Key Insights

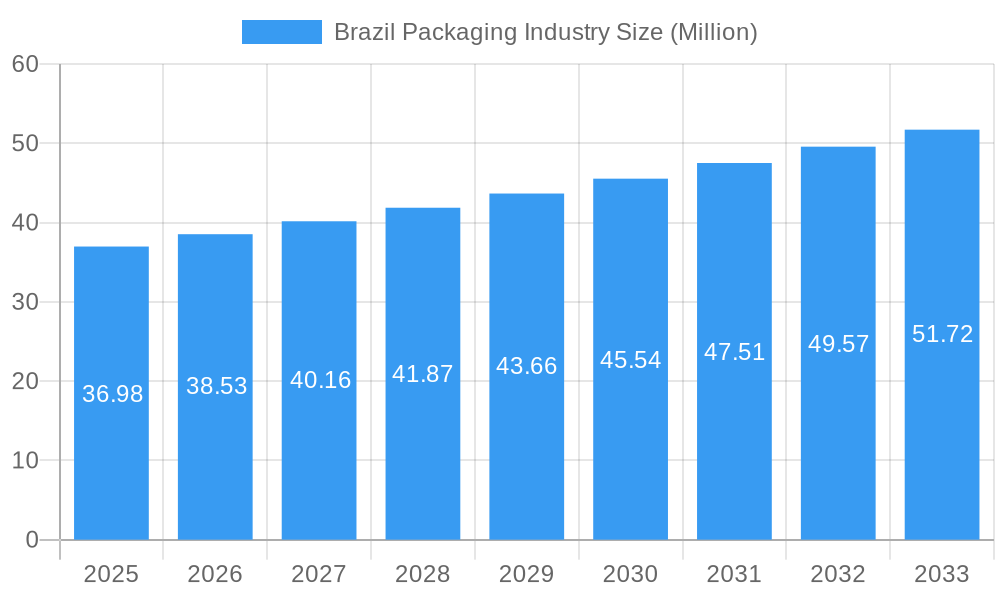

The Brazilian packaging industry, valued at $36.98 million in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.20% from 2025 to 2033. This growth is driven by several factors. The burgeoning food and beverage sector, fueled by a growing population and increasing disposable incomes, is a significant demand driver. The pharmaceutical industry's expansion, coupled with rising consumer demand for packaged goods, further contributes to market expansion. E-commerce's rapid growth in Brazil necessitates innovative and secure packaging solutions, stimulating demand for sustainable and efficient options. While increasing raw material costs present a challenge, the industry is actively adapting by exploring sustainable alternatives like recycled paper and biodegradable plastics, aligning with growing consumer preference for eco-friendly packaging. Key players like WestRock Company, Sonoco Products Company, and Smurfit Kappa Group are strategically investing in research and development to meet these evolving demands and capture market share. The segment breakdown reveals a significant reliance on paper and paperboard packaging, although plastic and metal packaging are also experiencing growth, driven by the needs of specific industries like consumer electronics. The robust growth trajectory of the Brazilian economy, coupled with government initiatives promoting industrial growth, creates a favorable environment for the packaging industry's continued expansion.

Brazil Packaging Industry Market Size (In Million)

The competitive landscape is characterized by a blend of multinational corporations and local players. Multinationals bring advanced technologies and global best practices, while local companies leverage their understanding of the Brazilian market and established distribution networks. This competition fosters innovation and efficiency, ultimately benefiting consumers and the economy. Looking ahead, the industry will need to address challenges such as fluctuating exchange rates and regulatory changes while continuing to invest in sustainable solutions to remain competitive and meet the evolving needs of Brazilian consumers and businesses. Opportunities abound for companies that can offer innovative, sustainable, and cost-effective packaging solutions tailored to the specific requirements of different end-user industries.

Brazil Packaging Industry Company Market Share

Brazil Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil packaging industry, encompassing market dynamics, leading players, key trends, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages data from the historical period (2019-2024) and provides detailed insights into a market valued at xx Million.

Brazil Packaging Industry Market Dynamics & Concentration

The Brazilian packaging market is experiencing robust and dynamic growth, fueled by a confluence of powerful drivers. A continuously rising consumer spending power, coupled with the exponential expansion of the e-commerce sector, is creating unprecedented demand for innovative and reliable packaging solutions. Furthermore, a significant and accelerating shift towards sustainable packaging materials and practices is not just a trend but a fundamental pillar of market evolution. The competitive landscape is characterized by moderate concentration, featuring a strategic interplay between established multinational corporations and a vibrant ecosystem of agile local players vying for significant market share. This intense competition compels companies to continuously prioritize groundbreaking innovation, rigorous cost optimization, and unwavering commitment to sustainable practices as key differentiators for gaining and maintaining a competitive edge.

Market Concentration: The top five players are projected to command approximately [Insert Estimated Percentage, e.g., 55%] of the market share in 2025. The industry is poised for further structural refinement through ongoing consolidation, driven by strategic mergers and acquisitions (M&A), which will undoubtedly reshape the competitive contours of the market.

Innovation Drivers: The escalating demand for packaging that is not only sustainable and lightweight but also highly functional is a potent catalyst for innovation across materials science and advanced manufacturing technologies. This push is amplified by increasingly stringent regulatory pressures aimed at drastically reducing plastic waste and promoting circular economy principles.

Regulatory Frameworks: Evolving government regulations governing material usage, ambitious recycling targets, and comprehensive waste management strategies are profoundly influencing the industry. These frameworks are actively fostering and accelerating the adoption of eco-friendly and recyclable packaging solutions.

Product Substitutes: The continuous emergence and growing viability of alternative packaging materials and innovative technologies present a significant competitive pressure, particularly for traditionally dominant materials like conventional plastics. This drives the need for enhanced performance and environmental credentials.

End-User Trends: Evolving consumer preferences, leaning heavily towards convenience, demonstrable sustainability, and premium packaging aesthetics, are fundamentally reshaping industry priorities. The relentless growth of e-commerce further accentuates the demand for highly protective and efficient packaging designed for transit and delivery.

M&A Activities: The Brazilian packaging industry has witnessed a substantial surge in M&A activities in recent years. Between 2020 and 2024, approximately [Insert Estimated Number, e.g., 30] significant deals were recorded. These transactions underscore the industry's strategic inclination towards consolidation, market expansion, and the acquisition of synergistic capabilities.

Brazil Packaging Industry Industry Trends & Analysis

The Brazilian packaging industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is driven by several factors, including rising disposable incomes, population growth, and increasing demand from diverse end-user industries. Technological advancements, specifically in automation and smart packaging solutions, are further contributing to this expansion. Consumer preferences towards eco-friendly and convenient packaging are shaping market trends, while competitive dynamics necessitate continuous innovation and differentiation. Market penetration of sustainable packaging options is increasing steadily, driven by governmental policies and heightened consumer awareness.

Leading Markets & Segments in Brazil Packaging Industry

Dominant Segments:

- By Material Type: Paper and paperboard currently commands the largest market share, estimated at [Insert Estimated Percentage, e.g., 45%], followed by plastic at [Insert Estimated Percentage, e.g., 30%], metal at [Insert Estimated Percentage, e.g., 15%], and glass at [Insert Estimated Percentage, e.g., 10%]. The burgeoning demand for sustainable and recyclable alternatives is a significant growth accelerator for paper-based packaging solutions.

- By End-user Industry: The food and beverage sector remains the dominant force in the packaging market, accounting for approximately [Insert Estimated Percentage, e.g., 60%], with personal and homecare following at [Insert Estimated Percentage, e.g., 15%], pharmaceuticals at [Insert Estimated Percentage, e.g., 10%], and consumer electronics at [Insert Estimated Percentage, e.g., 8%].

Key Drivers by Segment:

- Food & Beverage: Continuous growth in demand for convenient and safe packaged food and beverages, stringent food safety regulations, and the rapid expansion of e-grocery platforms are key drivers propelling this segment's robust growth.

- Personal/Homecare: Increased consumer discretionary spending on personal care products and a discernible shift towards innovative and user-friendly packaging formats are significantly fueling growth in this dynamic sector.

- Pharmaceutical: The pharmaceutical industry necessitates highly specialized packaging solutions that adhere to exacting standards for safety, sterility, and tamper-proofing, fostering consistent and sector-specific market expansion.

- Consumer Electronics: Growth in this segment is directly correlated with the increasing sales volumes of electronic devices, which require robust and protective packaging to ensure integrity during shipping and handling.

Regional Dominance: The Southeast region of Brazil continues to be the largest contributor to the packaging market, largely due to its high concentration of industrial manufacturing and a more substantial consumer base. However, other regions are experiencing noteworthy growth, propelled by ongoing infrastructure development and rising disposable incomes, indicating a more dispersed future market landscape.

Brazil Packaging Industry Product Developments

Recent product innovations focus on sustainable materials like recycled plastics and biodegradable polymers. Advances in flexible packaging, such as stand-up pouches and retort packaging, offer convenience and extended shelf life. Smart packaging incorporating RFID technology and traceability systems are gaining traction, improving supply chain efficiency and enhancing consumer engagement. These innovations address the increasing demand for sustainable, convenient, and technologically advanced packaging solutions, enhancing the competitive advantage of companies embracing these trends.

Key Drivers of Brazil Packaging Industry Growth

Several pivotal factors are collectively propelling the sustained growth of the Brazilian packaging industry:

- Economic Resilience and Growth: A steadily increasing disposable income and an expanding middle class are directly translating into higher consumer spending on a diverse range of packaged goods.

- E-commerce Expansion: The unparalleled and rapid expansion of e-commerce operations worldwide, including in Brazil, mandates the development and widespread adoption of highly efficient, protective, and cost-effective packaging solutions.

- Proactive Government Regulations: Supportive government policies actively promoting sustainable packaging practices, circular economy principles, and responsible waste management are acting as powerful incentives for the industry to adopt and innovate with eco-friendly materials and processes.

- Technological Advancements: The integration of cutting-edge technologies such as automation in manufacturing, the development of "smart" packaging solutions, and continuous innovation in materials science are significantly enhancing operational efficiency, improving product appeal, and offering enhanced functionality.

Challenges in the Brazil Packaging Industry Market

The Brazilian packaging industry navigates a complex set of challenges that require strategic foresight and adaptive solutions:

- Fluctuating Raw Material Prices: The inherent volatility in the global and domestic prices of key raw materials, including plastic resins, paper pulp, and metals, presents a significant challenge to maintaining stable profitability and predictable pricing strategies.

- Stringent Environmental Regulations: Increasingly rigorous environmental regulations, while essential for sustainability, necessitate substantial investment in compliance, the adoption of new technologies, and potentially increased operational costs.

- Supply Chain Disruptions: Logistical complexities, infrastructural limitations, and occasional disruptions within the national and international supply chains can impede the timely and efficient delivery of essential packaging materials, impacting production schedules and customer commitments.

- Intense Market Competition: The presence of both globally recognized multinational players and a dynamic array of innovative local firms fosters a highly competitive market environment, demanding continuous innovation, superior product quality, and competitive pricing.

Emerging Opportunities in Brazil Packaging Industry

The long-term growth of the Brazilian packaging market hinges on several opportunities:

- Sustainable Packaging Solutions: Growing demand for eco-friendly and recyclable packaging creates opportunities for innovative companies.

- E-commerce Packaging: The continued growth of e-commerce will drive demand for specialized packaging solutions designed for online deliveries.

- Smart Packaging Technologies: Integrating technology into packaging offers opportunities for brand enhancement and supply chain optimization.

- Strategic Partnerships and Joint Ventures: Collaborations between packaging manufacturers and consumer goods companies can foster innovation and market expansion.

Leading Players in the Brazil Packaging Industry Sector

- WestRock Company

- Sonoco Products Company

- SSI Schaefer LTDA

- Smurfit Kappa Group

- NEFAB Embalagens LTDA

- Graphic Packaging International LLC

- Trivium Packaging

- Amcor PLC

- Tetra Pak International SA

- Klabin SA

Key Milestones in Brazil Packaging Industry Industry

- May 2022: The Ardagh Group announced a new glass production facility in Juiz de Fora, Minas Gerais, signaling investment in sustainable packaging solutions and job creation.

- November 2022: Launch of a new online platform by the Brazilian Plastics Institute, Think Plastic Brazil, and ApexBrasil, promoting innovation and sustainability in the plastics industry. This highlights the industry's focus on sustainable practices and design. Unilever's successful launch of refill packs further solidified this trend.

- March 2023: Amcor and Nfinite Nanotechnology Inc.'s collaborative research project highlights the industry's commitment to developing recyclable and compostable packaging through technological advancements.

Strategic Outlook for Brazil Packaging Industry Market

The Brazilian packaging industry is poised for continued growth, driven by increasing consumer demand, technological innovation, and a focus on sustainability. Opportunities exist for companies to capitalize on the expanding e-commerce market, invest in sustainable packaging solutions, and leverage technological advancements to enhance efficiency and product appeal. Strategic partnerships and collaborations will be key to navigating the competitive landscape and achieving long-term success. The market's future is bright, with potential for significant expansion across various segments and regions.

Brazil Packaging Industry Segmentation

-

1. Material Type

- 1.1. Paper and Paperboard

- 1.2. Plastic

- 1.3. Metal

- 1.4. Glass

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Consumer Electronics

- 2.5. Personal/Homecare

- 2.6. Other End-user Industries

Brazil Packaging Industry Segmentation By Geography

- 1. Brazil

Brazil Packaging Industry Regional Market Share

Geographic Coverage of Brazil Packaging Industry

Brazil Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Longer-Lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Paper and Paperboard to be the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Consumer Electronics

- 5.2.5. Personal/Homecare

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WestRock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SSI Schaefer LTDA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Smurfit Kappa Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NEFAB Embalagens LTDA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Graphic Packaging International LLC*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trivium Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tetra Pak International SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Klabin SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 WestRock Company

List of Figures

- Figure 1: Brazil Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Brazil Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Brazil Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Brazil Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Brazil Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Brazil Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Packaging Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Brazil Packaging Industry?

Key companies in the market include WestRock Company, Sonoco Products Company, SSI Schaefer LTDA, Smurfit Kappa Group, NEFAB Embalagens LTDA, Graphic Packaging International LLC*List Not Exhaustive, Trivium Packaging, Amcor PLC, Tetra Pak International SA, Klabin SA.

3. What are the main segments of the Brazil Packaging Industry?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Longer-Lasting Packaging Products; Rising Demand for Sustainable and Innovative Food Packaging Products.

6. What are the notable trends driving market growth?

Paper and Paperboard to be the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations.

8. Can you provide examples of recent developments in the market?

March 2023: Amcor and Nfinite Nanotechnology Inc. revealed a collaborative research project agreement aimed at testing the potential of Nfinite's nanocoating technology to enhance the recyclable and compostable packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Packaging Industry?

To stay informed about further developments, trends, and reports in the Brazil Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence