Key Insights

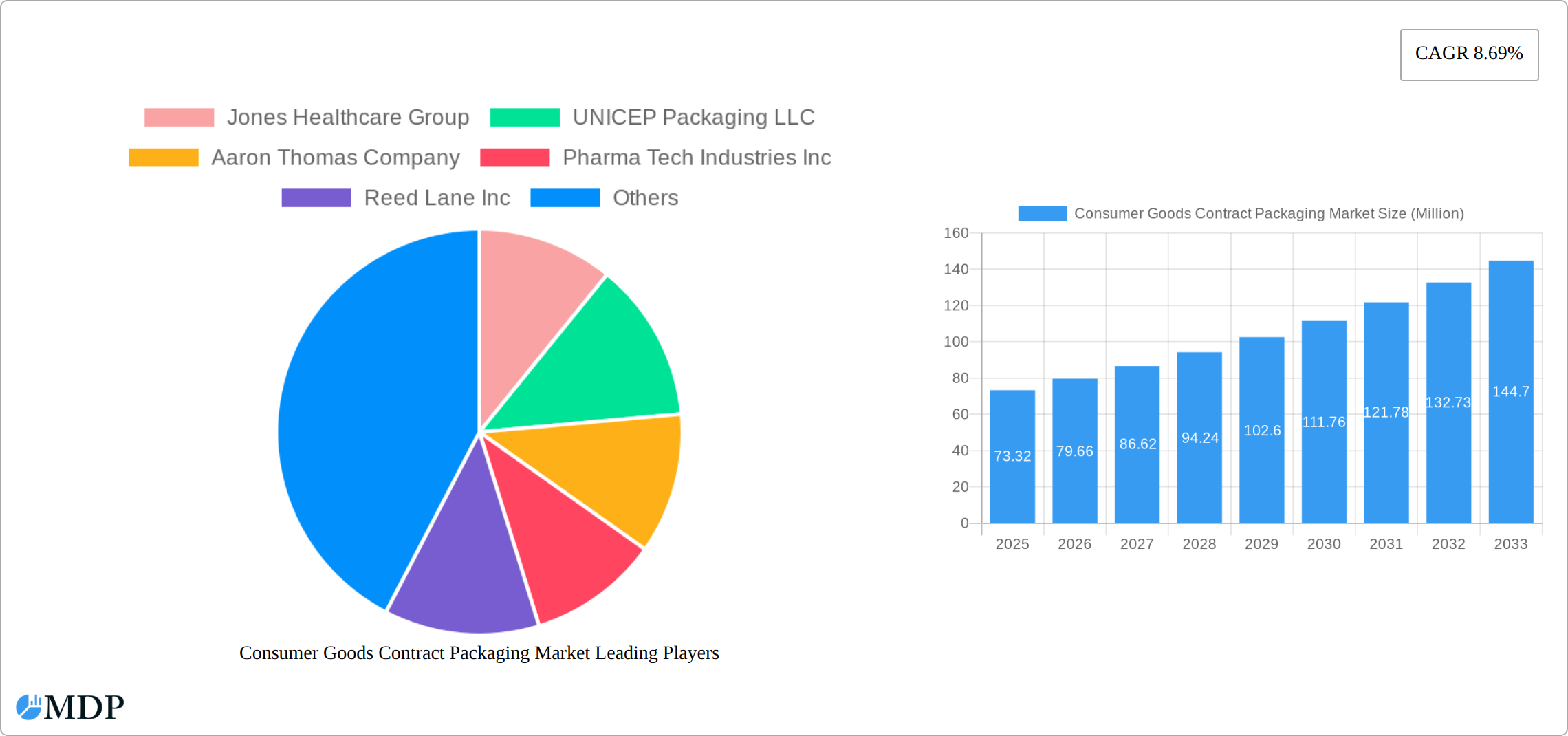

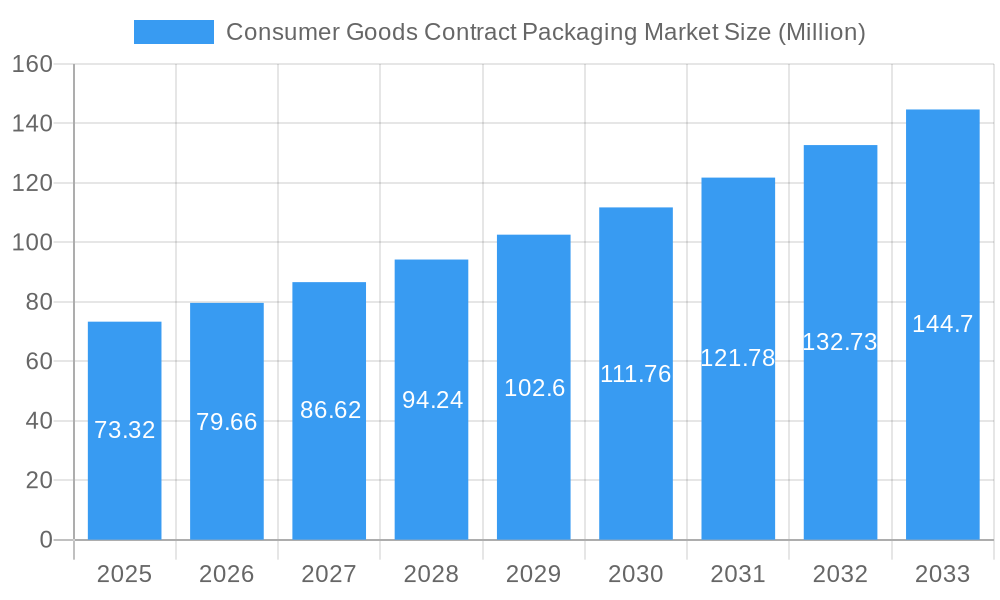

The global Consumer Goods Contract Packaging market is experiencing robust growth, projected to reach \$73.32 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 8.69% from 2025 to 2033. This expansion is driven by several key factors. Increasing demand for efficient and cost-effective packaging solutions across diverse consumer goods sectors, including food, beverages, pharmaceuticals, and personal care, is a significant catalyst. Brands are increasingly outsourcing packaging operations to specialize contract packagers, allowing them to focus on core competencies like product development and marketing. Furthermore, the rising adoption of sustainable and innovative packaging materials, such as eco-friendly plastics and recyclable materials, fuels market growth. The trend towards e-commerce and the need for robust, tamper-evident packaging for online deliveries further contributes to this expanding market. Geographical segmentation reveals strong growth potential in developing economies of Asia, particularly China and India, driven by rising disposable incomes and increasing consumer demand. North America and Europe, however, will maintain significant market shares due to established infrastructure and high consumer goods consumption. Market segmentation by packaging type (primary, secondary, tertiary) indicates strong demand across all segments, with primary packaging, the closest to the product, expected to hold the largest market share.

Consumer Goods Contract Packaging Market Market Size (In Million)

Competition in the Consumer Goods Contract Packaging market is moderately high, with a mix of both large multinational corporations and smaller, specialized companies. Key players like Jones Healthcare Group, UNICEP Packaging LLC, and others are investing in advanced technologies, expanding their service offerings, and focusing on strategic acquisitions to maintain a competitive edge. Challenges faced by the industry include fluctuations in raw material prices, stringent regulatory compliance requirements, and maintaining consistent quality across diverse packaging solutions. However, the long-term outlook for the Consumer Goods Contract Packaging market remains positive, propelled by continuous innovation, growing consumer demand, and the increasing preference for outsourcing among consumer goods companies. The market's growth trajectory suggests lucrative opportunities for both established players and new entrants who can provide specialized and efficient solutions. Future growth will be significantly influenced by technological advancements in packaging materials and automation.

Consumer Goods Contract Packaging Market Company Market Share

Consumer Goods Contract Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Consumer Goods Contract Packaging Market, offering invaluable insights for industry stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report delivers a data-driven understanding of market trends, competitive dynamics, and future growth potential. The report covers a market valued at xx Million in 2025, projecting significant growth over the forecast period.

Consumer Goods Contract Packaging Market Market Dynamics & Concentration

The Consumer Goods Contract Packaging Market exhibits a moderately concentrated landscape, with several key players vying for market share. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance. Innovation in packaging materials, automation, and sustainability drives market growth. Stringent regulatory frameworks concerning food safety, pharmaceutical regulations, and environmental concerns significantly impact market dynamics. The presence of substitute packaging options, such as reusable containers, challenges the market. Consumer preferences for eco-friendly and convenient packaging are reshaping the industry. Furthermore, M&A activities are relatively frequent, reflecting consolidation trends and the pursuit of market expansion.

- Market Share: The top 5 players collectively hold an estimated xx% market share in 2025.

- M&A Activity: An estimated xx M&A deals were recorded between 2019 and 2024.

- Innovation Drivers: Focus on sustainable materials (e.g., recycled plastics, biodegradable options), automation, and customized packaging solutions.

- Regulatory Influence: Compliance with FDA regulations (pharmaceuticals), food safety standards (food and beverage), and environmental regulations (e.g., plastic reduction initiatives) are crucial.

Consumer Goods Contract Packaging Market Industry Trends & Analysis

The Consumer Goods Contract Packaging Market is experiencing a period of robust and dynamic expansion, propelled by a confluence of influential factors. The escalating demand for meticulously packaged consumer goods across a diverse spectrum of industries, including essential food and beverages, critical pharmaceuticals, and a wide array of personal care products, stands as a primary growth catalyst. Furthermore, rapid technological advancements, particularly in the realms of sophisticated automation, the integration of intelligent "smart packaging" solutions that offer enhanced functionality and traceability, and the adoption of novel materials, are significantly contributing to improved operational efficiency, superior product quality, and greater consumer engagement. Concurrently, evolving consumer preferences, marked by a pronounced and growing inclination towards sustainable, environmentally conscious packaging options and an unyielding demand for convenience-driven formats, are actively reshaping market dynamics and driving innovation. The competitive landscape is characterized by a relentless pursuit of innovation, the forging of strategic alliances and collaborations, and targeted mergers and acquisitions aimed at consolidating market share and expanding capabilities. The market is projected to witness a substantial Compound Annual Growth Rate (CAGR) of xx% during the forecast period spanning 2025-2033, with increasing market penetration expected across diverse geographical regions as manufacturers increasingly leverage specialized contract packaging services.

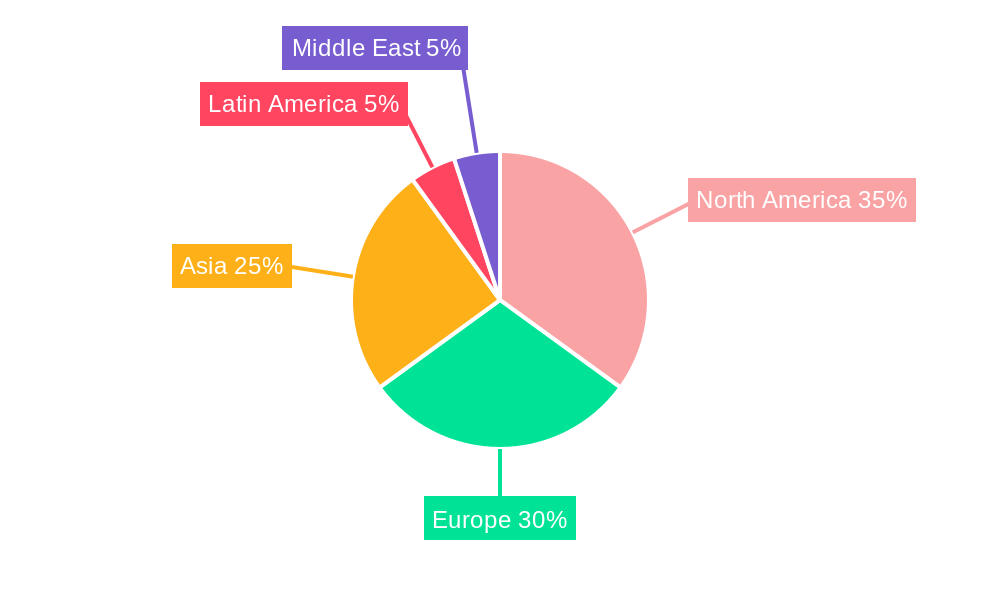

Leading Markets & Segments in Consumer Goods Contract Packaging Market

The Pharmaceutical segment currently dominates the Consumer Goods Contract Packaging Market, driven by stringent quality control requirements and growing demand for specialized packaging. The Food and Beverage sector also represents a substantial market segment, benefiting from rising consumer spending and a focus on extended shelf life. Geographically, North America and Europe are currently the leading markets, owing to established infrastructure and high consumer demand. However, Asia-Pacific is poised for rapid growth, fueled by increasing disposable incomes and expanding manufacturing capacities.

Key Drivers by Segment:

- Pharmaceutical: Stringent regulatory requirements, increasing demand for specialized packaging (e.g., blister packs, modified atmosphere packaging).

- Food & Beverage: Growing consumer demand, focus on product freshness and shelf-life extension, increasing adoption of sustainable packaging options.

- Household & Personal Care: rising consumer demand for convenient and aesthetically pleasing packaging.

Geographic Dominance:

- North America: Strong consumer spending, advanced infrastructure, and established contract packaging companies.

- Europe: Similar to North America, with strong regulatory frameworks and robust consumer goods sector.

- Asia-Pacific: Rapidly growing economies, increasing disposable incomes, and expansion of manufacturing base.

Consumer Goods Contract Packaging Market Product Developments

Recent product innovations focus on sustainable and technologically advanced packaging solutions. This includes the use of biodegradable materials, recyclable packaging, and smart packaging technologies that provide real-time product information to consumers. These advancements offer improved product shelf life, enhanced consumer experience, and a reduced environmental impact, providing a strong competitive advantage in the market. The integration of RFID and QR codes for tracking and authentication further enhances product security and traceability.

Key Drivers of Consumer Goods Contract Packaging Market Growth

Several pivotal factors are instrumental in propelling the growth trajectory of the Consumer Goods Contract Packaging Market:

- Technological Advancements: The widespread adoption of advanced automation, the implementation of innovative smart packaging technologies for enhanced product information and consumer interaction, and the increasing utilization of sustainable and biodegradable materials are not only boosting operational efficiency but also significantly enhancing the aesthetic appeal and perceived value of packaged goods.

- Economic Growth & Rising Disposable Incomes: Sustained economic growth, particularly in emerging economies, is leading to a tangible increase in disposable incomes. This empowers consumers to purchase a broader range of packaged goods, thereby stimulating demand for contract packaging services.

- Stringent Regulatory Frameworks: Increasingly rigorous regulatory requirements related to food safety standards, the uncompromising quality assurance for pharmaceutical products, and a global emphasis on environmental sustainability are compelling consumer goods manufacturers to seek specialized and compliant packaging solutions, a demand readily met by contract packagers.

- E-commerce Boom and Evolving Retail Landscapes: The exponential growth of e-commerce necessitates specialized packaging designed for online distribution, including robust protection, efficient packing, and often, direct-to-consumer appeal. Contract packagers are crucial in adapting to these unique requirements.

- Brand Differentiation and Shelf Appeal: In a highly competitive retail environment, unique and eye-catching packaging is a key differentiator. Contract packagers offer expertise in creating custom designs, innovative formats, and high-quality finishes that help brands stand out.

Challenges in the Consumer Goods Contract Packaging Market Market

The Consumer Goods Contract Packaging Market faces several challenges:

- Supply Chain Disruptions: Global supply chain volatility impacts raw material availability and cost.

- Intense Competition: Numerous players compete on price, quality, and innovation.

- Regulatory Compliance: Meeting stringent regulations across different geographies increases costs and complexity.

Emerging Opportunities in Consumer Goods Contract Packaging Market

The Consumer Goods Contract Packaging Market is ripe with promising opportunities poised for long-term sustainable growth:

- Pioneering Sustainable Packaging Solutions: The burgeoning consumer preference for eco-friendly and sustainable packaging materials, including recycled content, biodegradable options, and minimalist designs, presents a significant avenue for innovation and market leadership. Companies that can offer cutting-edge sustainable solutions will gain a competitive edge.

- Forge Strategic Partnerships and Alliances: Deepening collaborations and forging strategic partnerships between specialized contract packaging companies and major consumer goods manufacturers are vital. These alliances foster co-innovation, streamline supply chains, and facilitate market expansion into new product categories and regions.

- Exploiting Untapped Potential in Emerging Economies: Emerging markets, with their rapidly growing middle class and increasing urbanization, represent substantial growth opportunities. These regions often require tailored packaging solutions that address local preferences, affordability, and logistical challenges.

- Specialization in Niche Market Segments: Developing expertise in niche sectors like premium personal care, specialized dietary supplements, or eco-conscious household products can carve out lucrative market positions and command premium pricing.

- Leveraging Digitalization for Enhanced Services: Offering integrated digital services, such as advanced inventory management, real-time order tracking, and data analytics on packaging performance, can add significant value for clients and foster stronger customer relationships.

Leading Players in the Consumer Goods Contract Packaging Market Sector

- Jones Healthcare Group

- UNICEP Packaging LLC

- Aaron Thomas Company

- Pharma Tech Industries Inc

- Reed Lane Inc

- Multipack Solutions LLC

- Complete Co-Packing Services Ltd

- Sharp Packaging Services

- Budelpack Poortvliet BV

- Stamar Packaging Inc

- Green Packaging Asia

- Glenmore Packaging

- Pabst

- J. S. McCarthy Co., Inc.

Key Milestones in Consumer Goods Contract Packaging Market Industry

- 2021: Introduction of biodegradable packaging solutions by several key players.

- 2022: Significant investment in automation technologies by leading companies.

- 2023: Several mergers and acquisitions reshape the market landscape.

- 2024: Increased focus on sustainable sourcing and responsible packaging practices.

Strategic Outlook for Consumer Goods Contract Packaging Market Market

The Consumer Goods Contract Packaging Market is strategically positioned for sustained and accelerated growth. This expansion will be fundamentally driven by ongoing technological innovation, a persistent increase in consumer demand for a wide array of packaged goods, and an unwavering global focus on environmental sustainability. Key strategic opportunities for market participants lie in the proactive development and implementation of novel, intelligent, and highly efficient packaging solutions, the strategic expansion into promising emerging markets with tailored offerings, and the cultivation of robust, mutually beneficial partnerships across the entire consumer goods industry value chain. The future potential of this market is substantial, promising significant rewards and competitive advantages for those companies adept at anticipating and rapidly adapting to evolving consumer preferences, dynamic regulatory landscapes, and emerging technological advancements.

Consumer Goods Contract Packaging Market Segmentation

-

1. Packaging

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Household and Personal Care

- 2.5. Other End-user Industries

Consumer Goods Contract Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Netherlands

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Consumer Goods Contract Packaging Market Regional Market Share

Geographic Coverage of Consumer Goods Contract Packaging Market

Consumer Goods Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Increasing Demand from the E-commerce Industry; Increasing Need for Latest Technology and Innovative Packaging

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Competition from In-house Packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceuticals is Expected to Experience Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Household and Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Packaging

- 6. North America Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging

- 6.1.1. Primary

- 6.1.2. Secondary

- 6.1.3. Tertiary

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Household and Personal Care

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Packaging

- 7. Europe Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging

- 7.1.1. Primary

- 7.1.2. Secondary

- 7.1.3. Tertiary

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Household and Personal Care

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Packaging

- 8. Asia Pacific Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging

- 8.1.1. Primary

- 8.1.2. Secondary

- 8.1.3. Tertiary

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Household and Personal Care

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Packaging

- 9. Latin America Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging

- 9.1.1. Primary

- 9.1.2. Secondary

- 9.1.3. Tertiary

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Household and Personal Care

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Packaging

- 10. Middle East and Africa Consumer Goods Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging

- 10.1.1. Primary

- 10.1.2. Secondary

- 10.1.3. Tertiary

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Household and Personal Care

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Packaging

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jones Healthcare Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UNICEP Packaging LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aaron Thomas Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pharma Tech Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Reed Lane Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Multipack Solutions LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Complete Co-Packing Services Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sharp Packaging Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Budelpack Poortvliet BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stamar Packaging Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Green Packaging Asia

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Jones Healthcare Group

List of Figures

- Figure 1: Global Consumer Goods Contract Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 3: North America Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 4: North America Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 9: Europe Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 10: Europe Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 15: Asia Pacific Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 16: Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 21: Latin America Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 22: Latin America Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Consumer Goods Contract Packaging Market Revenue (Million), by Packaging 2025 & 2033

- Figure 27: Middle East and Africa Consumer Goods Contract Packaging Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 28: Middle East and Africa Consumer Goods Contract Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Consumer Goods Contract Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Consumer Goods Contract Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Consumer Goods Contract Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 2: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 5: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 10: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Netherlands Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 20: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Consumer Goods Contract Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 27: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Packaging 2020 & 2033

- Table 30: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Consumer Goods Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Goods Contract Packaging Market?

The projected CAGR is approximately 8.69%.

2. Which companies are prominent players in the Consumer Goods Contract Packaging Market?

Key companies in the market include Jones Healthcare Group, UNICEP Packaging LLC, Aaron Thomas Company, Pharma Tech Industries Inc, Reed Lane Inc, Multipack Solutions LLC, Complete Co-Packing Services Ltd*List Not Exhaustive, Sharp Packaging Services, Budelpack Poortvliet BV, Stamar Packaging Inc, Green Packaging Asia.

3. What are the main segments of the Consumer Goods Contract Packaging Market?

The market segments include Packaging, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations; Increasing Demand from the E-commerce Industry; Increasing Need for Latest Technology and Innovative Packaging.

6. What are the notable trends driving market growth?

Pharmaceuticals is Expected to Experience Significant Growth.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Competition from In-house Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Goods Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Goods Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Goods Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Consumer Goods Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence