Key Insights

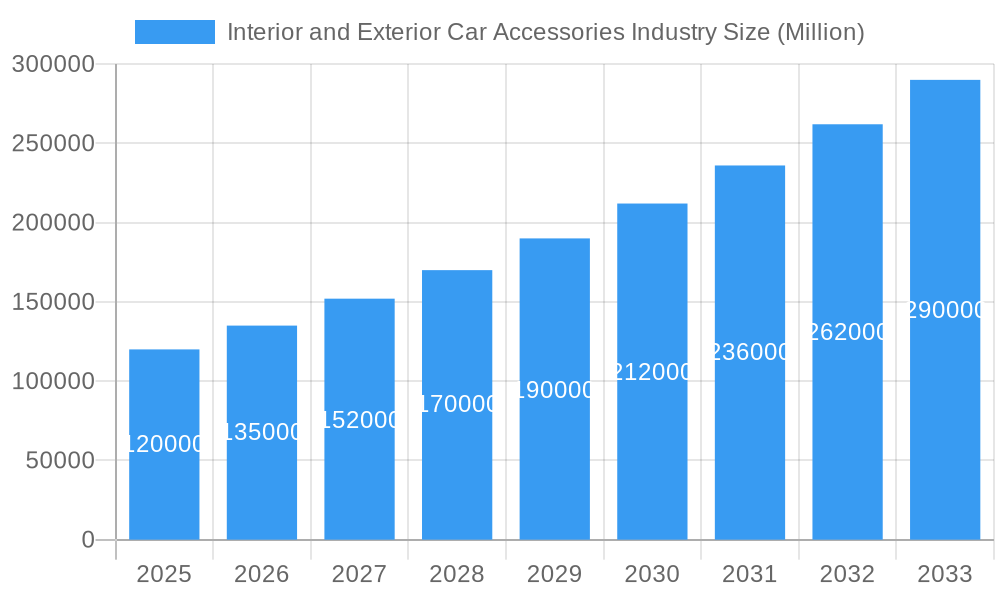

The global automotive aftermarket for interior and exterior accessories is projected to experience significant expansion. By 2025, the market is anticipated to reach approximately $321.99 billion, with a projected Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This growth is primarily attributed to a rising consumer demand for vehicle personalization and enhancement, driven by evolving preferences for comfort, aesthetics, and advanced functionality. The interior accessories segment, including infotainment systems, premium floor mats, and integrated electronics, is witnessing strong adoption as consumers increasingly view vehicles as personal living spaces. Similarly, the exterior segment, featuring LED lighting, alloy wheels, and aerodynamic enhancements, caters to a desire for improved performance, safety, and distinctive visual appeal.

Interior and Exterior Car Accessories Industry Market Size (In Billion)

Key growth drivers include the robust aftermarket segment, where consumers actively customize vehicles post-purchase. The Original Equipment Manufacturer (OEM) channel also contributes, with manufacturers offering a broader range of factory-fitted accessories. Emerging trends involve the integration of smart technology for enhanced connectivity and user experience, alongside a growing emphasis on sustainable materials. Market restraints include fluctuations in raw material prices and the complexity of vehicle electronics requiring specialized installation. Geographically, the Asia Pacific region, particularly China and India, is a pivotal growth area due to its expanding automotive sector and a growing middle class with increasing disposable income.

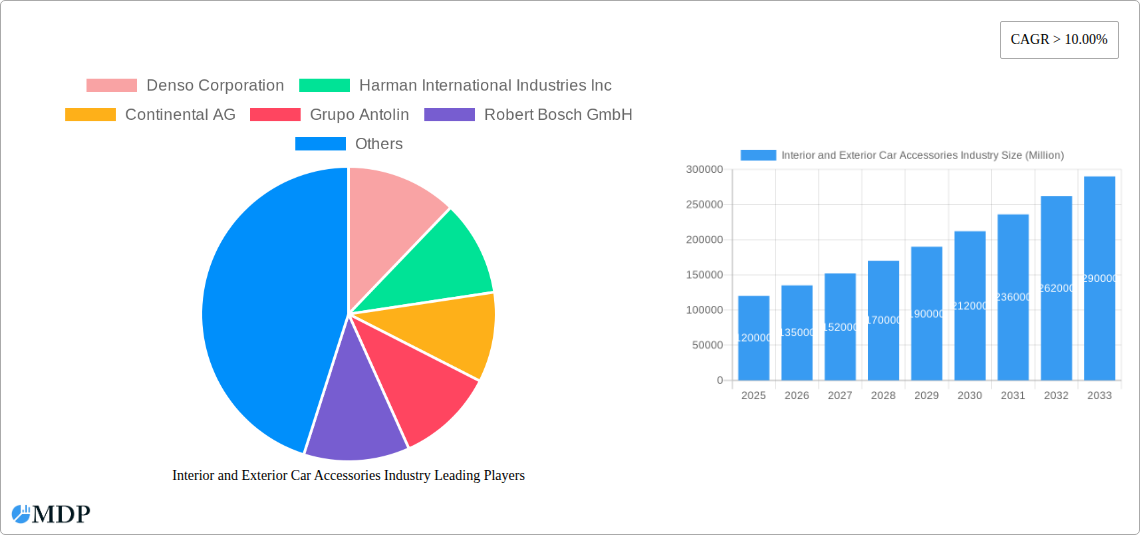

Interior and Exterior Car Accessories Industry Company Market Share

Comprehensive Report on the Global Interior and Exterior Car Accessories Industry

This in-depth analysis of the Interior and Exterior Car Accessories Industry offers a panoramic view of market dynamics, growth drivers, technological advancements, and competitive landscapes from 2019 to 2033, with a base year of 2025. The report leverages high-traffic keywords such as "automotive accessories market," "car interior accessories," "car exterior accessories," "infotainment systems," "LED car lights," "alloy wheels," "OEM automotive parts," and "aftermarket car parts" to ensure maximum search visibility for industry stakeholders, including manufacturers, suppliers, distributors, investors, and automotive OEMs. Covering critical aspects like market segmentation, leading players, and strategic outlook, this report provides actionable insights for informed decision-making in the rapidly evolving automotive aftermarket and OEM supply chain.

Interior and Exterior Car Accessories Industry Market Dynamics & Concentration

The global Interior and Exterior Car Accessories Industry exhibits a moderately concentrated market structure, with a mix of large multinational corporations and a significant number of niche players. Innovation remains a primary driver, propelled by the continuous demand for enhanced vehicle comfort, safety, aesthetics, and technology integration. Regulatory frameworks, particularly those related to safety standards and emissions for exterior components like LED lighting, are also shaping product development. Product substitutes exist across both interior and exterior segments, for instance, aftermarket seat covers can substitute for OEM options, and various decorative exterior elements can be swapped. End-user trends are increasingly skewed towards personalization and smart technology integration, driving demand for sophisticated infotainment systems, advanced driver-assistance systems (ADAS) related accessories, and customizable exterior accessories. Merger and acquisition (M&A) activities are moderately prevalent as key players seek to consolidate market share, expand their product portfolios, and acquire innovative technologies. For example, in February 2022, Bosch Mobility Solutions’ agreement to acquire Atlatec GmbH signals a strategic move to bolster capabilities in automated driving technologies. The market share of top players varies, but a collective share of approximately 50-60% is held by the top 5-10 companies. The M&A deal counts have seen fluctuations, with an average of 5-10 significant deals annually over the historical period.

Interior and Exterior Car Accessories Industry Industry Trends & Analysis

The Interior and Exterior Car Accessories Industry is experiencing robust growth, driven by several interconnected trends. The increasing adoption of sophisticated infotainment systems and connectivity features in new vehicles, alongside the aftermarket demand for upgrades, significantly fuels the interior accessories segment. Consumers are increasingly seeking personalized driving experiences, leading to a surge in demand for customizable floor mats, seat covers, and ambient lighting solutions. The exterior accessories market is being propelled by the growing popularity of SUVs and crossovers, which often feature add-ons like roof racks and body kits. Furthermore, the rising consumer awareness and demand for enhanced vehicle aesthetics and safety are driving the adoption of premium products such as alloy wheels and high-performance LED lights. Technological disruptions are a constant feature, with advancements in materials science leading to more durable and aesthetically pleasing accessories, while advancements in electronics are enabling smarter and more integrated solutions. The CAGR for the overall market is projected to be around 6.5% from 2025 to 2033. The market penetration of advanced electronic accessories, such as advanced security systems and integrated infotainment units, is rapidly increasing, particularly in developed economies. The competitive dynamics are characterized by intense price competition in mass-market segments, while innovation and brand reputation play a crucial role in premium and technology-driven segments. The expansion of the automotive fleet globally also presents a consistent underlying growth driver.

Leading Markets & Segments in Interior and Exterior Car Accessories Industry

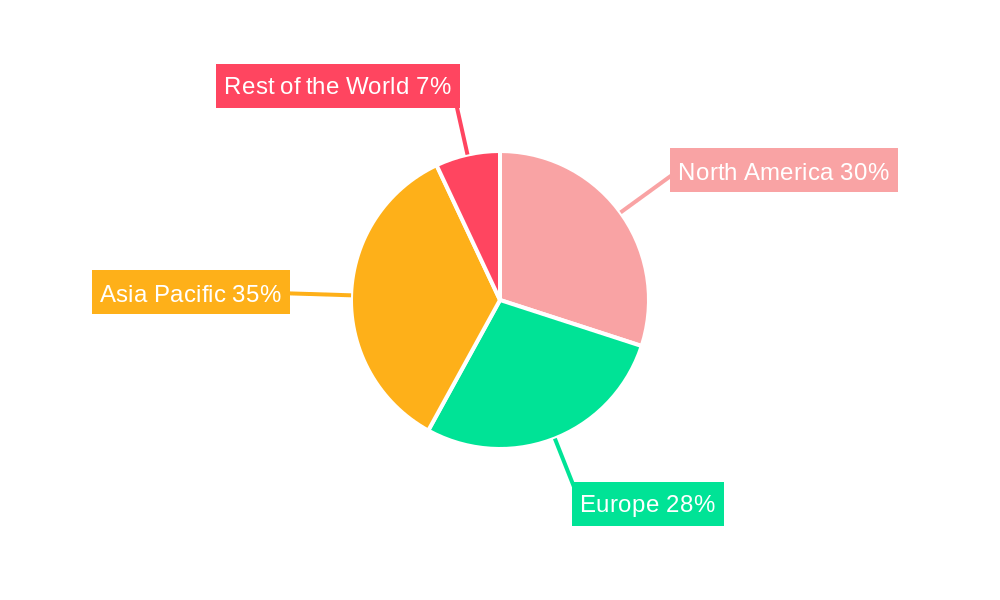

The Interior and Exterior Car Accessories Industry showcases significant regional and segmental variations.

Dominant Regions:

- Asia Pacific emerges as the leading market, driven by the sheer volume of vehicle production and sales, particularly in China and India. Favorable government policies supporting the automotive sector and a burgeoning middle class with increasing disposable income contribute to its dominance. Economic growth and rapid urbanization in this region further bolster demand for both OEM and aftermarket accessories.

- North America and Europe remain significant markets, characterized by a mature automotive industry with a strong aftermarket culture and a high demand for premium and technologically advanced accessories. Stringent safety regulations in these regions also drive innovation and demand for compliant accessories.

Dominant Segments:

- Application:

- Interior Accessories: The Infotainment System segment is a major growth engine, fueled by the consumer demand for seamless connectivity, navigation, and entertainment. The Electrical Systems segment, encompassing lighting, charging ports, and sensor-based accessories, also holds substantial market share due to the increasing electrification of vehicles and the integration of smart features.

- Exterior Accessories: LED Lights are experiencing exponential growth due to their energy efficiency, longevity, and enhanced visibility, becoming a standard in both new vehicles and aftermarket upgrades. Alloy Wheels continue to be a popular choice for customization, offering both aesthetic appeal and performance benefits.

- Sales Channel:

- OEM (Original Equipment Manufacturer): This channel commands a significant share due to the integration of accessories during the vehicle manufacturing process. Partnerships between accessory manufacturers and automotive OEMs are crucial for market penetration and brand recognition.

- Aftermarket: The aftermarket segment is robust and growing, driven by consumers seeking to personalize their vehicles, replace worn-out parts, or upgrade existing features. The availability of a wide range of products and competitive pricing makes this channel highly attractive.

- Application:

Key Drivers:

- Economic Policies: Government incentives for automotive manufacturing and consumer spending directly impact accessory sales.

- Infrastructure Development: Expansion of road networks and increasing vehicle ownership in emerging economies fuel demand.

- Technological Advancements: Integration of smart features and connectivity drives demand for advanced interior and exterior accessories.

- Consumer Preferences: Growing emphasis on personalization, comfort, and aesthetics.

Interior and Exterior Car Accessories Industry Product Developments

Product innovation in the Interior and Exterior Car Accessories Industry is rapidly evolving. Key developments include the integration of advanced sensor technologies for enhanced safety and driver assistance in interior systems, such as passive infrared sensors for occupant monitoring. In exterior accessories, the focus is on energy-efficient and high-performance LED lighting solutions with adaptive beam technology. Furthermore, lightweight and durable materials are being adopted for body kits and alloy wheels, offering both aesthetic appeal and performance benefits. Companies are also developing modular accessory systems that allow for easier installation and customization, catering to diverse consumer needs and preferences, thereby enhancing competitive advantage.

Key Drivers of Interior and Exterior Car Accessories Industry Growth

Several key drivers are propelling the growth of the Interior and Exterior Car Accessories Industry. Technological advancements, particularly in the realm of infotainment systems, connectivity, and smart electronics, are creating new product categories and driving upgrades. The increasing consumer demand for personalized and aesthetically pleasing vehicles, coupled with a rising disposable income in many global regions, fuels both OEM and aftermarket sales. Furthermore, evolving safety regulations are mandating the adoption of advanced safety features, which often translate into accessory sales, such as advanced security systems and improved lighting solutions. The expanding global vehicle parc, with millions of new vehicles entering the market annually, provides a continuous base for accessory demand.

Challenges in the Interior and Exterior Car Accessories Industry Market

Despite robust growth, the Interior and Exterior Car Accessories Industry faces several challenges. Intense competition, particularly in the aftermarket segment, can lead to price erosion and squeezed profit margins. Evolving regulatory frameworks, especially concerning safety and environmental standards for exterior components, require continuous investment in research and development to ensure compliance. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of raw materials and finished goods. Moreover, the rapid pace of technological change necessitates constant adaptation, posing a challenge for smaller players to keep up with innovation.

Emerging Opportunities in Interior and Exterior Car Accessories Industry

Emerging opportunities in the Interior and Exterior Car Accessories Industry are abundant and diverse. The burgeoning market for electric vehicles (EVs) presents a significant opportunity for specialized accessories designed for EV charging, battery management, and unique interior configurations. The growing demand for vehicle customization and personalization opens avenues for niche products and premium accessories. Strategic partnerships between accessory manufacturers and automotive OEMs are crucial for co-developing and integrating cutting-edge technologies. Furthermore, the expansion into emerging markets with rapidly growing automotive sectors offers substantial long-term growth potential for both interior and exterior accessory providers.

Leading Players in the Interior and Exterior Car Accessories Industry Sector

- Denso Corporation

- Harman International Industries Inc

- Continental AG

- Grupo Antolin

- Robert Bosch GmbH

- Alpine Compan

- Lear Corporation

- Faurecia

- Kenwood Corporation

- Adient PLC

- Panasonic Corporation

Key Milestones in Interior and Exterior Car Accessories Industry Industry

- November 2022: Continental AG announced the expansion of its automotive display plant at Timisoara in Romania. Continental AG will invest EUR 40 million (USD 41.2 million) to manufacture innovative User Experience solutions like displays at the plant. The investment will see the plant expand from 7000 square meters to 18000 square meters.

- October 2022: Denso Corp. and NTT Com collaborated to build Security Operation Center for Vehicles (VSOC1) to respond to the threat of increasingly sophisticated cyber-attacks against vehicles.

- September 2022: Harman International, a Samsung Electronics company, launched Ready Care, which is a set of solutions focused on Cognitive Distraction, Stress-Free Routing, and Personalized Comfort technologies that can work together or independently to improve vehicle safety and reduce driver stress.

- September 2022: Harman International, a Samsung Electronics company, acquired Israel-based CAARESYS, which develops vehicle passenger monitoring systems powered by contactless, low-emission radar. This acquisition is expected to make Harman International a leading player in Ipassenger In-Cabin Safety and Well-being market.

- February 2022: Bosch Mobility Solutions agreed to acquire Atlatec GmbH, one of the leading providers of high-resolution digital maps for driver assistance and autonomous driving. This acquisition will help Bosch to offer a complete ecosystem for automated driving, from sensors and actuators to software and maps to the manufacturers of autonomous vehicles. This acquisition is expected to enable Bosch to develop its SAE Level 4 automated driving capabilities.

- November 2021: Lear Corporation announced that it had signed an agreement with one of the global automobile OEMs to supply its proprietary Global Navigation Satellite System- a high-accuracy vehicle positioning technology integrated into Lear's 4G/5G telecommunications unit to that automobile OEM.

Strategic Outlook for Interior and Exterior Car Accessories Industry Market

The strategic outlook for the Interior and Exterior Car Accessories Industry is highly positive, characterized by strong growth accelerators. Continued innovation in connected car technologies, autonomous driving enablers, and advanced safety features will drive demand for sophisticated interior and exterior accessories. The increasing customization trend presents opportunities for players to offer personalized solutions and premium upgrades. Strategic alliances and acquisitions will remain critical for companies seeking to expand their market reach, technological capabilities, and product portfolios. The electrification of the automotive sector also opens new frontiers for accessory development, creating substantial long-term market potential.

Interior and Exterior Car Accessories Industry Segmentation

-

1. Application

-

1.1. Interior Accessories

- 1.1.1. Infotainment System

- 1.1.2. Floor Carpets and Mats

- 1.1.3. Seat Covers

- 1.1.4. Electrical Systems

- 1.1.5. Security Systems

- 1.1.6. Others

-

1.2. Exterior Accessories

- 1.2.1. LED Lights

- 1.2.2. Alloy Wheels

- 1.2.3. Body Kits

- 1.2.4. Racks

- 1.2.5. Window Films

- 1.2.6. Crash Guards

-

1.1. Interior Accessories

-

2. Sales Channel

- 2.1. OEM

- 2.2. Aftermarket

Interior and Exterior Car Accessories Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Interior and Exterior Car Accessories Industry Regional Market Share

Geographic Coverage of Interior and Exterior Car Accessories Industry

Interior and Exterior Car Accessories Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Infotainment System Dominates the Interiors Accessories Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Interior and Exterior Car Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Interior Accessories

- 5.1.1.1. Infotainment System

- 5.1.1.2. Floor Carpets and Mats

- 5.1.1.3. Seat Covers

- 5.1.1.4. Electrical Systems

- 5.1.1.5. Security Systems

- 5.1.1.6. Others

- 5.1.2. Exterior Accessories

- 5.1.2.1. LED Lights

- 5.1.2.2. Alloy Wheels

- 5.1.2.3. Body Kits

- 5.1.2.4. Racks

- 5.1.2.5. Window Films

- 5.1.2.6. Crash Guards

- 5.1.1. Interior Accessories

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Interior and Exterior Car Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Interior Accessories

- 6.1.1.1. Infotainment System

- 6.1.1.2. Floor Carpets and Mats

- 6.1.1.3. Seat Covers

- 6.1.1.4. Electrical Systems

- 6.1.1.5. Security Systems

- 6.1.1.6. Others

- 6.1.2. Exterior Accessories

- 6.1.2.1. LED Lights

- 6.1.2.2. Alloy Wheels

- 6.1.2.3. Body Kits

- 6.1.2.4. Racks

- 6.1.2.5. Window Films

- 6.1.2.6. Crash Guards

- 6.1.1. Interior Accessories

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Interior and Exterior Car Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Interior Accessories

- 7.1.1.1. Infotainment System

- 7.1.1.2. Floor Carpets and Mats

- 7.1.1.3. Seat Covers

- 7.1.1.4. Electrical Systems

- 7.1.1.5. Security Systems

- 7.1.1.6. Others

- 7.1.2. Exterior Accessories

- 7.1.2.1. LED Lights

- 7.1.2.2. Alloy Wheels

- 7.1.2.3. Body Kits

- 7.1.2.4. Racks

- 7.1.2.5. Window Films

- 7.1.2.6. Crash Guards

- 7.1.1. Interior Accessories

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Interior and Exterior Car Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Interior Accessories

- 8.1.1.1. Infotainment System

- 8.1.1.2. Floor Carpets and Mats

- 8.1.1.3. Seat Covers

- 8.1.1.4. Electrical Systems

- 8.1.1.5. Security Systems

- 8.1.1.6. Others

- 8.1.2. Exterior Accessories

- 8.1.2.1. LED Lights

- 8.1.2.2. Alloy Wheels

- 8.1.2.3. Body Kits

- 8.1.2.4. Racks

- 8.1.2.5. Window Films

- 8.1.2.6. Crash Guards

- 8.1.1. Interior Accessories

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Interior and Exterior Car Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Interior Accessories

- 9.1.1.1. Infotainment System

- 9.1.1.2. Floor Carpets and Mats

- 9.1.1.3. Seat Covers

- 9.1.1.4. Electrical Systems

- 9.1.1.5. Security Systems

- 9.1.1.6. Others

- 9.1.2. Exterior Accessories

- 9.1.2.1. LED Lights

- 9.1.2.2. Alloy Wheels

- 9.1.2.3. Body Kits

- 9.1.2.4. Racks

- 9.1.2.5. Window Films

- 9.1.2.6. Crash Guards

- 9.1.1. Interior Accessories

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Harman International Industries Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Continental AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Grupo Antolin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alpine Compan

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lear Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Faurecia

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kenwood Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Adient PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Panasonic Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Interior and Exterior Car Accessories Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Interior and Exterior Car Accessories Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Interior and Exterior Car Accessories Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Interior and Exterior Car Accessories Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 5: North America Interior and Exterior Car Accessories Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Interior and Exterior Car Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Interior and Exterior Car Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Interior and Exterior Car Accessories Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: Europe Interior and Exterior Car Accessories Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Interior and Exterior Car Accessories Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 11: Europe Interior and Exterior Car Accessories Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 12: Europe Interior and Exterior Car Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Interior and Exterior Car Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Interior and Exterior Car Accessories Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Asia Pacific Interior and Exterior Car Accessories Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Interior and Exterior Car Accessories Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 17: Asia Pacific Interior and Exterior Car Accessories Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 18: Asia Pacific Interior and Exterior Car Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Interior and Exterior Car Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Interior and Exterior Car Accessories Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Rest of the World Interior and Exterior Car Accessories Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Rest of the World Interior and Exterior Car Accessories Industry Revenue (billion), by Sales Channel 2025 & 2033

- Figure 23: Rest of the World Interior and Exterior Car Accessories Industry Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Rest of the World Interior and Exterior Car Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Interior and Exterior Car Accessories Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 6: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 12: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 20: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: India Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: China Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 28: Global Interior and Exterior Car Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: South America Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Interior and Exterior Car Accessories Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Interior and Exterior Car Accessories Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Interior and Exterior Car Accessories Industry?

Key companies in the market include Denso Corporation, Harman International Industries Inc, Continental AG, Grupo Antolin, Robert Bosch GmbH, Alpine Compan, Lear Corporation, Faurecia, Kenwood Corporation, Adient PLC, Panasonic Corporation.

3. What are the main segments of the Interior and Exterior Car Accessories Industry?

The market segments include Application, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 321.99 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

Infotainment System Dominates the Interiors Accessories Market.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Continental AG announced the expansion of its automotive display plant at Timisoara in Romania. Continental AG will invest EUR 40 million (USD 41.2 million) to manufacture innovative User Experience solutions like displays at the plant. The investment will see the plant expand from 7000 square meters to 18000 square meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Interior and Exterior Car Accessories Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Interior and Exterior Car Accessories Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Interior and Exterior Car Accessories Industry?

To stay informed about further developments, trends, and reports in the Interior and Exterior Car Accessories Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence