Key Insights

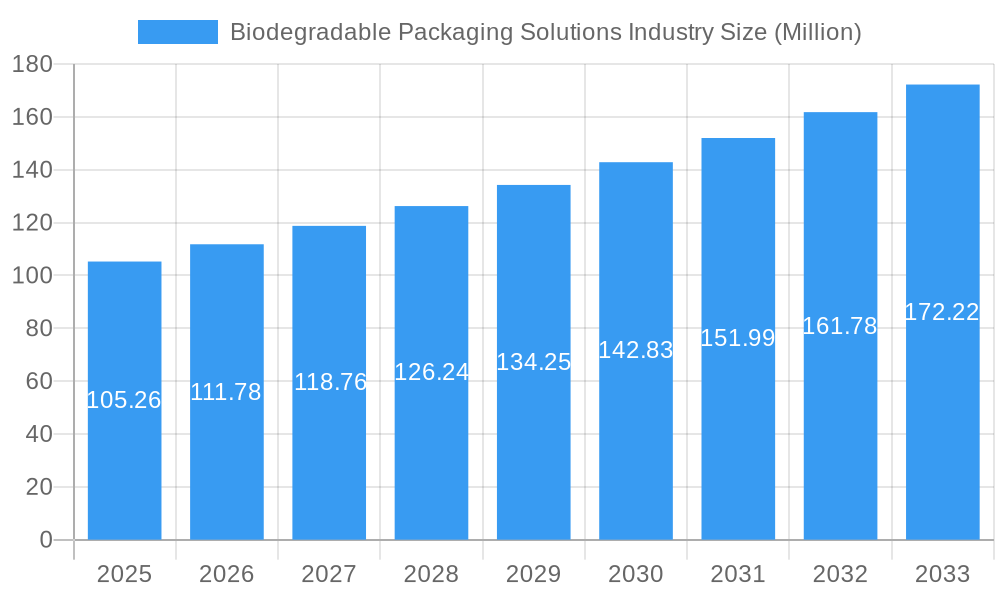

The biodegradable packaging solutions market, valued at $105.26 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.97% from 2025 to 2033. This expansion is driven by the escalating global demand for eco-friendly alternatives to conventional packaging materials, coupled with increasing consumer awareness of environmental sustainability and stricter government regulations regarding plastic waste. Key market drivers include the growing food and beverage industries, the expanding pharmaceutical sector requiring safe and sustainable packaging, and the rise of e-commerce leading to increased packaging demand. Furthermore, advancements in bio-based material technology, such as Polyhydroxyalkanoates (PHA), are contributing to the development of more durable and cost-effective biodegradable packaging options. The market segmentation reveals strong growth across various material types, including plastic alternatives like PHA and paper-based solutions, and applications spanning food, beverages, pharmaceuticals, and personal/homecare products. Leading companies like Amcor, Smurfit Kappa, and Tetra Pak are actively investing in research and development, driving innovation and expanding market offerings. Regional analysis indicates robust growth across North America, Europe, and the Asia-Pacific region, with China and India emerging as key growth markets due to their burgeoning populations and expanding consumer bases.

Biodegradable Packaging Solutions Industry Market Size (In Million)

The market's growth trajectory is projected to remain positive throughout the forecast period (2025-2033), fueled by continuous innovation in biodegradable materials, increased consumer preference for sustainable products, and the implementation of extended producer responsibility (EPR) schemes globally. However, challenges remain, including the relatively higher cost of biodegradable packaging compared to conventional options and the need for improved infrastructure for collection and composting of biodegradable waste. Addressing these challenges through technological advancements, improved supply chains, and targeted consumer education will be crucial to unlocking the full potential of the biodegradable packaging market. The market's success hinges on the collaboration between packaging manufacturers, retailers, consumers, and policymakers to create a truly circular economy for packaging materials.

Biodegradable Packaging Solutions Industry Company Market Share

Biodegradable Packaging Solutions Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Biodegradable Packaging Solutions industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report analyzes market dynamics, trends, leading players, and future growth opportunities within this rapidly expanding sector. The market is projected to reach xx Million by 2033, experiencing a CAGR of xx% during the forecast period (2025-2033).

Biodegradable Packaging Solutions Industry Market Dynamics & Concentration

The Biodegradable Packaging Solutions market is characterized by a dynamic yet moderately concentrated landscape. A select group of prominent players commands significant market share, their positions bolstered by substantial investments in economies of scale, cutting-edge technological advancements, and a keen ability to navigate evolving regulatory frameworks. This industry thrives on intense competition, a relentless pursuit of innovation in novel materials, advanced processing techniques, and the expansion of product applications. Mergers and acquisitions (M&A) are pivotal forces shaping the market's evolution, with an estimated [Insert Number] strategic M&A deals recorded during the historical period (2019-2024), indicating active consolidation and strategic growth.

- Market Share: Projections for 2025 indicate that the top 5 leading players are expected to collectively hold approximately [Insert Percentage] of the global biodegradable packaging market share.

- Innovation Drivers: The primary catalysts for market growth include increasingly stringent environmental regulations, a burgeoning consumer consciousness towards sustainability, and groundbreaking advancements in the development and application of biodegradable material technologies.

- Regulatory Frameworks: Supportive government mandates, policies, and incentives specifically designed to promote and accelerate the adoption of sustainable packaging solutions are profoundly influencing market expansion and competitive strategies.

- Product Substitutes: While traditional packaging materials continue to pose a competitive challenge, the escalating demand for genuinely eco-friendly and responsible alternatives is decisively tilting the scales in favor of advanced biodegradable solutions.

- End-User Trends: A discernible and growing preference for sustainable and ethically produced goods across a diverse array of end-use sectors, from food and beverage to cosmetics and pharmaceuticals, is a significant driver of market growth and product development.

Biodegradable Packaging Solutions Industry Industry Trends & Analysis

The Biodegradable Packaging Solutions industry is experiencing a period of robust and sustained growth, propelled by a confluence of powerful market forces. The escalating consumer desire for environmentally responsible products, harmonized with the implementation of stringent governmental regulations aimed at curbing plastic waste, is acting as a powerful accelerant for market expansion. Concurrently, significant technological breakthroughs in bio-based materials, leading to enhanced biodegradability profiles and superior performance characteristics, are further solidifying the industry's upward trajectory. The market is witnessing a pronounced shift towards packaging solutions that are not only biodegradable but also certified compostable and easily recyclable, profoundly influencing consumer choices and reshaping competitive dynamics. This era is also marked by substantial investments in research and development (R&D), fostering groundbreaking innovations in material science and advanced manufacturing processes.

- CAGR: The industry is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately [Insert Percentage] during the comprehensive forecast period spanning from 2025 to 2033.

- Market Penetration: The adoption and market penetration rates of biodegradable packaging are anticipated to witness a substantial surge across a wide spectrum of applications, with particular emphasis and accelerated growth expected within the high-demand food and beverage sectors.

Leading Markets & Segments in Biodegradable Packaging Solutions Industry

The Biodegradable Packaging Solutions market shows significant regional variations. While data specifics may vary, it is predicted that [Region X] holds the leading market position, driven by favorable government policies, robust economic growth, and high consumer awareness. Within segments, the food packaging application dominates, followed by beverage packaging. Paper-based biodegradable packaging currently holds the largest material-type share, although PHA and other innovative materials are gaining traction.

Key Drivers by Segment:

- Food Packaging: Stringent food safety regulations, increasing demand for convenient and sustainable food packaging.

- Beverage Packaging: Growing consumer preference for eco-friendly beverages and rising demand for on-the-go packaging.

- Paper-based Packaging: Established infrastructure, cost-effectiveness, and wide availability of raw materials.

- [Region X]: Strong environmental regulations, expanding consumer base, and favorable government initiatives.

- [Country Y]: (If applicable) Similar factors as [Region X] with additional details on specific country market.

Biodegradable Packaging Solutions Industry Product Developments

Recent product developments highlight a significant trend toward enhanced functionality and improved biodegradability. Companies are focusing on creating biodegradable packaging that matches or surpasses the performance of traditional materials in terms of durability, shelf life, and barrier properties. Innovative materials like PHA are gaining popularity, offering excellent biodegradability and performance. The market is also witnessing advancements in compostable packaging solutions suitable for both industrial and domestic composting systems.

Key Drivers of Biodegradable Packaging Solutions Industry Growth

The ascent of the biodegradable packaging solutions industry is being meticulously driven by a multifaceted array of critical factors. Foremost among these is the escalating global concern over environmental degradation and the pervasive issue of plastic pollution, compelling both consumers and corporations to actively seek and adopt sustainable packaging alternatives. Secondly, the implementation of supportive government regulations and forward-thinking policies, including outright bans on problematic single-use plastics and the provision of tangible incentives for the development and utilization of biodegradable packaging, are cultivating an exceptionally conducive market environment. Thirdly, continuous technological advancements are yielding more cost-effective, high-performance, and versatile biodegradable materials, thereby significantly fueling industry growth and broader market acceptance.

Challenges in the Biodegradable Packaging Solutions Industry Market

The industry faces challenges such as the relatively higher cost of biodegradable materials compared to conventional plastics, which can affect market adoption. Supply chain complexities and limitations in the availability of certain raw materials can also hinder growth. Furthermore, inconsistencies in biodegradability standards and certification processes across different regions create hurdles for manufacturers and consumers. These factors contribute to market growth limitations.

Emerging Opportunities in Biodegradable Packaging Solutions Industry

The biodegradable packaging solutions industry is ripe with compelling opportunities for innovation and expansion. Significant potential lies in pioneering technological breakthroughs that lead to the development of high-performance biodegradable materials possessing superior barrier properties, essential for a wider range of product applications. The forging of strategic partnerships between agile packaging manufacturers and influential brand owners is crucial to accelerate the adoption and promotion of sustainable packaging solutions across the value chain. Furthermore, tapping into new and rapidly emerging markets, especially in developing economies characterized by burgeoning consumer bases and a growing awareness of environmental issues, presents substantial untapped growth potential.

Leading Players in the Biodegradable Packaging Solutions Industry Sector

- Kruger Inc

- Berkley International Packaging Limited

- Elevate Packaging Inc

- Amcor Group GmbH

- Greenpack Limited

- Ranpak Holding Corporation

- Mondi Group

- International Paper Company

- Smurfit Kappa Group PLC

- Tetra Pak International SA

- Sealed Air Corporation

- Biopak PTY Ltd (Duni Group)

Key Milestones in Biodegradable Packaging Solutions Industry Industry

- February 2024: TIPA launches fully compostable packaging alternatives to conventional plastics, including coffee capsules and resealable containers. This signifies a major step toward wider adoption of compostable packaging.

- February 2024: Print & Pack launches, providing sustainable packaging solutions for North American small businesses. This initiative addresses the need for eco-friendly packaging options within a previously underserved market segment.

Strategic Outlook for Biodegradable Packaging Solutions Industry Market

The future trajectory for the biodegradable packaging solutions industry is exceptionally promising, underpinned by an ongoing wave of technological innovation and a deepening global commitment to environmental stewardship. The strategic emphasis on developing novel, cost-effective biodegradable materials that deliver superior performance characteristics will be paramount in unlocking sustained growth and broader market adoption. Cultivating robust strategic collaborations and synergistic partnerships across the entire value chain, from material suppliers to end-product manufacturers, will be instrumental. Coupled with proactive and supportive governmental policies and initiatives, these concerted efforts will collectively shape the future of this dynamic and increasingly vital sector.

Biodegradable Packaging Solutions Industry Segmentation

-

1. Material Type

-

1.1. Plastic

- 1.1.1. Starch-Based Plastics

- 1.1.2. Cellulose-Based Plastics

- 1.1.3. Polylactic Acid (PLA)

- 1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 1.1.5. Polyhydroxyalkanoates (PHA)

-

1.2. Paper

- 1.2.1. Kraft Paper

- 1.2.2. Flexible Paper

- 1.2.3. Corrugated Fiberboard

- 1.2.4. Boxboard

-

1.1. Plastic

-

2. Application

- 2.1. Food Packaging

- 2.2. Beverage Packaging

- 2.3. Pharmaceutical Packaging

- 2.4. Personal/Homecare Packaging

- 3. Rest of the World

Biodegradable Packaging Solutions Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

Biodegradable Packaging Solutions Industry Regional Market Share

Geographic Coverage of Biodegradable Packaging Solutions Industry

Biodegradable Packaging Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Sustainable Products By Consumers And Brands; Stringent Government Regulations

- 3.3. Market Restrains

- 3.3.1. Lack of Supply of Bio-plastics and Related Materials

- 3.4. Market Trends

- 3.4.1. Plastic will Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Starch-Based Plastics

- 5.1.1.2. Cellulose-Based Plastics

- 5.1.1.3. Polylactic Acid (PLA)

- 5.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 5.1.1.5. Polyhydroxyalkanoates (PHA)

- 5.1.2. Paper

- 5.1.2.1. Kraft Paper

- 5.1.2.2. Flexible Paper

- 5.1.2.3. Corrugated Fiberboard

- 5.1.2.4. Boxboard

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Packaging

- 5.2.2. Beverage Packaging

- 5.2.3. Pharmaceutical Packaging

- 5.2.4. Personal/Homecare Packaging

- 5.3. Market Analysis, Insights and Forecast - by Rest of the World

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.1.1. Starch-Based Plastics

- 6.1.1.2. Cellulose-Based Plastics

- 6.1.1.3. Polylactic Acid (PLA)

- 6.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 6.1.1.5. Polyhydroxyalkanoates (PHA)

- 6.1.2. Paper

- 6.1.2.1. Kraft Paper

- 6.1.2.2. Flexible Paper

- 6.1.2.3. Corrugated Fiberboard

- 6.1.2.4. Boxboard

- 6.1.1. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food Packaging

- 6.2.2. Beverage Packaging

- 6.2.3. Pharmaceutical Packaging

- 6.2.4. Personal/Homecare Packaging

- 6.3. Market Analysis, Insights and Forecast - by Rest of the World

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.1.1. Starch-Based Plastics

- 7.1.1.2. Cellulose-Based Plastics

- 7.1.1.3. Polylactic Acid (PLA)

- 7.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 7.1.1.5. Polyhydroxyalkanoates (PHA)

- 7.1.2. Paper

- 7.1.2.1. Kraft Paper

- 7.1.2.2. Flexible Paper

- 7.1.2.3. Corrugated Fiberboard

- 7.1.2.4. Boxboard

- 7.1.1. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food Packaging

- 7.2.2. Beverage Packaging

- 7.2.3. Pharmaceutical Packaging

- 7.2.4. Personal/Homecare Packaging

- 7.3. Market Analysis, Insights and Forecast - by Rest of the World

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Biodegradable Packaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.1.1. Starch-Based Plastics

- 8.1.1.2. Cellulose-Based Plastics

- 8.1.1.3. Polylactic Acid (PLA)

- 8.1.1.4. Poly-3-Hydroxybutyrate (PHB)

- 8.1.1.5. Polyhydroxyalkanoates (PHA)

- 8.1.2. Paper

- 8.1.2.1. Kraft Paper

- 8.1.2.2. Flexible Paper

- 8.1.2.3. Corrugated Fiberboard

- 8.1.2.4. Boxboard

- 8.1.1. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food Packaging

- 8.2.2. Beverage Packaging

- 8.2.3. Pharmaceutical Packaging

- 8.2.4. Personal/Homecare Packaging

- 8.3. Market Analysis, Insights and Forecast - by Rest of the World

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Kruger Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Berkley International Packaging Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Elevate Packaging Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Amcor Group Gmbh

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Greenpack Limited

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Ranpak Holding Corporation*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Mondi Group

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Paper Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Smurfit Kappa Group PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Tetra Pak International SA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Sealed Air Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Biopak PTY Ltd (Duni Group)

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Kruger Inc

List of Figures

- Figure 1: Global Biodegradable Packaging Solutions Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Rest of the World 2025 & 2033

- Figure 7: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 8: North America Biodegradable Packaging Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Biodegradable Packaging Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 11: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Rest of the World 2025 & 2033

- Figure 15: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 16: Europe Biodegradable Packaging Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Biodegradable Packaging Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 19: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Rest of the World 2025 & 2033

- Figure 23: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Rest of the World 2025 & 2033

- Figure 24: Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Biodegradable Packaging Solutions Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 4: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 8: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 14: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 20: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Rest of the World 2020 & 2033

- Table 22: Global Biodegradable Packaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Biodegradable Packaging Solutions Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biodegradable Packaging Solutions Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Biodegradable Packaging Solutions Industry?

Key companies in the market include Kruger Inc, Berkley International Packaging Limited, Elevate Packaging Inc, Amcor Group Gmbh, Greenpack Limited, Ranpak Holding Corporation*List Not Exhaustive, Mondi Group, International Paper Company, Smurfit Kappa Group PLC, Tetra Pak International SA, Sealed Air Corporation, Biopak PTY Ltd (Duni Group).

3. What are the main segments of the Biodegradable Packaging Solutions Industry?

The market segments include Material Type, Application, Rest of the World.

4. Can you provide details about the market size?

The market size is estimated to be USD 105.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Sustainable Products By Consumers And Brands; Stringent Government Regulations.

6. What are the notable trends driving market growth?

Plastic will Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Supply of Bio-plastics and Related Materials.

8. Can you provide examples of recent developments in the market?

February 2024: With the same durability, shelf life, barrier, transparency, and clarity as virgin plastic packaging, TIPA launches compostable packaging, offering an alternative to plastic packaging. Certified to biodegrade in domestic or industrial compost bins, they leave no trace in the environment and provide maximum convenience to consumers. The product range comprises coffee capsules, zipper bags, mesh packaging, and resealable plastic containers. At the same time, TIPA launched a fully compostable and recyclable rice straw container line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biodegradable Packaging Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biodegradable Packaging Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biodegradable Packaging Solutions Industry?

To stay informed about further developments, trends, and reports in the Biodegradable Packaging Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence