Key Insights

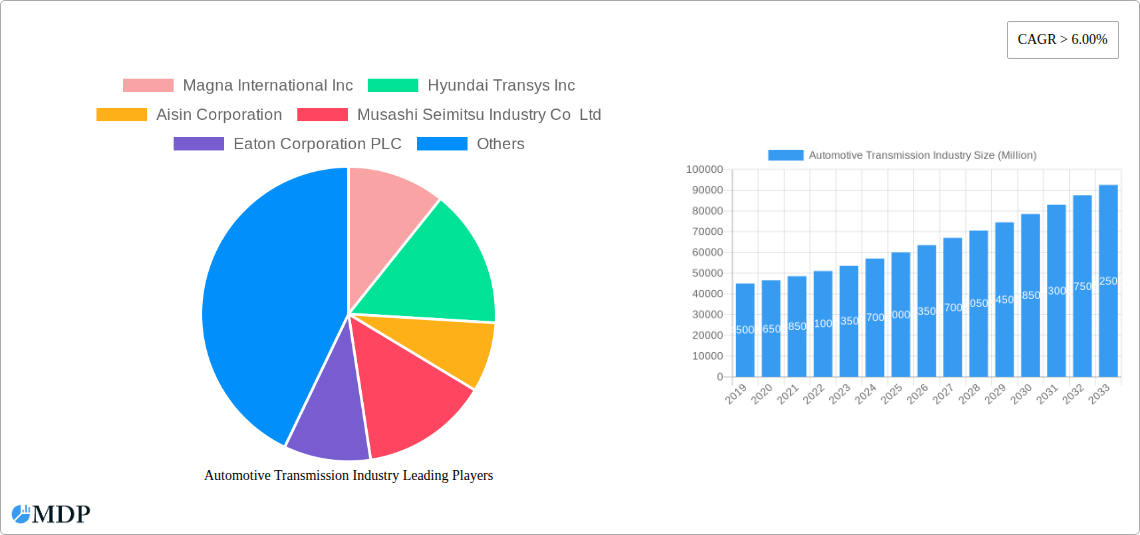

The global Automotive Transmission Industry is poised for significant expansion, projected to reach a substantial market size of approximately $60,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 6.00% throughout the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for advanced powertrain solutions that enhance fuel efficiency and reduce emissions across all vehicle segments, including passenger cars, light commercial vehicles, and heavy commercial vehicles. Key drivers include stringent government regulations on vehicle emissions, a growing consumer preference for automated and more efficient transmissions such as Automated Manual Transmissions (AMTs) and Automatic Transmissions (ATs), and the continuous innovation by leading manufacturers like Magna International Inc., Hyundai Transys Inc., and Aisin Corporation. The increasing adoption of electrified vehicles further stimulates this market, as the development of specialized transmissions for hybrid and electric powertrains presents new opportunities.

Automotive Transmission Industry Market Size (In Billion)

While traditional manual transmissions continue to hold a presence, the market is witnessing a pronounced shift towards intelligent manual transmissions (IMTs) and dual-clutch transmissions (DCTs) that offer improved performance and user experience. The Asia Pacific region, led by China and India, is expected to emerge as a dominant force due to its vast automotive production capacity and rapidly growing vehicle parc. Conversely, restraints such as the high initial cost of advanced transmission technologies and the continued development of continuously variable transmissions (CVTs) in certain segments could pose challenges. However, the industry's resilience, underscored by ongoing research and development in areas like multi-speed transmissions for electric vehicles and the integration of smart technologies, suggests a dynamic and evolving market landscape. Key players like ZF Friedrichshafen AG and BorgWarner Inc. are actively investing in next-generation transmission solutions to capitalize on these emerging trends and maintain a competitive edge.

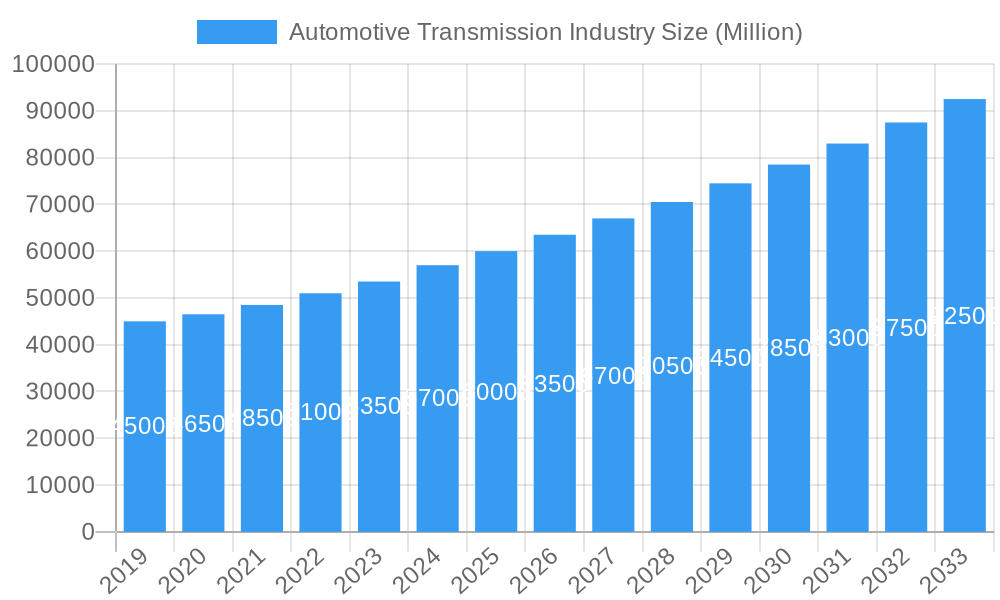

Automotive Transmission Industry Company Market Share

This comprehensive report offers an unparalleled deep dive into the global automotive transmission industry, providing critical insights for stakeholders navigating this dynamic and evolving sector. Spanning a study period of 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis meticulously covers historical trends, current market dynamics, and future projections. It addresses key segments, leading companies, technological advancements, and growth drivers, making it an indispensable resource for automotive manufacturers, tier-1 suppliers, investors, and industry analysts. With an estimated market size projected to reach hundreds of millions in value by 2025, this report leverages high-traffic keywords such as "automotive transmission market," "automatic transmission," "dual-clutch transmission," "electric vehicle transmissions," "hybrid transmissions," and "automotive powertrain" to ensure maximum search visibility and engagement.

Automotive Transmission Industry Market Dynamics & Concentration

The automotive transmission industry exhibits a moderately concentrated market structure, characterized by the presence of several global giants and a significant number of specialized component suppliers. Innovation remains a key driver, fueled by the relentless pursuit of fuel efficiency, reduced emissions, and enhanced driving performance. Regulatory frameworks, particularly those mandating stricter CO2 emission standards and promoting electrified powertrains, are profoundly shaping product development and market strategies. While traditional manual transmissions and automatic transmissions still hold substantial market share, the emergence of intelligent manual transmissions (IMT), automated manual transmissions (AMT), and especially dual-clutch transmissions (DCTs) signifies a technological shift. The growing adoption of electric vehicles (EVs) and hybrid electric vehicles (PHEVs) is introducing new product substitutes, such as single-speed EV gearboxes and integrated e-axles, necessitating strategic adaptation. End-user preferences are increasingly leaning towards smoother shifts, better fuel economy, and advanced functionalities like predictive shifting. Mergers and acquisitions (M&A) activities are a notable feature, as companies seek to consolidate their market position, acquire new technologies, or expand their geographical reach. For instance, the recent acquisition by Allison Transmission underscores the trend of strategic M&A aimed at bolstering specific market segments. M&A deal counts are expected to remain robust as companies re-align their portfolios for the electrified era.

Automotive Transmission Industry Industry Trends & Analysis

The automotive transmission industry is undergoing a profound transformation driven by several interconnected trends. A significant growth driver is the global push towards electrification and stricter environmental regulations, which are accelerating the adoption of hybrid and battery-electric powertrains. This shift is directly impacting the demand for new transmission architectures, including integrated e-drives and advanced reduction gears, moving away from traditional multi-gear systems for pure EVs. Technological disruptions, such as advancements in battery technology, autonomous driving, and connectivity, are further influencing transmission design, demanding more sophisticated control systems and integrated functionalities. Consumer preferences are evolving, with a growing demand for smoother gear shifts, improved fuel efficiency, and the convenience offered by advanced automatic and DCT systems in passenger cars. The competitive dynamics are intensifying, with established players facing new entrants and technology developers vying for market share in the rapidly expanding EV transmission segment. The CAGR for the automotive transmission market is projected to see substantial growth, particularly in the forecast period, driven by the increasing penetration of electrified vehicles. Market penetration of advanced transmission technologies like DCTs and electrified powertrains is steadily increasing, reshaping the overall market landscape. The focus is shifting from purely mechanical components to integrated mechatronic systems, incorporating sensors, actuators, and advanced software for optimal performance and efficiency across various vehicle types, including light commercial vehicles and even select heavy commercial vehicles in specialized applications. The interplay between gasoline and diesel engines, and the nascent but rapidly growing electric powertrains, defines the current and future trajectory of this vital industry segment.

Leading Markets & Segments in Automotive Transmission Industry

The automotive transmission industry is segmented across various transmission types, vehicle types, and fuel types, with distinct regional dominance.

Transmission Type Dominance:

- Automatic Transmission (AT): This segment consistently holds the largest market share due to its widespread adoption in passenger cars and its appeal for comfort and ease of driving. Its dominance is reinforced by increasing production volumes of vehicles equipped with sophisticated ATs globally.

- Dual-clutch Transmission (DCT): Experiencing significant growth, DCTs are becoming increasingly popular in performance-oriented passenger cars and certain light commercial vehicles due to their efficiency and rapid shift times, bridging the gap between automatics and manuals.

- Manual Transmission: While declining in market share in developed regions, manual transmissions remain relevant in certain emerging markets and for specific cost-sensitive vehicle segments, particularly in light commercial vehicles.

- Automated Manual Transmission (AMT): AMTs offer a cost-effective solution for automating gear shifts, finding application in budget-friendly vehicles and some light commercial vehicles, especially in price-sensitive markets.

- Intelligent Manual Transmission (IMT) & Other: IMTs, as a subset of manual transmissions with electronic control, are emerging with potential in specific niches, while the "Other" category includes single-speed EV gearboxes and integrated drive units crucial for the burgeoning EV market.

Vehicle Type Dominance:

- Passenger Cars: This segment represents the largest market by volume, driven by consumer demand for comfort, performance, and fuel efficiency, leading to widespread adoption of ATs and DCTs.

- Light Commercial Vehicles (LCVs): LCVs present a diverse market, with ATs and AMTs gaining traction for urban delivery and ease of operation, alongside the continued importance of manual transmissions for payload and cost efficiency.

- Heavy Commercial Vehicles (HCVs): While traditionally dominated by robust manual and specialized automatic transmissions for hauling applications, the HCV sector is seeing increased adoption of automated manual transmissions and advanced ATs to improve fuel economy and reduce driver fatigue.

Fuel Type Influence:

- Gasoline: This remains the dominant fuel type for the majority of transmissions, especially in passenger cars, influencing the demand for traditional automatic and DCT systems.

- Diesel: Still significant in commercial vehicles and certain passenger car segments, diesel engines are typically paired with robust manual or specialized automatic transmissions.

- Electrified (EVs & Hybrids): This segment is the fastest-growing, driving demand for specialized EV transmissions, hybrid transmissions, and integrated e-axles, fundamentally altering the technology landscape.

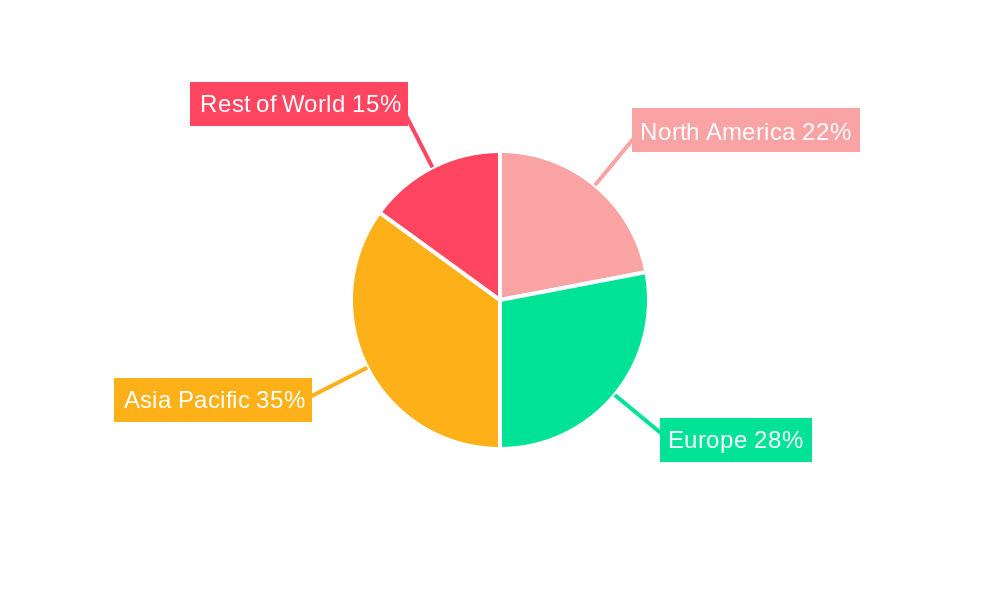

Geographically, Asia-Pacific, particularly China and India, is a major growth hub due to its large vehicle production volumes and increasing adoption of advanced transmission technologies. North America and Europe are leading in the transition towards electrified powertrains and sophisticated automatic/DCT systems, driven by stringent regulations and consumer preferences. Economic policies favoring automotive manufacturing, infrastructure development supporting EV charging, and government incentives for greener vehicles are key drivers influencing market dominance in these regions and segments.

Automotive Transmission Industry Product Developments

Product development in the automotive transmission industry is heavily focused on enhancing efficiency, reducing weight, and integrating advanced functionalities for both internal combustion engine (ICE) vehicles and electrified powertrains. Innovations include multi-speed transmissions for EVs to optimize range and performance, advanced DCTs with improved shift quality and efficiency, and sophisticated hybrid transmissions that seamlessly blend electric and ICE power. Companies are investing in lightweight materials and innovative gear designs to reduce parasitic losses. The competitive advantage lies in developing scalable, cost-effective solutions that meet evolving regulatory demands and consumer expectations for a smoother, more engaging, and environmentally conscious driving experience.

Key Drivers of Automotive Transmission Industry Growth

The automotive transmission industry's growth is propelled by several interconnected factors. A primary driver is the global shift towards electrified vehicles (EVs), including hybrid and battery-electric powertrains, which necessitates the development of specialized, often single-speed or multi-speed EV transmissions and integrated drive units. Stringent governmental regulations and emissions standards worldwide are compelling manufacturers to adopt more fuel-efficient transmission technologies, including advanced automatics, DCTs, and hybrid systems. Technological advancements, such as improved control software, predictive shifting capabilities, and the integration of transmissions with other vehicle systems like ADAS (Advanced Driver-Assistance Systems), are enhancing performance and driver experience. Furthermore, the increasing global demand for vehicles, particularly in emerging economies, and the rising disposable income leading to greater vehicle affordability, contribute significantly to the overall market expansion.

Challenges in the Automotive Transmission Industry Market

Despite robust growth, the automotive transmission industry faces several significant challenges. The rapid pace of technological change, particularly the transition to electrification, requires substantial and ongoing R&D investment, posing financial challenges for smaller players. Supply chain disruptions, amplified by geopolitical events and component shortages (e.g., semiconductors), can hinder production and increase costs. Intense competition among established OEMs and Tier-1 suppliers, along with the emergence of new technology providers, puts pressure on profit margins. Navigating diverse and evolving regulatory landscapes across different regions adds complexity. Furthermore, the substantial cost of developing and retooling manufacturing facilities for new transmission technologies, especially for EVs, represents a considerable barrier to entry and expansion.

Emerging Opportunities in Automotive Transmission Industry

The automotive transmission industry is brimming with emerging opportunities, primarily driven by the accelerating transition to sustainable mobility. The exponential growth of the electric vehicle (EV) market presents a vast opportunity for the development and supply of specialized EV transmissions, e-axles, and integrated powertrain modules. The increasing demand for advanced hybrid technologies also offers significant growth potential for sophisticated hybrid transmissions that optimize energy recuperation and electric-only driving. Strategic partnerships and collaborations between traditional transmission manufacturers, battery technology developers, and EV startups are emerging as key catalysts for innovation and market penetration. Expansion into new geographical markets, particularly those with rapidly growing automotive sectors and supportive government policies for EVs, also represents a substantial opportunity for market players.

Leading Players in the Automotive Transmission Industry Sector

- Magna International Inc

- Hyundai Transys Inc

- Aisin Corporation

- Musashi Seimitsu Industry Co Ltd

- Eaton Corporation PLC

- BorgWarner Inc

- Allison Transmission Inc

- JATCO

- Schaeffler Group

- ZF Friedrichshafen AG

Key Milestones in Automotive Transmission Industry Industry

- April 2022: Allison Transmission announced the completion of its acquisition of India-based AVTEC's off-highway transmission business and the off-highway component machining business of the Madras Export Processing Zone (MEPZ). This strategic move positions Allison for expansion in the off-highway transmission category in India and other global markets, emphasizing enhanced performance and durability.

- March 2021: Magna revealed its all-new linked plug-in hybrid electric vehicle (PHEV) transmission and next-generation battery electric vehicle (BEV) drive systems. Tested in real-world conditions, these innovations are designed for significant CO2 savings through optimized operational software, controls, and dedicated hybrid gearboxes.

- February 2021: Volvo Cars and Geely Auto committed to a broad partnership, including advancements in engines and transmissions. This collaboration aims to leverage their combined capabilities for next-generation hybrid systems and internal combustion engines, with powertrain activities to be consolidated into a new entity.

- February 2021: Eaton's Vehicle Group began developing gearing solutions for electrified vehicles (EVs). Leveraging its expertise in transmissions and contract-produced gear sets, Eaton aims to be a leader in EV reduction gearing, complementing its existing eMobility power electronics offerings.

Strategic Outlook for Automotive Transmission Industry Market

The strategic outlook for the automotive transmission industry is overwhelmingly positive, characterized by sustained growth and significant technological evolution. The continuing transition to electrified powertrains is the primary growth accelerator, creating immense demand for new transmission architectures and integrated e-drives. Manufacturers are strategically investing in R&D for advanced EV transmissions, multi-speed EV gearboxes, and efficient hybrid systems to meet future market needs. Furthermore, the integration of transmissions with autonomous driving systems and advanced vehicle electronics presents opportunities for value-added solutions and enhanced driving experiences. Companies that can successfully navigate the complexities of electrification, optimize their supply chains, and forge strategic partnerships will be well-positioned for long-term success and market leadership in this dynamic sector.

Automotive Transmission Industry Segmentation

-

1. Transmission Type

- 1.1. Manual Transmission

- 1.2. Intelligent Manual Transmission (IMT)

- 1.3. Automated Manual Transmission (AMT)

- 1.4. Automatic Transmission (AT)

- 1.5. Dual-clutch Transmission

- 1.6. Other

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Light Commercial Vehicles

- 2.3. Heavy Commercial Vehicles

-

3. Fuel type

- 3.1. Gasoline

- 3.2. Diesel

Automotive Transmission Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Transmission Industry Regional Market Share

Geographic Coverage of Automotive Transmission Industry

Automotive Transmission Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in Brake Pad Materials and Technologies

- 3.3. Market Restrains

- 3.3.1. The Brake Pad Market is Influenced by the Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Automatic Transmission Segment is Expected to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Manual Transmission

- 5.1.2. Intelligent Manual Transmission (IMT)

- 5.1.3. Automated Manual Transmission (AMT)

- 5.1.4. Automatic Transmission (AT)

- 5.1.5. Dual-clutch Transmission

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Light Commercial Vehicles

- 5.2.3. Heavy Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Fuel type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. North America Automotive Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6.1.1. Manual Transmission

- 6.1.2. Intelligent Manual Transmission (IMT)

- 6.1.3. Automated Manual Transmission (AMT)

- 6.1.4. Automatic Transmission (AT)

- 6.1.5. Dual-clutch Transmission

- 6.1.6. Other

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Light Commercial Vehicles

- 6.2.3. Heavy Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Fuel type

- 6.3.1. Gasoline

- 6.3.2. Diesel

- 6.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7. Europe Automotive Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 7.1.1. Manual Transmission

- 7.1.2. Intelligent Manual Transmission (IMT)

- 7.1.3. Automated Manual Transmission (AMT)

- 7.1.4. Automatic Transmission (AT)

- 7.1.5. Dual-clutch Transmission

- 7.1.6. Other

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Light Commercial Vehicles

- 7.2.3. Heavy Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Fuel type

- 7.3.1. Gasoline

- 7.3.2. Diesel

- 7.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8. Asia Pacific Automotive Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 8.1.1. Manual Transmission

- 8.1.2. Intelligent Manual Transmission (IMT)

- 8.1.3. Automated Manual Transmission (AMT)

- 8.1.4. Automatic Transmission (AT)

- 8.1.5. Dual-clutch Transmission

- 8.1.6. Other

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Light Commercial Vehicles

- 8.2.3. Heavy Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Fuel type

- 8.3.1. Gasoline

- 8.3.2. Diesel

- 8.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9. Rest of World Automotive Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 9.1.1. Manual Transmission

- 9.1.2. Intelligent Manual Transmission (IMT)

- 9.1.3. Automated Manual Transmission (AMT)

- 9.1.4. Automatic Transmission (AT)

- 9.1.5. Dual-clutch Transmission

- 9.1.6. Other

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Light Commercial Vehicles

- 9.2.3. Heavy Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Fuel type

- 9.3.1. Gasoline

- 9.3.2. Diesel

- 9.1. Market Analysis, Insights and Forecast - by Transmission Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Magna International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyundai Transys Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aisin Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Musashi Seimitsu Industry Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Eaton Corporation PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BorgWarner Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Allison Transmission Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JATCO

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schaeffler Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZF Friedrichshafen AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Magna International Inc

List of Figures

- Figure 1: Global Automotive Transmission Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Transmission Industry Revenue (Million), by Transmission Type 2025 & 2033

- Figure 3: North America Automotive Transmission Industry Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 4: North America Automotive Transmission Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Transmission Industry Revenue (Million), by Fuel type 2025 & 2033

- Figure 7: North America Automotive Transmission Industry Revenue Share (%), by Fuel type 2025 & 2033

- Figure 8: North America Automotive Transmission Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Transmission Industry Revenue (Million), by Transmission Type 2025 & 2033

- Figure 11: Europe Automotive Transmission Industry Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 12: Europe Automotive Transmission Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Transmission Industry Revenue (Million), by Fuel type 2025 & 2033

- Figure 15: Europe Automotive Transmission Industry Revenue Share (%), by Fuel type 2025 & 2033

- Figure 16: Europe Automotive Transmission Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Transmission Industry Revenue (Million), by Transmission Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Transmission Industry Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Transmission Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Transmission Industry Revenue (Million), by Fuel type 2025 & 2033

- Figure 23: Asia Pacific Automotive Transmission Industry Revenue Share (%), by Fuel type 2025 & 2033

- Figure 24: Asia Pacific Automotive Transmission Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of World Automotive Transmission Industry Revenue (Million), by Transmission Type 2025 & 2033

- Figure 27: Rest of World Automotive Transmission Industry Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 28: Rest of World Automotive Transmission Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of World Automotive Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of World Automotive Transmission Industry Revenue (Million), by Fuel type 2025 & 2033

- Figure 31: Rest of World Automotive Transmission Industry Revenue Share (%), by Fuel type 2025 & 2033

- Figure 32: Rest of World Automotive Transmission Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of World Automotive Transmission Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Transmission Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 2: Global Automotive Transmission Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Transmission Industry Revenue Million Forecast, by Fuel type 2020 & 2033

- Table 4: Global Automotive Transmission Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Transmission Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 6: Global Automotive Transmission Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Transmission Industry Revenue Million Forecast, by Fuel type 2020 & 2033

- Table 8: Global Automotive Transmission Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Transmission Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 13: Global Automotive Transmission Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Transmission Industry Revenue Million Forecast, by Fuel type 2020 & 2033

- Table 15: Global Automotive Transmission Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Transmission Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 23: Global Automotive Transmission Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Transmission Industry Revenue Million Forecast, by Fuel type 2020 & 2033

- Table 25: Global Automotive Transmission Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: India Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: China Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Transmission Industry Revenue Million Forecast, by Transmission Type 2020 & 2033

- Table 32: Global Automotive Transmission Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Transmission Industry Revenue Million Forecast, by Fuel type 2020 & 2033

- Table 34: Global Automotive Transmission Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: South America Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Automotive Transmission Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Transmission Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Automotive Transmission Industry?

Key companies in the market include Magna International Inc, Hyundai Transys Inc, Aisin Corporation, Musashi Seimitsu Industry Co Ltd, Eaton Corporation PLC, BorgWarner Inc, Allison Transmission Inc, JATCO, Schaeffler Group, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Transmission Industry?

The market segments include Transmission Type, Vehicle Type, Fuel type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Brake Pad Materials and Technologies.

6. What are the notable trends driving market growth?

Automatic Transmission Segment is Expected to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

The Brake Pad Market is Influenced by the Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

In April 2022, Allison Transmission announced the completion of its acquisition of India-based AVTEC's off-highway transmission business and the off-highway component machining business of the Madras Export Processing Zone (MEPZ). Allison's product range will be positioned for strategic expansion in the off-highway category in India and other worldwide markets that need purpose-built products that give better performance, durability, dependability, and productivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Transmission Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Transmission Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Transmission Industry?

To stay informed about further developments, trends, and reports in the Automotive Transmission Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence