Key Insights

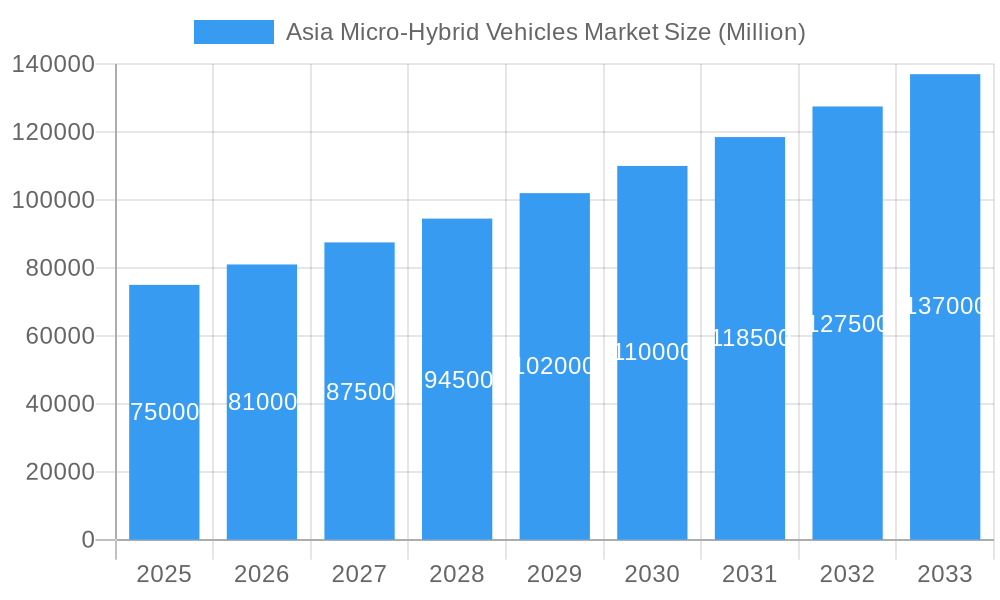

The Asia Micro-Hybrid Vehicles Market is projected for substantial growth, driven by increasing demand for fuel-efficient and eco-friendly transportation solutions. Anticipated to achieve a Compound Annual Growth Rate (CAGR) of 18.6%, the market size is expected to reach 654.61 billion by 2033, reflecting significant investment and adoption. Key growth catalysts include stringent emission regulations, rising fuel prices, and heightened consumer environmental awareness. The expanding integration of micro-hybrid technology in passenger and commercial vehicles, alongside advancements in battery technology (including Lithium-ion and Lead-acid), further propels this expansion. Leading automotive manufacturers are actively developing and launching micro-hybrid models to meet diverse regional needs. The Asia-Pacific region, particularly China, Japan, South Korea, and India, is a central hub for this market due to its substantial automotive production and consumer base.

Asia Micro-Hybrid Vehicles Market Market Size (In Billion)

Market segmentation highlights dynamic offerings, with 12V and 18V micro-hybrid capacities catering to varied vehicle functionalities and price points. While passenger cars dominate in volume, the commercial vehicle sector is also experiencing robust growth as businesses adopt fuel-saving technologies for operational efficiency and regulatory compliance. The competitive landscape features global automotive giants and emerging domestic manufacturers focused on innovation and cost-effectiveness. Challenges include the initial cost of micro-hybrid technology and the need for broader consumer education. Nevertheless, the overarching trend towards vehicle electrification and sustainability in the automotive sector strongly supports the sustained growth of the Asia Micro-Hybrid Vehicles Market, positioning it as a vital contributor to greener transportation.

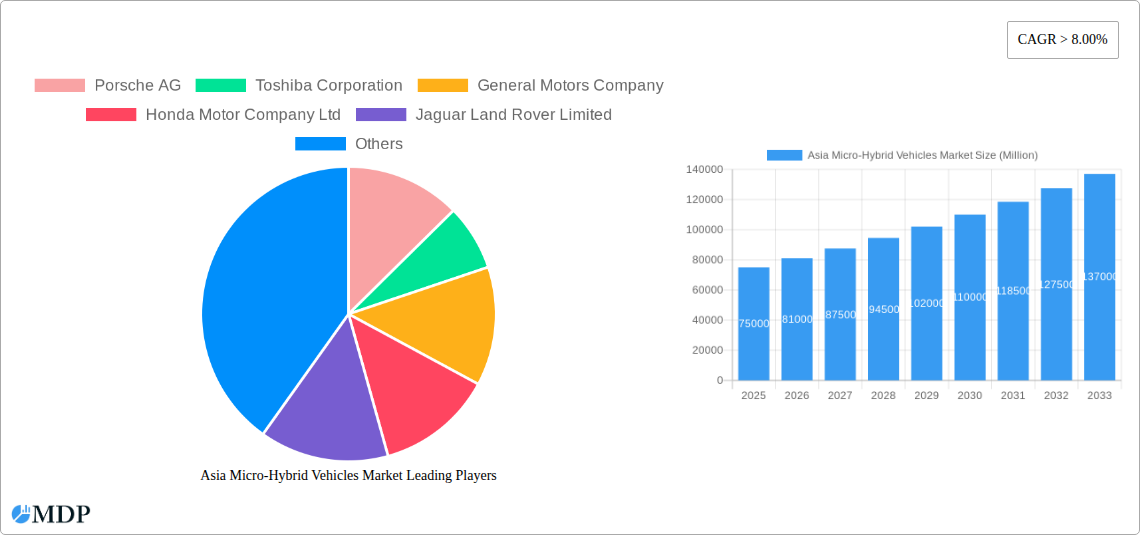

Asia Micro-Hybrid Vehicles Market Company Market Share

Asia Micro-Hybrid Vehicles Market: Growth Opportunities and Strategic Insights (2024-2033)

This comprehensive report provides critical intelligence on the Asia Micro-Hybrid Vehicles Market for stakeholders navigating this evolving sector. Spanning the historical period of 2019–2024, with a base year of 2025, and a forecast period of 2025–2033, the study utilizes high-traffic keywords like "micro-hybrid technology," "Asia automotive market," "vehicle electrification," "sustainable mobility," "automotive industry trends," and "electric vehicle components." Discover market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and strategic outlook. The market is estimated to reach 654.61 billion by 2033, with a robust CAGR of 18.6% during the forecast period.

Asia Micro-Hybrid Vehicles Market Market Dynamics & Concentration

The Asia Micro-Hybrid Vehicles Market exhibits a moderate to high concentration with key players like Toyota Motor Corporation, Honda Motor Company Ltd, and Nissan Motor Company Ltd holding significant market share. Innovation drivers are primarily fueled by increasing demand for fuel efficiency, reduced emissions, and cost-effective electrification solutions. Regulatory frameworks across various Asian nations are increasingly mandating stricter emission standards, pushing manufacturers towards micro-hybrid adoption. Product substitutes, such as fully electric vehicles and conventional internal combustion engine vehicles, present a competitive landscape, but micro-hybrids offer a compelling balance of affordability and improved fuel economy. End-user trends are shifting towards environmentally conscious purchasing decisions, with a growing preference for vehicles that offer tangible fuel savings. Merger and acquisition (M&A) activities are expected to increase as larger players seek to consolidate their market position and acquire advanced micro-hybrid technologies. The number of M&A deals in the past three years has been estimated at XX, with significant investment flowing into battery technology and power management systems.

Asia Micro-Hybrid Vehicles Market Industry Trends & Analysis

The Asia Micro-Hybrid Vehicles Market is poised for substantial growth, driven by a confluence of factors including escalating fuel prices, stringent environmental regulations, and a burgeoning middle class with increasing purchasing power. The market is experiencing a significant shift towards more sustainable transportation solutions, with micro-hybrid technology offering a practical and economically viable stepping stone towards full electrification. This segment benefits from its ability to integrate seamlessly with existing internal combustion engine architectures, thereby minimizing the cost of adoption for both manufacturers and consumers. Technological advancements in battery technology, such as the increasing adoption of Lithium-ion batteries over traditional Lead-acid in newer models, are enhancing the performance and lifespan of micro-hybrid systems, leading to improved regenerative braking efficiency and start-stop functionality.

Consumer preferences are increasingly influenced by the dual benefits of reduced fuel consumption and lower carbon footprints. Governments across the region are actively promoting the adoption of cleaner vehicles through various incentives, subsidies, and stricter emission norms, further propelling the micro-hybrid market forward. The market penetration of micro-hybrid vehicles is projected to rise from XX% in 2024 to over XX% by 2033, indicating a significant upswing in adoption rates. Competitive dynamics are characterized by intense innovation, with key players focusing on optimizing system integration, reducing component costs, and enhancing user experience. The market is segmented by capacity (12v Micro-Hybrid and 18v Micro-Hybrid), vehicle type (Passenger Cars and Commercial Vehicles), and battery type (Lead-acid and Lithium-ion), each segment presenting unique growth trajectories and opportunities. The increasing focus on urban mobility solutions and the need for efficient city driving further bolster the demand for micro-hybrid vehicles.

Leading Markets & Segments in Asia Micro-Hybrid Vehicles Market

The Asia Micro-Hybrid Vehicles Market is dominated by Passenger Cars, which represent the largest segment by vehicle type, accounting for an estimated XX% of the market share in the base year of 2025. This dominance is attributed to the region's vast population, rapid urbanization, and a growing middle class with a propensity for personal mobility. Within the capacity segment, the 12v Micro-Hybrid system is currently leading, driven by its lower cost of implementation and widespread integration in existing vehicle platforms. However, the 18v Micro-Hybrid segment is projected to witness a higher growth rate due to its enhanced capabilities in energy recuperation and support for more advanced electrical features, projected to reach XX% market penetration by 2033.

In terms of battery type, Lead-acid batteries continue to hold a significant share due to their established infrastructure and lower initial cost, especially in budget-friendly models. Nevertheless, the Lithium-ion battery segment is experiencing a rapid expansion, driven by its superior energy density, longer lifespan, and lighter weight, which are crucial for improving vehicle performance and efficiency. Economic policies, such as government subsidies for fuel-efficient vehicles and tax incentives for hybrid technology adoption in countries like China, Japan, and South Korea, are key drivers of market growth. Infrastructure development, including the availability of charging and maintenance facilities, also plays a crucial role, though micro-hybrids require less extensive infrastructure compared to full EVs. Consumer preferences for cost-effectiveness and immediate fuel savings in diverse Asian markets further solidify the dominance of passenger cars and the ongoing evolution from 12v to 18v systems.

Asia Micro-Hybrid Vehicles Market Product Developments

Product innovations in the Asia Micro-Hybrid Vehicles Market are centered on enhancing energy recuperation efficiency, optimizing battery management systems, and reducing the overall cost of micro-hybrid components. Manufacturers are focusing on developing more compact and lighter electrical components, such as advanced alternators and integrated starter generators, to minimize impact on vehicle weight and space. The application of sophisticated algorithms for regenerative braking and seamless engine start-stop functionality is improving fuel economy by an additional XX% in many models. Competitive advantages are being gained through superior integration of micro-hybrid systems with existing powertrain technologies and the development of robust, long-lasting battery solutions.

Key Drivers of Asia Micro-Hybrid Vehicles Market Growth

The Asia Micro-Hybrid Vehicles Market is propelled by several key drivers. Technological advancements in battery technology and power electronics are making micro-hybrid systems more efficient and affordable. Economic factors, including rising fuel prices and growing consumer awareness of fuel savings, are increasing demand for fuel-efficient vehicles. Regulatory frameworks mandating stricter emission standards and promoting cleaner mobility solutions are compelling manufacturers to adopt micro-hybrid technologies. Furthermore, government incentives and subsidies aimed at encouraging the adoption of fuel-efficient and low-emission vehicles play a significant role in market expansion. The growing demand for accessible eco-friendly transportation options fuels the market's upward trajectory.

Challenges in the Asia Micro-Hybrid Vehicles Market Market

Despite the positive outlook, the Asia Micro-Hybrid Vehicles Market faces several challenges. Regulatory hurdles in certain developing economies, where emission standards are still being established, can slow down adoption. Supply chain issues related to the sourcing of critical components, particularly batteries, can lead to production delays and increased costs. Competitive pressures from both internal combustion engine vehicles offering better fuel economy and fully electric vehicles with zero tailpipe emissions require continuous innovation and cost optimization. The initial cost of micro-hybrid systems, though lower than full hybrids, can still be a barrier for price-sensitive consumers in some markets.

Emerging Opportunities in Asia Micro-Hybrid Vehicles Market

Catalysts for long-term growth in the Asia Micro-Hybrid Vehicles Market lie in several key areas. Technological breakthroughs in next-generation battery chemistries and more efficient power management units are expected to further enhance performance and reduce costs. Strategic partnerships between automotive manufacturers and technology providers can accelerate the development and deployment of advanced micro-hybrid solutions. Market expansion strategies targeting emerging economies with a growing automotive sector and increasing environmental consciousness present significant opportunities. The increasing trend towards shared mobility and fleet management also presents a fertile ground for the adoption of cost-effective and fuel-efficient micro-hybrid vehicles.

Leading Players in the Asia Micro-Hybrid Vehicles Market Sector

- Porsche AG

- Toshiba Corporation

- General Motors Company

- Honda Motor Company Ltd

- Jaguar Land Rover Limited

- Kia Motor Corporation

- Daimler AG

- Mazda Motor Corporation

- Nissan Motor Company Ltd

- Mahindra & Mahindra Limited

- Toyota Motor Corporation

Key Milestones in Asia Micro-Hybrid Vehicles Market Industry

- 2019: Increased adoption of 12v micro-hybrid systems in mass-market passenger cars across East Asia.

- 2020: Significant advancements in Lithium-ion battery technology, improving the viability of 18v micro-hybrid systems.

- 2021: Introduction of stricter emission standards in several Southeast Asian countries, driving micro-hybrid adoption.

- 2022: Key manufacturers begin investing heavily in R&D for integrated starter-generator technologies.

- 2023: Growing consumer demand for fuel efficiency directly impacts sales of micro-hybrid vehicles.

- 2024 (Q1-Q4): Increased M&A activities focused on battery management systems and power electronics for micro-hybrid applications.

Strategic Outlook for Asia Micro-Hybrid Vehicles Market Market

The Asia Micro-Hybrid Vehicles Market is set for sustained growth, fueled by a strategic imperative to balance economic development with environmental sustainability. Future market potential lies in the continuous refinement of existing technologies and the development of more integrated powertrain solutions. Key growth accelerators include government mandates for fuel efficiency, increasing consumer preference for eco-friendly vehicles, and the ongoing evolution of battery technology. Strategic opportunities will arise from targeting urban mobility needs, expanding into underserved markets within Asia, and fostering collaborations that drive innovation in cost-effective electrification. The market is expected to transition from a supplementary technology to a mainstream offering, particularly in developing economies.

Asia Micro-Hybrid Vehicles Market Segmentation

-

1. Capacity

- 1.1. 12v Micro-Hybrid

- 1.2. 18v Micro-Hybrid

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Battery Type

- 3.1. Lead-acid

- 3.2. Lithium-ion

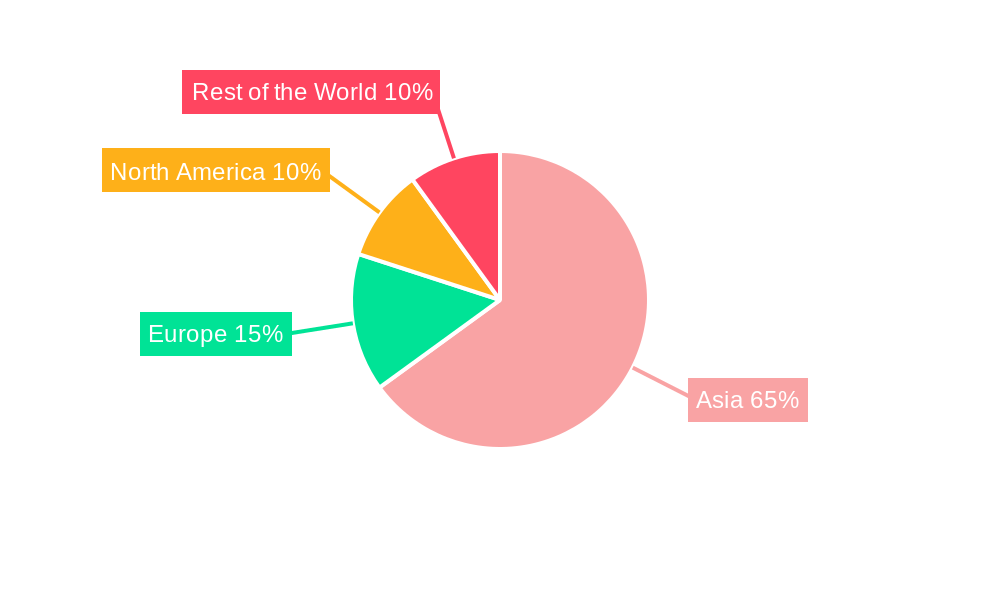

Asia Micro-Hybrid Vehicles Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Micro-Hybrid Vehicles Market Regional Market Share

Geographic Coverage of Asia Micro-Hybrid Vehicles Market

Asia Micro-Hybrid Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Lightweight Materials from the Automotive industry

- 3.3. Market Restrains

- 3.3.1. High Processing and Manufacturing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Lithium-ion Batteries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Micro-Hybrid Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. 12v Micro-Hybrid

- 5.1.2. 18v Micro-Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead-acid

- 5.3.2. Lithium-ion

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Porsche AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Motors Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honda Motor Company Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jaguar Land Rover Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kia Motor Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daimler AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mazda Motor Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nissan Motor Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mahindra & Mahindra Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Toyota Motor Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Porsche AG

List of Figures

- Figure 1: Asia Micro-Hybrid Vehicles Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Micro-Hybrid Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 2: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 4: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 6: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 8: Asia Micro-Hybrid Vehicles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asia Micro-Hybrid Vehicles Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Micro-Hybrid Vehicles Market?

The projected CAGR is approximately 18.6%.

2. Which companies are prominent players in the Asia Micro-Hybrid Vehicles Market?

Key companies in the market include Porsche AG, Toshiba Corporation, General Motors Company, Honda Motor Company Ltd, Jaguar Land Rover Limited, Kia Motor Corporation, Daimler AG, Mazda Motor Corporatio, Nissan Motor Company Ltd, Mahindra & Mahindra Limited, Toyota Motor Corporation.

3. What are the main segments of the Asia Micro-Hybrid Vehicles Market?

The market segments include Capacity, Vehicle Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 654.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Lightweight Materials from the Automotive industry.

6. What are the notable trends driving market growth?

Increasing Demand for Lithium-ion Batteries.

7. Are there any restraints impacting market growth?

High Processing and Manufacturing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Micro-Hybrid Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Micro-Hybrid Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Micro-Hybrid Vehicles Market?

To stay informed about further developments, trends, and reports in the Asia Micro-Hybrid Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence