Key Insights

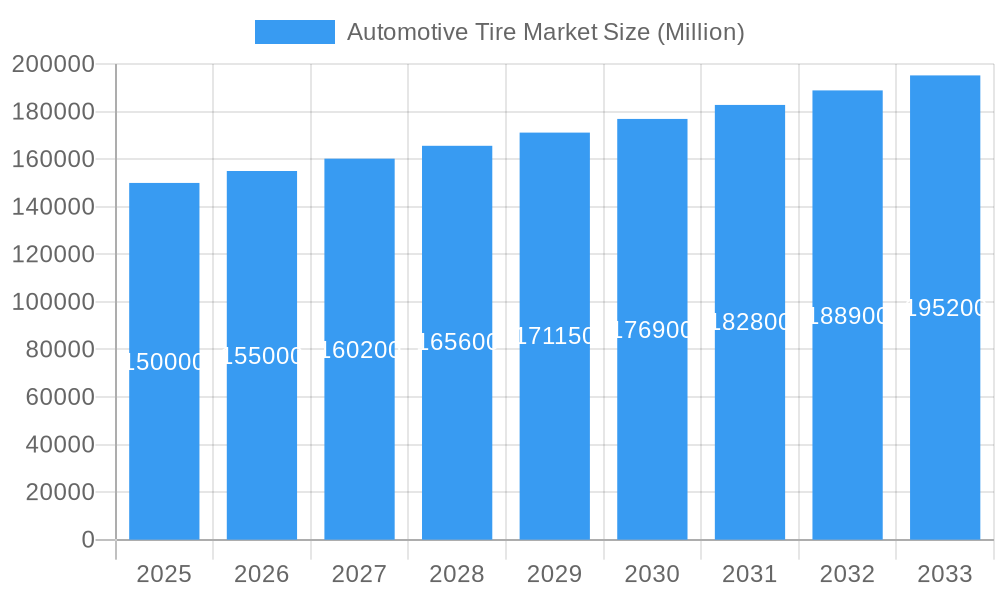

The global Automotive Tire Market is poised for substantial growth, projected to expand beyond an estimated market size of $150 billion by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.00%. This robust expansion is fueled by several key drivers, including the increasing global vehicle parc, the continuous introduction of new vehicle models across passenger and commercial segments, and the growing demand for specialized tires that enhance fuel efficiency, safety, and performance. The aftermarket segment, in particular, presents a significant opportunity as vehicle owners prioritize regular tire maintenance and replacement to ensure optimal vehicle operation and safety. Furthermore, advancements in tire technology, such as the development of run-flat tires, smart tires equipped with sensors for real-time monitoring, and sustainable tire materials, are actively contributing to market dynamism and value creation. Emerging economies, especially in the Asia Pacific region, are expected to be major contributors to this growth, driven by rising disposable incomes and increasing vehicle ownership.

Automotive Tire Market Market Size (In Billion)

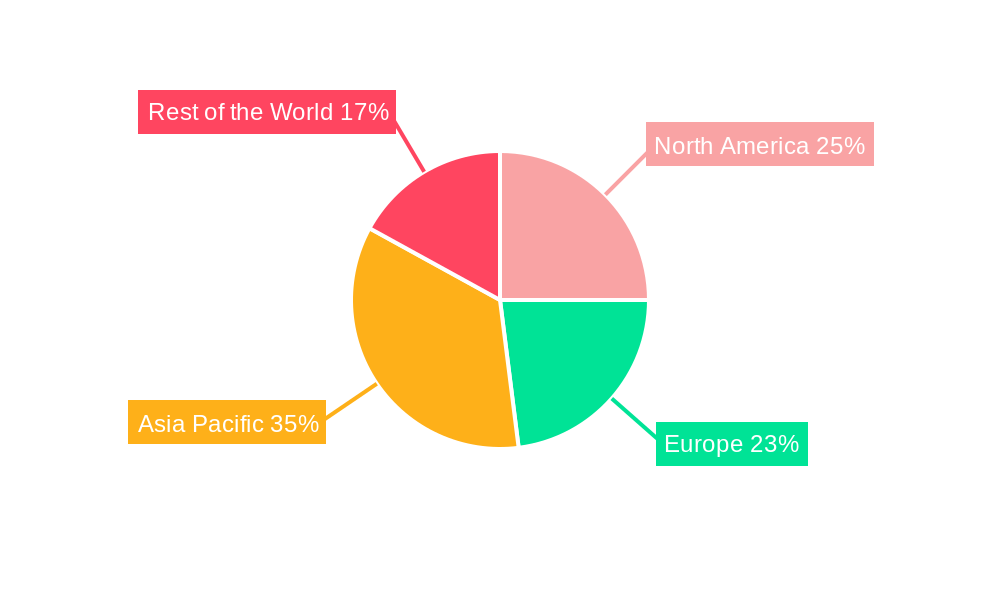

The market segmentation highlights diverse opportunities across various tire types and applications. Winter tires and summer tires dominate the tire type segment due to seasonal demands, while the "Other Tire Types" category, encompassing all-season and performance tires, is also experiencing steady growth. In terms of application, on-the-road tires are the largest segment, catering to the vast majority of passenger cars and commercial vehicles. However, off-the-road tires, used in specialized vehicles for agricultural, industrial, and mining purposes, represent a niche but crucial market. The vehicle type segmentation clearly indicates that passenger cars will continue to be the primary consumer base, followed by commercial vehicles. Both the Original Equipment Manufacturer (OEM) and aftermarket channels are vital, with the aftermarket expected to witness accelerated growth due to the aging global vehicle fleet. Geographically, Asia Pacific, led by China and India, is set to become the largest and fastest-growing regional market, owing to rapid industrialization and a burgeoning automotive sector.

Automotive Tire Market Company Market Share

Here is an SEO-optimized, engaging report description for the Automotive Tire Market, adhering to all your specifications.

Report Description:

Unlock Growth Opportunities in the Global Automotive Tire Market: 2019-2033

Dive deep into the dynamic automotive tire market with this comprehensive industry analysis. Covering the period from 2019 to 2033, with a base year of 2025 and a robust forecast period of 2025–2033, this report provides invaluable insights for stakeholders seeking to navigate and capitalize on evolving market trends. We meticulously examine tire type segments (Winter Tires, Summer Tires, Other Tire Types), application types (On-the-Road, Off-the-Road), vehicle type categories (Passenger Cars, Commercial Vehicles), and end-user markets (OEM, Aftermarket). Understand the strategies of industry giants like Bridgestone Corp, Michelin Tires, Goodyear Tire & Rubber Company, Continental Automotive AG, Cooper Tire & Rubber Company, MRF, Pirelli & C SpA, Hankook Tires Group, JK Tyre & Industrie, Yokohama Rubber Co Ltd, and Apollo Tires. With projected market sizes in the Millions, this report is your definitive guide to the global automotive tire industry, tire manufacturing, automotive components, and the future of tire technology.

Automotive Tire Market Market Dynamics & Concentration

The automotive tire market exhibits a moderate to high concentration, with a few dominant global players holding significant market share. Key innovation drivers include the relentless pursuit of enhanced fuel efficiency, improved safety features (such as reduced braking distances and wet grip), and the development of sustainable and eco-friendly tire materials. Regulatory frameworks, particularly those concerning tire labeling for fuel efficiency and wet grip performance, play a crucial role in shaping product development and consumer choices. Product substitutes, while not direct replacements, include advancements in vehicle suspension systems that might influence tire wear and performance expectations. End-user trends are strongly influenced by the automotive industry's shift towards electric vehicles (EVs), necessitating tires with lower rolling resistance, higher load-bearing capacity, and reduced noise levels. Mergers and acquisition (M&A) activities, while not as frequent as in some other sectors, are strategic moves for market expansion, technology acquisition, and portfolio diversification. For example, recent M&A activities in the aftermarket segment aim to consolidate distribution networks and expand service offerings. The market share of leading players can range from 8% to 15% for the top three companies, with a collective market share for the top ten exceeding 70%. The count of significant M&A deals averages around 2-4 per year, focusing on niche technologies or regional market entry.

Automotive Tire Market Industry Trends & Analysis

The automotive tire market is experiencing robust growth, propelled by a confluence of technological advancements, evolving consumer preferences, and expansion in global vehicle production. The global automotive tire market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033. This growth is significantly driven by the increasing global vehicle parc, particularly in emerging economies, and the continuous replacement demand from the aftermarket. Technological disruptions are at the forefront, with a strong emphasis on developing tires that offer superior fuel efficiency through reduced rolling resistance, contributing to lower CO2 emissions and operational cost savings for consumers. The rise of electric vehicles (EVs) is a transformative trend, demanding specialized tires that can handle higher torque, provide instant acceleration, and accommodate increased battery weight, all while maintaining a low noise profile and long tread life. Companies are investing heavily in research and development for smart tires, which incorporate sensors to monitor tire pressure, temperature, and wear in real-time, offering predictive maintenance capabilities and enhancing safety. Consumer preferences are shifting towards performance and sustainability. There's a growing demand for all-season tires that offer a balance of performance in various weather conditions, reducing the need for seasonal tire changes. Furthermore, eco-friendly materials, such as recycled rubber and bio-based compounds, are gaining traction as consumers become more environmentally conscious. The competitive dynamics are intensifying, with established players focusing on product differentiation, innovation, and strategic partnerships to maintain their market positions. The market penetration of high-performance tires and specialized EV tires is steadily increasing, indicating a move towards premiumization within the sector. The aftermarket segment remains a significant contributor to revenue, driven by the sheer volume of vehicles on the road requiring regular tire replacements and maintenance.

Leading Markets & Segments in Automotive Tire Market

The automotive tire market exhibits varied dominance across regions and segments, driven by distinct economic, infrastructural, and consumer behavior patterns. North America and Europe currently lead in terms of market value and technological adoption, largely due to a high per capita income, a mature automotive industry, and stringent safety and environmental regulations. However, the Asia-Pacific region, particularly China, India, and Southeast Asian countries, presents the fastest growth potential, fueled by a burgeoning middle class, increasing vehicle ownership, and government initiatives to boost automotive manufacturing.

Tire Type Dominance:

- Summer Tires: These dominate the global market due to their widespread use in temperate climates and their association with optimal performance during warmer months. Key drivers for their dominance include high passenger car penetration and robust original equipment manufacturer (OEM) demand.

- Winter Tires: While geographically concentrated in regions with harsh winter conditions (e.g., Northern Europe, Canada, parts of the US), their market share is significant and growing due to increasing awareness of safety and legal mandates in certain territories. Economic policies promoting vehicle safety and infrastructure development to handle snow and ice contribute to their demand.

- Other Tire Types (e.g., All-Season, Performance Tires): All-season tires are experiencing strong growth as consumers seek convenience and year-round performance. Performance tires are driven by the demand for sports cars and performance-oriented vehicles.

Application Dominance:

- On-the-Road: This segment overwhelmingly dominates, encompassing all tires used on paved surfaces for passenger cars, commercial vehicles, and light trucks. The sheer volume of vehicles operating on roads globally underpins this dominance.

- Off-the-Road (OTR): While a smaller segment in terms of volume, OTR tires (for construction, agriculture, mining) are characterized by higher unit values and specialized performance requirements. Infrastructure development projects and mining activities are key economic drivers for this segment.

Vehicle Type Dominance:

- Passenger Cars: This segment holds the largest market share due to the global ubiquity of passenger vehicles for personal transportation. The aftermarket for passenger car tires is particularly substantial.

- Commercial Vehicles: This segment includes trucks, buses, and vans. While lower in unit volume compared to passenger cars, commercial vehicle tires command higher prices due to their size, durability, and load-bearing requirements, making them a significant revenue generator.

End User Dominance:

- OEM (Original Equipment Manufacturer): This segment is crucial as it dictates the initial tire fitment on new vehicles. Strong relationships with automotive manufacturers and the ability to meet stringent quality and performance specifications are key to success in this segment.

- Aftermarket: This segment accounts for a larger volume of tire sales globally, driven by replacement cycles, vehicle servicing, and independent repair shops. The aftermarket is highly competitive and influenced by pricing, brand loyalty, and distribution network efficiency.

Automotive Tire Market Product Developments

Recent product developments in the automotive tire market are heavily focused on enhancing performance, sustainability, and intelligent functionality. Innovations include the introduction of lightweight, low-rolling-resistance tires specifically designed for electric vehicles, maximizing battery range and minimizing energy consumption. Advanced tread compounds and pattern designs are being developed to improve grip in both wet and dry conditions, enhancing safety and driver confidence. Furthermore, there's a significant push towards sustainable materials, with companies experimenting with recycled rubber and bio-based polymers to reduce the environmental footprint of tire manufacturing. The integration of sensor technology into tires, creating "smart tires," is another key trend, enabling real-time monitoring of tire pressure, temperature, and wear, which contributes to predictive maintenance and optimized vehicle performance. These developments offer a competitive advantage by addressing the evolving needs of automotive manufacturers and end-users seeking efficiency, safety, and environmental responsibility.

Key Drivers of Automotive Tire Market Growth

The automotive tire market is propelled by several key growth drivers. The expanding global vehicle parc, particularly in emerging economies, directly translates to higher demand for both original equipment tires and replacement tires. Technological advancements, such as the development of fuel-efficient and EV-specific tires, are creating new market opportunities and driving product innovation. Stringent government regulations mandating improved fuel economy and safety standards incentivize manufacturers to produce more advanced and performance-oriented tires. The aftermarket segment, driven by the continuous need for tire replacement and maintenance, remains a stable and significant contributor to market growth. Furthermore, the increasing preference for SUVs and crossovers, which typically require larger and more robust tires, also bolsters market expansion.

Challenges in the Automotive Tire Market Market

Despite robust growth, the automotive tire market faces several challenges. Fluctuations in raw material prices, particularly for natural rubber and petrochemicals, can significantly impact profit margins for manufacturers. Increasing regulatory hurdles related to environmental standards and tire performance can necessitate substantial investment in research and development, adding to operational costs. Intense competition within the market leads to price pressures, especially in the aftermarket segment. Furthermore, supply chain disruptions, as witnessed in recent global events, can impede production and distribution, leading to stockouts and increased lead times. The growing demand for sustainable and recycled materials also presents a challenge in terms of developing cost-effective and scalable production processes.

Emerging Opportunities in Automotive Tire Market

Emerging opportunities within the automotive tire market are substantial. The rapid growth of the electric vehicle (EV) sector presents a significant opportunity for tire manufacturers to develop and supply specialized EV tires that address unique performance requirements like low noise, high torque handling, and extended battery range. The increasing adoption of tire-as-a-service models and smart tire technologies, offering data-driven insights and predictive maintenance, opens new revenue streams and enhances customer loyalty. Strategic partnerships with automotive OEMs for the development of integrated tire and vehicle systems, as well as collaborations with technology providers for advanced material research, offer avenues for innovation and market differentiation. Furthermore, the expansion of manufacturing and distribution networks in high-growth emerging markets provides a significant opportunity for market penetration and increased sales volume.

Leading Players in the Automotive Tire Market Sector

- Continental Automotive AG

- Cooper Tire & Rubber Company

- MRF (Madras Rubber Factory Limited)

- Pirelli & C SpA

- Hankook Tires Group

- Bridgestone Corp

- Michelin Tires

- JK Tyre & Industrie

- Yokohama Rubber Co Ltd

- Goodyear Tire & Rubber Company

- Apollo Tires

Key Milestones in Automotive Tire Market Industry

- 2019: Increased focus on R&D for sustainable tire materials and EV-specific tire technology.

- 2020: Global launch of new tire models with enhanced fuel efficiency and wet grip ratings, responding to EU tire labeling regulations.

- 2021: Significant investments in smart tire technology and sensor integration for real-time monitoring and predictive maintenance.

- 2022: Expansion of manufacturing facilities in Southeast Asia to meet growing demand in emerging markets.

- 2023: Introduction of new tire lines specifically engineered for the growing electric vehicle market, featuring low rolling resistance and noise reduction.

- 2024: Strategic collaborations announced for the development of advanced recycled and bio-based tire compounds.

Strategic Outlook for Automotive Tire Market Market

The strategic outlook for the automotive tire market is characterized by a strong emphasis on innovation and sustainability. Companies will increasingly focus on developing high-performance, eco-friendly tires tailored for electric vehicles and autonomous driving systems. The integration of digital technologies, including IoT and AI, for smart tire solutions and data analytics will become a key differentiator, enabling enhanced safety, efficiency, and customer engagement. Strategic alliances and partnerships will be crucial for accelerating product development, securing supply chains, and expanding market reach, particularly in high-growth regions. The aftermarket segment will continue to be a vital revenue stream, with opportunities for value-added services and personalized customer experiences. Overall, the market is poised for sustained growth driven by technological advancements and the evolving demands of the global automotive industry.

Automotive Tire Market Segmentation

-

1. Tire Type

- 1.1. Winter Tires

- 1.2. Summer Tires

- 1.3. Other Tire Types

-

2. Application

- 2.1. On-the-Road

- 2.2. Off-the-Road

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. End User

- 4.1. OEM

- 4.2. Aftermarket

Automotive Tire Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Tire Market Regional Market Share

Geographic Coverage of Automotive Tire Market

Automotive Tire Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Passenger Vehicle Sales Across the Globe

- 3.3. Market Restrains

- 3.3.1. High Cost may Restrict the Growth Potential

- 3.4. Market Trends

- 3.4.1. Increased Demand for High-performance Tires

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Tire Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tire Type

- 5.1.1. Winter Tires

- 5.1.2. Summer Tires

- 5.1.3. Other Tire Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. On-the-Road

- 5.2.2. Off-the-Road

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tire Type

- 6. North America Automotive Tire Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tire Type

- 6.1.1. Winter Tires

- 6.1.2. Summer Tires

- 6.1.3. Other Tire Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. On-the-Road

- 6.2.2. Off-the-Road

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. OEM

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Tire Type

- 7. Europe Automotive Tire Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tire Type

- 7.1.1. Winter Tires

- 7.1.2. Summer Tires

- 7.1.3. Other Tire Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. On-the-Road

- 7.2.2. Off-the-Road

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. OEM

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Tire Type

- 8. Asia Pacific Automotive Tire Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tire Type

- 8.1.1. Winter Tires

- 8.1.2. Summer Tires

- 8.1.3. Other Tire Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. On-the-Road

- 8.2.2. Off-the-Road

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. OEM

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Tire Type

- 9. Rest of the World Automotive Tire Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tire Type

- 9.1.1. Winter Tires

- 9.1.2. Summer Tires

- 9.1.3. Other Tire Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. On-the-Road

- 9.2.2. Off-the-Road

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. OEM

- 9.4.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Tire Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Continental Automotive AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cooper Tire & Rubber Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MRF (Madras Rubber Factory Limited)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pirelli & C SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hankook Tires Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bridgestone Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Michelin Tires

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JK Tyre & Industrie

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yokohama Rubber Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Goodyear Tire & Rubber Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Apollo Tires

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Continental Automotive AG

List of Figures

- Figure 1: Global Automotive Tire Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Tire Market Revenue (Million), by Tire Type 2025 & 2033

- Figure 3: North America Automotive Tire Market Revenue Share (%), by Tire Type 2025 & 2033

- Figure 4: North America Automotive Tire Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Automotive Tire Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Automotive Tire Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Tire Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Tire Market Revenue (Million), by End User 2025 & 2033

- Figure 9: North America Automotive Tire Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Automotive Tire Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Automotive Tire Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Automotive Tire Market Revenue (Million), by Tire Type 2025 & 2033

- Figure 13: Europe Automotive Tire Market Revenue Share (%), by Tire Type 2025 & 2033

- Figure 14: Europe Automotive Tire Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Automotive Tire Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Automotive Tire Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Europe Automotive Tire Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Europe Automotive Tire Market Revenue (Million), by End User 2025 & 2033

- Figure 19: Europe Automotive Tire Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Europe Automotive Tire Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Automotive Tire Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Automotive Tire Market Revenue (Million), by Tire Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Tire Market Revenue Share (%), by Tire Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Tire Market Revenue (Million), by Application 2025 & 2033

- Figure 25: Asia Pacific Automotive Tire Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Asia Pacific Automotive Tire Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific Automotive Tire Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific Automotive Tire Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific Automotive Tire Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Automotive Tire Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Automotive Tire Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Automotive Tire Market Revenue (Million), by Tire Type 2025 & 2033

- Figure 33: Rest of the World Automotive Tire Market Revenue Share (%), by Tire Type 2025 & 2033

- Figure 34: Rest of the World Automotive Tire Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Rest of the World Automotive Tire Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Rest of the World Automotive Tire Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 37: Rest of the World Automotive Tire Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Rest of the World Automotive Tire Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Rest of the World Automotive Tire Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Rest of the World Automotive Tire Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Automotive Tire Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Tire Market Revenue Million Forecast, by Tire Type 2020 & 2033

- Table 2: Global Automotive Tire Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Automotive Tire Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Tire Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Global Automotive Tire Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Automotive Tire Market Revenue Million Forecast, by Tire Type 2020 & 2033

- Table 7: Global Automotive Tire Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Automotive Tire Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Automotive Tire Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Automotive Tire Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Tire Market Revenue Million Forecast, by Tire Type 2020 & 2033

- Table 15: Global Automotive Tire Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Automotive Tire Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Automotive Tire Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global Automotive Tire Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Automotive Tire Market Revenue Million Forecast, by Tire Type 2020 & 2033

- Table 25: Global Automotive Tire Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Tire Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Automotive Tire Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Automotive Tire Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: China Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: India Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Korea Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Automotive Tire Market Revenue Million Forecast, by Tire Type 2020 & 2033

- Table 35: Global Automotive Tire Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Automotive Tire Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Automotive Tire Market Revenue Million Forecast, by End User 2020 & 2033

- Table 38: Global Automotive Tire Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: South America Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Middle East and Africa Automotive Tire Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Tire Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Automotive Tire Market?

Key companies in the market include Continental Automotive AG, Cooper Tire & Rubber Company, MRF (Madras Rubber Factory Limited), Pirelli & C SpA, Hankook Tires Group, Bridgestone Corp, Michelin Tires, JK Tyre & Industrie, Yokohama Rubber Co Ltd, Goodyear Tire & Rubber Company, Apollo Tires.

3. What are the main segments of the Automotive Tire Market?

The market segments include Tire Type, Application, Vehicle Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Passenger Vehicle Sales Across the Globe.

6. What are the notable trends driving market growth?

Increased Demand for High-performance Tires.

7. Are there any restraints impacting market growth?

High Cost may Restrict the Growth Potential.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Tire Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Tire Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Tire Market?

To stay informed about further developments, trends, and reports in the Automotive Tire Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence