Key Insights

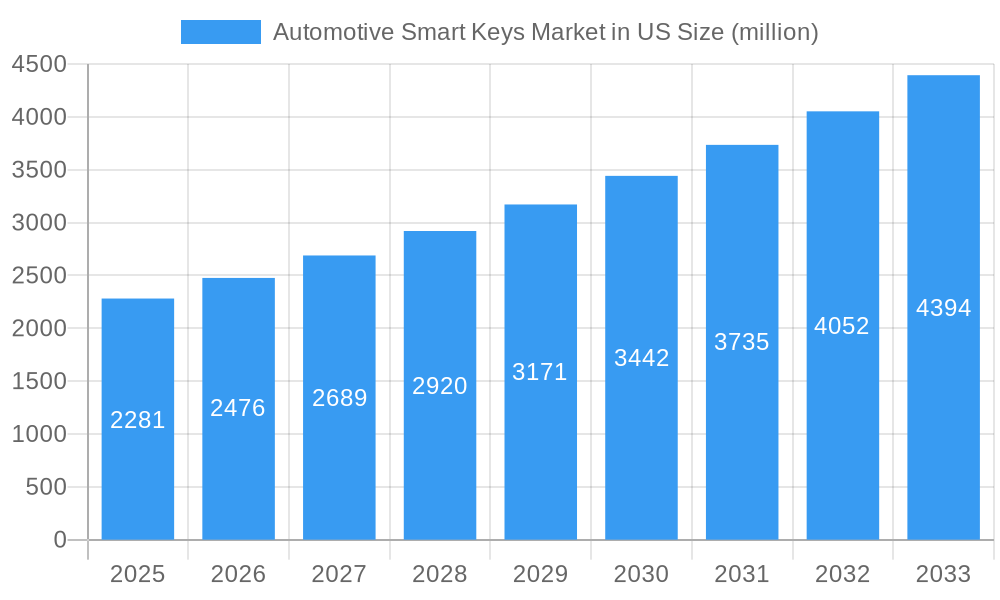

The Automotive Smart Keys market is poised for significant expansion, with an estimated market size of $2,281 million in 2025 and a projected CAGR of 8.55% through 2033. This robust growth is primarily fueled by the escalating demand for enhanced vehicle security and convenience features. Consumers are increasingly seeking advanced functionalities like remote keyless entry and passive keyless entry systems, which offer seamless access and ignition without the need for manual key insertion. The integration of these smart technologies into vehicles is becoming a standard expectation, driving adoption across both OEM and aftermarket segments. Furthermore, the rising disposable incomes and growing vehicle parc, particularly in emerging economies, are contributing to the overall market uptrend. The increasing sophistication of automotive electronics and the ongoing innovation in secure communication protocols are further bolstering the market's momentum, promising a dynamic and evolving landscape for automotive smart key solutions.

Automotive Smart Keys Market in US Market Size (In Billion)

Several key trends are shaping the automotive smart keys market, including the growing adoption of smartphone-based access and digital keys, which offer unparalleled convenience and a futuristic user experience. The continuous innovation in cybersecurity to combat sophisticated theft methods is also a significant driver, pushing manufacturers to develop more robust and secure smart key systems. The market is also witnessing a surge in demand for integrated solutions that combine smart key functionality with other vehicle features, such as personalization settings and advanced diagnostics. While the market presents immense opportunities, certain restraints need to be addressed. High development and implementation costs associated with advanced security features can pose a challenge, especially for budget-oriented vehicle segments. Additionally, concerns regarding the potential for signal jamming and hacking, though diminishing with advancements, can still create a degree of consumer apprehension. The ongoing shift towards electric vehicles (EVs) also presents both opportunities and challenges, as smart key integration needs to align with EV-specific charging and security protocols.

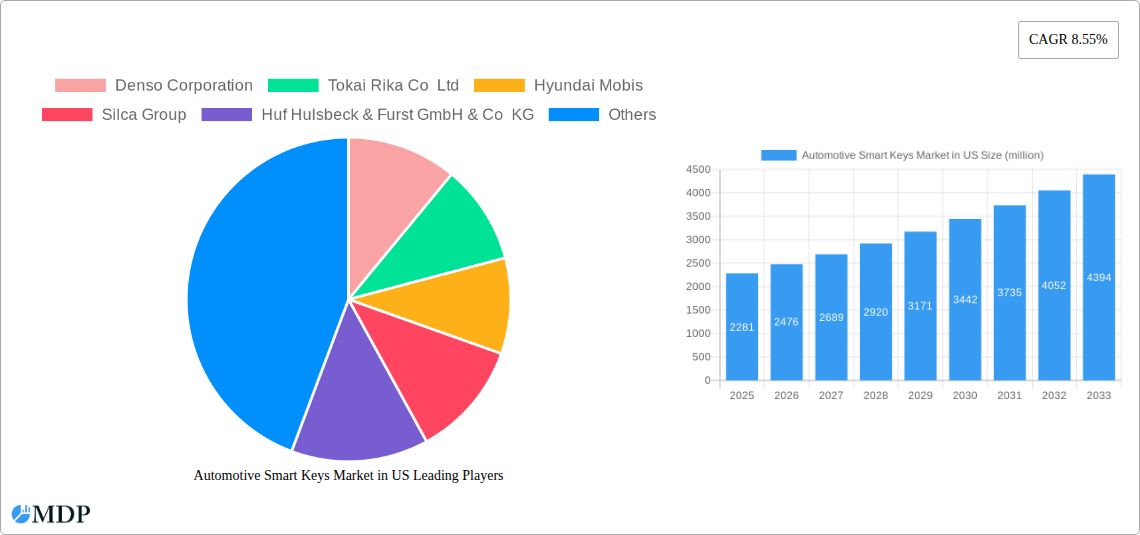

Automotive Smart Keys Market in US Company Market Share

Here's the SEO-optimized, engaging report description for the Automotive Smart Keys Market in the US, designed for maximum visibility and immediate use:

Unlock critical insights into the burgeoning US Automotive Smart Keys Market. This in-depth report, spanning the historical period of 2019-2024 and forecasting to 2033 with a base year of 2025, provides an indispensable resource for industry leaders, automotive manufacturers, technology providers, and investors. Dive deep into market dynamics, uncover key growth drivers, analyze segment-specific performance, and identify emerging opportunities within this rapidly evolving sector. With an estimated market size poised for substantial expansion, understanding the competitive landscape and technological advancements is paramount. Our analysis leverages high-traffic keywords such as "automotive smart keys," "keyless entry systems," "connected car technology," "vehicle access control," and "OEM smart keys" to ensure maximum discoverability.

This report details the market by Application Type (Single Function, Multi-function), Technology Type (Remote Keyless Entry, Passive Keyless Entry), and Installation Type (OEM, Aftermarket). We meticulously examine the strategic moves of key players like Denso Corporation, Tokai Rika Co Ltd, Hyundai Mobis, Silca Group, Huf Hulsbeck & Furst GmbH & Co KG, HELLA GmbH & Co KGaA, Continental AG, ALPHA Corporation, Valeo SA, Robert Bosch GmbH, and ZF Friedrichshafen AG. Explore critical market trends, technological innovations, and future projections.

Automotive Smart Keys Market in US Market Dynamics & Concentration

The US Automotive Smart Keys Market exhibits a dynamic and moderately concentrated landscape, driven by relentless innovation and increasing consumer demand for convenience and enhanced security. Key innovation drivers include the integration of advanced cybersecurity features, the push towards smartphone-as-a-key technology, and the development of more robust and feature-rich multi-function smart keys. Regulatory frameworks, primarily focused on vehicle security standards and data privacy, are also shaping product development and adoption rates. Product substitutes, while present in the form of traditional keys and simpler keyless entry systems, are increasingly being overshadowed by the superior functionality and user experience offered by smart keys. End-user trends clearly favor the adoption of Passive Keyless Entry (PKE) systems due to their seamless operation. Mergers and acquisitions (M&A) activity, while not hyperactive, signifies consolidation and strategic positioning among leading players seeking to expand their market share and technological portfolios. For instance, recent M&A deals, numbering approximately 5-10 significant transactions over the historical period, have aimed at acquiring innovative startups or integrating complementary technologies to bolster competitive advantage. Market share is notably distributed, with the top 3-5 players collectively holding around 50-65% of the market.

Automotive Smart Keys Market in US Industry Trends & Analysis

The US Automotive Smart Keys Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is fueled by several key trends, including the accelerating adoption of connected car technologies, which inherently necessitates sophisticated and secure vehicle access solutions. Consumers are increasingly prioritizing convenience and advanced features, driving the demand for multi-function smart keys that integrate with vehicle infotainment systems and offer personalized settings. Technological disruptions, such as the rise of smartphone-based digital keys and the integration of biometric authentication (fingerprint scanners, facial recognition), are redefining the user experience and pushing manufacturers to innovate. The market penetration of smart key systems, particularly Passive Keyless Entry (PKE), has already surpassed 70% in new vehicle sales and is expected to climb higher as older models are replaced and aftermarket installations gain traction. The competitive dynamics are characterized by intense R&D efforts, strategic partnerships between automotive OEMs and technology suppliers, and a growing focus on enhancing the security and reliability of these systems. The increasing average selling price (ASP) of smart keys, driven by the inclusion of more advanced features and sophisticated microcontrollers, also contributes to the market's overall revenue growth. Furthermore, the growing aftermarket for smart key replacements and upgrades, driven by vehicle lifespan and the desire for enhanced functionality in older vehicles, represents a significant and growing revenue stream. The market is also witnessing a shift towards more sustainable and energy-efficient smart key designs, aligning with broader automotive industry trends.

Leading Markets & Segments in Automotive Smart Keys Market in US

The US Automotive Smart Keys Market is dominated by the OEM Installation Type, reflecting the widespread integration of smart keys as a standard or optional feature in new vehicles. This segment accounts for an estimated 85-90% of the total market revenue. The dominance of OEM is driven by the collaborative efforts between automotive manufacturers and key technology suppliers to embed sophisticated smart key solutions from the point of vehicle production. Economic policies promoting automotive manufacturing and sales, coupled with robust infrastructure for automotive supply chains within the US, further bolster OEM installations.

Within Technology Type, Passive Keyless Entry (PKE) commands the largest market share, estimated at over 70% of the market value. PKE offers unparalleled convenience, allowing drivers to unlock and start their vehicles without physically interacting with the key fob, aligning perfectly with consumer preferences for seamless experiences. The widespread adoption of PKE is a testament to its technological maturity and the positive consumer feedback it consistently receives.

Regarding Application Type, Multi-function smart keys are increasingly gaining prominence, holding an estimated 55-60% of the market share and exhibiting a higher growth trajectory compared to Single Function keys. Multi-function keys offer a broader range of capabilities beyond basic unlocking and locking, such as remote engine start, trunk release, and integration with vehicle security systems and personal settings. This versatility caters to the growing demand for connected and personalized automotive experiences.

The Aftermarket Installation Type also presents a significant, albeit smaller, market segment, estimated at 10-15% of the total market. This segment is driven by vehicle owners seeking to upgrade older vehicles with modern smart key technology or replace lost or damaged keys. Government incentives for vehicle upgrades and consumer interest in enhancing vehicle security and convenience contribute to its steady growth.

Automotive Smart Keys Market in US Product Developments

Recent product developments in the US Automotive Smart Keys Market highlight a significant trend towards enhanced security and integration. Innovations include the introduction of advanced encryption protocols and anti-cloning technologies to combat sophisticated theft attempts. Furthermore, the proliferation of smartphone-as-a-key solutions, allowing users to control vehicle access via their mobile devices, is a key development, offering unprecedented convenience and interoperability. The integration of biometric authentication, such as fingerprint scanners within key fobs or directly on vehicle door handles, is also gaining traction, providing an additional layer of personalized security. These developments are driven by the need for more secure, user-friendly, and feature-rich automotive access systems that cater to the evolving demands of connected vehicle owners.

Key Drivers of Automotive Smart Keys Market in US Growth

The growth of the Automotive Smart Keys Market in the US is propelled by several interconnected factors. The increasing demand for enhanced vehicle security and anti-theft solutions is a primary driver, as sophisticated smart keys offer superior protection compared to traditional keys. The pervasive trend towards automotive connectivity and the rise of the Internet of Things (IoT) in vehicles necessitate advanced, digitalized access systems. Consumer preference for convenience and seamless user experiences strongly favors the adoption of keyless entry and ignition systems. Furthermore, technological advancements, including the development of longer-range communication protocols and more energy-efficient battery solutions for key fobs, are making smart keys more practical and appealing. Government mandates and evolving automotive safety standards also indirectly encourage the adoption of more advanced vehicle access technologies.

Challenges in the Automotive Smart Keys Market in US Market

Despite its robust growth, the US Automotive Smart Keys Market faces several challenges. The primary concern revolves around cybersecurity threats and the potential for sophisticated hacking, which can compromise vehicle security and lead to theft. Ensuring the integrity and resilience of these systems against evolving cyberattack vectors remains a continuous challenge for manufacturers. Supply chain disruptions, particularly for critical electronic components and semiconductors, can impact production volumes and increase costs. The high cost of some advanced smart key technologies can also be a barrier to widespread adoption, especially in the aftermarket segment or for entry-level vehicle models. Furthermore, regulatory complexities and the need for standardization across different vehicle platforms and regions can slow down the pace of innovation and market penetration. The ongoing need for user education regarding the proper use and security of smart key systems is also a factor.

Emerging Opportunities in Automotive Smart Keys Market in US

Emerging opportunities within the US Automotive Smart Keys Market are primarily driven by the continued evolution of connected car technology and the integration of smart keys into the broader digital ecosystem. The expansion of the smartphone-as-a-key functionality, allowing for seamless vehicle sharing and remote access management, presents a significant growth avenue. The development of highly personalized vehicle access experiences, where smart keys can automatically adjust seat positions, climate control, and infotainment settings based on user profiles, offers new avenues for differentiation. The growing demand for advanced authentication methods, including facial recognition and voice commands, will open up new product development opportunities. Strategic partnerships between automotive OEMs, technology providers, and telecommunications companies will be crucial for unlocking the full potential of integrated smart key solutions, paving the way for a truly connected and secure automotive future.

Leading Players in the Automotive Smart Keys Market in US Sector

- Denso Corporation

- Tokai Rika Co Ltd

- Hyundai Mobis

- Silca Group

- Huf Hulsbeck & Furst GmbH & Co KG

- HELLA GmbH & Co KGaA

- Continental AG

- ALPHA Corporation

- Valeo SA

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Key Milestones in Automotive Smart Keys Market in US Industry

- 2019: Introduction of advanced cybersecurity protocols in OEM smart keys to counter rising hacking threats.

- 2020: Significant growth in the development and adoption of smartphone-as-a-key technology by leading automakers.

- 2021: Increased focus on integration of multi-functionality, including remote engine start and personalized vehicle settings.

- 2022: Emergence of biometric authentication features (fingerprint sensors) in premium smart key fobs.

- 2023: Expansion of the aftermarket for smart key upgrades and replacements, driven by vehicle lifespan.

- 2024: Continued advancements in digital key solutions, enabling seamless vehicle sharing and remote management.

Strategic Outlook for Automotive Smart Keys Market in US Market

The strategic outlook for the US Automotive Smart Keys Market remains exceptionally positive, driven by sustained innovation and growing consumer demand for convenience and security. Key growth accelerators include the ongoing integration of smart keys with broader connected car ecosystems, the expansion of digital key platforms utilizing NFC and Bluetooth, and the development of more robust and personalized user experiences. Strategic opportunities lie in leveraging AI and machine learning for predictive security and enhanced user personalization, as well as exploring new business models around shared mobility and subscription-based vehicle access features. Companies that focus on seamless integration, advanced cybersecurity, and user-centric design will be well-positioned to capitalize on the significant future potential of this dynamic market.

Automotive Smart Keys Market in US Segmentation

-

1. Application Type

- 1.1. Single Function

- 1.2. Multi-function

-

2. Technology Type

- 2.1. Remote Keyless Entry

- 2.2. Passive Keyless Entry

-

3. Installation Type

- 3.1. OEM

- 3.2. Aftermarket

Automotive Smart Keys Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

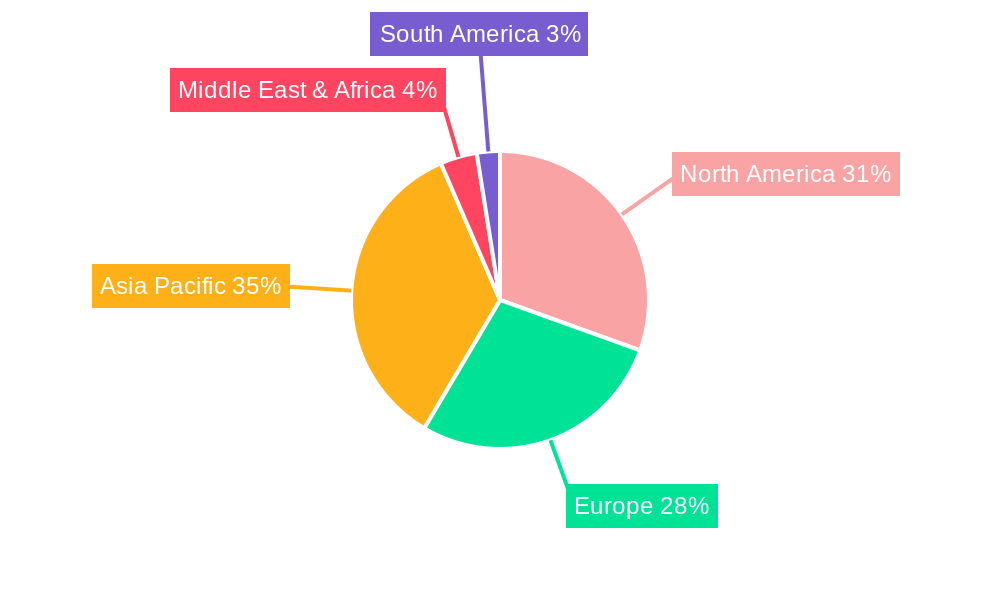

Automotive Smart Keys Market in US Regional Market Share

Geographic Coverage of Automotive Smart Keys Market in US

Automotive Smart Keys Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Security Risks is Hindering the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Smart Keys Market in US Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Single Function

- 5.1.2. Multi-function

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Remote Keyless Entry

- 5.2.2. Passive Keyless Entry

- 5.3. Market Analysis, Insights and Forecast - by Installation Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Smart Keys Market in US Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Single Function

- 6.1.2. Multi-function

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Remote Keyless Entry

- 6.2.2. Passive Keyless Entry

- 6.3. Market Analysis, Insights and Forecast - by Installation Type

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. South America Automotive Smart Keys Market in US Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Single Function

- 7.1.2. Multi-function

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Remote Keyless Entry

- 7.2.2. Passive Keyless Entry

- 7.3. Market Analysis, Insights and Forecast - by Installation Type

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Europe Automotive Smart Keys Market in US Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Single Function

- 8.1.2. Multi-function

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Remote Keyless Entry

- 8.2.2. Passive Keyless Entry

- 8.3. Market Analysis, Insights and Forecast - by Installation Type

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Middle East & Africa Automotive Smart Keys Market in US Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Single Function

- 9.1.2. Multi-function

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Remote Keyless Entry

- 9.2.2. Passive Keyless Entry

- 9.3. Market Analysis, Insights and Forecast - by Installation Type

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Asia Pacific Automotive Smart Keys Market in US Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 10.1.1. Single Function

- 10.1.2. Multi-function

- 10.2. Market Analysis, Insights and Forecast - by Technology Type

- 10.2.1. Remote Keyless Entry

- 10.2.2. Passive Keyless Entry

- 10.3. Market Analysis, Insights and Forecast - by Installation Type

- 10.3.1. OEM

- 10.3.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denso Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tokai Rika Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hyundai Mobis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Silca Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huf Hulsbeck & Furst GmbH & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HELLA GmbH & Co KGaA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Continental AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ALPHA Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Valeo SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Robert Bosch Gmb

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZF Friedrichshafen AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive Smart Keys Market in US Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Smart Keys Market in US Revenue (million), by Application Type 2025 & 2033

- Figure 3: North America Automotive Smart Keys Market in US Revenue Share (%), by Application Type 2025 & 2033

- Figure 4: North America Automotive Smart Keys Market in US Revenue (million), by Technology Type 2025 & 2033

- Figure 5: North America Automotive Smart Keys Market in US Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Automotive Smart Keys Market in US Revenue (million), by Installation Type 2025 & 2033

- Figure 7: North America Automotive Smart Keys Market in US Revenue Share (%), by Installation Type 2025 & 2033

- Figure 8: North America Automotive Smart Keys Market in US Revenue (million), by Country 2025 & 2033

- Figure 9: North America Automotive Smart Keys Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Automotive Smart Keys Market in US Revenue (million), by Application Type 2025 & 2033

- Figure 11: South America Automotive Smart Keys Market in US Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America Automotive Smart Keys Market in US Revenue (million), by Technology Type 2025 & 2033

- Figure 13: South America Automotive Smart Keys Market in US Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: South America Automotive Smart Keys Market in US Revenue (million), by Installation Type 2025 & 2033

- Figure 15: South America Automotive Smart Keys Market in US Revenue Share (%), by Installation Type 2025 & 2033

- Figure 16: South America Automotive Smart Keys Market in US Revenue (million), by Country 2025 & 2033

- Figure 17: South America Automotive Smart Keys Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Automotive Smart Keys Market in US Revenue (million), by Application Type 2025 & 2033

- Figure 19: Europe Automotive Smart Keys Market in US Revenue Share (%), by Application Type 2025 & 2033

- Figure 20: Europe Automotive Smart Keys Market in US Revenue (million), by Technology Type 2025 & 2033

- Figure 21: Europe Automotive Smart Keys Market in US Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Europe Automotive Smart Keys Market in US Revenue (million), by Installation Type 2025 & 2033

- Figure 23: Europe Automotive Smart Keys Market in US Revenue Share (%), by Installation Type 2025 & 2033

- Figure 24: Europe Automotive Smart Keys Market in US Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Automotive Smart Keys Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Automotive Smart Keys Market in US Revenue (million), by Application Type 2025 & 2033

- Figure 27: Middle East & Africa Automotive Smart Keys Market in US Revenue Share (%), by Application Type 2025 & 2033

- Figure 28: Middle East & Africa Automotive Smart Keys Market in US Revenue (million), by Technology Type 2025 & 2033

- Figure 29: Middle East & Africa Automotive Smart Keys Market in US Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Middle East & Africa Automotive Smart Keys Market in US Revenue (million), by Installation Type 2025 & 2033

- Figure 31: Middle East & Africa Automotive Smart Keys Market in US Revenue Share (%), by Installation Type 2025 & 2033

- Figure 32: Middle East & Africa Automotive Smart Keys Market in US Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Automotive Smart Keys Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Automotive Smart Keys Market in US Revenue (million), by Application Type 2025 & 2033

- Figure 35: Asia Pacific Automotive Smart Keys Market in US Revenue Share (%), by Application Type 2025 & 2033

- Figure 36: Asia Pacific Automotive Smart Keys Market in US Revenue (million), by Technology Type 2025 & 2033

- Figure 37: Asia Pacific Automotive Smart Keys Market in US Revenue Share (%), by Technology Type 2025 & 2033

- Figure 38: Asia Pacific Automotive Smart Keys Market in US Revenue (million), by Installation Type 2025 & 2033

- Figure 39: Asia Pacific Automotive Smart Keys Market in US Revenue Share (%), by Installation Type 2025 & 2033

- Figure 40: Asia Pacific Automotive Smart Keys Market in US Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Automotive Smart Keys Market in US Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Smart Keys Market in US Revenue million Forecast, by Application Type 2020 & 2033

- Table 2: Global Automotive Smart Keys Market in US Revenue million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Automotive Smart Keys Market in US Revenue million Forecast, by Installation Type 2020 & 2033

- Table 4: Global Automotive Smart Keys Market in US Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Smart Keys Market in US Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: Global Automotive Smart Keys Market in US Revenue million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Automotive Smart Keys Market in US Revenue million Forecast, by Installation Type 2020 & 2033

- Table 8: Global Automotive Smart Keys Market in US Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Smart Keys Market in US Revenue million Forecast, by Application Type 2020 & 2033

- Table 13: Global Automotive Smart Keys Market in US Revenue million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Automotive Smart Keys Market in US Revenue million Forecast, by Installation Type 2020 & 2033

- Table 15: Global Automotive Smart Keys Market in US Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Smart Keys Market in US Revenue million Forecast, by Application Type 2020 & 2033

- Table 20: Global Automotive Smart Keys Market in US Revenue million Forecast, by Technology Type 2020 & 2033

- Table 21: Global Automotive Smart Keys Market in US Revenue million Forecast, by Installation Type 2020 & 2033

- Table 22: Global Automotive Smart Keys Market in US Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Smart Keys Market in US Revenue million Forecast, by Application Type 2020 & 2033

- Table 33: Global Automotive Smart Keys Market in US Revenue million Forecast, by Technology Type 2020 & 2033

- Table 34: Global Automotive Smart Keys Market in US Revenue million Forecast, by Installation Type 2020 & 2033

- Table 35: Global Automotive Smart Keys Market in US Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Automotive Smart Keys Market in US Revenue million Forecast, by Application Type 2020 & 2033

- Table 43: Global Automotive Smart Keys Market in US Revenue million Forecast, by Technology Type 2020 & 2033

- Table 44: Global Automotive Smart Keys Market in US Revenue million Forecast, by Installation Type 2020 & 2033

- Table 45: Global Automotive Smart Keys Market in US Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Automotive Smart Keys Market in US Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Smart Keys Market in US?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Automotive Smart Keys Market in US?

Key companies in the market include Denso Corporation, Tokai Rika Co Ltd, Hyundai Mobis, Silca Group, Huf Hulsbeck & Furst GmbH & Co KG, HELLA GmbH & Co KGaA, Continental AG, ALPHA Corporation, Valeo SA, Robert Bosch Gmb, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Smart Keys Market in US?

The market segments include Application Type, Technology Type, Installation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2281 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Security Risks is Hindering the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Smart Keys Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Smart Keys Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Smart Keys Market in US?

To stay informed about further developments, trends, and reports in the Automotive Smart Keys Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence