Key Insights

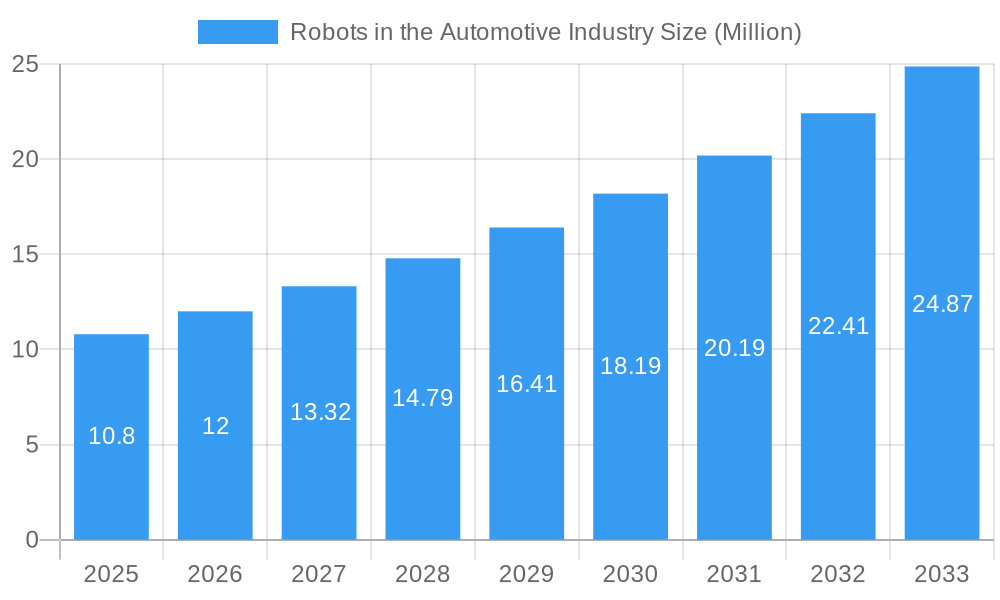

The automotive industry's increasing reliance on automation is fueling robust growth in the industrial robotics market. With a current market size estimated at 10.80 million value units in 2025, the sector is projected to expand at a significant Compound Annual Growth Rate (CAGR) of 11.00% through 2033. This expansion is primarily driven by the relentless pursuit of enhanced manufacturing efficiency, improved product quality, and the need for greater operational flexibility to adapt to evolving vehicle designs and production demands. Key trends shaping this market include the rise of collaborative robots (cobots) that work alongside human operators, the integration of AI and machine learning for smarter robot operations, and the adoption of advanced robotics for complex tasks like intricate welding, precision painting, and intricate assembly processes. The escalating demand for electric vehicles (EVs) and autonomous driving technologies also necessitates more sophisticated and adaptable robotic solutions for their specialized manufacturing requirements.

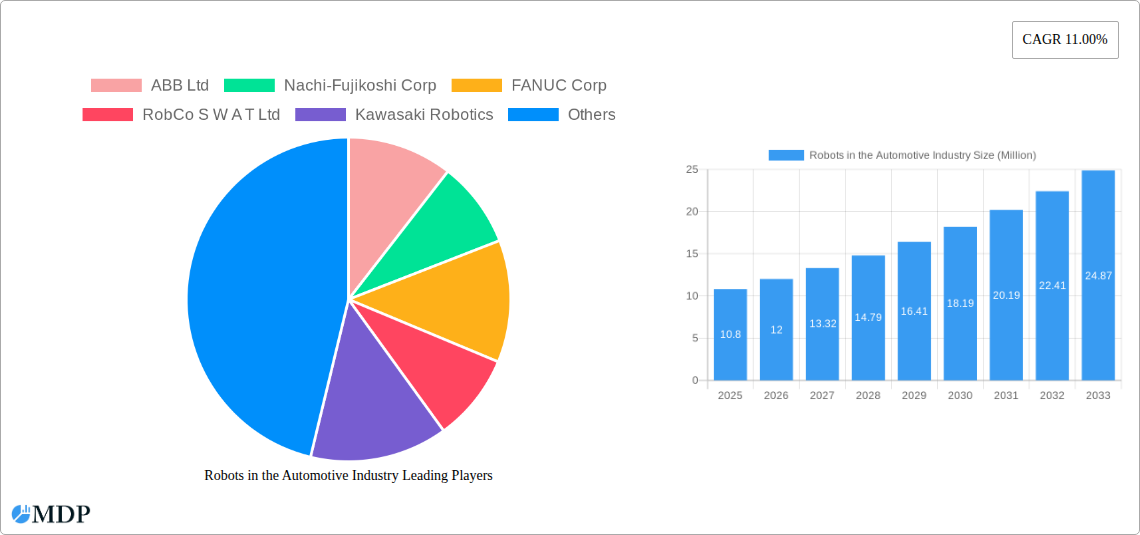

Robots in the Automotive Industry Market Size (In Million)

While the market shows immense promise, certain factors can influence its trajectory. Potential restraints include the high initial investment cost associated with advanced robotic systems and the ongoing need for skilled labor to program, operate, and maintain these sophisticated machines. However, the long-term benefits of increased throughput, reduced labor costs in hazardous environments, and consistent quality are compelling compelling factors for adoption. The market is segmented across various component types, including controllers, robotic arms, drive and sensors, and end effectors, with Cartesian, SCARA, and articulated robots being the predominant product types. Key end-users are vehicle manufacturers and automotive component manufacturers, who are increasingly deploying robots for welding, painting, assembling, and cutting/milling functions. Major players like ABB Ltd, FANUC Corp, KUKA Robotics, and Yaskawa Electric Corporation are at the forefront of innovation, introducing advanced solutions to meet the dynamic needs of the automotive sector.

Robots in the Automotive Industry Company Market Share

Unveiling the Future of Automotive Manufacturing: A Comprehensive Report on Robots in the Automotive Industry

Dive into the transformative landscape of robots in the automotive industry with this in-depth market report. Covering the study period of 2019–2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into the CAGR of xx% and market penetration of xx% within the forecast period of 2025–2033. Explore the critical role of industrial robots, robotic arms, automation solutions, and AI in revolutionizing vehicle manufacturing and component production. This report is essential for vehicle manufacturers, automotive component manufacturers, and stakeholders seeking to understand the market dynamics, industry trends, and leading players shaping the future of automotive production.

Robots in the Automotive Industry Market Dynamics & Concentration

The market for robots in the automotive industry is characterized by a moderate to high level of concentration, with a few key players dominating significant portions of the market share, estimated at xx Million in market value for the base year. The innovation drivers are intensely focused on enhancing precision, speed, and flexibility in automotive assembly lines. Regulatory frameworks, while still evolving, are increasingly emphasizing safety standards for human-robot collaboration and environmental sustainability in manufacturing processes. Product substitutes are limited, with traditional manual labor being the primary alternative, though advancements in collaborative robots are bridging this gap. End-user trends reveal a growing demand for highly customized vehicles, necessitating adaptable robotic solutions. Merger and acquisition (M&A) activities are strategic, aimed at consolidating market leadership, acquiring cutting-edge technologies, and expanding geographical reach. M&A deal counts in the historical period (2019-2024) are estimated at xx deals, signifying a proactive approach to market consolidation.

Robots in the Automotive Industry Industry Trends & Analysis

The automotive industry is undergoing a profound transformation driven by the increasing integration of robots, propelling market growth at an accelerated pace. This shift is fueled by the relentless pursuit of enhanced efficiency, improved product quality, and significant cost reductions in manufacturing processes. Technological disruptions, particularly in the realm of Artificial Intelligence (AI), machine learning, and advanced sensor technologies, are at the forefront of this evolution. These innovations are enabling robots to perform more complex tasks with greater autonomy, leading to the widespread adoption of industrial robots, robotic arms, and autonomous mobile robots (AMRs) across various production stages. Consumer preferences for personalized vehicles and shorter production cycles are further amplifying the demand for flexible and agile robotic systems that can adapt to diverse production needs. The competitive dynamics within the market are intensifying, with companies investing heavily in research and development to offer smarter, more connected, and collaborative robotic solutions. The CAGR for this sector is projected to be xx%, with market penetration of automated solutions reaching xx% by the end of the forecast period.

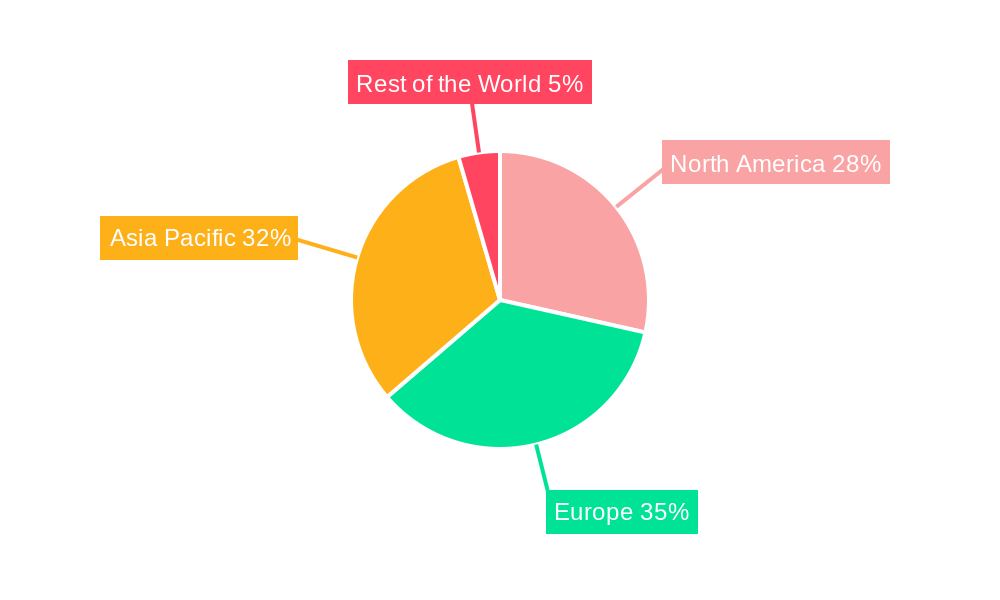

Leading Markets & Segments in Robots in the Automotive Industry

The Asia-Pacific region currently stands as the dominant market for robots in the automotive industry, driven by robust manufacturing bases in countries like China, Japan, and South Korea. Within this region, Japan exhibits particularly high adoption rates due to its advanced technological infrastructure and a long-standing commitment to industrial automation.

End-user Type:

- Vehicle Manufacturers: This segment represents the largest consumer of automotive robots, driven by the need for high-volume, precision assembly of complex vehicle components.

- Automotive Component Manufacturers: This segment is experiencing rapid growth as suppliers invest in automation to meet the stringent quality and volume demands of vehicle manufacturers.

Component Type:

- Robotic Arms: These are the cornerstone of automotive automation, essential for tasks ranging from welding and painting to assembly and material handling.

- Controllers: Advanced controllers are crucial for managing the sophisticated operations of modern robotic systems, enabling greater precision and integration.

- End Effectors: The diversity of end effectors allows robots to perform specialized tasks, from gripping and welding to intricate component placement.

- Drive and Sensors: These components are critical for robot performance, enabling smooth motion, precise positioning, and enhanced safety features.

Product Type:

- Articulated Robots: These versatile robots are widely adopted for their flexibility and ability to reach complex work envelopes, making them ideal for a broad range of automotive applications.

- SCARA Robots: Known for their speed and precision in planar movements, SCARA robots are increasingly employed in component assembly and kitting operations.

- Cartesian Robots: Offering linear movements, these robots are often used for pick-and-place operations and simpler assembly tasks.

Function Type:

- Welding Robots: Critical for structural integrity and efficiency, welding robots remain a dominant application, offering consistent and high-quality welds.

- Assembling and Disassembling Robots: With the rise of modular vehicle designs and repair automation, robots for assembly and disassembly are gaining significant traction.

- Painting Robots: These robots ensure consistent and efficient application of paints and coatings, crucial for vehicle aesthetics and protection.

Robots in the Automotive Industry Product Developments

Recent product developments highlight a strong trend towards smarter, more collaborative, and specialized robotic solutions within the automotive sector. Companies are focusing on enhancing robot capabilities for tasks requiring greater dexterity and human-robot interaction. Innovations in AI and sensor technology are enabling robots to adapt to dynamic environments and perform complex decision-making. The competitive advantage for manufacturers now lies in offering integrated solutions that can seamlessly connect with existing factory systems, improve throughput, and reduce downtime. Product development is increasingly geared towards addressing the specific needs of emerging automotive segments, such as electric vehicles and autonomous driving technology, requiring highly precise and specialized robotic applications.

Key Drivers of Robots in the Automotive Industry Growth

The growth of robots in the automotive industry is propelled by several key factors. Technological advancements in AI, machine learning, and sensor technology are enabling more sophisticated and autonomous robotic capabilities. The economic driver of cost reduction and efficiency gains in manufacturing is paramount, as robots can operate continuously with high precision, minimizing errors and waste. Furthermore, increasing labor shortages and the rising cost of human labor in developed economies are pushing manufacturers towards automation. Stringent quality control standards demanded by consumers and regulatory bodies necessitate the precision and consistency that robots provide. The global push towards electrification and autonomous vehicle development also requires new, specialized robotic solutions for the manufacturing of advanced components and battery systems, further fueling market expansion.

Challenges in the Robots in the Automotive Industry Market

Despite robust growth, the robots in the automotive industry market faces several challenges. High initial investment costs for sophisticated robotic systems and integration can be a significant barrier for smaller manufacturers. Complexity in integration with existing legacy systems requires specialized expertise and can lead to extended implementation timelines. Skilled workforce shortage for programming, operating, and maintaining advanced robotic systems poses a significant constraint. Cybersecurity risks associated with interconnected robotic systems and the potential for data breaches are growing concerns. Regulatory hurdles and evolving safety standards for human-robot collaboration require continuous adaptation and compliance, impacting adoption rates and development cycles.

Emerging Opportunities in Robots in the Automotive Industry

Emerging opportunities in the robots in the automotive industry market are abundant, driven by innovation and evolving industry demands. The rapid growth of the electric vehicle (EV) market is creating new opportunities for specialized robots capable of handling battery pack assembly, charging infrastructure deployment, and the manufacturing of lightweight composite materials. The advancement of collaborative robots (cobots), designed to work safely alongside human operators, is opening doors for increased flexibility and adaptability on the assembly line, particularly for smaller batch production and tasks requiring human dexterity. The integration of AI and machine learning is enabling robots to perform predictive maintenance, optimize production processes in real-time, and enhance quality control through advanced vision systems. Furthermore, the development of autonomous mobile robots (AMRs) for intralogistics and material handling within automotive plants promises to streamline supply chains and improve overall operational efficiency.

Leading Players in the Robots in the Automotive Industry Sector

ABB Ltd FANUC Corp KUKA Robotics Yaskawa Electric Corporation Kawasaki Robotics Nachi-Fujikoshi Corp Omron Adept Robotics Honda Motor Co Ltd RobCo S W A T Ltd Harmonic Drive System

Key Milestones in Robots in the Automotive Industry Industry

- September 2023: OTTO Motors announced the OTTO 1200, a high-performing, heavy-duty mobile robot for compact environments, capable of safely moving payloads up to 1,200 kg. Its patented adaptive fieldset technology allows for safe navigation around people in narrow spaces.

- August 2023: AKia, in collaboration with Boston Dynamics, announced plans to launch a new automotive robot in 2024, signaling further integration of advanced robotics into automotive manufacturing.

- November 2023: ABB Robotics expanded its industrial SCARA robot portfolio with the introduction of the IRB 930, offering variants with 12 kg and 22 kg payload capacities, designed to meet growing demands in both traditional and emerging markets.

Strategic Outlook for Robots in the Automotive Industry Market

The strategic outlook for the robots in the automotive industry market is overwhelmingly positive, driven by an unyielding commitment to innovation and efficiency. Future market potential will be significantly shaped by the increasing adoption of AI-powered robots for advanced manufacturing processes, including complex assembly and quality inspection. Strategic opportunities lie in the development and deployment of robots for the burgeoning electric vehicle sector, encompassing battery manufacturing and specialized component assembly. Partnerships between robot manufacturers, AI developers, and automotive OEMs will be crucial for creating integrated, intelligent automation solutions. Furthermore, the expansion of robotic applications into areas like in-plant logistics and aftermarket services presents new avenues for growth and market penetration.

Robots in the Automotive Industry Segmentation

-

1. End-user Type

- 1.1. Vehicle Manufacturers

- 1.2. Automotive Component Manufacturers

-

2. Component Type

- 2.1. Controllers

- 2.2. Robotic Arms

- 2.3. End Effectors

- 2.4. Drive and Sensors

-

3. Product Type

- 3.1. Cartesian Robots

- 3.2. SCARA Robots

- 3.3. Articulated Robots

- 3.4. Other Product Types

-

4. Function Type

- 4.1. Welding Robots

- 4.2. Painting Robots

- 4.3. Assembling and Disassembling Robots

- 4.4. Cutting and Milling Robots

Robots in the Automotive Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Robots in the Automotive Industry Regional Market Share

Geographic Coverage of Robots in the Automotive Industry

Robots in the Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. Welding Robots Hold the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 5.1.1. Vehicle Manufacturers

- 5.1.2. Automotive Component Manufacturers

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Controllers

- 5.2.2. Robotic Arms

- 5.2.3. End Effectors

- 5.2.4. Drive and Sensors

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Cartesian Robots

- 5.3.2. SCARA Robots

- 5.3.3. Articulated Robots

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Function Type

- 5.4.1. Welding Robots

- 5.4.2. Painting Robots

- 5.4.3. Assembling and Disassembling Robots

- 5.4.4. Cutting and Milling Robots

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 6. North America Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 6.1.1. Vehicle Manufacturers

- 6.1.2. Automotive Component Manufacturers

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Controllers

- 6.2.2. Robotic Arms

- 6.2.3. End Effectors

- 6.2.4. Drive and Sensors

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Cartesian Robots

- 6.3.2. SCARA Robots

- 6.3.3. Articulated Robots

- 6.3.4. Other Product Types

- 6.4. Market Analysis, Insights and Forecast - by Function Type

- 6.4.1. Welding Robots

- 6.4.2. Painting Robots

- 6.4.3. Assembling and Disassembling Robots

- 6.4.4. Cutting and Milling Robots

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 7. Europe Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 7.1.1. Vehicle Manufacturers

- 7.1.2. Automotive Component Manufacturers

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Controllers

- 7.2.2. Robotic Arms

- 7.2.3. End Effectors

- 7.2.4. Drive and Sensors

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Cartesian Robots

- 7.3.2. SCARA Robots

- 7.3.3. Articulated Robots

- 7.3.4. Other Product Types

- 7.4. Market Analysis, Insights and Forecast - by Function Type

- 7.4.1. Welding Robots

- 7.4.2. Painting Robots

- 7.4.3. Assembling and Disassembling Robots

- 7.4.4. Cutting and Milling Robots

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 8. Asia Pacific Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 8.1.1. Vehicle Manufacturers

- 8.1.2. Automotive Component Manufacturers

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Controllers

- 8.2.2. Robotic Arms

- 8.2.3. End Effectors

- 8.2.4. Drive and Sensors

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Cartesian Robots

- 8.3.2. SCARA Robots

- 8.3.3. Articulated Robots

- 8.3.4. Other Product Types

- 8.4. Market Analysis, Insights and Forecast - by Function Type

- 8.4.1. Welding Robots

- 8.4.2. Painting Robots

- 8.4.3. Assembling and Disassembling Robots

- 8.4.4. Cutting and Milling Robots

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 9. Rest of the World Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 9.1.1. Vehicle Manufacturers

- 9.1.2. Automotive Component Manufacturers

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Controllers

- 9.2.2. Robotic Arms

- 9.2.3. End Effectors

- 9.2.4. Drive and Sensors

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Cartesian Robots

- 9.3.2. SCARA Robots

- 9.3.3. Articulated Robots

- 9.3.4. Other Product Types

- 9.4. Market Analysis, Insights and Forecast - by Function Type

- 9.4.1. Welding Robots

- 9.4.2. Painting Robots

- 9.4.3. Assembling and Disassembling Robots

- 9.4.4. Cutting and Milling Robots

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nachi-Fujikoshi Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FANUC Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 RobCo S W A T Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kawasaki Robotics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Omron Adept Robotics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KUKA Robotics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Honda Motor Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harmonic Drive System

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yaskawa Electric Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Global Robots in the Automotive Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 3: North America Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 4: North America Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 5: North America Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 6: North America Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 7: North America Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 9: North America Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: North America Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 13: Europe Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 14: Europe Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 15: Europe Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Europe Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Europe Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 19: Europe Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 20: Europe Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 25: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 26: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 29: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 30: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 33: Rest of the World Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 34: Rest of the World Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 35: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 36: Rest of the World Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 39: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 40: Rest of the World Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 2: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 3: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 5: Global Robots in the Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 7: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 8: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 10: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 15: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 16: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 18: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 24: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 25: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 27: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Korea Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 34: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 35: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 37: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South America Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Middle East and Africa Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robots in the Automotive Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Robots in the Automotive Industry?

Key companies in the market include ABB Ltd, Nachi-Fujikoshi Corp, FANUC Corp, RobCo S W A T Ltd, Kawasaki Robotics, Omron Adept Robotics, KUKA Robotics, Honda Motor Co Ltd, Harmonic Drive System, Yaskawa Electric Corporation.

3. What are the main segments of the Robots in the Automotive Industry?

The market segments include End-user Type, Component Type, Product Type, Function Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Welding Robots Hold the Highest Share.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

September 2023: OTTO Motors announced the OTTO 1200, which it claimed is the highest-performing, heavy-duty mobile robot for compact environments. It can safely move payloads of up to 1,200 kg (2,650 lb). The autonomous mobile robot (AMR) is equipped with patented adaptive fieldset technology to quickly and safely maneuver around people in narrow spaces, as claimed by OTTO Motors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robots in the Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robots in the Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robots in the Automotive Industry?

To stay informed about further developments, trends, and reports in the Robots in the Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence