Key Insights

The South African automotive hydraulic actuators market is projected for substantial growth, with an estimated market size of 23576.68 million in the 2025 base year. The industry anticipates a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period. This expansion is propelled by the escalating demand for improved vehicle performance, advanced safety features, and enhanced fuel efficiency. Key growth catalysts include the increasing integration of Advanced Driver-Assistance Systems (ADAS), which necessitate precise hydraulic actuation for functionalities such as adaptive cruise control and automatic emergency braking. Moreover, the robust expansion of the passenger vehicle segment, alongside consistent demand from the commercial vehicle sector for applications like automatic transmissions and power steering systems, will significantly contribute to market penetration. The automotive electrification trend is also fostering innovation, driving the development of specialized hydraulic actuators for electric vehicle (EV) powertrains and thermal management solutions.

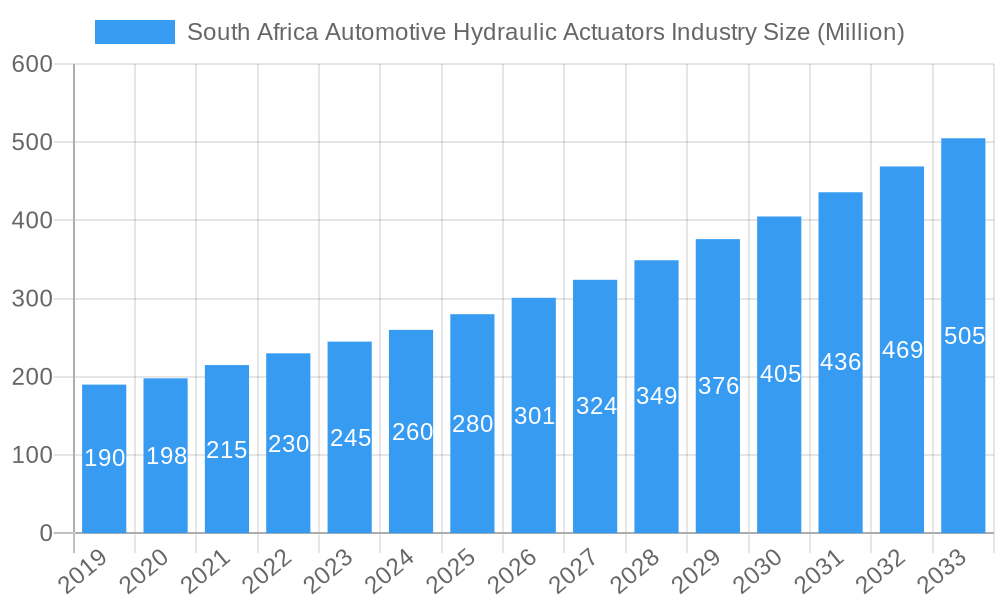

South Africa Automotive Hydraulic Actuators Industry Market Size (In Billion)

While the market demonstrates a positive trajectory, certain challenges may influence its growth. Volatility in raw material pricing, particularly for specialized alloys and hydraulic fluids, can affect manufacturing expenses and profitability. The ongoing shift towards electric vehicles, potentially reducing the long-term reliance on conventional hydraulic systems in specific applications, also represents a future consideration. Nevertheless, the inherent strengths of hydraulic actuators, including their durability, precision, and high power density, ensure their continued importance across numerous automotive functions. Dominant market segments encompass throttle actuators, seat adjustment actuators, and braking actuators, all critical components in contemporary vehicle design and operation. Leading industry participants such as Denso Corporation, Nidec Corporation, and Continental AG are actively investing in research and development to drive innovation and sustain their competitive standing within the dynamic South African automotive hydraulic actuators landscape.

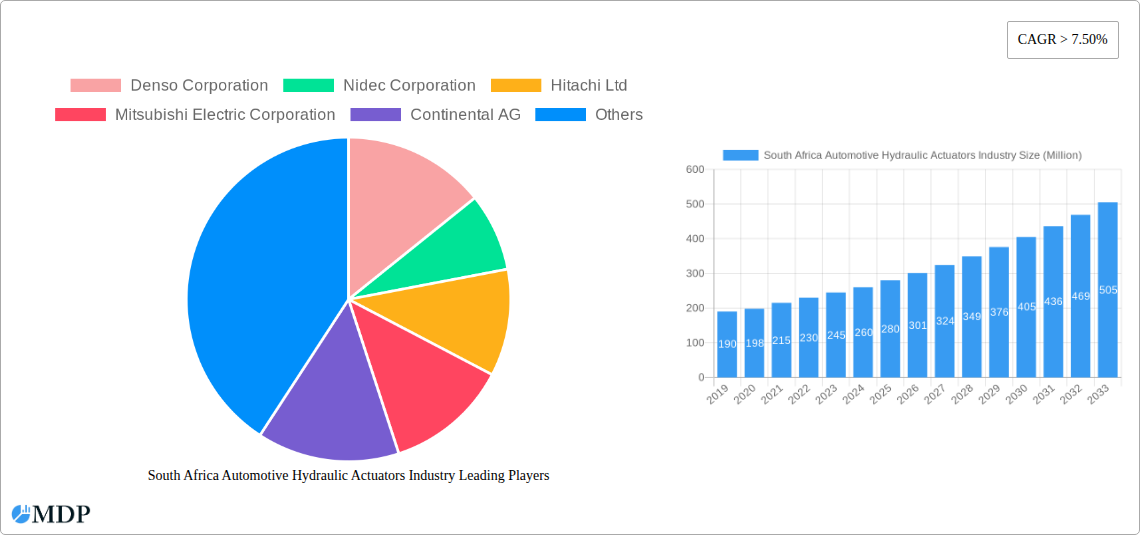

South Africa Automotive Hydraulic Actuators Industry Company Market Share

South Africa Automotive Hydraulic Actuators Market Report: Dynamics, Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the South Africa Automotive Hydraulic Actuators industry, a critical component in modern vehicle functionality and performance. We delve into market dynamics, explore key trends, identify leading segments, and provide strategic insights for stakeholders. The study period spans from 2019 to 2033, with a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024. Our analysis incorporates high-traffic keywords relevant to automotive components, hydraulic systems, and the South African market to maximize search visibility and attract industry participants including manufacturers, suppliers, automotive OEMs, and investors.

South Africa Automotive Hydraulic Actuators Industry Market Dynamics & Concentration

The South African automotive hydraulic actuators market exhibits a moderate concentration, with a few dominant players vying for market share. Key innovation drivers include the increasing demand for advanced driver-assistance systems (ADAS), enhanced fuel efficiency, and sophisticated comfort features. Regulatory frameworks, particularly those concerning vehicle safety and emissions, significantly influence product development and adoption. Product substitutes, such as electric actuators, are gaining traction, posing a competitive threat, although hydraulic actuators still hold a strong position due to their robustness and cost-effectiveness in certain applications. End-user trends are shifting towards vehicles with more automated functions and improved driving experiences, necessitating sophisticated actuation systems. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate their market position, expand their product portfolios, and acquire technological capabilities. Based on our analysis, the market share for key players is estimated to be distributed, with no single entity holding over 30% of the market. Projected M&A deal counts are expected to be between 2 to 5 significant transactions throughout the forecast period.

South Africa Automotive Hydraulic Actuators Industry Industry Trends & Analysis

The South Africa automotive hydraulic actuators industry is poised for substantial growth, driven by a confluence of factors including an expanding automotive production base and an increasing adoption of advanced vehicle technologies. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). This growth is fueled by the rising demand for sophisticated actuator systems that enhance vehicle performance, safety, and driver comfort. Technological disruptions, particularly in the realm of electrification and mechatronics, are reshaping the competitive landscape. While hydraulic actuators remain prevalent, there's a discernible trend towards hybrid solutions and the integration of electronic controls for greater precision and efficiency. Consumer preferences are increasingly leaning towards vehicles equipped with automated functions such as advanced parking assistance, adaptive cruise control, and sophisticated seat adjustment systems, all of which rely heavily on advanced actuation technologies. The competitive dynamics are characterized by intense innovation, strategic collaborations, and a focus on cost optimization to maintain market penetration. The market penetration of advanced hydraulic actuators is expected to reach 65% by 2033, driven by both OEM demand and aftermarket replacements. The shift towards more fuel-efficient and environmentally friendly vehicles also necessitates the use of lightweight and highly efficient actuation systems, further bolstering the market for advanced hydraulic actuators. Furthermore, the increasing stringency of automotive safety regulations worldwide is indirectly driving the demand for reliable and responsive hydraulic actuator systems that contribute to braking, steering, and other critical functions. The growing middle class in South Africa and their increasing purchasing power for new vehicles also contribute to the overall market expansion.

Leading Markets & Segments in South Africa Automotive Hydraulic Actuators Industry

Within the South African automotive hydraulic actuators industry, the Passenger Car segment is the dominant force, accounting for an estimated 70% of the total market revenue. This dominance is driven by several factors, including the higher sales volumes of passenger vehicles compared to commercial vehicles and the increasing integration of comfort and convenience features in this segment.

- Passenger Car Dominance:

- Economic Policies: Favorable economic policies supporting vehicle manufacturing and import duties on finished vehicles encourage local assembly and component sourcing, boosting demand for actuators in passenger cars.

- Consumer Preferences: South African consumers show a strong preference for passenger cars equipped with features like power seats, automatic transmissions, and advanced climate control systems, all of which utilize hydraulic actuators.

- Aftermarket Demand: The large installed base of passenger cars in South Africa translates to significant aftermarket demand for replacement hydraulic actuators.

The Application Type segment is led by Throttle Actuators and Brake Actuators, each contributing significantly to market revenue, followed by Seat Adjustment Actuators.

- Throttle Actuators: Essential for engine management and emissions control, throttle actuators are critical components in all internal combustion engine vehicles, thus ensuring consistent demand.

- Brake Actuators: With increasing emphasis on vehicle safety and the adoption of advanced braking systems like ABS and ESC, brake actuators represent a crucial and growing segment.

- Seat Adjustment Actuators: The demand for enhanced driver and passenger comfort in passenger cars fuels the growth of seat adjustment actuators, especially in higher trim levels.

- Closure Actuators: While a smaller segment, closure actuators for power tailgates and doors are gaining popularity in premium passenger vehicles.

The Commercial Vehicle segment, while smaller in volume, is characterized by its demand for robust and heavy-duty actuators for applications such as suspension systems and braking in trucks and buses.

South Africa Automotive Hydraulic Actuators Industry Product Developments

Product development in South Africa's automotive hydraulic actuators sector is primarily focused on enhancing efficiency, reducing weight, and improving responsiveness. Innovations include the development of more compact and lighter hydraulic actuator designs to meet stringent fuel economy standards. Furthermore, there's a growing trend towards integrating advanced sensor technology for precise control and feedback, enabling seamless integration with sophisticated electronic control units (ECUs). These developments are driven by the need to offer competitive advantages in terms of performance, durability, and cost-effectiveness, ensuring that hydraulic actuators remain a viable and attractive option for automotive manufacturers.

Key Drivers of South Africa Automotive Hydraulic Actuators Industry Growth

The growth of the South African automotive hydraulic actuators industry is propelled by several key factors. The increasing production of vehicles in the country, driven by OEM investments and export opportunities, directly translates to higher demand for automotive components. Furthermore, the evolving regulatory landscape, with a focus on enhanced vehicle safety and emissions standards, mandates the use of advanced actuation systems. The continuous technological advancements leading to more efficient and sophisticated hydraulic actuators also play a crucial role. Economic growth and rising disposable incomes in South Africa contribute to increased vehicle sales, thereby boosting the demand for actuators.

Challenges in the South Africa Automotive Hydraulic Actuators Industry Market

Despite the positive growth trajectory, the South African automotive hydraulic actuators market faces several challenges. The increasing competition from electric actuators, which offer distinct advantages in certain applications, poses a significant threat. Fluctuations in currency exchange rates can impact the cost of imported raw materials and finished components, affecting profitability. Supply chain disruptions, particularly for specialized components, can lead to production delays and increased costs. Furthermore, the overall economic volatility in South Africa can influence consumer spending on new vehicles, thereby impacting demand for actuators.

Emerging Opportunities in South Africa Automotive Hydraulic Actuators Industry

The South African automotive hydraulic actuators industry is ripe with emerging opportunities. The increasing adoption of electric vehicles (EVs) presents an opportunity for developing specialized hydraulic actuation systems tailored for EV powertrains and thermal management. Strategic partnerships between local actuator manufacturers and global Tier-1 suppliers can facilitate technology transfer and enhance manufacturing capabilities. The growing demand for advanced driver-assistance systems (ADAS) and autonomous driving features will create a need for more sophisticated and integrated hydraulic actuation solutions. Furthermore, the aftermarket segment for maintenance and repair of existing vehicle fleets presents a sustained revenue stream.

Leading Players in the South Africa Automotive Hydraulic Actuators Industry Sector

- Denso Corporation

- Nidec Corporation

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- BorgWarner Inc

- Robert Bosch GmbH

- Aptiv Plc

Key Milestones in South Africa Automotive Hydraulic Actuators Industry Industry

- 2019: Introduction of stricter emissions standards impacting actuator design for improved fuel efficiency.

- 2020: Global supply chain disruptions due to the COVID-19 pandemic leading to increased lead times for critical components.

- 2021: Significant investment by a major OEM in South Africa, boosting local component manufacturing and demand.

- 2022: Increased focus on ADAS development leading to the integration of more advanced hydraulic actuators in new vehicle models.

- 2023: Growing interest in hybrid actuator solutions to bridge the gap between traditional hydraulic and fully electric systems.

- 2024: Continued exploration of lightweight materials and advanced control algorithms for hydraulic actuators.

Strategic Outlook for South Africa Automotive Hydraulic Actuators Industry Market

The strategic outlook for the South African automotive hydraulic actuators market remains positive, with growth accelerators including the expansion of the local automotive manufacturing sector and the increasing integration of advanced vehicle technologies. Companies that focus on innovation, particularly in developing more efficient, compact, and electronically controlled hydraulic actuators, will be well-positioned for success. Strategic collaborations with OEMs and other industry players will be crucial for market penetration and technological advancement. The aftermarket segment also presents significant opportunities for steady revenue generation. Embracing a customer-centric approach, understanding evolving automotive trends, and adapting to regulatory changes will be vital for sustained growth and market leadership.

South Africa Automotive Hydraulic Actuators Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Throttle Actuator

- 2.2. Seat Adjustment Actuator

- 2.3. Brake Actuator

- 2.4. Closure Actuator

- 2.5. Others

South Africa Automotive Hydraulic Actuators Industry Segmentation By Geography

- 1. South Africa

South Africa Automotive Hydraulic Actuators Industry Regional Market Share

Geographic Coverage of South Africa Automotive Hydraulic Actuators Industry

South Africa Automotive Hydraulic Actuators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for ADAS Integration

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive Hydraulic Actuators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle Actuator

- 5.2.2. Seat Adjustment Actuator

- 5.2.3. Brake Actuator

- 5.2.4. Closure Actuator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nidec Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BorgWarner Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aptiv Pl

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: South Africa Automotive Hydraulic Actuators Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive Hydraulic Actuators Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: South Africa Automotive Hydraulic Actuators Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive Hydraulic Actuators Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the South Africa Automotive Hydraulic Actuators Industry?

Key companies in the market include Denso Corporation, Nidec Corporation, Hitachi Ltd, Mitsubishi Electric Corporation, Continental AG, BorgWarner Inc, Robert Bosch GmbH, Aptiv Pl.

3. What are the main segments of the South Africa Automotive Hydraulic Actuators Industry?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23576.68 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for ADAS Integration.

6. What are the notable trends driving market growth?

Rising Demand for Fuel-Efficient Vehicles Will Help the Hydraulic Actuators Market to Grow.

7. Are there any restraints impacting market growth?

High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive Hydraulic Actuators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive Hydraulic Actuators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive Hydraulic Actuators Industry?

To stay informed about further developments, trends, and reports in the South Africa Automotive Hydraulic Actuators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence