Key Insights

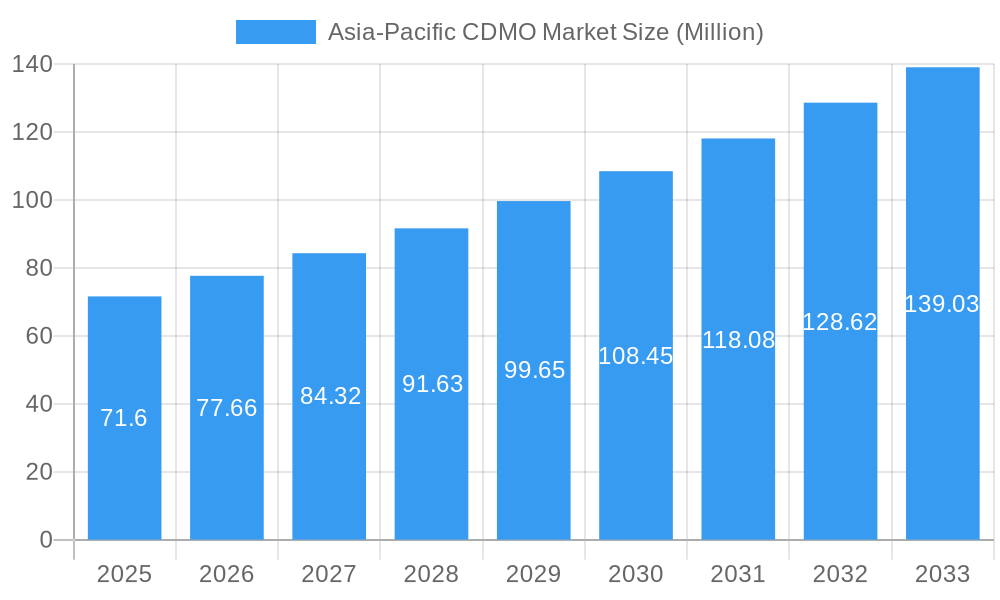

The Asia-Pacific Contract Development and Manufacturing Organization (CDMO) market, valued at $71.60 million in 2025, is projected to experience robust growth, driven by several key factors. The region's burgeoning pharmaceutical and biotechnology sectors, coupled with increasing outsourcing trends among pharmaceutical companies seeking cost-effective and efficient solutions, are major contributors to this expansion. Specifically, growing demand for Active Pharmaceutical Ingredients (APIs), particularly high-potency APIs (HPAPIs), is fueling market growth. Furthermore, the rising prevalence of chronic diseases and the consequent need for innovative drug development are significantly impacting market dynamics. The market is segmented by service type (API manufacturing, FDF development and manufacturing, solid and injectable dose formulations), research phase (pre-clinical to Phase IV), and by country, with China, Japan, and India emerging as key players. The presence of established CDMO players like Lonza, Syngene, and WuXi Biologics further solidifies the region's position as a significant global hub.

Asia-Pacific CDMO Market Market Size (In Million)

The projected Compound Annual Growth Rate (CAGR) of 8.60% from 2025 to 2033 indicates substantial market expansion. This growth will be influenced by ongoing technological advancements in drug development and manufacturing, increasing investments in research and development by both pharmaceutical companies and CDMOs, and a greater focus on speed and efficiency throughout the drug lifecycle. While regulatory hurdles and competition among established and emerging CDMOs represent potential restraints, the overall positive market outlook is expected to persist, driven by the aforementioned factors and the continued growth of the pharmaceutical sector in the Asia-Pacific region. The market's evolution will likely witness further consolidation among CDMOs, as well as increased strategic partnerships and collaborations to meet evolving industry demands.

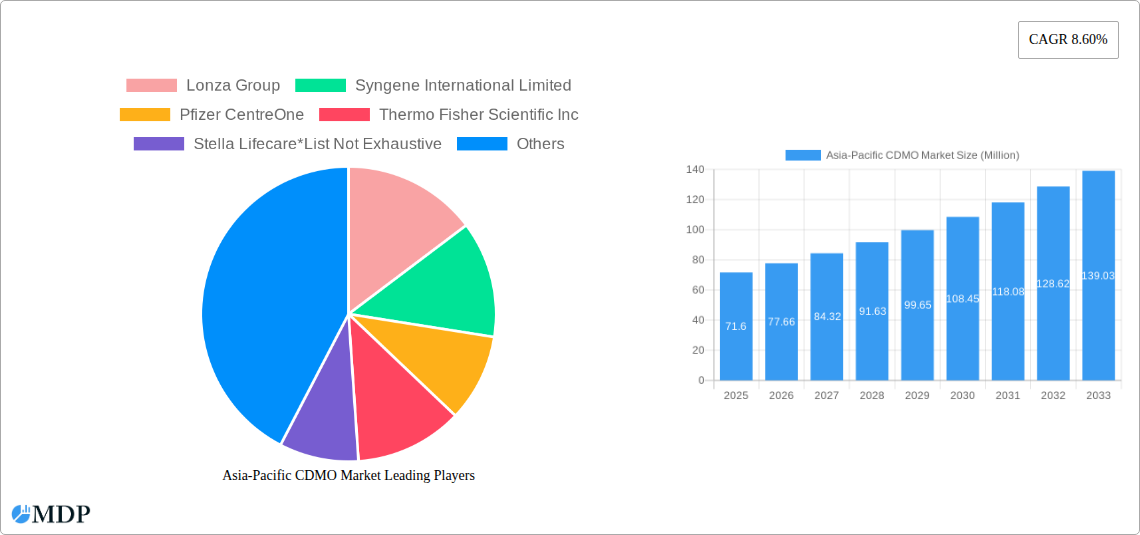

Asia-Pacific CDMO Market Company Market Share

Asia-Pacific CDMO Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Contract Development and Manufacturing Organization (CDMO) market, offering invaluable insights for stakeholders across the pharmaceutical and biotechnology industries. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, industry trends, leading players, and future growth potential. The report meticulously examines market segments by country (China, Japan, India, Australia, and New Zealand), service type (CMO: API Manufacturing, HPAPI FDF, Solid Dose, Injectable Dose; CRO: Pre-clinical to Phase IV), and incorporates recent key industry developments. The total market size is projected to reach xx Million by 2033, presenting significant opportunities for investment and growth.

Asia-Pacific CDMO Market Dynamics & Concentration

The Asia-Pacific CDMO market is characterized by a dynamic interplay of factors impacting its concentration and growth trajectory. Market concentration is currently moderate, with several key players holding significant market share, but a fragmented landscape still exists due to the presence of numerous smaller, specialized CDMOs. However, ongoing consolidation through mergers and acquisitions (M&A) is expected to increase concentration in the coming years. Between 2019 and 2024, an estimated xx M&A deals occurred, indicating a robust pace of consolidation. Innovation is a key driver, with companies constantly investing in advanced technologies like AI-driven drug discovery and continuous manufacturing. Stringent regulatory frameworks, particularly concerning Good Manufacturing Practices (GMP), influence market dynamics. While the availability of substitutes is limited due to specialized expertise required, end-user trends towards outsourcing non-core activities and the increasing prevalence of biologics drive market expansion.

Asia-Pacific CDMO Market Industry Trends & Analysis

The Asia-Pacific CDMO market exhibits a robust growth trajectory, fueled by several key factors. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately xx%, and a similar rate is projected for 2025-2033, indicating sustained market expansion. Technological advancements, such as the adoption of automation and digitalization across processes, are transforming the industry's efficiency and speed. A shift in consumer preferences toward specialized and high-quality contract services is another crucial driver. Competitive dynamics are characterized by a mix of established global players and emerging regional CDMOs, leading to intensified competition and innovation. Market penetration is expected to increase steadily as more pharmaceutical and biotech companies adopt outsourcing strategies.

Leading Markets & Segments in Asia-Pacific CDMO Market

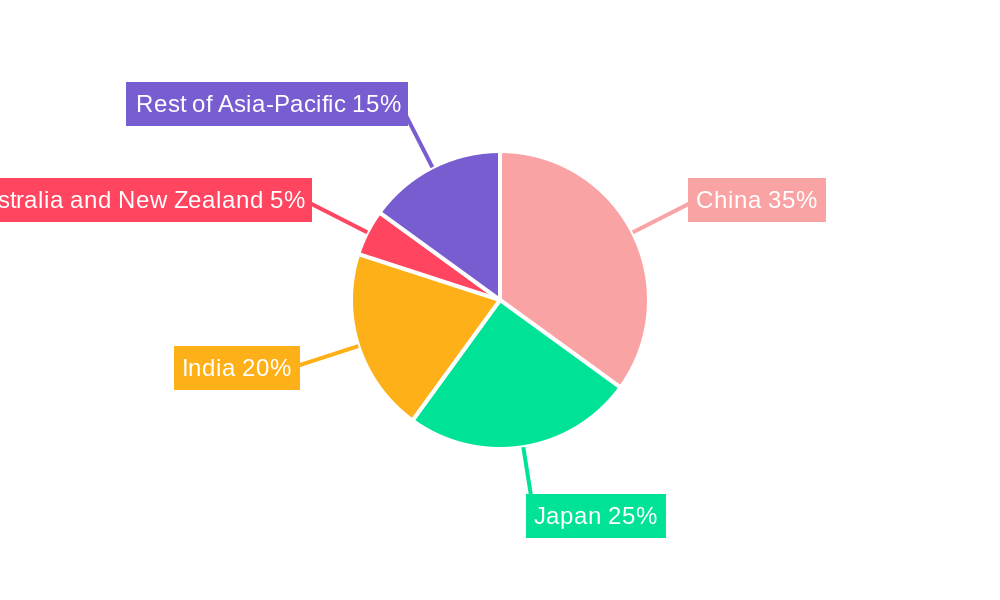

By Country: China dominates the Asia-Pacific CDMO market, driven by its large and growing pharmaceutical industry, supportive government policies, and a large pool of skilled labor. Japan follows closely, benefiting from a strong focus on research and development and a mature pharmaceutical market. India exhibits significant growth potential due to its cost-effectiveness and increasing investment in life sciences infrastructure. Australia and New Zealand present a smaller but steadily growing market.

By Service Type (CMO): The API manufacturing segment commands a significant share of the market, reflecting the substantial demand for active pharmaceutical ingredients. The growing prevalence of complex molecules and the need for specialized handling fuels the expansion of the HPAPI and FDF development and manufacturing segment. Solid and injectable dose formulations continue to be major segments driven by high demand for various drug delivery methods.

By Research Phase (CRO): The market demonstrates significant demand across all research phases, with a strong focus on pre-clinical and Phase I-III trials. The expansion of the biopharmaceutical industry and the increasing reliance on outsourced research services contribute to sustained growth across all segments. Key drivers in each region include robust economic policies supporting the healthcare industry, advanced infrastructure conducive to research and manufacturing, and the growing presence of multinational pharmaceutical corporations within these markets.

Asia-Pacific CDMO Market Product Developments

Recent product innovations focus on advanced technologies that improve efficiency, reduce costs, and enhance drug quality. These include the use of continuous manufacturing processes, single-use technologies, and automation in API manufacturing and formulation. Moreover, companies are increasingly offering integrated services that encompass the entire drug development lifecycle, from discovery to manufacturing. The market fit of these innovations is exceptionally strong due to industry-wide demand for speed, efficiency, and regulatory compliance.

Key Drivers of Asia-Pacific CDMO Market Growth

Several key factors fuel the Asia-Pacific CDMO market’s robust expansion. Firstly, the increasing outsourcing of drug development and manufacturing by pharmaceutical and biotechnology companies, driven by cost optimization and access to specialized expertise, significantly propels the market's growth. Secondly, government initiatives and supportive regulations in several key countries are encouraging investments in the sector, furthering expansion. Finally, technological advancements and innovations in manufacturing processes are enhancing efficiency, driving increased production capacity, and meeting the growing demand for pharmaceutical products.

Challenges in the Asia-Pacific CDMO Market

The Asia-Pacific CDMO market faces several challenges, including stringent regulatory compliance requirements which can increase costs and slow down approvals. Supply chain disruptions, particularly the availability of raw materials and skilled labor, can impact production and profitability. Furthermore, intense competition among established and emerging CDMOs necessitates ongoing innovation and operational efficiency to maintain a competitive edge. The combined effect of these challenges impacts overall market growth, reducing market penetration and limiting overall profitability by an estimated xx%.

Emerging Opportunities in Asia-Pacific CDMO Market

Significant opportunities exist for long-term growth in the Asia-Pacific CDMO market. The rise of innovative technologies like personalized medicine and cell and gene therapy is creating substantial demand for specialized CDMO services. Furthermore, strategic partnerships between CDMOs and pharmaceutical companies can lead to mutually beneficial collaborations, enhancing efficiency and streamlining drug development. Finally, expanding into emerging markets within the region can unlock significant growth potential.

Leading Players in the Asia-Pacific CDMO Market Sector

- Lonza Group

- Syngene International Limited

- Pfizer CentreOne

- Thermo Fisher Scientific Inc

- Stella Lifecare

- WuXi Biologics

- Catalent Inc

- FUJIFILM Diosynth Biotechnologies

- Samsung Biologics

- Jubilant Biosys Ltd

- Boehringer Ingelheim Group

- Recipharm AB

Key Milestones in Asia-Pacific CDMO Market Industry

- September 2023: WuXi Vaccines launched a standalone vaccines CDMO site in Suzhou, China, significantly boosting capacity for drug substances and products.

- March 2023: Samsung Biologics announced the development of a fifth facility, demonstrating commitment to meeting growing market demands with a USD 1.44 Billion investment.

Strategic Outlook for Asia-Pacific CDMO Market Market

The Asia-Pacific CDMO market holds significant promise, fueled by ongoing technological advancements, increasing outsourcing trends, and favorable regulatory environments. Strategic partnerships, capacity expansion, and a focus on innovative services will be crucial for success in this competitive landscape. The market's future growth potential is substantial, with significant opportunities for players who can adapt to evolving industry trends and leverage technological advancements.

Asia-Pacific CDMO Market Segmentation

-

1. Service Type CMO Segment

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency (HPAPI)

-

1.2. Finished

-

1.2.1. Solid Dose Formulation

- 1.2.1.1. Tablets

- 1.2.1.2. Others

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

-

1.2.1. Solid Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

-

2. Research Phase CRO Segment

- 2.1. Pre-clinical

- 2.2. Phase I

- 2.3. Phase II

- 2.4. Phase III

- 2.5. Phase IV

Asia-Pacific CDMO Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific CDMO Market Regional Market Share

Geographic Coverage of Asia-Pacific CDMO Market

Asia-Pacific CDMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Outsourcing Volume by Big Pharmaceutical Companies4.; Increasing Investment in Research and Development

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Lead Time Owing to Supply Chain Related Constraints in the Region4.; Skilled Labour Shortages Across the Region

- 3.4. Market Trends

- 3.4.1. The Demand For Injectable Dose Formulation is Rising in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific CDMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type CMO Segment

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.1.1. Tablets

- 5.1.2.1.2. Others

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.2.1. Solid Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Research Phase CRO Segment

- 5.2.1. Pre-clinical

- 5.2.2. Phase I

- 5.2.3. Phase II

- 5.2.4. Phase III

- 5.2.5. Phase IV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type CMO Segment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lonza Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syngene International Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pfizer CentreOne

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thermo Fisher Scientific Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Stella Lifecare*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WuXi Biologics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Catalent Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUJIFILM Diosynth Biotechnologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung Biologics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jubilant Biosys Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Recipharm AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Lonza Group

List of Figures

- Figure 1: Asia-Pacific CDMO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific CDMO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific CDMO Market Revenue Million Forecast, by Service Type CMO Segment 2020 & 2033

- Table 2: Asia-Pacific CDMO Market Revenue Million Forecast, by Research Phase CRO Segment 2020 & 2033

- Table 3: Asia-Pacific CDMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific CDMO Market Revenue Million Forecast, by Service Type CMO Segment 2020 & 2033

- Table 5: Asia-Pacific CDMO Market Revenue Million Forecast, by Research Phase CRO Segment 2020 & 2033

- Table 6: Asia-Pacific CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific CDMO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific CDMO Market?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Asia-Pacific CDMO Market?

Key companies in the market include Lonza Group, Syngene International Limited, Pfizer CentreOne, Thermo Fisher Scientific Inc, Stella Lifecare*List Not Exhaustive, WuXi Biologics, Catalent Inc, FUJIFILM Diosynth Biotechnologies, Samsung Biologics, Jubilant Biosys Ltd, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the Asia-Pacific CDMO Market?

The market segments include Service Type CMO Segment, Research Phase CRO Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.60 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Outsourcing Volume by Big Pharmaceutical Companies4.; Increasing Investment in Research and Development.

6. What are the notable trends driving market growth?

The Demand For Injectable Dose Formulation is Rising in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Lead Time Owing to Supply Chain Related Constraints in the Region4.; Skilled Labour Shortages Across the Region.

8. Can you provide examples of recent developments in the market?

September 2023: WuXi Vaccines, a key pharmaceutical CDMO firm, introduced a standalone vaccines CDMO site in Suzhou, China. The expansion was expected to introduce enhanced capacity for both drug substances and drug products, offering comprehensive services for a range of vaccines. This move aimed to expedite project timelines for the company's global clients, covering everything from process and drug product development to manufacturing clinical-scale drug substances (DS) and small-to-medium sterile drug products (DP).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific CDMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific CDMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific CDMO Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific CDMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence