Key Insights

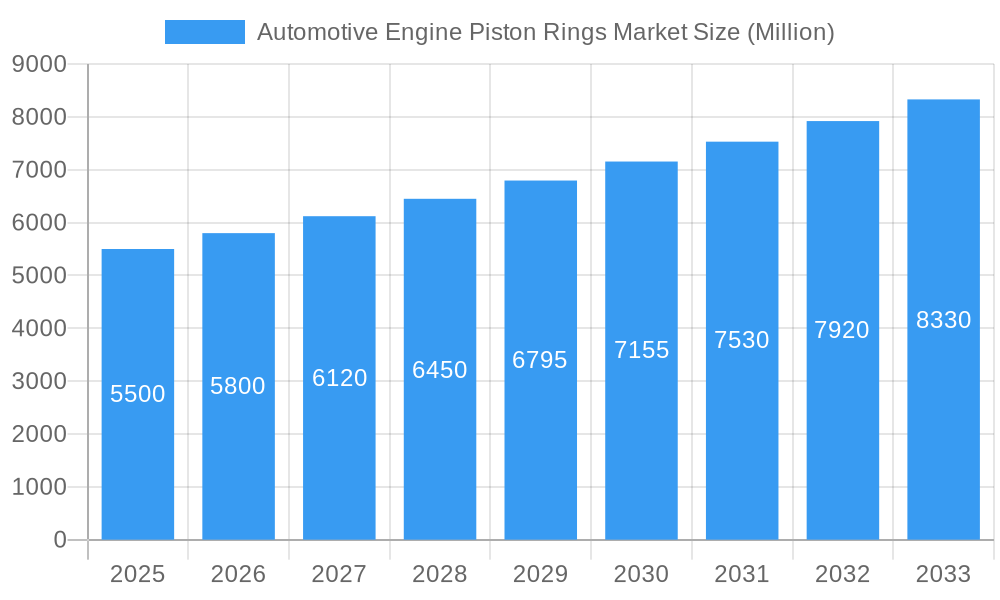

The Automotive Engine Piston Rings Market is poised for significant expansion, projected to surpass a substantial market size with a Compound Annual Growth Rate (CAGR) exceeding 5.00% during the forecast period of 2025-2033. This robust growth is underpinned by several key drivers, including the escalating global demand for vehicles, particularly in emerging economies within the Asia Pacific region, and advancements in engine technology that necessitate high-performance piston rings. The increasing adoption of internal combustion engines in both passenger and commercial vehicles, despite the rise of electric mobility, continues to fuel the demand for these critical engine components. Furthermore, the ongoing evolution of engine designs towards greater fuel efficiency and reduced emissions directly contributes to the market's upward trajectory, as manufacturers invest in innovative piston ring materials and designs to meet stringent regulatory standards. The market's value, measured in millions, is expected to reflect this sustained demand, creating substantial opportunities for key players.

Automotive Engine Piston Rings Market Market Size (In Billion)

The market's segmentation reveals distinct growth patterns across various vehicle types and material compositions. Passenger vehicles represent a dominant segment due to their sheer volume in global automotive production, while the commercial vehicle segment is driven by the increasing logistics and transportation needs worldwide. In terms of material, the demand for steel piston rings remains strong owing to their durability and cost-effectiveness, though aluminum is gaining traction due to its lightweight properties and improved thermal conductivity, aligning with the industry's push for enhanced fuel economy and performance. Restraints, such as the growing penetration of electric vehicles (EVs), are being mitigated by the sustained demand for internal combustion engines in specific applications and regions, as well as the aftermarket replacement market for existing fleets. Key companies within this competitive landscape are actively engaged in research and development to innovate and capture a larger market share by offering advanced solutions that cater to evolving industry requirements.

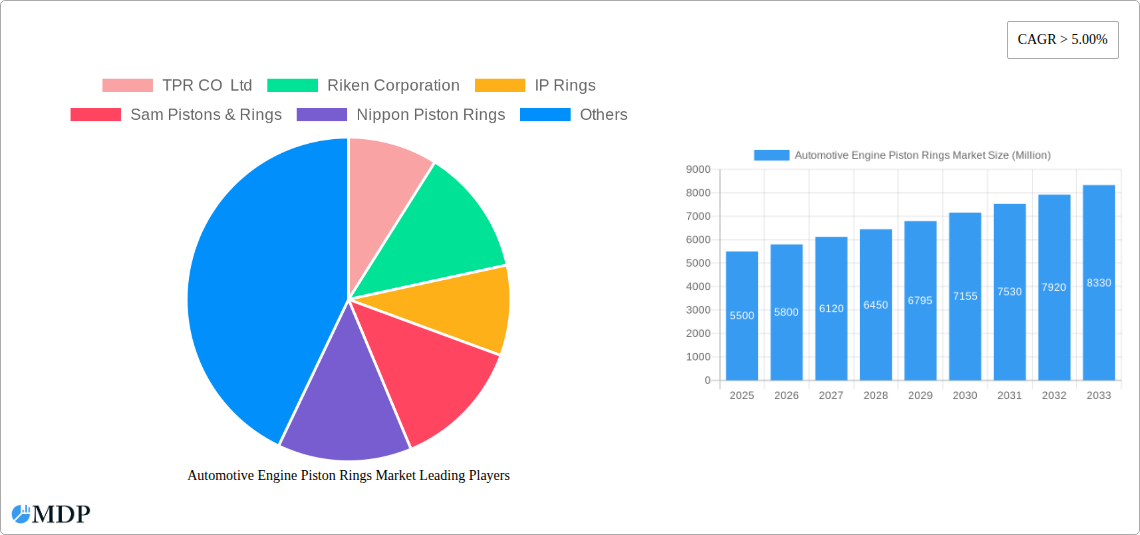

Automotive Engine Piston Rings Market Company Market Share

Automotive Engine Piston Rings Market: In-Depth Analysis & Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the global Automotive Engine Piston Rings market, offering critical insights for industry stakeholders. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a robust forecast period from 2025 to 2033, this report leverages historical data from 2019–2024 to deliver accurate projections. We delve into market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the strategic outlook for this vital automotive component market. Our analysis incorporates high-traffic keywords such as "piston rings market," "automotive engine components," "vehicle aftermarket," "engine performance parts," and "OEM piston rings" to ensure maximum search visibility and engagement.

Automotive Engine Piston Rings Market Market Dynamics & Concentration

The Automotive Engine Piston Rings market exhibits a moderate to high concentration, driven by a few key players holding significant market share. Innovation is a primary driver, with constant advancements in material science and manufacturing processes aimed at improving engine efficiency, durability, and emissions. Regulatory frameworks, particularly concerning emissions standards (e.g., Euro 7, EPA regulations), significantly influence product development and market trends. Product substitutes, though less common for core piston ring functions, might include advanced coating technologies or integrated sealing solutions. End-user trends are dominated by the growing demand for fuel-efficient and low-emission vehicles, pushing for lighter and more robust piston ring designs. Mergers & Acquisitions (M&A) activities are strategic, aimed at consolidating market position, expanding product portfolios, and gaining access to new technologies or geographic markets. For instance, strategic acquisitions by leading manufacturers to enhance their aftermarket presence or secure supply chains are anticipated.

- Market Concentration: Moderate to high, with key players dominating global production.

- Innovation Drivers: Enhanced fuel efficiency, reduced emissions, increased engine lifespan, advanced material technologies.

- Regulatory Frameworks: Strict emissions standards, fuel economy mandates.

- Product Substitutes: Advanced coating technologies, integrated sealing solutions (limited impact on core function).

- End-User Trends: Demand for fuel-efficient vehicles, growth in commercial vehicle segment, aftermarket replacement needs.

- M&A Activities: Strategic acquisitions for market expansion, technology integration, and supply chain optimization.

Automotive Engine Piston Rings Market Industry Trends & Analysis

The Automotive Engine Piston Rings market is poised for sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period. This expansion is fueled by several interconnected industry trends. A primary growth driver is the persistent demand for internal combustion engines (ICE), which, despite the rise of electric vehicles (EVs), will continue to dominate global automotive production for the foreseeable future. Piston rings are fundamental components in these engines, essential for sealing combustion gases, regulating oil consumption, and transferring heat. Technological disruptions are continuously reshaping the market. Innovations such as advanced plasma spraying, chrome plating, and PVD (Physical Vapor Deposition) coatings are enhancing the durability, wear resistance, and friction reduction properties of piston rings, leading to improved engine performance and longevity. Furthermore, the development of low-friction coatings directly contributes to better fuel economy, aligning with global environmental regulations and consumer preferences for greener transportation. Consumer preferences are shifting towards vehicles that offer a balance of performance, efficiency, and reduced environmental impact. This translates to a demand for higher-quality, more durable piston rings that can withstand harsher operating conditions and contribute to overall vehicle efficiency. The competitive dynamics within the market are characterized by intense R&D efforts, strategic partnerships between OEMs and component manufacturers, and a growing emphasis on aftermarket support. The increasing average age of the global vehicle fleet also contributes significantly to the aftermarket demand for replacement piston rings, further bolstering market penetration. The robust performance of the passenger vehicle segment, coupled with the expanding commercial vehicle sector, provides a broad and stable demand base for piston ring manufacturers.

Leading Markets & Segments in Automotive Engine Piston Rings Market

The Automotive Engine Piston Rings market is segmented by Vehicle Type and Material Type, with distinct regional dominance shaping its landscape. The Passenger Vehicles segment is currently the largest and is projected to maintain its lead throughout the forecast period. This dominance is attributed to the sheer volume of passenger car production and sales globally, driven by increasing disposable incomes in emerging economies and the continuous demand for personal mobility. Key drivers for this segment include favorable economic policies, urbanization leading to increased commuting, and the ongoing replacement cycle of older vehicles.

The Commercial Vehicles segment, encompassing trucks, buses, and light commercial vehicles, represents a significant and rapidly growing segment. Its growth is propelled by the expansion of logistics and transportation networks, particularly in developing regions, and the increasing trade volumes globally. Infrastructure development initiatives worldwide also contribute to the sustained demand for commercial vehicles and, consequently, their engine components.

In terms of Material Type, Steel piston rings continue to hold a substantial market share due to their established durability, cost-effectiveness, and superior performance in high-stress applications. They are a preferred choice for heavy-duty engines and high-performance applications where robustness is paramount.

The Aluminum segment, while smaller, is experiencing robust growth. Aluminum alloys offer advantages in terms of weight reduction, which is crucial for improving fuel efficiency in passenger vehicles. Advances in aluminum alloy technology and manufacturing processes are enabling their use in an increasing number of applications, especially in modern, high-performance engines designed for optimal thermal management and reduced reciprocating mass.

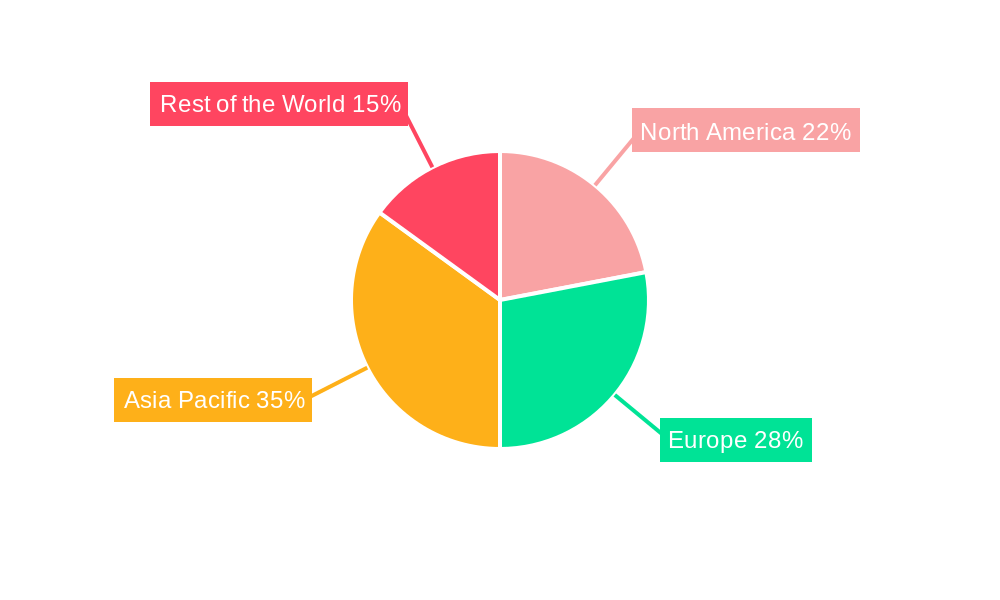

Geographically, Asia Pacific stands as the dominant market for automotive engine piston rings. This supremacy is driven by the region's position as a global manufacturing hub for automobiles, housing major automotive production facilities for both domestic and international brands. Countries like China, India, and Japan are major contributors to this dominance, supported by strong domestic demand, export-oriented manufacturing, and government initiatives promoting the automotive industry. The region's burgeoning middle class, increasing vehicle ownership, and significant investments in transportation infrastructure further solidify its leading position.

- Vehicle Type Dominance: Passenger Vehicles lead due to high production volumes and replacement demand.

- Commercial Vehicles Growth: Driven by expanding logistics and infrastructure development.

- Material Type Preference: Steel for durability and heavy-duty applications, Aluminum for weight reduction and fuel efficiency.

- Regional Leadership: Asia Pacific dominates due to extensive automotive manufacturing and strong domestic demand.

Automotive Engine Piston Rings Market Product Developments

Product developments in the Automotive Engine Piston Rings market are primarily focused on enhancing engine efficiency, reducing friction, and improving emissions control. Manufacturers are innovating with advanced materials and coatings, such as diamond-like carbon (DLC) and specialized ceramic composites, to achieve superior wear resistance and lower frictional losses. Plasma-sprayed piston ring coatings are gaining traction for their ability to withstand higher temperatures and pressures, crucial for modern high-performance engines. Furthermore, the development of optimized ring designs, including multi-piece oil control rings and optimized compression ring profiles, contributes to better oil consumption control and improved sealing, directly impacting fuel economy and exhaust emissions. These innovations offer competitive advantages by enabling engines to meet stringent environmental regulations while delivering enhanced performance and durability.

Key Drivers of Automotive Engine Piston Rings Market Growth

The Automotive Engine Piston Rings market is propelled by several key drivers. Firstly, the continued global demand for internal combustion engine (ICE) vehicles, particularly in emerging economies, ensures a steady market for piston rings. Secondly, increasing stringency of emissions regulations worldwide necessitates the development of more efficient and cleaner engines, driving innovation in piston ring technology for reduced friction and improved sealing. Thirdly, the growing average age of the global vehicle parc fuels the demand for replacement parts in the aftermarket. Technological advancements in material science and manufacturing processes, leading to lighter, more durable, and lower-friction piston rings, also act as significant growth accelerators. Finally, the expansion of the commercial vehicle sector, driven by global trade and logistics, provides a substantial market opportunity.

Challenges in the Automotive Engine Piston Rings Market Market

Despite the positive growth trajectory, the Automotive Engine Piston Rings market faces several challenges. The accelerating shift towards electric vehicles (EVs) poses a long-term threat to the demand for ICE components. Intense competition among a fragmented supplier base can lead to price pressures and reduced profit margins. Volatility in raw material prices, particularly for steel and specialized alloys, can impact manufacturing costs and profitability. Stringent environmental regulations, while driving innovation, also necessitate significant R&D investment, which can be a barrier for smaller players. Supply chain disruptions, as experienced in recent years, can affect the availability of raw materials and finished goods, leading to production delays and increased logistics costs.

Emerging Opportunities in Automotive Engine Piston Rings Market

Emerging opportunities in the Automotive Engine Piston Rings market are centered around technological advancements and strategic market expansion. The increasing adoption of advanced materials and coating technologies presents a significant opportunity for manufacturers to develop high-performance, premium piston rings that offer superior durability and efficiency. Furthermore, the growing demand for heavy-duty vehicles and specialized industrial engines, particularly in developing regions, opens up new market avenues. Strategic partnerships and collaborations between piston ring manufacturers and engine OEMs can lead to the co-development of next-generation piston ring solutions tailored for future engine technologies. The expanding aftermarket segment in mature markets, driven by the aging vehicle fleet, also offers sustained revenue streams.

Leading Players in the Automotive Engine Piston Rings Market Sector

- TPR CO Ltd

- Riken Corporation

- IP Rings

- Sam Pistons & Rings

- Nippon Piston Rings

- Abilities India Piston & Ring

- Grover Corporation

- Asimco Technologies

- Feder Mogul LLC

- Shriram Pistons & Rings Ltd

Key Milestones in Automotive Engine Piston Rings Market Industry

- 2019: Increased focus on advanced coatings for friction reduction in response to evolving fuel efficiency mandates.

- 2020: Supply chain disruptions due to global events impacted raw material availability and production schedules.

- 2021: Accelerated R&D in plasma-sprayed coatings and advanced steel alloys for enhanced engine performance and durability.

- 2022: Growing demand for aftermarket piston rings due to the aging global vehicle population.

- 2023: Introduction of new piston ring designs for hybrid vehicle engines to optimize performance across different operational modes.

- 2024: Increased investment in sustainable manufacturing processes and recycled material utilization.

Strategic Outlook for Automotive Engine Piston Rings Market Market

The strategic outlook for the Automotive Engine Piston Rings market remains cautiously optimistic, with a focus on adapting to evolving automotive trends. Manufacturers will continue to invest heavily in research and development to create lightweight, high-strength, and low-friction piston rings that meet ever-increasing fuel economy and emissions standards. The aftermarket segment will remain a crucial revenue stream, with an emphasis on providing high-quality replacement parts. Strategic partnerships with OEMs will be vital for staying ahead of technological advancements in engine design. While the long-term transition to EVs presents a challenge, the continued relevance of ICE technology in various applications, particularly in commercial and heavy-duty segments, ensures sustained market demand for the foreseeable future. Diversification into related engine components or exploring opportunities in emerging vehicle technologies could also be strategic considerations.

Automotive Engine Piston Rings Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

Automotive Engine Piston Rings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Engine Piston Rings Market Regional Market Share

Geographic Coverage of Automotive Engine Piston Rings Market

Automotive Engine Piston Rings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Sales During the Forecast Period will be a Restraint for the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Steel

- 6.2.2. Aluminum

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Steel

- 7.2.2. Aluminum

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Steel

- 8.2.2. Aluminum

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Steel

- 9.2.2. Aluminum

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TPR CO Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Riken Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IP Rings

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sam Pistons & Rings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Piston Rings

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abilities India Piston & Ring

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Grover Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Asimco Technologies

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Feder Mogul LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Shriram Pistons & Rings Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 TPR CO Ltd

List of Figures

- Figure 1: Global Automotive Engine Piston Rings Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 5: North America Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 9: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 23: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 12: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 19: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: India Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: China Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 27: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Brazil Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Mexico Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Engine Piston Rings Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Automotive Engine Piston Rings Market?

Key companies in the market include TPR CO Ltd, Riken Corporation, IP Rings, Sam Pistons & Rings, Nippon Piston Rings, Abilities India Piston & Ring, Grover Corporation, Asimco Technologies, Feder Mogul LLC, Shriram Pistons & Rings Ltd.

3. What are the main segments of the Automotive Engine Piston Rings Market?

The market segments include Vehicle Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Electric Vehicles Sales During the Forecast Period will be a Restraint for the Market.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Engine Piston Rings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Engine Piston Rings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Engine Piston Rings Market?

To stay informed about further developments, trends, and reports in the Automotive Engine Piston Rings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence