Key Insights

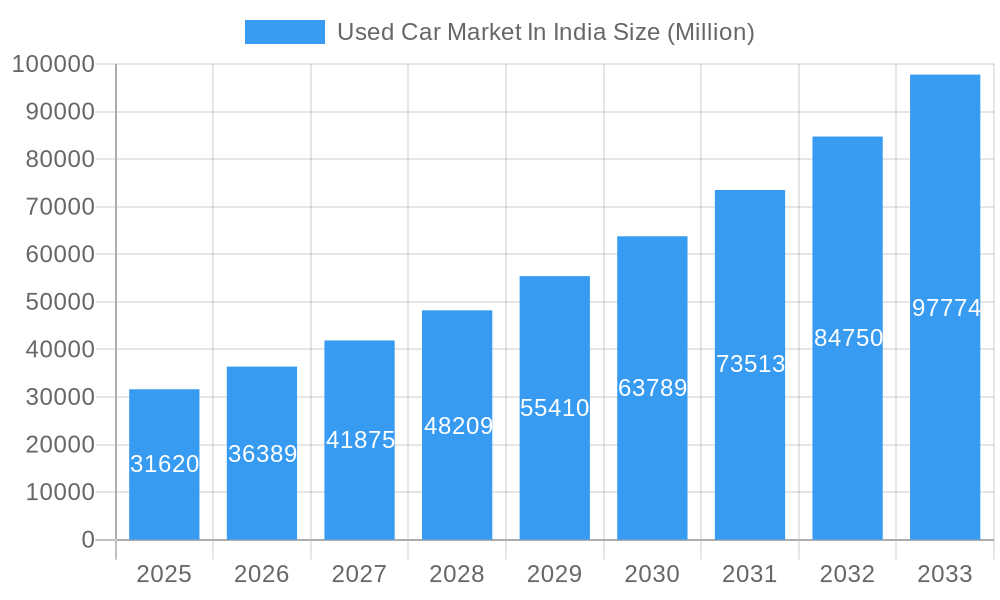

The Indian Used Car Market is experiencing robust growth, projected to reach a substantial valuation of USD 31.62 billion. This impressive expansion is fueled by a compelling Compound Annual Growth Rate (CAGR) of 15.10% over the forecast period of 2025-2033. A primary driver for this surge is the increasing affordability and accessibility of pre-owned vehicles, making them an attractive option for a broader segment of the Indian population. The growing middle class, coupled with a desire for personal mobility and upgrading to newer models, significantly contributes to demand. Furthermore, the rise of organized used car dealerships and online platforms has instilled greater trust and transparency in the market, addressing previous concerns about quality and authenticity. These organized players offer certified pre-owned vehicles with warranties, making the purchase of used cars a more secure and appealing proposition. The expansion of vendor networks, both online and offline, is also playing a crucial role in making used cars readily available across diverse geographical locations.

Used Car Market In India Market Size (In Billion)

The market's dynamic segmentation by vehicle type highlights the enduring popularity of Sports Utility Vehicles (SUVs), reflecting evolving consumer preferences for larger, more versatile vehicles. Hatchbacks and Sedans continue to command significant market share, catering to budget-conscious buyers and urban commuters. The fuel type segmentation reveals a sustained demand for both Petrol and Diesel variants, although the long-term outlook may see a gradual shift influenced by evolving emission norms and the increasing availability of alternative fuel vehicles in the new car market, which will eventually impact the used car landscape. The competitive landscape is characterized by the presence of both established automotive manufacturers' certified pre-owned programs and independent dealerships, all vying for market dominance. This competitive environment fosters innovation, improved customer service, and attractive pricing, further benefiting consumers. The study period spanning from 2019 to 2033, with a base year in 2025, provides a comprehensive view of market evolution and future trajectories.

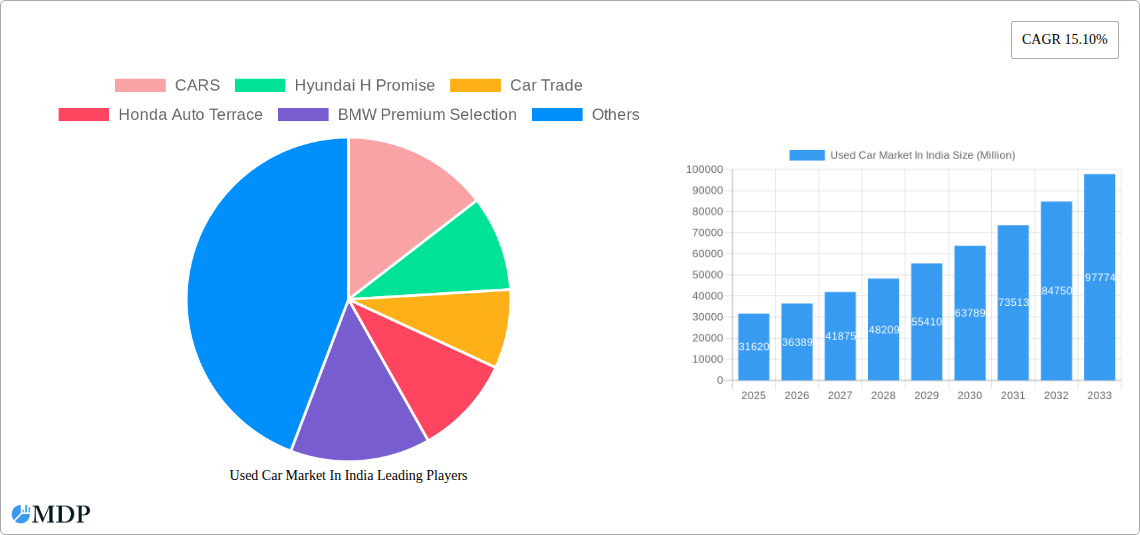

Used Car Market In India Company Market Share

Dive deep into the rapidly expanding Indian used car market with this authoritative report. Covering the historical period of 2019–2024, the base year of 2025, and extending to an insightful forecast period of 2025–2033, this comprehensive analysis provides critical intelligence for automotive manufacturers, dealerships, financial institutions, investors, and tech innovators. Explore market dynamics, industry trends, leading segments, product developments, key growth drivers, challenges, emerging opportunities, and strategic outlook, all underpinned by high-traffic keywords like "used car market India," "pre-owned vehicles India," "certified pre-owned cars," "car resale value," "online car sales India," and "automotive industry India."

Used Car Market In India Market Dynamics & Concentration

The Indian used car market, a significant pillar of the automotive sector, is experiencing robust growth, driven by increasing disposable incomes, a burgeoning middle class, and evolving consumer preferences for value-driven mobility solutions. Market concentration is gradually shifting towards organized players who offer transparency, warranty, and financing options, thereby building consumer trust. Key innovation drivers include the adoption of digital platforms for sales and marketing, enhanced vehicle inspection technologies, and the development of innovative financing and insurance products tailored for pre-owned vehicles. Regulatory frameworks, while still evolving, are increasingly focused on standardization and consumer protection. Product substitutes, such as new entry-level cars and public transportation, remain a consideration, but the affordability and accessibility of used cars continue to attract a significant customer base. End-user trends highlight a growing demand for feature-rich, reliable, and newer models of pre-owned cars. Mergers and acquisition (M&A) activities are on the rise as established players aim to consolidate their market position and expand their geographical reach. The market share for organized players is projected to grow significantly, with an estimated M&A deal count of 15-20 annually over the forecast period.

- Market Concentration: Increasing shift towards organized players like Maruti True Value, Mahindra First Choice Wheels, and organized dealership networks.

- Innovation Drivers: Digitalization of sales processes, AI-powered vehicle inspection, enhanced financing options, and transparent pricing mechanisms.

- Regulatory Frameworks: Evolving policies aimed at standardizing quality, warranty provisions, and consumer rights in the pre-owned segment.

- Product Substitutes: New entry-level vehicles, carpooling, and public transportation remain alternatives, though affordability of used cars is a key differentiator.

- End-User Trends: Demand for well-maintained, feature-rich, and relatively newer used cars across all vehicle segments.

- M&A Activities: Consolidation and strategic partnerships to enhance market reach and operational efficiency.

Used Car Market In India Industry Trends & Analysis

The used car market in India is poised for substantial expansion, propelled by a confluence of economic, technological, and social factors. The estimated CAGR for the forecast period (2025–2033) is projected to be an impressive 12-15%, indicating a high growth trajectory. Market penetration of organized used car sales is steadily increasing, currently estimated at around 30% and expected to reach over 50% by 2033. This growth is primarily fueled by the increasing affordability gap between new and used vehicles, making pre-owned cars an attractive proposition for a wider demographic. The rise of online platforms has revolutionized the way consumers research, purchase, and sell used cars, offering unprecedented convenience and transparency. Technological disruptions, such as AI-driven vehicle inspection and valuation tools, are enhancing trust and efficiency in the market. Consumer preferences are evolving, with a growing emphasis on quality assurance, warranty coverage, and a seamless buying experience, leading to the proliferation of certified pre-owned (CPO) programs offered by manufacturers and independent players. Competitive dynamics are intensifying, with a mix of established automotive giants, specialized used car retailers, and burgeoning online marketplaces vying for market share. The increasing availability of nearly-new vehicles due to shorter ownership cycles of new cars also contributes significantly to the supply side.

Leading Markets & Segments in Used Car Market In India

The Indian used car market is characterized by its diverse regional penetration and segmented preferences across vehicle types, vendor types, and fuel types. The organized sector, encompassing dealership networks and dedicated used car outlets, is witnessing accelerated growth due to its emphasis on quality, transparency, and customer service. This segment is expected to capture a larger market share, projected to grow from 30% to over 50% by 2033. Unorganized players, traditionally comprising independent dealers and individual sellers, still hold a significant portion but are facing increasing competition from organized entities.

Within vehicle types, Hatchbacks remain the dominant segment, driven by their affordability, fuel efficiency, and suitability for urban commuting. Their market share is estimated to be around 40-45%. Sedans follow closely, appealing to a segment seeking a balance of comfort and style, accounting for approximately 30-35% of the market. Sports Utility Vehicles (SUV) are experiencing rapid growth, particularly in the pre-owned market, as consumers increasingly desire their robust build, higher driving position, and versatile capabilities, currently holding about 25-30% market share and projected for higher growth rates.

Fuel types continue to be influenced by market dynamics and government policies. Petrol variants continue to hold a substantial share due to their widespread availability and smoother performance, estimated at around 60-65%. Diesel vehicles, while facing some regulatory headwinds in certain regions, remain popular for their fuel efficiency and torque, particularly in larger vehicles, representing approximately 30-35% of the market. Electric and hybrid used car segments are nascent but are expected to see significant growth in the long term as the adoption of these technologies increases in the new car market.

- Organized Vendor Type Dominance: Driven by trust, transparency, warranty, and financing options. Key players are investing heavily in digital infrastructure and standardized processes.

- Hatchback Segment Popularity: Sustained demand due to affordability, fuel efficiency, and suitability for urban mobility.

- SUV Segment Growth: Increasing consumer aspiration for feature-rich, versatile vehicles, leading to strong demand in the pre-owned market.

- Petrol Fuel Type Prevalence: Continued dominance due to widespread availability, lower initial cost, and performance characteristics.

- Diesel Fuel Type Relevance: Strong demand for fuel efficiency, especially in higher mileage usage scenarios.

Used Car Market In India Product Developments

Product developments in the Indian used car market are increasingly focused on enhancing consumer trust and convenience. The integration of Artificial Intelligence (AI) for vehicle inspection and damage assessment, exemplified by partnerships like Mahindra First Choice Wheels with CamCom, is revolutionizing the grading and valuation process. Manufacturers are enhancing their Certified Pre-Owned (CPO) programs, offering extended warranties, genuine parts replacements, and comprehensive multi-point inspections to ensure quality and reduce buyer risk. The development of digital platforms is enabling virtual showrooms, online financing applications, and doorstep delivery services. These innovations provide a significant competitive advantage by addressing key consumer concerns about reliability and transparency in the pre-owned vehicle ecosystem.

Key Drivers of Used Car Market In India Growth

The Indian used car market's growth is propelled by several synergistic factors. The increasing disposable incomes of the middle class, coupled with rising vehicle ownership aspirations, makes pre-owned cars an attractive and accessible option. The significant price differential between new and used vehicles, often ranging from 20-30%, remains a primary driver. Technological advancements in AI-powered inspections and online sales platforms enhance transparency, convenience, and trust, thereby reducing perceived risks for buyers. Favorable financing options and extended warranty programs offered by organized players further boost confidence and affordability. Evolving consumer preferences towards value-for-money and access to feature-rich vehicles at lower price points also contribute significantly to market expansion.

Challenges in the Used Car Market In India Market

Despite its robust growth, the Indian used car market faces several challenges. The dominance of the unorganized sector, which often lacks standardized quality checks and transparency, can lead to buyer hesitancy and mistrust. Regulatory hurdles, though evolving, can still pose complexities regarding title transfers and documentation. Supply chain issues, particularly concerning the availability of specific models or low-mileage vehicles, can sometimes impact inventory for organized players. Intense competition among a growing number of players, including online aggregators and established dealerships, can lead to price wars and pressure on margins. Furthermore, counterfeit parts and fraudulent practices can undermine consumer confidence.

Emerging Opportunities in Used Car Market In India

The used car market in India presents numerous exciting opportunities for growth and innovation. The rapid adoption of electric vehicles (EVs) in the new car segment will soon translate into a growing market for pre-owned EVs, creating a new niche for specialized dealers and service centers. Strategic partnerships between automotive OEMs, financial institutions, and technology providers are paving the way for integrated mobility solutions, including subscription models and innovative financing for used cars. The expansion of online platforms into Tier-2 and Tier-3 cities, coupled with a focus on rural markets, represents a significant untapped potential. Furthermore, the development of advanced diagnostics and refurbishment technologies will enhance the quality and lifespan of pre-owned vehicles, further boosting their appeal.

Leading Players in the Used Car Market In India Sector

- CARS

- Hyundai H Promise

- Car Trade

- Honda Auto Terrace

- BMW Premium Selection

- Big Boy Toyz

- Mercedes-Benz Certified

- Audi Approved Plus

- Toyota U Trust

- Mahindra First Choice Wheels

- Ford Assured

- OLX

- Maruti True Value

Key Milestones in Used Car Market In India Industry

- August 2022: Lexus, a Toyota subsidiary, launched its Lexus Certified Programme in India, aiming to enhance resale value for existing owners and make Lexus models more accessible to new customers.

- August 2021: Mahindra First Choice Wheels (MFCW) partnered with CamCom, an AI solutions provider, to enable AI-powered vehicle inspection and damage assessment.

- August 2021: Mercedes-Benz India introduced 'Marketplace,' a direct customer-to-customer selling platform for pre-owned luxury cars.

Strategic Outlook for Used Car Market In India Market

The strategic outlook for the Indian used car market is overwhelmingly positive, characterized by continuous growth and evolving business models. Key growth accelerators include the sustained demand for affordable mobility, the increasing trust and transparency driven by technology, and the expansion of organized retail. Manufacturers are expected to further strengthen their certified pre-owned programs, leveraging their brand equity and service networks. Technology players will play an increasingly vital role in digitizing the entire value chain, from inspection to sales and financing. Strategic partnerships, cross-sector collaborations, and a focus on customer-centric innovations will be crucial for market players to capitalize on the immense future potential and maintain a competitive edge in this dynamic and rapidly expanding sector.

Used Car Market In India Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports Utility Vehicles (SUV)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

Used Car Market In India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

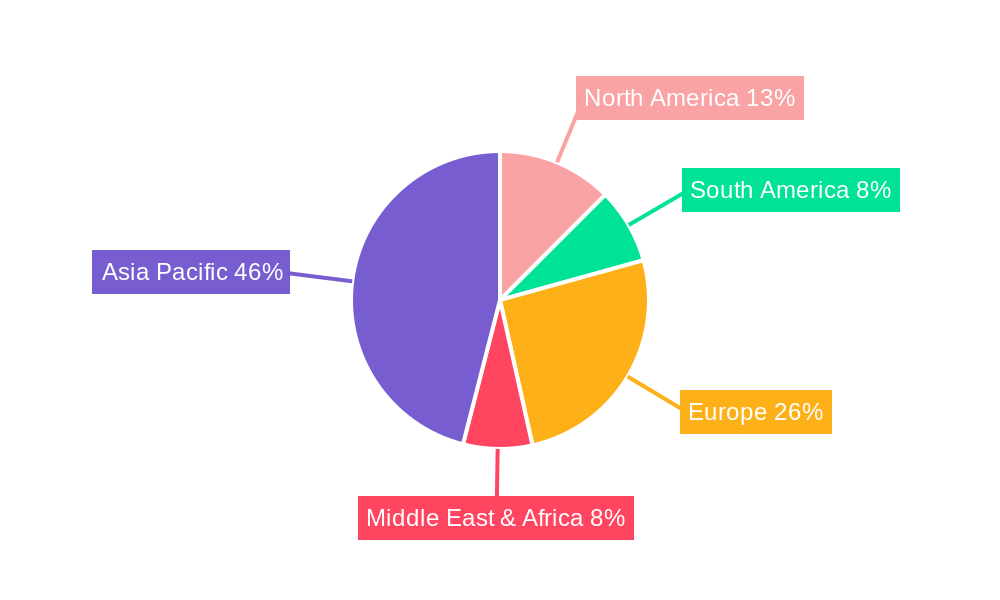

Used Car Market In India Regional Market Share

Geographic Coverage of Used Car Market In India

Used Car Market In India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Selection Among Car Models Is Anticipated To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Counterfeit and Illegally Imported Vehicles Is Restraining The Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Middle Class and Young Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports Utility Vehicles (SUV)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports Utility Vehicles (SUV)

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Petrol

- 6.3.2. Diesel

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports Utility Vehicles (SUV)

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Petrol

- 7.3.2. Diesel

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports Utility Vehicles (SUV)

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Petrol

- 8.3.2. Diesel

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports Utility Vehicles (SUV)

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Petrol

- 9.3.2. Diesel

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Market In India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports Utility Vehicles (SUV)

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Fuel Type

- 10.3.1. Petrol

- 10.3.2. Diesel

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CARS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai H Promise

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Car Trade

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honda Auto Terrace

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BMW Premium Selection

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Big Boy Toyz

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mercedes-Benz Certified

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Audi Approved Plus

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toyota U Trust

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mahindra First Choice Wheels

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ford Assured

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 OL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Maruti True Value

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 CARS

List of Figures

- Figure 1: Global Used Car Market In India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 5: North America Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 6: North America Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 7: North America Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 8: North America Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: South America Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 13: South America Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 14: South America Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 15: South America Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 16: South America Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 21: Europe Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 22: Europe Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 23: Europe Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 24: Europe Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 29: Middle East & Africa Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 30: Middle East & Africa Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 31: Middle East & Africa Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 32: Middle East & Africa Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Used Car Market In India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Used Car Market In India Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific Used Car Market In India Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific Used Car Market In India Revenue (Million), by Vendor Type 2025 & 2033

- Figure 37: Asia Pacific Used Car Market In India Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 38: Asia Pacific Used Car Market In India Revenue (Million), by Fuel Type 2025 & 2033

- Figure 39: Asia Pacific Used Car Market In India Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 40: Asia Pacific Used Car Market In India Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Used Car Market In India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Global Used Car Market In India Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 14: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 15: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 21: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 22: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 34: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 35: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Used Car Market In India Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global Used Car Market In India Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 44: Global Used Car Market In India Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 45: Global Used Car Market In India Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Used Car Market In India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market In India?

The projected CAGR is approximately 15.10%.

2. Which companies are prominent players in the Used Car Market In India?

Key companies in the market include CARS, Hyundai H Promise, Car Trade, Honda Auto Terrace, BMW Premium Selection, Big Boy Toyz, Mercedes-Benz Certified, Audi Approved Plus, Toyota U Trust, Mahindra First Choice Wheels, Ford Assured, OL, Maruti True Value.

3. What are the main segments of the Used Car Market In India?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Diverse Selection Among Car Models Is Anticipated To Drive The Market Growth.

6. What are the notable trends driving market growth?

Rising Middle Class and Young Population.

7. Are there any restraints impacting market growth?

Counterfeit and Illegally Imported Vehicles Is Restraining The Market Growth.

8. Can you provide examples of recent developments in the market?

In August 2022, Lexus, which is owned by Toyota, has launched its Lexus Certified Programme in the Indian market. Lexus India hopes that by launching this initiative, existing Lexus vehicle owners will be able to get a higher resale value for their vehicles, while also making Lexus models more accessible and affordable to new customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market In India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market In India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market In India?

To stay informed about further developments, trends, and reports in the Used Car Market In India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence