Key Insights

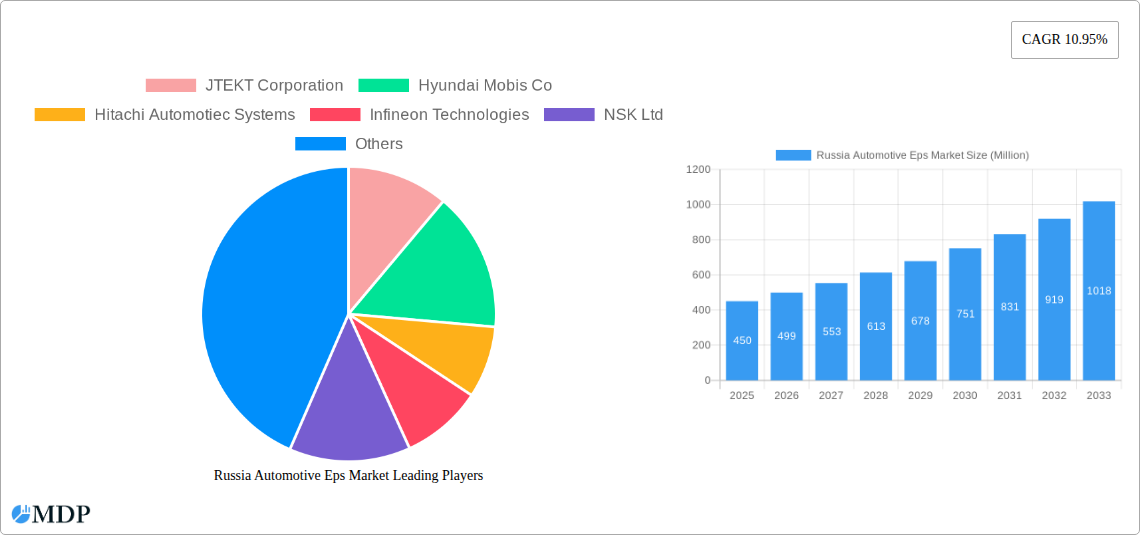

The Russian Electric Power Steering (EPS) market is projected for substantial growth, reaching an estimated market size of $10.34 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This expansion is driven by the increasing integration of Advanced Driver-Assistance Systems (ADAS) and the rising demand for fuel-efficient vehicles. Stringent government mandates on vehicle safety and emissions are also compelling automakers to adopt EPS systems, particularly for passenger cars, to improve maneuverability and reduce weight compared to hydraulic systems. Continuous innovation in EPS technology, including more compact and efficient motors and control units, further fuels market penetration.

Russia Automotive Eps Market Market Size (In Million)

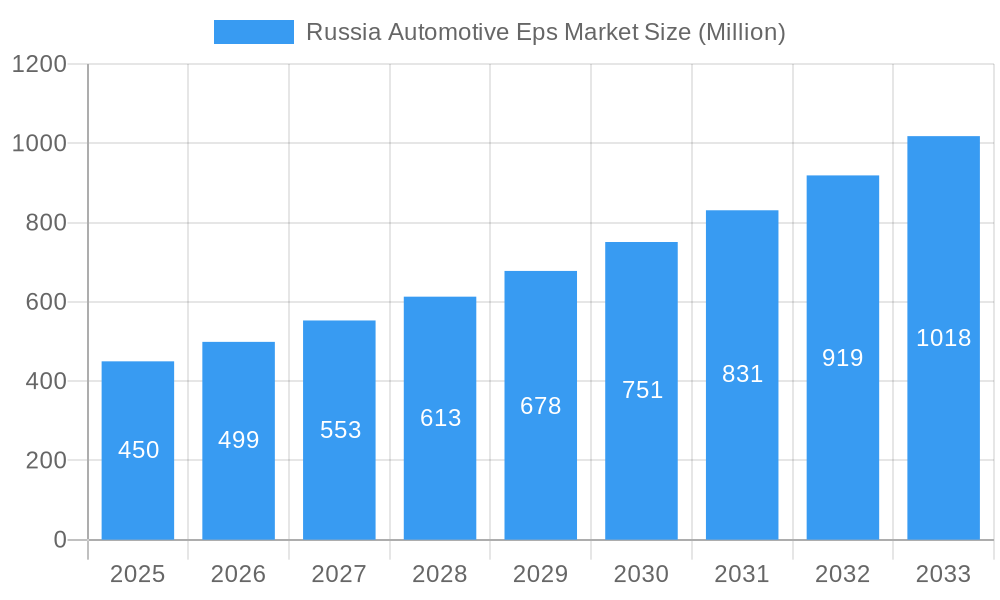

The Russian EPS market is segmented by product type, with Rack Assist Electric Power Steering (REPS) anticipated to lead due to its prevalent use in passenger vehicles. Column Assist Electric Power Steering (CEPS) and Pinion Assist Electric Power Steering (PEPS) are also gaining adoption for specific vehicle needs. Both the Original Equipment Manufacturer (OEM) and aftermarket segments are expected to contribute significantly to market value. While initial system costs and the availability of skilled technicians present potential challenges, the long-term advantages of enhanced safety, driving experience, and fuel economy are expected to overcome these hurdles. Key industry players, including JTEKT Corporation, Hyundai Mobis, and Hitachi Automotive Systems, are actively shaping this evolving market through innovation and competition.

Russia Automotive Eps Market Company Market Share

This report provides an in-depth analysis and forecast for the Russia Automotive EPS Market, offering valuable insights for industry stakeholders.

Russia Automotive EPS Market: Comprehensive Analysis, Trends, and Forecasts (2019–2033)

This in-depth report provides a definitive analysis of the Russia Automotive Electric Power Steering (EPS) market, delving into market dynamics, key trends, leading players, and future outlook. The Russian automotive sector is undergoing significant transformation, with Electric Power Steering (EPS) systems emerging as a critical component for enhanced safety, fuel efficiency, and driving comfort. This report offers invaluable insights for manufacturers, suppliers, automotive OEMs, investors, and policymakers navigating this evolving landscape.

The study covers a comprehensive Study Period from 2019 to 2033, with a detailed Base Year of 2025, and includes an Estimated Year of 2025 to establish current market conditions. The Forecast Period runs from 2025 to 2033, building upon a thorough examination of the Historical Period from 2019 to 2024. Explore the global automotive EPS market trends specifically tailored to Russia's unique economic and regulatory environment.

Key Segments Covered:

- Vehicle Type: Passenger Cars, Commercial Vehicles

- Product Type: Rack Assist Type (REPS), Column Assist Type (CEPS), Pinion Assist Type (PEPS)

- Demand Category: OEM, Replacement

Leading Companies profiled: JTEKT Corporation, Hyundai Mobis Co, Hitachi Automotive Systems, Infineon Technologies, NSK Ltd, GKN PLC, Mitsubishi Electric Corporation, Mando Corporation, Nexteer Automotive, ATS Automation Tooling Systems Inc, Delphi Automotive Systems.

Unlock critical information on market size, growth drivers, technological innovations, and competitive strategies shaping the future of the Russia Automotive EPS market.

Russia Automotive Eps Market Market Dynamics & Concentration

The Russia Automotive EPS market exhibits a dynamic and evolving concentration, characterized by a growing demand for advanced safety features and increasing regulatory push for fuel efficiency. Market concentration is influenced by a mix of established global players and emerging domestic capabilities. Innovation drivers are primarily focused on developing more compact, lighter, and energy-efficient EPS systems, alongside the integration of advanced driver-assistance systems (ADAS) functionalities. Regulatory frameworks, particularly concerning vehicle safety standards and emissions, are indirectly promoting EPS adoption due to its inherent benefits. Product substitutes, such as hydraulic power steering (HPS), are rapidly losing ground to the superior performance and efficiency of EPS. End-user trends indicate a strong preference for vehicles equipped with EPS, driven by consumer awareness of enhanced driving experience and safety. Mergers and acquisitions (M&A) activities, while perhaps less frequent than in more mature markets, are strategic moves by key players to consolidate market share, acquire new technologies, and expand their geographical footprint within Russia. For instance, a recent M&A deal in the automotive components market Russia aimed to bolster local production capabilities for EPS. The automotive steering systems Russia landscape is witnessing a gradual shift towards consolidation, with market share of leading EPS suppliers expected to grow. The M&A deal count in this niche segment of automotive parts Russia is modest but strategically significant.

Russia Automotive Eps Market Industry Trends & Analysis

The Russia Automotive EPS market is poised for significant expansion, driven by a confluence of robust market growth drivers, disruptive technological advancements, evolving consumer preferences, and intricate competitive dynamics. The overarching trend within the Russian automotive sector is the imperative to modernize vehicle fleets, aligning with global standards for safety and environmental sustainability. This transition is a primary catalyst for the burgeoning automotive EPS market Russia. The adoption of EPS systems is witnessing an accelerated growth trajectory, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% projected over the forecast period. This growth is underpinned by government initiatives promoting the local manufacturing of automotive components and the increasing penetration of vehicles equipped with advanced steering technologies. The Russian automotive industry is actively seeking to reduce its reliance on imported components, fostering an environment conducive to the local production and development of EPS.

Technological disruptions are at the forefront of this market evolution. The integration of sophisticated sensor technology, advanced algorithms for precise steering control, and the burgeoning trend of steer-by-wire systems are transforming the capabilities of EPS. These innovations not only enhance driving precision and responsiveness but also pave the way for higher levels of vehicle autonomy, a critical consideration for the future of mobility in Russia. Furthermore, the increasing sophistication of vehicle electronics and the growing demand for intelligent transportation systems are directly fueling the demand for advanced EPS solutions that can seamlessly integrate with these complex architectures. The automotive steering solutions Russia sector is thus a hotbed of innovation.

Consumer preferences are also playing a pivotal role. Russian car buyers are increasingly prioritizing vehicles that offer a superior driving experience, characterized by effortless steering, enhanced stability, and improved fuel efficiency. The tangible benefits of EPS, such as reduced driver fatigue on long drives and improved maneuverability in urban environments, are becoming key selling points. As the average age of vehicles on Russian roads decreases and new vehicle sales rebound, the demand for modern features like EPS is expected to surge. This shift in consumer perception directly impacts the automotive parts Russia market, compelling manufacturers to equip their vehicles with these advanced systems.

The competitive dynamics within the Russia Automotive EPS market are characterized by intense innovation and strategic partnerships. Global automotive component giants are vying for market share, investing heavily in research and development to offer cutting-edge solutions. Simultaneously, there's a growing emphasis on localizing production and fostering domestic expertise to meet the specific needs and regulatory requirements of the Russian market. The automotive suppliers Russia ecosystem is thus becoming more sophisticated. The market penetration of EPS systems, currently around 60% for new passenger vehicles, is anticipated to climb to over 85% by 2033, signaling a substantial opportunity for growth. The growing emphasis on vehicle safety standards, such as those mandating Electronic Stability Control (ESC), which is often integrated with EPS, further amplifies this trend. The auto components market Russia is also benefiting from the increasing integration of ADAS features, where EPS plays a crucial role. The demand for electric power steering systems Russia is thus experiencing an exponential rise.

Leading Markets & Segments in Russia Automotive Eps Market

The Russia Automotive EPS market is predominantly influenced by the Passenger Car segment, which accounts for a substantial majority of the overall demand. This dominance is driven by the sheer volume of passenger vehicles manufactured and sold within the country, as well as the growing consumer preference for enhanced driving comfort and safety features that EPS provides. Within the Passenger Car segment, the Rack Assist Type (REPS) product category is the most significant, owing to its widespread application across various car models and its cost-effectiveness compared to other EPS types. The OEM demand category overwhelmingly leads the market, reflecting the increasing integration of EPS systems directly into new vehicle production lines by Russian and international automotive manufacturers operating in the country.

The Commercial Vehicle segment, while smaller in comparison, presents a growing opportunity for EPS adoption. As regulations around driver fatigue and road safety become more stringent, and as commercial vehicle manufacturers seek to improve fuel efficiency and reduce emissions, the integration of EPS in trucks and buses is expected to gain traction. The Replacement demand category, though currently smaller than OEM, is projected to witness robust growth over the forecast period. This is attributed to the aging vehicle parc in Russia and the increasing availability of aftermarket EPS components, driven by the need to replace worn-out steering systems in older vehicles.

Geographically, the European Russia region, particularly around major automotive manufacturing hubs like Moscow, St. Petersburg, and Kaluga, represents the leading market for automotive EPS. This concentration is a direct result of the presence of numerous automotive assembly plants and a well-developed supply chain infrastructure. Economic policies aimed at boosting domestic automotive production and encouraging the localization of component manufacturing are key drivers of this regional dominance. Infrastructure development, including improved road networks, also indirectly supports the demand for more sophisticated vehicle technologies like EPS.

In terms of product types, while REPS leads, the Column Assist Type (CEPS) is also gaining prominence, particularly in smaller passenger cars and urban mobility solutions, due to its compact design and cost efficiency. The Pinion Assist Type (PEPS), offering higher torque and performance, is increasingly being adopted in performance-oriented vehicles and premium passenger cars. The interplay between these segments and their respective growth drivers underscores the dynamic nature of the automotive steering systems Russia market. The increasing adoption of EPS in the automotive parts Russia sector is a testament to its growing importance. The market penetration of electric power steering systems Russia is a key indicator of this trend.

Russia Automotive Eps Market Product Developments

Recent product developments in the Russia Automotive EPS market are largely driven by the pursuit of enhanced efficiency, safety, and integration capabilities. Manufacturers are focusing on developing lighter and more compact EPS units to optimize vehicle weight and packaging. Innovations include the integration of advanced sensor technologies for more precise steering input, enabling seamless compatibility with Advanced Driver-Assistance Systems (ADAS) such as lane-keeping assist and automated parking. Furthermore, the focus on energy efficiency is leading to the development of EPS systems with lower power consumption, contributing to improved fuel economy. The competitive advantage lies in offering modular designs that can be easily adapted to various vehicle platforms and offering robust, reliable solutions suitable for the challenging Russian climate.

Key Drivers of Russia Automotive Eps Market Growth

The Russia Automotive EPS market's growth is propelled by several key factors. Firstly, stringent government regulations mandating enhanced vehicle safety features and fuel efficiency standards are a significant catalyst. The increasing adoption of Advanced Driver-Assistance Systems (ADAS), which heavily rely on precise steering control provided by EPS, further amplifies this demand. Secondly, rising consumer awareness and preference for modern driving experiences, characterized by improved steering responsiveness, comfort, and maneuverability, are driving demand for EPS-equipped vehicles. Thirdly, the ongoing modernization and expansion of the Russian automotive manufacturing base, coupled with government initiatives to localize automotive component production, are fostering local EPS development and adoption.

Challenges in the Russia Automotive Eps Market Market

Despite its growth potential, the Russia Automotive EPS market faces several challenges. Regulatory hurdles related to the homologation and certification of new automotive components can sometimes slow down market entry and adoption. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities, can impact the availability and cost of raw materials and critical electronic components required for EPS manufacturing. Intense competitive pressures from both global and potentially emerging domestic players can lead to pricing challenges. Furthermore, the initial higher upfront cost of EPS systems compared to traditional hydraulic systems can be a restraint, especially in the budget-conscious segments of the market, although this gap is narrowing.

Emerging Opportunities in Russia Automotive Eps Market

Emerging opportunities in the Russia Automotive EPS market are abundant, driven by technological breakthroughs and strategic market expansion. The increasing demand for electric vehicles (EVs) and hybrid vehicles in Russia presents a significant opportunity, as EPS is an integral component of EV powertrains, contributing to their efficiency and performance. Strategic partnerships between global EPS manufacturers and local Russian automotive companies can foster technology transfer, enhance local production capabilities, and create new market entry points. The growing trend towards autonomous driving features will further necessitate the adoption of sophisticated EPS systems, creating long-term growth prospects for advanced EPS solutions.

Leading Players in the Russia Automotive Eps Market Sector

- JTEKT Corporation

- Hyundai Mobis Co

- Hitachi Automotive Systems

- Infineon Technologies

- NSK Ltd

- GKN PLC

- Mitsubishi Electric Corporation

- Mando Corporation

- Nexteer Automotive

- ATS Automation Tooling Systems Inc

- Delphi Automotive Systems

Key Milestones in Russia Automotive Eps Market Industry

- 2019: Increased focus on vehicle safety regulations, driving initial EPS adoption in new models.

- 2020: Impact of global supply chain disruptions on automotive component availability in Russia.

- 2021: Growing consumer interest in advanced vehicle features like ADAS, indirectly boosting EPS demand.

- 2022: Government initiatives to boost local automotive production and component localization gain momentum.

- 2023: Several major OEMs begin phasing out traditional hydraulic steering in new passenger car models manufactured in Russia.

- Early 2024: Introduction of new safety standards requiring advanced steering functionalities, further accelerating EPS integration.

- Mid-2024: Expansion of aftermarket services for EPS repair and replacement becomes more prominent.

- Late 2024: Emerging discussions around the potential for local R&D for next-generation EPS systems.

Strategic Outlook for Russia Automotive Eps Market Market

The strategic outlook for the Russia Automotive EPS market is overwhelmingly positive, with significant growth accelerators in play. The continued push for vehicle electrification and the increasing integration of autonomous driving technologies will be paramount drivers. Strategic opportunities lie in forming robust local partnerships to enhance manufacturing capabilities, foster innovation, and tailor solutions to the specific demands of the Russian market. Companies that can offer advanced, energy-efficient, and cost-effective EPS solutions, while navigating the evolving regulatory landscape and supply chain complexities, are best positioned for sustained success in this burgeoning market.

Russia Automotive Eps Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Product Type

- 2.1. By Rack assist type (REPS)

- 2.2. Colum assist type (CEPS)

- 2.3. Pinion assist type (PEPS)

-

3. Demand Category

- 3.1. OEM

- 3.2. Replacement

Russia Automotive Eps Market Segmentation By Geography

- 1. Russia

Russia Automotive Eps Market Regional Market Share

Geographic Coverage of Russia Automotive Eps Market

Russia Automotive Eps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Luxury Cars Across the Country

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Product

- 3.4. Market Trends

- 3.4.1. ECU is the fastest-growing component amongst all Electric Power Steering (EPS) components

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Automotive Eps Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. By Rack assist type (REPS)

- 5.2.2. Colum assist type (CEPS)

- 5.2.3. Pinion assist type (PEPS)

- 5.3. Market Analysis, Insights and Forecast - by Demand Category

- 5.3.1. OEM

- 5.3.2. Replacement

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JTEKT Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Mobis Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Automotiec Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NSK Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GKN PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mando Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nexteer Automotive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ATS Automation Tooling Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Delphi Automotive Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 JTEKT Corporation

List of Figures

- Figure 1: Russia Automotive Eps Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Russia Automotive Eps Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Automotive Eps Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Russia Automotive Eps Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Russia Automotive Eps Market Revenue million Forecast, by Demand Category 2020 & 2033

- Table 4: Russia Automotive Eps Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Russia Automotive Eps Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Russia Automotive Eps Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Russia Automotive Eps Market Revenue million Forecast, by Demand Category 2020 & 2033

- Table 8: Russia Automotive Eps Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Automotive Eps Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Russia Automotive Eps Market?

Key companies in the market include JTEKT Corporation, Hyundai Mobis Co, Hitachi Automotiec Systems, Infineon Technologies, NSK Ltd, GKN PLC, Mitsubishi Electric Corporation, Mando Corporation, Nexteer Automotive, ATS Automation Tooling Systems Inc, Delphi Automotive Systems.

3. What are the main segments of the Russia Automotive Eps Market?

The market segments include Vehicle Type, Product Type, Demand Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.34 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Luxury Cars Across the Country.

6. What are the notable trends driving market growth?

ECU is the fastest-growing component amongst all Electric Power Steering (EPS) components.

7. Are there any restraints impacting market growth?

High Cost Associated with the Product.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Automotive Eps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Automotive Eps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Automotive Eps Market?

To stay informed about further developments, trends, and reports in the Russia Automotive Eps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence