Key Insights

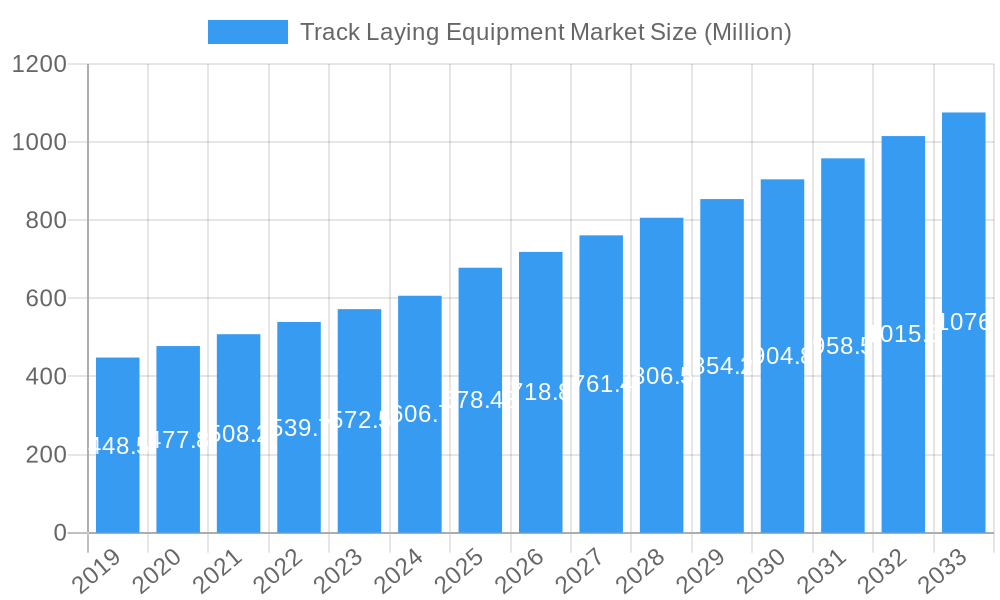

The global Track Laying Equipment Market is poised for robust expansion, projected to reach USD 678.43 million by 2025 and ascend at a compound annual growth rate (CAGR) of 6.25% through 2033. This significant growth is fueled by a confluence of factors, including escalating investments in new railway infrastructure projects worldwide, particularly in developing economies, and the ongoing need for renewal and maintenance of existing rail networks. The increasing demand for efficient and modern track laying solutions, driven by urbanization and the expansion of heavy rail networks for freight and passenger transport, is a primary catalyst. Furthermore, advancements in technology are leading to the development of more sophisticated, automated, and eco-friendly track laying equipment, enhancing productivity and safety, which further stimulates market adoption. The focus on reducing construction times and operational costs in railway projects directly translates to higher demand for advanced track laying machinery.

Track Laying Equipment Market Market Size (In Million)

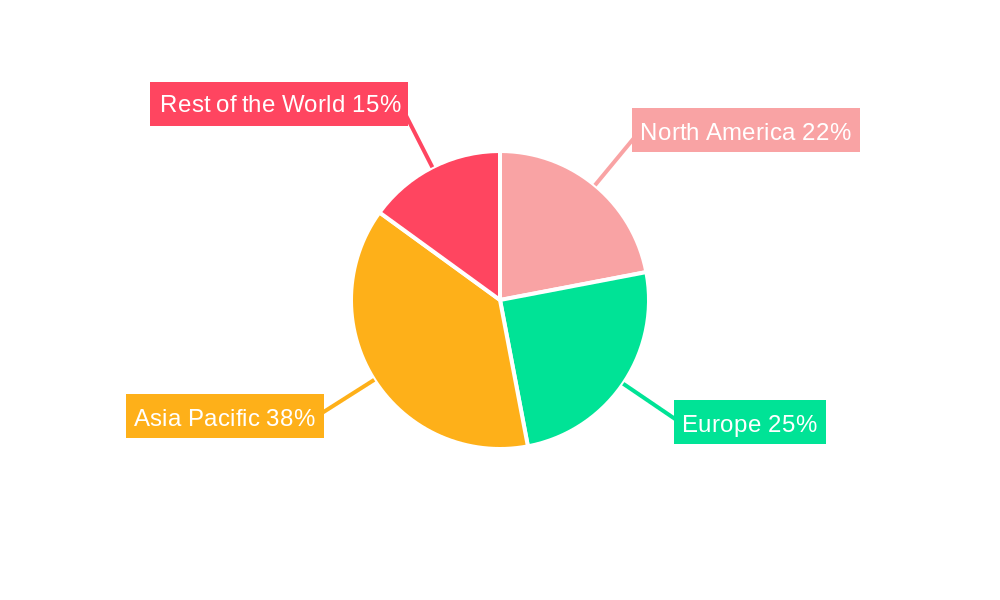

The market is segmented across various types, applications, and lifting capacities to cater to diverse railway construction and maintenance needs. While new construction equipment drives initial demand, the renewal and maintenance segment is expected to exhibit consistent growth as aging rail infrastructure requires upgrades and repairs. Urban rail development, characterized by shorter, more complex routes, and heavy rail, demanding high-capacity equipment, both represent significant application areas. Lifting capacities ranging from up to 9 tonnes to over 12 tonnes highlight the varied requirements of different project scales. Geographically, Asia Pacific, led by China and India, is anticipated to be a dominant region due to substantial government initiatives for railway expansion and modernization. North America and Europe also represent mature yet continuously growing markets, driven by infrastructure upgrades and the development of high-speed rail networks. Emerging economies in the Rest of the World are also showing promising potential as railway networks are established and expanded.

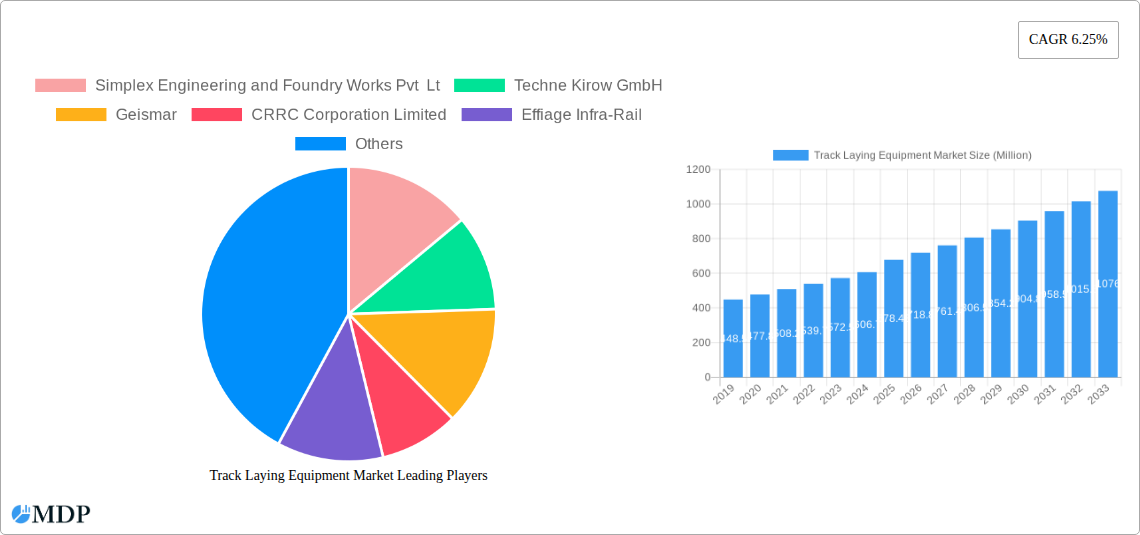

Track Laying Equipment Market Company Market Share

Track Laying Equipment Market: Comprehensive Analysis and Forecast (2019-2033)

Unlock critical insights into the global track laying equipment market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, this analysis provides a deep dive into market dynamics, industry trends, leading segments, and future opportunities. Discover the strategic initiatives of key players, understand growth drivers and challenges, and gain a competitive edge in the evolving railway infrastructure sector.

This report is essential for industry stakeholders including manufacturers, suppliers, rail infrastructure developers, government bodies, and investors seeking to understand the intricate landscape of track laying equipment. It offers actionable intelligence on market concentration, technological advancements, regulatory influences, and emerging trends. With a focus on high-traffic keywords such as "railway construction equipment," "track maintenance machinery," "high-speed rail infrastructure," and "urban rail development," this report ensures maximum visibility and relevance for industry professionals.

Key Metrics:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Key Players Covered: Simplex Engineering and Foundry Works Pvt Lt, Techne Kirow GmbH, Geismar, CRRC Corporation Limited, Effiage Infra-Rail, Salcef Group SpA, Weihua Group, Plasser & Theurer, Vossloh AG, Matisa Matariel Industriel SA, BEML India, Harsco Corporation (Enviri).

Segments Analyzed:

- Type: New Construction Equipment, Renewal Equipment

- Application: Heavy Rail, Urban Rail

- Lifting Capacity: Up to 9 Tonnes, 9-12 Tonnes, More than 12 Tonnes

Track Laying Equipment Market Market Dynamics & Concentration

The track laying equipment market exhibits moderate to high concentration, with a few dominant global players controlling a significant market share. Innovation is a key driver, propelled by the continuous need for faster, more efficient, and safer track construction and maintenance solutions. Companies are investing heavily in R&D to develop automated and intelligent track laying machines that reduce manual labor and improve precision. Regulatory frameworks, particularly those related to safety standards and environmental compliance, play a crucial role in shaping market entry and product development. Product substitutes are limited, as specialized track laying equipment is essential for rail infrastructure projects; however, incremental improvements and integration with digital technologies can be seen as competitive advantages. End-user trends are shifting towards a greater demand for durable, energy-efficient, and versatile machinery capable of handling diverse rail types and applications. Merger and acquisition (M&A) activities are strategic, aimed at consolidating market presence, expanding product portfolios, and gaining access to new technologies or geographical markets. The estimated M&A deal count for the historical period is 7, indicating active consolidation efforts.

Track Laying Equipment Market Industry Trends & Analysis

The global track laying equipment market is poised for robust growth, driven by escalating investments in railway infrastructure development worldwide. This surge is underpinned by government initiatives to expand high-speed rail networks, enhance freight transportation capabilities, and modernize urban transit systems. The increasing urbanization and the need for sustainable transportation solutions are significant growth catalysts, fueling demand for new construction equipment and renewal equipment. Technological disruptions are continuously reshaping the industry, with a focus on automation, digitalization, and the integration of AI and IoT for enhanced operational efficiency and predictive maintenance. Track-laying machines equipped with advanced GPS guidance systems, real-time data analytics, and robotic components are gaining traction, promising reduced project timelines and improved safety outcomes. Consumer preferences are increasingly leaning towards equipment that offers higher productivity, lower operating costs, and greater adaptability to varied project requirements, including different track gauges and terrains. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a growing emphasis on after-sales services and support. The compound annual growth rate (CAGR) for the forecast period is estimated at XX%, reflecting a healthy expansion trajectory. Market penetration is expected to deepen as developing economies accelerate their rail infrastructure projects, further integrating advanced track laying technologies. The trend towards electrification of rail networks also indirectly fuels demand for specialized equipment capable of handling the unique requirements of electrified lines.

Leading Markets & Segments in Track Laying Equipment Market

The heavy rail segment is currently the dominant application within the track laying equipment market, driven by extensive freight and passenger rail networks globally. Countries with substantial railway expansion plans, such as China and India, are leading the market, supported by favorable economic policies and significant infrastructure spending. The new construction equipment segment also holds a substantial market share, reflecting ongoing efforts to build new railway lines, especially high-speed corridors and dedicated freight routes.

- Dominant Region: Asia-Pacific, due to massive ongoing railway projects and government investments in connectivity, particularly in China and India.

- Dominant Country: China, leading in both high-speed rail construction and the deployment of advanced track laying machinery.

- Key Drivers for Heavy Rail: Increased freight traffic, expansion of long-distance passenger services, and the need for upgraded infrastructure to handle higher speeds and capacities.

- Key Drivers for New Construction Equipment: Government stimulus packages for infrastructure development, economic growth spurring demand for efficient logistics, and the ongoing expansion of high-speed rail networks.

The more than 12 Tonnes lifting capacity segment is crucial for heavy-duty track laying operations, particularly in the construction of new lines and the replacement of worn-out sections in heavy rail applications. This segment benefits from large-scale infrastructure projects that require robust and powerful machinery.

- Dominance Analysis (Lifting Capacity): Equipment with higher lifting capacities are indispensable for handling heavy rails, sleepers, and ballast required for mainline railways and large-scale construction projects. This demand is projected to grow consistently as projects become more ambitious in scale.

- Segmental Dominance (Type): While new construction is significant, the renewal equipment segment is also experiencing steady growth as older rail networks require modernization and maintenance to meet current operational standards and safety regulations.

- Application Dominance: The heavy rail application is the primary driver of the market due to the sheer volume of track laid and maintained. However, the urban rail segment is experiencing rapid growth, fueled by the expansion of metro and light rail systems in major cities worldwide.

Track Laying Equipment Market Product Developments

The track laying equipment market is witnessing a continuous stream of product innovations aimed at enhancing efficiency, safety, and sustainability. Manufacturers are focusing on developing automated track laying machines that leverage advanced robotics and AI for precise alignment and installation. These advancements reduce reliance on manual labor, minimize errors, and significantly speed up construction timelines. Digital integration, including GPS navigation, real-time monitoring, and data analytics, is becoming standard, allowing for better project management and predictive maintenance. The development of versatile machines capable of handling different track types and terrains, along with improved fuel efficiency and reduced emissions, further strengthens their market appeal and competitive advantage.

Key Drivers of Track Laying Equipment Market Growth

The growth of the track laying equipment market is propelled by several key factors. Firstly, significant government investments in railway infrastructure expansion, particularly in emerging economies, are driving demand for new track construction and modernization. Secondly, the global push towards sustainable transportation solutions and the increasing adoption of high-speed rail networks necessitate advanced track laying machinery. Thirdly, technological advancements, including automation, digitalization, and the development of more efficient and versatile equipment, are enhancing productivity and reducing operational costs. The growing need for railway renewal and maintenance to ensure safety and operational efficiency also contributes significantly to market expansion.

Challenges in the Track Laying Equipment Market Market

Despite the positive growth trajectory, the track laying equipment market faces several challenges. High initial investment costs for advanced machinery can be a barrier for smaller contractors and developing regions. Stringent regulatory requirements and safety standards, while ensuring quality, can increase development and compliance costs. Supply chain disruptions, particularly for specialized components, can lead to project delays and increased expenses. Furthermore, the availability of skilled labor to operate and maintain complex machinery can be a constraint in certain markets. Intense competition among established players and the emergence of new entrants also exert pressure on pricing and profit margins.

Emerging Opportunities in Track Laying Equipment Market

The track laying equipment market presents numerous emerging opportunities for growth and innovation. The rapid expansion of high-speed rail networks globally, coupled with massive infrastructure development projects in emerging economies, offers substantial market potential. The increasing focus on urban rail and metro systems in densely populated areas creates a dedicated demand for specialized, compact, and efficient track laying solutions. Furthermore, the integration of smart technologies, such as AI-powered diagnostics and autonomous operation, presents opportunities for differentiation and value-added services. Strategic partnerships between equipment manufacturers and rail infrastructure developers can lead to customized solutions and long-term contracts, fostering market penetration and customer loyalty. The global trend towards decarbonization also encourages the development of more eco-friendly and energy-efficient track laying equipment.

Leading Players in the Track Laying Equipment Market Sector

- Simplex Engineering and Foundry Works Pvt Lt

- Techne Kirow GmbH

- Geismar

- CRRC Corporation Limited

- Effiage Infra-Rail

- Salcef Group SpA

- Weihua Group

- Plasser & Theurer

- Vossloh AG

- Matisa Matariel Industriel SA

- BEML India

- Harsco Corporation (Enviri)

Key Milestones in Track Laying Equipment Market Industry

- February 2024: Ozbir Vagon, a Turkey-based company, unveiled its new track machines for deployment in Switzerland as part of a project by national operator SBB Bahninfrastruktur. Ozbir Vagon, in collaboration with Harsco Rail, will supply 59 units of track equipment to SBB Bahninfrastruktur.

- January 2024: The Malaysian government announced that 41.5% of the East Coast Rail Link (ECRL) track-laying was completed in its first phase, utilizing the CCPG-500A track-laying machine capable of laying 1.5 to 2 km per day. This machine will subsequently be deployed for track installation between KPC and Temerloh.

- November 2023: Chinese authorities announced plans to commence track laying for a 46.9 km direct high-speed railway between China and Vietnam, operating at 200 km/hr. The project will utilize on-site track-laying machines for seamless completion.

Strategic Outlook for Track Laying Equipment Market Market

The strategic outlook for the track laying equipment market is highly optimistic, driven by sustained global investments in railway infrastructure. Growth accelerators include the ongoing expansion of high-speed rail networks, the development of urban transit systems, and the increasing demand for freight transportation efficiency. Manufacturers are expected to focus on technological innovation, particularly in automation and digitalization, to enhance productivity and reduce project costs. Strategic partnerships and collaborations will be crucial for market penetration and for developing tailor-made solutions for diverse regional requirements. The market's future potential lies in its ability to support sustainable transportation goals and contribute to the modernization of global rail networks. Companies that can offer advanced, reliable, and eco-friendly track laying solutions are well-positioned for long-term success.

Track Laying Equipment Market Segmentation

-

1. Type

- 1.1. New Construction Equipment

- 1.2. Renewal Equipment

-

2. Application

- 2.1. Heavy Rail

- 2.2. Urban Rail

-

3. Lifting Capacity

- 3.1. Up to 9 Tonnes

- 3.2. 9-12 Tonnes

- 3.3. More than 12 Tonnes

Track Laying Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Track Laying Equipment Market Regional Market Share

Geographic Coverage of Track Laying Equipment Market

Track Laying Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Investments to Expand the Railway Network is Expected to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Maintenance and Renewal Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The New Construction Equipment Segment is Dominating the Track-Laying Equipment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Construction Equipment

- 5.1.2. Renewal Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Heavy Rail

- 5.2.2. Urban Rail

- 5.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 5.3.1. Up to 9 Tonnes

- 5.3.2. 9-12 Tonnes

- 5.3.3. More than 12 Tonnes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. New Construction Equipment

- 6.1.2. Renewal Equipment

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Heavy Rail

- 6.2.2. Urban Rail

- 6.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 6.3.1. Up to 9 Tonnes

- 6.3.2. 9-12 Tonnes

- 6.3.3. More than 12 Tonnes

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. New Construction Equipment

- 7.1.2. Renewal Equipment

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Heavy Rail

- 7.2.2. Urban Rail

- 7.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 7.3.1. Up to 9 Tonnes

- 7.3.2. 9-12 Tonnes

- 7.3.3. More than 12 Tonnes

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. New Construction Equipment

- 8.1.2. Renewal Equipment

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Heavy Rail

- 8.2.2. Urban Rail

- 8.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 8.3.1. Up to 9 Tonnes

- 8.3.2. 9-12 Tonnes

- 8.3.3. More than 12 Tonnes

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Track Laying Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. New Construction Equipment

- 9.1.2. Renewal Equipment

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Heavy Rail

- 9.2.2. Urban Rail

- 9.3. Market Analysis, Insights and Forecast - by Lifting Capacity

- 9.3.1. Up to 9 Tonnes

- 9.3.2. 9-12 Tonnes

- 9.3.3. More than 12 Tonnes

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Simplex Engineering and Foundry Works Pvt Lt

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Techne Kirow GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Geismar

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CRRC Corporation Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Effiage Infra-Rail

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Salcef Group SpA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Weihua Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Plasser & Theurer

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vossloh AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Matisa Matariel Industriel SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BEML India

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Harsco Corporation (Enviri)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Simplex Engineering and Foundry Works Pvt Lt

List of Figures

- Figure 1: Global Track Laying Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 7: North America Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 8: North America Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 15: Europe Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 16: Europe Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 23: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 24: Asia Pacific Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Track Laying Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Track Laying Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Track Laying Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Rest of the World Track Laying Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Track Laying Equipment Market Revenue (Million), by Lifting Capacity 2025 & 2033

- Figure 31: Rest of the World Track Laying Equipment Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 32: Rest of the World Track Laying Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Track Laying Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 4: Global Track Laying Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 8: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 15: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 24: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Track Laying Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Track Laying Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Track Laying Equipment Market Revenue Million Forecast, by Lifting Capacity 2020 & 2033

- Table 33: Global Track Laying Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Track Laying Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Track Laying Equipment Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Track Laying Equipment Market?

Key companies in the market include Simplex Engineering and Foundry Works Pvt Lt, Techne Kirow GmbH, Geismar, CRRC Corporation Limited, Effiage Infra-Rail, Salcef Group SpA, Weihua Group, Plasser & Theurer, Vossloh AG, Matisa Matariel Industriel SA, BEML India, Harsco Corporation (Enviri).

3. What are the main segments of the Track Laying Equipment Market?

The market segments include Type, Application, Lifting Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 678.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Investments to Expand the Railway Network is Expected to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The New Construction Equipment Segment is Dominating the Track-Laying Equipment Market.

7. Are there any restraints impacting market growth?

High Cost of Maintenance and Renewal Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Ozbir Vagon, a Turkey-based company, unveiled its new track machines to be deployed in Switzerland as part of the project undertaken by the national operator SBB Bahninfrastruktur. The company also announced that, along with Harsco Rail, it is tasked with supplying 59 units of track equipment to SBB Bahninfrastruktur.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Track Laying Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Track Laying Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Track Laying Equipment Market?

To stay informed about further developments, trends, and reports in the Track Laying Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence