Poortvliet B V, Warren Industries Inc, Aaron Thomas Company Inc, Multi-Pac Solutions LLC, AmeriPac Inc, FW Logistics, Assemblies Unlimited Inc, ActionPak Inc, Boughey Distribution Ltd, Kane Logistics, Sharp (UDG Healthcare plc), PAC Worldwide Inc, Sonoco Products Company*List Not Exhaustive, Wasdell Packaging Group, Swan Packaging Fulfillment Inc.

3. What are the main segments of the Contract Fulfillment and Packaging Services Market?

The market segments include Service Type , End-user Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 98.31 Million as of 2022.

5. What are some drivers contributing to market growth?

; Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Steady Demand from Key Verticals. such as the Food and Beverage Sector; Entry of Key Warehousing Vendors in the Field of Contract Packaging Expected to Drive Innovation.

6. What are the notable trends driving market growth?

Contract Packing is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Stringent Government Regulations; Competition from In-house Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Fulfillment and Packaging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Fulfillment and Packaging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Fulfillment and Packaging Services Market?

To stay informed about further developments, trends, and reports in the Contract Fulfillment and Packaging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence