Key Insights

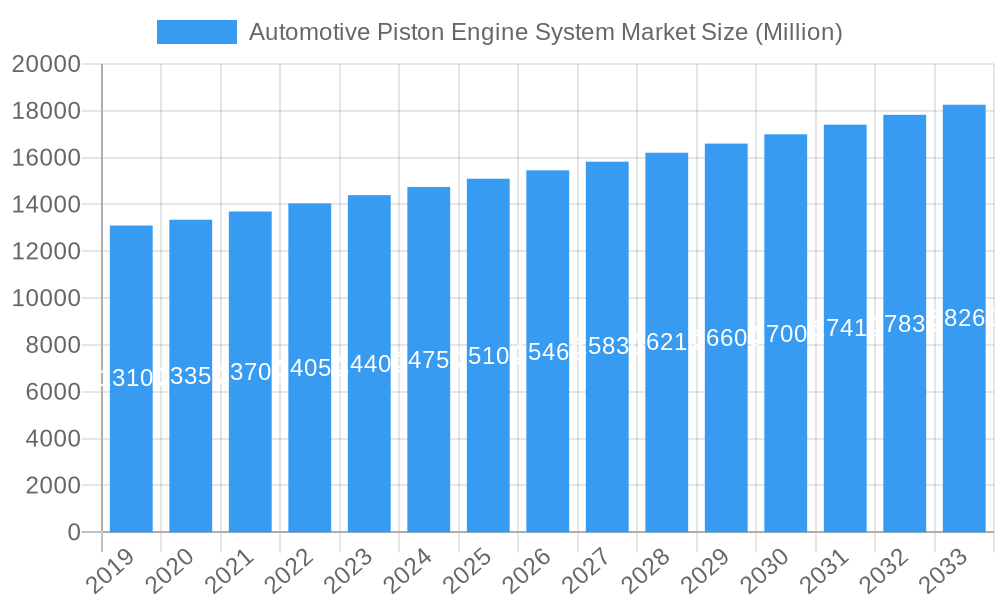

The global Automotive Piston Engine System Market is projected for robust growth, with an estimated market size of $15.5 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 4.23%, extending through 2033. This expansion is driven by sustained demand for internal combustion engine (ICE) vehicles, particularly in emerging economies, alongside technological advancements focused on improving fuel efficiency and reducing emissions. Innovations in piston design, materials, and coatings enhance durability and performance. The aftermarket, supported by a vast existing vehicle fleet, also contributes significantly to market vitality. While the industry transitions towards electrification, the substantial volume of ICE vehicles ensures a growing market for piston engine systems.

Automotive Piston Engine System Market Market Size (In Million)

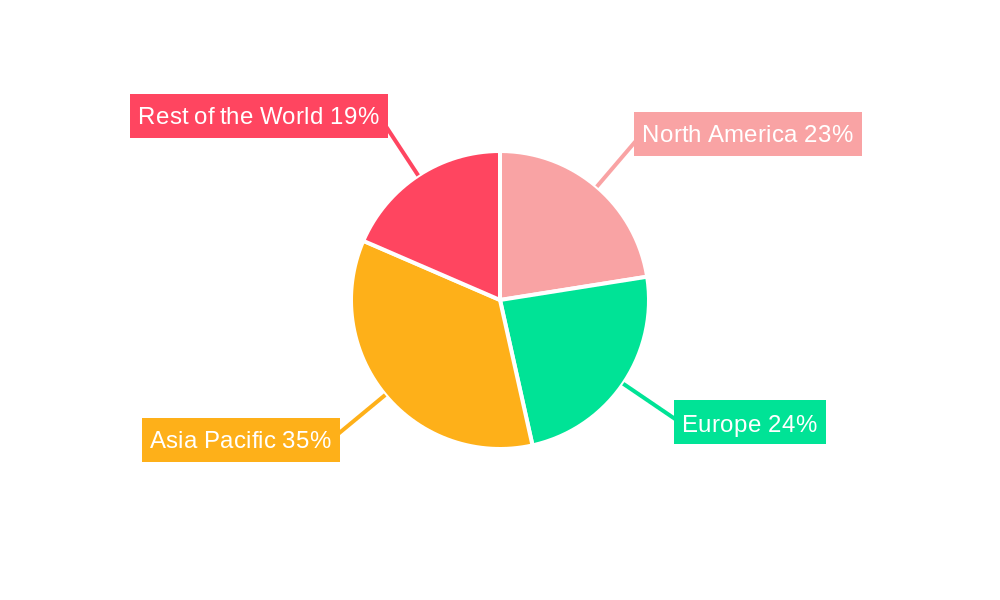

Segmentation analysis reveals diverse opportunities. The Raw Material Type segment is dominated by Cast Iron and Aluminum Alloy, with Aluminum Alloy expected to see increased adoption due to its lightweight properties. In terms of Vehicle Type, Passenger Cars represent the largest segment, followed by Commercial Vehicles. The Fuel Type segment indicates persistent demand for Gasoline and Diesel engines, though regulatory pressures may favor gasoline in certain regions. From a Component Type perspective, pistons and piston rings are critical, commanding significant market share. Geographically, the Asia Pacific region, led by China and India, is expected to drive growth due to burgeoning automotive production and a large consumer base for ICE vehicles. North America and Europe will maintain substantial markets driven by mature automotive sectors and aftermarket demand.

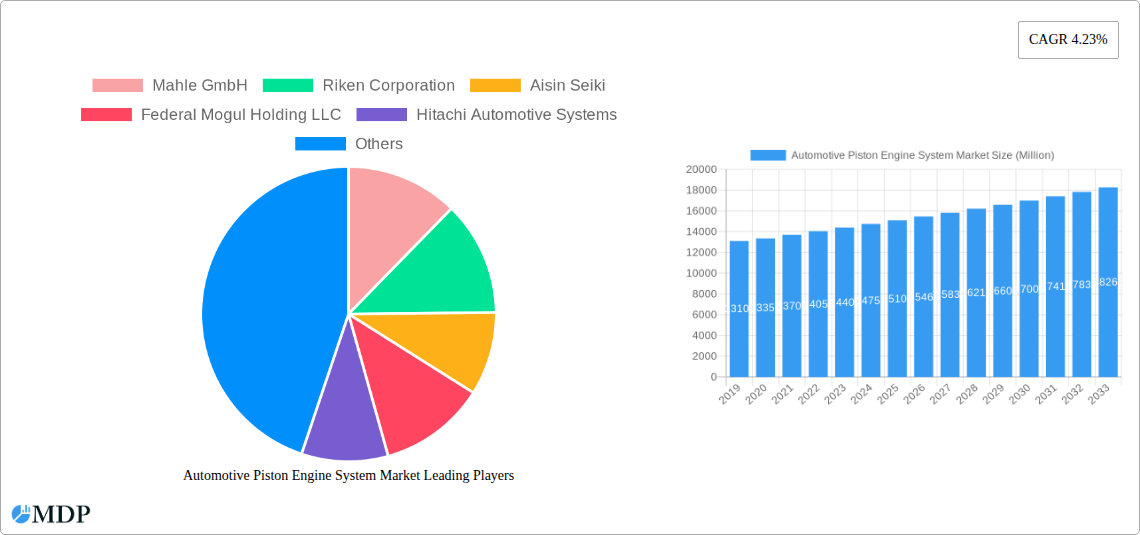

Automotive Piston Engine System Market Company Market Share

Report Overview:

This comprehensive report offers an in-depth analysis of the dynamic Automotive Piston Engine System Market. It explores market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities from 2019 to 2033, with a base year of 2025. Key aspects covered include piston manufacturing, piston ring suppliers, piston pin technology, and the impact of alternative fuel engines, providing an indispensable resource for automotive stakeholders seeking to understand the evolving ICE landscape.

The automotive piston market is intrinsically linked to the broader automotive sector, influenced by vehicle production, emission regulations, and the shift towards cleaner mobility. This report meticulously examines the global piston engine market, offering granular insights into cast iron pistons, aluminum alloy pistons, and the role of advanced materials. It also highlights the contributions of key players such as Mahle GmbH, Riken Corporation, Aisin Seiki, and others in shaping the automotive component market.

With growing demand for fuel-efficient and emissions-compliant vehicles, the automotive piston ring market and piston pin market are experiencing continuous innovation. This report analyzes the interplay between gasoline engines and diesel engines, alongside demand for components supporting CNG and LNG engines. Whether focusing on passenger car piston systems or commercial vehicle engine components, this report delivers actionable intelligence.

The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Gain a competitive edge by understanding market share of piston manufacturers, the impact of M&A activities in the automotive components sector, and strategic implications of hydrogen engine development.

Automotive Piston Engine System Market Market Dynamics & Concentration

The Automotive Piston Engine System Market exhibits a moderately consolidated structure, with key players like Mahle GmbH, Riken Corporation, and Aisin Seiki holding significant market shares. The market's concentration is influenced by high capital expenditure requirements for advanced manufacturing facilities and extensive R&D investments in developing lighter, more durable, and emission-compliant piston systems. Innovation drivers are primarily focused on enhancing fuel efficiency, reducing friction, and improving the thermal efficiency of internal combustion engines, particularly in the context of evolving emission standards such as Euro 7 and EPA regulations. Regulatory frameworks play a crucial role, pushing manufacturers towards lighter materials and optimized designs to meet stringent CO2 emission targets. Product substitutes, while emerging in the form of electric vehicle powertrains, are not yet displacing the demand for piston engine systems in many applications, especially in commercial vehicles and certain segments of passenger cars. End-user trends show a growing preference for smaller displacement engines with advanced turbocharging and direct injection technologies, all of which rely on sophisticated piston systems. Merger and acquisition (M&A) activities, while not overtly frequent, are strategic and aimed at consolidating R&D capabilities, expanding geographical reach, or acquiring complementary technologies. For instance, a recent trend involves smaller component suppliers being acquired by larger entities to integrate their specialized expertise into broader powertrain solutions. The market share of the top three players is estimated to be around 55-60%. The count of significant M&A deals in the last three years has been approximately 5-7, often involving technology acquisitions rather than outright company takeovers.

Automotive Piston Engine System Market Industry Trends & Analysis

The Automotive Piston Engine System Market is poised for steady growth, driven by the persistent demand for internal combustion engines (ICEs) in a wide range of applications, even as the automotive industry navigates the transition towards electrification. The CAGR for the forecast period 2025-2033 is projected to be approximately 3.5% to 4.0%. Market penetration of advanced piston technologies is increasing, as manufacturers strive to meet evolving emission regulations and fuel efficiency mandates. This includes the widespread adoption of lightweight materials like aluminum alloys, advanced coatings for reduced friction, and optimized piston designs for improved combustion efficiency. Technological disruptions are a key theme, with ongoing research into piston materials capable of withstanding higher combustion temperatures and pressures, leading to more powerful and efficient engines. The development of hydrogen-powered ICEs, as highlighted by industry developments, is creating new avenues for piston manufacturers, requiring specialized piston solutions that can handle the unique combustion characteristics of hydrogen. Consumer preferences, though increasingly leaning towards EVs, still favor the cost-effectiveness, range, and refueling convenience of ICE vehicles, particularly in emerging markets and for specific vehicle segments like heavy-duty trucks and specialized utility vehicles. Competitive dynamics are characterized by a strong focus on cost optimization, quality, and the ability to innovate rapidly in response to regulatory changes and OEM demands. Companies are investing heavily in R&D to develop next-generation piston systems that can extend the life and performance of ICEs. Market penetration for advanced aluminum alloy pistons is estimated to be over 70% in passenger cars, with continuous advancements in other raw material types.

Leading Markets & Segments in Automotive Piston Engine System Market

The dominant region for the Automotive Piston Engine System Market continues to be Asia-Pacific, driven by the robust automotive manufacturing base in countries like China, India, and Japan, coupled with significant domestic demand for both passenger cars and commercial vehicles. Within this region, China stands out as the largest market due to its massive vehicle production volumes and the substantial presence of both global and local automotive component manufacturers.

Raw Material Type:

- Aluminum Alloy dominates the market, accounting for an estimated 75-80% of demand. Its lightweight properties are crucial for improving fuel efficiency and reducing emissions. Key drivers include advancements in aluminum alloy casting and forging technologies, and cost-effectiveness compared to other high-performance materials.

- Cast Iron remains significant, particularly for heavy-duty diesel engines where its strength and durability are paramount. Its share is estimated at 15-20%. The demand is sustained by the commercial vehicle sector and specific industrial applications.

- Other Raw Materials (Steel, etc.) represent a smaller but growing segment, driven by specialized applications requiring extreme strength or temperature resistance. This includes advancements in steel alloys and composite materials for niche high-performance engines.

Vehicle Type:

- Passenger Cars represent the largest segment by volume, comprising over 65-70% of the market. The continuous innovation in engine technology for passenger cars, including downsized turbocharged engines, fuels demand for sophisticated piston systems. Economic policies encouraging domestic automobile production and consumer demand for fuel-efficient vehicles are key drivers.

- Commercial Vehicles constitute a substantial segment, approximately 30-35%, driven by the global growth in logistics, e-commerce, and infrastructure development. The demand for robust and durable pistons in heavy-duty diesel engines remains strong, supported by government investments in infrastructure projects.

Fuel Type:

- Gasoline engines continue to be a primary consumer of piston systems, representing around 55-60% of the market. The ongoing optimization of gasoline direct injection (GDI) and turbocharged engines sustains this demand.

- Diesel engines, while facing some headwinds due to stricter emissions, still hold a significant share, estimated at 35-40%, particularly in commercial vehicles and certain passenger car segments. The development of advanced diesel combustion technologies to meet emissions standards is a key driver.

- The emerging demand for alternative fuels like CNG and LNG is slowly gaining traction, with an estimated 5-10% of the market, driven by regulatory support and the search for cleaner fuel options for ICEs.

Component Type:

- Pistons are the largest component segment, naturally, accounting for over 50% of the market value. Their complexity and material science advancements drive this.

- Piston Rings represent a significant sub-segment, estimated at 25-30% of the market value, crucial for sealing, heat transfer, and oil control.

- Piston Pins form the remaining segment, around 15-20%, essential for connecting the piston to the connecting rod.

Automotive Piston Engine System Market Product Developments

Recent product developments in the Automotive Piston Engine System Market are focused on enhancing performance, durability, and environmental compatibility. Manufacturers are innovating with advanced materials, such as high-strength aluminum alloys and even ceramic composites, to reduce piston weight and improve thermal efficiency, thereby contributing to better fuel economy and lower emissions. Furthermore, sophisticated surface treatments and coatings are being applied to pistons and piston rings to minimize friction, a key factor in energy loss within an engine. The development of pistons specifically designed for alternative fuels like hydrogen, CNG, and LNG is a significant trend, adapting combustion chamber designs and material properties to suit the unique characteristics of these fuels. This includes designs that can withstand the potentially higher combustion temperatures or different combustion pressures associated with these fuels, ensuring optimal performance and longevity. These advancements offer competitive advantages by enabling OEMs to meet increasingly stringent regulatory requirements and consumer demands for cleaner, more efficient powertrains.

Key Drivers of Automotive Piston Engine System Market Growth

The growth of the Automotive Piston Engine System Market is propelled by several key drivers. Firstly, the sheer volume of global vehicle production, particularly in emerging economies, ensures sustained demand for ICE components. Secondly, tightening emission regulations worldwide necessitate continuous innovation in engine technology, directly impacting the demand for advanced piston systems that can improve combustion efficiency and reduce pollutant output. Thirdly, the ongoing development and adoption of alternative fuel ICEs, such as those running on CNG, LNG, and potentially hydrogen, are creating new market opportunities for specialized piston solutions. Economic factors, including rising disposable incomes and the expansion of logistics networks, further stimulate the demand for both passenger and commercial vehicles, thereby driving the need for piston engine systems.

Challenges in the Automotive Piston Engine System Market Market

Despite the robust growth drivers, the Automotive Piston Engine System Market faces several challenges. The most significant is the accelerating global shift towards electrification, which poses a long-term threat to the ICE market. Stringent emission standards, while driving innovation, also increase R&D and manufacturing costs for piston systems. Supply chain disruptions, amplified by geopolitical events and raw material price volatility, can impact production costs and lead times. Furthermore, intense price competition among manufacturers, particularly in highly commoditized segments, pressures profit margins. The high capital investment required for advanced manufacturing and R&D can also be a barrier for smaller players trying to compete with established market leaders.

Emerging Opportunities in Automotive Piston Engine System Market

Emerging opportunities within the Automotive Piston Engine System Market are largely centered around the evolution of ICE technology and the increasing focus on sustainability. The development of highly efficient ICEs designed to meet future emission standards, including those utilizing advanced combustion strategies like homogeneous charge compression ignition (HCCI), presents significant opportunities for piston manufacturers. The growing niche market for alternative fuel ICEs, especially in commercial transportation and industrial applications, offers substantial growth potential. Strategic partnerships between piston manufacturers and engine developers are crucial for co-creating innovative solutions for these emerging powertrains. Furthermore, the increasing demand for remanufactured and refurbished ICE components in specific markets can also provide a steady revenue stream.

Leading Players in the Automotive Piston Engine System Market Sector

- Mahle GmbH

- Riken Corporation

- Aisin Seiki

- Federal Mogul Holding LLC

- Hitachi Automotive Systems

- Capricorn Automotive

- PT Astra Otoparts Tb

- Tenneco Inc

- Rheinmetall

- Magna International

- Shriram Pistons & Rings Ltd

Key Milestones in Automotive Piston Engine System Market Industry

- July 2023: Mahle received a series of orders from engine manufacturer Deutz for the development and supply of components for hydrogen engines, including pistons, piston rings pack, and piston pins. Deutz plans to use these engines in stationary hydrogen engines for the first time from the end of 2024, signaling a significant step in adapting ICE technology for hydrogen fuel.

- January 2023: Shriram Pistons & Rings, a leading Indian component player in the conventional powertrain domain, developed a range of solutions to cater to alternative fuel systems within the internal combustion engine (ICE) space. The company reaffirmed its commitment to develop advanced piston solutions for hydrogen, CNG, and LNG engines, demonstrating a proactive approach to future industry requirements and clean mobility technologies.

Strategic Outlook for Automotive Piston Engine System Market Market

The strategic outlook for the Automotive Piston Engine System Market is one of adaptation and continued innovation. While the long-term trend favors electrification, ICEs are expected to remain relevant for a considerable period, particularly in heavy-duty transportation, industrial applications, and specific geographic markets where charging infrastructure is less developed. Manufacturers will need to focus on developing ultra-efficient and low-emission ICE piston systems that can comply with increasingly stringent global regulations. Investing in R&D for alternative fuel ICE applications, such as hydrogen and advanced synthetic fuels, will be critical for future growth. Strategic collaborations with OEMs and a strong emphasis on cost-effective manufacturing will also be key to maintaining market share and capitalizing on emerging opportunities in this evolving automotive landscape.

Automotive Piston Engine System Market Segmentation

-

1. Raw Material Type

- 1.1. Cast Iron

- 1.2. Aluminum Alloy

- 1.3. Other Raw Materials (Steel, etc.)

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commerical Vehicles

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

-

4. Component Type

- 4.1. Piston

- 4.2. Piston Ring

- 4.3. Piston Pin

Automotive Piston Engine System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Piston Engine System Market Regional Market Share

Geographic Coverage of Automotive Piston Engine System Market

Automotive Piston Engine System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Pistons

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Electric Vehicles Deters the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment is Anticipated to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Piston Engine System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 5.1.1. Cast Iron

- 5.1.2. Aluminum Alloy

- 5.1.3. Other Raw Materials (Steel, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commerical Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.4. Market Analysis, Insights and Forecast - by Component Type

- 5.4.1. Piston

- 5.4.2. Piston Ring

- 5.4.3. Piston Pin

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6. North America Automotive Piston Engine System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6.1.1. Cast Iron

- 6.1.2. Aluminum Alloy

- 6.1.3. Other Raw Materials (Steel, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commerical Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Gasoline

- 6.3.2. Diesel

- 6.4. Market Analysis, Insights and Forecast - by Component Type

- 6.4.1. Piston

- 6.4.2. Piston Ring

- 6.4.3. Piston Pin

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7. Europe Automotive Piston Engine System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7.1.1. Cast Iron

- 7.1.2. Aluminum Alloy

- 7.1.3. Other Raw Materials (Steel, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commerical Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Gasoline

- 7.3.2. Diesel

- 7.4. Market Analysis, Insights and Forecast - by Component Type

- 7.4.1. Piston

- 7.4.2. Piston Ring

- 7.4.3. Piston Pin

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8. Asia Pacific Automotive Piston Engine System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8.1.1. Cast Iron

- 8.1.2. Aluminum Alloy

- 8.1.3. Other Raw Materials (Steel, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commerical Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Gasoline

- 8.3.2. Diesel

- 8.4. Market Analysis, Insights and Forecast - by Component Type

- 8.4.1. Piston

- 8.4.2. Piston Ring

- 8.4.3. Piston Pin

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9. Rest of the World Automotive Piston Engine System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9.1.1. Cast Iron

- 9.1.2. Aluminum Alloy

- 9.1.3. Other Raw Materials (Steel, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commerical Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Gasoline

- 9.3.2. Diesel

- 9.4. Market Analysis, Insights and Forecast - by Component Type

- 9.4.1. Piston

- 9.4.2. Piston Ring

- 9.4.3. Piston Pin

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mahle GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Riken Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aisin Seiki

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Federal Mogul Holding LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hitachi Automotive Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Capricorn Automotive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PT Astra Otoparts Tb

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tenneco Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rheinmetall

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Magna International

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Shriram Pistons & Rings Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Mahle GmbH

List of Figures

- Figure 1: Global Automotive Piston Engine System Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Piston Engine System Market Revenue (billion), by Raw Material Type 2025 & 2033

- Figure 3: North America Automotive Piston Engine System Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 4: North America Automotive Piston Engine System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Piston Engine System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Piston Engine System Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 7: North America Automotive Piston Engine System Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 8: North America Automotive Piston Engine System Market Revenue (billion), by Component Type 2025 & 2033

- Figure 9: North America Automotive Piston Engine System Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: North America Automotive Piston Engine System Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Automotive Piston Engine System Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Piston Engine System Market Revenue (billion), by Raw Material Type 2025 & 2033

- Figure 13: Europe Automotive Piston Engine System Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 14: Europe Automotive Piston Engine System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Piston Engine System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Piston Engine System Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 17: Europe Automotive Piston Engine System Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 18: Europe Automotive Piston Engine System Market Revenue (billion), by Component Type 2025 & 2033

- Figure 19: Europe Automotive Piston Engine System Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 20: Europe Automotive Piston Engine System Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Automotive Piston Engine System Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Piston Engine System Market Revenue (billion), by Raw Material Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Piston Engine System Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Piston Engine System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 25: Asia Pacific Automotive Piston Engine System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 26: Asia Pacific Automotive Piston Engine System Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 27: Asia Pacific Automotive Piston Engine System Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 28: Asia Pacific Automotive Piston Engine System Market Revenue (billion), by Component Type 2025 & 2033

- Figure 29: Asia Pacific Automotive Piston Engine System Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 30: Asia Pacific Automotive Piston Engine System Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Piston Engine System Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Automotive Piston Engine System Market Revenue (billion), by Raw Material Type 2025 & 2033

- Figure 33: Rest of the World Automotive Piston Engine System Market Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 34: Rest of the World Automotive Piston Engine System Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 35: Rest of the World Automotive Piston Engine System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Rest of the World Automotive Piston Engine System Market Revenue (billion), by Fuel Type 2025 & 2033

- Figure 37: Rest of the World Automotive Piston Engine System Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 38: Rest of the World Automotive Piston Engine System Market Revenue (billion), by Component Type 2025 & 2033

- Figure 39: Rest of the World Automotive Piston Engine System Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 40: Rest of the World Automotive Piston Engine System Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Automotive Piston Engine System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Piston Engine System Market Revenue billion Forecast, by Raw Material Type 2020 & 2033

- Table 2: Global Automotive Piston Engine System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Piston Engine System Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: Global Automotive Piston Engine System Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 5: Global Automotive Piston Engine System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Piston Engine System Market Revenue billion Forecast, by Raw Material Type 2020 & 2033

- Table 7: Global Automotive Piston Engine System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Piston Engine System Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 9: Global Automotive Piston Engine System Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 10: Global Automotive Piston Engine System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Piston Engine System Market Revenue billion Forecast, by Raw Material Type 2020 & 2033

- Table 15: Global Automotive Piston Engine System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 16: Global Automotive Piston Engine System Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 17: Global Automotive Piston Engine System Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 18: Global Automotive Piston Engine System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Automotive Piston Engine System Market Revenue billion Forecast, by Raw Material Type 2020 & 2033

- Table 25: Global Automotive Piston Engine System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Piston Engine System Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 27: Global Automotive Piston Engine System Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 28: Global Automotive Piston Engine System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: India Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: China Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Japan Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Korea Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Automotive Piston Engine System Market Revenue billion Forecast, by Raw Material Type 2020 & 2033

- Table 35: Global Automotive Piston Engine System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 36: Global Automotive Piston Engine System Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 37: Global Automotive Piston Engine System Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 38: Global Automotive Piston Engine System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 39: South America Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Middle East and Africa Automotive Piston Engine System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Piston Engine System Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Automotive Piston Engine System Market?

Key companies in the market include Mahle GmbH, Riken Corporation, Aisin Seiki, Federal Mogul Holding LLC, Hitachi Automotive Systems, Capricorn Automotive, PT Astra Otoparts Tb, Tenneco Inc, Rheinmetall, Magna International, Shriram Pistons & Rings Ltd.

3. What are the main segments of the Automotive Piston Engine System Market?

The market segments include Raw Material Type, Vehicle Type, Fuel Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Pistons.

6. What are the notable trends driving market growth?

Passenger Car Segment is Anticipated to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Electric Vehicles Deters the Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2023: Mahle received a series of orders from engine manufacturer Deutz for the development and supply of components for hydrogen engines, including pistons, piston rings pack, and piston pins. Deutz plans to use these engines in stationary hydrogen engines for the first time from the end of 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Piston Engine System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Piston Engine System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Piston Engine System Market?

To stay informed about further developments, trends, and reports in the Automotive Piston Engine System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence