Key Insights

The South African airbag system market is projected for significant expansion, forecasting a CAGR of 16.98% from 2025 to 2033. The market size is estimated at $17.34 billion by 2025. This growth is driven by stringent government safety regulations mandating advanced airbag technologies and increasing consumer demand for vehicles with comprehensive safety features. Key trends include the adoption of multi-stage inflators, advanced side-curtain airbags, and knee airbags, alongside the integration of smart airbag systems that adapt deployment based on occupant characteristics and impact severity.

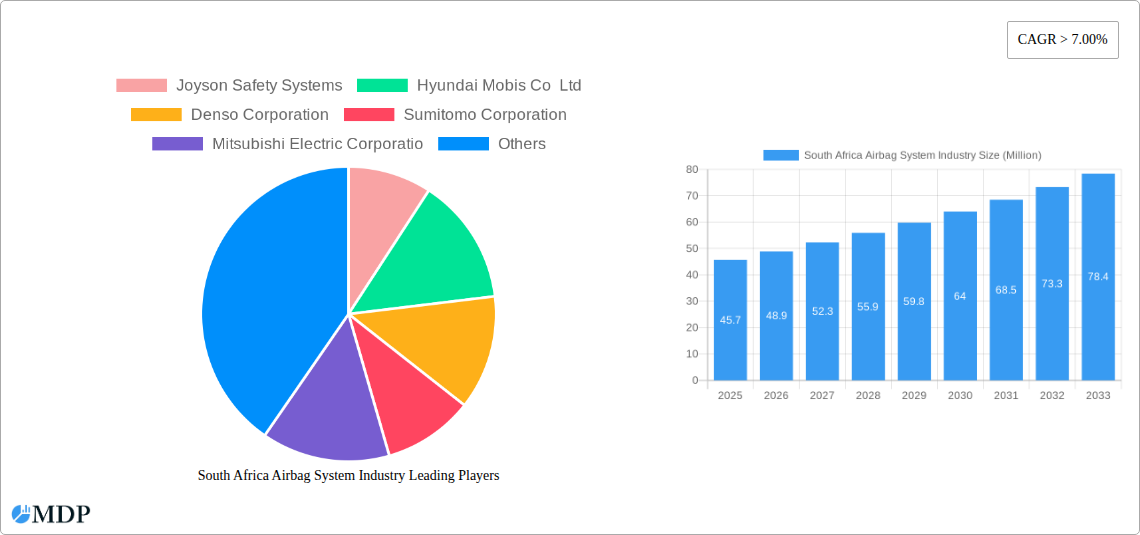

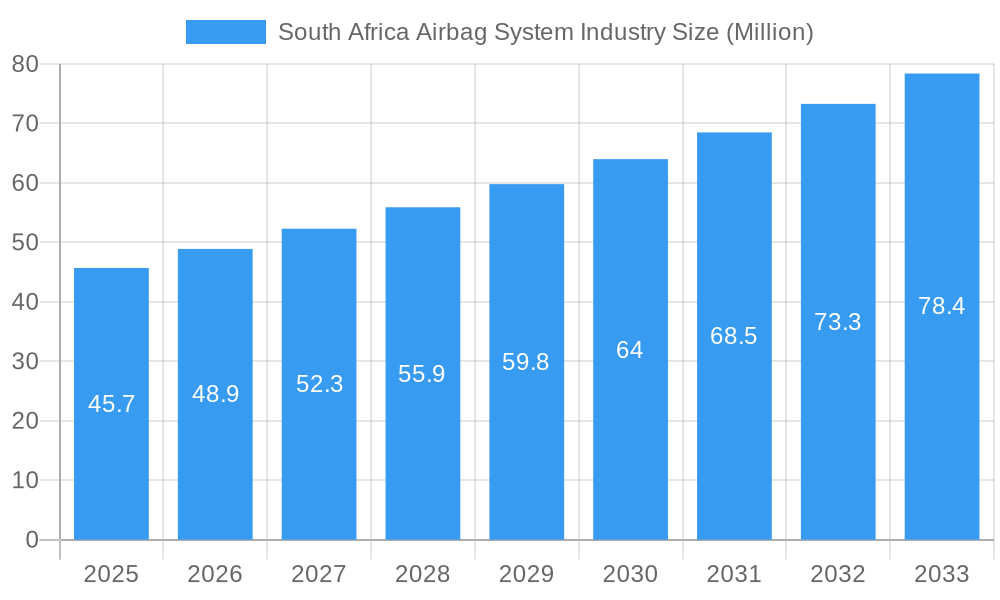

South Africa Airbag System Industry Market Size (In Billion)

Challenges to market growth include high manufacturing costs for sophisticated components and the initial cost burden on consumers for vehicles equipped with advanced airbag technologies. However, the unwavering commitment to enhancing road safety, continuous technological innovation, and anticipated decreases in production costs are expected to sustain positive market growth. The market segmentation analysis indicates strong demand for driver and passenger airbags, with a rising interest in curtain and knee airbags, reflecting a shift towards comprehensive occupant protection.

South Africa Airbag System Industry Company Market Share

South Africa Airbag System Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

Unlock critical insights into the dynamic South Africa Airbag System Industry with this in-depth market research report. Covering a comprehensive Study Period of 2019–2033, with the Base Year and Estimated Year as 2025, and a robust Forecast Period of 2025–2033, this report provides an unparalleled understanding of market dynamics, growth drivers, competitive landscape, and future opportunities. Examine the intricate details of the South African automotive safety sector, focusing on the indispensable airbag systems that are increasingly vital for passenger protection and regulatory compliance. Our analysis delves into the segmentation of the market by Airbag Type, Inflator Type, and Vehicle Type, offering granular data and strategic recommendations for stakeholders navigating this evolving industry.

South Africa Airbag System Industry Market Dynamics & Concentration

The South Africa Airbag System Industry is characterized by a moderate to high level of market concentration, with a few key global players dominating a significant portion of the market share. Companies like Joyson Safety Systems, Hyundai Mobis Co Ltd, Denso Corporation, Continental AG, and Autoliv Inc. are prominent, holding substantial influence due to their technological expertise, extensive product portfolios, and established supply chains. Innovation drivers are predominantly focused on enhancing occupant safety through advanced airbag technologies, such as multi-stage inflation, smart airbags that adapt to occupant size and position, and integrated systems for side and curtain protection. Regulatory frameworks, driven by global safety standards and increasing domestic demand for safer vehicles, are a primary catalyst for market growth, mandating higher airbag deployment rates and the inclusion of more sophisticated airbag types. Product substitutes for airbags are virtually non-existent in their primary function of rapid, in-cabin impact cushioning during a collision. However, advancements in active safety systems, such as autonomous emergency braking and lane-keeping assist, indirectly influence the perceived need for passive safety features like airbags, though they are complementary rather than substitutive. End-user trends indicate a growing preference for vehicles equipped with a comprehensive suite of safety features, driven by consumer awareness and vehicle safety ratings. Mergers and acquisitions (M&A) activities within the global automotive component industry, while not as frequent domestically, can impact the South African market through consolidation and strategic alliances among the leading players. M&A deal counts in recent years have been driven by a need for technological integration and market expansion, with an estimated xx number of significant transactions influencing supply chain dynamics and competitive positioning globally.

South Africa Airbag System Industry Industry Trends & Analysis

The South Africa Airbag System Industry is poised for significant expansion driven by a confluence of powerful market growth drivers. The Compound Annual Growth Rate (CAGR) is projected to be robust, estimated at xx% over the forecast period (2025–2033), indicating a healthy upward trajectory. This growth is intrinsically linked to the increasing market penetration of advanced safety features in vehicles sold within South Africa. The primary growth engine is the escalating demand for enhanced vehicle safety, propelled by stringent government regulations and a growing consumer awareness regarding road safety. As South Africa strives to align with international safety benchmarks, the mandate for a higher number of airbags per vehicle is becoming more pronounced, directly boosting the demand for driver airbags, passenger airbags, curtain airbags, and knee airbags. Technological disruptions are also playing a pivotal role. Innovations in airbag inflator technology, moving towards more efficient and environmentally friendly solutions, alongside advancements in sensor technology that enable intelligent airbag deployment, are shaping the market. The transition from traditional pyrotechnic inflators to more sophisticated stored gas and hybrid inflators is a notable trend, offering improved performance and safety. Consumer preferences are increasingly leaning towards vehicles equipped with a comprehensive safety package, making airbags a non-negotiable feature rather than a premium option. This shift is influenced by global safety rating systems and media coverage of accident outcomes. Competitive dynamics within the industry are intense, with global giants vying for market share through product differentiation, cost optimization, and strategic partnerships with local automotive manufacturers. The presence of major Tier 1 suppliers ensures a competitive environment, driving down costs and fostering continuous innovation. The historical performance from 2019–2024 has laid the groundwork for this expansion, with consistent demand growth driven by new vehicle sales and an increasing emphasis on safety. The South African automotive industry's resilience and its role as a manufacturing hub for certain vehicle segments further contribute to the sustained demand for airbag systems. The integration of airbags with other advanced driver-assistance systems (ADAS) is also emerging as a significant trend, creating opportunities for holistic safety solutions. The economic landscape, including GDP growth and disposable income, indirectly influences vehicle sales and thus the demand for airbag systems, creating a positive feedback loop for industry expansion.

Leading Markets & Segments in South Africa Airbag System Industry

The South Africa Airbag System Industry is predominantly driven by the Passenger Car segment, which accounts for the largest share of the market. This dominance is attributed to the higher sales volumes of passenger vehicles compared to commercial vehicles in the country. Within the airbag type segmentation, the Driver airbag and Passenger airbag continue to hold the largest market share due to their fundamental role in frontal collision safety and their mandated inclusion in virtually all new vehicles. However, there is a significant and growing demand for Curtain airbags, driven by increasing awareness of side-impact protection and the rising popularity of SUVs and MPVs, which often feature multiple rows of seating requiring extended curtain coverage. The Knee airbag segment is also experiencing growth, particularly in higher-end passenger vehicles, as manufacturers seek to offer comprehensive occupant protection. The Others segment, encompassing airbags for specialized applications like center airbags, seatbelt airbags, and pedestrian airbags (though less prevalent in the South African market currently), represents a smaller but evolving portion of the market.

In terms of inflator types, the Pyrotechnic inflator remains the most widely used due to its cost-effectiveness and proven reliability. However, the market is witnessing a gradual shift towards Stored Gas and Hybrid inflators, especially in premium vehicle segments and for advanced airbag systems requiring precise control over inflation. These technologies offer advantages in terms of faster response times and tunable inflation characteristics, contributing to improved occupant safety outcomes. The Hybrid inflator, in particular, is gaining traction for its ability to provide a more controlled and softer airbag deployment.

The economic policies of South Africa, aimed at promoting local automotive manufacturing and encouraging the adoption of advanced safety technologies, are key drivers for the growth of these segments. Infrastructure development, including improvements in road networks, indirectly supports the automotive industry and consequently the demand for safety components. Government initiatives and collaborations with international safety organizations to enhance road safety standards are directly influencing the adoption rates of advanced airbag systems. For instance, initiatives to improve crash test ratings for locally manufactured vehicles compel manufacturers to incorporate a higher number and more advanced types of airbags. The increasing focus on vehicle safety as a differentiator in the competitive automotive market also plays a crucial role in driving the adoption of these sophisticated airbag systems.

South Africa Airbag System Industry Product Developments

Product development in the South Africa Airbag System Industry is intensely focused on enhancing occupant safety through technological advancements. Innovations include the development of smart airbags capable of adjusting inflation force based on occupant weight, height, and seating position, as well as the introduction of multi-stage inflators for more controlled deployment. The integration of airbags with advanced driver-assistance systems (ADAS) is a growing trend, allowing for proactive safety measures where airbag deployment can be coordinated with braking or steering interventions. Companies are also exploring lighter-weight materials and more compact designs to improve fuel efficiency and vehicle packaging. These advancements offer competitive advantages by meeting increasingly stringent safety regulations and catering to evolving consumer demand for sophisticated safety features.

Key Drivers of South Africa Airbag System Industry Growth

The growth of the South Africa Airbag System Industry is propelled by several key factors. Foremost is the increasingly stringent government regulations mandating higher standards of vehicle safety, which directly necessitate the inclusion of more advanced airbag systems. Growing consumer awareness and demand for enhanced occupant protection are significant drivers, as safety features are becoming a key purchasing criterion for new vehicles. Technological advancements in airbag design, such as smart and multi-stage inflation systems, are enhancing safety performance and creating a market for newer, more sophisticated products. Furthermore, the expansion of the automotive manufacturing sector in South Africa, coupled with the country's role as an export hub for certain vehicle models, directly fuels the demand for airbag components. The ongoing push for improved road safety initiatives further underpins this growth, encouraging the adoption of comprehensive safety solutions.

Challenges in the South Africa Airbag System Industry Market

Despite its growth potential, the South Africa Airbag System Industry faces several challenges. High import duties and taxes on certain raw materials and finished components can increase manufacturing costs and impact affordability. Fluctuations in the South African Rand against major currencies can affect the cost of imported technologies and materials. Supply chain disruptions, exacerbated by global events, can lead to delays and increased lead times for essential components. Intense competition from global players and potential for price wars can squeeze profit margins for local manufacturers. Furthermore, the economic volatility and affordability concerns among consumers can impact new vehicle sales, consequently affecting the demand for airbag systems. Regulatory compliance with evolving international standards can also pose a challenge for smaller domestic players.

Emerging Opportunities in South Africa Airbag System Industry

Emerging opportunities in the South Africa Airbag System Industry are abundant, driven by innovation and evolving safety paradigms. The increasing adoption of electric vehicles (EVs) presents an opportunity for specialized airbag solutions tailored to their unique structural designs and safety requirements. The growing trend of autonomous driving necessitates the development of intelligent airbag systems that can seamlessly integrate with advanced driver-assistance systems (ADAS) and adapt to new driving scenarios. Strategic partnerships between local automotive manufacturers and global airbag suppliers can foster technology transfer and enhance local manufacturing capabilities. Market expansion strategies, including the development of cost-effective airbag solutions for the entry-level vehicle segment and the exploration of export markets for locally manufactured components, offer significant potential. Furthermore, the focus on pedestrian safety presents an avenue for the development and integration of external airbag systems.

Leading Players in the South Africa Airbag System Industry Sector

- Joyson Safety Systems

- Hyundai Mobis Co Ltd

- Denso Corporation

- Sumitomo Corporation

- Mitsubishi Electric Corporation

- Continental AG

- Autoliv Inc.

- Robert Bosch GmbH

- ZF TRW

- Toyoda Gosei Co Ltd

Key Milestones in South Africa Airbag System Industry Industry

- 2019: Increased adoption of curtain airbags in new SUV models launched in the South Africa market.

- 2020: Global automotive suppliers begin exploring localized production of advanced airbag control units in South Africa.

- 2021: South African automotive industry experiences a rebound in new vehicle sales, driving demand for safety components.

- 2022: Introduction of vehicles with integrated knee airbags and side-impact airbags as standard features in mid-range segments.

- 2023: Growing emphasis on vehicle safety ratings by consumer bodies influences manufacturer investment in comprehensive airbag systems.

- 2024: Increased interest in hybrid inflator technology for its tunable performance characteristics.

- 2025 (Estimated): Projected increase in the average number of airbags per vehicle manufactured and sold in South Africa.

- 2026-2033 (Forecast): Expected introduction of next-generation intelligent airbag systems in line with global automotive safety advancements.

Strategic Outlook for South Africa Airbag System Industry Market

The strategic outlook for the South Africa Airbag System Industry is highly positive, characterized by sustained growth driven by robust market fundamentals. The increasing regulatory landscape and a rising consumer consciousness for safety are set to accelerate the adoption of advanced airbag technologies, including curtain, knee, and potentially center airbags. Opportunities lie in the localization of advanced manufacturing processes and the development of cost-effective solutions for emerging vehicle segments. Strategic collaborations between global technology providers and local automotive manufacturers will be crucial for transferring expertise and fostering innovation. The industry's ability to adapt to evolving automotive trends, such as electrification and enhanced ADAS integration, will be key to capitalizing on future market potential and solidifying its position as a critical component of vehicle safety in South Africa.

South Africa Airbag System Industry Segmentation

-

1. Airbag Type

- 1.1. Driver airbag

- 1.2. Passenger airbag

- 1.3. Curtain airbag

- 1.4. Knee airbag

- 1.5. Others

-

2. Inflator Type

- 2.1. Pyrotechnic

- 2.2. Stored Gas

- 2.3. Hybrid

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicle

South Africa Airbag System Industry Segmentation By Geography

- 1. South Africa

South Africa Airbag System Industry Regional Market Share

Geographic Coverage of South Africa Airbag System Industry

South Africa Airbag System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth; Cyber Security Threats Remain a Concern for the Market

- 3.4. Market Trends

- 3.4.1. Hybrid Inflator Segment is Growing with a High Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Airbag System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Driver airbag

- 5.1.2. Passenger airbag

- 5.1.3. Curtain airbag

- 5.1.4. Knee airbag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Inflator Type

- 5.2.1. Pyrotechnic

- 5.2.2. Stored Gas

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Joyson Safety Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Mobis Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Denso Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sumitomo Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Autoliv Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZF TRW

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyoda Gosei Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Joyson Safety Systems

List of Figures

- Figure 1: South Africa Airbag System Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Airbag System Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Airbag System Industry Revenue billion Forecast, by Airbag Type 2020 & 2033

- Table 2: South Africa Airbag System Industry Revenue billion Forecast, by Inflator Type 2020 & 2033

- Table 3: South Africa Airbag System Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: South Africa Airbag System Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South Africa Airbag System Industry Revenue billion Forecast, by Airbag Type 2020 & 2033

- Table 6: South Africa Airbag System Industry Revenue billion Forecast, by Inflator Type 2020 & 2033

- Table 7: South Africa Airbag System Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: South Africa Airbag System Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Airbag System Industry?

The projected CAGR is approximately 16.98%.

2. Which companies are prominent players in the South Africa Airbag System Industry?

Key companies in the market include Joyson Safety Systems, Hyundai Mobis Co Ltd, Denso Corporation, Sumitomo Corporation, Mitsubishi Electric Corporatio, Continental AG, Autoliv Inc, Robert Bosch GmbH, ZF TRW, Toyoda Gosei Co Ltd.

3. What are the main segments of the South Africa Airbag System Industry?

The market segments include Airbag Type, Inflator Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth; Other Drivers.

6. What are the notable trends driving market growth?

Hybrid Inflator Segment is Growing with a High Rate.

7. Are there any restraints impacting market growth?

Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth; Cyber Security Threats Remain a Concern for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Airbag System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Airbag System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Airbag System Industry?

To stay informed about further developments, trends, and reports in the South Africa Airbag System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence