Key Insights

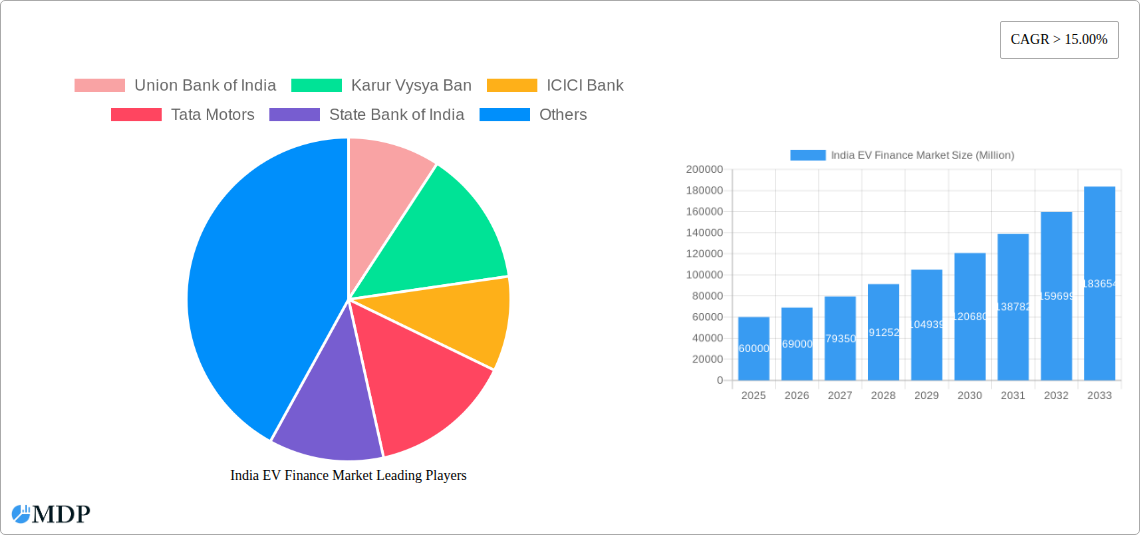

India's Electric Vehicle (EV) Finance Market is projected for significant expansion. With an estimated market size of USD 2.37 billion in 2025, the market is expected to grow at a compound annual growth rate (CAGR) of 15.4% through 2033. This growth is propelled by supportive government initiatives, rising environmental awareness, and advancements in EV technology, including extended range and reduced costs. Key government programs like FAME and state-level EV policies are driving demand for electric mobility. Growing consumer preference for sustainable transport, particularly in urban areas, and the increasing availability of diverse EV models across segments, are further accelerating market penetration. While still developing, the expanding EV charging infrastructure is also boosting consumer confidence.

India EV Finance Market Market Size (In Billion)

The market features evolving financing models and increased involvement from diverse financial institutions. Original Equipment Manufacturers (OEMs) are partnering with banks and Non-Banking Financial Companies (NBFCs) to offer attractive financing options, enhancing EV affordability. Financial institutions are developing specialized loan products for EV buyers, including extended repayment periods and competitive interest rates. While new vehicles currently lead, the used EV segment is anticipated to gain traction as the market matures. Passenger cars and commercial vehicles remain the primary focus, with growing interest in electric two-wheelers and three-wheelers for last-mile delivery and urban commuting. Although higher initial costs for some EVs and evolving charging infrastructure present challenges, these are being mitigated by technological advancements and policy interventions, ensuring sustained market growth.

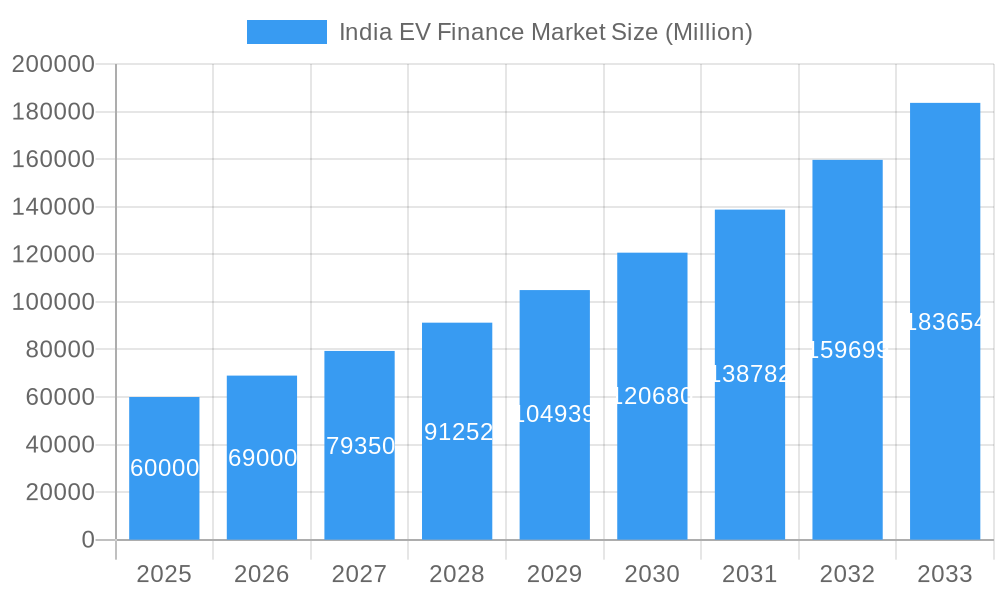

India EV Finance Market Company Market Share

Gain critical insights into India's burgeoning EV finance market with this comprehensive report. Covering 2019-2033, with a base and estimated year of 2025, this analysis details market dynamics, industry trends, key segments, and future opportunities. Essential for investors, financial institutions, OEMs, and policymakers, this report provides a strategic roadmap for navigating the evolving EV financing landscape. Leverage high-impact keywords including "EV finance India," "electric vehicle loans," "India automotive finance," "new energy vehicle financing," "EV market growth," and "sustainable mobility finance" to optimize your strategy.

India EV Finance Market Market Dynamics & Concentration

The India EV Finance Market is exhibiting dynamic growth, driven by increasing government support for electric mobility and a burgeoning consumer interest in sustainable transportation. Market concentration is moderate, with a significant presence of major public and private sector banks alongside specialized financial institutions and NBFCs. Key innovation drivers include the development of tailored financing products, digital lending platforms, and partnerships between financial entities and EV manufacturers. Regulatory frameworks, such as FAME India schemes and production-linked incentives, are crucial in shaping the market. Product substitutes, like traditional ICE vehicle financing, are gradually losing ground to the growing appeal of EV financing. End-user trends point towards a strong demand from the two-wheeler and passenger car segments, with an increasing focus on fleet electrification. Mergers and acquisition activities, while nascent, are expected to escalate as companies seek to capitalize on market share expansion. For instance, the market share of Tata Motors in passenger EVs stands at a commanding 89% by Q1 FY23, highlighting a concentrated OEM presence. M&A deal counts are projected to rise as consolidation occurs to achieve economies of scale and broaden service offerings. The overall market is poised for significant expansion, attracting substantial investment.

India EV Finance Market Industry Trends & Analysis

The India EV Finance Market is experiencing exponential growth, fueled by a confluence of factors including aggressive government targets for EV adoption, declining battery costs, and a growing environmental consciousness among consumers. The projected Compound Annual Growth Rate (CAGR) for the EV finance sector is anticipated to be in the range of 30-40% over the forecast period. Market penetration of EV financing solutions is currently estimated at around 15-20% and is expected to surge to over 50% by 2030. Technological disruptions are continuously reshaping the industry, with digital lending platforms and AI-powered credit assessment becoming increasingly prevalent, thereby improving accessibility and reducing turnaround times for loan approvals. Consumer preferences are rapidly shifting towards EVs, driven by lower running costs, reduced pollution, and the aspirational appeal of adopting new-age technology. The competitive dynamics are characterized by intense rivalry among established banks, new-age fintech lenders, and dedicated EV finance providers, all vying for a larger share of this lucrative market. The increasing availability of a wider range of EV models across various price points, from affordable two-wheelers to premium passenger cars, further stimulates demand for financing. The government's emphasis on local manufacturing of EVs and components, coupled with favorable policies, is creating a robust ecosystem that supports sustained growth in EV finance.

Leading Markets & Segments in India EV Finance Market

The Two-Wheeler segment dominates the India EV Finance Market, driven by their affordability, widespread adoption for personal mobility and last-mile delivery services, and supportive government incentives. The Passenger Cars segment is experiencing rapid growth, propelled by increasing model availability, improving charging infrastructure, and a growing preference for sustainable personal transport.

Type:

- New Vehicles: This segment holds the largest market share, as the majority of EV sales currently involve brand-new vehicles. Financial institutions are actively developing attractive loan schemes to incentivize the purchase of new EVs.

- Used Vehicles: The used EV finance market is an emerging segment with significant growth potential as the stock of pre-owned EVs increases. Challenges remain in accurate valuation and residual risk assessment.

Source Type:

- Banks: Public and private sector banks are leading the market, leveraging their extensive customer base and established lending infrastructure. They offer a wide range of loan products for individual buyers and fleet operators.

- Financial Institutions/NBFCs: Non-Banking Financial Companies (NBFCs) and specialized financial institutions play a crucial role, particularly in financing commercial EVs and providing flexible solutions for OEMs and dealers.

- OEMs: Original Equipment Manufacturers (OEMs) are increasingly partnering with financial institutions to offer integrated financing solutions, simplifying the purchase process for customers and driving sales.

Vehicle Type:

- Two-Wheelers: This segment is the largest and fastest-growing, with a strong demand from urban and semi-urban areas for both personal use and commercial purposes like last-mile delivery.

- Passenger Cars: The demand for electric passenger cars is on an upward trajectory, fueled by rising disposable incomes and a growing awareness of environmental benefits.

- Commercial Vehicles: The electrification of commercial fleets, including buses and trucks, presents a significant opportunity for EV finance, driven by operational cost savings and corporate sustainability goals.

- Three-Wheelers: Electric three-wheelers are vital for last-mile logistics and personal transport in many parts of India, making their financing a key segment.

Economic policies promoting EV adoption, such as subsidies and tax benefits, are major drivers across all segments. The expansion of charging infrastructure is also a critical enabler, directly impacting the viability and financing of EVs.

India EV Finance Market Product Developments

Product development in the India EV Finance Market is characterized by innovative financing schemes and digital integration. Tailored loan products with flexible repayment options, lower interest rates for eco-friendly vehicles, and longer tenures are becoming commonplace. Several financial institutions are collaborating with EV manufacturers to offer bundled financing and insurance packages. The focus is on streamlining the loan application and approval process through digital platforms, enabling faster disbursals. Competitive advantages are being gained by those who offer end-to-end digital solutions, personalized financing options, and attractive interest rates, thereby enhancing customer convenience and accessibility.

Key Drivers of India EV Finance Market Growth

The significant growth of the India EV Finance Market is propelled by several key drivers. Government initiatives, including subsidies under schemes like FAME India and tax incentives for EV buyers and manufacturers, are creating a highly conducive environment. Technological advancements in battery technology and decreasing EV prices are making electric mobility more accessible. The rising cost of fossil fuels and the increasing awareness of environmental pollution are making EVs a more attractive and economical choice for consumers. Furthermore, the expansion of charging infrastructure across the country is alleviating range anxiety and boosting consumer confidence in EV adoption.

Challenges in the India EV Finance Market Market

Despite its rapid growth, the India EV Finance Market faces several challenges. High initial upfront costs of EVs, although declining, remain a barrier for a significant portion of the population. The nascent stage of the used EV market, with concerns around battery degradation and resale value, poses a challenge for financing. Inadequate charging infrastructure in certain regions, along with inconsistent electricity supply, can impact the practicality of EV ownership. Furthermore, evolving regulatory frameworks and the need for standardized valuation methodologies for EVs can create uncertainties for financial institutions. Limited awareness and understanding of EV financing products among potential borrowers also present a hurdle.

Emerging Opportunities in India EV Finance Market

The India EV Finance Market is brimming with emerging opportunities. The rapid growth of the electric two-wheeler segment, especially for last-mile delivery and personal commute, presents a massive financing opportunity. The government's focus on electrifying public transportation, including buses and commercial fleets, opens up significant avenues for fleet financing. Strategic partnerships between financial institutions, OEMs, and charging infrastructure providers can create synergistic ecosystems, offering comprehensive solutions to consumers. The development of specialized financial products for battery swapping services and charging infrastructure development further expands the market's scope.

Leading Players in the India EV Finance Market Sector

- Union Bank of India

- Karur Vysya Bank

- ICICI Bank

- Tata Motors

- State Bank of India

- Axis Bank

- Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited)

- IDFC FIRST Bank

- Shriram Transport Finance Company (STFC)

Key Milestones in India EV Finance Market Industry

- November 2022: Shriram Transport Finance Co. (STFC) tied up with Euler Motors (Euler) to finance electric 3-wheeler cargo vehicles for last-mile logistics solutions, aligning with STFC's commitment to a green and sustainable future and acknowledging the rising demand for e-commerce and logistics-related vehicles.

- October 2022: BYD India Private Limited partnered with ICICI Bank through an MOU to offer comprehensive financing solutions for its dealers and customers, providing a bouquet of financial products.

- August 2022: Tata Motors collaborated with State Bank of India to introduce an Electronic Dealer Finance solution (e-DFS) for its authorized passenger EV dealers, supporting Tata Motors' leadership in India's e-mobility wave, which saw over 30,000 Tata EVs on the road by Q1 FY23.

- June 2022: Ather Energy and State Bank of India announced a collaboration to provide financing options for electric vehicle buyers, leveraging SBI's extensive reach to facilitate easier purchase of electric scooters.

Strategic Outlook for India EV Finance Market Market

The strategic outlook for the India EV Finance Market is exceptionally positive, characterized by sustained growth and increasing financial innovation. Key growth accelerators include the continued expansion of government support through policy interventions and incentives, driving both EV adoption and the demand for financing. The ongoing decline in battery costs and increasing production efficiencies will further lower the total cost of ownership for EVs, making them more attractive to a wider consumer base. Financial institutions are expected to increasingly leverage digital technologies for enhanced customer experience, faster loan processing, and more efficient risk assessment. The growing emphasis on ESG (Environmental, Social, and Governance) principles by investors will also catalyze investment in the EV finance sector. Strategic partnerships will remain crucial for expanding reach and offering integrated solutions, ultimately driving market penetration and fostering a robust ecosystem for sustainable mobility finance in India.

India EV Finance Market Segmentation

-

1. Type

- 1.1. New Vehicles

- 1.2. Used Vehicles

-

2. Source Type

- 2.1. OEMs

- 2.2. Banks

- 2.3. Credit Unions

- 2.4. Financial Institutions

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

- 3.3. Two-Wheelers

- 3.4. Three-Wheelers

India EV Finance Market Segmentation By Geography

- 1. India

India EV Finance Market Regional Market Share

Geographic Coverage of India EV Finance Market

India EV Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Penetration of Electric Vehicles in India to Spur Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicles

- 5.1.2. Used Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. OEMs

- 5.2.2. Banks

- 5.2.3. Credit Unions

- 5.2.4. Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.3.3. Two-Wheelers

- 5.3.4. Three-Wheelers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Union Bank of India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Karur Vysya Ban

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ICICI Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Motors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 State Bank of India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDFC FIRST Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shriram Transport Finance Company (STFC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Union Bank of India

List of Figures

- Figure 1: India EV Finance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India EV Finance Market Share (%) by Company 2025

List of Tables

- Table 1: India EV Finance Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India EV Finance Market Revenue billion Forecast, by Source Type 2020 & 2033

- Table 3: India EV Finance Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: India EV Finance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India EV Finance Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India EV Finance Market Revenue billion Forecast, by Source Type 2020 & 2033

- Table 7: India EV Finance Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: India EV Finance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Finance Market?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the India EV Finance Market?

Key companies in the market include Union Bank of India, Karur Vysya Ban, ICICI Bank, Tata Motors, State Bank of India, Axis Bank, Poonawalla Fincorp Limited (Formerly Magma Fincorp Limited), IDFC FIRST Bank, Shriram Transport Finance Company (STFC).

3. What are the main segments of the India EV Finance Market?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Penetration of Electric Vehicles in India to Spur Market Growth.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Shriram Transport Finance Co. (STFC) tied up with Euler Motors (Euler) to finance electric 3-wheeler cargo vehicles for last-mile logistics solutions. The partnership is in line with the objective of a green and sustainable future that Shriram embarked upon in 2022. STFC has witnessed the rising demand for e-commerce and logistics-related vehicles and the rising need for their financing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Finance Market?

To stay informed about further developments, trends, and reports in the India EV Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence