Key Insights

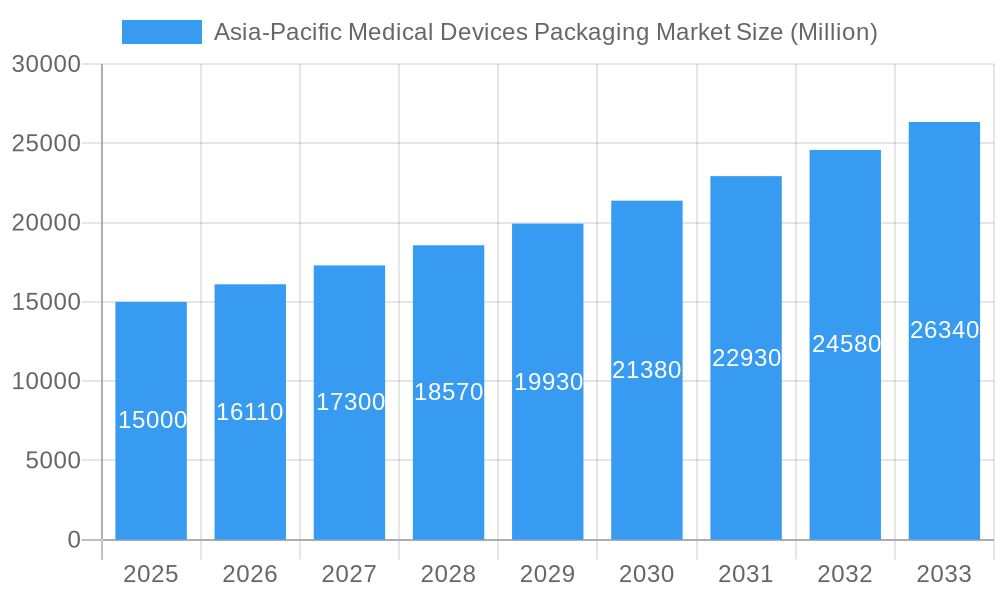

The Asia-Pacific medical device packaging market is poised for substantial growth, propelled by increasing chronic disease prevalence, escalating demand for sophisticated medical devices, and stringent regulatory mandates for secure product delivery. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.42% from 2025 to 2033, building upon a market size of 31.9 billion in the base year 2025. Growth drivers include expanding regional healthcare infrastructure, rising disposable incomes, and heightened awareness of hygiene and infection control, particularly in key economies like China, India, and Japan. The demand for sterile and tamper-evident packaging is fostering innovation in advanced materials and technologies. While plastic containers currently dominate due to cost-effectiveness and versatility, environmental concerns are driving a transition towards sustainable alternatives such as paper cans and biodegradable pouches, which will significantly influence market dynamics.

Asia-Pacific Medical Devices Packaging Market Market Size (In Billion)

Key industry players are actively investing in research and development to address the growing demand for sustainable and innovative packaging solutions. The competitive landscape is robust, featuring both multinational corporations and specialized firms. The forecast period anticipates continued expansion, with a potential moderation in CAGR due to market saturation and economic factors. However, the long-term outlook remains optimistic, supported by the sustained growth of the medical device industry in the Asia-Pacific region. Segments such as aseptic and specialized pharmaceutical packaging are expected to outpace the overall market average. Significant regional variations are anticipated, with China and India projected to be major contributors to market size owing to their large populations and developing healthcare sectors. Evolving regulations and technological advancements in packaging materials and sterilization techniques will continue to shape market evolution, presenting both opportunities and challenges.

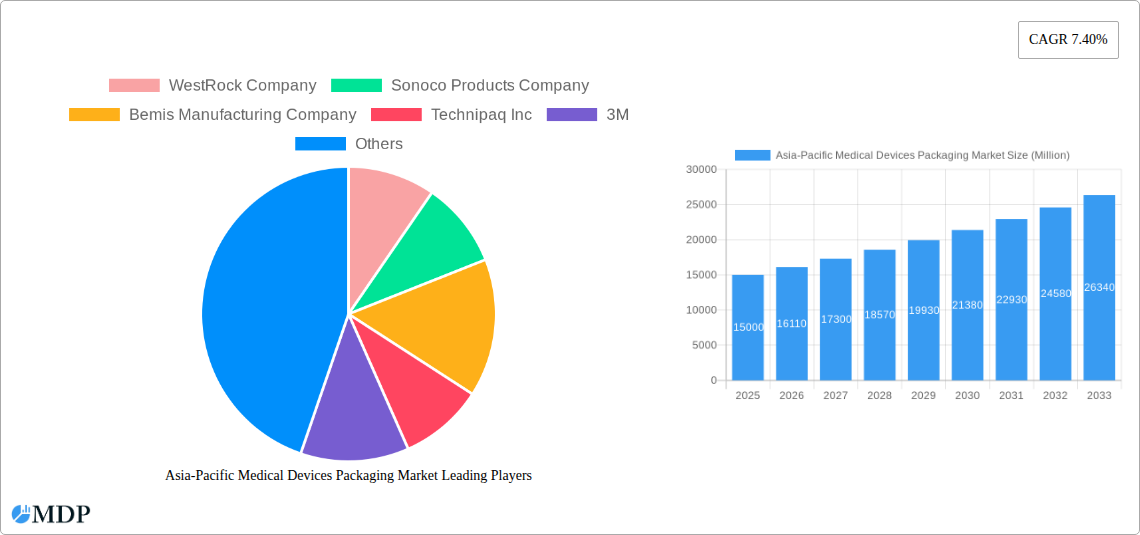

Asia-Pacific Medical Devices Packaging Market Company Market Share

Asia-Pacific Medical Devices Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific medical devices packaging market, offering invaluable insights for stakeholders across the industry. From market dynamics and concentration to leading players and future growth opportunities, this report is your essential guide to navigating this rapidly evolving landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia-Pacific Medical Devices Packaging Market Market Dynamics & Concentration

The Asia-Pacific medical devices packaging market is characterized by a moderately concentrated landscape, with key players vying for market share. Market concentration is influenced by factors such as the scale of operations, technological capabilities, and brand recognition. Several metrics highlight this dynamic:

Market Share: While precise market share data for individual companies requires further research, major players like Amcor PLC, Berry Global Inc., and 3M hold significant positions, accounting for an estimated xx% of the overall market in 2025. Smaller, regional players also contribute significantly.

M&A Activity: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years. The number of deals fluctuated, with xx deals recorded in 2024. This activity is driven by a need to expand market reach, enhance product portfolios, and integrate technologies. The most impactful acquisitions focused on securing new technologies and expanding distribution networks.

Innovation is a crucial driver, with continuous development of sustainable and advanced packaging materials tailored to specific medical device needs (e.g., tamper-evident seals, sterilization packaging). Stringent regulatory frameworks in countries like China (NMPA regulations) shape product development and manufacturing processes, emphasizing quality, safety, and traceability. The market experiences competitive pressure from substitute materials, as companies strive for cost optimization and sustainability. End-user preferences are shifting towards eco-friendly options and increased convenience, impacting packaging design and selection.

Asia-Pacific Medical Devices Packaging Market Industry Trends & Analysis

The Asia-Pacific medical devices packaging market is experiencing robust growth, driven by several key factors. Increasing healthcare expenditure across the region, particularly in emerging economies, fuels demand for medical devices and associated packaging solutions. Technological advancements, such as the adoption of smart packaging incorporating sensors and RFID tags, enable enhanced traceability and product security, leading to increased adoption. Shifting consumer preferences toward convenient and sustainable packaging options are also influencing the market trajectory. The competitive landscape is marked by both established multinational corporations and local manufacturers competing on price, quality, and innovation. The CAGR for the market is estimated at xx%, with xx% market penetration predicted by 2033 for sustainable packaging. This growth reflects a positive trend towards innovative and responsible packaging solutions.

Leading Markets & Segments in Asia-Pacific Medical Devices Packaging Market

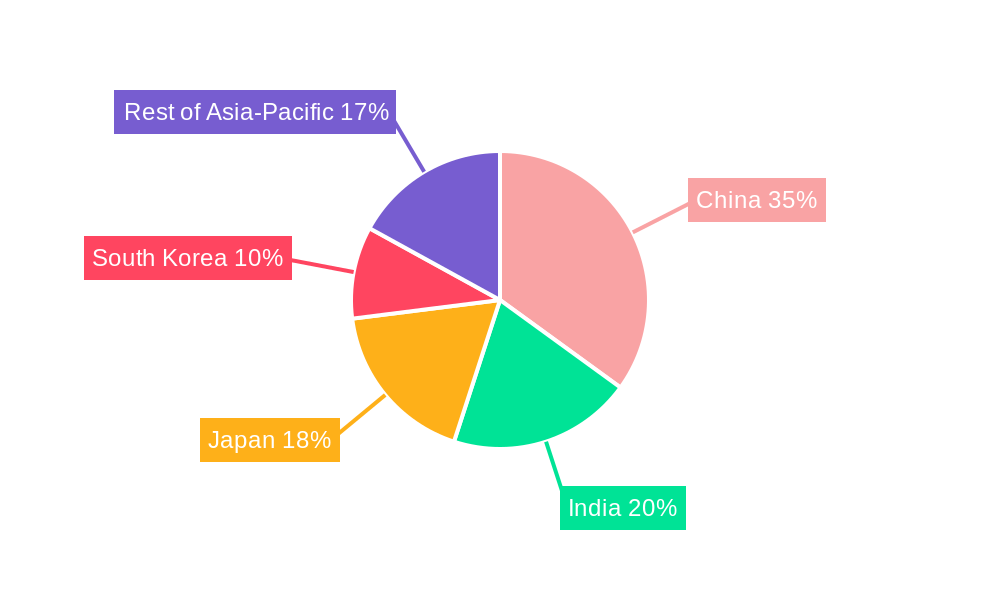

The Asia-Pacific medical devices packaging market is dominated by several key regions and segments. China and India represent the largest markets within the region, driven by expanding healthcare infrastructure and increased medical device manufacturing. Within packaging types, plastic containers constitute the leading segment due to their versatility, cost-effectiveness, and suitability for a broad range of medical devices.

Key Drivers for Dominance:

- China: Rapid economic growth, expanding healthcare infrastructure, and government initiatives promoting medical device manufacturing are major contributing factors.

- India: A burgeoning middle class, rising healthcare expenditure, and government initiatives to strengthen the healthcare sector are boosting market growth.

- Plastic Containers: Cost-effectiveness, versatility, and suitability for various applications make plastic containers the dominant packaging type.

The dominance of these markets and segments is underpinned by several factors, including supportive government policies, robust economic growth, and rising healthcare expenditure. Other important factors include the increasing prevalence of chronic diseases, a growing elderly population, and a rising demand for advanced medical technologies.

Asia-Pacific Medical Devices Packaging Market Product Developments

Recent product innovations in the Asia-Pacific medical devices packaging market are focused on enhancing product safety, sterility, and convenience. This includes advancements in materials science, leading to the development of biodegradable and recyclable options that meet sustainability standards. Technological integration with smart packaging features like tamper-evident seals and RFID tracking is gaining traction. These advancements enhance supply chain visibility and reduce the risk of counterfeiting. This aligns with market demands for high-quality, safe, and reliable medical device packaging.

Key Drivers of Asia-Pacific Medical Devices Packaging Market Growth

The growth of the Asia-Pacific medical devices packaging market is fueled by several factors. Technological advancements in packaging materials and design are improving product protection, sterility, and convenience. The rise in healthcare expenditure across the region is creating significant demand for medical devices and their associated packaging. Favorable regulatory policies supporting medical device manufacturing and distribution further stimulate market expansion. Finally, the increasing prevalence of chronic diseases and aging populations fuels the demand for better packaging solutions.

Challenges in the Asia-Pacific Medical Devices Packaging Market Market

The Asia-Pacific medical devices packaging market faces several challenges. Stringent regulatory compliance requirements, especially in countries like China and Japan, necessitate significant investment in quality control and regulatory approvals, increasing costs for manufacturers. Fluctuations in raw material prices can impact profitability. Intense competition among established players and emerging regional companies adds further pressure.

Emerging Opportunities in the Asia-Pacific Medical Devices Packaging Market

Significant opportunities exist for growth in the Asia-Pacific medical devices packaging market. The increasing adoption of sustainable and eco-friendly packaging materials presents lucrative avenues for manufacturers. Strategic partnerships between packaging companies and medical device manufacturers can lead to innovation in product design and development. Expanding into emerging markets within the region can create significant growth potential. Moreover, technological breakthroughs in areas like smart packaging and advanced material science present opportunities for market expansion and differentiation.

Leading Players in the Asia-Pacific Medical Devices Packaging Market Sector

- WestRock Company

- Sonoco Products Company

- Bemis Manufacturing Company

- Technipaq Inc

- 3M

- DuPont de Nemours Inc

- Steripack Group

- SDG Pharma

- CCL Industries Inc

- Amcor PLC

- Mitsubishi Chemical Holdings

- Berry Global Inc

Key Milestones in Asia-Pacific Medical Devices Packaging Market Industry

- August 2021: Berry Global Inc. announces plans for a new manufacturing facility and healthcare center of excellence in Bangalore, India, expanding R&D and production capacity for key healthcare sectors.

- June 2021: China's NMPA implements revised Regulations on the Supervision and Administration of Medical Devices, enhancing quality, safety, and risk management for medical devices.

Strategic Outlook for Asia-Pacific Medical Devices Packaging Market Market

The Asia-Pacific medical devices packaging market presents a significant growth potential in the coming years. Continued innovation in sustainable and smart packaging technologies will be crucial for success. Strategic partnerships and collaborations will be vital for companies to expand their market reach and integrate technological advancements. Focusing on emerging markets and adapting to evolving regulatory landscapes will be essential for long-term growth and profitability within this dynamic sector.

Asia-Pacific Medical Devices Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Plastic Containers

- 1.2. Glass Containers

- 1.3. Lids

- 1.4. Pouches

- 1.5. Wrap Films

- 1.6. Paper Cans

- 1.7. Other Packaging Types

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. Australia

Asia-Pacific Medical Devices Packaging Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia-Pacific Medical Devices Packaging Market Regional Market Share

Geographic Coverage of Asia-Pacific Medical Devices Packaging Market

Asia-Pacific Medical Devices Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Medical Devices Market; Increasing Awareness Among the People About Better Packaging

- 3.3. Market Restrains

- 3.3.1. Market Pressure to Reduce Costs

- 3.4. Market Trends

- 3.4.1. The Plastic Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Medical Devices Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Plastic Containers

- 5.1.2. Glass Containers

- 5.1.3. Lids

- 5.1.4. Pouches

- 5.1.5. Wrap Films

- 5.1.6. Paper Cans

- 5.1.7. Other Packaging Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. Australia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. China Asia-Pacific Medical Devices Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Plastic Containers

- 6.1.2. Glass Containers

- 6.1.3. Lids

- 6.1.4. Pouches

- 6.1.5. Wrap Films

- 6.1.6. Paper Cans

- 6.1.7. Other Packaging Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. Australia

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. Japan Asia-Pacific Medical Devices Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Plastic Containers

- 7.1.2. Glass Containers

- 7.1.3. Lids

- 7.1.4. Pouches

- 7.1.5. Wrap Films

- 7.1.6. Paper Cans

- 7.1.7. Other Packaging Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. Australia

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. India Asia-Pacific Medical Devices Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Plastic Containers

- 8.1.2. Glass Containers

- 8.1.3. Lids

- 8.1.4. Pouches

- 8.1.5. Wrap Films

- 8.1.6. Paper Cans

- 8.1.7. Other Packaging Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. Australia

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Australia Asia-Pacific Medical Devices Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Plastic Containers

- 9.1.2. Glass Containers

- 9.1.3. Lids

- 9.1.4. Pouches

- 9.1.5. Wrap Films

- 9.1.6. Paper Cans

- 9.1.7. Other Packaging Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. Australia

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 WestRock Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sonoco Products Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bemis Manufacturing Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Technipaq Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 3M

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DuPont de Nemours Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Steripack Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SDG Pharma

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CCL Industries Inc *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Amcor PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mitsubishi Chemical Holdings

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Berry Global Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 WestRock Company

List of Figures

- Figure 1: Asia-Pacific Medical Devices Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Medical Devices Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 5: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 8: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 11: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 14: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Medical Devices Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Medical Devices Packaging Market?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the Asia-Pacific Medical Devices Packaging Market?

Key companies in the market include WestRock Company, Sonoco Products Company, Bemis Manufacturing Company, Technipaq Inc, 3M, DuPont de Nemours Inc, Steripack Group, SDG Pharma, CCL Industries Inc *List Not Exhaustive, Amcor PLC, Mitsubishi Chemical Holdings, Berry Global Inc.

3. What are the main segments of the Asia-Pacific Medical Devices Packaging Market?

The market segments include Packaging Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Medical Devices Market; Increasing Awareness Among the People About Better Packaging.

6. What are the notable trends driving market growth?

The Plastic Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Market Pressure to Reduce Costs.

8. Can you provide examples of recent developments in the market?

In August 2021, Berry Global Inc. announced its plans to establish a second manufacturing facility and global healthcare center of excellence in Bangalore, India. The new facility will enable the company to extend its R&D expertise and scale up production in several key healthcare sectors: ophthalmic, nasal pumps, inhalation, and injectable administrations. The increased capacity will also enhance supply in India and throughout South Asia, addressing some of the fastest-growing healthcare market geographies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Medical Devices Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Medical Devices Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Medical Devices Packaging Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Medical Devices Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence