Key Insights

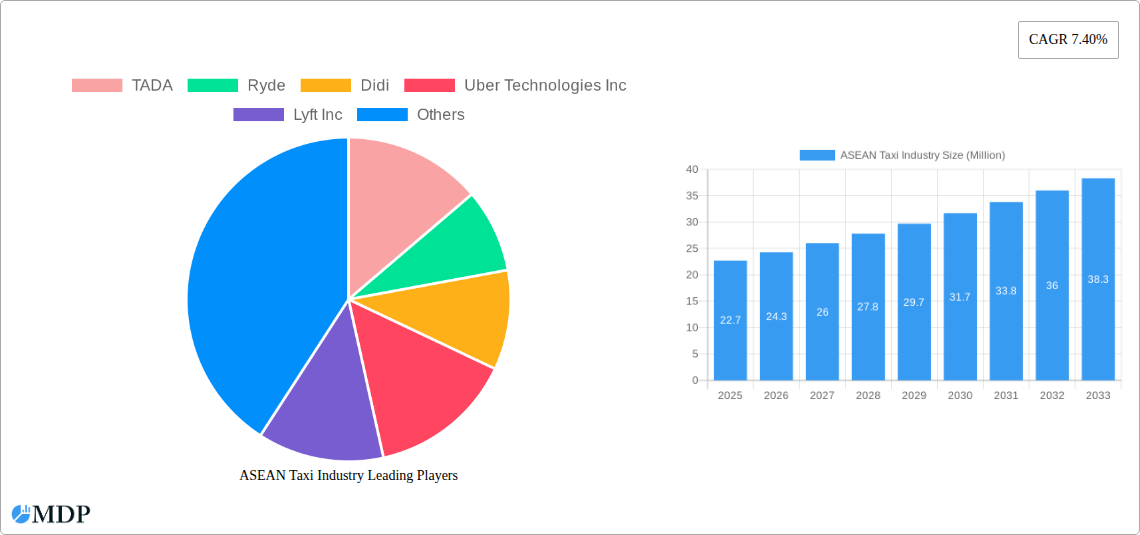

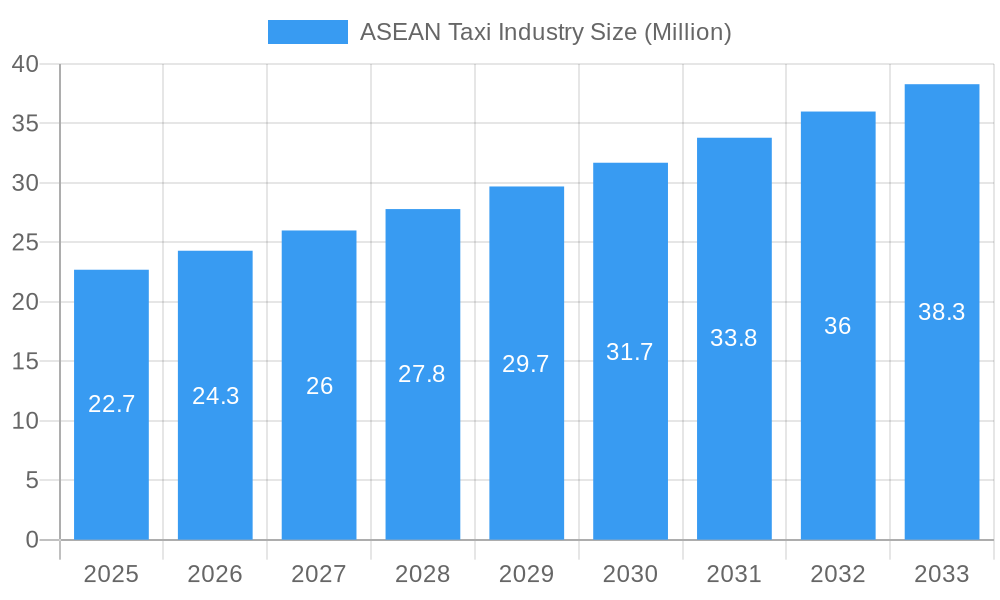

The ASEAN taxi industry is poised for substantial growth, projected to reach USD 22.70 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.40% throughout the forecast period of 2025-2033. This expansion is fueled by a confluence of factors, including the increasing adoption of ride-hailing services, particularly through online booking platforms, which have revolutionized urban mobility across Southeast Asia. The convenience and affordability offered by these digital solutions, alongside the growing smartphone penetration and internet accessibility in the region, are primary drivers. Furthermore, a rising middle class with increased disposable income and a greater demand for convenient and efficient transportation options are propelling market expansion. The burgeoning tourism sector in many ASEAN nations also contributes significantly, as visitors increasingly rely on ride-hailing apps for seamless travel. The market is characterized by intense competition among key players like Grab, Gojek, and TADA, who are continuously innovating with new service offerings and loyalty programs to capture market share.

ASEAN Taxi Industry Market Size (In Million)

The market's trajectory is further shaped by evolving consumer preferences and technological advancements. While traditional offline taxi bookings still hold a presence, the clear trend is towards online platforms. Within vehicle types, cars remain dominant, but the growing popularity of motorcycles for ride-hailing, especially in congested urban areas, presents a significant growth avenue. The rise of ride-sharing, offering a more economical option for commuters, is also gaining traction. However, challenges such as regulatory hurdles in certain countries, infrastructure limitations, and intense price competition can act as restraining forces. Despite these, the underlying demand for efficient, accessible, and technology-enabled transportation in the rapidly urbanizing and developing ASEAN region ensures a dynamic and promising outlook for the taxi and ride-hailing industry. Continuous investment in technology, driver empowerment, and diversified service portfolios will be crucial for sustained success.

ASEAN Taxi Industry Company Market Share

Here's the SEO-optimized and engaging report description for the ASEAN Taxi Industry, designed for maximum visibility and stakeholder attraction:

Report Description: ASEAN Taxi Industry Market Insights & Forecast 2019-2033

Unlock comprehensive insights into the dynamic ASEAN Taxi Industry with our definitive market report. Covering the period from 2019 to 2033, with a deep dive into the Base Year 2025 and an extensive Forecast Period of 2025-2033, this report is your essential guide to navigating one of the fastest-growing transportation sectors in Southeast Asia. We analyze the market concentration, innovation drivers, regulatory frameworks, and evolving end-user trends shaping the future of ride-hailing and ride-sharing. Understand the competitive landscape featuring key players like Grab Holdings Inc., PT Gojek, TADA, Ryde, Didi, Uber Technologies Inc., Lyft Inc., Public Cab Sdn Bhd, and Blue Cab Malaysia. Delve into segment-specific analyses across Online and Offline Booking Types, Motorcycles, Cars, and Other Vehicle Types, and for Service Types including Ride Hailing and Ride Sharing.

ASEAN Taxi Industry Market Dynamics & Concentration

The ASEAN Taxi Industry is characterized by intense competition and rapid evolution, with market concentration heavily influenced by the dominance of major ride-hailing platforms. Grab Holdings Inc. consistently holds a significant market share across most key economies, followed closely by PT Gojek, TADA, and Ryde. While new entrants and localized players like Public Cab Sdn Bhd and Blue Cab Malaysia attempt to capture niche markets, the landscape remains largely consolidated by these dominant forces. Innovation drivers are primarily technological, focusing on app enhancements, AI-powered dispatch, and seamless payment integration. Regulatory frameworks vary significantly across ASEAN nations, impacting operational flexibility and market entry for both established and emerging companies. Product substitutes include traditional taxis, public transport, and increasingly, personal vehicle ownership, though the convenience and accessibility of app-based services continue to erode their market share. End-user trends lean towards on-demand mobility solutions, prioritizing speed, affordability, and user experience. Mergers and Acquisitions (M&A) activities have been instrumental in shaping this concentration, with significant past transactions solidifying market positions and eliminating potential competitors. For instance, historical M&A deal counts indicate a trend towards consolidation rather than fragmented acquisition. Understanding these dynamics is crucial for stakeholders aiming to thrive in this competitive environment.

ASEAN Taxi Industry Industry Trends & Analysis

The ASEAN Taxi Industry is poised for robust growth, driven by an escalating demand for convenient and accessible transportation solutions across the region. The Compound Annual Growth Rate (CAGR) is projected to be substantial throughout the forecast period, fueled by increasing urbanization, a burgeoning middle class, and a growing young, tech-savvy population. Market penetration for ride-hailing services continues to expand, particularly in Tier 2 and Tier 3 cities, as smartphone adoption and internet connectivity become more widespread. Technological disruptions are at the forefront of this evolution, with advancements in Artificial Intelligence (AI) for route optimization, demand prediction, and driver management significantly enhancing operational efficiency. The integration of electric vehicles (EVs) into ride-hailing fleets is an emerging trend, driven by environmental concerns and government incentives, promising a more sustainable future for urban mobility. Consumer preferences are increasingly shifting towards personalized mobility experiences, with a growing emphasis on safety features, transparent pricing, and diverse vehicle options. This has led companies to invest heavily in app features that offer real-time tracking, driver ratings, and in-app safety measures. The competitive dynamics are intense, characterized by aggressive pricing strategies, lucrative driver incentives, and innovative service offerings designed to capture and retain market share. Companies like Grab Holdings Inc. and PT Gojek are not only focusing on ride-hailing but also expanding into adjacent services such as food delivery and digital payments, creating integrated ecosystems that foster customer loyalty. The influence of Uber Technologies Inc. and Lyft Inc., while more established in Western markets, also plays a role in setting global standards and driving innovation within the sector. Furthermore, the increasing adoption of ride-sharing models, where multiple passengers share a single ride, is contributing to cost-effectiveness and reduced traffic congestion, appealing to a wider demographic of users. The industry is also witnessing a rise in specialized services, catering to specific needs such as female drivers for female passengers or premium vehicle options, further diversifying the market.

Leading Markets & Segments in ASEAN Taxi Industry

The ASEAN Taxi Industry exhibits distinct leadership across various geographical markets and service segments. Dominant Regions and Countries: Southeast Asia, particularly countries like Indonesia, Thailand, Vietnam, and the Philippines, represent the leading markets due to their large, young, and increasingly urbanized populations, coupled with high smartphone penetration rates. Singapore, despite its smaller size, is a highly developed market with sophisticated infrastructure and a strong reliance on app-based transportation. Booking Type Dominance: The Online booking type significantly dominates the market, driven by the widespread adoption of ride-hailing applications. This segment benefits from convenience, real-time tracking, cashless payments, and user reviews, making it the preferred choice for the majority of consumers. Offline bookings, while still present, are gradually declining as traditional taxi services integrate more digital solutions or lose out to the superior user experience of online platforms. Vehicle Type Landscape: Cars constitute the largest segment within vehicle types, offering a balance of comfort, capacity, and affordability for everyday commuting and travel. Motorcycles are a rapidly growing segment, particularly in densely populated urban areas and emerging economies, offering a cost-effective and agile alternative for short-distance travel, often referred to as "ojek" or "moto-taxi." Other Vehicle Types, such as vans and premium cars, cater to specific needs like group travel or executive transport, contributing to market diversification. Service Type Segmentation: Ride Hailing is the cornerstone of the ASEAN taxi industry, encompassing the on-demand booking of private vehicles through digital platforms. This service type benefits from its direct consumer-to-driver connection, offering unparalleled flexibility and accessibility. Ride Sharing, where multiple passengers traveling in the same direction share a ride, is also gaining traction as a more sustainable and cost-effective option. Key drivers for dominance in these segments include favorable economic policies promoting digital adoption, continuous infrastructure development supporting connectivity, and a growing consumer appetite for convenient, affordable, and technology-enabled mobility solutions. The expansion of these services into non-metropolitan areas also contributes to their widespread adoption and market penetration.

ASEAN Taxi Industry Product Developments

Product innovation in the ASEAN Taxi Industry centers on enhancing user experience, operational efficiency, and safety. Companies are continuously developing advanced AI algorithms for smarter dispatch systems, predictive demand forecasting, and personalized route planning. Key features include in-app safety buttons, real-time driver verification, and carbon footprint tracking for eco-conscious rides. Competitive advantages are being built through seamless integration with digital wallets, loyalty programs, and partnerships with local businesses for bundled service offerings. The adoption of electric vehicles (EVs) is a significant product development, aligning with sustainability goals and offering quieter, cleaner rides.

Key Drivers of ASEAN Taxi Industry Growth

The ASEAN Taxi Industry is propelled by several powerful growth drivers. Technological advancements in mobile internet, smartphone penetration, and AI are fundamental, enabling the seamless operation of ride-hailing platforms. Economic growth and rising disposable incomes across Southeast Asia are increasing the demand for convenient personal transportation. Urbanization leads to higher population densities and greater reliance on efficient mobility solutions. Furthermore, supportive government initiatives aimed at fostering digital economies and improving urban infrastructure create a conducive environment for growth.

Challenges in the ASEAN Taxi Industry Market

Despite its rapid growth, the ASEAN Taxi Industry faces significant challenges. Regulatory hurdles and varying compliance standards across different countries can impede market expansion and operational uniformity. Intense competition leads to price wars and reduced profit margins, impacting the sustainability of smaller players. Driver acquisition and retention remain a constant challenge, influenced by incentives, working conditions, and alternative employment opportunities. Infrastructure limitations in certain regions, such as poor road networks or inconsistent internet connectivity, can also hinder service reliability and reach.

Emerging Opportunities in ASEAN Taxi Industry

Emerging opportunities in the ASEAN Taxi Industry are ripe for innovation and expansion. The growing demand for sustainable transportation presents a significant avenue with the increasing adoption of electric vehicles and optimized routing to reduce emissions. Expansion into Tier 2 and Tier 3 cities offers untapped potential as these markets exhibit growing connectivity and a need for accessible mobility. Strategic partnerships with local businesses, tourism operators, and e-commerce platforms can create diversified revenue streams and enhanced customer value propositions.

Leading Players in the ASEAN Taxi Industry Sector

- Grab Holdings Inc.

- PT Gojek

- TADA

- Ryde

- Didi

- Uber Technologies Inc.

- Lyft Inc.

- Public Cab Sdn Bhd

- Blue Cab Malaysia

Key Milestones in ASEAN Taxi Industry Industry

- 2019: Increased investment in AI and machine learning for enhanced user experience by major players.

- 2020: Accelerated adoption of contactless payment options and enhanced safety protocols due to global health concerns.

- 2021: Significant expansion of ride-sharing services to optimize vehicle utilization and reduce costs.

- 2022: Growing focus on fleet electrification and sustainable mobility solutions across the region.

- 2023: Introduction of diversified services beyond core ride-hailing, including delivery and financial services, by leading platforms.

- 2024: Continued consolidation and strategic partnerships to strengthen market positions and expand service offerings.

Strategic Outlook for ASEAN Taxi Industry Market

The strategic outlook for the ASEAN Taxi Industry is characterized by sustained growth, driven by technological innovation and evolving consumer demands. Future growth accelerators include the expansion of electric vehicle fleets, further integration of mobility services into comprehensive lifestyle platforms, and targeted expansion into underserved urban and semi-urban areas. Companies that can successfully navigate regulatory landscapes, foster strong driver communities, and deliver a superior, personalized customer experience will be well-positioned for long-term success in this dynamic market.

ASEAN Taxi Industry Segmentation

-

1. Booking Type

- 1.1. Online

- 1.2. Offline

-

2. Vehicle Type

- 2.1. Motorcycles

- 2.2. Cars

- 2.3. Other Vehicle Types

-

3. Service Type

- 3.1. Ride Hailing

- 3.2. Ride Sharing

ASEAN Taxi Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

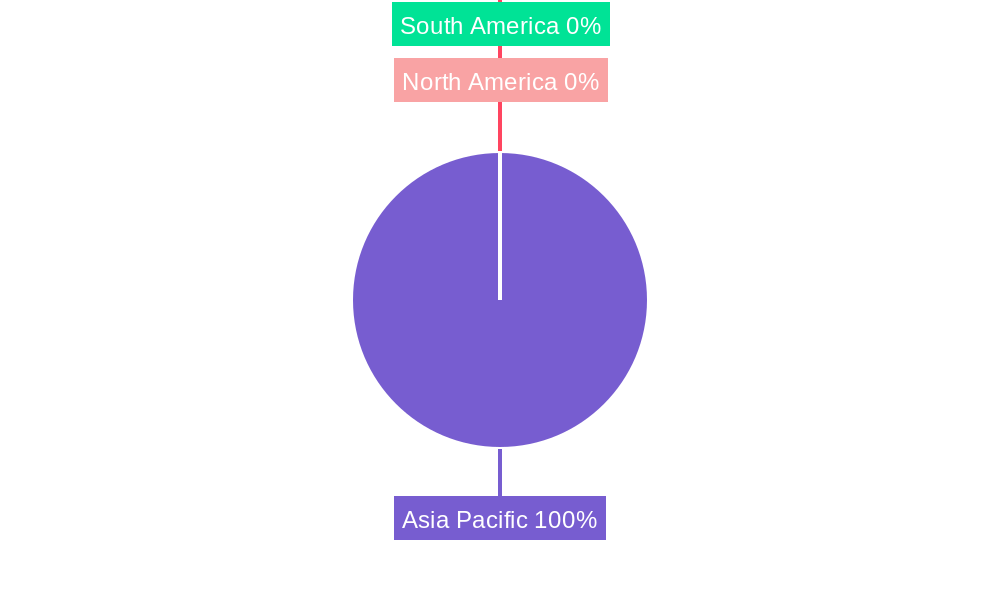

ASEAN Taxi Industry Regional Market Share

Geographic Coverage of ASEAN Taxi Industry

ASEAN Taxi Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand From Online Channel

- 3.3. Market Restrains

- 3.3.1. Increasing Traffic Problems And Reliability Issues

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of Online Channels for Booking Taxis

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Motorcycles

- 5.2.2. Cars

- 5.2.3. Other Vehicle Types

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Ride Hailing

- 5.3.2. Ride Sharing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. North America ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Motorcycles

- 6.2.2. Cars

- 6.2.3. Other Vehicle Types

- 6.3. Market Analysis, Insights and Forecast - by Service Type

- 6.3.1. Ride Hailing

- 6.3.2. Ride Sharing

- 6.1. Market Analysis, Insights and Forecast - by Booking Type

- 7. South America ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Motorcycles

- 7.2.2. Cars

- 7.2.3. Other Vehicle Types

- 7.3. Market Analysis, Insights and Forecast - by Service Type

- 7.3.1. Ride Hailing

- 7.3.2. Ride Sharing

- 7.1. Market Analysis, Insights and Forecast - by Booking Type

- 8. Europe ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Motorcycles

- 8.2.2. Cars

- 8.2.3. Other Vehicle Types

- 8.3. Market Analysis, Insights and Forecast - by Service Type

- 8.3.1. Ride Hailing

- 8.3.2. Ride Sharing

- 8.1. Market Analysis, Insights and Forecast - by Booking Type

- 9. Middle East & Africa ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Motorcycles

- 9.2.2. Cars

- 9.2.3. Other Vehicle Types

- 9.3. Market Analysis, Insights and Forecast - by Service Type

- 9.3.1. Ride Hailing

- 9.3.2. Ride Sharing

- 9.1. Market Analysis, Insights and Forecast - by Booking Type

- 10. Asia Pacific ASEAN Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Booking Type

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Motorcycles

- 10.2.2. Cars

- 10.2.3. Other Vehicle Types

- 10.3. Market Analysis, Insights and Forecast - by Service Type

- 10.3.1. Ride Hailing

- 10.3.2. Ride Sharing

- 10.1. Market Analysis, Insights and Forecast - by Booking Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TADA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ryde

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Didi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Uber Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lyft Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Public Cab Sdn Bhd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PT Gojek

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Blue Cab Malaysi

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Grab Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 TADA

List of Figures

- Figure 1: Global ASEAN Taxi Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 3: North America ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 4: North America ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 7: North America ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: North America ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 11: South America ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 12: South America ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: South America ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: South America ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: South America ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: South America ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 19: Europe ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 20: Europe ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Europe ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Europe ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 23: Europe ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 24: Europe ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 27: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 28: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 31: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 32: Middle East & Africa ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Booking Type 2025 & 2033

- Figure 35: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Booking Type 2025 & 2033

- Figure 36: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 37: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 39: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 40: Asia Pacific ASEAN Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific ASEAN Taxi Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global ASEAN Taxi Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 6: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 13: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 15: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 20: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 22: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 33: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 35: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global ASEAN Taxi Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 43: Global ASEAN Taxi Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 44: Global ASEAN Taxi Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 45: Global ASEAN Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific ASEAN Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Taxi Industry?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the ASEAN Taxi Industry?

Key companies in the market include TADA, Ryde, Didi, Uber Technologies Inc, Lyft Inc, Public Cab Sdn Bhd, PT Gojek, Blue Cab Malaysi, Grab Holdings Inc.

3. What are the main segments of the ASEAN Taxi Industry?

The market segments include Booking Type, Vehicle Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand From Online Channel.

6. What are the notable trends driving market growth?

Increasing Penetration of Online Channels for Booking Taxis.

7. Are there any restraints impacting market growth?

Increasing Traffic Problems And Reliability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Taxi Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Taxi Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Taxi Industry?

To stay informed about further developments, trends, and reports in the ASEAN Taxi Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence