Key Insights

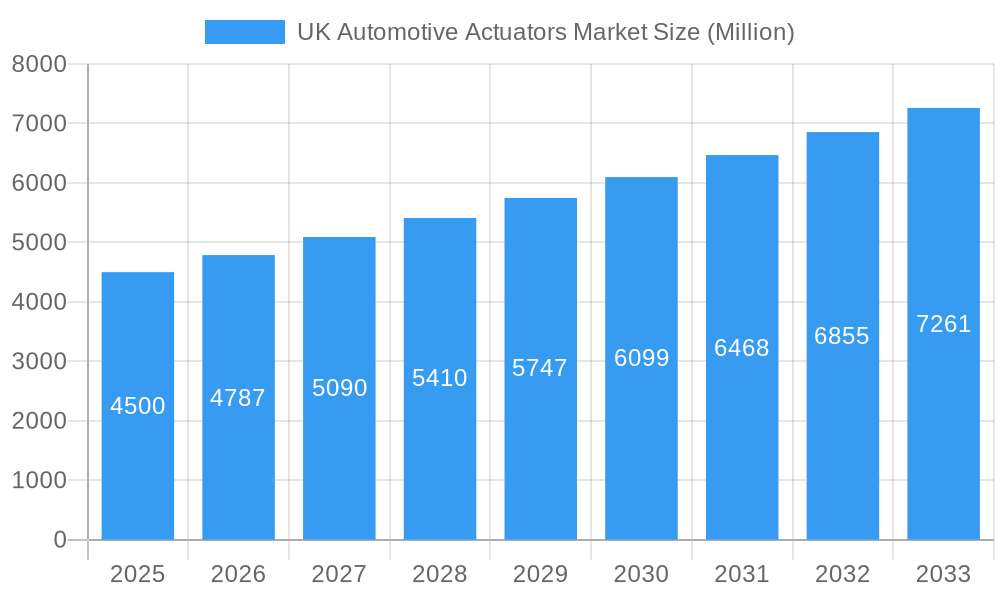

The UK automotive actuators market is projected for significant expansion, estimated to reach a market size of £2.8 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 8.2% from 2024 to 2033. This growth is fueled by the escalating demand for advanced vehicle safety features and improved performance. The increasing prevalence of electric vehicles (EVs) and the growing sophistication of internal combustion engine (ICE) vehicles require advanced actuator systems for critical functions like throttle management, braking, and seat adjustment. Additionally, stringent government mandates for emissions reduction and enhanced road safety are driving automotive manufacturers to adopt more efficient and precise actuator technologies. The advancement of autonomous driving capabilities also significantly contributes to market growth, as actuators are fundamental to the precise control of vehicle systems necessary for self-driving technology.

UK Automotive Actuators Market Market Size (In Billion)

The market demonstrates clear segmentation by vehicle type, actuator type, and application. Passenger cars are expected to lead the market share, driven by consumer preferences for comfort, convenience, and advanced features. Commercial vehicles, however, are anticipated to grow at a faster rate due to increased automation in logistics and transportation. Electric actuators are increasingly favored over hydraulic and pneumatic systems, offering superior efficiency, a smaller physical profile, and enhanced control, aligning with the electrification trend. Key applications such as throttle and brake actuators are experiencing substantial demand. Seat adjustment and closure actuators are also growing, reflecting an emphasis on user experience and premium features. Leading global manufacturers, including Robert Bosch GmbH, Continental AG, and Denso Corporation, are prioritizing research and development, focusing on miniaturization, enhanced power efficiency, and the integration of smart technologies to maintain market leadership.

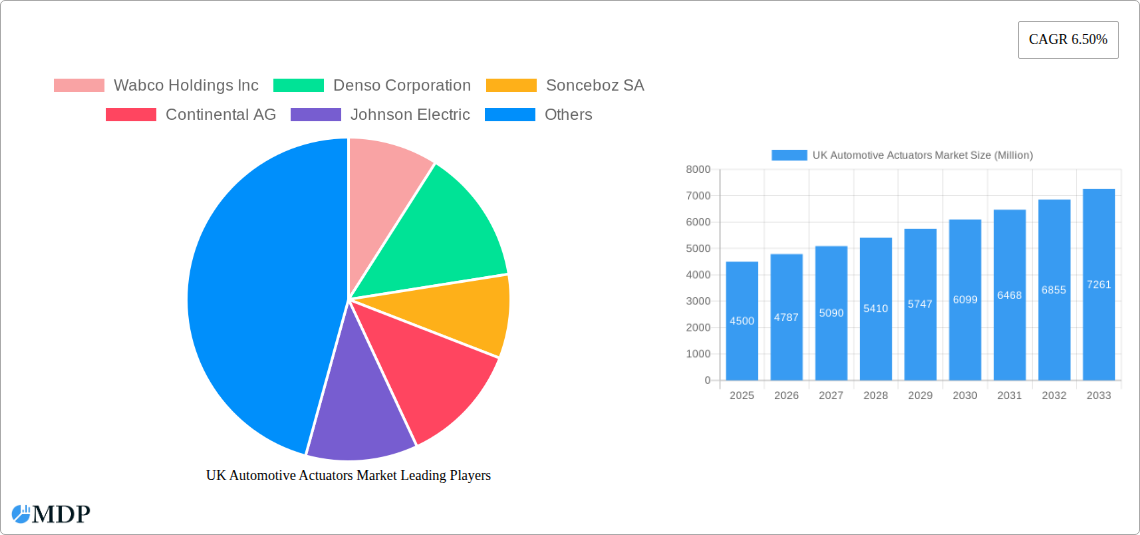

UK Automotive Actuators Market Company Market Share

UK Automotive Actuators Market Report: Comprehensive Analysis and Forecast (2019–2033)

Unlock deep insights into the dynamic UK automotive actuators market. This in-depth report delivers an authoritative analysis, forecast, and strategic outlook, equipping industry stakeholders with actionable intelligence for informed decision-making. Leveraging high-traffic keywords, this report targets maximum search visibility for automotive manufacturers, Tier 1 suppliers, R&D professionals, and investors in the UK.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

UK Automotive Actuators Market Dynamics & Concentration

The UK automotive actuators market is characterized by a moderate concentration, with a few key players holding significant market share. Key innovation drivers include the relentless pursuit of fuel efficiency, emissions reduction targets, and the burgeoning demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies. Regulatory frameworks, particularly stringent emissions standards and evolving safety mandates, play a pivotal role in shaping product development and market entry. Product substitutes, while present in some rudimentary applications, are increasingly being phased out in favor of more efficient and reliable actuator solutions. End-user trends are leaning towards enhanced comfort, convenience, and safety features, directly fueling demand for sophisticated actuator systems. Merger and acquisition (M&A) activities, while not excessively high, are strategic, often aimed at acquiring specific technological capabilities or expanding market reach. For instance, in the historical period of 2019-2024, an estimated 15 M&A deals were recorded, indicating a steady consolidation drive. The market share of the top 5 players is estimated to be around 60% as of the base year 2025.

UK Automotive Actuators Market Industry Trends & Analysis

The UK automotive actuators market is poised for substantial growth, driven by a confluence of technological advancements and evolving consumer demands. The increasing sophistication of vehicle electronics, coupled with the electrification trend, is a primary growth driver. Electric actuators, in particular, are witnessing a significant surge in demand due to their precision, energy efficiency, and suitability for complex control systems. The integration of advanced sensor technologies and the rise of smart actuators, capable of adaptive control and self-diagnosis, are transforming the automotive landscape. Consumer preferences are increasingly prioritizing personalized driving experiences, comfort features, and enhanced safety, all of which rely heavily on the precise and responsive operation of various actuators. The competitive dynamics are characterized by intense innovation and a focus on developing lighter, more compact, and energy-efficient actuator solutions. The market penetration of advanced actuator systems is projected to reach over 75% by the end of the forecast period in 2033. The Compound Annual Growth Rate (CAGR) for the UK automotive actuators market is estimated to be approximately 7.2% during the forecast period of 2025–2033. This robust growth is fueled by the continuous integration of these components into new vehicle platforms and the aftermarket replacement market.

Leading Markets & Segments in UK Automotive Actuators Market

The Passenger Car segment dominates the UK automotive actuators market, primarily driven by the sheer volume of production and sales in this category. Within this segment, Electrical actuators are leading the charge due to their versatility, precision, and suitability for a wide array of applications. The Throttle Actuator application segment is particularly robust, essential for precise engine control and fuel efficiency in both internal combustion engine (ICE) and electric vehicles.

Passenger Car Dominance:

- Economic Policies: Favorable government incentives for new car purchases and the strong presence of automotive manufacturing facilities contribute to sustained demand.

- Consumer Preferences: A growing demand for enhanced comfort features like advanced seat adjustment, panoramic sunroofs, and power tailgates directly fuels the need for specialized actuators.

- Technological Integration: The rapid adoption of ADAS and infotainment systems necessitates a higher number of sophisticated electrical actuators for various functions.

Electrical Actuators Ascendancy:

- Energy Efficiency: Electric actuators consume less energy compared to hydraulic or pneumatic systems, aligning with the industry's focus on reducing emissions and improving fuel economy.

- Precision and Control: Their ability to offer fine-grained control makes them indispensable for modern automotive systems, from electric power steering to adaptive suspension.

- Compact Design: The trend towards miniaturization in vehicle components favors the smaller footprint of electric actuators.

Throttle Actuator Application Growth:

- Emissions Regulations: Strict emissions standards necessitate precise engine management, making throttle actuators critical for optimizing combustion and exhaust aftertreatment.

- EV Powertrain Integration: While EVs have different powertrain architectures, actuators are still vital for thermal management, battery cooling, and other auxiliary functions, including throttle-like controls for power delivery.

Other significant application segments include Seat Adjustment Actuators, driven by the luxury and comfort features demanded by consumers, and Brake Actuators, with the increasing adoption of electronic stability control (ESC) and advanced braking systems. The Commercial Vehicle segment also presents considerable growth potential, particularly for applications like air suspension and door systems.

UK Automotive Actuators Market Product Developments

Product developments in the UK automotive actuators market are heavily focused on miniaturization, increased efficiency, and enhanced intelligence. Innovations in brushless DC (BLDC) motors and advanced control algorithms are leading to the creation of smaller, more powerful, and energy-efficient actuators. The integration of sensors directly into actuator units provides real-time feedback, enabling more precise control and diagnostics, crucial for ADAS and autonomous driving. These advancements offer a competitive advantage by meeting the industry's demand for integrated, high-performance solutions that contribute to vehicle safety, comfort, and fuel economy. For instance, self-calibrating actuators are emerging, reducing assembly time and ensuring optimal performance.

Key Drivers of UK Automotive Actuators Market Growth

The growth of the UK automotive actuators market is primarily propelled by the stringent emission regulations and the overarching trend towards vehicle electrification, necessitating advanced control systems. The increasing integration of sophisticated comfort and safety features in vehicles, such as ADAS and automated convenience functions, directly drives demand for a wider array of actuators. Furthermore, the continuous pursuit of improved fuel efficiency and reduced environmental impact by automotive manufacturers compels them to adopt more efficient and precise actuator technologies. The growing adoption of electric vehicles (EVs) also presents a significant opportunity, as EVs often require a complex network of actuators for thermal management, battery systems, and other auxiliary functions.

Challenges in the UK Automotive Actuators Market Market

Despite the positive outlook, the UK automotive actuators market faces several challenges. The high cost of advanced actuator technologies, particularly those incorporating sophisticated sensors and intelligent control systems, can hinder widespread adoption, especially in the mid-market segments. Supply chain complexities and potential disruptions, exacerbated by global geopolitical factors and component shortages, pose a significant risk to production timelines and costs. Intense competitive pressures from established players and emerging manufacturers can lead to price erosion and impact profit margins. Furthermore, the evolving regulatory landscape for automotive components, while driving innovation, also requires significant investment in research and development to ensure compliance, presenting a continuous hurdle for market participants. The potential for technical obsolescence due to rapid technological advancements also necessitates ongoing investment in R&D.

Emerging Opportunities in UK Automotive Actuators Market

Emerging opportunities in the UK automotive actuators market are primarily centered around the rapid advancements in automotive technology and the shift towards sustainable mobility. The increasing demand for autonomous driving features will necessitate highly sophisticated and reliable actuator systems for steering, braking, and acceleration control, opening up a significant growth avenue. The expansion of electric vehicle (EV) production in the UK presents a substantial opportunity, as EVs rely heavily on actuators for thermal management, battery cooling, and various other critical functions. Strategic partnerships between actuator manufacturers and EV battery technology providers could unlock innovative solutions. Furthermore, the growing aftermarket for actuator replacements, driven by the aging vehicle parc and the demand for premium features, offers a stable revenue stream. The development of predictive maintenance solutions leveraging actuator data also presents a nascent but promising opportunity.

Leading Players in the UK Automotive Actuators Market Sector

- Wabco Holdings Inc

- Denso Corporation

- Sonceboz SA

- Continental AG

- Johnson Electric

- BorgWarner Inc

- Robert Bosch GmbH

- CTS Corporation

- Hella KGaA Hueck & Co

Key Milestones in UK Automotive Actuators Market Industry

- 2019: Increased focus on electrification leads to significant R&D investment in electric actuators for EVs by key players.

- 2020: Launch of new compact and high-torque electric actuators by BorgWarner Inc for advanced powertrain applications.

- 2021: Continental AG expands its portfolio of smart actuators with integrated sensors for ADAS applications.

- 2022: Denso Corporation announces advancements in electromagnetic actuators for improved vehicle efficiency.

- 2023: Robert Bosch GmbH introduces innovative brake-by-wire actuator systems, signaling a shift towards highly electrified braking.

- 2024: Increased strategic collaborations observed between actuator manufacturers and autonomous vehicle technology developers.

- Early 2025: Anticipated launch of next-generation lightweight actuators designed for enhanced energy recovery in EVs.

Strategic Outlook for UK Automotive Actuators Market Market

The strategic outlook for the UK automotive actuators market remains exceptionally positive, driven by the sustained pace of technological innovation and the clear direction of the automotive industry towards electrification and autonomy. Future growth will be significantly accelerated by the ongoing development and integration of advanced driver-assistance systems (ADAS) and fully autonomous driving capabilities, which demand increasingly sophisticated and precise actuator solutions. The continued expansion of the electric vehicle market in the UK, supported by government targets and consumer adoption, will be a primary growth catalyst. Companies that focus on developing intelligent, highly integrated, and energy-efficient actuators will be best positioned to capitalize on emerging market trends. Strategic investments in R&D, strategic partnerships with EV manufacturers, and a proactive approach to regulatory compliance will be crucial for long-term success. The market is expected to witness further consolidation as companies seek to expand their technological portfolios and market reach.

UK Automotive Actuators Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Actuators Type

- 2.1. Electrical actuators

- 2.2. Hydraulic actuators

- 2.3. Pneumatic actuators

-

3. Application Type

- 3.1. Throttle Actuator

- 3.2. Seat Adjustment Actuator

- 3.3. Brake Actuator

- 3.4. Closure Actuator

- 3.5. Other

UK Automotive Actuators Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

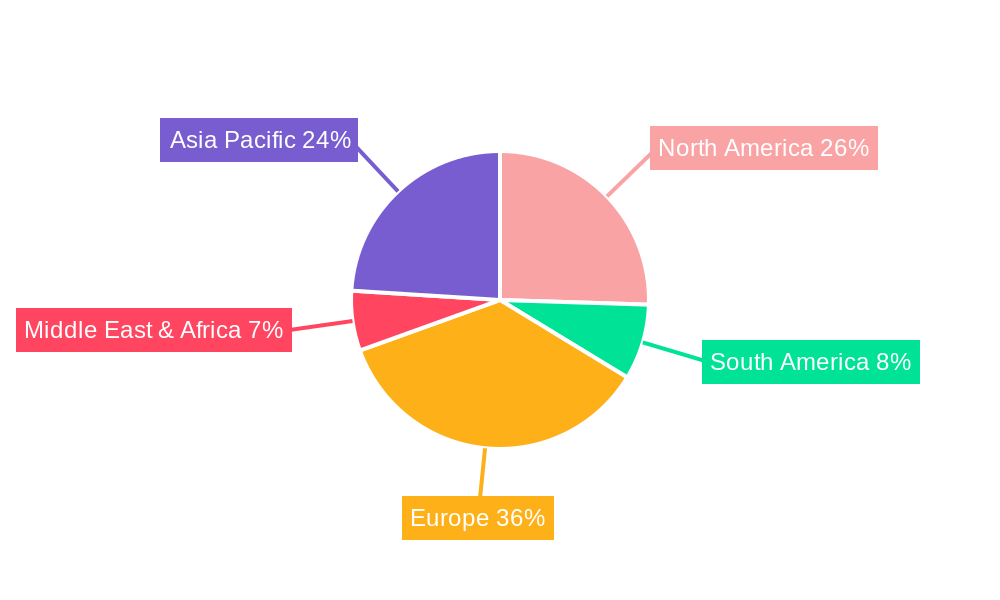

UK Automotive Actuators Market Regional Market Share

Geographic Coverage of UK Automotive Actuators Market

UK Automotive Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Actuators Type

- 5.2.1. Electrical actuators

- 5.2.2. Hydraulic actuators

- 5.2.3. Pneumatic actuators

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Throttle Actuator

- 5.3.2. Seat Adjustment Actuator

- 5.3.3. Brake Actuator

- 5.3.4. Closure Actuator

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America UK Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Actuators Type

- 6.2.1. Electrical actuators

- 6.2.2. Hydraulic actuators

- 6.2.3. Pneumatic actuators

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Throttle Actuator

- 6.3.2. Seat Adjustment Actuator

- 6.3.3. Brake Actuator

- 6.3.4. Closure Actuator

- 6.3.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America UK Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Actuators Type

- 7.2.1. Electrical actuators

- 7.2.2. Hydraulic actuators

- 7.2.3. Pneumatic actuators

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Throttle Actuator

- 7.3.2. Seat Adjustment Actuator

- 7.3.3. Brake Actuator

- 7.3.4. Closure Actuator

- 7.3.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe UK Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Actuators Type

- 8.2.1. Electrical actuators

- 8.2.2. Hydraulic actuators

- 8.2.3. Pneumatic actuators

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Throttle Actuator

- 8.3.2. Seat Adjustment Actuator

- 8.3.3. Brake Actuator

- 8.3.4. Closure Actuator

- 8.3.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa UK Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Actuators Type

- 9.2.1. Electrical actuators

- 9.2.2. Hydraulic actuators

- 9.2.3. Pneumatic actuators

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Throttle Actuator

- 9.3.2. Seat Adjustment Actuator

- 9.3.3. Brake Actuator

- 9.3.4. Closure Actuator

- 9.3.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific UK Automotive Actuators Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Actuators Type

- 10.2.1. Electrical actuators

- 10.2.2. Hydraulic actuators

- 10.2.3. Pneumatic actuators

- 10.3. Market Analysis, Insights and Forecast - by Application Type

- 10.3.1. Throttle Actuator

- 10.3.2. Seat Adjustment Actuator

- 10.3.3. Brake Actuator

- 10.3.4. Closure Actuator

- 10.3.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wabco Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Denso Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonceboz SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Continental AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Electric

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BorgWarner Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robert Bosch GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CTS Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hella KGaA Hueck & Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Wabco Holdings Inc

List of Figures

- Figure 1: Global UK Automotive Actuators Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Automotive Actuators Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America UK Automotive Actuators Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America UK Automotive Actuators Market Revenue (billion), by Actuators Type 2025 & 2033

- Figure 5: North America UK Automotive Actuators Market Revenue Share (%), by Actuators Type 2025 & 2033

- Figure 6: North America UK Automotive Actuators Market Revenue (billion), by Application Type 2025 & 2033

- Figure 7: North America UK Automotive Actuators Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 8: North America UK Automotive Actuators Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UK Automotive Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Automotive Actuators Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: South America UK Automotive Actuators Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America UK Automotive Actuators Market Revenue (billion), by Actuators Type 2025 & 2033

- Figure 13: South America UK Automotive Actuators Market Revenue Share (%), by Actuators Type 2025 & 2033

- Figure 14: South America UK Automotive Actuators Market Revenue (billion), by Application Type 2025 & 2033

- Figure 15: South America UK Automotive Actuators Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 16: South America UK Automotive Actuators Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UK Automotive Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Automotive Actuators Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 19: Europe UK Automotive Actuators Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe UK Automotive Actuators Market Revenue (billion), by Actuators Type 2025 & 2033

- Figure 21: Europe UK Automotive Actuators Market Revenue Share (%), by Actuators Type 2025 & 2033

- Figure 22: Europe UK Automotive Actuators Market Revenue (billion), by Application Type 2025 & 2033

- Figure 23: Europe UK Automotive Actuators Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Europe UK Automotive Actuators Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UK Automotive Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Automotive Actuators Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa UK Automotive Actuators Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa UK Automotive Actuators Market Revenue (billion), by Actuators Type 2025 & 2033

- Figure 29: Middle East & Africa UK Automotive Actuators Market Revenue Share (%), by Actuators Type 2025 & 2033

- Figure 30: Middle East & Africa UK Automotive Actuators Market Revenue (billion), by Application Type 2025 & 2033

- Figure 31: Middle East & Africa UK Automotive Actuators Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 32: Middle East & Africa UK Automotive Actuators Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Automotive Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Automotive Actuators Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific UK Automotive Actuators Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific UK Automotive Actuators Market Revenue (billion), by Actuators Type 2025 & 2033

- Figure 37: Asia Pacific UK Automotive Actuators Market Revenue Share (%), by Actuators Type 2025 & 2033

- Figure 38: Asia Pacific UK Automotive Actuators Market Revenue (billion), by Application Type 2025 & 2033

- Figure 39: Asia Pacific UK Automotive Actuators Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 40: Asia Pacific UK Automotive Actuators Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Automotive Actuators Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Automotive Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global UK Automotive Actuators Market Revenue billion Forecast, by Actuators Type 2020 & 2033

- Table 3: Global UK Automotive Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: Global UK Automotive Actuators Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Automotive Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global UK Automotive Actuators Market Revenue billion Forecast, by Actuators Type 2020 & 2033

- Table 7: Global UK Automotive Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: Global UK Automotive Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UK Automotive Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global UK Automotive Actuators Market Revenue billion Forecast, by Actuators Type 2020 & 2033

- Table 14: Global UK Automotive Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: Global UK Automotive Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Automotive Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global UK Automotive Actuators Market Revenue billion Forecast, by Actuators Type 2020 & 2033

- Table 21: Global UK Automotive Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 22: Global UK Automotive Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Automotive Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global UK Automotive Actuators Market Revenue billion Forecast, by Actuators Type 2020 & 2033

- Table 34: Global UK Automotive Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 35: Global UK Automotive Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UK Automotive Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global UK Automotive Actuators Market Revenue billion Forecast, by Actuators Type 2020 & 2033

- Table 44: Global UK Automotive Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 45: Global UK Automotive Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Automotive Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Automotive Actuators Market?

The projected CAGR is approximately 8.2%.

2. Which companies are prominent players in the UK Automotive Actuators Market?

Key companies in the market include Wabco Holdings Inc, Denso Corporation, Sonceboz SA, Continental AG, Johnson Electric, BorgWarner Inc, Robert Bosch GmbH, CTS Corporatio, Hella KGaA Hueck & Co.

3. What are the main segments of the UK Automotive Actuators Market?

The market segments include Vehicle Type, Actuators Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Actuators Market to Grow.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Automotive Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Automotive Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Automotive Actuators Market?

To stay informed about further developments, trends, and reports in the UK Automotive Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence