Key Insights

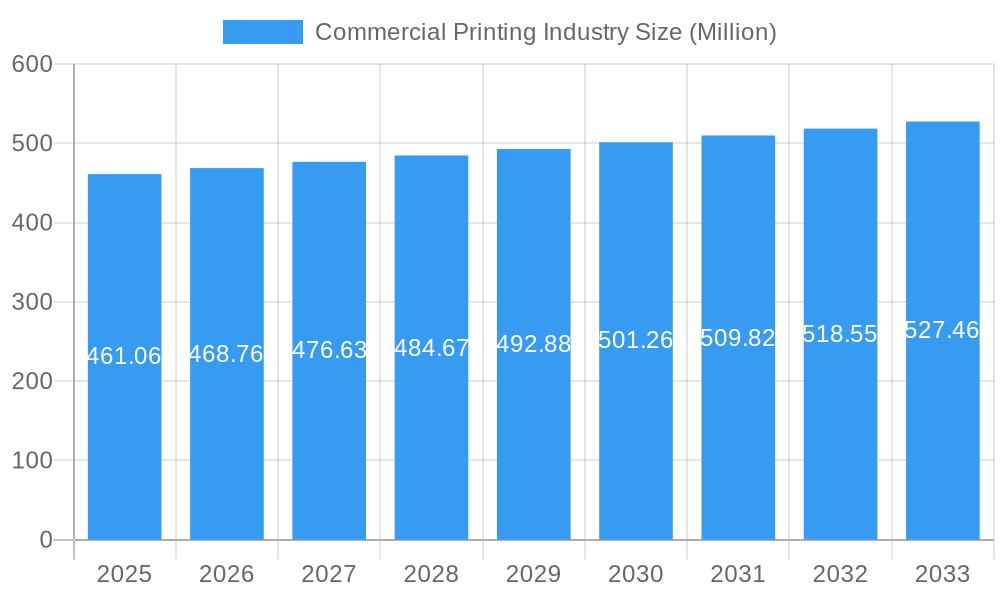

The global commercial printing market, valued at $461.06 million in 2025, is projected to experience steady growth, driven primarily by the continued demand for packaging solutions across various industries. The rise of e-commerce and the need for efficient, attractive product packaging are major catalysts. Growth in advertising and publishing, while potentially slower than packaging, will also contribute to overall market expansion. Offset lithography remains a dominant printing type, benefiting from its scalability and cost-effectiveness for large-volume printing jobs. However, inkjet and other digital printing methods are gaining traction, particularly for shorter print runs and personalized marketing materials. The market's growth is tempered by factors like the increasing adoption of digital marketing and the ongoing shift towards electronic documentation. This transition necessitates adaptation and innovation within the commercial printing sector, with a focus on value-added services and specialized printing solutions.

Commercial Printing Industry Market Size (In Million)

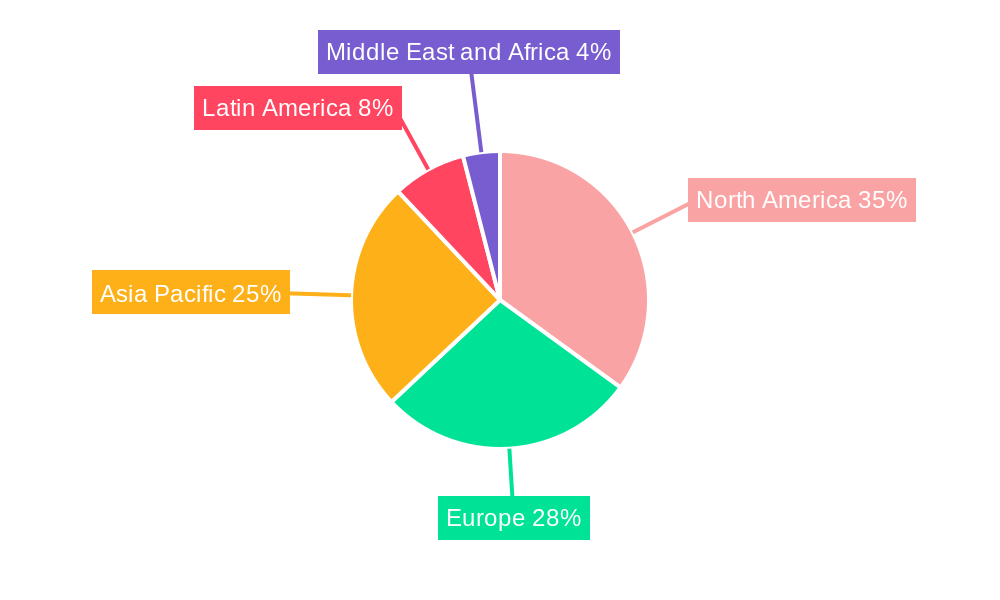

Despite the challenges, the market is expected to see a compound annual growth rate (CAGR) of 1.67% from 2025 to 2033. This indicates a gradual but sustained expansion. Regional variations in growth are likely, with mature markets like North America and Europe exhibiting potentially slower growth compared to emerging economies in Asia Pacific and Latin America, where increased disposable income and expanding industries are driving demand for printed materials. The competitive landscape is characterized by both large multinational corporations and smaller, specialized printing companies. Consolidation and strategic partnerships are expected as companies adapt to changing market dynamics and seek to optimize operations and offer a broader range of services. Successful players will leverage technology to improve efficiency, reduce costs, and offer customized printing solutions tailored to specific client needs.

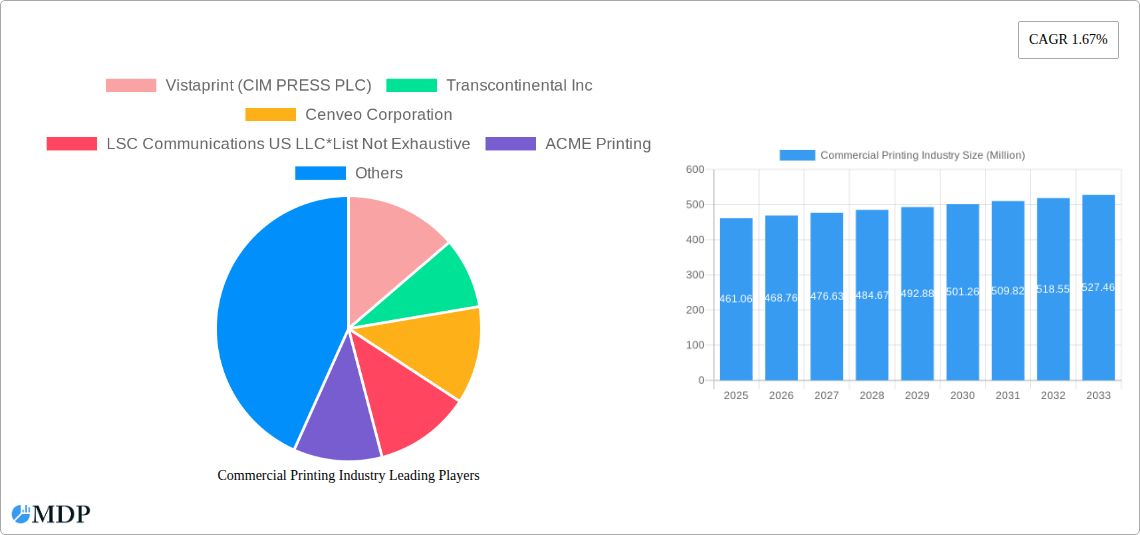

Commercial Printing Industry Company Market Share

Commercial Printing Industry Market Report: 2019-2033

Uncover lucrative growth opportunities and navigate the evolving landscape of the $XX Million Commercial Printing market. This comprehensive report provides an in-depth analysis of the commercial printing industry, covering market dynamics, leading players, technological advancements, and future projections from 2019 to 2033. Ideal for industry stakeholders, investors, and strategic decision-makers seeking actionable insights to thrive in this dynamic sector.

Commercial Printing Industry Market Dynamics & Concentration

The global commercial printing market, valued at $XX Million in 2024, is expected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). Market concentration is moderate, with several key players holding significant shares. Vistaprint (CIM PRESS PLC), Transcontinental Inc, Cenveo Corporation, and LSC Communications US LLC are among the prominent players, though the market also includes numerous smaller, specialized printers like ACME Printing, R R Donnelley & Sons, and Toppan Co Limited.

- Market Share: The top 5 players collectively hold approximately XX% of the market share in 2024.

- M&A Activity: The historical period (2019-2024) witnessed approximately XX M&A deals, driven by consolidation efforts and expansion strategies. This activity is predicted to continue at a similar pace during the forecast period.

- Innovation Drivers: Sustainability initiatives (e.g., eco-friendly inks) and technological advancements (e.g., digital printing technologies) are key drivers of innovation.

- Regulatory Frameworks: Environmental regulations regarding waste management and ink composition are influencing market dynamics.

- Product Substitutes: Digital printing and online solutions present significant competitive pressure, impacting traditional offset lithography.

- End-User Trends: Increased demand for personalized and on-demand printing services is shaping market trends.

Commercial Printing Industry Industry Trends & Analysis

The commercial printing industry is experiencing a period of transformation. While traditional methods like offset lithography remain significant, the market is witnessing a robust shift towards digital printing technologies. This shift is driven by factors such as the increasing demand for shorter print runs, personalized content, and faster turnaround times. The overall market growth is being influenced by several key factors:

- Technological Disruptions: The rise of digital printing and automation is increasing efficiency and reducing costs.

- Consumer Preferences: Demand for personalized and customized printing services is on the rise.

- Competitive Dynamics: Intense competition, especially from digital printing providers, is shaping pricing strategies and service offerings.

- Market Growth Drivers: Growth in packaging, advertising, and publishing sectors fuels demand for commercial printing services. The projected CAGR reflects a consistent, albeit moderate, growth trajectory across these segments.

- Market Penetration: Digital printing's market penetration is steadily increasing, particularly within the advertising and short-run printing segments.

Leading Markets & Segments in Commercial Printing Industry

The North American region currently dominates the commercial printing market, driven by a robust economy and significant demand from various sectors. However, growth in Asia-Pacific, particularly in emerging economies, is expected to increase.

By Type:

- Offset Lithography: Remains the dominant segment due to its cost-effectiveness for large-scale printing. Key drivers include established infrastructure and economies of scale.

- Digital Printing (Inkjet): Demonstrates the fastest growth, driven by its ability to produce personalized and on-demand printing.

- Flexographic, Screen, Gravure: These niche segments cater to specific applications, with relatively stable growth rates.

- Other Types: This segment encompasses emerging technologies and specialized printing methods.

By Application:

- Packaging: A significant and consistently growing segment driven by the demand for high-quality packaging across diverse industries.

- Advertising: Subject to market fluctuations, though digital printing solutions are increasing penetration.

- Publishing: Relatively stable, though facing competition from digital alternatives.

Regional dominance stems from factors such as strong economic growth, developed infrastructure, and a well-established printing industry.

Commercial Printing Industry Product Developments

Recent innovations focus on sustainable materials, enhanced personalization options, and faster turnaround times. The introduction of eco-friendly inks, like Siegwerk's SICURA Litho Pack ECO, highlights a growing emphasis on sustainability. Furthermore, technological advancements like Toppan's light-activated hologram demonstrate innovative security features. These developments enhance product differentiation and cater to evolving market demands.

Key Drivers of Commercial Printing Industry Growth

Technological advancements (digital printing, automation), economic growth in developing economies, and increasing demand for personalized printing are key growth drivers. Government initiatives promoting sustainable printing practices are further influencing market expansion.

Challenges in the Commercial Printing Industry Market

The commercial printing industry faces several challenges: intense competition from digital printing services, rising material costs, fluctuating demand in specific segments (e.g., advertising), and environmental regulations impacting operations. These challenges create pricing pressures and necessitate ongoing innovation.

Emerging Opportunities in Commercial Printing Industry

Strategic partnerships, expansion into emerging markets, and the development of specialized printing services (e.g., high-security printing, 3D printing) present significant growth opportunities. Technological breakthroughs in sustainable and personalized printing solutions continue to provide lucrative avenues for growth.

Leading Players in the Commercial Printing Industry Sector

- Vistaprint (CIM PRESS PLC)

- Transcontinental Inc

- Cenveo Corporation

- LSC Communications US LLC

- ACME Printing

- R R Donnelley & Sons

- Toppan Co Limited

Key Milestones in Commercial Printing Industry Industry

- June 2022: Toppan developed a light-activated hologram enhancing security features for printed materials.

- May 2022: Siegwerk launched a sustainable UV offset ink, SICURA Litho Pack ECO, with a high bio-renewable content, promoting environmentally conscious practices.

Strategic Outlook for Commercial Printing Industry Market

The commercial printing industry's future hinges on adapting to technological advancements, embracing sustainable practices, and focusing on specialized, high-value services. By strategically focusing on personalization, automation, and environmentally friendly solutions, companies can capitalize on the long-term growth potential of this dynamic market.

Commercial Printing Industry Segmentation

-

1. Printing Type

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Other Printing Types

-

2. Application

- 2.1. Packaging

- 2.2. Advertising

-

2.3. Publishing

- 2.3.1. Books

- 2.3.2. Magazines

- 2.3.3. Newspapers

- 2.3.4. Other Publishing

- 2.4. Other Applications

Commercial Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Commercial Printing Industry Regional Market Share

Geographic Coverage of Commercial Printing Industry

Commercial Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Demand for Promotional Materials from the Retail

- 3.2.2 Food

- 3.2.3 and Beverage Industries; Introduction of Eco-friendly Practices

- 3.3. Market Restrains

- 3.3.1. Increase in Digitization and Rising Dependence on Feedstock Prices

- 3.4. Market Trends

- 3.4.1. Packaging Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Type

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Other Printing Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Advertising

- 5.2.3. Publishing

- 5.2.3.1. Books

- 5.2.3.2. Magazines

- 5.2.3.3. Newspapers

- 5.2.3.4. Other Publishing

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Type

- 6. North America Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Type

- 6.1.1. Offset Lithography

- 6.1.2. Inkjet

- 6.1.3. Flexographic

- 6.1.4. Screen

- 6.1.5. Gravure

- 6.1.6. Other Printing Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Packaging

- 6.2.2. Advertising

- 6.2.3. Publishing

- 6.2.3.1. Books

- 6.2.3.2. Magazines

- 6.2.3.3. Newspapers

- 6.2.3.4. Other Publishing

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Printing Type

- 7. Europe Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Type

- 7.1.1. Offset Lithography

- 7.1.2. Inkjet

- 7.1.3. Flexographic

- 7.1.4. Screen

- 7.1.5. Gravure

- 7.1.6. Other Printing Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Packaging

- 7.2.2. Advertising

- 7.2.3. Publishing

- 7.2.3.1. Books

- 7.2.3.2. Magazines

- 7.2.3.3. Newspapers

- 7.2.3.4. Other Publishing

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Printing Type

- 8. Asia Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Type

- 8.1.1. Offset Lithography

- 8.1.2. Inkjet

- 8.1.3. Flexographic

- 8.1.4. Screen

- 8.1.5. Gravure

- 8.1.6. Other Printing Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Packaging

- 8.2.2. Advertising

- 8.2.3. Publishing

- 8.2.3.1. Books

- 8.2.3.2. Magazines

- 8.2.3.3. Newspapers

- 8.2.3.4. Other Publishing

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Printing Type

- 9. Australia and New Zealand Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Type

- 9.1.1. Offset Lithography

- 9.1.2. Inkjet

- 9.1.3. Flexographic

- 9.1.4. Screen

- 9.1.5. Gravure

- 9.1.6. Other Printing Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Packaging

- 9.2.2. Advertising

- 9.2.3. Publishing

- 9.2.3.1. Books

- 9.2.3.2. Magazines

- 9.2.3.3. Newspapers

- 9.2.3.4. Other Publishing

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Printing Type

- 10. Latin America Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Type

- 10.1.1. Offset Lithography

- 10.1.2. Inkjet

- 10.1.3. Flexographic

- 10.1.4. Screen

- 10.1.5. Gravure

- 10.1.6. Other Printing Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Packaging

- 10.2.2. Advertising

- 10.2.3. Publishing

- 10.2.3.1. Books

- 10.2.3.2. Magazines

- 10.2.3.3. Newspapers

- 10.2.3.4. Other Publishing

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Printing Type

- 11. Middle East and Africa Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Printing Type

- 11.1.1. Offset Lithography

- 11.1.2. Inkjet

- 11.1.3. Flexographic

- 11.1.4. Screen

- 11.1.5. Gravure

- 11.1.6. Other Printing Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Packaging

- 11.2.2. Advertising

- 11.2.3. Publishing

- 11.2.3.1. Books

- 11.2.3.2. Magazines

- 11.2.3.3. Newspapers

- 11.2.3.4. Other Publishing

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Printing Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vistaprint (CIM PRESS PLC)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Transcontinental Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cenveo Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LSC Communications US LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ACME Printing

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 R R Donnelley & Sons

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Toppan Co Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Vistaprint (CIM PRESS PLC)

List of Figures

- Figure 1: Global Commercial Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 3: North America Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 4: North America Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 9: Europe Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 10: Europe Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 15: Asia Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 16: Asia Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 21: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 22: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 27: Latin America Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 28: Latin America Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 33: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 34: Middle East and Africa Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 2: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Commercial Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 5: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 8: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 11: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 14: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 17: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 20: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Printing Industry?

The projected CAGR is approximately 1.67%.

2. Which companies are prominent players in the Commercial Printing Industry?

Key companies in the market include Vistaprint (CIM PRESS PLC), Transcontinental Inc, Cenveo Corporation, LSC Communications US LLC*List Not Exhaustive, ACME Printing, R R Donnelley & Sons, Toppan Co Limited.

3. What are the main segments of the Commercial Printing Industry?

The market segments include Printing Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 461.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Promotional Materials from the Retail. Food. and Beverage Industries; Introduction of Eco-friendly Practices.

6. What are the notable trends driving market growth?

Packaging Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increase in Digitization and Rising Dependence on Feedstock Prices.

8. Can you provide examples of recent developments in the market?

June 2022: Toppan created a hologram that could respond to bright light by displaying text and images. This made verification easier for those who do not have specialized hardware or a QR code.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Printing Industry?

To stay informed about further developments, trends, and reports in the Commercial Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence