Key Insights

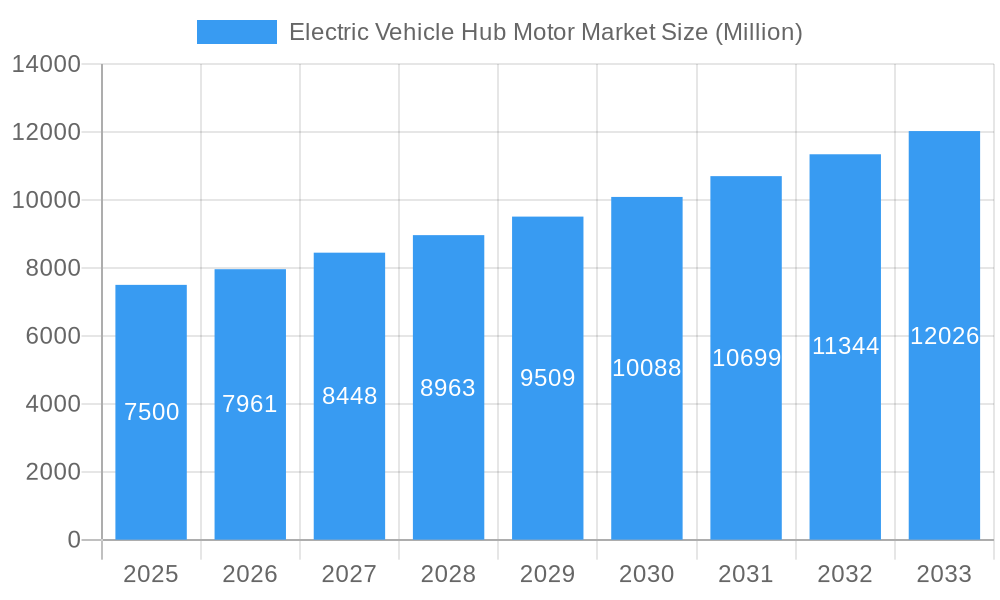

The global Electric Vehicle Hub Motor Market is projected to reach $12 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.1% through 2033. This robust expansion is driven by the escalating adoption of electric vehicles (EVs) across all segments, fueled by increasing consumer preference for sustainable transportation and stringent government regulations promoting zero-emission vehicles. Advancements in motor efficiency, power density, and cost-effectiveness are making hub motors an increasingly attractive solution for EV manufacturers. The market is characterized by a dynamic competitive landscape, with established automotive giants and specialized electric drive technology providers competing for market share. Innovation in materials, thermal management, and integrated control systems will be critical for sustained success.

Electric Vehicle Hub Motor Market Market Size (In Billion)

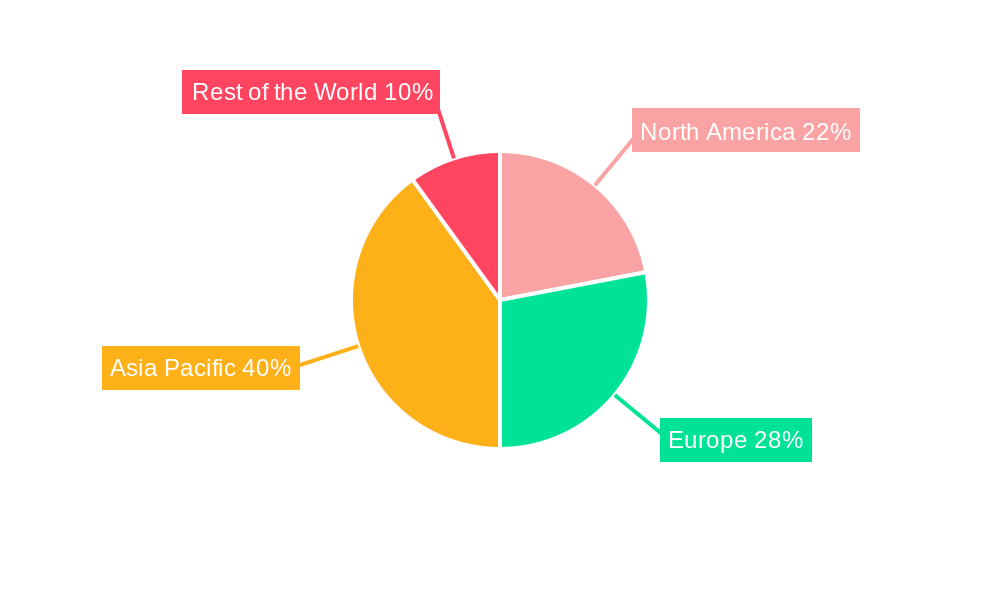

Market segmentation highlights strong demand for both gearless and geared hub motors, addressing diverse performance requirements for e-bikes, electric two-wheelers, passenger cars, and commercial vehicles. While e-bikes and electric two-wheelers currently lead demand due to inherent suitability for hub motor integration, the increasing electrification of passenger cars and the emerging potential in commercial vehicles are expected to significantly contribute to future market growth. Geographically, the Asia Pacific region, particularly China, is anticipated to dominate, driven by its extensive EV manufacturing base and supportive government policies. Europe and North America are also experiencing significant growth, propelled by ambitious emission reduction targets and burgeoning EV infrastructure. Restraints such as initial integration costs for certain applications and the need for enhanced thermal management in high-performance vehicles are being addressed through continuous technological innovation.

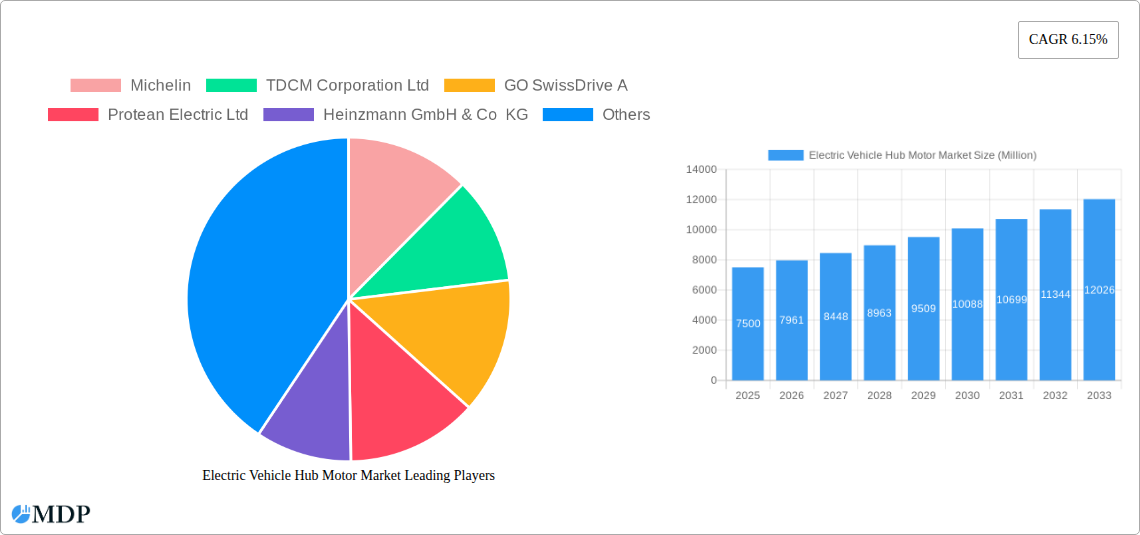

Electric Vehicle Hub Motor Market Company Market Share

This report provides critical insights into the dynamic Electric Vehicle Hub Motor Market for industry stakeholders, investors, and manufacturers. Analyzing the market from 2019 to 2033, with a base year of 2025, this report forecasts significant growth and evolution in the electric mobility sector. Explore the forces shaping the future of EV hub motors, from technological advancements and regulatory landscapes to burgeoning consumer demand.

Electric Vehicle Hub Motor Market Dynamics & Concentration

The Electric Vehicle Hub Motor Market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Michelin, TDCM Corporation Ltd, and GO SwissDrive AG are prominent entities actively shaping the competitive landscape. Innovation drivers are primarily focused on increasing motor efficiency, reducing weight, enhancing power density, and improving thermal management to meet the escalating demands of electric vehicle performance and range. Regulatory frameworks, particularly those mandating stricter emissions standards and incentivizing EV adoption globally, are powerful catalysts for market expansion. The growing availability of government subsidies and tax credits for electric vehicles directly fuels the demand for hub motors. Product substitutes, such as traditional in-wheel motors or integrated powertrain systems, exist but the unique advantages of hub motors, including simplified design, regenerative braking efficiency, and independent wheel control, are increasingly favored. End-user trends highlight a strong preference for lightweight, compact, and powerful electric vehicle components, driving demand for advanced hub motor solutions across various vehicle types. Merger and acquisition (M&A) activities, while not yet at their peak, are expected to increase as larger automotive suppliers seek to bolster their EV powertrain capabilities and smaller, innovative hub motor developers aim for broader market access. Historically, M&A deal counts have been in the low single digits annually but are projected to rise to 5-7 deals per year within the forecast period as consolidation becomes a strategic imperative.

Electric Vehicle Hub Motor Market Industry Trends & Analysis

The Electric Vehicle Hub Motor Market is poised for robust expansion, driven by a confluence of technological advancements, shifting consumer preferences, and supportive government policies. The projected Compound Annual Growth Rate (CAGR) for the market is a substantial XX%, indicating a rapid trajectory towards wider adoption. A significant trend is the continuous innovation in motor design, with a focus on increasing power output while simultaneously reducing weight and improving energy efficiency. This is crucial for enhancing the range and performance of electric vehicles. The market penetration of electric vehicles, from e-bikes and electric two-wheelers to passenger cars and commercial vehicles, is a primary growth driver. As governments worldwide implement stricter emission regulations and offer incentives for EV adoption, the demand for electric powertrains, including hub motors, surges. Technological disruptions such as advancements in magnet materials, improved winding techniques, and integrated power electronics are enabling the development of more compact, powerful, and cost-effective hub motors. Consumer preferences are increasingly leaning towards sustainable transportation solutions, with a growing awareness of the environmental benefits of EVs. Furthermore, the enhanced driving experience offered by EVs, including quiet operation and instant torque, further fuels demand. The competitive dynamics within the market are intensifying, with established automotive component manufacturers and specialized electric drive companies vying for market share. Strategic partnerships between motor manufacturers and EV OEMs are becoming more prevalent, fostering collaboration in product development and supply chain optimization. The overall market penetration of electric vehicles is projected to reach XX% by 2030, a figure that directly translates to increased demand for electric vehicle hub motors.

Leading Markets & Segments in Electric Vehicle Hub Motor Market

The Passenger Cars segment is currently the dominant market for electric vehicle hub motors, driven by the rapid global expansion of the electric passenger vehicle market and the increasing integration of hub motors in new EV architectures. This dominance is fueled by significant investments from automotive OEMs in electrifying their passenger car fleets, coupled with favorable economic policies and infrastructure development aimed at promoting EV adoption.

Motor Type: Gearless motors represent a substantial portion of the market. Key drivers for this segment include their inherent simplicity, higher efficiency due to the absence of mechanical gears, and reduced maintenance requirements. The direct drive nature of gearless hub motors also contributes to a smoother and quieter ride, aligning with consumer expectations for premium EV experiences.

Vehicle Type: Passenger Cars are at the forefront of adopting advanced hub motor technology. Economic policies such as tax credits, subsidies, and emission mandates are compelling manufacturers to accelerate EV production, thereby increasing the demand for sophisticated hub motor solutions. Furthermore, the development of charging infrastructure and advancements in battery technology are mitigating range anxiety, making passenger EVs a more viable and attractive option for consumers. The pursuit of lightweight designs and optimized vehicle packaging further favors the integration of compact and powerful hub motors in passenger vehicles.

Motor Type: Geared hub motors, while currently holding a smaller market share compared to their gearless counterparts in the passenger car segment, are witnessing steady growth, particularly in applications where high torque at low speeds is critical, such as in some electric two-wheelers and commercial vehicles. The ability to achieve higher torque and control speed more precisely makes them suitable for specific niche applications within the broader EV landscape.

Vehicle Type: E-bikes and Electric Two-wheelers constitute another significant and rapidly growing segment for electric vehicle hub motors. The affordability, ease of use, and environmental benefits of these vehicles are driving their popularity in urban commuting and recreational use. Government initiatives to promote sustainable urban mobility and reduce traffic congestion further bolster this segment. The cost-effectiveness and robust performance of hub motors make them an ideal choice for the mass production of e-bikes and electric scooters.

Vehicle Type: Commercial Vehicles are also emerging as a key growth area. As businesses increasingly seek to decarbonize their fleets and reduce operational costs through electrification, the demand for electric trucks, vans, and buses is on the rise. Hub motors offer advantages in terms of modularity, enabling easier retrofitting and diverse powertrain configurations for different commercial vehicle applications. The focus on total cost of ownership and the long-term economic benefits of electric commercial vehicles are significant drivers in this segment.

Electric Vehicle Hub Motor Market Product Developments

Product developments in the Electric Vehicle Hub Motor Market are intensely focused on enhancing power density, efficiency, and thermal management. Innovations include the integration of advanced materials like rare-earth magnets and high-performance conductors to reduce motor size and weight while increasing torque output. Furthermore, smart motor controllers with advanced algorithms for regenerative braking and torque vectoring are being developed to optimize performance and extend EV range. Applications are expanding from e-bikes and electric scooters to passenger cars and even light commercial vehicles, where hub motors offer advantages in terms of packaging flexibility and simplified drivetrain architecture. The competitive advantage lies in the ability to deliver customized solutions that meet specific OEM requirements for power, efficiency, and form factor.

Key Drivers of Electric Vehicle Hub Motor Market Growth

The Electric Vehicle Hub Motor Market is propelled by a multifaceted set of drivers. Technological advancements in motor design, including improved magnet technology and efficient winding techniques, are crucial for enhancing performance and reducing costs. Government regulations mandating emissions reductions and incentivizing EV adoption, such as subsidies and tax credits, significantly boost demand. The growing consumer demand for sustainable transportation and the increasing awareness of the environmental benefits of EVs are major economic catalysts. Furthermore, the declining cost of battery technology makes electric vehicles more affordable and accessible, indirectly driving the market for their core components like hub motors.

Challenges in the Electric Vehicle Hub Motor Market Market

Despite the promising growth trajectory, the Electric Vehicle Hub Motor Market faces several challenges. High manufacturing costs, particularly for advanced motor technologies and specialized components, can hinder widespread adoption, especially in price-sensitive segments. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical raw materials and components, leading to production delays and increased costs. Intense competition from established powertrain manufacturers and the emergence of new market entrants exert downward pressure on pricing. Furthermore, developing robust and reliable thermal management systems for high-power hub motors remains a technical hurdle, as overheating can significantly impact performance and longevity.

Emerging Opportunities in Electric Vehicle Hub Motor Market

Emerging opportunities within the Electric Vehicle Hub Motor Market are abundant and poised to drive long-term growth. Technological breakthroughs in areas like advanced cooling solutions and lightweight composite materials will unlock new levels of performance and efficiency. Strategic partnerships between hub motor manufacturers and electric vehicle OEMs are crucial for co-developing integrated powertrain solutions and securing long-term supply agreements. The expansion into emerging geographical markets, particularly in developing economies with a growing interest in electric mobility, presents significant untapped potential. Furthermore, the development of specialized hub motor solutions for niche applications, such as autonomous vehicles and electric micro-mobility devices, offers avenues for diversification and market leadership.

Leading Players in the Electric Vehicle Hub Motor Market Sector

- Michelin

- TDCM Corporation Ltd

- GO Swiss Drive AG

- Protean Electric Ltd

- Heinzmann GmbH & Co KG

- SIM-Drive Corporation

- Magnetic Systems Technology Ltd

- Taizhou Quanshun Electric Drive Technology Co Ltd (QS Motor)

- Mitsubishi Motors Corporation

- Schaeffler Technologies AG & Co KG

- Elaphe Ltd

Key Milestones in Electric Vehicle Hub Motor Market Industry

- 2020: Launch of enhanced efficiency gearless hub motors by major players, improving EV range by an estimated 5-10%.

- 2021: Increased M&A activity with a significant acquisition of a specialized hub motor technology firm by a Tier-1 automotive supplier.

- 2022: Introduction of advanced thermal management systems for high-performance hub motors, enabling sustained power output.

- 2023: Several passenger car manufacturers announce plans to integrate in-wheel hub motors into future EV platforms.

- 2024: Development of lighter and more compact hub motor designs, facilitating broader application in electric two-wheelers.

Strategic Outlook for Electric Vehicle Hub Motor Market Market

The strategic outlook for the Electric Vehicle Hub Motor Market is exceptionally bright, driven by the unstoppable momentum of electric vehicle adoption. Growth accelerators include the continuous innovation in power density and efficiency, enabling longer EV ranges and improved performance. Strategic opportunities lie in forming deeper collaborations with EV manufacturers to integrate hub motor solutions from the design phase, fostering a modular and scalable approach. The market is also poised for expansion into new segments, such as electric buses and heavy-duty trucks, where the unique advantages of hub motors can be leveraged. Furthermore, advancements in smart motor control and connectivity will unlock new revenue streams through advanced features and predictive maintenance services.

Electric Vehicle Hub Motor Market Segmentation

-

1. Motor Type

- 1.1. Gearless

- 1.2. Geared

-

2. Vehicle Type

- 2.1. E-bikes

- 2.2. Electric Two-wheelers

- 2.3. Passenger Cars

- 2.4. Commercial Vehicles

Electric Vehicle Hub Motor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Hub Motor Market Regional Market Share

Geographic Coverage of Electric Vehicle Hub Motor Market

Electric Vehicle Hub Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in sales of E-bike will fuel the market growth.

- 3.3. Market Restrains

- 3.3.1. Limited Performance in Some Applications such as Heavy-Duty Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Hub Motors from E-bike Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Hub Motor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Motor Type

- 5.1.1. Gearless

- 5.1.2. Geared

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. E-bikes

- 5.2.2. Electric Two-wheelers

- 5.2.3. Passenger Cars

- 5.2.4. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Motor Type

- 6. North America Electric Vehicle Hub Motor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Motor Type

- 6.1.1. Gearless

- 6.1.2. Geared

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. E-bikes

- 6.2.2. Electric Two-wheelers

- 6.2.3. Passenger Cars

- 6.2.4. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Motor Type

- 7. Europe Electric Vehicle Hub Motor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Motor Type

- 7.1.1. Gearless

- 7.1.2. Geared

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. E-bikes

- 7.2.2. Electric Two-wheelers

- 7.2.3. Passenger Cars

- 7.2.4. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Motor Type

- 8. Asia Pacific Electric Vehicle Hub Motor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Motor Type

- 8.1.1. Gearless

- 8.1.2. Geared

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. E-bikes

- 8.2.2. Electric Two-wheelers

- 8.2.3. Passenger Cars

- 8.2.4. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Motor Type

- 9. Rest of the World Electric Vehicle Hub Motor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Motor Type

- 9.1.1. Gearless

- 9.1.2. Geared

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. E-bikes

- 9.2.2. Electric Two-wheelers

- 9.2.3. Passenger Cars

- 9.2.4. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Motor Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Michelin

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TDCM Corporation Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GO SwissDrive A

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Protean Electric Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Heinzmann GmbH & Co KG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SIM-Drive Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Magnetic Systems Technology Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Taizhou Quanshun Electric Drive Technology Co Ltd (QS Motor)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi Motors Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Schaeffler Technologies AG & Co KG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Elaphe Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Michelin

List of Figures

- Figure 1: Global Electric Vehicle Hub Motor Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Electric Vehicle Hub Motor Market Revenue (billion), by Motor Type 2025 & 2033

- Figure 3: North America Electric Vehicle Hub Motor Market Revenue Share (%), by Motor Type 2025 & 2033

- Figure 4: North America Electric Vehicle Hub Motor Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Electric Vehicle Hub Motor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Electric Vehicle Hub Motor Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Electric Vehicle Hub Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electric Vehicle Hub Motor Market Revenue (billion), by Motor Type 2025 & 2033

- Figure 9: Europe Electric Vehicle Hub Motor Market Revenue Share (%), by Motor Type 2025 & 2033

- Figure 10: Europe Electric Vehicle Hub Motor Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Electric Vehicle Hub Motor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Electric Vehicle Hub Motor Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Electric Vehicle Hub Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electric Vehicle Hub Motor Market Revenue (billion), by Motor Type 2025 & 2033

- Figure 15: Asia Pacific Electric Vehicle Hub Motor Market Revenue Share (%), by Motor Type 2025 & 2033

- Figure 16: Asia Pacific Electric Vehicle Hub Motor Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Electric Vehicle Hub Motor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Electric Vehicle Hub Motor Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Electric Vehicle Hub Motor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Electric Vehicle Hub Motor Market Revenue (billion), by Motor Type 2025 & 2033

- Figure 21: Rest of the World Electric Vehicle Hub Motor Market Revenue Share (%), by Motor Type 2025 & 2033

- Figure 22: Rest of the World Electric Vehicle Hub Motor Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Rest of the World Electric Vehicle Hub Motor Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Rest of the World Electric Vehicle Hub Motor Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Electric Vehicle Hub Motor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 2: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 5: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 11: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Russia Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 19: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: India Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: China Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Motor Type 2020 & 2033

- Table 27: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Electric Vehicle Hub Motor Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: South America Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Electric Vehicle Hub Motor Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Hub Motor Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Electric Vehicle Hub Motor Market?

Key companies in the market include Michelin, TDCM Corporation Ltd, GO SwissDrive A, Protean Electric Ltd, Heinzmann GmbH & Co KG, SIM-Drive Corporation, Magnetic Systems Technology Ltd, Taizhou Quanshun Electric Drive Technology Co Ltd (QS Motor), Mitsubishi Motors Corporation, Schaeffler Technologies AG & Co KG, Elaphe Ltd.

3. What are the main segments of the Electric Vehicle Hub Motor Market?

The market segments include Motor Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in sales of E-bike will fuel the market growth..

6. What are the notable trends driving market growth?

Increasing Demand for Hub Motors from E-bike Segment.

7. Are there any restraints impacting market growth?

Limited Performance in Some Applications such as Heavy-Duty Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Hub Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Hub Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Hub Motor Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Hub Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence