Key Insights

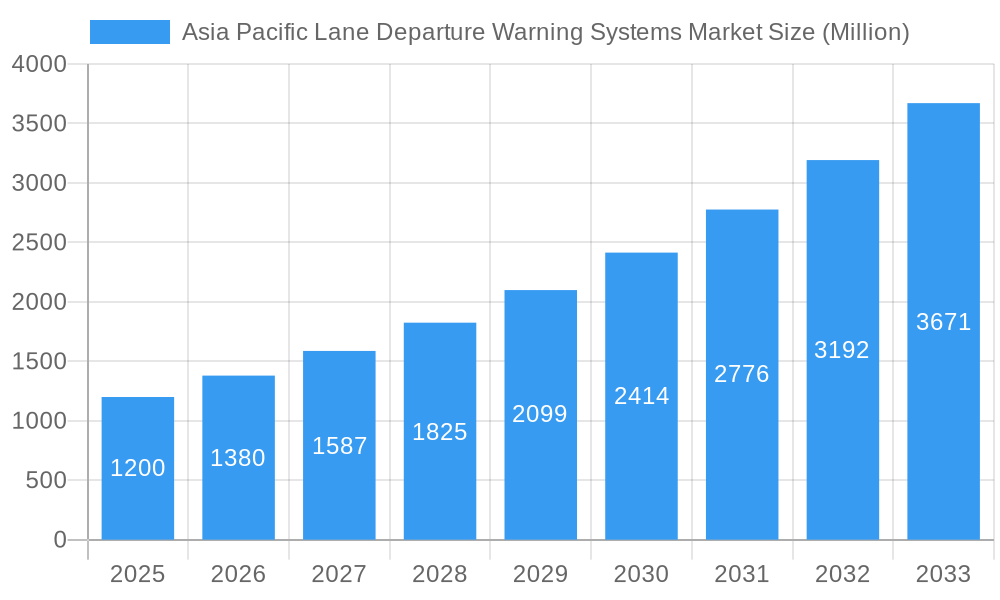

The Asia Pacific Lane Departure Warning Systems (LDWS) market is projected to experience significant growth, reaching an estimated market size of $4.6 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 5.86%. This expansion is driven by increased driver safety awareness, mandatory government regulations for advanced driver-assistance systems (ADAS) in new vehicles, and the rising adoption of semi-autonomous driving technology. Factors such as increasing per capita income, higher vehicle ownership, and a growing demand for premium features in passenger cars are key contributors. The commercial vehicle sector's focus on fleet safety and operational efficiency is also fueling market growth. Technological advancements in sensor fusion and artificial intelligence are enhancing LDWS capabilities, further accelerating market penetration.

Asia Pacific Lane Departure Warning Systems Market Market Size (In Billion)

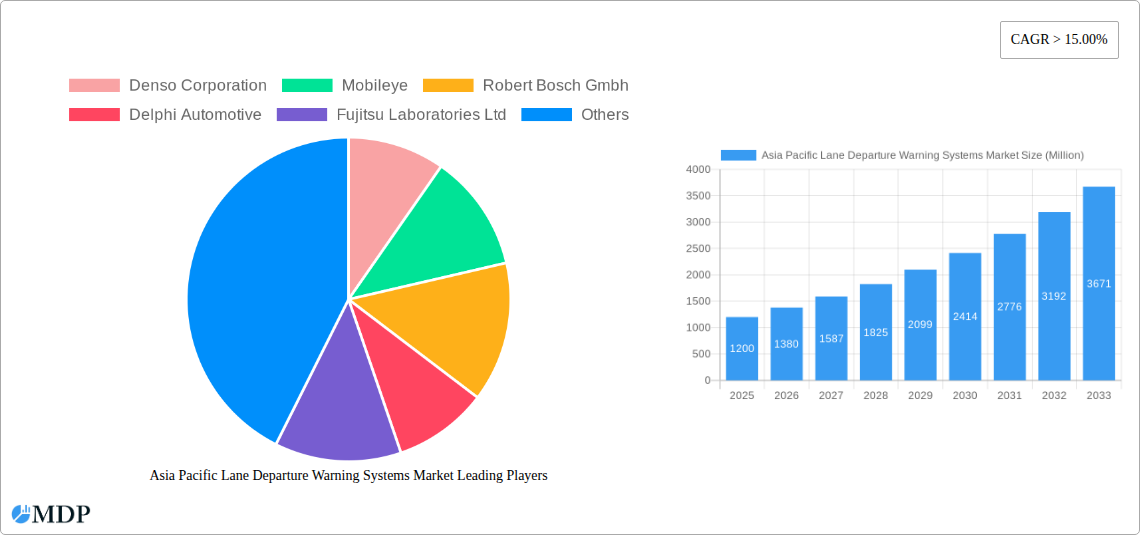

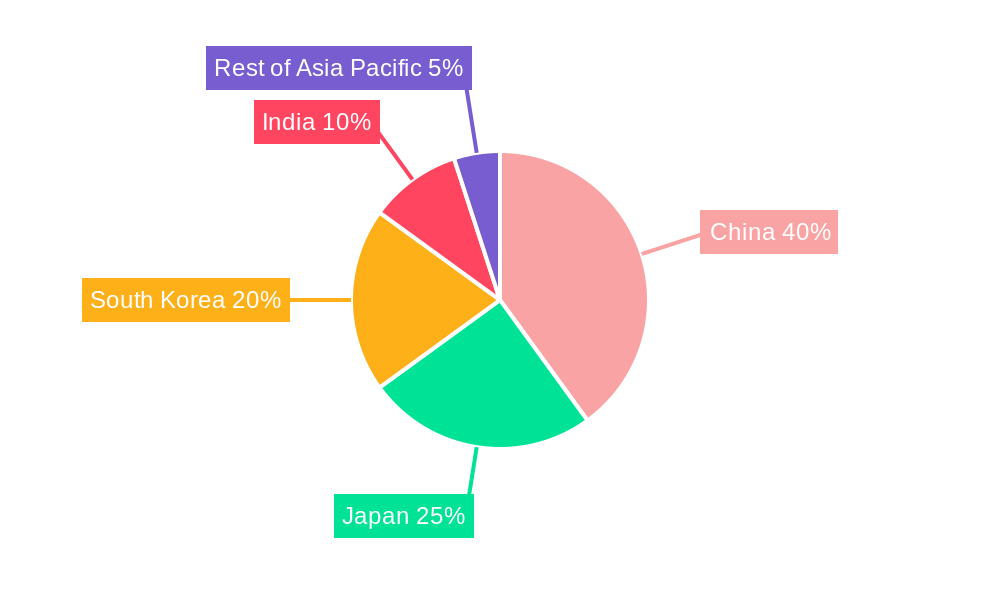

Key market trends include the integration of sensor fusion technologies for improved accuracy and reduced false positives, along with the seamless incorporation of LDWS with other ADAS features like Automatic Emergency Braking (AEB) to create a holistic safety ecosystem. However, challenges such as the initial high cost of ADAS implementation and the necessity for comprehensive consumer education regarding system functionality may present some market restraints. Geographically, China, Japan, and South Korea are anticipated to be the leading markets, owing to their mature automotive industries and early ADAS adoption. India and the broader Asia Pacific region offer substantial growth opportunities, supported by evolving safety standards and a robust automotive manufacturing base. Leading innovators such as Denso Corporation, Mobileye, and Robert Bosch GmbH are actively shaping the competitive landscape with their advanced solutions.

Asia Pacific Lane Departure Warning Systems Market Company Market Share

Asia Pacific Lane Departure Warning Systems Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Asia Pacific Lane Departure Warning Systems (LDWS) market, encompassing market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, opportunities, key players, and strategic outlook. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report offers invaluable insights for stakeholders looking to understand and capitalize on the evolving landscape of automotive safety technology in the region.

Asia Pacific Lane Departure Warning Systems Market Dynamics & Concentration

The Asia Pacific Lane Departure Warning Systems (LDWS) market exhibits a moderate to high concentration, driven by a few dominant global automotive component manufacturers and increasingly by specialized technology providers. Innovation is a key driver, with significant investment in AI, machine learning, and advanced sensor fusion to enhance system accuracy and reduce false alerts. Regulatory frameworks are progressively tightening across major Asian economies, mandating advanced driver-assistance systems (ADAS) for new vehicle registrations, thereby boosting demand. Product substitutes, while present in the form of basic driver alert systems, are largely outpaced by the sophistication and integrated nature of modern LDWS. End-user trends lean towards increased consumer awareness of safety features and a growing preference for vehicles equipped with advanced safety technologies, influenced by safety ratings and governmental initiatives. Merger and acquisition (M&A) activities are observed, primarily involving technology startups being acquired by larger Tier-1 suppliers or automotive manufacturers seeking to integrate cutting-edge ADAS capabilities. The market share of leading players is expected to be relatively consolidated, with top 5 companies holding an estimated XX% of the market by 2025. The number of M&A deals in the ADAS sector in Asia Pacific has seen a steady increase, with approximately XX deals anticipated between 2023 and 2025.

Asia Pacific Lane Departure Warning Systems Market Industry Trends & Analysis

The Asia Pacific Lane Departure Warning Systems (LDWS) market is poised for robust growth, propelled by a confluence of factors including increasing automotive production, stringent safety regulations, and a rising consumer demand for advanced vehicle safety features. The market's trajectory is significantly influenced by technological advancements that are continuously enhancing the performance and capabilities of LDWS. These systems are evolving from simple audible alerts to more sophisticated functionalities like active lane-keeping assistance, incorporating advanced sensor technologies such as high-resolution cameras, radar, and LiDAR. The growing awareness among consumers regarding road safety and the potential of ADAS to prevent accidents is a crucial demand driver. Governments across the region are actively promoting road safety through various initiatives, including the establishment of safety standards and the incentivization of vehicle manufacturers to integrate advanced safety features.

The Compound Annual Growth Rate (CAGR) for the Asia Pacific LDWS market is projected to be robust, estimated at XX% during the forecast period. This growth is further fueled by the increasing market penetration of ADAS features in both passenger cars and commercial vehicles. The competitive landscape is characterized by intense rivalry among established automotive suppliers, innovative technology companies, and emerging local players. Strategic partnerships and collaborations between automakers and technology providers are becoming increasingly common, aimed at accelerating the development and deployment of next-generation LDWS. The shift towards autonomous driving is also indirectly benefiting the LDWS market, as these systems serve as foundational components for higher levels of automation. Economic development in countries like India and Southeast Asian nations is leading to a surge in vehicle ownership, consequently expanding the addressable market for LDWS.

Leading Markets & Segments in Asia Pacific Lane Departure Warning Systems Market

The Asia Pacific Lane Departure Warning Systems (LDWS) market showcases distinct dominance across various segments, with specific regions and vehicle types leading the charge.

Dominant Geography: China China stands as the largest and most influential market for LDWS in Asia Pacific. This dominance is driven by:

- Massive Automotive Production & Sales: As the world's largest automotive market, China's sheer volume of vehicle production and sales creates substantial demand for all automotive components, including LDWS.

- Governmental Mandates & Safety Initiatives: The Chinese government has been increasingly implementing safety regulations and promoting ADAS adoption through various policies and incentives, pushing manufacturers to equip vehicles with LDWS.

- Technological Adoption & Innovation Hub: China is a significant hub for automotive technology development and adoption, with both domestic and international players investing heavily in R&D for ADAS.

- Growing Consumer Awareness: Increasing consumer awareness about vehicle safety, coupled with rising disposable incomes, has led to a greater demand for premium and safety-featured vehicles.

Leading Function Type: Lane Keeping Assist (LKA) While Lane Departure Warning (LDW) is the foundational technology, Lane Keeping Assist (LKA) is emerging as a more sought-after feature.

- Enhanced Safety & Convenience: LKA offers a higher level of safety by actively intervening to keep the vehicle within its lane, reducing driver fatigue and the risk of unintentional lane departures.

- Foundation for Autonomous Driving: LKA systems are critical building blocks for more advanced autonomous driving features, making them a focus for technological development and integration.

- Premium Feature Appeal: LKA is often positioned as a premium safety feature, commanding higher prices and appealing to consumers seeking advanced driver assistance.

Dominant Sensor Type: Video Sensors Video sensors, primarily camera-based systems, are the most prevalent and cost-effective sensor technology for LDWS in the Asia Pacific market.

- Cost-Effectiveness: Cameras offer a good balance of performance and cost, making them accessible for integration into a wide range of vehicle segments.

- Rich Data for ADAS: Video sensors provide rich visual data that can be used not only for lane detection but also for other ADAS functions like traffic sign recognition and pedestrian detection, offering a strong return on investment for manufacturers.

- Advancements in Image Processing: Continuous improvements in image processing algorithms and AI enable cameras to perform reliably in various lighting and weather conditions.

Leading Vehicle Type: Passenger Cars Passenger cars constitute the largest segment for LDWS adoption in Asia Pacific.

- High Sales Volume: The sheer volume of passenger car sales in the region, particularly in China and India, dwarfs that of commercial vehicles.

- Consumer Demand: As mentioned earlier, consumer preference for safety features in personal vehicles is a significant driver.

- Standard Feature Integration: LDWS is increasingly becoming a standard or optional feature in many new passenger car models across various price segments.

Key Geographical Sub-segments Driving Growth:

- China: As detailed above, its sheer market size and regulatory push make it paramount.

- Japan: A technologically advanced market with a strong focus on automotive safety and a mature automotive industry.

- South Korea: Home to major automotive manufacturers that are actively integrating advanced safety technologies into their global offerings.

- India: Emerging as a significant growth market due to increasing vehicle ownership, a growing middle class, and a rising emphasis on road safety, coupled with government initiatives like the Bharat NCAP.

- Rest of Asia-Pacific: Countries like Thailand, Indonesia, and Malaysia are witnessing growing automotive sectors and increasing ADAS adoption, albeit at a slower pace than the leading economies.

Asia Pacific Lane Departure Warning Systems Market Product Developments

Product development in the Asia Pacific LDWS market is characterized by a relentless pursuit of accuracy, integration, and enhanced functionality. Innovations are heavily focused on improving sensor fusion, combining data from cameras, radar, and LiDAR to create a more robust perception of the vehicle's surroundings. advancements in AI and machine learning are enabling systems to better interpret complex road scenarios, reducing false positives and improving the predictive capabilities of lane departure warnings and assistance. Many manufacturers are developing integrated ADAS platforms where LDWS works seamlessly with other safety features like adaptive cruise control and automatic emergency braking. The trend is towards more intuitive and less intrusive driver alerts, aiming to enhance driver comfort and trust in the technology. Competitive advantages are being gained through smaller, more power-efficient sensor designs and the development of scalable software solutions that can be adapted across various vehicle platforms.

Key Drivers of Asia Pacific Lane Departure Warning Systems Market Growth

The Asia Pacific Lane Departure Warning Systems market growth is primarily propelled by a combination of crucial factors. Stringent government regulations mandating ADAS features in new vehicles across countries like China, Japan, and South Korea are a significant catalyst. The increasing consumer awareness and demand for vehicle safety features, driven by heightened safety concerns and the desire for advanced technologies, further fuels market expansion. Technological advancements, including the development of more accurate and cost-effective sensors and sophisticated AI algorithms, are making LDWS more viable and attractive to automakers. Furthermore, the growing automotive production in the region, especially in emerging economies, provides a larger base for LDWS integration.

Challenges in the Asia Pacific Lane Departure Warning Systems Market Market

Despite the promising growth, the Asia Pacific LDWS market faces several hurdles. High initial development and integration costs can be a barrier for some smaller automakers and in cost-sensitive market segments. Variations in road infrastructure and lane markings across different countries and even within regions can impact the accuracy and reliability of LDWS, leading to potential performance issues. Consumer understanding and acceptance of ADAS technology, particularly the potential for system inaccuracies or over-reliance, can slow down adoption. Supply chain disruptions and the availability of critical electronic components can also pose challenges to consistent production. Finally, intense competition among numerous suppliers can lead to price pressures, impacting profit margins.

Emerging Opportunities in Asia Pacific Lane Departure Warning Systems Market

The Asia Pacific LDWS market is ripe with emerging opportunities for growth and innovation. The increasing adoption of electric vehicles (EVs) presents a significant opportunity, as EVs are often designed with advanced technologies, including sophisticated ADAS. The development of smart city initiatives and connected infrastructure can further enhance the capabilities of LDWS by enabling vehicle-to-infrastructure (V2I) communication. Strategic partnerships between automotive manufacturers and technology providers, focusing on co-development and localization of ADAS solutions for specific Asian markets, are crucial. Furthermore, the expansion of LDWS into the commercial vehicle segment, including trucks and buses, offers a substantial untapped market potential driven by fleet safety regulations and operational efficiency demands.

Leading Players in the Asia Pacific Lane Departure Warning Systems Market Sector

- Denso Corporation

- Mobileye

- Robert Bosch GmbH

- Delphi Technologies (now part of BorgWarner)

- Fujitsu Laboratories Ltd

- Continental AG

- Infineon Technologies AG

- Magna International Inc.

- ZF Friedrichshafen AG (including ZF TRW)

- WABCO Vehicle Control Systems (now part of ZF Friedrichshafen AG)

Key Milestones in Asia Pacific Lane Departure Warning Systems Market Industry

- 2019: Major automakers in China begin offering advanced LDWS as standard on select premium models, driven by rising consumer interest.

- 2020: South Korean government announces stricter safety regulations for new vehicles, including ADAS mandates, boosting LDWS demand.

- 2021: Development of AI-powered algorithms for improved lane detection accuracy in diverse weather conditions gains momentum among sensor providers.

- 2022: Several Tier-1 suppliers establish dedicated R&D centers in the Asia Pacific region to cater to the growing demand for localized ADAS solutions.

- 2023: Increased mergers and acquisitions activity involving smaller ADAS technology startups by larger automotive component manufacturers.

- 2024: Introduction of more sophisticated Lane Keeping Assist systems with enhanced steering intervention capabilities in new vehicle launches across the region.

- 2025 (Estimated): Significant increase in the market penetration of LDWS in the passenger car segment, reaching an estimated XX% across key Asia Pacific markets.

Strategic Outlook for Asia Pacific Lane Departure Warning Systems Market Market

The strategic outlook for the Asia Pacific Lane Departure Warning Systems market is exceptionally bright, driven by continuous technological advancements and a strong push from regulatory bodies and consumer demand. Growth accelerators include the ongoing integration of AI and machine learning to enhance system performance and reduce false alerts, making LDWS more reliable and trustworthy. The increasing focus on vehicle-to-everything (V2X) communication will unlock new opportunities for advanced ADAS functionalities, including more integrated lane management systems. Strategic partnerships and collaborations will be key for market players to leverage each other's strengths, whether in sensor technology, software development, or automotive manufacturing. The expansion of LDWS into emerging markets within Southeast Asia and the increasing adoption in the commercial vehicle sector represent significant untapped potential that will shape the future landscape of automotive safety in the region.

Asia Pacific Lane Departure Warning Systems Market Segmentation

-

1. Funciton Type

- 1.1. Lane Departure Warning

- 1.2. Lane Keeping Assist

-

2. Sensor Type

- 2.1. Video Sensors

- 2.2. Laser Sensors

- 2.3. Infrared Sensors

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

Asia Pacific Lane Departure Warning Systems Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Lane Departure Warning Systems Market Regional Market Share

Geographic Coverage of Asia Pacific Lane Departure Warning Systems Market

Asia Pacific Lane Departure Warning Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Autonomous Vehicle Demand To Propel The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Installation Cost May Hamper The Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Emphasis On Safety Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Funciton Type

- 5.1.1. Lane Departure Warning

- 5.1.2. Lane Keeping Assist

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Video Sensors

- 5.2.2. Laser Sensors

- 5.2.3. Infrared Sensors

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Funciton Type

- 6. China Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Funciton Type

- 6.1.1. Lane Departure Warning

- 6.1.2. Lane Keeping Assist

- 6.2. Market Analysis, Insights and Forecast - by Sensor Type

- 6.2.1. Video Sensors

- 6.2.2. Laser Sensors

- 6.2.3. Infrared Sensors

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Funciton Type

- 7. Japan Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Funciton Type

- 7.1.1. Lane Departure Warning

- 7.1.2. Lane Keeping Assist

- 7.2. Market Analysis, Insights and Forecast - by Sensor Type

- 7.2.1. Video Sensors

- 7.2.2. Laser Sensors

- 7.2.3. Infrared Sensors

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Funciton Type

- 8. India Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Funciton Type

- 8.1.1. Lane Departure Warning

- 8.1.2. Lane Keeping Assist

- 8.2. Market Analysis, Insights and Forecast - by Sensor Type

- 8.2.1. Video Sensors

- 8.2.2. Laser Sensors

- 8.2.3. Infrared Sensors

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Funciton Type

- 9. South Korea Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Funciton Type

- 9.1.1. Lane Departure Warning

- 9.1.2. Lane Keeping Assist

- 9.2. Market Analysis, Insights and Forecast - by Sensor Type

- 9.2.1. Video Sensors

- 9.2.2. Laser Sensors

- 9.2.3. Infrared Sensors

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Funciton Type

- 10. Rest of Asia Pacific Asia Pacific Lane Departure Warning Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Funciton Type

- 10.1.1. Lane Departure Warning

- 10.1.2. Lane Keeping Assist

- 10.2. Market Analysis, Insights and Forecast - by Sensor Type

- 10.2.1. Video Sensors

- 10.2.2. Laser Sensors

- 10.2.3. Infrared Sensors

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial Vehicles

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Funciton Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denso Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mobileye

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Robert Bosch Gmbh

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Delphi Automotive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu Laboratories Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Continental AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Infineon Technologie

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Magna International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZF TRW

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 WABCO Vehicle Control Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Denso Corporation

List of Figures

- Figure 1: Asia Pacific Lane Departure Warning Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Lane Departure Warning Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 2: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 3: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 7: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 8: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 12: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 13: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 14: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 17: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 18: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 22: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 23: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Funciton Type 2020 & 2033

- Table 27: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 28: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 29: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Lane Departure Warning Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Lane Departure Warning Systems Market?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the Asia Pacific Lane Departure Warning Systems Market?

Key companies in the market include Denso Corporation, Mobileye, Robert Bosch Gmbh, Delphi Automotive, Fujitsu Laboratories Ltd, Continental AG, Infineon Technologie, Magna International, ZF TRW, WABCO Vehicle Control Services.

3. What are the main segments of the Asia Pacific Lane Departure Warning Systems Market?

The market segments include Funciton Type, Sensor Type, Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Autonomous Vehicle Demand To Propel The Market Growth.

6. What are the notable trends driving market growth?

Growing Emphasis On Safety Solutions.

7. Are there any restraints impacting market growth?

High Installation Cost May Hamper The Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Lane Departure Warning Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Lane Departure Warning Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Lane Departure Warning Systems Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Lane Departure Warning Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence