Key Insights

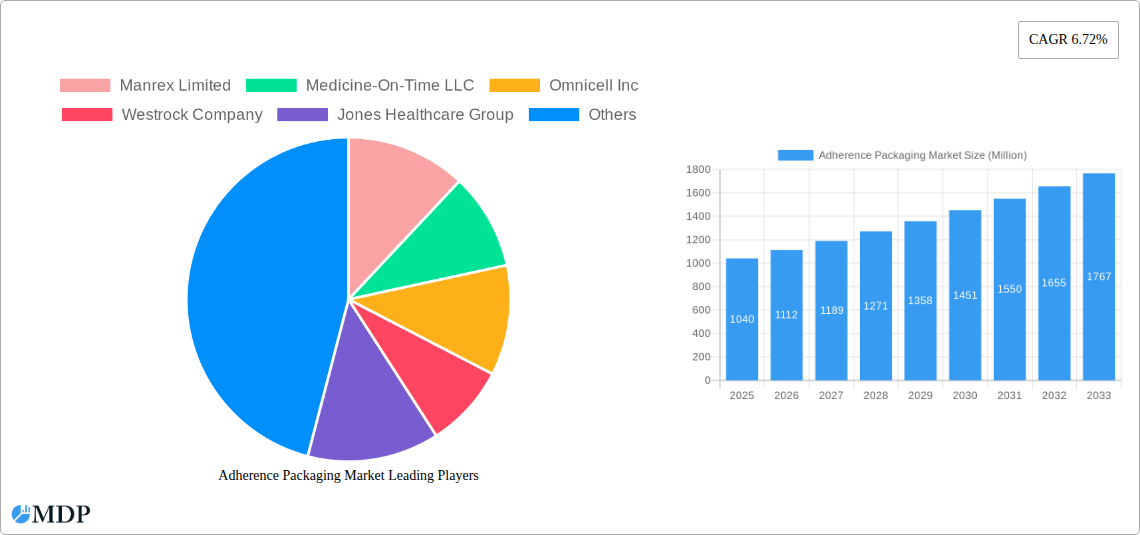

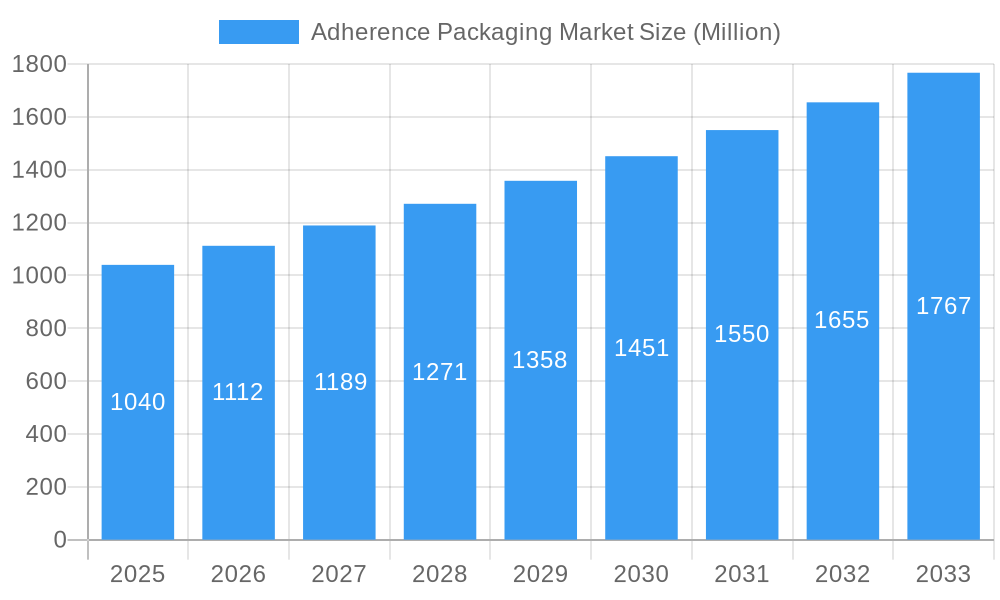

The global adherence packaging market, valued at $1.04 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.72% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of chronic diseases necessitates medication adherence, boosting demand for packaging solutions that simplify and improve medication intake. Furthermore, the growing elderly population, with its higher incidence of chronic conditions, contributes significantly to market growth. Technological advancements, such as smart packaging incorporating digital reminders and sensors, are revolutionizing the industry, enhancing patient compliance and providing valuable data for healthcare providers. The pharmaceutical industry's focus on improving patient outcomes and reducing healthcare costs further strengthens the market's trajectory. Different packaging materials, including plastic (PE, PET, PVC, and PP), paper and paperboard, and aluminum, cater to diverse needs and preferences, impacting market segmentation. The prevalent packaging types—blister packs, pouches, and other innovative designs—contribute to the market's dynamism. Key players like Manrex Limited, Omnicell Inc., and Cardinal Health Inc. are driving innovation and market penetration through strategic partnerships and product development. The market is geographically diverse, with significant growth expected across North America, Europe, and the Asia-Pacific region, reflecting varying healthcare infrastructure and patient demographics.

Adherence Packaging Market Market Size (In Billion)

The market segmentation by type (unit-dose and multi-dose packaging) presents varied growth opportunities. Unit-dose packaging, offering precise medication control, is expected to dominate in certain segments like hospitals and pharmacies due to its convenience and reduced risk of medication errors. Multi-dose packaging, while offering cost advantages, may see slower growth due to challenges in ensuring patient adherence. The end-user industry segmentation reveals high demand from pharmacies and hospitals, which are expected to remain major drivers, but the “other end-user industries” segment, encompassing clinics and home healthcare, is likely to experience significant growth potential. Regulatory changes influencing pharmaceutical packaging and increasing investments in healthcare infrastructure are expected to positively impact the market's expansion throughout the forecast period. The competitive landscape is characterized by both established players and emerging companies, leading to innovative product development and market diversification.

Adherence Packaging Market Company Market Share

Adherence Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Adherence Packaging Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025). The market is segmented by material (Plastic (PE, PET, PVC, and PP), Paper and Paperboard, Aluminum), type (Unit-dose Packaging, Multi-dose Packaging), packaging type (Blisters, Pouches, Other Packaging Types), and end-user industry (Pharmacies, Hospitals, Other End-user Industries). The report values the market at xx Million in 2025 and projects a CAGR of xx% during the forecast period. Key players analyzed include Manrex Limited, Medicine-On-Time LLC, Omnicell Inc, Westrock Company, Jones Healthcare Group, Cardinal Health Inc, Keystone Folding Box Co, Parata Systems LLC, Rx Systems Inc, Drug Package LLC, and others.

Adherence Packaging Market Market Dynamics & Concentration

The Adherence Packaging Market is characterized by moderate concentration, with a few major players holding significant market share. The market size is estimated at xx Million in 2025. Innovation is a key driver, with companies continually developing new materials, designs, and technologies to improve medication adherence and patient experience. Stringent regulatory frameworks, particularly concerning drug safety and packaging standards, significantly influence market dynamics. The presence of substitute packaging options, such as traditional pill bottles, presents a competitive challenge. End-user trends, such as the increasing adoption of digital health technologies and personalized medicine, are shaping market demand. M&A activity in the sector has been moderate, with approximately xx deals recorded in the last five years. This level of activity reflects the consolidation trend in the healthcare packaging industry.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An average of xx M&A deals per year were recorded between 2020 and 2024.

- Innovation Drivers: Development of smart packaging solutions and sustainable materials.

- Regulatory Landscape: Stringent regulations concerning drug safety and packaging integrity.

Adherence Packaging Market Industry Trends & Analysis

The Adherence Packaging Market is experiencing robust growth, driven by factors such as the rising prevalence of chronic diseases, an aging global population, and increasing demand for convenient and safe medication management solutions. Technological advancements, particularly in smart packaging and digital health integration, are revolutionizing the industry. Consumer preferences are shifting towards sustainable and user-friendly packaging options. Competitive dynamics are intense, with companies focusing on product differentiation, innovation, and strategic partnerships to gain market share. The market's CAGR is projected at xx% from 2025 to 2033, indicating significant growth potential. Market penetration of innovative adherence packaging solutions is steadily increasing, with xx% adoption rate in key regions by 2025.

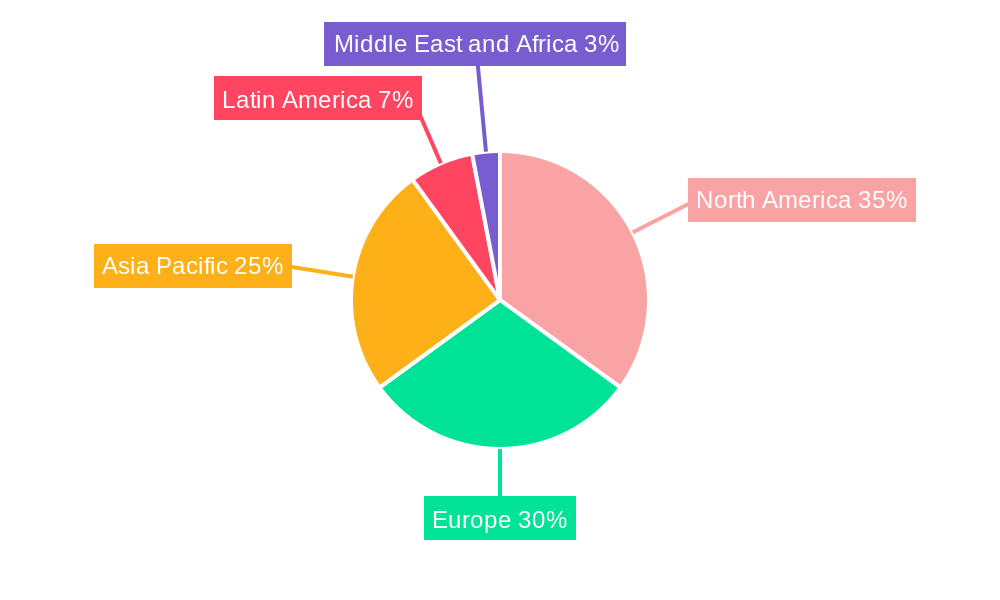

Leading Markets & Segments in Adherence Packaging Market

The North American region currently dominates the Adherence Packaging Market, driven by high healthcare expenditure, a large aging population, and well-established healthcare infrastructure. Within material types, plastic (PE, PET, PVC, and PP) holds the largest market share due to its cost-effectiveness and versatility. Unit-dose packaging is the leading type, owing to its precise medication delivery and reduced risk of errors. Blister packs represent the dominant packaging format due to their ease of use and tamper-evidence features. Pharmacies constitute the primary end-user segment, driven by increased demand for convenient medication dispensing solutions.

- Key Drivers for North American Dominance:

- High healthcare expenditure

- Large aging population

- Advanced healthcare infrastructure

- Stringent regulatory frameworks promoting patient safety

Adherence Packaging Market Product Developments

Recent product innovations focus on incorporating smart technologies into adherence packaging, such as sensors and digital tracking systems. This enhances medication management and improves patient compliance. The integration of sustainable materials, such as recycled plastics and biodegradable polymers, addresses growing environmental concerns. These innovations cater to the increasing demand for personalized medicine and improved patient outcomes, offering significant competitive advantages.

Key Drivers of Adherence Packaging Market Growth

Technological advancements in smart packaging and digital health integration are key growth drivers. The rising prevalence of chronic diseases and an aging population are fueling demand for improved medication adherence solutions. Stringent regulatory frameworks emphasizing patient safety further support market growth. For instance, the increasing adoption of telehealth and remote patient monitoring is driving demand for smart adherence packaging.

Challenges in the Adherence Packaging Market Market

Regulatory hurdles associated with drug approvals and packaging standards pose significant challenges. Supply chain disruptions and fluctuations in raw material prices impact profitability and market stability. Intense competition and the need for continuous innovation to stay ahead of the curve pose a constant pressure. These challenges collectively impact the overall market growth by approximately xx% annually.

Emerging Opportunities in Adherence Packaging Market

Technological breakthroughs, such as the development of advanced sensors and data analytics capabilities, are creating exciting new opportunities. Strategic partnerships between packaging manufacturers, pharmaceutical companies, and technology providers are driving innovation and expanding market reach. Expansion into emerging markets with growing healthcare infrastructure presents significant long-term growth potential. The growing focus on personalized medicine will further boost market demand for customized adherence packaging solutions.

Leading Players in the Adherence Packaging Market Sector

- Manrex Limited

- Medicine-On-Time LLC

- Omnicell Inc

- Westrock Company

- Jones Healthcare Group

- Cardinal Health Inc

- Keystone Folding Box Co

- Parata Systems LLC

- Rx Systems Inc

- Drug Package LLC

Key Milestones in Adherence Packaging Market Industry

- December 2021: Jones Healthcare Group launched sustainable packaging solutions for its Qube and FlexRx product lines, driving market adoption of eco-friendly options.

- February 2022: CuePath Innovation launched its second-generation smart blister packaging solution for remote patient care, enhancing medication monitoring capabilities and market potential.

Strategic Outlook for Adherence Packaging Market Market

The Adherence Packaging Market is poised for continued growth, driven by ongoing technological advancements, evolving healthcare trends, and an increasing focus on patient-centric care. Strategic partnerships, market expansion into emerging economies, and innovation in sustainable and smart packaging technologies will be crucial for achieving long-term success. The market presents significant opportunities for companies that can effectively address the challenges and capitalize on the emerging trends.

Adherence Packaging Market Segmentation

-

1. Material

- 1.1. Plastic (PE, PET, PVC, and PP)

- 1.2. Paper and Paperboard

- 1.3. Aluminum

-

2. Type

- 2.1. Unit-dose Packaging

- 2.2. Multi-dose Packaging

-

3. Packaging Type

- 3.1. Blisters

- 3.2. Pouches

- 3.3. Other Packaging Types

-

4. End-user Industry

- 4.1. Pharmacies

- 4.2. Hospitals

- 4.3. Other End-user Industries

Adherence Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Adherence Packaging Market Regional Market Share

Geographic Coverage of Adherence Packaging Market

Adherence Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Need to Minimize Medication Wastage; High Rate of Medication Non-adherence

- 3.3. Market Restrains

- 3.3.1. Concerns over Material Availability and Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Multi-dose Packaging is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adherence Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic (PE, PET, PVC, and PP)

- 5.1.2. Paper and Paperboard

- 5.1.3. Aluminum

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Unit-dose Packaging

- 5.2.2. Multi-dose Packaging

- 5.3. Market Analysis, Insights and Forecast - by Packaging Type

- 5.3.1. Blisters

- 5.3.2. Pouches

- 5.3.3. Other Packaging Types

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Pharmacies

- 5.4.2. Hospitals

- 5.4.3. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Adherence Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic (PE, PET, PVC, and PP)

- 6.1.2. Paper and Paperboard

- 6.1.3. Aluminum

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Unit-dose Packaging

- 6.2.2. Multi-dose Packaging

- 6.3. Market Analysis, Insights and Forecast - by Packaging Type

- 6.3.1. Blisters

- 6.3.2. Pouches

- 6.3.3. Other Packaging Types

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Pharmacies

- 6.4.2. Hospitals

- 6.4.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Adherence Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic (PE, PET, PVC, and PP)

- 7.1.2. Paper and Paperboard

- 7.1.3. Aluminum

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Unit-dose Packaging

- 7.2.2. Multi-dose Packaging

- 7.3. Market Analysis, Insights and Forecast - by Packaging Type

- 7.3.1. Blisters

- 7.3.2. Pouches

- 7.3.3. Other Packaging Types

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Pharmacies

- 7.4.2. Hospitals

- 7.4.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Adherence Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic (PE, PET, PVC, and PP)

- 8.1.2. Paper and Paperboard

- 8.1.3. Aluminum

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Unit-dose Packaging

- 8.2.2. Multi-dose Packaging

- 8.3. Market Analysis, Insights and Forecast - by Packaging Type

- 8.3.1. Blisters

- 8.3.2. Pouches

- 8.3.3. Other Packaging Types

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Pharmacies

- 8.4.2. Hospitals

- 8.4.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Adherence Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic (PE, PET, PVC, and PP)

- 9.1.2. Paper and Paperboard

- 9.1.3. Aluminum

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Unit-dose Packaging

- 9.2.2. Multi-dose Packaging

- 9.3. Market Analysis, Insights and Forecast - by Packaging Type

- 9.3.1. Blisters

- 9.3.2. Pouches

- 9.3.3. Other Packaging Types

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Pharmacies

- 9.4.2. Hospitals

- 9.4.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Adherence Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic (PE, PET, PVC, and PP)

- 10.1.2. Paper and Paperboard

- 10.1.3. Aluminum

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Unit-dose Packaging

- 10.2.2. Multi-dose Packaging

- 10.3. Market Analysis, Insights and Forecast - by Packaging Type

- 10.3.1. Blisters

- 10.3.2. Pouches

- 10.3.3. Other Packaging Types

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Pharmacies

- 10.4.2. Hospitals

- 10.4.3. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Manrex Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medicine-On-Time LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Omnicell Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Westrock Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jones Healthcare Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cardinal Health Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Keystone Folding Box Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parata Systems LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rx Systems Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Drug Package LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Manrex Limited

List of Figures

- Figure 1: Global Adherence Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Adherence Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Adherence Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Adherence Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Adherence Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Adherence Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 7: North America Adherence Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 8: North America Adherence Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America Adherence Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Adherence Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Adherence Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Adherence Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 13: Europe Adherence Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: Europe Adherence Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Adherence Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Adherence Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 17: Europe Adherence Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 18: Europe Adherence Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Adherence Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Adherence Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Adherence Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Adherence Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 23: Asia Pacific Adherence Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 24: Asia Pacific Adherence Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 25: Asia Pacific Adherence Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Asia Pacific Adherence Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 27: Asia Pacific Adherence Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 28: Asia Pacific Adherence Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Adherence Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Adherence Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Adherence Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Adherence Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 33: Latin America Adherence Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 34: Latin America Adherence Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Latin America Adherence Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Latin America Adherence Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 37: Latin America Adherence Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Latin America Adherence Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Adherence Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Adherence Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Adherence Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Adherence Packaging Market Revenue (Million), by Material 2025 & 2033

- Figure 43: Middle East and Africa Adherence Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 44: Middle East and Africa Adherence Packaging Market Revenue (Million), by Type 2025 & 2033

- Figure 45: Middle East and Africa Adherence Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Adherence Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 47: Middle East and Africa Adherence Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 48: Middle East and Africa Adherence Packaging Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 49: Middle East and Africa Adherence Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 50: Middle East and Africa Adherence Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Adherence Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Adherence Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Adherence Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Adherence Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 4: Global Adherence Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Adherence Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Adherence Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Global Adherence Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Adherence Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 9: Global Adherence Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Adherence Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Adherence Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Global Adherence Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Adherence Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Adherence Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Adherence Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Adherence Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 17: Global Adherence Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Adherence Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 19: Global Adherence Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Adherence Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Adherence Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Adherence Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Adherence Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 24: Global Adherence Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Adherence Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Adherence Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 27: Global Adherence Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Adherence Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 29: Global Adherence Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Adherence Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adherence Packaging Market?

The projected CAGR is approximately 6.72%.

2. Which companies are prominent players in the Adherence Packaging Market?

Key companies in the market include Manrex Limited, Medicine-On-Time LLC, Omnicell Inc, Westrock Company, Jones Healthcare Group, Cardinal Health Inc, Keystone Folding Box Co, Parata Systems LLC, Rx Systems Inc *List Not Exhaustive, Drug Package LLC.

3. What are the main segments of the Adherence Packaging Market?

The market segments include Material, Type, Packaging Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Need to Minimize Medication Wastage; High Rate of Medication Non-adherence.

6. What are the notable trends driving market growth?

Multi-dose Packaging is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Concerns over Material Availability and Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

February 2022 - CuePath Innovation, a provider of medication adherence solutions for the home healthcare sector, announced the release of its second-generation suite of remote patient care medication adherence monitoring tools that includes the Smart Blister Packaging Solution. The announcement comes with the launch of the company's critical care project with Wellness Pharmacy Group, which will provide medication monitoring and adherence support for patients on complicated regimens.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adherence Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adherence Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adherence Packaging Market?

To stay informed about further developments, trends, and reports in the Adherence Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence