Key Insights

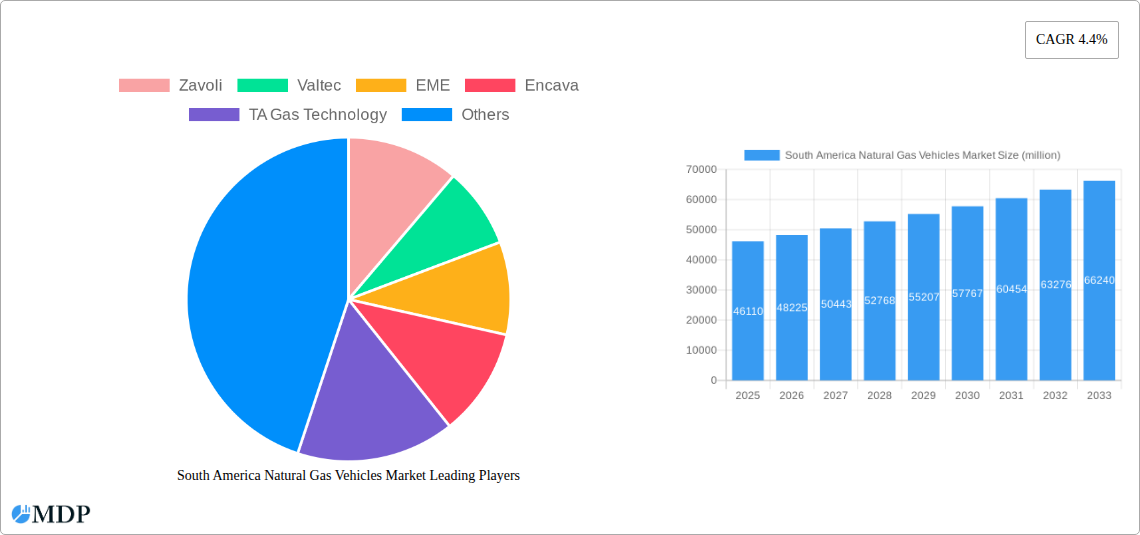

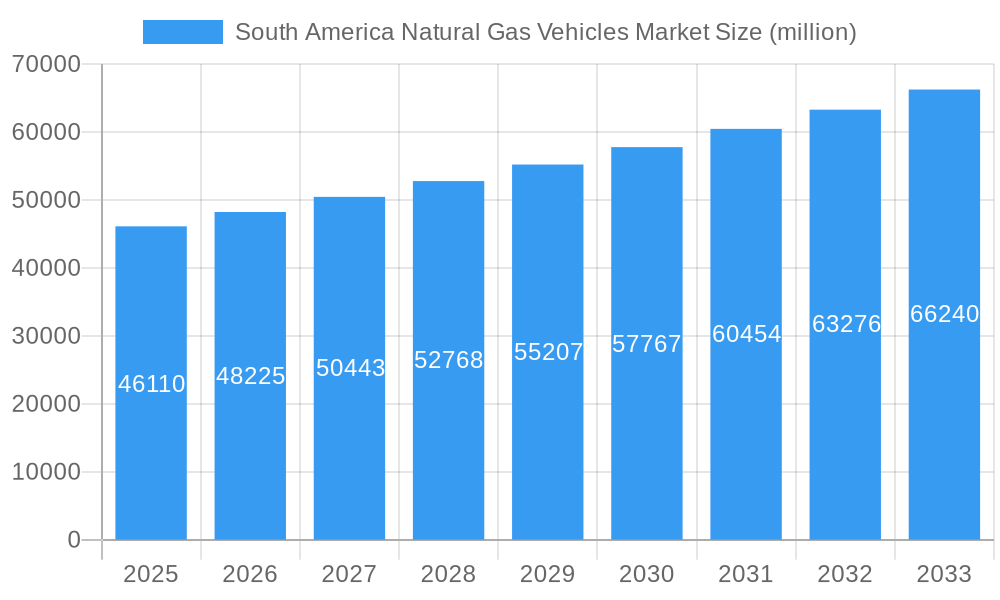

The South America Natural Gas Vehicles (NGV) market is poised for substantial growth, projected to reach an estimated USD 46,110 million in 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 4.4% through 2033. This expansion is primarily fueled by an increasing demand for cleaner and more economical transportation alternatives across the region. Governments in South America are actively promoting the adoption of NGVs through favorable policies, subsidies, and the development of refueling infrastructure, driven by concerns over air quality and the desire to reduce reliance on volatile fossil fuel prices. The inherent cost savings offered by natural gas, particularly Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG), over traditional fuels like gasoline and diesel, make it an attractive option for both individual consumers and fleet operators in passenger cars and commercial vehicles alike. The OEM segment is expected to lead, integrating NGV technology into new vehicle production, while the aftermarket will play a crucial role in retrofitting existing fleets.

South America Natural Gas Vehicles Market Market Size (In Billion)

The market's upward trajectory is underpinned by strategic initiatives from key players such as Cummins Inc. and Fiat Motors, who are investing in NGV technology and expanding their product portfolios. Companies like Zavoli, Valtec, and BRC Gas Equipments are contributing significantly to the supply chain with their specialized NGV components. While the market demonstrates strong growth potential, certain restraints may include the initial upfront cost of NGV vehicles and the ongoing expansion required for a comprehensive refueling network, particularly in more remote areas. However, the clear environmental benefits and long-term economic advantages are expected to outweigh these challenges, solidifying South America's position as a significant and growing market for natural gas vehicles. Brazil and Argentina are anticipated to be the leading markets within the region, owing to their established natural gas reserves and proactive government policies.

South America Natural Gas Vehicles Market Company Market Share

This in-depth report offers an exhaustive analysis of the South America Natural Gas Vehicles Market, a dynamic sector poised for significant expansion driven by environmental concerns, economic advantages, and evolving regulatory landscapes. Covering the period from 2019 to 2033, with a detailed focus on the Base Year 2025 and a comprehensive Forecast Period from 2025 to 2033, this report provides actionable intelligence for stakeholders seeking to capitalize on the burgeoning opportunities within the region's natural gas vehicle (NGV) ecosystem.

South America Natural Gas Vehicles Market Market Dynamics & Concentration

The South America Natural Gas Vehicles Market exhibits a moderately concentrated structure, with a few key players holding substantial market share. Innovation is a primary driver, fueled by the pursuit of cleaner emission technologies and enhanced fuel efficiency. Regulatory frameworks are increasingly favoring NGVs, with governments enacting policies to promote their adoption as part of broader environmental and energy diversification strategies. Product substitutes, primarily traditional internal combustion engine vehicles and emerging electric vehicles, present a competitive challenge, though the lower operating costs of NGVs offer a distinct advantage. End-user trends indicate a growing preference for cost-effective and environmentally conscious transportation solutions, particularly within the commercial vehicle segment. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate their market positions and expand their technological capabilities. For instance, the number of strategic partnerships and acquisitions in the NGV component manufacturing sector is projected to increase by approximately 15% over the next three years.

South America Natural Gas Vehicles Market Industry Trends & Analysis

The South America Natural Gas Vehicles Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period. This expansion is primarily propelled by escalating fuel prices for gasoline and diesel, making natural gas a more economically viable alternative for fleet operators and individual consumers. Technological advancements in engine design and fuel system efficiency are further enhancing the appeal of NGVs, leading to improved performance and reduced emissions. Consumer preferences are shifting towards sustainability, with a growing awareness of the environmental benefits offered by natural gas as a cleaner-burning fuel. The competitive landscape is characterized by increasing investment in NGV infrastructure development, including refueling stations, which is crucial for wider market penetration. Market penetration of NGVs is estimated to reach 12% of the total vehicle fleet in key South American countries by 2030. The ongoing development of dual-fuel and tri-fuel engine technologies is also expanding the versatility and adoption potential of natural gas in various vehicle types.

Leading Markets & Segments in South America Natural Gas Vehicles Market

The dominance within the South America Natural Gas Vehicles Market is primarily attributed to Compressed Natural Gas (CNG) as the leading fuel type, owing to its established infrastructure and lower cost compared to Liquefied Petroleum Gas (LPG). Commercial Vehicles represent the largest segment by vehicle type, driven by the substantial operational cost savings and the increasing demand for sustainable logistics solutions from businesses.

Fuel Type Dominance (CNG):

- Extensive existing CNG refueling infrastructure in countries like Argentina and Brazil.

- Government incentives and subsidies supporting CNG conversion and adoption.

- Lower per-unit cost of CNG compared to LPG, making it more attractive for high-mileage vehicles.

Vehicle Type Dominance (Commercial Vehicles):

- High operational mileage of buses, trucks, and delivery vans leads to significant fuel cost savings with NGVs.

- Corporate sustainability initiatives pushing fleet operators towards cleaner fuel options.

- Supportive regulatory mandates for public transportation fleets to adopt lower-emission vehicles.

Sales Channel Dominance (OEMs):

- Increasing partnerships between NGV manufacturers and traditional automotive OEMs to offer factory-fitted NGV models.

- OEM integration ensures better quality control, warranty support, and consumer confidence in NGV technology.

- Streamlined adoption process for buyers opting for original equipment manufacturer (OEM) supplied NGVs.

The Aftermarket segment is also experiencing significant growth, driven by the conversion of existing gasoline and diesel vehicles to CNG or LPG. This is particularly prevalent in countries with a less developed OEM NGV offering. Economic policies encouraging domestic fuel production and utilization further bolster the market for both CNG and LPG vehicles.

South America Natural Gas Vehicles Market Product Developments

Recent product developments in the South America Natural Gas Vehicles Market are focused on enhancing engine efficiency, expanding the range of NGV models, and improving refueling infrastructure. Innovations include the introduction of advanced CNG injection systems for passenger cars, offering improved fuel economy and reduced emissions. For commercial vehicles, developments are centered on more powerful and durable NGV engines designed for heavy-duty applications. The integration of smart refueling technologies and the development of bi-fuel and tri-fuel systems are also key trends, providing consumers with greater flexibility and convenience. These advancements aim to bridge the gap with traditional fuels and electric vehicles, offering competitive advantages in terms of cost of ownership and environmental impact.

Key Drivers of South America Natural Gas Vehicles Market Growth

Several key factors are propelling the growth of the South America Natural Gas Vehicles Market. Economically, the significantly lower cost of natural gas compared to gasoline and diesel directly translates into substantial operational savings for fleet owners and individual drivers. Environmentally, the reduced greenhouse gas emissions and improved air quality offered by NGVs align with global sustainability goals and national environmental regulations. Technologically, advancements in NGV engine efficiency and conversion technologies are making these vehicles more practical and appealing. Regulatory support, including tax incentives, subsidies for NGV purchases and conversions, and mandates for public transportation fleets to adopt cleaner fuels, is a crucial catalyst. The growing availability of refueling infrastructure is also a significant growth driver, alleviating range anxiety for potential adopters.

Challenges in the South America Natural Gas Vehicles Market Market

Despite the promising growth trajectory, the South America Natural Gas Vehicles Market faces several challenges. A primary restraint is the underdeveloped refueling infrastructure in certain regions, which can limit widespread adoption, particularly for long-haul transportation. The initial cost of NGV vehicles or conversion kits can also be higher than their traditional counterparts, posing a barrier for price-sensitive consumers, though this is often offset by lower running costs. Stringent and evolving emission standards, while ultimately beneficial, can also present compliance challenges for manufacturers. Additionally, fluctuations in natural gas prices, though generally more stable than oil, can create some uncertainty. The availability of skilled technicians for NGV maintenance and repair is also a factor in some markets.

Emerging Opportunities in South America Natural Gas Vehicles Market

Emerging opportunities within the South America Natural Gas Vehicles Market are numerous and poised to shape its future. The increasing focus on decarbonization and the pursuit of energy independence are creating fertile ground for NGV expansion. Technological breakthroughs in areas like advanced material science for lighter and more robust fuel tanks, and the development of more efficient NGV powertrains, will further enhance the competitiveness of natural gas vehicles. Strategic partnerships between NGV manufacturers, fuel suppliers, and infrastructure developers are crucial for accelerating the build-out of refueling networks. Market expansion into new geographical regions within South America and the development of specialized NGV applications, such as waste management vehicles and agricultural machinery, represent significant untapped potential. The growing popularity of shared mobility services also presents an opportunity for NGV adoption in fleet operations.

Leading Players in the South America Natural Gas Vehicles Market Sector

- Zavoli

- Valtec

- EME

- Encava

- TA Gas Technology

- Cummins Inc.

- BRC Gas Equipments

- Fiat Motors

Key Milestones in South America Natural Gas Vehicles Market Industry

- 2019: Increased government incentives for NGV adoption in Argentina, leading to a surge in commercial vehicle conversions.

- 2020: Fiat Motors launches a new range of factory-fitted CNG passenger cars in Brazil, boosting OEM offerings.

- 2021: Expansion of CNG refueling station networks in Colombia and Peru, driven by private investment.

- 2022: Cummins Inc. announces plans to develop advanced NGV engines specifically for the South American market.

- 2023: Several key players, including BRC Gas Equipments and Valtec, reported significant growth in their aftermarket conversion kit sales.

- 2024: The emergence of new start-ups focused on innovative NGV conversion technologies, signaling increased competition and innovation.

Strategic Outlook for South America Natural Gas Vehicles Market Market

The strategic outlook for the South America Natural Gas Vehicles Market is overwhelmingly positive, driven by a confluence of environmental imperative and economic pragmatism. Future growth will be accelerated by continued government support, including the establishment of clearer long-term policy frameworks and financial incentives for both consumers and manufacturers. Investment in robust and widespread NGV refueling infrastructure will be paramount to overcoming adoption hurdles. Furthermore, collaborative efforts between technology providers, vehicle manufacturers, and energy companies will foster innovation in NGV engines, fuel systems, and integrated solutions. The increasing global demand for cleaner transportation alternatives, coupled with South America's abundant natural gas resources, positions the region as a key player in the future of sustainable mobility. Strategic partnerships and a focus on addressing infrastructure gaps will be crucial for unlocking the full market potential.

South America Natural Gas Vehicles Market Segmentation

-

1. Fuel Type

- 1.1. Compressed Natural Gas

- 1.2. Liquified Petroleum Gas

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Sales Channel

- 3.1. OEMs

- 3.2. Aftermarket

South America Natural Gas Vehicles Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Natural Gas Vehicles Market Regional Market Share

Geographic Coverage of South America Natural Gas Vehicles Market

South America Natural Gas Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Low Fuel Cost Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Natural Gas Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Compressed Natural Gas

- 5.1.2. Liquified Petroleum Gas

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEMs

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zavoli

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valtec

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EME

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Encava

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TA Gas Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cummins Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BRC Gas Equipments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fiat Motors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Zavoli

List of Figures

- Figure 1: South America Natural Gas Vehicles Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Natural Gas Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: South America Natural Gas Vehicles Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 2: South America Natural Gas Vehicles Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: South America Natural Gas Vehicles Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 4: South America Natural Gas Vehicles Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: South America Natural Gas Vehicles Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 6: South America Natural Gas Vehicles Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 7: South America Natural Gas Vehicles Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 8: South America Natural Gas Vehicles Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Argentina South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Chile South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Colombia South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Peru South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Venezuela South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Ecuador South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Bolivia South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Paraguay South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Uruguay South America Natural Gas Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Natural Gas Vehicles Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the South America Natural Gas Vehicles Market?

Key companies in the market include Zavoli, Valtec, EME, Encava, TA Gas Technology, Cummins Inc, BRC Gas Equipments, Fiat Motors.

3. What are the main segments of the South America Natural Gas Vehicles Market?

The market segments include Fuel Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 46110 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Low Fuel Cost Driving Growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Natural Gas Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Natural Gas Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Natural Gas Vehicles Market?

To stay informed about further developments, trends, and reports in the South America Natural Gas Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence