Key Insights

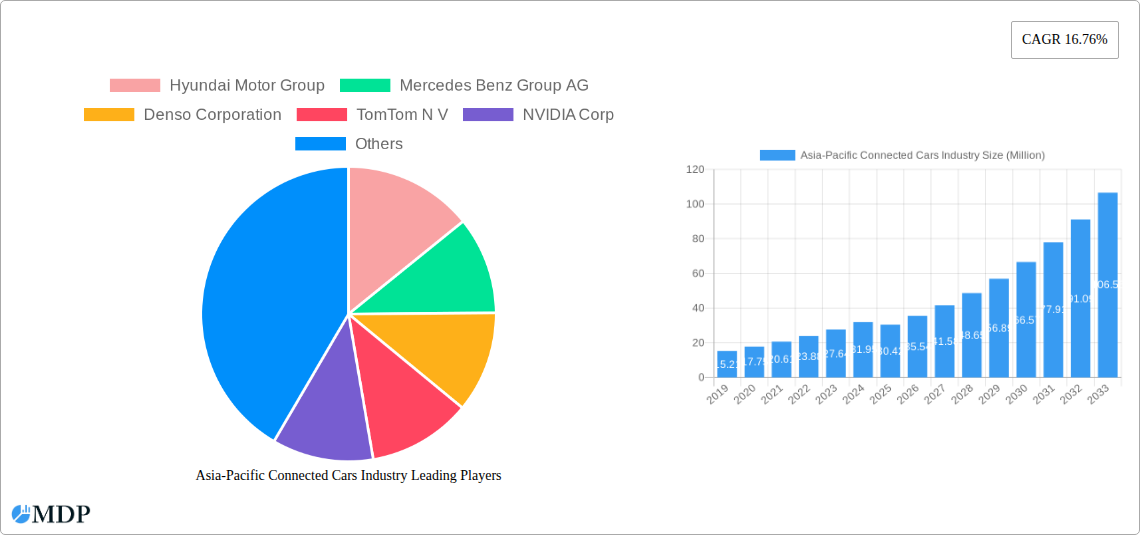

The Asia-Pacific Connected Cars Industry is poised for remarkable expansion, with a current market size estimated at USD 30.42 billion. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 16.76% projected over the forecast period, indicating a significant surge in value and adoption. Key drivers include escalating consumer demand for advanced in-car technologies, the rapid proliferation of 5G infrastructure, and increasing government initiatives promoting smart mobility and digital transformation within the automotive sector. The passenger car segment is expected to dominate, driven by the integration of sophisticated navigation, entertainment, and safety systems. Furthermore, the growing adoption of advanced driver-assistance systems (ADAS) and the inherent demand for enhanced vehicle management solutions will continue to propel market expansion. The increasing interconnectedness of vehicles through Vehicle-to-Everything (V2X) communication technologies, encompassing V2V, V2I, and V2X, is rapidly becoming a cornerstone of future automotive ecosystems, promising safer and more efficient transportation.

Asia-Pacific Connected Cars Industry Market Size (In Million)

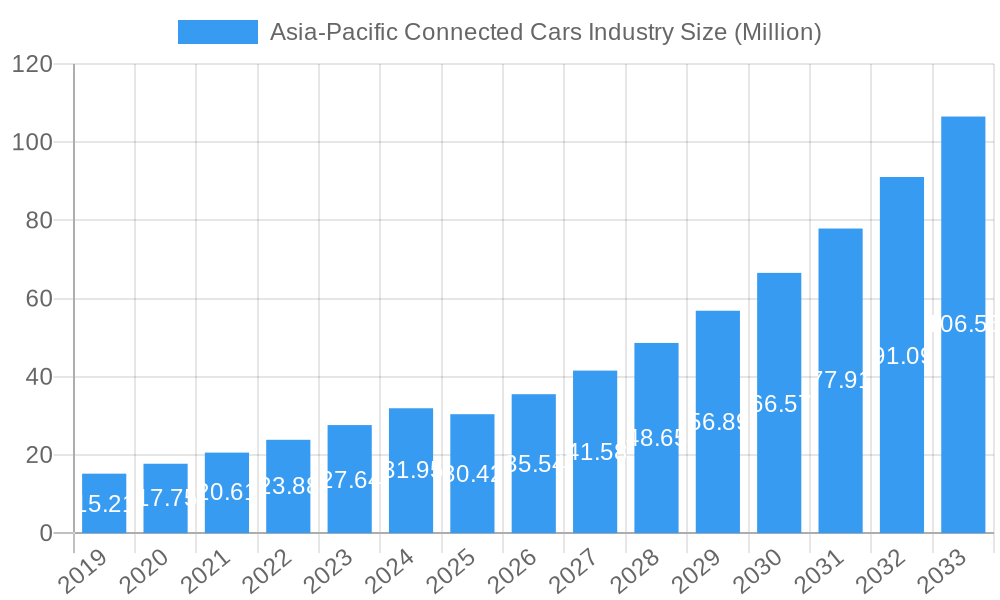

This dynamic market is segmented across various technology types, including navigation, entertainment, safety, vehicle management, and multimedia streaming. The aftermarket segment is anticipated to witness substantial growth as consumers seek to upgrade their existing vehicles with the latest connected car features. Major players like Hyundai Motor Group, Mercedes Benz Group AG, Denso Corporation, TomTom N.V., NVIDIA Corp, ZF Friedrichshafen, Aptiv PLC, NXP Semiconductors, Harman International, Continental AG, BMW AG, Robert Bosch GmbH, SAIC Motor Corporation, Audi AG, Volvo AB, and Airbiquity Inc. are actively investing in research and development and forming strategic partnerships to capture market share. The Asia-Pacific region, with its burgeoning economies and high adoption rates of new technologies, particularly in China, Japan, and South Korea, is expected to be the primary growth engine for the global connected cars market. The study period from 2019 to 2033, with a base year of 2025, provides a comprehensive outlook on this evolving industry.

Asia-Pacific Connected Cars Industry Company Market Share

Asia-Pacific Connected Cars Industry Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a panoramic view of the burgeoning Asia-Pacific Connected Cars Industry, meticulously analyzing market dynamics, technological advancements, leading players, and future trajectories. Covering the study period from 2019 to 2033, with 2025 as the base and estimated year, this comprehensive research offers actionable insights for automotive manufacturers (OEMs), technology providers, telecommunication companies, and investors. We delve into critical segments including Vehicle Type (Passenger Cars, Commercial Vehicles), Technology Type (Navigation, Entertainment, Safety, Vehicle Management, Others), Vehicle Connectivity (V2V, V2I, V2X), and End-User Type (Aftermarket/Replacement). With a focus on high-traffic keywords such as "connected car technology," "automotive software," "vehicle connectivity," "autonomous driving," and specific regional markets, this report aims to maximize search visibility and attract key industry stakeholders.

Asia-Pacific Connected Cars Industry Market Dynamics & Concentration

The Asia-Pacific connected cars industry is characterized by a dynamic market concentration, driven by rapid technological innovation and a burgeoning consumer demand for enhanced vehicle experiences. Key innovation drivers include the increasing integration of Artificial Intelligence (AI), the rollout of 5G networks, and advancements in data analytics, enabling sophisticated in-car services and vehicle-to-everything (V2X) communication. Regulatory frameworks are evolving, with governments in countries like China, Japan, and South Korea implementing supportive policies for smart mobility and data security, although inconsistencies across the region can present challenges. Product substitutes, such as standalone navigation devices and aftermarket infotainment systems, are rapidly being superseded by integrated connected car solutions. End-user trends highlight a growing preference for personalized in-car experiences, seamless smartphone integration, and advanced safety features. Mergers and acquisitions (M&A) activities are on the rise as major players consolidate their market positions and acquire new technologies. For instance, the pursuit of advanced semiconductor solutions for connected vehicles has fueled several strategic acquisitions. Market share in key segments is largely held by a mix of established automotive giants and agile technology firms, with Hyundai Motor Group demonstrating significant subscriber growth. The M&A deal count in the sector has seen a consistent upward trend, reflecting the industry's consolidation phase and the pursuit of synergistic growth.

Asia-Pacific Connected Cars Industry Industry Trends & Analysis

The Asia-Pacific connected cars industry is experiencing robust growth, projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. This expansion is propelled by several key market growth drivers, including the rising disposable incomes in emerging economies, the increasing adoption of electric vehicles (EVs), and a growing consumer demand for advanced safety and convenience features. Technological disruptions are at the forefront, with the widespread implementation of 5G infrastructure enabling faster data transmission for real-time updates, over-the-air (OTA) software upgrades, and enhanced V2X capabilities. Furthermore, the integration of AI and machine learning is transforming the driving experience through personalized infotainment, predictive maintenance, and advanced driver-assistance systems (ADAS). Consumer preferences are increasingly shifting towards a seamless digital ecosystem within the vehicle, mirroring their smartphone experiences, with a strong emphasis on intuitive user interfaces and access to a wide array of digital services, including multimedia streaming. Competitive dynamics are intensifying, with collaborations between traditional automotive manufacturers and tech giants becoming a common strategy to leverage expertise and accelerate product development. Market penetration of connected car features is steadily increasing across passenger cars and is beginning to gain traction in commercial vehicles, driven by the promise of improved fleet management and operational efficiency. The growing acceptance of autonomous driving technologies further fuels the demand for robust connectivity solutions.

Leading Markets & Segments in Asia-Pacific Connected Cars Industry

The Asia-Pacific Connected Cars Industry is dominated by key markets and segments, driven by unique economic policies, infrastructure development, and consumer adoption rates.

Dominant Region/Country:

- China stands out as the leading market, propelled by its massive automotive sales volume, strong government support for smart mobility and IoT technologies, and a highly tech-savvy consumer base eager for connected features. The country's extensive investment in 5G infrastructure is a critical enabler for advanced connected car functionalities.

- Japan and South Korea are also significant players, known for their advanced automotive manufacturing capabilities and a long-standing focus on in-car technology and safety. Hyundai Motor Group's substantial subscriber base highlights the strength of this region.

Dominant Segments:

- Vehicle Type: Passenger Cars represent the largest segment, as they are the primary focus for consumer-oriented connected features like navigation, entertainment, and safety. However, commercial vehicles are showing rapid growth potential driven by fleet management solutions and efficiency gains.

- Technology Type:

- Safety features, including ADAS and emergency calling services, are paramount, driven by stringent safety regulations and consumer demand.

- Navigation systems remain a core connected car offering, continuously enhanced with real-time traffic data and personalized routing.

- Entertainment and Multimedia Streaming are gaining significant traction, with consumers expecting seamless access to their digital content on the go.

- Vehicle Management features, such as remote diagnostics and predictive maintenance, are becoming increasingly important, particularly for fleet operators.

- Vehicle Connectivity: Vehicle-to-Everything (V2X), encompassing V2V (Vehicle-to-Vehicle), V2I (Vehicle-to-Infrastructure), and V2P (Vehicle-to-Pedestrian) communication, is the future frontier, promising enhanced safety and traffic efficiency, and is a major focus of research and development.

- End-User Type: The Original Equipment Manufacturer (OEM) segment holds the largest market share, as most connected car features are integrated during the manufacturing process. The aftermarket segment is also growing as consumers seek to retrofit their existing vehicles with modern connectivity solutions.

Asia-Pacific Connected Cars Industry Product Developments

Product development in the Asia-Pacific connected cars industry is characterized by a rapid integration of advanced technologies aimed at enhancing user experience, safety, and efficiency. Innovations are focused on developing more intuitive and personalized in-car infotainment systems, sophisticated AI-powered virtual assistants, and robust V2X communication modules. The trend towards seamless smartphone integration and the proliferation of over-the-air (OTA) software updates are creating a more dynamic and upgradable vehicle ecosystem. Furthermore, advancements in data analytics are enabling predictive maintenance and personalized driver behavior insights. Companies are actively developing solutions for advanced driver-assistance systems (ADAS) and autonomous driving, which rely heavily on robust connectivity and processing power. The competitive advantage lies in offering integrated, secure, and user-friendly connected car solutions that cater to evolving consumer demands for convenience and safety.

Key Drivers of Asia-Pacific Connected Cars Industry Growth

The Asia-Pacific connected cars industry's growth is fueled by a confluence of technological, economic, and regulatory factors. Economically, rising disposable incomes and a burgeoning middle class across the region are driving demand for premium features and advanced automotive technologies. Technologically, the rapid expansion of 5G networks is a critical enabler, facilitating high-speed data transmission for real-time services, over-the-air updates, and sophisticated V2X communication. Government initiatives in countries like China and South Korea actively promoting smart cities and digital infrastructure further bolster this growth. Consumer demand for enhanced safety, convenience, and personalized entertainment experiences within their vehicles is a significant pull factor. The increasing adoption of electric vehicles also plays a role, as many EVs are designed with integrated connectivity for battery management and charging station information.

Challenges in the Asia-Pacific Connected Cars Industry Market

Despite its robust growth, the Asia-Pacific connected cars industry faces several challenges. Regulatory hurdles, including varying data privacy laws and cybersecurity standards across different countries, can complicate global product rollout and compliance. The significant investment required for R&D and infrastructure development, particularly for advanced V2X technologies, presents a financial challenge for many companies. Supply chain disruptions, especially for critical semiconductor components, can impact production timelines and cost-effectiveness. Furthermore, ensuring robust cybersecurity to protect sensitive vehicle and user data from evolving threats remains a paramount concern. The high cost of advanced connected car features can also be a barrier to adoption in some price-sensitive markets, limiting market penetration.

Emerging Opportunities in Asia-Pacific Connected Cars Industry

The Asia-Pacific connected cars industry is ripe with emerging opportunities. The increasing focus on autonomous driving technology creates a significant demand for advanced sensor fusion, AI processing, and high-bandwidth connectivity solutions. Strategic partnerships between automotive OEMs and technology companies are crucial for co-developing innovative solutions and accelerating market entry. The expansion of 5G networks will unlock new possibilities for real-time data streaming, enhanced infotainment, and advanced V2X services that improve traffic safety and efficiency. The growing demand for personalized in-car experiences, including tailored entertainment and proactive vehicle maintenance, presents an opportunity for service providers. Furthermore, the aftermarket segment offers a vast untapped market for retrofitting older vehicles with connected capabilities, catering to a wider consumer base.

Leading Players in the Asia-Pacific Connected Cars Industry Sector

- Hyundai Motor Group

- Mercedes Benz Group AG

- Denso Corporation

- TomTom N V

- NVIDIA Corp

- ZF Friedrichshafen

- Aptiv PLC

- NXP Semiconductors

- Harman International

- Continental AG

- BMW AG

- Robert Bosch GmbH

- SAIC Motor Corporation

- Audi AG

- Volvo AB

- Airbiquity In

Key Milestones in Asia-Pacific Connected Cars Industry Industry

- June 2023: Hyundai Motor Group announced that its connected car services surpassed 10 million subscribers, driven by international growth in Bluelink, Kia Connect, and Genesis Connected Services. The company projects reaching 20 million subscribers by the end of 2026.

- April 2023: MG Motor India launched its Comet electric vehicle, featuring an integrated iSmart system with over 55 connected car features and more than 100 voice commands, priced at INR 7.98 lakh (USD 9,608).

- September 2022: Hyundai Motor Group and KT Corporation formed a joint venture focused on next-generation infrastructure and ICT, including 6G autonomous driving technology and satellite communication-based Advanced Air Mobility (AAM) networks.

Strategic Outlook for Asia-Pacific Connected Cars Industry Market

The strategic outlook for the Asia-Pacific connected cars industry is exceptionally positive, driven by ongoing technological advancements and increasing consumer adoption. Future market potential is immense, with continued investment in 5G infrastructure and the development of AI-powered automotive solutions expected to drive innovation. Strategic opportunities lie in forging deeper collaborations between automakers and tech firms to accelerate the development and deployment of advanced connectivity features, including autonomous driving capabilities. The expansion of V2X technology will be a key growth accelerator, paving the way for safer and more efficient transportation systems. Furthermore, a focus on developing robust cybersecurity measures and ensuring data privacy will be crucial for building consumer trust and fostering long-term market growth. The integration of connected car services with smart city ecosystems also presents a significant avenue for future expansion and value creation.

Asia-Pacific Connected Cars Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology Type

- 2.1. Navigation

- 2.2. Entertainment

- 2.3. Safety

- 2.4. Vehicle Management

- 2.5. Others (Multimedia Streaming etc.)

-

3. Vehicle Connectivity

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Vehicle-to-Everything (V2X)

-

4. End-User Type

- 4.1. Original Equipment Manufacturer (OEM)

- 4.2. Aftermarket/Replacement

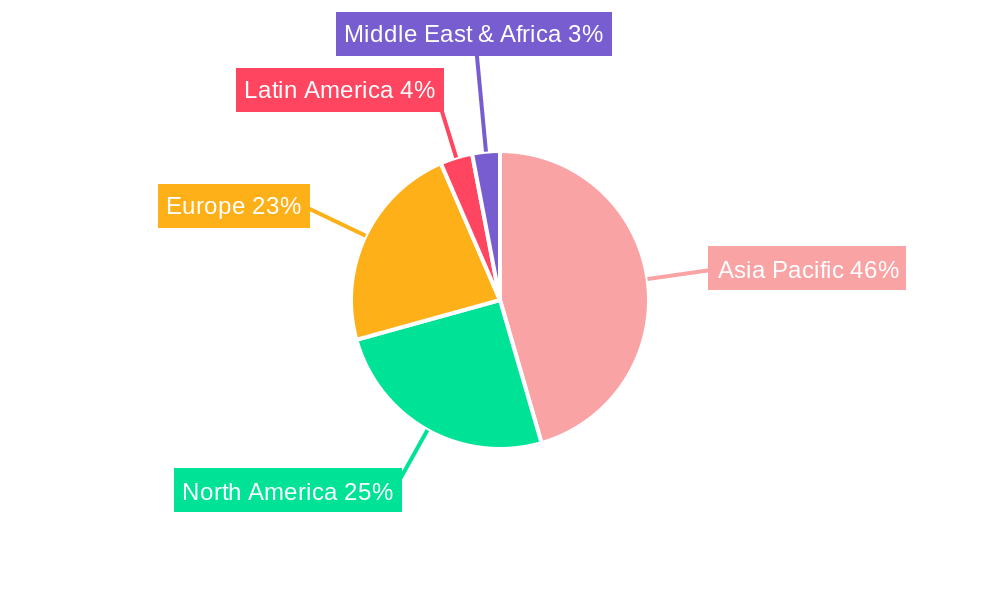

Asia-Pacific Connected Cars Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Connected Cars Industry Regional Market Share

Geographic Coverage of Asia-Pacific Connected Cars Industry

Asia-Pacific Connected Cars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vehicle Safety and User Convenience

- 3.3. Market Restrains

- 3.3.1. Vulnerability to Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Integrated Navigation System to gain significant Traction in the coming years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Navigation

- 5.2.2. Entertainment

- 5.2.3. Safety

- 5.2.4. Vehicle Management

- 5.2.5. Others (Multimedia Streaming etc.)

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Connectivity

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Vehicle-to-Everything (V2X)

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Original Equipment Manufacturer (OEM)

- 5.4.2. Aftermarket/Replacement

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hyundai Motor Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mercedes Benz Group AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Denso Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TomTom N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NVIDIA Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZF Friedrichshafen

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aptiv PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NXP Semiconductors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Harman International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Continental AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BMW AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Robert Bosch GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SAIC Motor Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Audi AG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Volvo AB

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Airbiquity In

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Hyundai Motor Group

List of Figures

- Figure 1: Asia-Pacific Connected Cars Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Connected Cars Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Connectivity 2020 & 2033

- Table 4: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 5: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 8: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Connectivity 2020 & 2033

- Table 9: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Connected Cars Industry?

The projected CAGR is approximately 16.76%.

2. Which companies are prominent players in the Asia-Pacific Connected Cars Industry?

Key companies in the market include Hyundai Motor Group, Mercedes Benz Group AG, Denso Corporation, TomTom N V, NVIDIA Corp, ZF Friedrichshafen, Aptiv PLC, NXP Semiconductors, Harman International, Continental AG, BMW AG, Robert Bosch GmbH, SAIC Motor Corporation, Audi AG, Volvo AB, Airbiquity In.

3. What are the main segments of the Asia-Pacific Connected Cars Industry?

The market segments include Vehicle Type, Technology Type, Vehicle Connectivity, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vehicle Safety and User Convenience.

6. What are the notable trends driving market growth?

Integrated Navigation System to gain significant Traction in the coming years.

7. Are there any restraints impacting market growth?

Vulnerability to Cyber Attacks.

8. Can you provide examples of recent developments in the market?

June 2023: Hyundai Motor Group, a multinational automotive manufacturer based out of South Korea, announced that its connected car services reached 10 million subscribers, owing to the growth in overseas subscribers using Bluelink, Kia Connect, and Genesis Connected Services. The company further stated that it expected that its connected car services would reach 20 million subscribers by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Connected Cars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Connected Cars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Connected Cars Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Connected Cars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence