Key Insights

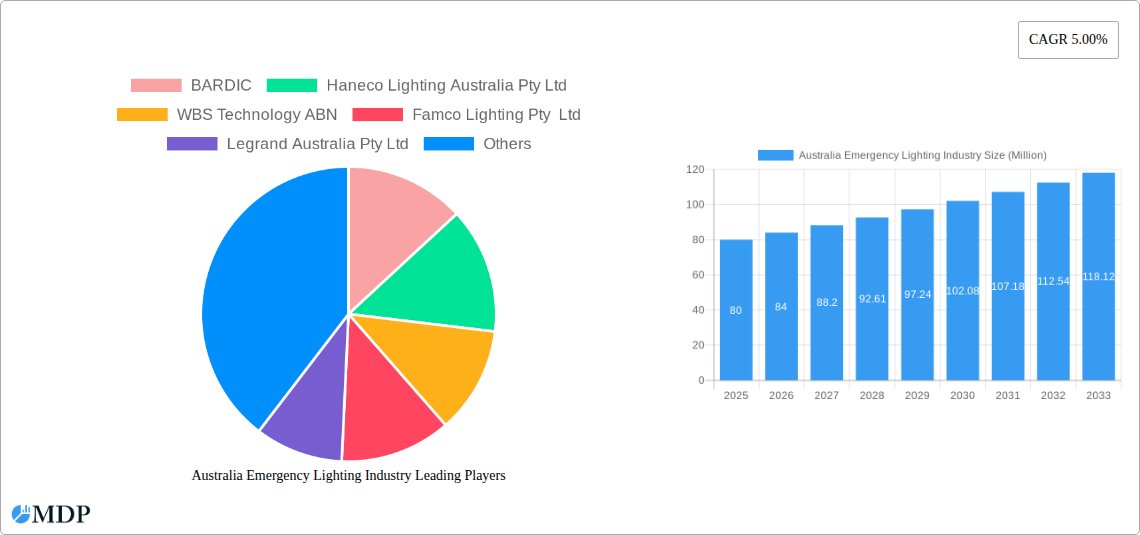

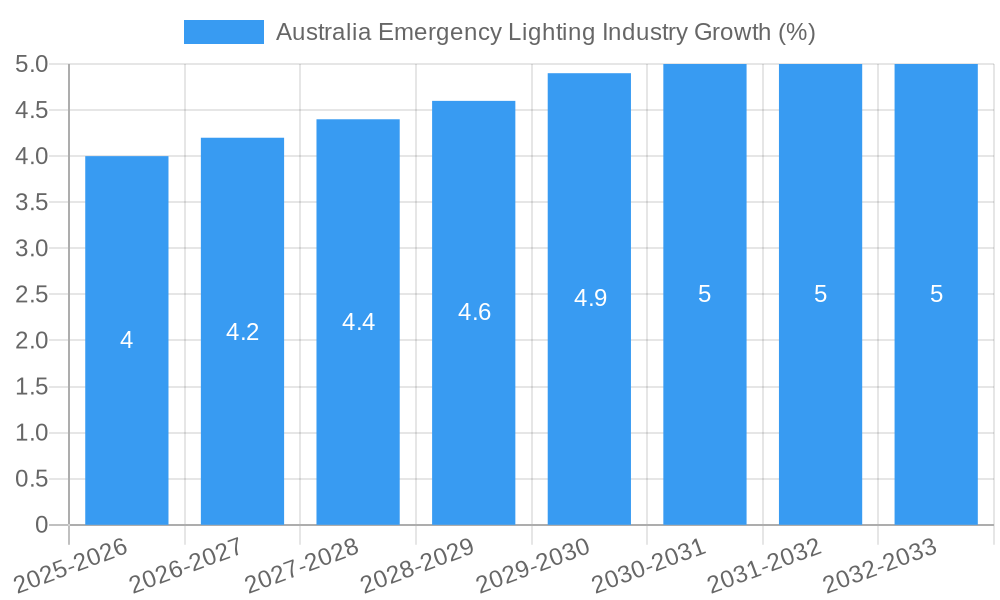

The Australian emergency lighting market, valued at approximately $80 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033. This growth is fueled by several key drivers. Stringent building codes and regulations mandating emergency lighting systems in commercial, industrial, and residential spaces are a primary catalyst. Increasing awareness of workplace safety and the need for reliable emergency illumination during power outages further bolsters market expansion. The adoption of technologically advanced features, such as smart lighting systems with remote monitoring and control capabilities, is also contributing to market growth. Furthermore, the rising construction activity across Australia, particularly in urban areas, creates a significant demand for new emergency lighting installations. The market is segmented by power system (self-contained and central) and end-user vertical (residential, industrial, and commercial), with the commercial sector currently dominating due to the higher density of buildings and stricter safety regulations. While the residential segment is smaller, it is expected to show promising growth driven by increased homeowner awareness of safety features and energy-efficient lighting solutions. Potential restraints include economic fluctuations that might impact construction projects and the initial high investment costs associated with advanced emergency lighting systems. However, the long-term benefits in terms of safety and compliance are likely to outweigh these initial costs, ensuring sustained market growth.

Competitive activity within the Australian emergency lighting market is characterized by a mix of established international players like ABB Australia and local companies such as Haneco Lighting Australia Pty Ltd and Legrand Australia Pty Ltd. This competitive landscape fosters innovation and provides diverse product offerings catering to various customer needs and budget considerations. The presence of both large multinational corporations and smaller specialized firms indicates a market with opportunities for both established players seeking market share expansion and smaller companies focusing on niche segments or innovative solutions. The ongoing technological advancements in LED technology and smart lighting are expected to further shape the competitive landscape, driving efficiency and functionality improvements in emergency lighting products.

Australia Emergency Lighting Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian emergency lighting industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical data and projections for informed decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033. This report covers key market segments, leading players, and emerging trends, ensuring a holistic understanding of this vital sector.

Australia Emergency Lighting Industry Market Dynamics & Concentration

The Australian emergency lighting market exhibits a moderately concentrated landscape, with several key players vying for market share. Market concentration is influenced by factors such as stringent regulatory frameworks emphasizing safety compliance, ongoing technological innovations driving product differentiation, and the increasing prevalence of mergers and acquisitions (M&A) activities among industry players. Substitute products, while present, are typically limited due to specific safety requirements and performance standards. End-user trends are shifting towards smarter, more interconnected solutions, particularly within the commercial and industrial sectors.

- Market Share: The top five players collectively hold approximately xx% of the market share in 2025, with Legrand Australia Pty Ltd and ABB Australia (ABB Ltd) being the prominent players.

- M&A Activity: The past five years have witnessed approximately xx M&A deals, reflecting the industry's consolidation and pursuit of economies of scale. These deals have predominantly focused on acquiring smaller companies with specialized technologies or expanding geographical reach.

- Innovation Drivers: Key drivers include advancements in LED technology, the increasing adoption of IoT-enabled solutions, and the development of centralized emergency lighting management systems.

- Regulatory Framework: Stringent Australian Standards (AS) and building codes mandate compliance with safety and performance requirements, shaping product design and influencing market dynamics.

- End-User Trends: The commercial sector demonstrates the highest growth, driven by increasing focus on building safety, workplace regulations, and the adoption of smart building technologies.

Australia Emergency Lighting Industry Industry Trends & Analysis

The Australian emergency lighting industry is characterized by steady growth, driven by several key factors. The market is witnessing a significant shift towards technologically advanced solutions, including smart emergency lighting systems with remote monitoring capabilities and advanced analytics. This trend is fueled by consumer preferences for improved safety, enhanced energy efficiency, and seamless integration with existing building management systems. The CAGR for the forecast period (2025-2033) is estimated to be xx%, reflecting consistent industry expansion. Market penetration of smart emergency lighting systems is projected to increase from xx% in 2025 to xx% by 2033, indicative of strong market adoption. Competitive dynamics are influenced by technological innovation, pricing strategies, and the development of strategic partnerships.

Leading Markets & Segments in Australia Emergency Lighting Industry

The commercial segment dominates the Australian emergency lighting market, representing approximately xx% of total revenue in 2025. This dominance is driven by stringent safety regulations, a high concentration of buildings requiring comprehensive emergency lighting systems, and significant investments in infrastructure development. The industrial segment holds the second-largest market share due to the critical role of emergency lighting in ensuring worker safety in diverse industrial settings.

- Commercial Sector Key Drivers:

- Stringent building codes and safety regulations.

- Growing adoption of smart building technologies.

- Increasing focus on enhancing workplace safety and emergency preparedness.

- Significant investment in commercial infrastructure projects.

- Industrial Sector Key Drivers:

- Safety regulations specific to industrial workplaces.

- Requirement for robust and reliable emergency lighting systems in hazardous environments.

- Demand for integrated safety solutions.

- Power System: The Central Power System segment holds a larger market share compared to Self-contained Power System due to cost-effectiveness and ease of management in large commercial and industrial installations.

- Residential Sector: While the residential sector shows slower growth compared to commercial and industrial segments, it demonstrates a growing demand for advanced and aesthetically pleasing emergency lighting solutions.

Australia Emergency Lighting Industry Product Developments

Recent product innovations focus on enhanced safety features, energy efficiency, and smart functionalities. The integration of IoT technology enables remote monitoring, predictive maintenance, and centralized control of emergency lighting systems. LED technology dominates, offering superior energy efficiency and longer lifespan compared to traditional lighting solutions. New products emphasize ease of installation, intuitive user interfaces, and interoperability with existing building management systems, catering to the demand for seamless integration and streamlined management.

Key Drivers of Australia Emergency Lighting Industry Growth

Several key factors are driving the growth of the Australian emergency lighting industry. Stringent safety regulations enforce compliance, stimulating demand for advanced systems. The growing focus on energy efficiency drives the adoption of energy-saving LED-based solutions. Technological advancements, such as IoT integration and smart lighting systems, provide enhanced safety, monitoring, and management capabilities. Finally, increasing infrastructure development, particularly in the commercial and industrial sectors, creates opportunities for growth.

Challenges in the Australia Emergency Lighting Industry Market

The Australian emergency lighting industry faces challenges such as high initial investment costs associated with advanced systems, potential supply chain disruptions affecting component availability, and intense competition from both domestic and international players. Furthermore, complex regulatory compliance requirements and stringent testing procedures can increase development and market entry barriers, thus restricting the growth and adoption of innovative solutions in some segments.

Emerging Opportunities in Australia Emergency Lighting Industry

The increasing adoption of smart building technologies creates significant opportunities for the integration of intelligent emergency lighting systems with broader building management platforms. Strategic partnerships between emergency lighting manufacturers and IoT solution providers are expected to expand the market for innovative, data-driven solutions. Further market expansion could be driven by growing awareness of safety standards and increasing demand for robust, reliable systems in diverse environments like infrastructure projects, mining operations, and renewable energy installations.

Leading Players in the Australia Emergency Lighting Industry Sector

- BARDIC

- Haneco Lighting Australia Pty Ltd

- WBS Technology ABN

- Famco Lighting Pty Ltd

- Legrand Australia Pty Ltd

- EnLighten Australia

- ABB Australia (ABB Ltd)

- E&E Lighting Australia

- Clevertronics Pty Ltd

Key Milestones in Australia Emergency Lighting Industry Industry

- October 2021: Clevertronics partnered with Wirepas, boosting the availability of cost-effective smart emergency lighting solutions. This partnership has already resulted in 630 deployments across Australia, New Zealand, and the UK.

- September 2022: MineGlow launched em-Control, a technologically advanced interoperable emergency lighting system for underground mines. This system enhances safety through multi-directional light pulses and integration with third-party systems.

Strategic Outlook for Australia Emergency Lighting Industry Market

The Australian emergency lighting industry is poised for continued growth, driven by technological innovation, stringent safety regulations, and increasing infrastructure development. Strategic partnerships, investment in R&D, and the expansion into new market segments will be crucial for maximizing long-term growth potential. The focus on smart, interconnected systems and energy-efficient solutions will continue to shape market dynamics, creating opportunities for innovative players to capture significant market share.

Australia Emergency Lighting Industry Segmentation

-

1. Power System

- 1.1. Self-contained Power System

- 1.2. Central Power System

-

2. End-user Vertical

- 2.1. Residential

- 2.2. Industrial

- 2.3. Commercial

Australia Emergency Lighting Industry Segmentation By Geography

- 1. Australia

Australia Emergency Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supporting Government Regulations (Building Code of Australia (BCA))

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Amongst Non-data Center Applications

- 3.4. Market Trends

- 3.4.1. Commercial Segment in Australia is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Emergency Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power System

- 5.1.1. Self-contained Power System

- 5.1.2. Central Power System

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Residential

- 5.2.2. Industrial

- 5.2.3. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Power System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BARDIC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haneco Lighting Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WBS Technology ABN

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Famco Lighting Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand Australia Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EnLighten Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABB Australia (ABB Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 E&E Lighting Australia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clevertronics Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 BARDIC

List of Figures

- Figure 1: Australia Emergency Lighting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Emergency Lighting Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Emergency Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Emergency Lighting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Emergency Lighting Industry Revenue Million Forecast, by Power System 2019 & 2032

- Table 4: Australia Emergency Lighting Industry Volume K Unit Forecast, by Power System 2019 & 2032

- Table 5: Australia Emergency Lighting Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Australia Emergency Lighting Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 7: Australia Emergency Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Emergency Lighting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Emergency Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Emergency Lighting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Emergency Lighting Industry Revenue Million Forecast, by Power System 2019 & 2032

- Table 12: Australia Emergency Lighting Industry Volume K Unit Forecast, by Power System 2019 & 2032

- Table 13: Australia Emergency Lighting Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 14: Australia Emergency Lighting Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 15: Australia Emergency Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Emergency Lighting Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Emergency Lighting Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Australia Emergency Lighting Industry?

Key companies in the market include BARDIC, Haneco Lighting Australia Pty Ltd, WBS Technology ABN, Famco Lighting Pty Ltd, Legrand Australia Pty Ltd, EnLighten Australia, ABB Australia (ABB Ltd), E&E Lighting Australia, Clevertronics Pty Ltd.

3. What are the main segments of the Australia Emergency Lighting Industry?

The market segments include Power System, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Supporting Government Regulations (Building Code of Australia (BCA)).

6. What are the notable trends driving market growth?

Commercial Segment in Australia is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness Amongst Non-data Center Applications.

8. Can you provide examples of recent developments in the market?

September 2022: MineGlow has launched em-Control, a new technologically advanced, interoperable emergency lighting system designed to improve the safety of underground mines. The em-Control is an intelligent, network-based solution that warns and directs an underground workforce to safety with multi-directional light pulses and colors. The complete system comprises em-Lighting, the LED light strip, em-View, a web interface, and em-Controller, a network-based controller that integrates with third-party systems via an open application programming interface (API).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Emergency Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Emergency Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Emergency Lighting Industry?

To stay informed about further developments, trends, and reports in the Australia Emergency Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence