Key Insights

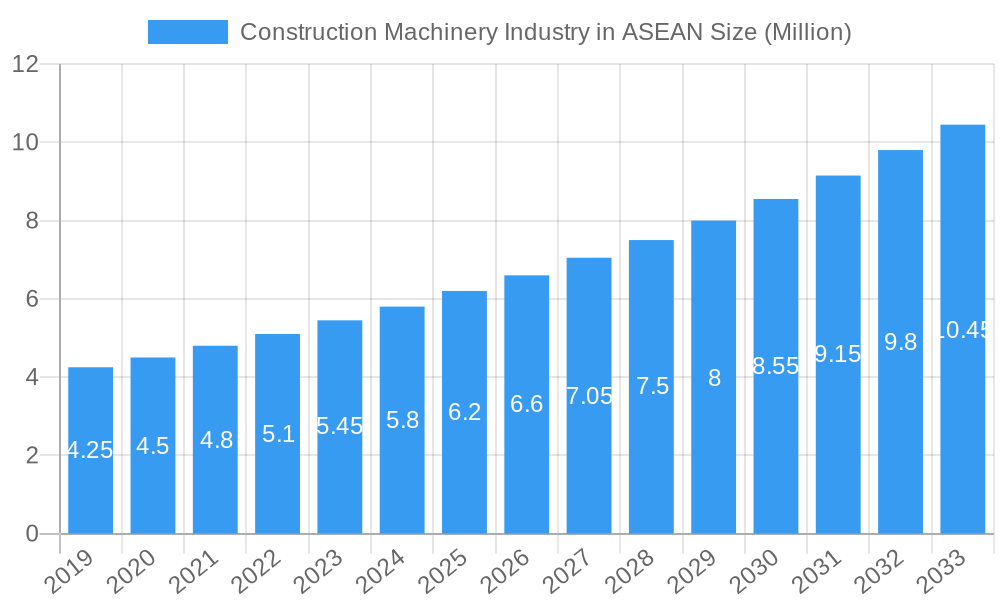

The ASEAN construction machinery market is poised for robust expansion, projected to reach $7.63 million by 2033, driven by a healthy Compound Annual Growth Rate (CAGR) of 6.59%. This significant growth is fueled by substantial infrastructure development across the region, including ambitious road construction projects, rapid urbanization necessitating more residential and commercial buildings, and ongoing investments in logistics and material handling infrastructure. The demand for excavators and loaders remains particularly strong, supporting extensive earth-moving activities. Emerging economies within ASEAN are experiencing a surge in construction projects, supported by government initiatives and foreign direct investment, further bolstering the market for advanced construction equipment. The region's focus on modernizing its infrastructure and expanding its industrial capacity are key factors contributing to this upward trajectory.

Construction Machinery Industry in ASEAN Market Size (In Million)

While the market demonstrates strong growth potential, certain restraints could temper the pace. High initial investment costs for sophisticated machinery and the availability of skilled labor to operate and maintain them present ongoing challenges. However, the increasing adoption of advanced technologies, such as telematics and automation, is expected to enhance operational efficiency and potentially mitigate some of these concerns. Furthermore, the "Rest of ASEAN" segment is anticipated to contribute significantly to the overall market, driven by untapped potential in less developed economies within the bloc. The competitive landscape is characterized by the presence of global giants like Caterpillar, Komatsu, and Hitachi, alongside strong regional players, all vying for market share through innovation and strategic partnerships. The evolving regulatory landscape and a growing emphasis on sustainable construction practices will also play a crucial role in shaping market dynamics in the coming years.

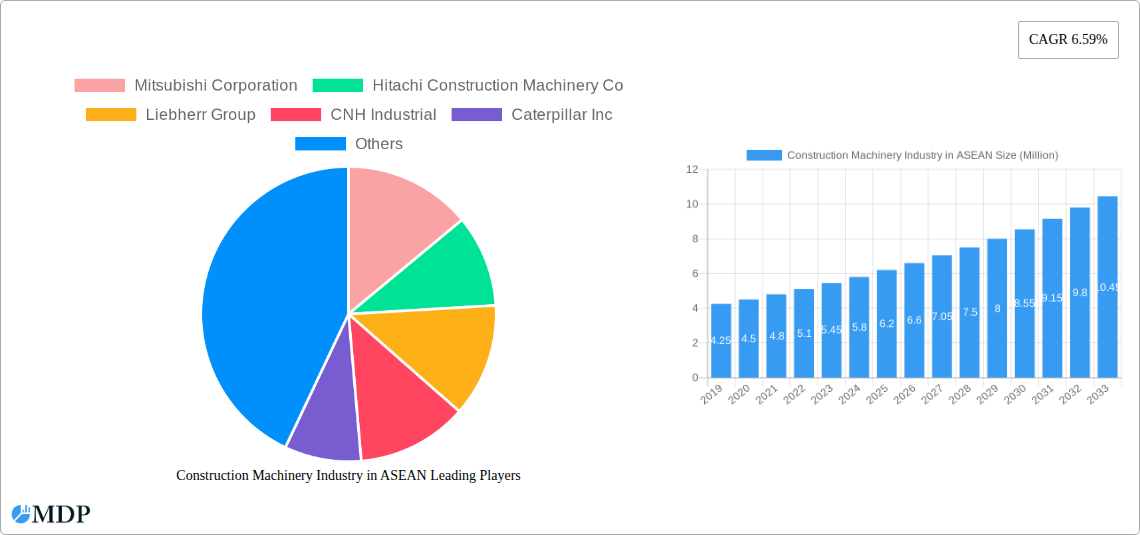

Construction Machinery Industry in ASEAN Company Market Share

Unlock critical insights into the booming construction machinery industry in ASEAN. This comprehensive report, covering the study period 2019–2033 with base year 2025, offers an in-depth analysis of market dynamics, industry trends, leading segments, and strategic outlook. Dive into high-traffic keywords like ASEAN construction equipment, excavator market Southeast Asia, crane demand Vietnam, loader sales Indonesia, earthmoving machinery Malaysia, and road construction equipment Philippines. Understand the competitive landscape featuring giants like Caterpillar Inc, Komatsu Ltd, Hitachi Construction Machinery Co, Liebherr Group, Xuzhou Construction Machinery Group Co Ltd, CNH Industrial, Mitsubishi Corporation, and JC Bamford Excavators Ltd (JCB). Essential for stakeholders, investors, and industry professionals seeking to capitalize on infrastructure development ASEAN and urbanization Southeast Asia.

Construction Machinery Industry in ASEAN Market Dynamics & Concentration

The construction machinery industry in ASEAN is characterized by a moderate to high market concentration, with a few key global players like Caterpillar, Komatsu, and Hitachi holding significant market share. Innovation is driven by demand for fuel-efficient construction equipment, advanced digital technologies, and sustainable construction solutions. Regulatory frameworks are evolving, focusing on emission standards and safety, influencing product development. While direct product substitutes are limited for specialized machinery, incremental technological advancements and the adoption of newer, more efficient models serve as a form of continuous substitution. End-user trends are shifting towards rental and leasing models, particularly for smaller contractors, and an increasing preference for integrated solutions and smart construction technology. Merger and acquisition (M&A) activities, though not extensively documented with specific deal counts, are strategic moves by major players to expand their geographical reach and product portfolios within the rapidly growing ASEAN region. For instance, past strategic alliances have aimed to bolster local manufacturing capabilities and distribution networks, crucial for serving diverse markets like Indonesia and Vietnam. The market anticipates an increasing number of M&A opportunities as companies seek to consolidate their presence and leverage economies of scale.

Construction Machinery Industry in ASEAN Industry Trends & Analysis

The construction machinery industry in ASEAN is experiencing robust growth, projected at a significant CAGR (estimated 6.5%) over the forecast period of 2025–2033. This expansion is propelled by substantial government investments in infrastructure projects across countries like Indonesia, Vietnam, and the Philippines, including highways, railways, and airports. Urbanization Southeast Asia is a major catalyst, driving demand for residential and commercial construction, which in turn fuels the need for excavators, loaders, and concrete machinery. Technological disruptions are increasingly shaping the market. The adoption of IoT-enabled equipment for fleet management, predictive maintenance, and enhanced operational efficiency is gaining traction. Electric construction vehicles are beginning to make inroads, with initial deployments in markets like Singapore, signaling a future shift towards sustainability. Consumer preferences are evolving to favor equipment that offers lower operating costs, higher productivity, and better resale value. The competitive dynamics are intense, with global manufacturers leveraging their technological prowess and established distribution networks to compete with emerging local players. Market penetration of advanced machinery is steadily increasing, driven by a growing awareness of the benefits of modern construction equipment among contractors and developers. The overall market penetration is estimated to reach xx% by 2025, with significant growth potential.

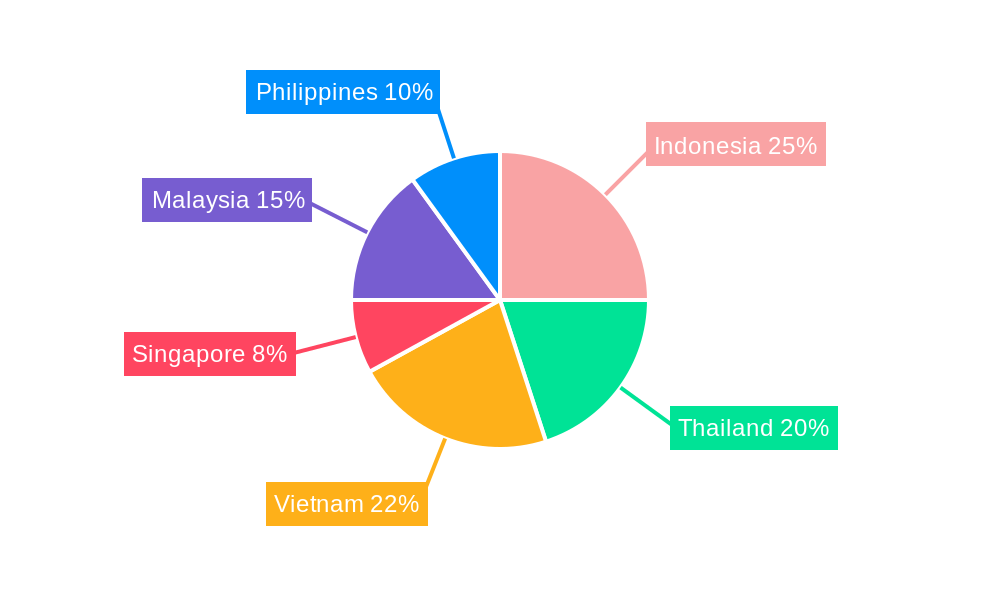

Leading Markets & Segments in Construction Machinery Industry in ASEAN

The construction machinery industry in ASEAN is dominated by a few key geographies and machinery types, driven by distinct economic and developmental factors.

Dominant Geography:

- Indonesia and Vietnam are leading markets, fueled by extensive infrastructure development ASEAN initiatives, large-scale urban expansion, and significant foreign direct investment in construction projects. Their vast landmass and growing populations necessitate substantial earthmoving and road construction activities.

- Thailand remains a strong market due to ongoing upgrades in transportation networks and a recovering tourism sector driving hotel and resort development.

- Malaysia continues to see demand from its ongoing large infrastructure projects and property development.

- Philippines is experiencing a surge in construction driven by government's "Build, Build, Build" program and increasing private sector investments.

- Singapore, despite its smaller size, is a key market for advanced, high-value machinery, particularly for its sophisticated urban development and infrastructure maintenance.

Dominant Machinery Types:

- Excavators consistently lead the market, crucial for a wide range of applications including earthmoving, demolition, and material handling.

- Loaders, including wheel loaders and skid steer loaders, are in high demand for material handling, site preparation, and loading/unloading operations.

- Cranes are essential for the booming high-rise construction and infrastructure projects across the region.

- Backhoes remain important for smaller-scale construction and agricultural applications.

- Motor Graders are vital for road construction and maintenance.

Dominant Applications:

- Earth Moving is a foundational application, driving demand for excavators and loaders across all major infrastructure and construction projects.

- Concrete and Road Construction is a significant growth driver, fueled by government spending on transportation networks and urbanization.

- Material Handling applications are supported by the increasing complexity of construction sites and logistics.

Key drivers for the dominance of these segments include government economic policies promoting infrastructure growth, rapid urbanization leading to increased construction activity, and the need for efficient machinery to meet project timelines and budget constraints. The demand for rental equipment also plays a crucial role in segment penetration.

Construction Machinery Industry in ASEAN Product Developments

Product innovation in the ASEAN construction machinery sector is focused on enhancing efficiency, sustainability, and connectivity. Manufacturers are introducing fuel-efficient excavators, articulated dump trucks, and advanced wheel loaders with optimized hydraulics and improved operator comfort. The integration of telematics and IoT solutions allows for real-time monitoring of equipment performance, enabling predictive maintenance and better fleet management. Electrification of construction machinery is a growing trend, with the introduction of battery-powered compact equipment like mini excavators and loaders, catering to environmentally conscious markets and indoor applications. Competitive advantages are being gained through robust local support networks, competitive pricing, and machinery tailored to the specific operational conditions and demands of the ASEAN region, such as durability in tropical climates and ease of maintenance.

Key Drivers of Construction Machinery Industry in ASEAN Growth

Several factors are fueling the growth of the construction machinery industry in ASEAN. Government initiatives focusing on infrastructure development, such as road networks, railways, and urban regeneration projects across countries like Indonesia, Vietnam, and the Philippines, are primary drivers. Rapid urbanization and population growth are stimulating demand for residential, commercial, and industrial construction. Furthermore, foreign direct investment in manufacturing and infrastructure projects is bringing significant capital and demand for heavy equipment. Technological advancements, including the adoption of telematics and smart machinery, are enhancing productivity and efficiency, encouraging upgrades. Economic recovery post-pandemic and a general increase in construction activity across various sectors contribute significantly to the upward trajectory of the market.

Challenges in the Construction Machinery Industry in ASEAN Market

The construction machinery industry in ASEAN faces several challenges that could impede growth. Stringent emission regulations and the push for electrification require significant investment in R&D and manufacturing adaptation, which can be costly. Supply chain disruptions, exacerbated by global events, can lead to delays in parts and machinery delivery, impacting project timelines and increasing costs. Intense competition from both global giants and emerging local manufacturers puts pressure on pricing and profit margins. High initial investment costs for advanced machinery can be a barrier for smaller contractors, leading to a preference for older or less sophisticated equipment. The availability of skilled labor to operate and maintain modern machinery also presents a regional challenge. Lastly, political and economic instability in certain parts of the region can deter investment and slow down construction projects.

Emerging Opportunities in Construction Machinery Industry in ASEAN

Emerging opportunities in the construction machinery industry in ASEAN are abundant, driven by technological advancements and evolving market demands. The growing interest in sustainable construction presents a significant opportunity for manufacturers of electric and hybrid construction equipment, particularly in more developed markets like Singapore. Strategic partnerships and joint ventures can help companies expand their reach, share technology, and establish stronger local presence, especially in markets with high growth potential like Vietnam and the Philippines. The increasing adoption of rental and leasing models offers a recurring revenue stream and can lower the barrier to entry for smaller businesses. Furthermore, the demand for specialized machinery for niche applications, such as underground mining and tunnel boring, is expected to rise with ambitious infrastructure projects. The implementation of smart construction technologies and data analytics for improved efficiency and safety opens up new service revenue streams.

Leading Players in the Construction Machinery Industry in ASEAN Sector

- Mitsubishi Corporation

- Hitachi Construction Machinery Co

- Liebherr Group

- CNH Industrial

- Caterpillar Inc

- JC Bamford Excavators Ltd (JCB)

- Komatsu Ltd

- Xuzhou Construction Machinery Group Co Ltd

Key Milestones in Construction Machinery Industry in ASEAN Industry

- June 2023: Volvo Construction Equipment's (Volvo CE) first fully electric construction machinery arrived in Singapore, marking a significant step for the introduction of sustainable solutions to the Southeast Asia market.

- May 2022: CASE Construction Equipment launched a range of new products across South Asia, including a loader backhoe, vibratory compactor, excavator, and motor grader. A specific model, the 770 NXe 49.5hp loader backhoe, was also launched.

- April 2022: Liebherr redeveloped and fundamentally revised its range of mid-sized wheel loaders, enhancing their performance with a new lift arm design for maximum forces and optimized z-bar kinematics.

- January 2022: Liebherr introduced three new wheel loaders, the L550, L566, and L580, featuring the highly efficient hydrostatic Liebherr travel drive.

Strategic Outlook for Construction Machinery Industry in ASEAN Market

The strategic outlook for the construction machinery industry in ASEAN remains exceptionally positive, driven by sustained infrastructure development and rapid urbanization across the region. Key growth accelerators include the increasing adoption of advanced construction technologies, such as IoT-enabled equipment and automation, which enhance productivity and operational efficiency. Manufacturers and distributors that can effectively offer integrated solutions, including financing, after-sales support, and digital services, will gain a competitive edge. The transition towards sustainable construction machinery, particularly electric and hybrid models, presents a significant long-term opportunity, especially as environmental regulations become more stringent and awareness grows. Strategic partnerships and localized manufacturing efforts will be crucial for navigating diverse market demands and regulatory landscapes. The focus on expanding the rental and leasing segment will also unlock new revenue streams and cater to a wider customer base, ensuring continued market expansion and robust growth for the industry.

Construction Machinery Industry in ASEAN Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Excavators

- 1.3. Loaders

- 1.4. Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Application

- 2.1. Concrete and Road Construction

- 2.2. Earth Moving

- 2.3. Material Handling

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Vietnam

- 3.4. Singapore

- 3.5. Malaysia

- 3.6. Philippines

- 3.7. Rest of ASEAN

Construction Machinery Industry in ASEAN Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Singapore

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

Construction Machinery Industry in ASEAN Regional Market Share

Geographic Coverage of Construction Machinery Industry in ASEAN

Construction Machinery Industry in ASEAN REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activity May Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Equipment Cost may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Concrete and Road Construction To Propel The Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Excavators

- 5.1.3. Loaders

- 5.1.4. Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete and Road Construction

- 5.2.2. Earth Moving

- 5.2.3. Material Handling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Vietnam

- 5.3.4. Singapore

- 5.3.5. Malaysia

- 5.3.6. Philippines

- 5.3.7. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Vietnam

- 5.4.4. Singapore

- 5.4.5. Malaysia

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Indonesia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Cranes

- 6.1.2. Excavators

- 6.1.3. Loaders

- 6.1.4. Backhoe

- 6.1.5. Motor Graders

- 6.1.6. Other Machinery Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete and Road Construction

- 6.2.2. Earth Moving

- 6.2.3. Material Handling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Vietnam

- 6.3.4. Singapore

- 6.3.5. Malaysia

- 6.3.6. Philippines

- 6.3.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Thailand Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Cranes

- 7.1.2. Excavators

- 7.1.3. Loaders

- 7.1.4. Backhoe

- 7.1.5. Motor Graders

- 7.1.6. Other Machinery Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete and Road Construction

- 7.2.2. Earth Moving

- 7.2.3. Material Handling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Vietnam

- 7.3.4. Singapore

- 7.3.5. Malaysia

- 7.3.6. Philippines

- 7.3.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Vietnam Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Cranes

- 8.1.2. Excavators

- 8.1.3. Loaders

- 8.1.4. Backhoe

- 8.1.5. Motor Graders

- 8.1.6. Other Machinery Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete and Road Construction

- 8.2.2. Earth Moving

- 8.2.3. Material Handling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Vietnam

- 8.3.4. Singapore

- 8.3.5. Malaysia

- 8.3.6. Philippines

- 8.3.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Singapore Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Cranes

- 9.1.2. Excavators

- 9.1.3. Loaders

- 9.1.4. Backhoe

- 9.1.5. Motor Graders

- 9.1.6. Other Machinery Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Concrete and Road Construction

- 9.2.2. Earth Moving

- 9.2.3. Material Handling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Vietnam

- 9.3.4. Singapore

- 9.3.5. Malaysia

- 9.3.6. Philippines

- 9.3.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Malaysia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Cranes

- 10.1.2. Excavators

- 10.1.3. Loaders

- 10.1.4. Backhoe

- 10.1.5. Motor Graders

- 10.1.6. Other Machinery Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Concrete and Road Construction

- 10.2.2. Earth Moving

- 10.2.3. Material Handling

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Vietnam

- 10.3.4. Singapore

- 10.3.5. Malaysia

- 10.3.6. Philippines

- 10.3.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Philippines Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11.1.1. Cranes

- 11.1.2. Excavators

- 11.1.3. Loaders

- 11.1.4. Backhoe

- 11.1.5. Motor Graders

- 11.1.6. Other Machinery Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Concrete and Road Construction

- 11.2.2. Earth Moving

- 11.2.3. Material Handling

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Thailand

- 11.3.3. Vietnam

- 11.3.4. Singapore

- 11.3.5. Malaysia

- 11.3.6. Philippines

- 11.3.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12. Rest of ASEAN Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12.1.1. Cranes

- 12.1.2. Excavators

- 12.1.3. Loaders

- 12.1.4. Backhoe

- 12.1.5. Motor Graders

- 12.1.6. Other Machinery Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Concrete and Road Construction

- 12.2.2. Earth Moving

- 12.2.3. Material Handling

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Indonesia

- 12.3.2. Thailand

- 12.3.3. Vietnam

- 12.3.4. Singapore

- 12.3.5. Malaysia

- 12.3.6. Philippines

- 12.3.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Construction Machinery Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Liebherr Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 CNH Industrial

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Caterpillar Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 JC Bamford Excavators Ltd (JCB)*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Komatsu Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xuzhou Construction Machinery Group Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Corporation

List of Figures

- Figure 1: Global Construction Machinery Industry in ASEAN Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 3: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 5: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 6: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 7: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 9: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 10: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 11: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 13: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 14: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 15: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 17: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 18: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 19: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 21: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 22: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 23: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 25: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 26: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 27: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 29: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 30: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 31: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 33: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 34: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 35: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 36: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 37: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 38: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 39: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 41: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 42: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 43: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 44: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 45: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 46: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 47: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 49: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 51: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 52: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 53: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 55: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 56: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 57: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 14: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 18: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 22: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 26: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 30: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Industry in ASEAN?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Construction Machinery Industry in ASEAN?

Key companies in the market include Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JC Bamford Excavators Ltd (JCB)*List Not Exhaustive, Komatsu Ltd, Xuzhou Construction Machinery Group Co Ltd.

3. What are the main segments of the Construction Machinery Industry in ASEAN?

The market segments include Machinery Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activity May Drive the Market.

6. What are the notable trends driving market growth?

Concrete and Road Construction To Propel The Demand.

7. Are there any restraints impacting market growth?

High Equipment Cost may Hamper the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Volvo Construction Equipment's (Volvo CE) first fully electric construction machinery arrived in Singapore and was formally introduced to the Southeast Asia market at a grand event on the island of Sentosa in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Machinery Industry in ASEAN," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Machinery Industry in ASEAN report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Machinery Industry in ASEAN?

To stay informed about further developments, trends, and reports in the Construction Machinery Industry in ASEAN, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence