Key Insights

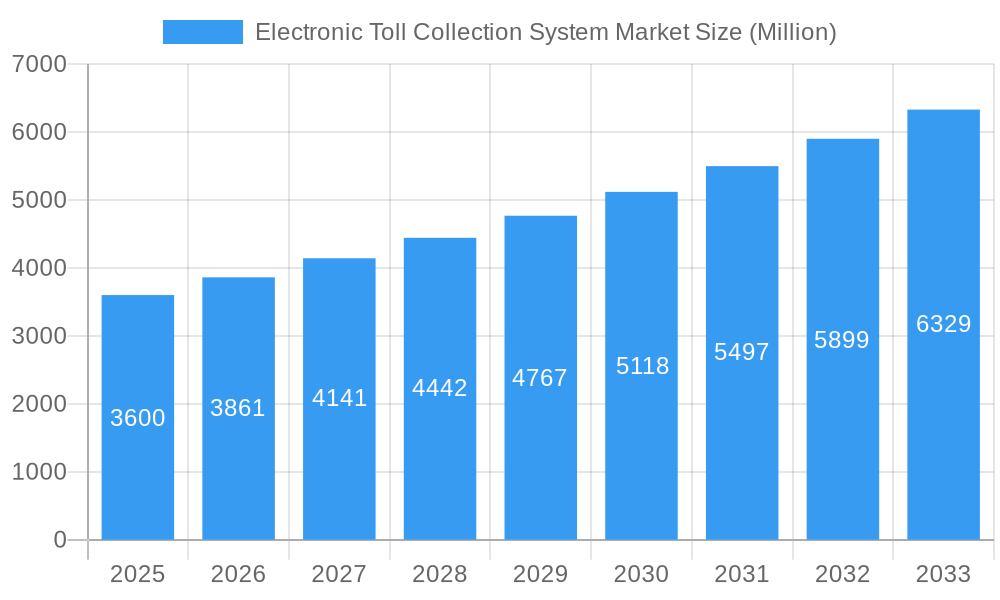

The global Electronic Toll Collection (ETC) System Market is experiencing robust growth, projected to reach an estimated USD 3.6 billion in 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 7.49%. This expansion is fueled by the increasing adoption of advanced technologies for efficient traffic management and the rising demand for seamless, contactless payment solutions. Key drivers include government initiatives to modernize toll infrastructure, reduce traffic congestion, and enhance road safety. The transition from manual to automated tolling systems is a significant trend, offering improved operational efficiency for toll operators and enhanced convenience for motorists. Furthermore, the integration of AI, IoT, and cloud computing is enabling more sophisticated functionalities within ETC systems, such as real-time data analytics and predictive maintenance, further accelerating market penetration.

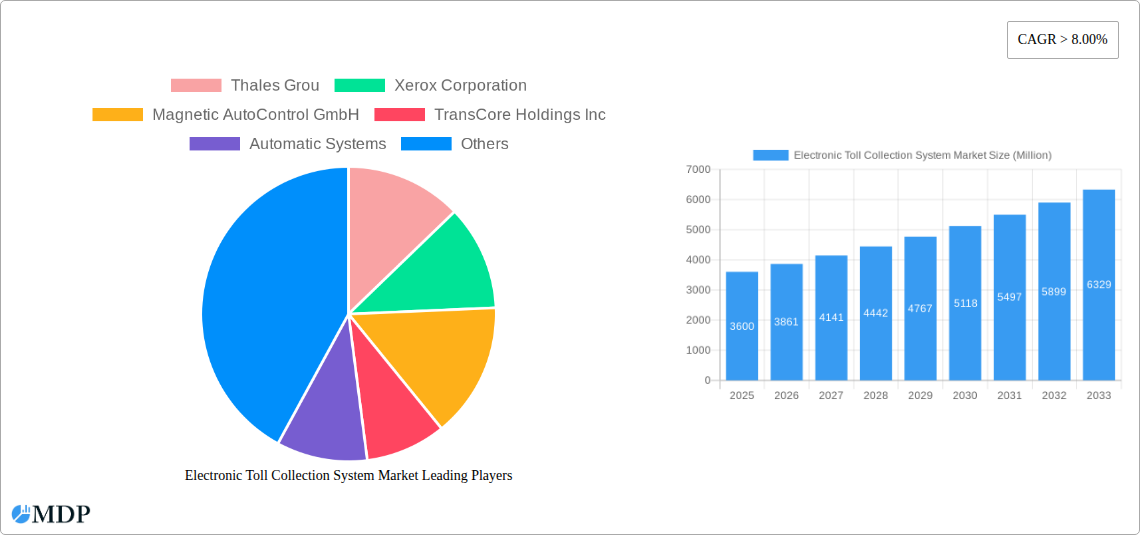

Electronic Toll Collection System Market Market Size (In Billion)

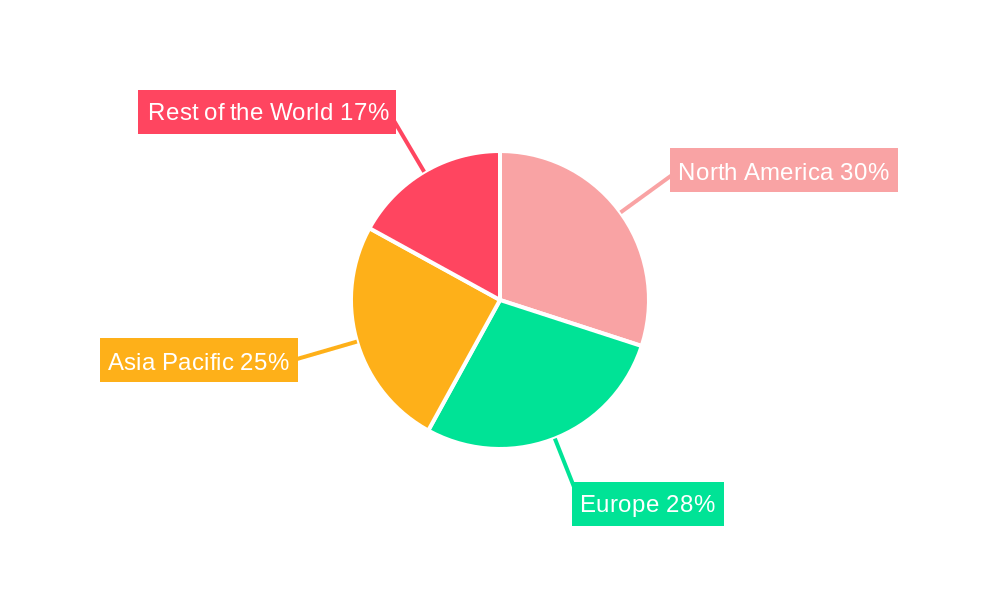

The market segmentation highlights the dominance of Electronic Toll Collection as the primary toll collection type, reflecting a clear shift away from traditional barrier and entry/exit methods. In terms of applications, roads represent the largest segment, followed by bridges and tunnels, indicating the widespread deployment of ETC systems across various transportation infrastructures. While the market is poised for significant growth, certain restraints, such as high initial investment costs for infrastructure upgrades and concerns regarding data security and privacy, need to be strategically addressed by market players. The competitive landscape features established players like Thales Group, Xerox Corporation, and Siemens AG, alongside emerging innovators, all vying for market share through technological advancements and strategic partnerships. Regional analysis indicates North America and Europe as mature markets with high adoption rates, while the Asia Pacific region presents substantial growth opportunities due to rapid urbanization and infrastructure development.

Electronic Toll Collection System Market Company Market Share

Electronic Toll Collection System Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a panoramic view of the global Electronic Toll Collection (ETC) System Market, essential for stakeholders navigating this rapidly evolving landscape. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, key players, historical milestones, and strategic outlook. The market is projected to reach an estimated value of $15.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.2% from 2025 to 2033. This report utilizes a robust methodology, incorporating high-traffic keywords such as "electronic toll collection," "tolling systems," "smart roads," "traffic management," and "ITS solutions" to maximize search visibility and attract industry professionals, government bodies, and technology providers.

Electronic Toll Collection System Market Market Dynamics & Concentration

The Electronic Toll Collection System Market exhibits a moderately concentrated structure, with a few key players holding significant market share. Innovation drivers are primarily fueled by the increasing demand for seamless traffic flow, reduced congestion, and enhanced revenue collection efficiency for transportation authorities. Regulatory frameworks globally are increasingly mandating or incentivizing the adoption of ETC, pushing market growth. Product substitutes, such as manual toll booths and manual payment systems, are gradually being phased out due to their inherent inefficiencies. End-user trends reveal a growing preference for contactless and automated payment solutions, driven by convenience and speed. Mergers and acquisitions (M&A) activities are a notable feature, with an estimated 15 M&A deals in the historical period (2019-2024), indicating consolidation and strategic expansion efforts. Key companies like Thales Group and Xerox Corporation are at the forefront of these strategic moves, aiming to capture greater market share and technological leadership. The market is projected to witness further consolidation as larger entities acquire innovative startups and smaller competitors to enhance their product portfolios and geographical reach.

Electronic Toll Collection System Market Industry Trends & Analysis

The Electronic Toll Collection System Market is experiencing robust growth, propelled by several interconnected industry trends. A primary market growth driver is the escalating global investment in smart infrastructure and Intelligent Transportation Systems (ITS). Governments worldwide are recognizing the economic and environmental benefits of efficient toll collection, leading to increased deployment of ETC technologies on highways, bridges, and tunnels. Technological disruptions, including the advancement of Radio-Frequency Identification (RFID) and Dedicated Short-Range Communications (DSRC) technologies, along with the burgeoning adoption of GPS and mobile-based payment solutions, are reshaping the market. These innovations offer enhanced accuracy, greater convenience for users, and richer data for traffic management. Consumer preferences are strongly leaning towards friction-less payment experiences, minimizing stop times and improving overall journey efficiency. This demand is a significant catalyst for the widespread adoption of ETC. The competitive dynamics within the market are intensifying, with both established players and new entrants vying for dominance. Market penetration for ETC systems is projected to increase from approximately 65% in 2023 to an estimated 85% by 2030. The global ETC market size, estimated at $11.8 billion in 2024, is on a trajectory to reach an estimated $15.5 billion by 2025, growing at a CAGR of 10.2% between 2025 and 2033. This sustained growth is also attributed to the increasing number of vehicles on the road and the need for sophisticated traffic management solutions in urban and intercity areas.

Leading Markets & Segments in Electronic Toll Collection System Market

North America currently leads the Electronic Toll Collection System Market, driven by extensive highway networks and early adoption of advanced tolling technologies. Within North America, the United States dominates due to significant infrastructure projects and state-level mandates for ETC. Globally, Asia-Pacific is emerging as a high-growth region, fueled by rapid urbanization, massive infrastructure development, and government initiatives promoting smart city concepts.

- Dominant Region: North America (primarily USA and Canada)

- Key Drivers: Extensive existing toll road infrastructure, high vehicle density, government initiatives for traffic management, technological innovation.

- Emerging High-Growth Region: Asia-Pacific (particularly China, India, and Southeast Asian countries)

- Key Drivers: Rapidly expanding road networks, increasing vehicle ownership, government focus on smart city development, adoption of new technologies, large population centers.

In terms of Toll Collection Type:

- Electronic Toll Collection (ETC): This segment is the undisputed leader and the fastest-growing.

- Key Drivers: Superior efficiency, reduced environmental impact (less idling), enhanced user experience, potential for integration with other ITS services, government mandates. The ETC segment is projected to account for over 80% of the total market revenue by 2030.

- Entry/Exit Toll Collection: This traditional method is gradually being supplanted by ETC but remains relevant in certain regions or for specific tolling points.

- Barrier Toll Collection: While still present, this manual or semi-automated system is facing significant decline due to its inefficiencies.

In terms of Application Type:

- Roads: This is the largest application segment, encompassing major highways, expressways, and arterial roads.

- Key Drivers: High traffic volumes, need for efficient revenue collection, traffic flow optimization, reduction of congestion. The global road tolling segment is estimated to contribute over 70% of the ETC market revenue.

- Bridges: ETC systems are crucial for managing traffic and revenue on high-traffic bridges, where congestion can be a major issue.

- Key Drivers: High usage, critical infrastructure status, need for rapid transit.

- Tunnels: Similar to bridges, ETC systems are vital for maintaining smooth traffic flow and efficient tolling on tunnels.

- Key Drivers: Bottleneck points, traffic management imperatives, safety considerations.

Electronic Toll Collection System Market Product Developments

Product developments in the Electronic Toll Collection System Market are characterized by a relentless pursuit of greater accuracy, faster transaction speeds, and enhanced user convenience. Innovations are increasingly focusing on the integration of AI and machine learning for intelligent traffic analysis and fraud detection. Advancements in DSRC and 5G connectivity are enabling real-time data exchange, facilitating seamless communication between vehicles and tolling infrastructure. The development of cloud-based platforms and mobile applications offers users more flexibility in managing their toll accounts and making payments. These product innovations are designed to provide a competitive edge by offering superior system performance, lower operational costs for authorities, and an improved experience for drivers.

Key Drivers of Electronic Toll Collection System Market Growth

The growth of the Electronic Toll Collection System Market is driven by a confluence of technological, economic, and regulatory factors.

- Technological Advancements: The continuous evolution of RFID, DSRC, GPS, and AI technologies enables more efficient, accurate, and contactless tolling solutions.

- Government Mandates and Investments: Growing government initiatives to modernize infrastructure, improve traffic management, and reduce congestion are strong drivers. Many countries are mandating ETC for new road projects.

- Increasing Vehicle Ownership: The rising global vehicle population directly correlates with the need for sophisticated tolling systems to manage traffic flow and generate revenue.

- Environmental Concerns: Reduced vehicle idling time at toll plazas contributes to lower emissions, aligning with global sustainability goals and encouraging ETC adoption.

- Demand for Convenience: End-users increasingly seek seamless and automated payment methods, pushing for the widespread adoption of ETC.

Challenges in the Electronic Toll Collection System Market Market

Despite its strong growth trajectory, the Electronic Toll Collection System Market faces several challenges.

- High Initial Investment Costs: The upfront cost of implementing and integrating advanced ETC systems can be substantial for some authorities.

- Interoperability Issues: Ensuring seamless operation across different tolling systems and geographical regions remains a significant challenge.

- Data Security and Privacy Concerns: The collection and storage of user data raise concerns about security breaches and privacy violations, requiring robust cybersecurity measures.

- Resistance to Change: In some regions, there might be resistance from users accustomed to traditional payment methods, necessitating effective public awareness campaigns.

- Regulatory Hurdles: Navigating diverse and sometimes slow-moving regulatory landscapes across different countries can impede rapid deployment.

Emerging Opportunities in Electronic Toll Collection System Market

Emerging opportunities in the Electronic Toll Collection System Market are poised to shape its future landscape. The integration of ETC with broader smart city initiatives presents significant potential, enabling functionalities beyond simple toll collection, such as parking management, congestion pricing, and data analytics for urban planning. The development of advanced AI-powered analytics can provide deeper insights into traffic patterns, enabling predictive maintenance and optimized route planning. Strategic partnerships between technology providers, infrastructure developers, and government bodies are crucial for developing comprehensive and integrated mobility solutions. Furthermore, the expansion of ETC systems into emerging economies, particularly in developing nations undergoing rapid infrastructure development, offers substantial untapped market potential. The growing demand for electric vehicles (EVs) also opens avenues for specialized tolling solutions and data services tailored to EV owners.

Leading Players in the Electronic Toll Collection System Market Sector

- Thales Group

- Xerox Corporation

- Magnetic AutoControl GmbH

- TransCore Holdings Inc

- Automatic Systems

- Feig Electronics

- TRMI Systems Integration

- Siemens AG

- Schneider Electric SE

- Nedap NV

- DENSO Corporation

- Mitsubishi Heavy Industries Ltd

Key Milestones in Electronic Toll Collection System Market Industry

- 2019: Increased adoption of cashless payments and smartphone-integrated tolling solutions globally.

- 2020: COVID-19 pandemic accelerates the adoption of contactless ETC solutions due to public health concerns.

- 2021: Major infrastructure projects in Asia-Pacific commence, heavily featuring advanced ETC deployments.

- 2022: Introduction of AI and machine learning into ETC systems for enhanced traffic analysis and fraud detection.

- 2023: Focus on interoperability standards and cross-border tolling solutions gains momentum.

- 2024: Significant investments in cloud-based ETC platforms and data analytics for smart city integration.

Strategic Outlook for Electronic Toll Collection System Market Market

The strategic outlook for the Electronic Toll Collection System Market is exceptionally promising, driven by sustained global investments in smart infrastructure and the ongoing digital transformation of transportation. Growth accelerators will center on the widespread integration of AI and IoT for smarter, more predictive tolling operations. The expansion of interoperable ETC networks, facilitating seamless travel across regions and countries, will be a key focus. Strategic partnerships between public and private sectors will be vital for unlocking new revenue streams and implementing innovative mobility-as-a-service (MaaS) solutions. The market will witness a continued shift towards highly automated, data-driven systems that offer enhanced efficiency, improved user experiences, and valuable insights for transportation planning and management. The projected market value of $15.5 billion by 2025 is just the beginning of a significant upward trend.

Electronic Toll Collection System Market Segmentation

-

1. Toll Collection Type

- 1.1. Barrier Toll Collection

- 1.2. Entry/Exit Toll Collection

- 1.3. Electronic Toll Collection

-

2. Application Type

- 2.1. Bridges

- 2.2. Roads

- 2.3. Tunnels

Electronic Toll Collection System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Electronic Toll Collection System Market Regional Market Share

Geographic Coverage of Electronic Toll Collection System Market

Electronic Toll Collection System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. Electronic Toll Collection is Expected to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Toll Collection System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 5.1.1. Barrier Toll Collection

- 5.1.2. Entry/Exit Toll Collection

- 5.1.3. Electronic Toll Collection

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Bridges

- 5.2.2. Roads

- 5.2.3. Tunnels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 6. North America Electronic Toll Collection System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 6.1.1. Barrier Toll Collection

- 6.1.2. Entry/Exit Toll Collection

- 6.1.3. Electronic Toll Collection

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Bridges

- 6.2.2. Roads

- 6.2.3. Tunnels

- 6.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 7. Europe Electronic Toll Collection System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 7.1.1. Barrier Toll Collection

- 7.1.2. Entry/Exit Toll Collection

- 7.1.3. Electronic Toll Collection

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Bridges

- 7.2.2. Roads

- 7.2.3. Tunnels

- 7.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 8. Asia Pacific Electronic Toll Collection System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 8.1.1. Barrier Toll Collection

- 8.1.2. Entry/Exit Toll Collection

- 8.1.3. Electronic Toll Collection

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Bridges

- 8.2.2. Roads

- 8.2.3. Tunnels

- 8.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 9. Rest of the World Electronic Toll Collection System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 9.1.1. Barrier Toll Collection

- 9.1.2. Entry/Exit Toll Collection

- 9.1.3. Electronic Toll Collection

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Bridges

- 9.2.2. Roads

- 9.2.3. Tunnels

- 9.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Thales Grou

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Xerox Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Magnetic AutoControl GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TransCore Holdings Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Automatic Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Feig Electronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TRMI Systems Integration

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schneider Electric SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nedap NV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DENSO Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mitsubishi Heavy Industries Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Thales Grou

List of Figures

- Figure 1: Global Electronic Toll Collection System Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electronic Toll Collection System Market Revenue (undefined), by Toll Collection Type 2025 & 2033

- Figure 3: North America Electronic Toll Collection System Market Revenue Share (%), by Toll Collection Type 2025 & 2033

- Figure 4: North America Electronic Toll Collection System Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 5: North America Electronic Toll Collection System Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Electronic Toll Collection System Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electronic Toll Collection System Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electronic Toll Collection System Market Revenue (undefined), by Toll Collection Type 2025 & 2033

- Figure 9: Europe Electronic Toll Collection System Market Revenue Share (%), by Toll Collection Type 2025 & 2033

- Figure 10: Europe Electronic Toll Collection System Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 11: Europe Electronic Toll Collection System Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Electronic Toll Collection System Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Electronic Toll Collection System Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electronic Toll Collection System Market Revenue (undefined), by Toll Collection Type 2025 & 2033

- Figure 15: Asia Pacific Electronic Toll Collection System Market Revenue Share (%), by Toll Collection Type 2025 & 2033

- Figure 16: Asia Pacific Electronic Toll Collection System Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Electronic Toll Collection System Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Electronic Toll Collection System Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Electronic Toll Collection System Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Electronic Toll Collection System Market Revenue (undefined), by Toll Collection Type 2025 & 2033

- Figure 21: Rest of the World Electronic Toll Collection System Market Revenue Share (%), by Toll Collection Type 2025 & 2033

- Figure 22: Rest of the World Electronic Toll Collection System Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 23: Rest of the World Electronic Toll Collection System Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Rest of the World Electronic Toll Collection System Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Electronic Toll Collection System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Toll Collection Type 2020 & 2033

- Table 2: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Toll Collection Type 2020 & 2033

- Table 5: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Toll Collection Type 2020 & 2033

- Table 11: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 12: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Toll Collection Type 2020 & 2033

- Table 19: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 20: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: China Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Toll Collection Type 2020 & 2033

- Table 27: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 28: Global Electronic Toll Collection System Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Electronic Toll Collection System Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Toll Collection System Market?

The projected CAGR is approximately 10.8%.

2. Which companies are prominent players in the Electronic Toll Collection System Market?

Key companies in the market include Thales Grou, Xerox Corporation, Magnetic AutoControl GmbH, TransCore Holdings Inc, Automatic Systems, Feig Electronics, TRMI Systems Integration, Siemens AG, Schneider Electric SE, Nedap NV, DENSO Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Electronic Toll Collection System Market?

The market segments include Toll Collection Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

Electronic Toll Collection is Expected to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Toll Collection System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Toll Collection System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Toll Collection System Market?

To stay informed about further developments, trends, and reports in the Electronic Toll Collection System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence