Key Insights

The bioplastic packaging market is poised for significant expansion, fueled by increasing consumer preference for sustainable alternatives and stringent environmental regulations. With a projected Compound Annual Growth Rate (CAGR) of 17.2%, the market is expected to reach a size of $24.71 billion by 2025. Key growth drivers include heightened environmental consciousness, the rising demand for compostable and biodegradable packaging, and widespread adoption across food, beverage, pharmaceutical, and personal care sectors. Polylactic Acid (PLA) and Polybutylene Adipate Terephthalate (PBAT) are leading biomaterial types, with rigid and flexible packaging formats dominating product segments. While North America and Europe currently lead market share, the Asia-Pacific region presents substantial growth potential driven by economic development and rising disposable incomes.

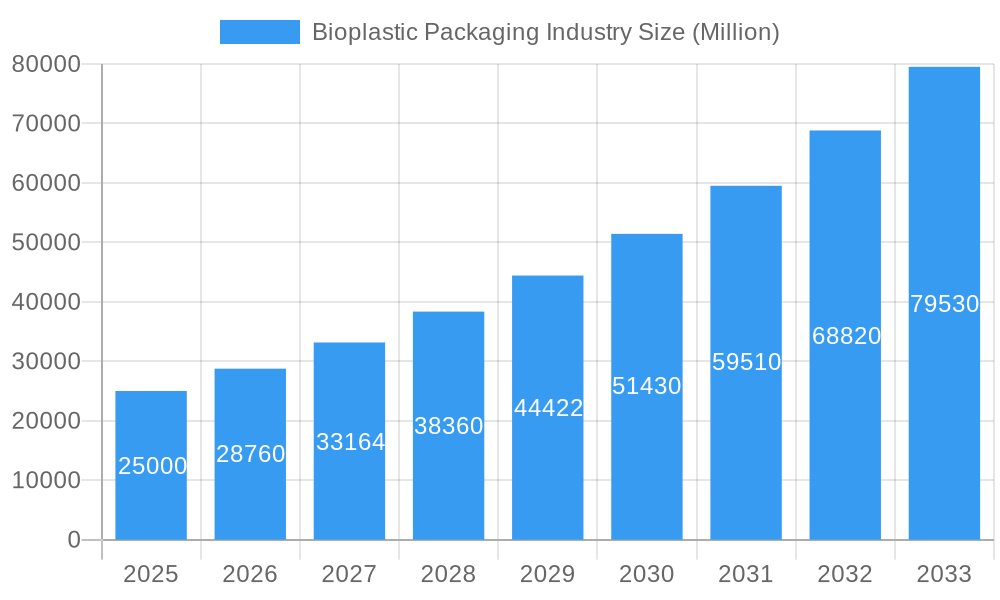

Bioplastic Packaging Industry Market Size (In Billion)

Challenges persist, including higher production costs compared to conventional plastics and the necessity for improved recycling and composting infrastructure. Enhancing the performance characteristics of certain bioplastics is also critical for broader application suitability. The competitive environment features established players and innovative startups, with strategic collaborations, mergers, acquisitions, and continuous product development shaping the industry landscape. Overcoming scalability and cost-effectiveness hurdles, alongside developing fully compostable and recyclable solutions, will be vital for realizing the sector's full potential. Ongoing governmental support and sustained consumer demand for eco-friendly products will further accelerate market growth.

Bioplastic Packaging Industry Company Market Share

Bioplastic Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the bioplastic packaging industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to present a clear picture of current trends and future projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

This report covers key aspects of the bioplastic packaging market, including market size, segmentation analysis, leading companies, and future growth prospects. It provides actionable insights into various segments, including material types (BIO-PET, BIO-PE, BIO-PA, PLA, PBAT, PHA, and others), product types (rigid and flexible packaging), and end-user industries (food, beverage, pharmaceuticals, and more).

High-traffic keywords: Bioplastic packaging market, biodegradable packaging, bioplastics industry, sustainable packaging, PLA packaging, PBAT packaging, PHA packaging, bio-based polymers, food packaging, flexible packaging, rigid packaging, market analysis, market forecast, industry trends, competitive landscape, market growth, leading companies.

Bioplastic Packaging Industry Market Dynamics & Concentration

The bioplastic packaging market is characterized by a dynamic interplay of factors driving both growth and challenges. Market concentration is currently moderate, with several major players holding significant market share, but a fragmented landscape also exists with many smaller specialized companies. Key players like BASF SE and Amcor Limited exert influence, yet emerging businesses are continuously innovating, driving competition. The market share of the top 5 players is estimated at xx%, indicating a degree of consolidation, but this is expected to shift with further M&A activity.

Innovation Drivers: The industry is heavily influenced by the increasing demand for sustainable and eco-friendly packaging solutions. This is fueled by stringent environmental regulations and growing consumer awareness of plastic pollution. Technological advancements in biopolymer production and processing are further driving innovation.

Regulatory Frameworks: Government regulations concerning plastic waste and the promotion of sustainable materials are significant catalysts for market growth. Varying regulations across different regions, however, present challenges for global players. The EU's single-use plastics directive, for example, is a major driver.

Product Substitutes: While bioplastic packaging offers an alternative to conventional plastics, it faces competition from other sustainable packaging materials, such as paper, cardboard, and glass. The cost-effectiveness and performance of bioplastics compared to these alternatives significantly impact market dynamics.

End-User Trends: The food and beverage industry is currently the largest end-user segment for bioplastic packaging, driven by consumer preference for eco-friendly products and retailer sustainability initiatives. However, growth is expanding into other sectors like pharmaceuticals and personal care.

M&A Activities: The past five years have seen xx M&A deals in the bioplastic packaging sector, indicating ongoing consolidation and strategic expansion by major players. These activities are primarily aimed at acquiring specialized technologies, expanding market reach, and securing access to raw materials.

Bioplastic Packaging Industry Industry Trends & Analysis

The bioplastic packaging market is experiencing robust growth, driven by a confluence of factors. The rising global consciousness regarding environmental sustainability is a primary driver, leading to increased consumer demand for eco-friendly alternatives to traditional plastic packaging. This is further amplified by governmental regulations promoting the reduction of plastic waste and incentivizing the adoption of sustainable packaging solutions. The market witnessed a CAGR of xx% from 2019 to 2024.

Technological advancements are continuously improving the biodegradability, performance, and cost-effectiveness of bioplastic materials. Innovations in polymer chemistry and manufacturing processes are broadening the range of applications for bioplastics in packaging. Furthermore, the development of compostable bioplastics is attracting increasing consumer interest and driving market expansion. Market penetration of bioplastic packaging is estimated at xx% globally in 2025, with higher rates observed in certain regions and for specific applications.

Competitive dynamics within the industry are shaping the landscape. Established players are investing heavily in R&D, expanding production capacity, and forging strategic partnerships to maintain their market position. New entrants are entering the market with innovative products and business models, leading to increased competition and market innovation. Pricing pressures, however, remain a challenge for many industry players.

Leading Markets & Segments in Bioplastic Packaging Industry

The bioplastic packaging market is geographically diverse, with significant variations in growth rates and market share across different regions. While exact figures vary depending on the specific segment, Europe and North America are currently leading the market due to stringent environmental regulations, heightened consumer awareness, and a well-established recycling infrastructure. Asia-Pacific is expected to witness the fastest growth in the coming years, driven by increasing industrialization and rising disposable incomes in several key markets.

Key Drivers by Region:

- Europe: Strong environmental regulations, consumer awareness of sustainability, well-developed recycling infrastructure.

- North America: Growing demand for sustainable packaging, increasing adoption of compostable plastics, government initiatives to reduce plastic waste.

- Asia-Pacific: Rapid economic growth, expanding middle class, increasing demand for consumer goods, and government support for sustainable development.

Dominant Segments:

- By Material Type: PLA and PBAT currently dominate the market due to their balance of cost, performance, and biodegradability. PHA is experiencing rapid growth due to its exceptional biodegradability, but its cost remains a challenge for widespread adoption.

- By Product Type: Flexible packaging currently holds the larger market share, driven by high demand from the food and beverage industry. However, the rigid packaging segment is growing rapidly due to innovations in material properties and manufacturing technology.

- By End-user Industry: The food and beverage industry continues to be the largest end-user, followed by pharmaceuticals and personal care.

Bioplastic Packaging Industry Product Developments

Recent years have witnessed significant advancements in bioplastic packaging materials, focusing on improved biodegradability, barrier properties, and processability. Innovations include the development of bioplastics with enhanced mechanical strength, heat resistance, and water vapor barrier properties, extending their applicability across diverse packaging formats. Companies are also focusing on developing compostable and industrially compostable materials, expanding options for end-of-life management. This has led to increased market fit across various applications.

Key Drivers of Bioplastic Packaging Industry Growth

The bioplastic packaging market is fueled by a potent combination of factors. Stringent environmental regulations worldwide are driving the shift away from conventional plastics. Increasing consumer awareness of environmental issues and preference for sustainable products are creating significant demand. Furthermore, technological advancements in biopolymer production are making bioplastics more cost-competitive and performance-efficient. The rising demand for sustainable packaging in the food and beverage sector is also a major contributing factor. The development of improved biodegradation and composting infrastructure further encourages market growth.

Challenges in the Bioplastic Packaging Industry Market

The bioplastic packaging industry faces several challenges. The higher cost of bioplastics compared to conventional plastics remains a major hurdle to wider adoption, particularly in price-sensitive markets. Inconsistencies in biodegradability standards and infrastructure create uncertainties in end-of-life management. The availability and cost of raw materials for bioplastic production are also important factors influencing overall market growth. Supply chain disruptions and the need to compete with established packaging materials like paper and glass are additional difficulties. The overall impact of these factors is estimated to have reduced the growth rate by xx% in 2024.

Emerging Opportunities in Bioplastic Packaging Industry

The bioplastic packaging market presents substantial long-term growth opportunities. Advancements in biopolymer technology, leading to improved performance and reduced costs, are opening new applications. Strategic partnerships between bioplastic producers, packaging companies, and brand owners are fostering innovation and driving market penetration. The expansion into emerging markets in Asia and Africa, coupled with rising consumer awareness of sustainability, presents vast potential for growth. The development of innovative packaging solutions tailored to specific end-user needs offers further opportunities.

Leading Players in the Bioplastic Packaging Industry Sector

- Plasto Manufacturing Company

- Minima Technology

- Arkema SA

- Alpagro Packaging

- Taghleef Industries Group

- BASF SE

- Plastic Suppliers Inc

- Mondi PLC

- Mitsubishi Chemicals Corporation

- Element Packaging Ltd

- Eastman Chemical Company

- Treemera GmbH

- Tipa-corp Ltd

- FKuR Ploymers GmbH

- COMPOSTPACK SAS

- Biogreen Packaging Pvt Ltd

- Tetra Pak International SA

- Biome Bioplastics Limited

- Amcor Limited

- Raepak Ltd

Key Milestones in Bioplastic Packaging Industry Industry

- January 2022: Vikas Ecotech Limited announced plans to invest in PHA technology, aiming to produce biodegradable plastics through a potential joint venture with Aurapha Private Ltd. This signaled a move towards more sustainable solutions and increased competition in the PHA segment.

- August 2022: LG Chem Ltd. and Archer Daniels Midland Co. (ADM) partnered to build two biodegradable plastics manufacturing plants in Illinois, US. This significant investment underscored the growing interest in bioplastics for food packaging applications and increased capacity for biodegradable plastics.

Strategic Outlook for Bioplastic Packaging Industry Market

The future of the bioplastic packaging market appears bright. Continued technological advancements, driven by R&D investments and strategic collaborations, will further enhance the performance and cost-effectiveness of bioplastics. Growing regulatory pressures globally will accelerate the transition towards sustainable packaging solutions. Expanding consumer demand for eco-friendly products will continue to drive market growth. Companies that can effectively address the challenges of cost, scalability, and end-of-life management will be best positioned to capitalize on the significant growth opportunities in this sector. The market's potential for innovation and sustainability makes it a highly attractive area for investment and development.

Bioplastic Packaging Industry Segmentation

-

1. Material Type

- 1.1. BIO - PET

- 1.2. BIO - PE

- 1.3. BIO - PA

- 1.4. Other Bio-Based/Non-Biodegradable Materials

- 1.5. Starch Blends

- 1.6. PLA

- 1.7. PBAT

- 1.8. PHA

- 1.9. Other Biodegradable Materials

-

2. Product Type

- 2.1. Rigid Pl

- 2.2. Flexible

-

3. End-user Industries

- 3.1. Food

- 3.2. Beverage

- 3.3. Pharmaceuticals

- 3.4. Personal Care & Household Care

- 3.5. Other End-user Applications

Bioplastic Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Bioplastic Packaging Industry Regional Market Share

Geographic Coverage of Bioplastic Packaging Industry

Bioplastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Stringent Government Regulations against the Use of Conventional Plastics; Increased Usage of Green Products

- 3.2.2 Sustainability

- 3.2.3 and Inclination toward Environment Protection

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Rigid Packaging to Hold Dominant Position in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. BIO - PET

- 5.1.2. BIO - PE

- 5.1.3. BIO - PA

- 5.1.4. Other Bio-Based/Non-Biodegradable Materials

- 5.1.5. Starch Blends

- 5.1.6. PLA

- 5.1.7. PBAT

- 5.1.8. PHA

- 5.1.9. Other Biodegradable Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Rigid Pl

- 5.2.2. Flexible

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Pharmaceuticals

- 5.3.4. Personal Care & Household Care

- 5.3.5. Other End-user Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. BIO - PET

- 6.1.2. BIO - PE

- 6.1.3. BIO - PA

- 6.1.4. Other Bio-Based/Non-Biodegradable Materials

- 6.1.5. Starch Blends

- 6.1.6. PLA

- 6.1.7. PBAT

- 6.1.8. PHA

- 6.1.9. Other Biodegradable Materials

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Rigid Pl

- 6.2.2. Flexible

- 6.3. Market Analysis, Insights and Forecast - by End-user Industries

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Pharmaceuticals

- 6.3.4. Personal Care & Household Care

- 6.3.5. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. BIO - PET

- 7.1.2. BIO - PE

- 7.1.3. BIO - PA

- 7.1.4. Other Bio-Based/Non-Biodegradable Materials

- 7.1.5. Starch Blends

- 7.1.6. PLA

- 7.1.7. PBAT

- 7.1.8. PHA

- 7.1.9. Other Biodegradable Materials

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Rigid Pl

- 7.2.2. Flexible

- 7.3. Market Analysis, Insights and Forecast - by End-user Industries

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Pharmaceuticals

- 7.3.4. Personal Care & Household Care

- 7.3.5. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. BIO - PET

- 8.1.2. BIO - PE

- 8.1.3. BIO - PA

- 8.1.4. Other Bio-Based/Non-Biodegradable Materials

- 8.1.5. Starch Blends

- 8.1.6. PLA

- 8.1.7. PBAT

- 8.1.8. PHA

- 8.1.9. Other Biodegradable Materials

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Rigid Pl

- 8.2.2. Flexible

- 8.3. Market Analysis, Insights and Forecast - by End-user Industries

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Pharmaceuticals

- 8.3.4. Personal Care & Household Care

- 8.3.5. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. BIO - PET

- 9.1.2. BIO - PE

- 9.1.3. BIO - PA

- 9.1.4. Other Bio-Based/Non-Biodegradable Materials

- 9.1.5. Starch Blends

- 9.1.6. PLA

- 9.1.7. PBAT

- 9.1.8. PHA

- 9.1.9. Other Biodegradable Materials

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Rigid Pl

- 9.2.2. Flexible

- 9.3. Market Analysis, Insights and Forecast - by End-user Industries

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Pharmaceuticals

- 9.3.4. Personal Care & Household Care

- 9.3.5. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Bioplastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. BIO - PET

- 10.1.2. BIO - PE

- 10.1.3. BIO - PA

- 10.1.4. Other Bio-Based/Non-Biodegradable Materials

- 10.1.5. Starch Blends

- 10.1.6. PLA

- 10.1.7. PBAT

- 10.1.8. PHA

- 10.1.9. Other Biodegradable Materials

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Rigid Pl

- 10.2.2. Flexible

- 10.3. Market Analysis, Insights and Forecast - by End-user Industries

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Pharmaceuticals

- 10.3.4. Personal Care & Household Care

- 10.3.5. Other End-user Applications

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Plasto Manufacturing Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Minima Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arkema SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alpagro Packaging

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taghleef Industries Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Plastic Suppliers Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mondi PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Chemicals Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Element Packaging Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eastman Chemical Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Treemera GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tipa-corp Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 FKuR Ploymers GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 COMPOSTPACK SAS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Biogreen Packaging Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tetra Pak International SA*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Biome Bioplastics Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Amcor Limited

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Raepak Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Plasto Manufacturing Company

List of Figures

- Figure 1: Global Bioplastic Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 7: North America Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 8: North America Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 11: Europe Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Europe Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 15: Europe Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 16: Europe Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 23: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Asia Pacific Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Latin America Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Latin America Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Latin America Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 31: Latin America Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 32: Latin America Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 35: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by End-user Industries 2025 & 2033

- Figure 39: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 40: Middle East and Africa Bioplastic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Bioplastic Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 4: Global Bioplastic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 8: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 16: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 19: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 20: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Bioplastic Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 22: Global Bioplastic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Bioplastic Packaging Industry Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 24: Global Bioplastic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bioplastic Packaging Industry?

The projected CAGR is approximately 17.2%.

2. Which companies are prominent players in the Bioplastic Packaging Industry?

Key companies in the market include Plasto Manufacturing Company, Minima Technology, Arkema SA, Alpagro Packaging, Taghleef Industries Group, BASF SE, Plastic Suppliers Inc, Mondi PLC, Mitsubishi Chemicals Corporation, Element Packaging Ltd, Eastman Chemical Company, Treemera GmbH, Tipa-corp Ltd, FKuR Ploymers GmbH, COMPOSTPACK SAS, Biogreen Packaging Pvt Ltd, Tetra Pak International SA*List Not Exhaustive, Biome Bioplastics Limited, Amcor Limited, Raepak Ltd.

3. What are the main segments of the Bioplastic Packaging Industry?

The market segments include Material Type, Product Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations against the Use of Conventional Plastics; Increased Usage of Green Products. Sustainability. and Inclination toward Environment Protection.

6. What are the notable trends driving market growth?

Rigid Packaging to Hold Dominant Position in the Market.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2022: LG Chem Ltd., the largest Korean chemical firm, announced a partnership with the US-based food processing organization Archer Daniels Midland Co. (ADM) to build two manufacturing plants in Illinois, US. The production facilities will be manufacturing biodegradable plastics that are extensively used in food packaging applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bioplastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bioplastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bioplastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Bioplastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence