Key Insights

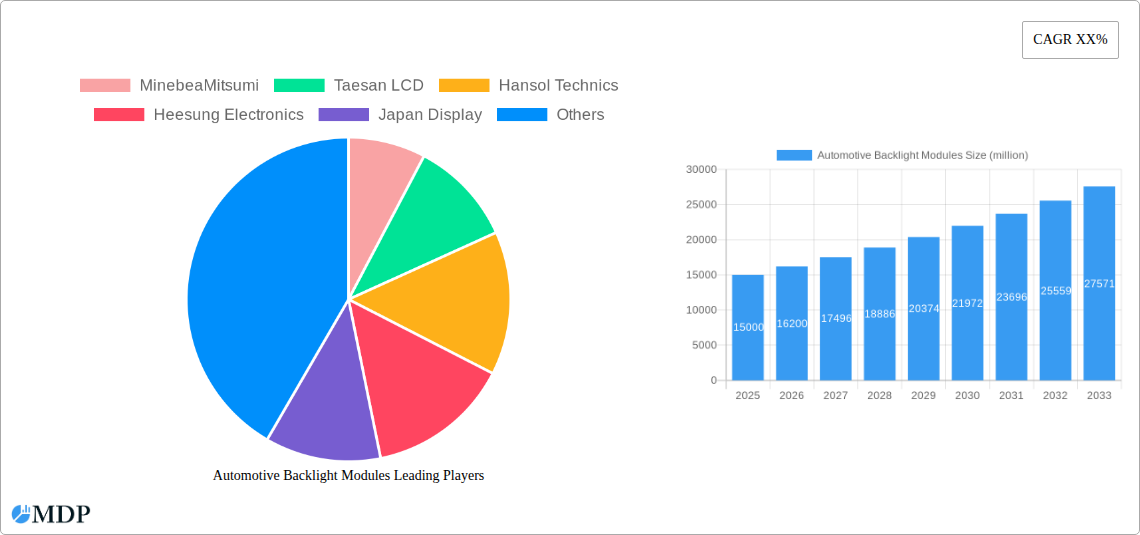

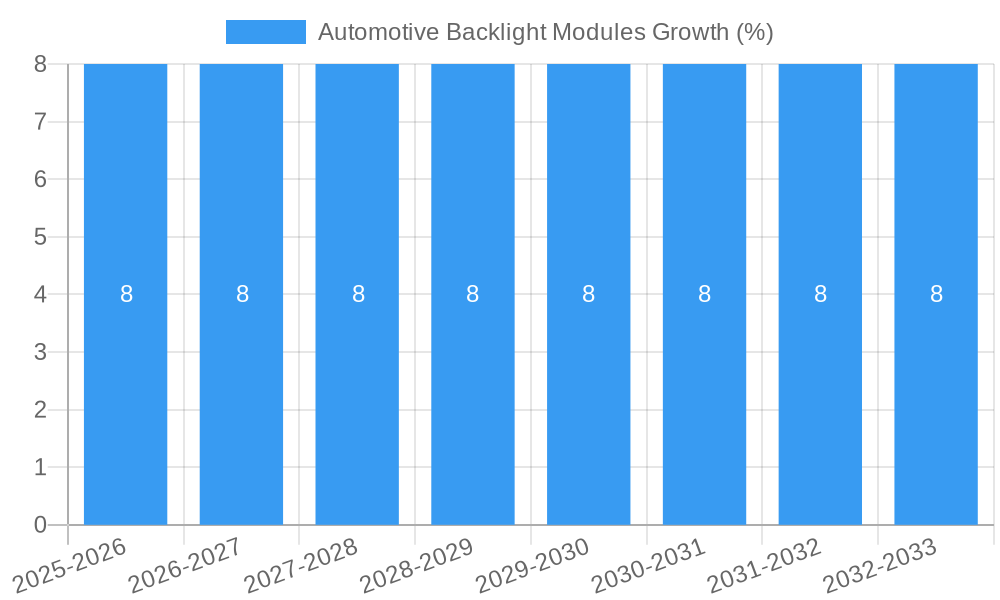

The global automotive backlight modules market is poised for significant expansion, projected to reach an estimated $15 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 8% anticipated from 2025 through 2033. This growth trajectory is primarily fueled by the escalating demand for advanced in-car infotainment systems, sophisticated dashboard displays, and integrated rear-seat entertainment solutions. The increasing adoption of electric vehicles (EVs), which often feature more advanced and customizable interior lighting, further amplifies the market's potential. Furthermore, the drive towards enhanced driver safety through clearer and more informative displays, coupled with the growing trend of personalized cabin ambiance, are key accelerators. The integration of augmented reality (AR) features in head-up displays (HUDs) and the evolving design language of automotive interiors, emphasizing sleek and integrated lighting, are also significant drivers.

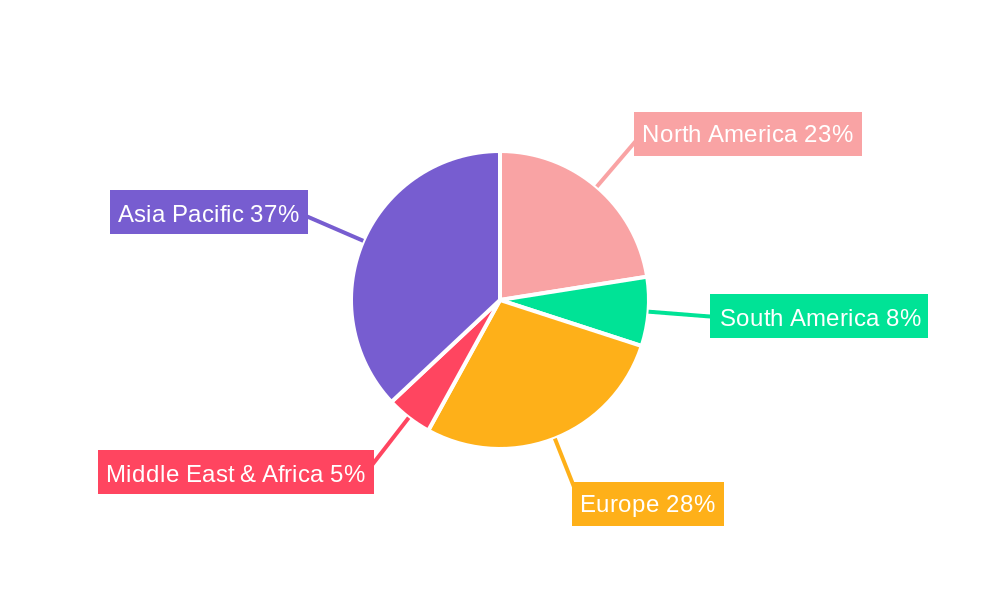

Despite the promising outlook, the market faces certain restraints. Supply chain disruptions, particularly concerning the availability of specialized display components and raw materials, could pose challenges. Additionally, the high initial investment required for advanced manufacturing processes and the stringent quality control standards in the automotive industry can present hurdles for smaller players. However, the rapid technological advancements in LED and OLED technologies, offering superior brightness, color accuracy, and energy efficiency, are expected to mitigate these restraints. The market's segmentation reveals a strong dominance of the dashboard application segment, followed by rear-seat monitors, indicating a clear consumer preference for enhanced front-cabin experiences. The RGB backlight module type is gaining traction due to its flexibility in color customization, aligning with the personalized cabin trend. Asia Pacific, led by China, is expected to remain the largest regional market, driven by its substantial automotive production and rapidly growing domestic demand for technologically advanced vehicles.

This in-depth report provides a detailed analysis of the global Automotive Backlight Modules market, offering critical insights for industry stakeholders. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report delves into market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and a strategic outlook. We analyze market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities, alongside key industry developments and leading players.

Automotive Backlight Modules Market Dynamics & Concentration

The Automotive Backlight Modules market exhibits a moderate concentration, with a few key players holding significant market share, estimated at around 60% for the top five companies. Innovation is a primary driver, fueled by advancements in display technology and the increasing demand for sophisticated in-car entertainment and information systems. Regulatory frameworks, particularly those concerning automotive safety and emissions, indirectly influence backlight module specifications, encouraging the adoption of energy-efficient and durable solutions. Product substitutes, while limited, include advancements in micro-LED and OLED technologies that could eventually offer alternatives for certain display applications. End-user trends are strongly dictated by consumer demand for larger, higher-resolution, and more interactive displays in vehicles, driving the need for advanced backlight solutions. Mergers and acquisitions (M&A) activities are on the rise, with an estimated 15 significant M&A deals occurring between 2019 and 2024, aimed at consolidating market share, acquiring new technologies, and expanding geographical reach.

Automotive Backlight Modules Industry Trends & Analysis

The Automotive Backlight Modules industry is poised for substantial growth, driven by several interconnected factors. The escalating demand for advanced driver-assistance systems (ADAS) and the increasing integration of complex infotainment systems within vehicles are paramount growth drivers. As vehicles evolve into connected living spaces, the need for high-quality, visually appealing, and functional displays for navigation, entertainment, and critical information display becomes indispensable. This trend is further amplified by the rising adoption of electric vehicles (EVs), which often feature larger, more integrated digital cockpits requiring advanced display technologies.

Technological disruptions are continuously shaping the market landscape. The transition from traditional CCFL (cold cathode fluorescent lamp) backlights to more energy-efficient and versatile LED (light-emitting diode) backlights has been a significant evolution. Currently, the industry is witnessing a push towards localized dimming, quantum dot enhancement films, and thinner, more flexible backlight designs to improve contrast ratios, color accuracy, and overall display performance. The integration of RGB backlight modules, offering a wider color gamut and greater control over color temperature, is also gaining traction for premium automotive applications.

Consumer preferences are increasingly aligning with enhanced in-car digital experiences. Drivers and passengers expect seamless integration of their digital lives into the vehicle, leading to a demand for brighter, clearer, and more responsive displays that can be easily viewed under various lighting conditions. This includes a preference for customizable ambient lighting that complements the dashboard and interior design. The competitive dynamics within the automotive backlight module sector are characterized by intense R&D efforts, strategic partnerships between display manufacturers and automotive OEMs, and a focus on cost optimization without compromising performance. The market penetration of advanced backlight modules is expected to grow significantly, with a projected compound annual growth rate (CAGR) of approximately 8% during the forecast period.

Leading Markets & Segments in Automotive Backlight Modules

The Dashboard segment is anticipated to maintain its dominant position in the Automotive Backlight Modules market. This dominance is driven by the increasing complexity and functionality of modern vehicle dashboards, which now serve as the primary interface for essential driving information, navigation, and vehicle diagnostics. The integration of digital instrument clusters, central information displays, and heads-up displays (HUDs) all rely heavily on advanced backlight technologies to ensure optimal visibility and user experience.

- Dominance Drivers for Dashboard:

- Increasing ADAS Integration: The proliferation of Advanced Driver-Assistance Systems necessitates larger, higher-resolution displays for displaying real-time sensor data, camera feeds, and safety alerts, all of which require robust backlight solutions.

- Digital Cockpit Adoption: The shift towards digital cockpits in both premium and mass-market vehicles mandates sophisticated displays that offer customization and enhanced user interaction, making advanced backlights crucial.

- Regulatory Mandates: Evolving safety regulations often stipulate the clear and immediate presentation of critical driving information, encouraging the adoption of high-performance displays with superior backlight capabilities.

- Consumer Demand for Information Access: Consumers expect comprehensive vehicle information at a glance, driving the need for larger, more informative dashboard displays.

In terms of Types, the White Backlight Module segment is expected to continue its significant market share due to its widespread application and cost-effectiveness in providing general illumination for displays. However, the RGB Backlight Module segment is poised for rapid growth.

- Key Drivers for RGB Backlight Module Growth:

- Enhanced Color Gamut and Accuracy: RGB backlights offer superior color reproduction capabilities, crucial for applications like navigation systems, virtual instrument clusters, and in-car entertainment where visual fidelity is paramount.

- Improved Contrast and Brightness Control: The ability to independently control red, green, and blue light allows for more dynamic contrast ratios and precise brightness adjustments, enhancing readability in diverse lighting conditions and contributing to a premium user experience.

- Customization and Ambient Lighting: RGB technology enables sophisticated color tuning, facilitating personalized ambient lighting schemes within the vehicle interior, a feature increasingly desired by consumers.

- Technological Advancements: Ongoing innovations in LED efficiency and control systems are making RGB backlight modules more cost-competitive and power-efficient, accelerating their adoption.

Geographically, Asia Pacific is projected to be the leading region, driven by its position as a global automotive manufacturing hub and the rapid adoption of advanced automotive technologies in countries like China, Japan, and South Korea.

Automotive Backlight Modules Product Developments

Automotive backlight modules are witnessing rapid innovation focused on enhanced display quality, energy efficiency, and integration. Product developments include the introduction of thinner, more flexible designs utilizing advanced optical films and mini-LED or micro-LED backlighting technologies for improved contrast ratios and brightness. The increasing demand for personalized in-car experiences is driving the adoption of RGB backlight modules, offering a wider color gamut and precise color control for infotainment systems, digital clusters, and ambient lighting. These innovations aim to enhance driver and passenger comfort, improve safety through better visibility, and contribute to the aesthetic appeal of vehicle interiors, providing competitive advantages in the discerning automotive market.

Key Drivers of Automotive Backlight Modules Growth

The growth of the Automotive Backlight Modules market is propelled by several key factors. The relentless advancement in automotive electronics, particularly the proliferation of sophisticated infotainment systems, digital instrument clusters, and advanced driver-assistance systems (ADAS), necessitates higher-performing displays. The increasing consumer demand for a premium and interactive in-car experience, characterized by larger, brighter, and more color-accurate screens, is a significant catalyst. Furthermore, evolving vehicle designs, including the trend towards larger displays and panoramic cockpit layouts, directly fuels the demand for advanced backlight solutions. Regulatory mandates pushing for enhanced safety features and energy efficiency also indirectly contribute to the adoption of next-generation backlight technologies.

Challenges in the Automotive Backlight Modules Market

Despite robust growth prospects, the Automotive Backlight Modules market faces several challenges. The stringent quality and reliability standards within the automotive industry pose significant hurdles, requiring extensive testing and validation for new technologies. The complexity of automotive supply chains, coupled with potential geopolitical disruptions, can lead to material shortages and price volatility. Furthermore, intense competition among manufacturers drives a constant need for cost reduction without compromising performance, placing pressure on profit margins. The development and integration of novel backlight technologies, such as mini-LED and micro-LED, require substantial R&D investment and can face adoption challenges due to higher initial costs compared to established solutions.

Emerging Opportunities in Automotive Backlight Modules

Emerging opportunities in the Automotive Backlight Modules sector are primarily driven by technological breakthroughs and evolving automotive trends. The growing adoption of augmented reality (AR) heads-up displays (HUDs) presents a significant avenue for growth, requiring highly transparent and precisely controlled backlight modules. The increasing demand for in-car connectivity and entertainment, leading to larger and more sophisticated rear-seat entertainment systems, also opens up new market potential. Furthermore, strategic partnerships between backlight module manufacturers, display makers, and automotive OEMs are crucial for co-developing tailored solutions that meet specific vehicle platform requirements and accelerate the adoption of innovative technologies. The continued focus on energy efficiency in vehicles also creates opportunities for advanced, low-power backlight solutions.

Leading Players in the Automotive Backlight Modules Sector

- MinebeaMitsumi

- Taesan LCD

- Hansol Technics

- Heesung Electronics

- Japan Display

- Ways Electron

- Longtech Optics

- Coretronic

- Darwin Precisions Corporation

- Sharp

- Stanley Electronic

- OMRON

- Kenmos Technology

- Sezhen Royal Display

- Shenzhen Longli Technology

- Shenzhen Jufei Optoelectronics

- Jingjiang Yong Sheng Optoelectronics Technology

Key Milestones in Automotive Backlight Modules Industry

- 2019: Widespread adoption of LED backlighting surpassing CCFL in new vehicle models.

- 2020: Introduction of mini-LED technology for automotive displays, offering improved contrast.

- 2021: Increased integration of RGB backlight modules for enhanced color accuracy in infotainment.

- 2022: Significant advancements in flexible OLED and quantum dot technologies influencing backlight module design.

- 2023: Growing emphasis on energy-efficient backlight solutions driven by EV market expansion.

- 2024: Increased M&A activities aimed at consolidating market share and acquiring advanced display technologies.

- 2025 (Projected): Widespread commercialization of localized dimming techniques for enhanced HDR capabilities.

- 2026 (Projected): Emerging applications for transparent backlight modules in AR-HUDs.

Strategic Outlook for Automotive Backlight Modules Market

The strategic outlook for the Automotive Backlight Modules market is exceptionally positive, driven by continued innovation and the automotive industry's relentless pursuit of enhanced in-car experiences. Growth accelerators include the increasing demand for sophisticated digital cockpits, advanced ADAS integration, and the expanding market for electric vehicles, all of which require superior display technologies. Manufacturers will focus on developing thinner, more energy-efficient, and highly customizable backlight solutions, such as those utilizing mini-LED, micro-LED, and advanced RGB technologies. Strategic partnerships and vertical integration will be key for ensuring a stable supply chain and co-creating next-generation display solutions that meet the evolving demands of consumers and automotive OEMs, positioning the market for sustained growth and technological advancement.

Automotive Backlight Modules Segmentation

-

1. Application

- 1.1. Car Navigator

- 1.2. Dashboard

- 1.3. Rear Seat Monitor

- 1.4. Other

-

2. Types

- 2.1. RGB Backlight Module

- 2.2. White Backlight Module

- 2.3. Other Backlight Modules

Automotive Backlight Modules Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Backlight Modules REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Backlight Modules Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Car Navigator

- 5.1.2. Dashboard

- 5.1.3. Rear Seat Monitor

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. RGB Backlight Module

- 5.2.2. White Backlight Module

- 5.2.3. Other Backlight Modules

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Backlight Modules Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Car Navigator

- 6.1.2. Dashboard

- 6.1.3. Rear Seat Monitor

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. RGB Backlight Module

- 6.2.2. White Backlight Module

- 6.2.3. Other Backlight Modules

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Backlight Modules Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Car Navigator

- 7.1.2. Dashboard

- 7.1.3. Rear Seat Monitor

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. RGB Backlight Module

- 7.2.2. White Backlight Module

- 7.2.3. Other Backlight Modules

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Backlight Modules Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Car Navigator

- 8.1.2. Dashboard

- 8.1.3. Rear Seat Monitor

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. RGB Backlight Module

- 8.2.2. White Backlight Module

- 8.2.3. Other Backlight Modules

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Backlight Modules Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Car Navigator

- 9.1.2. Dashboard

- 9.1.3. Rear Seat Monitor

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. RGB Backlight Module

- 9.2.2. White Backlight Module

- 9.2.3. Other Backlight Modules

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Backlight Modules Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Car Navigator

- 10.1.2. Dashboard

- 10.1.3. Rear Seat Monitor

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. RGB Backlight Module

- 10.2.2. White Backlight Module

- 10.2.3. Other Backlight Modules

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MinebeaMitsumi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Taesan LCD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hansol Technics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Heesung Electronics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Japan Display

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ways Electron

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Longtech Optics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Coretronic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Darwin Precisions Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sharp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Stanley Electronic

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OMRON

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kenmos Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sezhen Royal Display

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Shenzhen Longli Technology

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Shenzhen Jufei Optoelectronics

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Jingjiang Yong Sheng Optoelectronics Technology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 MinebeaMitsumi

List of Figures

- Figure 1: Global Automotive Backlight Modules Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Automotive Backlight Modules Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Automotive Backlight Modules Revenue (million), by Application 2024 & 2032

- Figure 4: North America Automotive Backlight Modules Volume (K), by Application 2024 & 2032

- Figure 5: North America Automotive Backlight Modules Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Automotive Backlight Modules Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Automotive Backlight Modules Revenue (million), by Types 2024 & 2032

- Figure 8: North America Automotive Backlight Modules Volume (K), by Types 2024 & 2032

- Figure 9: North America Automotive Backlight Modules Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Automotive Backlight Modules Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Automotive Backlight Modules Revenue (million), by Country 2024 & 2032

- Figure 12: North America Automotive Backlight Modules Volume (K), by Country 2024 & 2032

- Figure 13: North America Automotive Backlight Modules Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Automotive Backlight Modules Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Automotive Backlight Modules Revenue (million), by Application 2024 & 2032

- Figure 16: South America Automotive Backlight Modules Volume (K), by Application 2024 & 2032

- Figure 17: South America Automotive Backlight Modules Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Automotive Backlight Modules Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Automotive Backlight Modules Revenue (million), by Types 2024 & 2032

- Figure 20: South America Automotive Backlight Modules Volume (K), by Types 2024 & 2032

- Figure 21: South America Automotive Backlight Modules Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Automotive Backlight Modules Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Automotive Backlight Modules Revenue (million), by Country 2024 & 2032

- Figure 24: South America Automotive Backlight Modules Volume (K), by Country 2024 & 2032

- Figure 25: South America Automotive Backlight Modules Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Automotive Backlight Modules Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Automotive Backlight Modules Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Automotive Backlight Modules Volume (K), by Application 2024 & 2032

- Figure 29: Europe Automotive Backlight Modules Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Automotive Backlight Modules Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Automotive Backlight Modules Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Automotive Backlight Modules Volume (K), by Types 2024 & 2032

- Figure 33: Europe Automotive Backlight Modules Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Automotive Backlight Modules Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Automotive Backlight Modules Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Automotive Backlight Modules Volume (K), by Country 2024 & 2032

- Figure 37: Europe Automotive Backlight Modules Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Automotive Backlight Modules Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Automotive Backlight Modules Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Automotive Backlight Modules Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Automotive Backlight Modules Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Automotive Backlight Modules Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Automotive Backlight Modules Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Automotive Backlight Modules Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Automotive Backlight Modules Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Automotive Backlight Modules Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Automotive Backlight Modules Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Automotive Backlight Modules Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Automotive Backlight Modules Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Automotive Backlight Modules Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Automotive Backlight Modules Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Automotive Backlight Modules Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Automotive Backlight Modules Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Automotive Backlight Modules Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Automotive Backlight Modules Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Automotive Backlight Modules Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Automotive Backlight Modules Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Automotive Backlight Modules Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Automotive Backlight Modules Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Automotive Backlight Modules Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Automotive Backlight Modules Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Automotive Backlight Modules Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Backlight Modules Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Backlight Modules Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Automotive Backlight Modules Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Automotive Backlight Modules Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Automotive Backlight Modules Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Automotive Backlight Modules Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Automotive Backlight Modules Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Automotive Backlight Modules Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Automotive Backlight Modules Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Backlight Modules Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Backlight Modules Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Automotive Backlight Modules Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Automotive Backlight Modules Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Automotive Backlight Modules Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Automotive Backlight Modules Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Automotive Backlight Modules Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Backlight Modules Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Automotive Backlight Modules Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Automotive Backlight Modules Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Automotive Backlight Modules Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Automotive Backlight Modules Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Automotive Backlight Modules Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Automotive Backlight Modules Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Automotive Backlight Modules Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Automotive Backlight Modules Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Automotive Backlight Modules Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Automotive Backlight Modules Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Automotive Backlight Modules Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Automotive Backlight Modules Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Automotive Backlight Modules Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Automotive Backlight Modules Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Automotive Backlight Modules Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Automotive Backlight Modules Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Automotive Backlight Modules Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Automotive Backlight Modules Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Automotive Backlight Modules Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Automotive Backlight Modules Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Automotive Backlight Modules Volume K Forecast, by Country 2019 & 2032

- Table 81: China Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Automotive Backlight Modules Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Automotive Backlight Modules Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Backlight Modules?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Automotive Backlight Modules?

Key companies in the market include MinebeaMitsumi, Taesan LCD, Hansol Technics, Heesung Electronics, Japan Display, Ways Electron, Longtech Optics, Coretronic, Darwin Precisions Corporation, Sharp, Stanley Electronic, OMRON, Kenmos Technology, Sezhen Royal Display, Shenzhen Longli Technology, Shenzhen Jufei Optoelectronics, Jingjiang Yong Sheng Optoelectronics Technology.

3. What are the main segments of the Automotive Backlight Modules?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Backlight Modules," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Backlight Modules report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Backlight Modules?

To stay informed about further developments, trends, and reports in the Automotive Backlight Modules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence