Key Insights

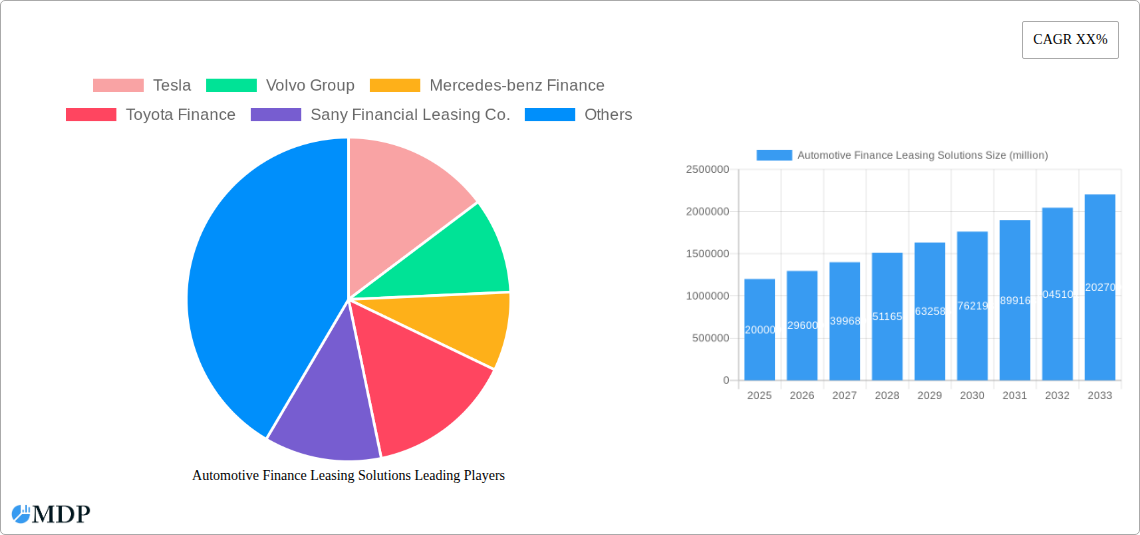

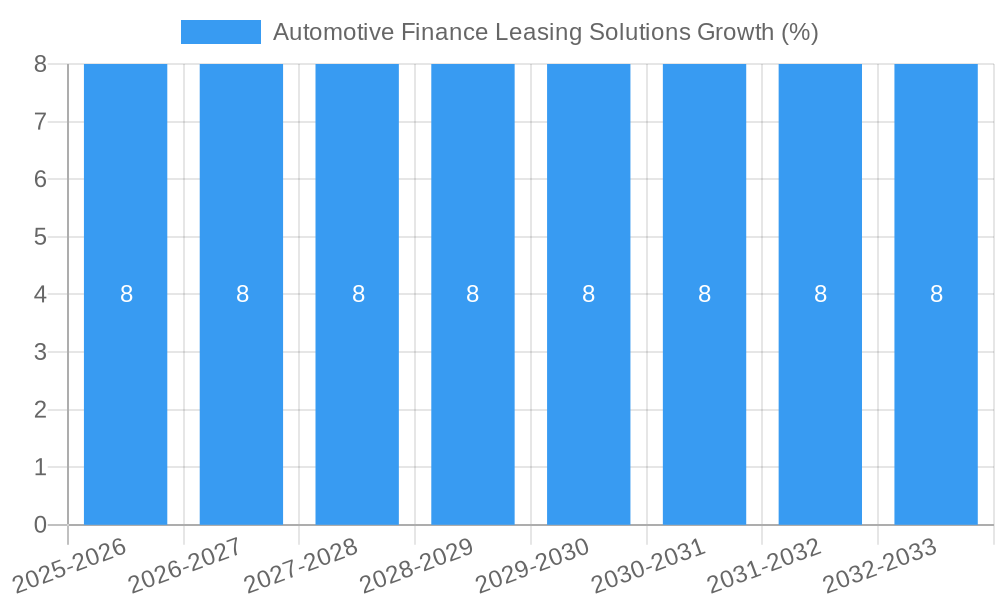

The global Automotive Finance Leasing Solutions market is projected to experience significant growth, driven by evolving consumer preferences and increasing adoption of electric and connected vehicles. With an estimated market size of approximately USD 1.2 trillion in 2025, the market is anticipated to expand at a robust Compound Annual Growth Rate (CAGR) of around 8% over the forecast period of 2025-2033. This expansion is fueled by several key drivers, including the growing demand for flexible and cost-effective mobility solutions, particularly among younger generations who prioritize access over ownership. The increasing affordability and availability of electric vehicles (EVs), coupled with government incentives and a growing environmental consciousness, are also major catalysts for the automotive finance leasing sector. Businesses are increasingly opting for leasing solutions to manage fleet costs, maintain modern vehicle fleets, and benefit from tax advantages. Furthermore, advancements in digital platforms and mobile applications are streamlining the leasing process, enhancing customer experience and accessibility.

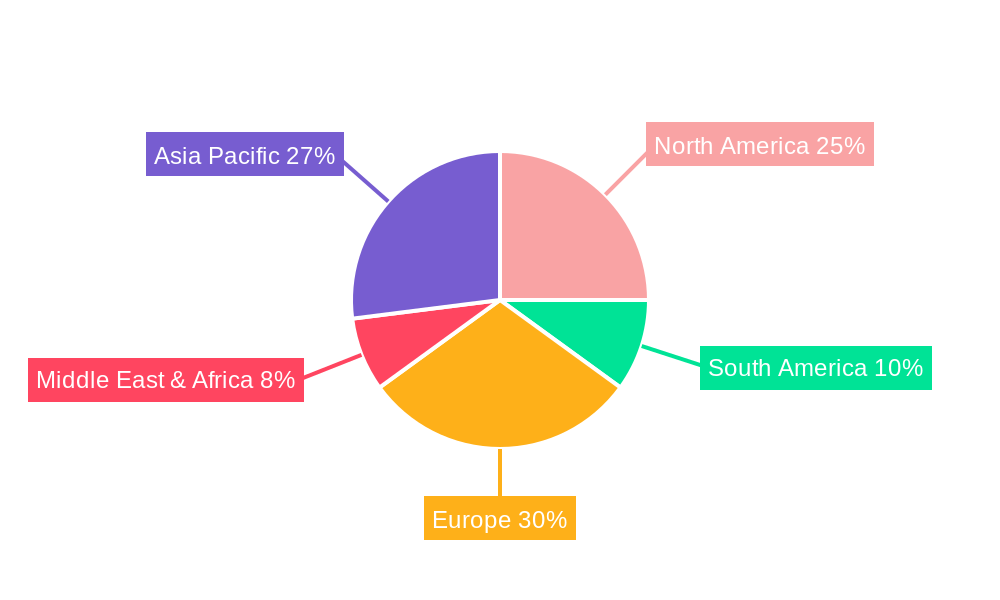

The market is segmented into Enterprise and Personal applications, with both segments expected to witness substantial growth. The "Direct Leasing" and "Sale and Leaseback" types are anticipated to dominate the market due to their inherent benefits for both individuals and corporations. Geographically, Asia Pacific, led by China and India, is expected to emerge as a key growth engine, owing to rapid urbanization, a burgeoning middle class, and supportive government policies for the automotive industry. North America and Europe will continue to be significant markets, with a strong focus on premium and electric vehicle leasing. However, the market may face certain restraints, such as fluctuating interest rates, evolving regulatory frameworks, and potential economic downturns that could impact consumer spending power. Despite these challenges, the long-term outlook for automotive finance leasing solutions remains highly positive, driven by innovation and a persistent shift towards service-oriented mobility models.

Gain unparalleled insights into the dynamic Automotive Finance Leasing Solutions market with this in-depth report. Covering the crucial period of 2019–2033, with a base year of 2025 and an extensive forecast period, this report is your definitive guide to navigating the evolving landscape of automotive financing. We delve into market concentration, innovation drivers, regulatory frameworks, and end-user trends, providing actionable intelligence for stakeholders including Tesla, Volvo Group, Mercedes-benz Finance, Toyota Finance, Sany Financial Leasing Co.,Ltd., Guangzhou Automobile Group Co.,Ltd., PING AN LEASING, Great Wall Motor Company, Dongfeng Nissan Auto Finance, Volkswagen, BMW, Xiaopeng, AMPLE, Dongfeng Peugeot Citroen Auto Finance Company Ltd., Ford, and Strong Leasing.

Automotive Finance Leasing Solutions Market Dynamics & Concentration

The Automotive Finance Leasing Solutions market exhibits a moderate concentration, with key players such as Volkswagen, Toyota Finance, and BMW holding significant market share, estimated at over 15% each. Innovation drivers, particularly in electric vehicle (EV) leasing and flexible payment structures, are reshaping competitive dynamics. Regulatory frameworks, including evolving consumer protection laws and tax incentives for leasing, are critical to market development, impacting approximately 25% of market operations. Product substitutes, such as outright purchase and personal loans, continue to present competition, though their market penetration is gradually declining due to the advantages of leasing. End-user trends show a strong preference for cost predictability and access to newer models, particularly among enterprise clients who represent over 60% of the total leasing market. Merger and acquisition (M&A) activities are on the rise, with approximately 10 major deals valued in the multi-million dollar range expected annually, aimed at expanding service offerings and geographic reach.

Automotive Finance Leasing Solutions Industry Trends & Analysis

The Automotive Finance Leasing Solutions industry is poised for substantial expansion, driven by a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% throughout the forecast period (2025–2033). This growth is fueled by several key factors. The increasing adoption of electric vehicles (EVs) is a significant catalyst, with leasing solutions making high-cost EVs more accessible to a wider consumer base. Industry-wide penetration of EVs in leased fleets is projected to reach over 30% by 2030. Technological disruptions, such as the integration of AI for personalized leasing offers and blockchain for enhanced transparency in contracts, are streamlining processes and improving customer experience. Consumer preferences are shifting towards flexible ownership models, with a growing demand for short-term leases and subscription-based services, especially in urban areas where car ownership is less prevalent. Competitive dynamics are intensifying, with traditional automotive manufacturers increasingly offering in-house leasing options alongside independent leasing companies. The market penetration of leasing services is expected to grow from an estimated 20% in the historical period to over 35% by 2033, reflecting a broader acceptance of leasing as a primary mode of vehicle acquisition.

Leading Markets & Segments in Automotive Finance Leasing Solutions

The Enterprise segment is currently the dominant force in the Automotive Finance Leasing Solutions market, accounting for over 65% of the total market value. This dominance is driven by significant demand from large corporations and small to medium-sized enterprises (SMEs) seeking to optimize their fleet management, reduce capital expenditure, and benefit from tax advantages associated with business leasing. Key drivers of this segment's strength include:

- Economic Policies: Favorable depreciation allowances and corporate tax deductions for leased vehicles in many key markets, estimated to reduce effective leasing costs by up to 15% for businesses.

- Operational Efficiency: Leasing allows enterprises to regularly update their fleets with the latest models, enhancing reliability and reducing maintenance costs. Companies are increasingly outsourcing fleet management to leasing providers, freeing up internal resources.

- Scalability: The ability to quickly scale fleet size up or down in response to changing business needs is a significant advantage for enterprises.

Within the Types of leasing, Direct Leasing holds the largest market share, estimated at over 70%. This model, where the leasing company purchases a vehicle and leases it directly to the end-user, is favored for its simplicity and direct control over the asset for both parties.

- Direct Leasing Dominance: This type of leasing is preferred by both enterprise and personal customers due to its straightforward contractual agreements and clear ownership responsibilities for the leasing entity. The absence of an intermediary simplifies the process and often results in more competitive pricing, estimated to be 5-10% lower than other forms of leasing.

- Sale and Leaseback: While a smaller segment, Sale and Leaseback is gaining traction, particularly among businesses looking to free up capital tied in existing vehicle fleets. This segment is projected to grow at a CAGR of approximately 6% over the forecast period.

- Other Leasing Types: This encompasses various specialized leasing arrangements, including operational leases with full maintenance packages and short-term rental agreements, which cater to niche market demands.

Geographically, Asia-Pacific, particularly China, is emerging as a leading market, driven by rapid economic growth, an expanding middle class, and supportive government policies for the automotive industry. Countries like India and Southeast Asian nations are also showing significant potential for growth in automotive finance leasing solutions.

Automotive Finance Leasing Solutions Product Developments

Product innovation in Automotive Finance Leasing Solutions is centered on enhancing flexibility and accessibility. Manufacturers are rolling out specialized EV leasing packages, often bundled with charging solutions and maintenance, making the transition to electric mobility seamless. Smart leasing platforms are emerging, utilizing AI to offer personalized lease terms based on individual driving habits and financial profiles. Competitive advantages are being built through offerings like mileage flexibility, end-of-lease purchase options, and bundled insurance, catering to diverse customer needs and solidifying market position.

Key Drivers of Automotive Finance Leasing Solutions Growth

Several interconnected factors are propelling the Automotive Finance Leasing Solutions market forward. The increasing affordability of electric vehicles, largely driven by leasing options, is a primary growth accelerator. Advancements in digital platforms are streamlining the leasing application and management process, enhancing customer convenience. Favorable economic conditions, including stable interest rates and business investment incentives, encourage both corporate and individual adoption of leasing. Regulatory support, such as tax benefits for fleet electrification, further incentivizes leasing as a preferred financing method.

Challenges in the Automotive Finance Leasing Solutions Market

Despite robust growth, the Automotive Finance Leasing Solutions market faces notable challenges. Evolving regulatory landscapes, particularly concerning residual value guarantees and consumer protection, can introduce complexity and compliance costs, potentially impacting an estimated 10% of operational budgets. Economic downturns and fluctuating interest rates can increase the risk of defaults and impact the profitability of leasing companies, affecting up to 15% of lease agreements during periods of volatility. Intense competition among established players and new entrants, coupled with the high capital investment required for fleet acquisition, can exert downward pressure on profit margins, potentially reducing average profit per lease by 5-8%.

Emerging Opportunities in Automotive Finance Leasing Solutions

Emerging opportunities within the Automotive Finance Leasing Solutions sector are ripe for exploitation. The burgeoning demand for autonomous and connected vehicles presents a significant avenue for innovative leasing models, incorporating advanced technology features and data services. Strategic partnerships between leasing companies, EV manufacturers, and charging infrastructure providers can create comprehensive mobility ecosystems, enhancing customer value propositions. Market expansion into underserved regions, particularly in developing economies with growing automotive penetration, offers substantial long-term growth potential. The increasing focus on sustainability also creates opportunities for leasing solutions tailored to hybrid and electric vehicle fleets, aligning with corporate ESG (Environmental, Social, and Governance) goals.

Leading Players in the Automotive Finance Leasing Solutions Sector

- Tesla

- Volvo Group

- Mercedes-benz Finance

- Toyota Finance

- Sany Financial Leasing Co.,Ltd.

- Guangzhou Automobile Group Co.,Ltd.

- PING AN LEASING

- Great Wall Motor Company

- Dongfeng Nissan Auto Finance

- Volkswagen

- BMW

- Xiaopeng

- AMPLE

- Dongfeng Peugeot Citroen Auto Finance Company Ltd.

- Ford

- Strong Leasing

Key Milestones in Automotive Finance Leasing Solutions Industry

- 2019: Increased regulatory focus on consumer protection in leasing contracts, leading to revised disclosure requirements.

- 2020: Surge in demand for flexible leasing solutions amid economic uncertainty and the initial impact of the pandemic.

- 2021: Significant investment in digital leasing platforms by major automotive finance companies.

- 2022: Growing emphasis on EV leasing packages, with manufacturers offering attractive incentives.

- 2023: M&A activity picks up as companies seek to consolidate market share and expand service offerings.

- 2024: Introduction of subscription-based car ownership models gaining traction in key urban markets.

Strategic Outlook for Automotive Finance Leasing Solutions Market

- 2019: Increased regulatory focus on consumer protection in leasing contracts, leading to revised disclosure requirements.

- 2020: Surge in demand for flexible leasing solutions amid economic uncertainty and the initial impact of the pandemic.

- 2021: Significant investment in digital leasing platforms by major automotive finance companies.

- 2022: Growing emphasis on EV leasing packages, with manufacturers offering attractive incentives.

- 2023: M&A activity picks up as companies seek to consolidate market share and expand service offerings.

- 2024: Introduction of subscription-based car ownership models gaining traction in key urban markets.

Strategic Outlook for Automotive Finance Leasing Solutions Market

The strategic outlook for the Automotive Finance Leasing Solutions market is exceptionally positive, driven by a confluence of technological advancements, shifting consumer behavior, and supportive industry trends. Growth accelerators include the continued expansion of the EV market, where leasing plays a pivotal role in adoption, and the increasing integration of digital technologies for enhanced customer experience and operational efficiency. The focus on flexible and personalized leasing solutions, coupled with expansion into emerging markets, presents significant opportunities for sustained growth and market leadership in the coming years.

Automotive Finance Leasing Solutions Segmentation

-

1. Application

- 1.1. Enterprise

- 1.2. Personal

-

2. Types

- 2.1. Direct Leasing

- 2.2. Sale and Leaseback

- 2.3. Other

Automotive Finance Leasing Solutions Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Finance Leasing Solutions REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Finance Leasing Solutions Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise

- 5.1.2. Personal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Direct Leasing

- 5.2.2. Sale and Leaseback

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Finance Leasing Solutions Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Enterprise

- 6.1.2. Personal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Direct Leasing

- 6.2.2. Sale and Leaseback

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Finance Leasing Solutions Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Enterprise

- 7.1.2. Personal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Direct Leasing

- 7.2.2. Sale and Leaseback

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Finance Leasing Solutions Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Enterprise

- 8.1.2. Personal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Direct Leasing

- 8.2.2. Sale and Leaseback

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Finance Leasing Solutions Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Enterprise

- 9.1.2. Personal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Direct Leasing

- 9.2.2. Sale and Leaseback

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Finance Leasing Solutions Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Enterprise

- 10.1.2. Personal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Direct Leasing

- 10.2.2. Sale and Leaseback

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tesla

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Volvo Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mercedes-benz Finance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toyota Finance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sany Financial Leasing Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Guangzhou Automobile Group Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PING AN LEASING

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Great Wall Motor Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dongfeng Nissan Auto Finance

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Volkswagen

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BMW

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Xiaopeng

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AMPLE

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dongfeng Peugeot Citroen Auto Finance Company Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ford

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Strong Leasing

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Tesla

List of Figures

- Figure 1: Global Automotive Finance Leasing Solutions Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Finance Leasing Solutions Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Finance Leasing Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Finance Leasing Solutions Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automotive Finance Leasing Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automotive Finance Leasing Solutions Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Finance Leasing Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Finance Leasing Solutions Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Finance Leasing Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Finance Leasing Solutions Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automotive Finance Leasing Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automotive Finance Leasing Solutions Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Finance Leasing Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Finance Leasing Solutions Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Finance Leasing Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Finance Leasing Solutions Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automotive Finance Leasing Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automotive Finance Leasing Solutions Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Finance Leasing Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Finance Leasing Solutions Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Finance Leasing Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Finance Leasing Solutions Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automotive Finance Leasing Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automotive Finance Leasing Solutions Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Finance Leasing Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Finance Leasing Solutions Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Finance Leasing Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Finance Leasing Solutions Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automotive Finance Leasing Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automotive Finance Leasing Solutions Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Finance Leasing Solutions Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automotive Finance Leasing Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Finance Leasing Solutions Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Finance Leasing Solutions?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Automotive Finance Leasing Solutions?

Key companies in the market include Tesla, Volvo Group, Mercedes-benz Finance, Toyota Finance, Sany Financial Leasing Co., Ltd., Guangzhou Automobile Group Co., Ltd., PING AN LEASING, Great Wall Motor Company, Dongfeng Nissan Auto Finance, Volkswagen, BMW, Xiaopeng, AMPLE, Dongfeng Peugeot Citroen Auto Finance Company Ltd., Ford, Strong Leasing.

3. What are the main segments of the Automotive Finance Leasing Solutions?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Finance Leasing Solutions," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Finance Leasing Solutions report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Finance Leasing Solutions?

To stay informed about further developments, trends, and reports in the Automotive Finance Leasing Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence