Key Insights

The Americas plastic bag market, spanning North and South America, is a dynamic sector influenced by various economic and environmental factors. Current projections indicate a Compound Annual Growth Rate (CAGR) of 3.6%. The estimated market size is valued at 27.31 billion as of 2025. Growth is primarily propelled by consistent demand from the consumer and retail industries, especially within burgeoning Latin American economies. The expansion of e-commerce and its associated packaging requirements further bolsters this demand. Nevertheless, the market confronts significant challenges due to escalating environmental concerns and increasingly stringent regulations targeting plastic waste reduction. This is prompting a transition towards biodegradable alternatives, such as PLA and PHA, though their current adoption rate remains modest compared to conventional non-biodegradable plastics. The market segmentation by application—consumer/retail, institutional, and industrial—underscores the varied end-use scenarios and the differential impact of environmental policies across these segments. Institutional and industrial sectors may experience slower growth due to stricter regulations and a heightened emphasis on sustainable solutions. Leading entities like International Plastics Inc., Mondi PLC, and Berry Global Inc. are adapting to this evolving market through material innovation and packaging advancements, focusing on lightweight designs and strategic alliances to enhance recyclability and advance circular economy principles.

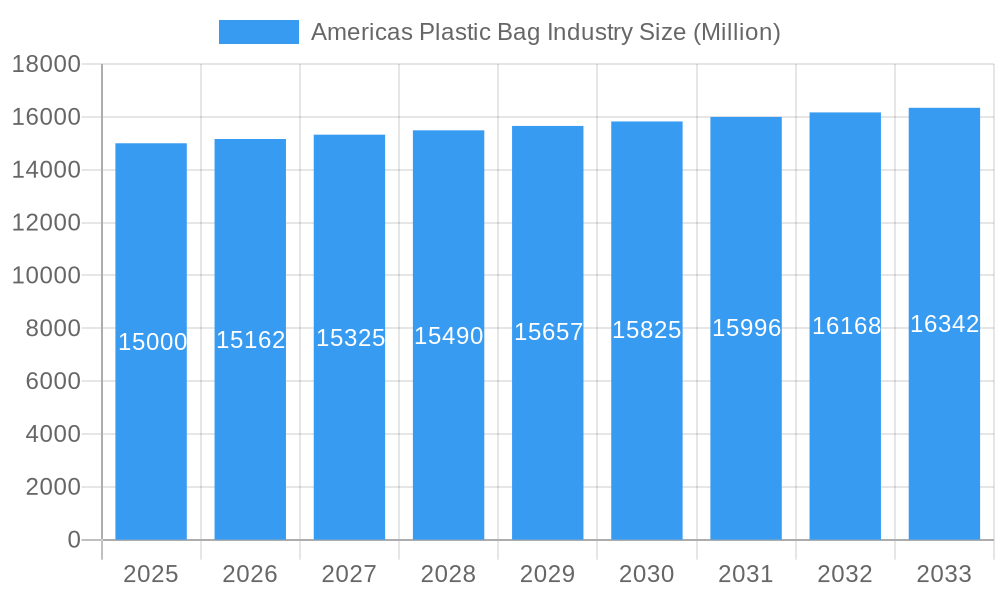

Americas Plastic Bag Industry Market Size (In Billion)

The market share distribution across North and South America reflects diverse economic development levels and regulatory frameworks. North America, characterized by mature economies and established regulations, is anticipated to show moderate growth, contrasting with certain South American regions where developing infrastructure and rising consumer spending may drive higher demand. The competitive environment includes both global corporations and regional enterprises, each employing distinct strategies to address industry challenges and capitalize on emerging opportunities. The intensified focus on sustainability necessitates adaptation and innovation, highlighting the critical need for eco-friendly alternatives and responsible waste management practices. Companies prioritizing sustainability are positioned to achieve a competitive advantage in the long run.

Americas Plastic Bag Industry Company Market Share

Americas Plastic Bag Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Americas plastic bag industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market trends, competitive landscapes, and future growth potential. The report is crucial for investors, manufacturers, retailers, and regulatory bodies looking to understand the complexities and opportunities within this sector.

Americas Plastic Bag Industry Market Dynamics & Concentration

The Americas plastic bag market, valued at xx Million in 2024, is characterized by moderate concentration with several major players vying for market share. Key dynamics shaping the industry include:

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2024. This concentration is expected to shift slightly by 2033 due to anticipated M&A activity and the emergence of new players.

- Innovation Drivers: Growing demand for sustainable and recyclable alternatives is driving innovation in biodegradable and compostable plastic bag materials. Advancements in film technology, such as ProAmpac LLC's ProActive Recyclable R-2000F, are enhancing product performance and recyclability.

- Regulatory Frameworks: Stringent environmental regulations and bans on single-use plastics in various regions are significantly impacting market dynamics, pushing manufacturers towards eco-friendly solutions. These regulations vary across different states and provinces, leading to a fragmented regulatory landscape.

- Product Substitutes: The rise of reusable bags and alternative packaging materials presents a significant challenge to traditional plastic bags. The market share of reusable bags is projected to increase by xx% between 2025 and 2033, exerting pressure on traditional plastic bag manufacturers.

- End-User Trends: Shifting consumer preferences towards sustainable products and increased awareness of environmental issues are influencing demand for eco-friendly plastic bag alternatives. E-commerce growth also contributes to increased demand for packaging materials, creating both challenges and opportunities.

- M&A Activities: Consolidation within the industry is anticipated, with an estimated xx M&A deals projected between 2025 and 2033. These activities will likely reshape the competitive landscape and drive further innovation.

Americas Plastic Bag Industry Industry Trends & Analysis

The Americas plastic bag market is projected to experience a robust CAGR of 4.5% during the forecast period (2025-2033), indicating steady expansion. Several key factors are contributing to this growth:

The market is witnessing substantial growth driven by the escalating demand from the consumer and retail sectors. This surge is fueled by rising disposable incomes, evolving consumer lifestyles, and the persistent preference for convenience. Simultaneously, significant advancements in material science and manufacturing processes are paving the way for the development of more sustainable, efficient, and eco-friendly plastic bag solutions. While consumer preference for the convenience and cost-effectiveness of single-use plastic bags continues to be a major driver, growing environmental awareness is also influencing purchasing decisions. However, the increasing adoption of reusable alternatives and the implementation of stringent government regulations aimed at reducing plastic waste present considerable challenges and necessitate adaptive strategies for sustained market growth. The competitive landscape remains dynamic, characterized by continuous innovation from both established industry leaders and agile new entrants seeking to enhance their market positions. The penetration of biodegradable and compostable plastic bags is gradually increasing, propelled by heightened consumer awareness and environmental concerns. While still representing a smaller segment, this eco-conscious category is poised for significant future expansion.

Leading Markets & Segments in Americas Plastic Bag Industry

The United States stands as the largest market for plastic bags within the Americas, propelled by high consumption levels across its diverse retail sectors. Other significant markets contributing to regional demand include Canada, Mexico, and Brazil, each with unique consumption patterns and regulatory environments.

- By Material Type: Non-biodegradable plastics continue to dominate the market, holding an estimated 75% market share in 2025, primarily due to their inherent cost-effectiveness and widespread availability. However, the biodegradable segment, encompassing materials like Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA), is experiencing accelerated growth. This expansion is driven by increasing environmental consciousness and supportive government regulations. This segment is projected to achieve a compelling CAGR of 7.0% during the forecast period, signaling a significant shift towards sustainable alternatives.

- By Application Type: Consumer and retail applications remain the largest segment by a substantial margin, fueled by the robust growth of e-commerce and consistently high consumer spending. The institutional segment, encompassing hospitality and healthcare, also demonstrates steady growth, driven by the continuous demand for reliable and hygienic packaging solutions. The industrial segment exhibits moderate growth, with demand influenced by the diverse packaging needs across various manufacturing and logistics operations. Other niche applications represent a smaller but progressively growing segment of the market.

Key drivers underpinning growth in these leading markets include: favorable economic policies that actively support retail sector expansion, the presence of well-developed infrastructure ensuring efficient distribution networks, and a persistent consumer preference for convenient and readily available packaging solutions.

Americas Plastic Bag Industry Product Developments

Recent product developments have focused on enhancing recyclability and sustainability. For instance, ProAmpac LLC's launch of ProActive Recyclable R-2000F highlights the trend toward improved performance and recyclability in polyethylene-based films. This reflects a broader industry trend toward creating products with enhanced durability, improved printability, and reduced environmental impact, catering to growing consumer demand for eco-friendly options.

Key Drivers of Americas Plastic Bag Industry Growth

Several factors are driving growth in the Americas plastic bag industry:

- Technological advancements: Innovations in materials science are leading to stronger, more durable, and recyclable plastic bags.

- Economic growth: Rising disposable incomes in several regions are fueling increased consumption of packaged goods, boosting demand for plastic bags.

- Favorable regulatory environment: While some regulations restrict single-use plastics, others incentivize innovation in recyclable and biodegradable alternatives, supporting market growth.

Challenges in the Americas Plastic Bag Industry Market

The Americas plastic bag industry is navigating a complex landscape of significant challenges:

- Stringent Environmental Regulations: The widespread implementation of bans and restrictions on single-use plastics across various jurisdictions presents a substantial impact on market size and necessitates innovative product development and adoption of alternative materials.

- Supply Chain Volatility: Fluctuations in the prices of key raw materials, coupled with ongoing logistical challenges and potential disruptions, can significantly affect production costs, impacting overall profitability and operational efficiency.

- Intense Competition: The market is characterized by a high degree of competition, with numerous players vying for market share. This intense rivalry places considerable pressure on pricing strategies and profit margins, demanding constant efforts in differentiation and value creation. The projected impact of these combined challenges is an estimated 15% reduction in market growth by 2033 compared to initial projections that did not fully account for these factors.

Emerging Opportunities in Americas Plastic Bag Industry

Despite the challenges, several promising opportunities are poised to drive future growth within the Americas plastic bag industry:

- Technological Breakthroughs in Sustainable Materials: Continued innovation in the development of advanced biodegradable, compostable, and recyclable plastic materials offers substantial growth potential, catering to increasing demand for eco-friendly packaging solutions.

- Strategic Partnerships and Collaborations: The formation of strategic alliances between plastic bag manufacturers, raw material suppliers, and major retailers can foster the co-development and adoption of sustainable packaging solutions, creating new market avenues and enhancing brand reputation.

- Market Expansion in Developing Economies: As developing economies within the Americas continue to grow, their expanding consumer bases and evolving retail landscapes present significant untapped opportunities for market penetration and increased demand for plastic bag products.

- Circular Economy Initiatives: Embracing and investing in circular economy models, including advanced recycling technologies and product redesign for enhanced recyclability, can create new revenue streams and address environmental concerns proactively.

Leading Players in the Americas Plastic Bag Industry Sector

- International Plastics Inc

- Mondi PLC

- ProAmpac LLC

- Gulf Coast Bag and Bagging Co Inc

- The Buckeye Bag Company

- Novolex Holdings

- Berry Global Inc

- Sealed Air Corporation

- Schur Flexibles Holding GmbH

- Ampacet Corporation

List Not Exhaustive - The competitive landscape is dynamic and includes many other regional and specialized manufacturers.

Key Milestones in Americas Plastic Bag Industry Industry

- July 2020: Walmart, Target, CVS Health, Kroger, and Walgreens form the Consortium to Reinvent the Retail Plastic Bag, signaling a shift towards sustainable alternatives.

- February 2021: ProAmpac LLC launches ProActive Recyclable R-2000F, showcasing innovation in recyclable polyethylene films.

Strategic Outlook for Americas Plastic Bag Industry Market

The Americas plastic bag market is poised for continued growth, albeit at a moderated pace due to regulatory pressures. Strategic opportunities lie in investing in sustainable and recyclable solutions, fostering partnerships across the value chain, and expanding into high-growth markets. The focus on sustainability and eco-friendly alternatives will be crucial for long-term success in this evolving market.

Americas Plastic Bag Industry Segmentation

-

1. Material Type

-

1.1. Non-Biodegradable

- 1.1.1. High Density Polyethylene (HDPE)

- 1.1.2. Polystyrene (PS)

- 1.1.3. Low Density Polyethylene (LDPE)

- 1.1.4. Others

- 1.2. Bio-degradable (PLA, PHA, etc.)

-

1.1. Non-Biodegradable

-

2. Application Type

- 2.1. Consumer

- 2.2. Institut

- 2.3. Industrial (includes sacks, etc.)

- 2.4. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.2. Latin America

-

3.1. North America

Americas Plastic Bag Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 2. Latin America

Americas Plastic Bag Industry Regional Market Share

Geographic Coverage of Americas Plastic Bag Industry

Americas Plastic Bag Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Unit Sales in Key End-user Markets; Advancements in Printing Industry has Enabling Firms to Use Plastic Bags to Promote their Brands

- 3.3. Market Restrains

- 3.3.1. ; Government Regulations and Interventions

- 3.4. Market Trends

- 3.4.1. Consumer and Retail Accounts for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Plastic Bag Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Non-Biodegradable

- 5.1.1.1. High Density Polyethylene (HDPE)

- 5.1.1.2. Polystyrene (PS)

- 5.1.1.3. Low Density Polyethylene (LDPE)

- 5.1.1.4. Others

- 5.1.2. Bio-degradable (PLA, PHA, etc.)

- 5.1.1. Non-Biodegradable

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Consumer

- 5.2.2. Institut

- 5.2.3. Industrial (includes sacks, etc.)

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.2. Latin America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Americas Plastic Bag Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Non-Biodegradable

- 6.1.1.1. High Density Polyethylene (HDPE)

- 6.1.1.2. Polystyrene (PS)

- 6.1.1.3. Low Density Polyethylene (LDPE)

- 6.1.1.4. Others

- 6.1.2. Bio-degradable (PLA, PHA, etc.)

- 6.1.1. Non-Biodegradable

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Consumer

- 6.2.2. Institut

- 6.2.3. Industrial (includes sacks, etc.)

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. North America

- 6.3.1.1. United States

- 6.3.1.2. Canada

- 6.3.2. Latin America

- 6.3.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Latin America Americas Plastic Bag Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Non-Biodegradable

- 7.1.1.1. High Density Polyethylene (HDPE)

- 7.1.1.2. Polystyrene (PS)

- 7.1.1.3. Low Density Polyethylene (LDPE)

- 7.1.1.4. Others

- 7.1.2. Bio-degradable (PLA, PHA, etc.)

- 7.1.1. Non-Biodegradable

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Consumer

- 7.2.2. Institut

- 7.2.3. Industrial (includes sacks, etc.)

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. North America

- 7.3.1.1. United States

- 7.3.1.2. Canada

- 7.3.2. Latin America

- 7.3.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 International Plastics Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Mondi PLC

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 ProAmpac LLC

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Gulf Coast Bag and Bagging Co Inc

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 The Buckeye Bag Company

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Novolex Holdings

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Berry Global Inc *List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.1 International Plastics Inc

List of Figures

- Figure 1: Americas Plastic Bag Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Americas Plastic Bag Industry Share (%) by Company 2025

List of Tables

- Table 1: Americas Plastic Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Americas Plastic Bag Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Americas Plastic Bag Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Americas Plastic Bag Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Americas Plastic Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Americas Plastic Bag Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Americas Plastic Bag Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Americas Plastic Bag Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Americas Plastic Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Americas Plastic Bag Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Americas Plastic Bag Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 12: Americas Plastic Bag Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 13: Americas Plastic Bag Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Americas Plastic Bag Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Plastic Bag Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Americas Plastic Bag Industry?

Key companies in the market include International Plastics Inc, Mondi PLC, ProAmpac LLC, Gulf Coast Bag and Bagging Co Inc, The Buckeye Bag Company, Novolex Holdings, Berry Global Inc *List Not Exhaustive.

3. What are the main segments of the Americas Plastic Bag Industry?

The market segments include Material Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Unit Sales in Key End-user Markets; Advancements in Printing Industry has Enabling Firms to Use Plastic Bags to Promote their Brands.

6. What are the notable trends driving market growth?

Consumer and Retail Accounts for the Largest Market Share.

7. Are there any restraints impacting market growth?

; Government Regulations and Interventions.

8. Can you provide examples of recent developments in the market?

February 2021 - ProAmpac LLC has launched ProActive Recyclable R-2000F, a polyethylene-based laminated structure that offers excellent performance in cold temperature conditions. The product was designed with enhanced stiffness and scuff-resistance compared to standard surface printed films and showed outstanding display characteristics in the freezer case.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Plastic Bag Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Plastic Bag Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Plastic Bag Industry?

To stay informed about further developments, trends, and reports in the Americas Plastic Bag Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence