Key Insights

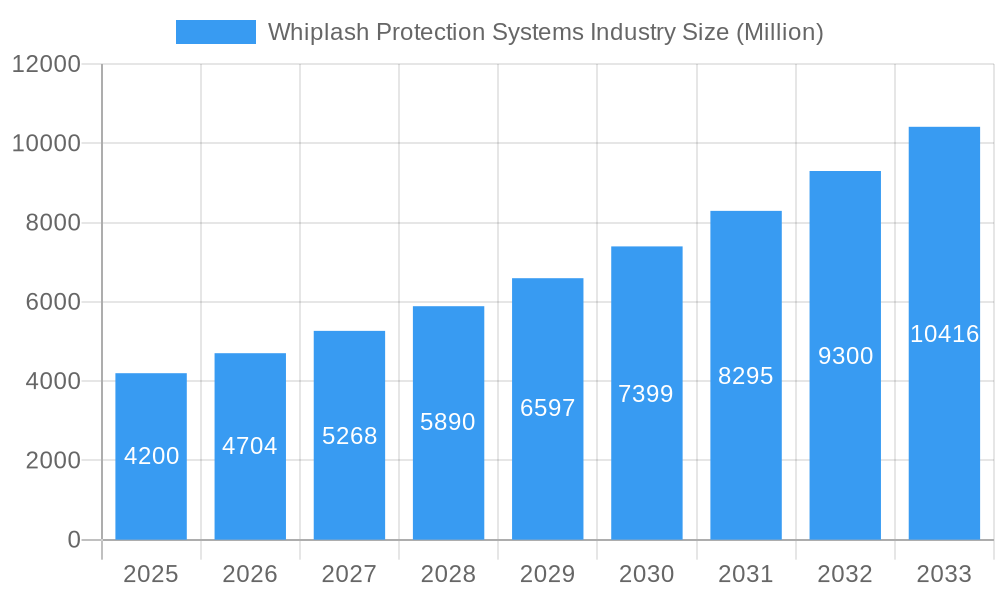

The Whiplash Protection Systems (WPS) market is experiencing substantial growth, propelled by stringent safety regulations, heightened consumer awareness of automotive safety, and continuous technological advancements. The market is projected to reach a size of $8.93 billion by 2033, with a projected Compound Annual Growth Rate (CAGR) of 8.42% from the base year 2025. Key growth drivers include evolving governmental mandates for occupant protection, particularly in Europe and North America, and the integration of advanced driver-assistance systems (ADAS) and sophisticated vehicle interiors. Innovations span both reactive and proactive whiplash protection technologies.

Whiplash Protection Systems Industry Market Size (In Billion)

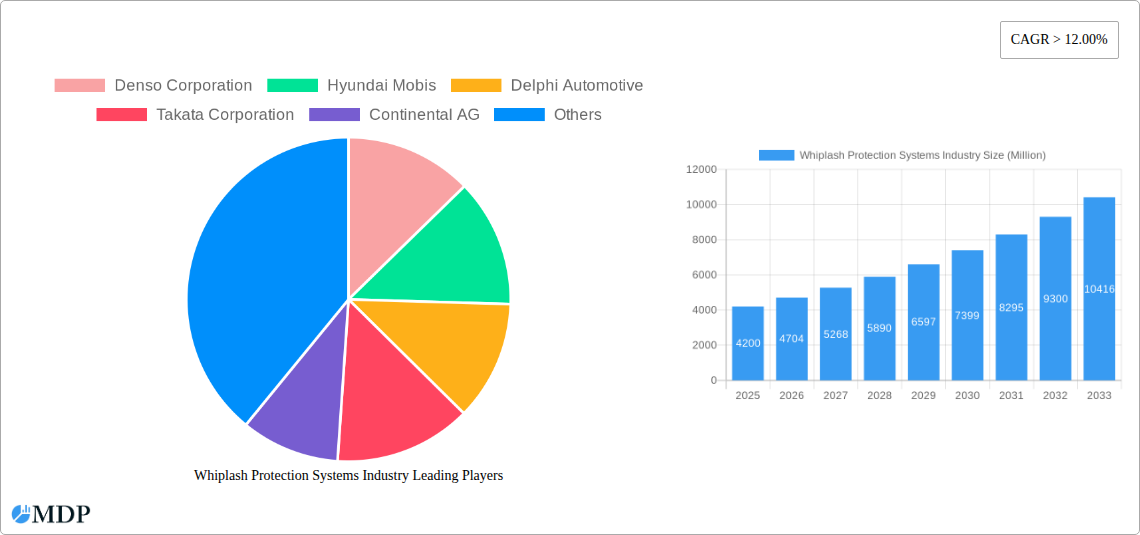

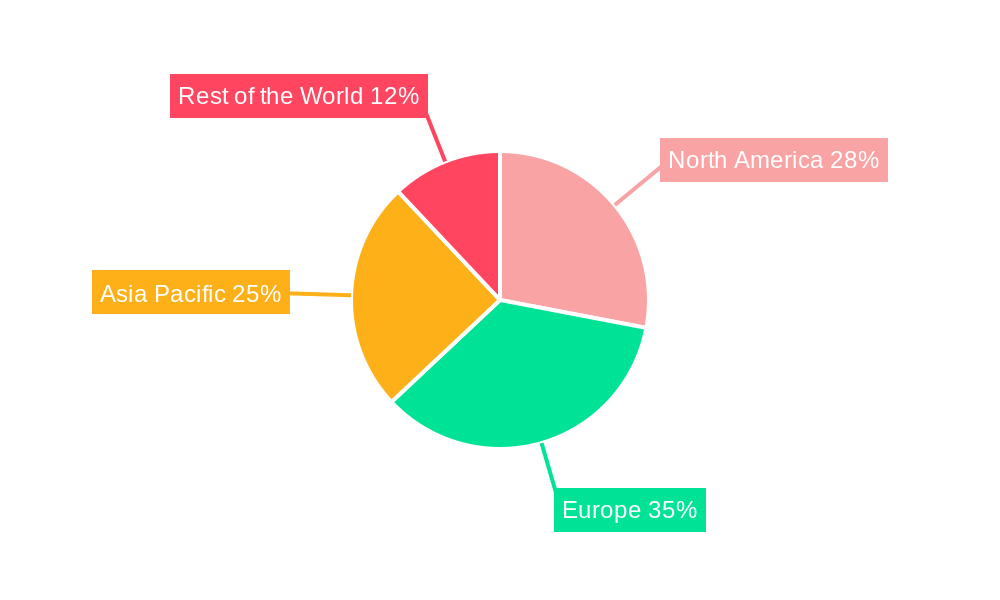

The market is segmented by vehicle type, with passenger cars leading due to high production volumes and demand for safety features. Commercial vehicles represent a growing segment as safety regulations expand to fleets. Leading companies such as Denso Corporation, Hyundai Mobis, Delphi Automotive, Continental AG, and Autoliv Inc. are investing in R&D for enhanced WPS solutions. Emerging trends include adaptive "smart" head restraints and WPS integration with active safety systems. While system cost and price sensitivity pose challenges, technological advancements are addressing these concerns. The Asia Pacific region, especially China and India, is anticipated to be the fastest-growing market, mirroring the rapid expansion of its automotive sector and increasing safety standards.

Whiplash Protection Systems Industry Company Market Share

Whiplash Protection Systems Industry: Market Dynamics, Trends, and Strategic Outlook (2025-2033)

This comprehensive market research report provides in-depth insights into the global Whiplash Protection Systems industry from 2025 to 2033, with 2025 as the base year. It analyzes market dynamics, emerging trends, key segments, and strategic opportunities, offering a detailed understanding of the factors shaping automotive safety innovation and whiplash injury prevention.

Key Focus Areas:

- Market Size & Growth: Current market valuation and projected growth trajectory.

- Segmentation Analysis: Breakdown by Vehicle Type (Passenger Cars, Commercial Vehicles) and System Type (Reactive Head Restraint, Proactive Head Restraint, Others).

- Regional Markets: Identification of leading and emerging regional markets.

- Competitive Landscape: Analysis of key players, strategies, and recent developments.

- Technological Advancements: Exploration of innovation drivers and product developments.

- Regulatory Impact: Understanding the influence of safety standards and mandates.

Whiplash Protection Systems Industry Market Dynamics & Concentration

The Whiplash Protection Systems industry exhibits a moderate market concentration, with a few key global players holding significant market share. The market is driven by continuous innovation in automotive safety technologies, spurred by stringent regulatory frameworks worldwide that mandate improved occupant protection. Product substitutes, while limited in direct alternatives, can include broader passive safety system advancements. End-user trends are overwhelmingly focused on enhanced safety and comfort, influencing the demand for sophisticated whiplash mitigation solutions. Mergers and acquisitions (M&A) activities, though not rampant, are strategic, aimed at consolidating market position, acquiring innovative technologies, or expanding geographical reach. For instance, recent M&A deal counts indicate an average of 2-3 significant transactions annually over the historical period. Market share analysis reveals that top-tier companies account for approximately 60-70% of the global market. The increasing adoption of advanced driver-assistance systems (ADAS) also indirectly influences the demand for integrated whiplash protection.

Whiplash Protection Systems Industry Industry Trends & Analysis

The Whiplash Protection Systems industry is poised for robust growth, driven by a confluence of factors that underscore the increasing global emphasis on automotive safety. The compound annual growth rate (CAGR) is projected to be approximately 5.5% during the forecast period of 2025–2033. Market penetration of advanced whiplash protection systems is steadily rising, moving beyond premium vehicle segments to become standard in mid-range and even some entry-level models. This trend is largely fueled by escalating consumer awareness regarding the prevalence and impact of whiplash injuries in rear-end collisions.

Technological disruptions are playing a pivotal role in shaping the industry. The evolution from traditional reactive head restraints to more advanced proactive systems is a significant development. Proactive systems, often integrated with sensors and pre-collision warning systems, are designed to anticipate and mitigate the forces leading to whiplash before an impact occurs. This includes technologies like active head restraints that move forward and upward to cradle the occupant's head during a collision, significantly reducing the hyperextension and hyperflexion that cause whiplash.

Consumer preferences are increasingly leaning towards integrated safety solutions that offer seamless protection without compromising comfort or aesthetics. Manufacturers are responding by developing sleeker, more ergonomic designs for head restraints and integrating them more effectively with the overall interior of the vehicle. The demand for enhanced comfort features, such as adjustable lumbar support and ergonomic seating, also indirectly benefits the adoption of advanced head restraint systems that contribute to a more comfortable ride.

The competitive dynamics within the Whiplash Protection Systems market are characterized by intense R&D efforts and strategic alliances between automotive OEMs and Tier-1 suppliers. Companies are investing heavily in developing next-generation whiplash protection technologies that offer superior performance, lower weight, and reduced cost. The pressure to meet evolving safety regulations, such as those from NHTSA and Euro NCAP, further intensifies this competitive landscape. The increasing stringency of these regulations directly correlates with market growth, as manufacturers are compelled to adopt and innovate within the whiplash protection domain to achieve higher safety ratings and maintain consumer trust. The global market value for whiplash protection systems is estimated to reach around $5 Billion by 2025 and is projected to grow to over $8 Billion by 2033.

Leading Markets & Segments in Whiplash Protection Systems Industry

The Passenger Cars segment commands the largest market share within the Whiplash Protection Systems industry, driven by the sheer volume of production and sales of passenger vehicles globally. This dominance is further amplified by increasingly stringent safety mandates specifically targeting passenger vehicles, such as those from the National Highway Traffic Safety Administration (NHTSA) in the United States and the European New Car Assessment Programme (Euro NCAP). The economic policies in major automotive markets, including North America, Europe, and Asia-Pacific, actively promote vehicle safety enhancements, thereby bolstering the demand for advanced whiplash protection systems in passenger cars. Infrastructure development, particularly in emerging economies, leads to increased vehicle ownership and, consequently, a higher demand for safety features across all vehicle types.

Within the system types, Reactive Head Restraint systems currently hold a substantial market share due to their established technology and cost-effectiveness. However, the Proactive Head Restraint segment is exhibiting the fastest growth rate. This surge is attributable to technological advancements and a growing preference among consumers and OEMs for systems that offer superior, predictive safety. Proactive systems, which can deploy or adjust before or during the initial impact, are seen as the future of whiplash mitigation. Key drivers for the dominance of passenger cars include:

- Regulatory Mandates: Strict safety standards specifically target passenger vehicles, pushing for advanced whiplash protection.

- Consumer Demand: Growing awareness and preference for advanced safety features in personal vehicles.

- OEM Integration: Automotive manufacturers are increasingly making these systems standard to achieve higher safety ratings.

- Technological Advancement: Innovations in proactive systems are driving their adoption in this segment.

While Commercial Vehicles represent a smaller, yet growing, segment, the safety imperative for these larger vehicles is also increasing, especially for driver and passenger comfort and injury prevention during long hauls. The "Others" segment, encompassing specialized vehicles or aftermarket solutions, is relatively niche but presents potential for tailored innovation. Geographically, North America and Europe currently lead in terms of market penetration and adoption of advanced whiplash protection systems due to their mature automotive markets and stringent regulatory environments. However, the Asia-Pacific region, particularly China, is expected to witness the most rapid growth due to its expanding automotive production and increasing focus on vehicle safety standards.

Whiplash Protection Systems Industry Product Developments

Product innovations in the Whiplash Protection Systems industry are centered on enhancing occupant safety and comfort through more intelligent and responsive technologies. The development of advanced proactive head restraints, which can sense an impending impact and adjust position to cradle the occupant's head, represents a significant leap forward. These systems often utilize sophisticated sensor arrays and algorithms to predict impact dynamics, offering superior protection compared to traditional reactive systems. Furthermore, integration with active headrest technology, where the headrest moves forward and upward to reduce the space between the occupant's head and the restraint, is becoming more prevalent. Lightweight materials and innovative deployment mechanisms are also key areas of development, aiming to reduce system weight and cost while maintaining or improving performance. The competitive advantage lies in offering highly effective, seamlessly integrated, and cost-efficient solutions that meet or exceed evolving global safety standards.

Key Drivers of Whiplash Protection Systems Industry Growth

Several key drivers are propelling the growth of the Whiplash Protection Systems industry. Firstly, stringent government regulations and evolving safety standards worldwide, such as those from NHTSA and Euro NCAP, are mandating improved occupant protection, directly influencing the adoption of advanced whiplash mitigation technologies. Secondly, increasing consumer awareness regarding the severity and commonality of whiplash injuries, coupled with a growing demand for enhanced vehicle safety features, is pushing automotive manufacturers to integrate these systems as standard. Technological advancements, particularly in the development of proactive and active head restraint systems, are offering more effective solutions, making them attractive for OEMs. Finally, the projected growth in the global automotive market, especially in emerging economies, will naturally lead to a larger base for whiplash protection system integration.

Challenges in the Whiplash Protection Systems Industry Market

Despite the promising growth outlook, the Whiplash Protection Systems industry faces several challenges. Regulatory Hurdles: While regulations drive adoption, the complexity and evolving nature of global safety standards can present compliance challenges and increase R&D costs for manufacturers aiming to meet diverse requirements. Supply Chain Issues: Disruptions in the automotive supply chain, whether due to geopolitical factors, material shortages, or logistical complexities, can impact production volumes and lead times for essential components. Cost Pressures: The ongoing demand for cost-effective solutions from automotive OEMs puts pressure on manufacturers to innovate while keeping production costs down, particularly for entry-level and mid-range vehicles. Competitive Landscape: Intense competition among established players and new entrants necessitates continuous investment in R&D and manufacturing efficiency. The market for passive safety systems is estimated to be valued at $10 Billion in 2025 and is expected to grow significantly, but the specific segment for whiplash protection needs to carve out its share effectively.

Emerging Opportunities in Whiplash Protection Systems Industry

Emerging opportunities in the Whiplash Protection Systems industry are largely driven by technological innovation and evolving consumer expectations for vehicle safety. The continued advancement of sensor technology and artificial intelligence (AI) opens doors for more sophisticated proactive whiplash protection systems that can predict and react to collisions with even greater precision. Strategic partnerships between whiplash system manufacturers and automotive OEMs are crucial for seamless integration and co-development of next-generation safety solutions. Furthermore, the growing demand for advanced safety features in electric vehicles (EVs) and autonomous driving systems presents a significant growth avenue, as these vehicles often incorporate more advanced electronic systems that can readily support integrated whiplash protection. Market expansion into underserved regions with rapidly growing automotive sectors also represents a substantial opportunity for market penetration.

Leading Players in the Whiplash Protection Systems Industry Sector

- Denso Corporation

- Hyundai Mobis

- Delphi Automotive

- Takata Corporation

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Lear Corporation

- Wabco

- Grammer AG

Key Milestones in Whiplash Protection Systems Industry Industry

- 2019: Increased focus on advanced reactive head restraint systems, meeting stricter FMVSS 202-19 regulations.

- 2020: Initial development and testing phases of integrated proactive head restraint systems with advanced sensor technology.

- 2021: Major automotive OEMs begin exploring partnerships for next-generation whiplash protection integration in new vehicle platforms.

- 2022: Launch of enhanced reactive head restraint systems with improved energy absorption capabilities, achieving higher Euro NCAP ratings.

- 2023: Growing interest and investment in AI-driven predictive whiplash protection technologies.

- 2024: Market penetration of smart head restraints with active pre-tensioning mechanisms increases in premium vehicle segments.

Strategic Outlook for Whiplash Protection Systems Industry Market

The strategic outlook for the Whiplash Protection Systems industry is characterized by a strong emphasis on innovation, integration, and a proactive approach to safety. Growth accelerators will include the continued development and adoption of intelligent proactive head restraint systems, leveraging advancements in AI and sensor technology. Deeper collaborations between system suppliers and automotive manufacturers will be critical for embedding these safety solutions seamlessly into vehicle architectures. Furthermore, the expanding electric vehicle (EV) market presents a significant opportunity, as the integration of advanced electronic safety systems is more straightforward. Manufacturers will also focus on developing cost-effective solutions to drive adoption across a wider range of vehicle segments, including emerging markets. The ongoing evolution of safety regulations globally will continue to be a primary catalyst, ensuring sustained demand and driving innovation in this vital sector of automotive safety.

Whiplash Protection Systems Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicle

-

2. System Type

- 2.1. Reactive Head Restraint

- 2.2. Proactive Head Restraint

- 2.3. Others

Whiplash Protection Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. South Africa

- 4.4. Other Countries

Whiplash Protection Systems Industry Regional Market Share

Geographic Coverage of Whiplash Protection Systems Industry

Whiplash Protection Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others

- 3.3. Market Restrains

- 3.3.1. RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others

- 3.4. Market Trends

- 3.4.1. Technological Developments Will Help This Market Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by System Type

- 5.2.1. Reactive Head Restraint

- 5.2.2. Proactive Head Restraint

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by System Type

- 6.2.1. Reactive Head Restraint

- 6.2.2. Proactive Head Restraint

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by System Type

- 7.2.1. Reactive Head Restraint

- 7.2.2. Proactive Head Restraint

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by System Type

- 8.2.1. Reactive Head Restraint

- 8.2.2. Proactive Head Restraint

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by System Type

- 9.2.1. Reactive Head Restraint

- 9.2.2. Proactive Head Restraint

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyundai Mobis

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Delphi Automotive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Takata Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Autoliv Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lear Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wabco*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Grammer AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Whiplash Protection Systems Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 5: North America Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 6: North America Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: Europe Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 11: Europe Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 12: Europe Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 17: Asia Pacific Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 18: Asia Pacific Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 23: Rest of the World Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 24: Rest of the World Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 3: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 6: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 12: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 20: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: India Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: China Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 28: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Mexico Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: South Africa Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Other Countries Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Whiplash Protection Systems Industry?

The projected CAGR is approximately 8.42%.

2. Which companies are prominent players in the Whiplash Protection Systems Industry?

Key companies in the market include Denso Corporation, Hyundai Mobis, Delphi Automotive, Takata Corporation, Continental AG, Autoliv Inc, Robert Bosch GmbH, Lear Corporation, Wabco*List Not Exhaustive, Grammer AG.

3. What are the main segments of the Whiplash Protection Systems Industry?

The market segments include Vehicle Type, System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.93 billion as of 2022.

5. What are some drivers contributing to market growth?

ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others.

6. What are the notable trends driving market growth?

Technological Developments Will Help This Market Grow.

7. Are there any restraints impacting market growth?

RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Whiplash Protection Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Whiplash Protection Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Whiplash Protection Systems Industry?

To stay informed about further developments, trends, and reports in the Whiplash Protection Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence