Key Insights

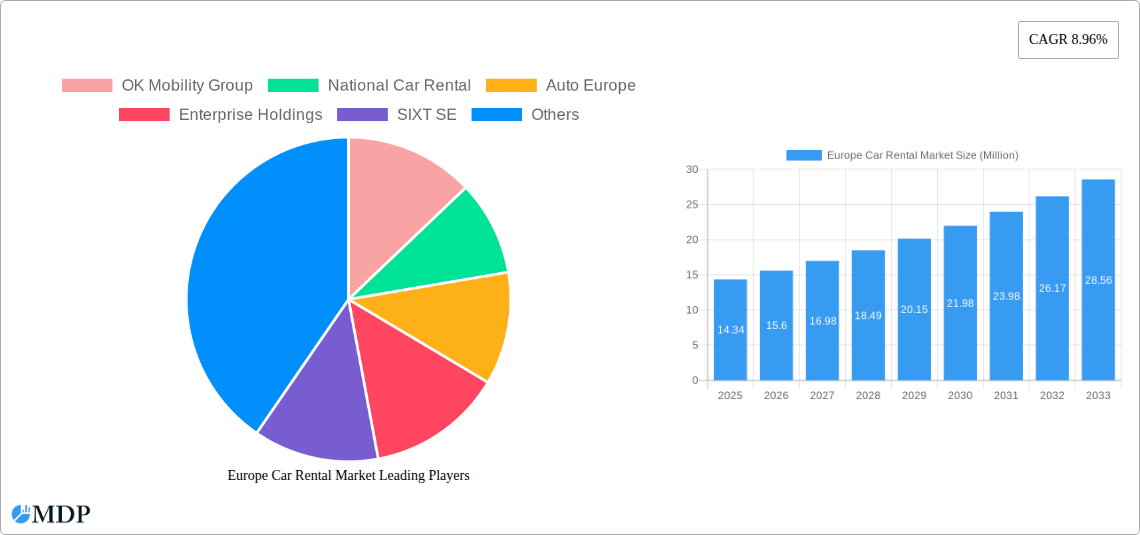

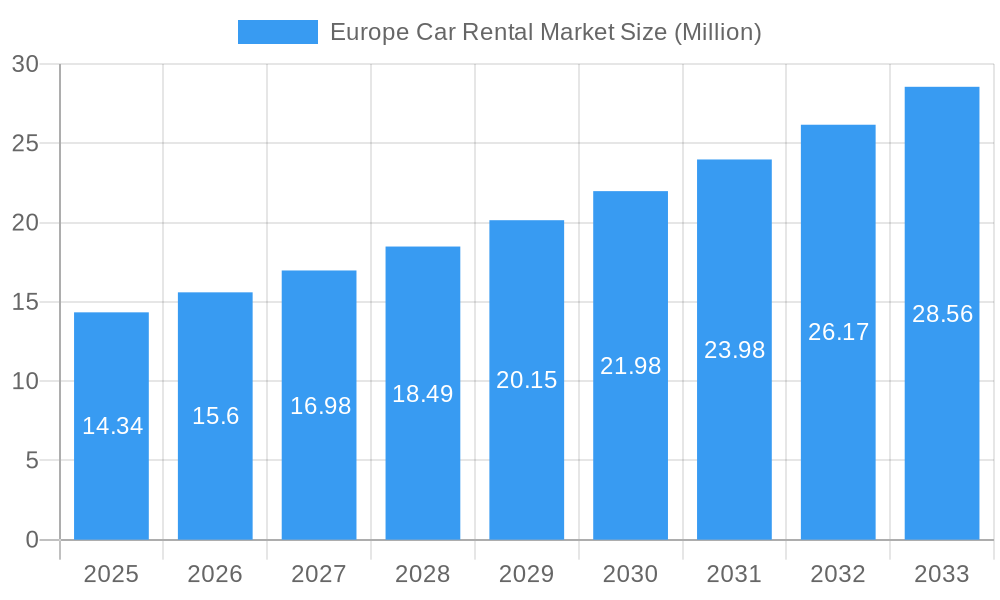

The Europe Car Rental Market is poised for significant expansion, currently valued at approximately 14.34 Million (in value units, presumed to be millions of Euros or USD, aligning with market size conventions). This robust growth is fueled by a projected Compound Annual Growth Rate (CAGR) of 8.96% over the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing demand for flexible and convenient transportation solutions for both leisure and business travelers across the continent. The resurgence of tourism post-pandemic, coupled with the growing need for efficient corporate travel arrangements, is directly contributing to market expansion. Furthermore, advancements in booking technologies and the proliferation of online platforms are making car rentals more accessible and appealing, particularly for short-term rentals that cater to spontaneous travel plans and local exploration. The convenience offered by these digital solutions is a key factor in attracting a broader customer base.

Europe Car Rental Market Market Size (In Million)

The market is segmented across various booking types, with a notable shift towards online bookings due to their ease of use and competitive pricing. Rental duration also plays a crucial role, with short-term rentals seeing substantial demand driven by weekend getaways and short business trips, while long-term rentals are gaining traction for extended stays and project-based corporate needs. The application types are diverse, encompassing both the leisure/tourism sector, which benefits from increased travel and exploration, and the business segment, which relies on rental cars for corporate mobility and employee travel. The vehicle types range from economical budget cars, preferred for cost-conscious travelers, to premium and luxury cars, catering to those seeking comfort and status. Key players like Enterprise Holdings, Hertz Global Holdings, and Europcar Mobility Group are strategically navigating this landscape by offering diverse fleets and innovative service models to capture market share across these segments and major European regions such as the United Kingdom, Germany, France, Italy, and Spain.

Europe Car Rental Market Company Market Share

Unveiling the Europe Car Rental Market: A Comprehensive Analysis for Strategic Decision-Making (2019-2033)

This in-depth report provides an authoritative analysis of the dynamic Europe car rental market, offering critical insights and actionable intelligence for industry stakeholders. Spanning the historical period from 2019 to 2024 and projecting forward to 2033, with a base year of 2025, this study is meticulously crafted to guide strategic planning, investment, and competitive positioning. Explore key trends, market drivers, challenges, and opportunities shaping the future of mobility across Europe. Delve into the intricacies of car hire Europe, vehicle rental Europe, and automotive rental Europe to understand evolving consumer preferences and emerging business models. With extensive coverage of segments including booking types (online car rental Europe, offline car hire Europe), rental durations (short-term car rental Europe, long-term vehicle rental Europe), applications (leisure car rental Europe, business car hire Europe), and vehicle types (economy car rental Europe, luxury car hire Europe), this report is an indispensable resource for navigating this complex and rapidly evolving landscape.

Europe Car Rental Market Market Dynamics & Concentration

The Europe car rental market exhibits a moderately concentrated landscape, with Enterprise Holdings holding a substantial market share, estimated to be around 20-25% by 2025. Major players like Europcar Mobility Group, Avis Budget Group Inc, and SIXT SE also command significant portions of the market, collectively accounting for over 50%. Innovation drivers include the burgeoning demand for electric vehicle (EV) rentals, enhanced digital booking platforms, and the integration of mobility-as-a-service (MaaS) solutions. Regulatory frameworks, particularly concerning environmental standards and data privacy, play a crucial role in shaping operational strategies. Product substitutes, such as ride-sharing services and public transportation, present ongoing competition, especially in urban centers. End-user trends point towards an increasing preference for flexible rental options, seamless online booking experiences, and a growing interest in premium and electric vehicles. Mergers and acquisitions (M&A) activities, though not pervasive, have occurred, with instances of consolidation to achieve economies of scale and expand geographic reach. The number of significant M&A deals in the past five years is estimated to be around 8-12, indicating a strategic but measured approach to market expansion.

Europe Car Rental Market Industry Trends & Analysis

The Europe car rental market is poised for robust growth, driven by a confluence of economic recovery, an uptick in tourism, and evolving consumer mobility needs. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be approximately 5.5% to 6.5%. Market penetration is expected to deepen, particularly in emerging economies within Europe. Technological disruptions are at the forefront, with the widespread adoption of AI-powered booking engines, advanced telematics for fleet management, and the integration of connected car technologies significantly enhancing operational efficiency and customer experience. The shift towards electric vehicles, while presenting initial challenges in terms of infrastructure and resale value, is becoming a key differentiator, with companies actively investing in EV fleets to meet sustainability goals and cater to eco-conscious travelers. Consumer preferences are increasingly leaning towards personalized rental solutions, on-demand services, and digital-first interactions. This is evident in the soaring popularity of online booking platforms, which are projected to capture over 70% of the market share by 2027. The competitive dynamics are intensifying, with established players innovating to stay ahead of new entrants and technology-driven disruptors. The focus is shifting from mere vehicle provision to offering comprehensive mobility solutions, encompassing car sharing, subscription services, and integrated travel planning. The market is witnessing a strategic push towards fleet diversification, with a growing emphasis on a mix of ICE, hybrid, and electric vehicles to cater to diverse customer needs and regulatory requirements. The rise of the gig economy and flexible work arrangements is also contributing to the demand for flexible rental durations, blurring the lines between short-term and long-term rentals. Furthermore, the increasing digitalization of travel itineraries and the growing reliance on smartphones for navigation and booking are creating new avenues for seamless integration of car rental services into broader travel ecosystems.

Leading Markets & Segments in Europe Car Rental Market

The Europe car rental market is significantly dominated by online booking channels, which are expected to account for approximately 75% of total bookings by 2033. This trend is fueled by the convenience, price transparency, and wide selection offered by online platforms, making online car rental Europe the preferred choice for a vast majority of consumers. Among application types, leisure/tourism remains the largest segment, projected to represent over 60% of the market share, propelled by the rebound in global travel and the growing appeal of European destinations. However, the business segment is showing resilient growth, driven by corporate travel policies and the need for flexible transportation solutions. In terms of rental duration, short-term rentals continue to be the primary driver, catering to vacationers and business travelers on shorter trips. Nonetheless, long-term rentals are gaining traction, particularly among individuals seeking alternatives to car ownership or requiring extended mobility during projects.

Dominant Booking Type:

- Online: Driven by ease of access, competitive pricing, and real-time availability updates. Key drivers include widespread internet penetration, smartphone adoption, and a strong preference for self-service options.

- Offline: Still relevant for specific demographics and complex corporate bookings, though its market share is steadily declining.

Dominant Application Type:

- Leisure/Tourism: Fueled by strong post-pandemic travel recovery, the allure of European cultural heritage, and the increasing accessibility of travel packages. Economic policies supporting tourism and improved travel infrastructure are crucial enablers.

- Business: Supported by the resurgence of corporate events, conferences, and the increasing need for flexible employee mobility solutions.

Dominant Vehicle Type:

- Economy/Budget Cars: Consistently the most popular choice due to their affordability and suitability for most travel needs. This segment benefits from cost-conscious travelers and the high volume of short-term rentals.

- Premium/Luxury Cars: Experiencing steady growth as a segment, catering to discerning travelers seeking comfort, status, and enhanced driving experiences.

Dominant Rental Duration:

- Short Term: Dominates due to the nature of leisure travel and frequent business trips. Factors like seasonal travel demand and ad-hoc transportation needs contribute to its prevalence.

- Long Term: Growing in prominence with the rise of subscription models and the desire for flexible mobility solutions outside traditional ownership.

Europe Car Rental Market Product Developments

Recent product developments in the Europe car rental market are centered on enhancing customer experience and fleet sustainability. The integration of AI-driven personalized recommendations for vehicle selection and add-on services is becoming more prevalent. Companies are also focusing on simplifying the rental process through advanced mobile apps for keyless entry and contactless pick-up/drop-off. Furthermore, the strategic deployment of connected car technology allows for real-time vehicle diagnostics, predictive maintenance, and improved fleet utilization, leading to significant operational cost savings. The competitive advantage lies in offering seamless digital integration, a diverse and sustainable fleet, and responsive customer support.

Key Drivers of Europe Car Rental Market Growth

Several key factors are propelling the Europe car rental market forward. The robust recovery of the tourism sector post-pandemic is a primary driver, with international and domestic travel increasing significantly. Technological advancements, such as the widespread adoption of online booking platforms and mobile applications, have streamlined the rental process and enhanced customer convenience. The growing demand for flexible mobility solutions, including short-term and long-term rentals, is also contributing to market expansion. Regulatory support for sustainable transportation, encouraging the adoption of electric and hybrid vehicles, is another significant growth catalyst. Economic stability and rising disposable incomes across Europe are further bolstering consumer spending on travel and mobility services.

Challenges in the Europe Car Rental Market Market

Despite its growth trajectory, the Europe car rental market faces several challenges. Intense competition from ride-sharing services and emerging mobility solutions puts pressure on pricing and market share. Fluctuations in fuel prices and the increasing cost of vehicle maintenance can impact profitability. Regulatory hurdles, particularly concerning emissions standards and the phased introduction of EVs, require continuous adaptation and investment in new fleet technologies. Supply chain disruptions can affect vehicle availability and fleet replenishment, leading to potential shortages during peak demand periods. The evolving landscape of car ownership models, such as car-sharing and subscription services, also presents a competitive challenge to traditional car rental.

Emerging Opportunities in Europe Car Rental Market

The Europe car rental market is ripe with emerging opportunities. The increasing consumer demand for sustainable and electric vehicle rentals presents a significant opportunity for companies to expand their EV fleets and cater to eco-conscious travelers. The integration of car rental services into broader MaaS platforms offers a chance to create bundled mobility packages and enhance customer loyalty. Partnerships with airlines, hotels, and online travel agencies can unlock new customer acquisition channels and create synergistic revenue streams. The growing popularity of remote work and digital nomadism is driving demand for flexible, long-term rental solutions, opening up new market segments. Investing in data analytics to understand customer behavior and personalize offerings will be crucial for future success.

Leading Players in the Europe Car Rental Market Sector

- OK Mobility Group

- National Car Rental

- Auto Europe

- Enterprise Holdings

- SIXT SE

- Budget Rent a Car System Inc

- Alamo Rent a Car

- ACE Rent A Car

- Hertz Global Holdings

- Europcar Mobility Group

- Avis Budget Group Inc

Key Milestones in Europe Car Rental Market Industry

- December 2023: SIXT SE announced the phasing out of Tesla electric rental cars due to reduced resale costs, marking a significant strategic adjustment in EV fleet management.

- October 2023: Enterprise Holdings announced its rebranding to Enterprise Mobility to reflect its expanded global mobility solutions, accompanied by a new logo and tagline, while assuring brand continuity.

- June 2023: Europcar partnered with the BringOz logistics platform to digitize internal processes, automate vehicle movement, and optimize resource utilization through enhanced vehicle transfer efficiency.

Strategic Outlook for Europe Car Rental Market Market

The strategic outlook for the Europe car rental market is characterized by a strong emphasis on digital transformation, fleet electrification, and the development of integrated mobility solutions. Companies that successfully leverage technology to enhance customer experience, offer a diverse and sustainable fleet, and adapt to evolving consumer preferences will be best positioned for long-term growth. Strategic partnerships and collaborations will be crucial for expanding reach and creating value-added services. The market is expected to witness continued innovation in fleet management, pricing models, and customer engagement strategies, with a focus on building resilient and agile operations capable of responding to dynamic market conditions.

Europe Car Rental Market Segmentation

-

1. Booking Type

- 1.1. Offline

- 1.2. Online

-

2. Rental Duration

- 2.1. Short Term

- 2.2. Long Term

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Economy/Budget Cars

- 4.2. Premium/Luxury Cars

Europe Car Rental Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Car Rental Market Regional Market Share

Geographic Coverage of Europe Car Rental Market

Europe Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inbound Tourism to Fuel Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Online Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short Term

- 5.2.2. Long Term

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Economy/Budget Cars

- 5.4.2. Premium/Luxury Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OK Mobility Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Car Rental

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Auto Europe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enterprise Holdings

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SIXT SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Budget Rent a Car System Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alamo Rent a Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACE Rent A Ca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hertz Global Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Europcar Mobility Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Avis Budget Group Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 OK Mobility Group

List of Figures

- Figure 1: Europe Car Rental Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 3: Europe Car Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Europe Car Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Car Rental Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Europe Car Rental Market Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 8: Europe Car Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 9: Europe Car Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Europe Car Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Car Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Car Rental Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the Europe Car Rental Market?

Key companies in the market include OK Mobility Group, National Car Rental, Auto Europe, Enterprise Holdings, SIXT SE, Budget Rent a Car System Inc, Alamo Rent a Car, ACE Rent A Ca, Hertz Global Holdings, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Europe Car Rental Market?

The market segments include Booking Type, Rental Duration, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inbound Tourism to Fuel Market Growth.

6. What are the notable trends driving market growth?

Online Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth.

8. Can you provide examples of recent developments in the market?

December 2023: SIXT SE, a German-based car rental company, announced that it was phasing out Tesla electric rental cars from its fleets because of reduced resale costs. SIXT was the second company apart from Hertz to announce the replacement of its electric vehicle fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Car Rental Market?

To stay informed about further developments, trends, and reports in the Europe Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence