Key Insights

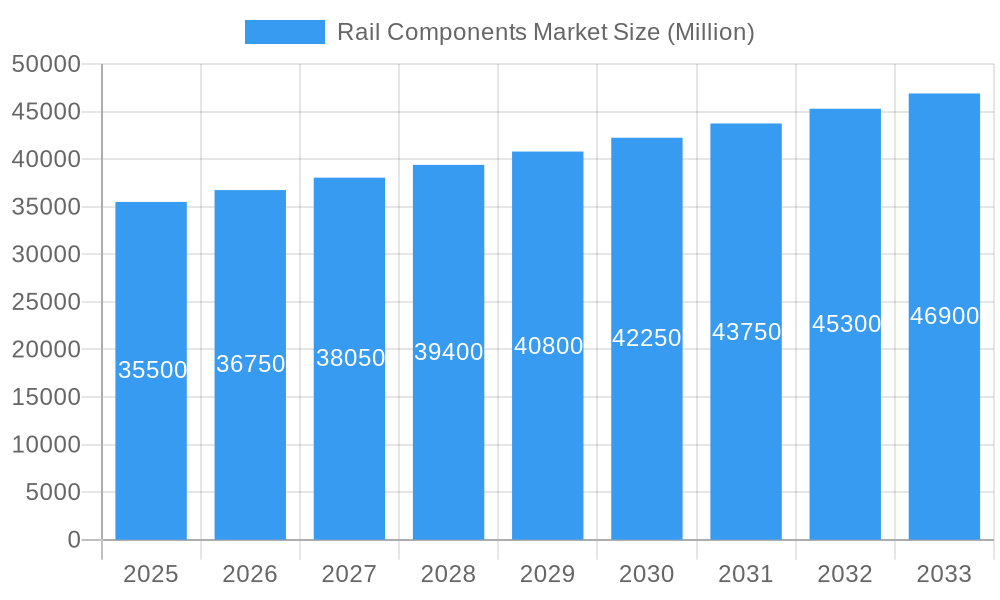

The global Rail Components Market is projected for significant expansion, expected to reach USD 82.01 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.79% during the forecast period. Growth is driven by substantial investments in railway infrastructure development and modernization worldwide. Key factors include rising demand for efficient, sustainable public transportation, increased freight rail operations supporting global trade, and government initiatives to enhance rail networks. The shift towards greener transportation solutions also benefits the rail sector due to its lower carbon footprint. Technological advancements in predictive maintenance, lightweight materials, and enhanced safety features further stimulate market demand.

Rail Components Market Market Size (In Billion)

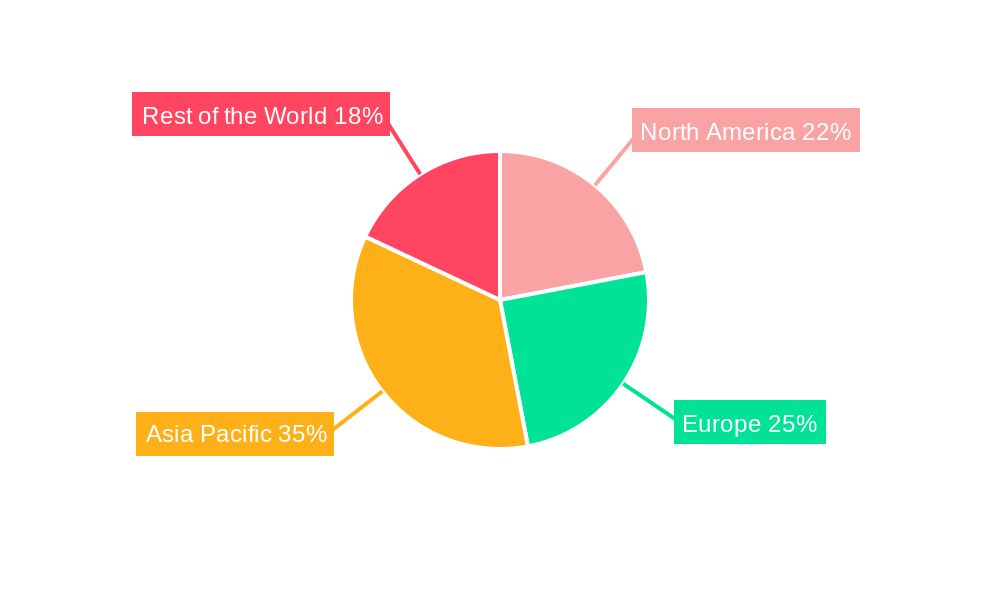

The market is segmented by product type. The Bogie segment, including brake systems, suspension systems, and wheel and axle assemblies, is anticipated to lead due to its critical role in train performance and safety. The Engine segment also holds a significant share, driven by the need for efficient propulsion systems. Emerging trends include the adoption of smart technologies, IoT integration for real-time monitoring, and the increased use of composite materials for improved energy efficiency. Market restraints include the high initial cost of advanced components, the long lifecycle of existing rolling stock, and stringent regulatory approvals. Geographically, the Asia Pacific region, led by China and India, is expected to dominate due to extensive railway expansion and urbanization. North America and Europe are also key markets, fueled by infrastructure upgrades and the renewal of aging rail fleets.

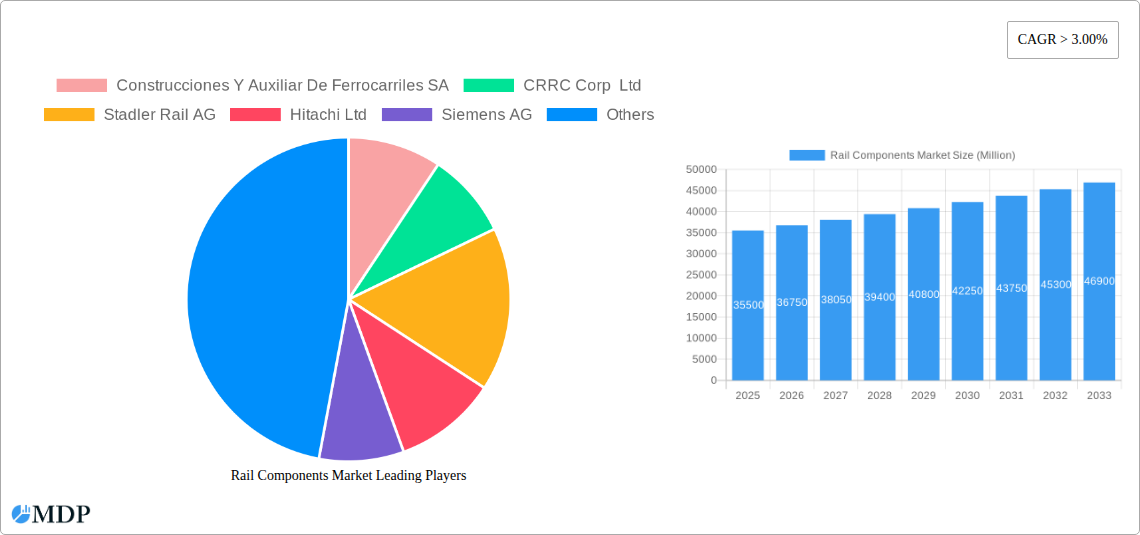

Rail Components Market Company Market Share

Global Rail Components Market: Market Dynamics & Concentration (2019–2033)

The global Rail Components Market is characterized by a moderate to high concentration, with a few key players dominating significant market share. The study period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, reveals a dynamic landscape shaped by technological advancements, stringent regulatory frameworks, and evolving end-user preferences. Innovation drivers are primarily focused on enhancing safety, efficiency, and sustainability in rail operations. This includes the development of lighter, more durable materials, advanced braking systems, and intelligent monitoring solutions for component health. Regulatory frameworks, driven by government initiatives to promote sustainable transportation and improve rail safety standards, play a crucial role in shaping market entry and product development. For instance, stricter emissions standards and safety certifications mandate continuous product innovation and adherence to specific industry benchmarks. Product substitutes, while limited in the core functional components, can emerge in the form of integrated solutions or alternative maintenance strategies. End-user trends are increasingly leaning towards modernization of existing fleets, demand for high-speed rail, and growth in urban mass transit systems, all of which directly influence the demand for specific rail components. Mergers and acquisitions (M&A) activities have been significant, particularly within the last decade, consolidating the market and expanding global reach. For example, the acquisition of Bombardier's rail business by Alstom significantly reshaped the competitive landscape. The number of M&A deals in the historical period (2019-2024) indicates a strategic drive for market consolidation and synergy. The market is expected to witness continued M&A activities as companies seek to strengthen their product portfolios and geographic presence.

Global Rail Components Market: Industry Trends & Analysis

The Rail Components Market is poised for robust growth driven by several interconnected industry trends and analyses. A significant growth driver is the global push towards sustainable and efficient transportation networks. Governments worldwide are investing heavily in upgrading and expanding their railway infrastructure, spurred by environmental concerns and the need to alleviate road congestion. This surge in infrastructure development directly translates into increased demand for a wide array of rail components, from foundational elements like body frames and couplers to sophisticated systems such as braking and suspension. The market penetration of advanced technologies is also a key trend. The integration of IoT (Internet of Things) and AI (Artificial Intelligence) into rail components is revolutionizing predictive maintenance, operational efficiency, and passenger safety. Smart sensors embedded in wheels, bogies, and engines can monitor component health in real-time, allowing for proactive maintenance and minimizing downtime. This technological disruption leads to enhanced reliability and reduced operational costs for rail operators. Consumer preferences are shifting towards faster, more comfortable, and environmentally friendly travel options, further bolstering the demand for modern rolling stock and, consequently, their constituent components. The increasing adoption of electric and hybrid trains necessitates specialized components like advanced battery systems and efficient traction motors, creating new market segments. The competitive dynamics within the industry are intensifying, with both established global players and emerging regional manufacturers vying for market share. Companies are increasingly focusing on R&D to develop innovative solutions that offer superior performance, lower maintenance costs, and a reduced environmental footprint. The projected Compound Annual Growth Rate (CAGR) for the Rail Components Market is expected to be substantial, reflecting the confluence of these growth drivers and technological advancements. The increasing demand for high-speed rail networks and the expansion of metro and suburban rail lines in urban centers are expected to contribute significantly to market penetration of specialized and high-performance components. The growing emphasis on lifecycle cost reduction is also pushing manufacturers to develop components with extended durability and reduced maintenance requirements.

Leading Markets & Segments in Rail Components Market

The global Rail Components Market is characterized by dominant regional markets and crucial component segments that are witnessing significant growth and innovation.

Dominant Regions & Countries:

- Europe: Historically a stronghold for rail technology, Europe continues to be a leading market due to extensive existing infrastructure, ongoing modernization projects, and a strong emphasis on sustainable transportation. Countries like Germany, France, and the UK are major consumers of rail components, driven by high-speed rail development and urban rail expansion. Economic policies supporting rail infrastructure investment and stringent regulatory requirements for safety and emissions are key drivers.

- Asia Pacific: This region is experiencing the most rapid growth, fueled by massive infrastructure investments in countries like China, India, and Japan. China, in particular, has emerged as a dominant force in both manufacturing and consumption of rail components, driven by its extensive high-speed rail network and large-scale urban transit projects. Government initiatives promoting rapid urbanization and intercity connectivity are pivotal to this growth.

- North America: The North American market is driven by the need to modernize aging infrastructure and the growing demand for commuter and freight rail services. Investments in passenger rail expansion and freight capacity enhancement are key factors. Regulatory frameworks focused on safety improvements and the adoption of new technologies are shaping market trends.

Dominant Segments:

- Bogie: This critical component, comprising sub-segments like Brake System, Suspension System, and Wheel and Axle, represents a significant portion of the rail components market. The demand for advanced braking systems that offer improved stopping power, reduced wear, and enhanced safety is continuously growing. Similarly, sophisticated suspension systems are crucial for passenger comfort and operational stability, especially in high-speed applications. The Wheel and Axle segment benefits from the overall increase in rail traffic and the need for durable, high-performance components that can withstand extreme operational conditions. The "Other Bogie" components also see consistent demand for various structural and functional parts.

- Key Drivers for Bogie Dominance:

- Increased focus on safety and operational efficiency in rail transport.

- Demand for high-speed rail and enhanced passenger comfort, requiring advanced suspension and braking technologies.

- Growing need for durable and reliable wheel and axle sets for both passenger and freight applications.

- Strict regulatory compliance for braking performance and material integrity.

- Key Drivers for Bogie Dominance:

- Engine: The engine segment is vital for the propulsion of locomotives and other rail vehicles. While there is a shift towards electric and hybrid powertrains, traditional diesel engines continue to be in demand for freight operations and in regions where electrification is less advanced. Innovations in engine efficiency, emission reduction, and hybrid integration are key trends.

- Key Drivers for Engine Segment:

- Continued demand for freight rail, which relies heavily on powerful engines.

- Development of more fuel-efficient and lower-emission diesel engines.

- Integration of hybrid technologies for reduced environmental impact and improved operational flexibility.

- Key Drivers for Engine Segment:

- Others (Couplers, Body Frames, etc.): This broad category encompasses essential structural and connectivity components. Couplers are critical for train assembly and safety, with advancements focusing on automation and improved coupling mechanisms. Body Frames provide the structural integrity of the rolling stock and are increasingly manufactured using lighter, stronger materials to improve energy efficiency.

- Key Drivers for "Others" Segment:

- Continuous need for replacement and upgrades of existing rolling stock.

- Development of lighter and more robust materials for body frames to enhance fuel efficiency.

- Advancements in coupler technology for automated operations and improved safety.

- Key Drivers for "Others" Segment:

Rail Components Market Product Developments

Product developments in the Rail Components Market are centered on enhancing safety, efficiency, and sustainability. Innovations in braking systems focus on regenerative braking and advanced materials for reduced wear and improved performance. Lightweight and high-strength alloys are increasingly used for body frames and bogie components to reduce energy consumption. Smart sensors and integrated diagnostics are being embedded into components like wheels and engines for predictive maintenance, minimizing downtime and optimizing operational costs. Furthermore, developments in modular component design are facilitating easier maintenance and upgrades, aligning with the trend towards longer asset lifecycles and reduced TCO (Total Cost of Ownership). These advancements not only improve the performance and reliability of rail vehicles but also contribute to a more environmentally friendly and cost-effective rail transport ecosystem.

Key Drivers of Rail Components Market Growth

The global Rail Components Market is propelled by a confluence of robust growth drivers. Significant government investments in infrastructure development and modernization projects worldwide are a primary catalyst. The increasing global emphasis on sustainable transportation solutions, aimed at reducing carbon emissions and alleviating road congestion, directly boosts rail infrastructure and component demand. Technological advancements, such as the integration of IoT and AI for predictive maintenance and enhanced operational efficiency, are creating new market opportunities and driving the adoption of advanced components. The expansion of high-speed rail networks and the growing demand for urban mass transit systems in developing economies are also major contributors to market expansion. Furthermore, the need to replace aging rolling stock and the continuous drive for improved safety and performance standards mandate the adoption of innovative and high-quality rail components.

Challenges in the Rail Components Market Market

Despite its growth trajectory, the Rail Components Market faces several challenges. Stringent and evolving regulatory frameworks, while promoting safety, can also increase compliance costs and lengthen product development cycles. Intense competition from both established global players and emerging manufacturers, particularly from low-cost regions, exerts downward pressure on pricing and profit margins. Supply chain disruptions, exacerbated by geopolitical events and global economic volatility, can impact the availability and cost of raw materials and finished components. The high initial capital investment required for manufacturing advanced rail components and the lengthy procurement processes by rail operators can also pose barriers to market entry and growth. Furthermore, the technical expertise required for developing and implementing cutting-edge rail technologies necessitates continuous investment in R&D and skilled personnel.

Emerging Opportunities in Rail Components Market

The Rail Components Market is ripe with emerging opportunities for growth and innovation. The global transition towards decarbonization presents a significant opportunity for manufacturers of components for electric and hydrogen-powered trains, including advanced battery systems, fuel cells, and efficient electric traction motors. The increasing demand for smart rail solutions, driven by the adoption of IoT, AI, and big data analytics, opens avenues for the development of sensor-equipped components, advanced diagnostic tools, and integrated data management systems. The expansion of urban rail networks and the development of metro systems in emerging economies offer substantial market potential for specialized components like signaling systems, power electronics, and passenger amenities. Strategic partnerships and collaborations between component manufacturers, rail operators, and technology providers can foster innovation and accelerate the development and deployment of next-generation rail technologies. Furthermore, the aftermarket services segment, encompassing maintenance, repair, and overhaul, presents a consistent revenue stream and an opportunity to build long-term customer relationships.

Leading Players in the Rail Components Market Sector

- Construcciones Y Auxiliar De Ferrocarriles SA

- CRRC Corp Ltd

- Stadler Rail AG

- Hitachi Ltd

- Siemens AG

- Progress Rail (Caterpillar Company)

- Alstom SA

- Trinity Industries Inc

- Nippon Sharyo Ltd

- Kawasaki Heavy Industries Lt

- Bombardier Inc

- Wabtec Corp (previously GE Transportation)

- Escorts Group

- The Greenbrier Companies

- Hyundai Rotem

Key Milestones in Rail Components Market Industry

- May 2020: CRRC acquired the locomotive manufacturer, Vossloh Group, in Europe. The primary aim of the acquisition was to retain engineering expertise for the development of new products with innovative traction concepts through a partnership structure in the region.

- March 2020: Alstom acquired Bombardier's rail business worth USD 5.5 billion, which allows Alstom to have a more visible global presence and complements its activities in North America.

- March 2020: Stadler won a contract to supply 1,500 Metro cars to Berlin Verkehrsbetriebe. The agreement is worth USD 3.2 billion, which also includes the provision of spare parts.

Strategic Outlook for Rail Components Market Market

The strategic outlook for the Rail Components Market is overwhelmingly positive, driven by a sustained global demand for modern, efficient, and sustainable rail transportation. Key growth accelerators include ongoing government investments in infrastructure upgrades and expansions, particularly in emerging economies. The increasing adoption of advanced technologies like AI, IoT, and predictive maintenance will continue to shape product development and create opportunities for value-added services. The ongoing shift towards decarbonization will further stimulate demand for components suited for electric and alternative fuel powertrains. Strategic opportunities lie in expanding market presence in high-growth regions, forging partnerships to co-develop innovative solutions, and focusing on aftermarket services to build recurring revenue streams. Companies that can effectively leverage technological advancements, adapt to evolving regulatory landscapes, and meet the increasing demands for performance and sustainability are well-positioned for significant success in the coming years.

Rail Components Market Segmentation

-

1. Component

-

1.1. Bogie

- 1.1.1. Brake System

- 1.1.2. Suspension System

- 1.1.3. Wheel and Axle

- 1.1.4. Other Bo

- 1.2. Engine

- 1.3. Others ( Couplers, Body Frames, etc)

-

1.1. Bogie

Rail Components Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Rail Components Market Regional Market Share

Geographic Coverage of Rail Components Market

Rail Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Selection Among Car Models is Anticipated to Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1. Counterfeit and Illegally Imported Vehicles are Restraining the Market Growth

- 3.4. Market Trends

- 3.4.1. Bogie Segment to Witness the Fastest Growth During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Components Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Bogie

- 5.1.1.1. Brake System

- 5.1.1.2. Suspension System

- 5.1.1.3. Wheel and Axle

- 5.1.1.4. Other Bo

- 5.1.2. Engine

- 5.1.3. Others ( Couplers, Body Frames, etc)

- 5.1.1. Bogie

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Rail Components Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Bogie

- 6.1.1.1. Brake System

- 6.1.1.2. Suspension System

- 6.1.1.3. Wheel and Axle

- 6.1.1.4. Other Bo

- 6.1.2. Engine

- 6.1.3. Others ( Couplers, Body Frames, etc)

- 6.1.1. Bogie

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Rail Components Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Bogie

- 7.1.1.1. Brake System

- 7.1.1.2. Suspension System

- 7.1.1.3. Wheel and Axle

- 7.1.1.4. Other Bo

- 7.1.2. Engine

- 7.1.3. Others ( Couplers, Body Frames, etc)

- 7.1.1. Bogie

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Rail Components Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Bogie

- 8.1.1.1. Brake System

- 8.1.1.2. Suspension System

- 8.1.1.3. Wheel and Axle

- 8.1.1.4. Other Bo

- 8.1.2. Engine

- 8.1.3. Others ( Couplers, Body Frames, etc)

- 8.1.1. Bogie

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Rail Components Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Bogie

- 9.1.1.1. Brake System

- 9.1.1.2. Suspension System

- 9.1.1.3. Wheel and Axle

- 9.1.1.4. Other Bo

- 9.1.2. Engine

- 9.1.3. Others ( Couplers, Body Frames, etc)

- 9.1.1. Bogie

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Construcciones Y Auxiliar De Ferrocarriles SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CRRC Corp Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stadler Rail AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Progress Rail (Caterpillar Company)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Alstom SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Trinity Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nippon Sharyo Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kawasaki Heavy Industries Lt

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bombardier Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Wabtec Corp (previously GE Transportation)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Escorts Group

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 The Greenbrier Companies

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Hyundai Rotem

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Construcciones Y Auxiliar De Ferrocarriles SA

List of Figures

- Figure 1: Global Rail Components Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Rail Components Market Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Rail Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Rail Components Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Rail Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Rail Components Market Revenue (billion), by Component 2025 & 2033

- Figure 7: Europe Rail Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 8: Europe Rail Components Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Rail Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Rail Components Market Revenue (billion), by Component 2025 & 2033

- Figure 11: Asia Pacific Rail Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Asia Pacific Rail Components Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Rail Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Rail Components Market Revenue (billion), by Component 2025 & 2033

- Figure 15: Rest of the World Rail Components Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Rest of the World Rail Components Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Rail Components Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rail Components Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Rail Components Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Rail Components Market Revenue billion Forecast, by Component 2020 & 2033

- Table 4: Global Rail Components Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Rail Components Market Revenue billion Forecast, by Component 2020 & 2033

- Table 9: Global Rail Components Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Rail Components Market Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Global Rail Components Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: India Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: China Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Japan Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: South Korea Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Rail Components Market Revenue billion Forecast, by Component 2020 & 2033

- Table 22: Global Rail Components Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Brazil Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Africa Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Other Countries Rail Components Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Components Market?

The projected CAGR is approximately 3.79%.

2. Which companies are prominent players in the Rail Components Market?

Key companies in the market include Construcciones Y Auxiliar De Ferrocarriles SA, CRRC Corp Ltd, Stadler Rail AG, Hitachi Ltd, Siemens AG, Progress Rail (Caterpillar Company), Alstom SA, Trinity Industries Inc, Nippon Sharyo Ltd, Kawasaki Heavy Industries Lt, Bombardier Inc, Wabtec Corp (previously GE Transportation), Escorts Group, The Greenbrier Companies, Hyundai Rotem.

3. What are the main segments of the Rail Components Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Diverse Selection Among Car Models is Anticipated to Drive the Market Growth.

6. What are the notable trends driving market growth?

Bogie Segment to Witness the Fastest Growth During Forecast Period.

7. Are there any restraints impacting market growth?

Counterfeit and Illegally Imported Vehicles are Restraining the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2020, CRRC acquired the locomotive manufacturer, Vossloh Group, in Europe. The primary aim of the acquisition was to retain engineering expertise for the development of new products with innovative traction concepts through a partnership structure in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Components Market?

To stay informed about further developments, trends, and reports in the Rail Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence