Key Insights

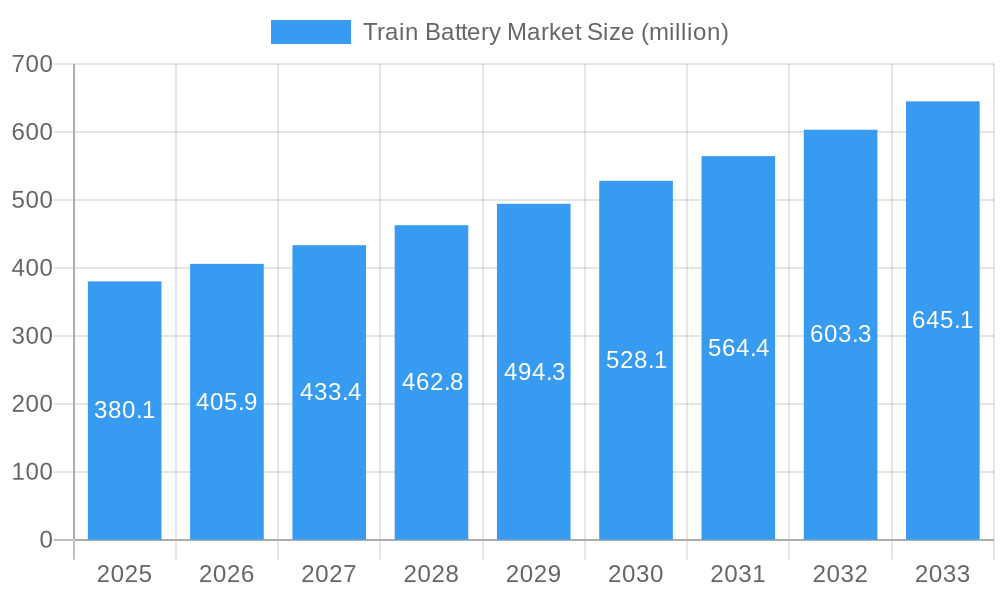

The global Train Battery Market is poised for significant expansion, projected to reach $380.1 million by 2025 and grow at a robust CAGR of 6.5% through 2033. This upward trajectory is propelled by the increasing demand for efficient and reliable power solutions in rolling stock, encompassing locomotives, metros, monorails, trams, freight wagons, and passenger coaches. The drive towards modernization of railway infrastructure, coupled with the growing adoption of electric and hybrid trains, is a primary catalyst. Furthermore, the necessity for dependable auxiliary power in existing rail networks for essential functions like lighting, communication, and passenger amenities contributes substantially to market growth. Advancements in battery technology, particularly the increasing adoption of Lithium-ion batteries due to their superior energy density, longer lifespan, and faster charging capabilities compared to traditional Lead-acid and Nickel-Cadmium batteries, are also shaping the market landscape.

Train Battery Market Market Size (In Million)

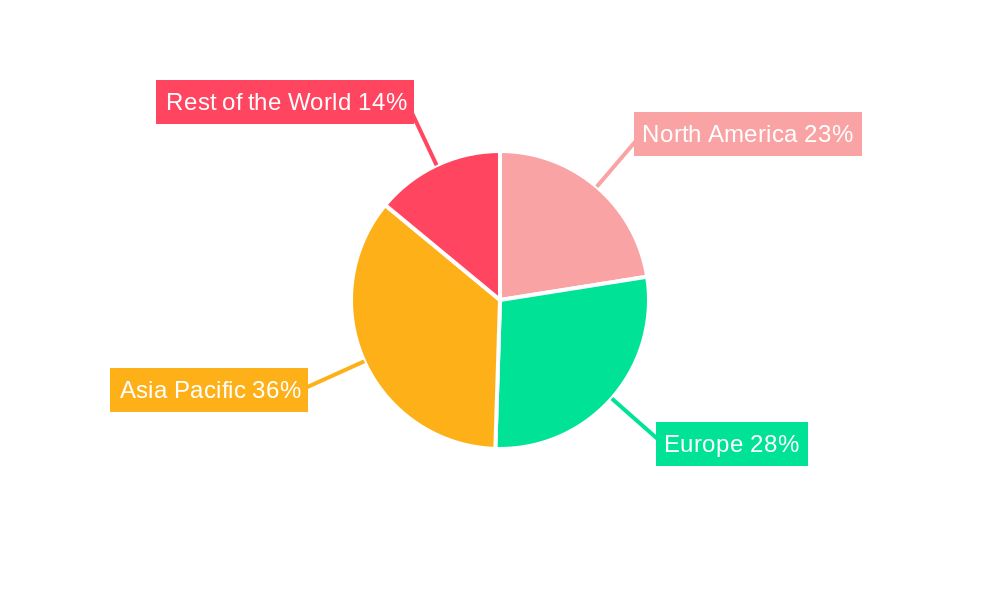

The market is segmented by battery type, with Lithium-ion batteries expected to witness the most dynamic growth, driven by their suitability for high-performance applications and their environmental benefits. In terms of application, starter batteries remain crucial for initial power provision, while auxiliary batteries play a vital role in ensuring continuous operation of critical systems. Geographically, the Asia Pacific region, led by burgeoning economies like India and China, is anticipated to emerge as a dominant force due to substantial investments in railway network expansion and upgrades. North America and Europe also represent significant markets, driven by a strong focus on sustainable transportation and the replacement of aging rail infrastructure. Key players such as HBL Power Systems Limited, Amara Raja Batteries Ltd, and GS Yuasa Corporation are actively innovating and expanding their product portfolios to cater to the evolving demands of the train battery sector, focusing on enhanced safety, performance, and cost-effectiveness.

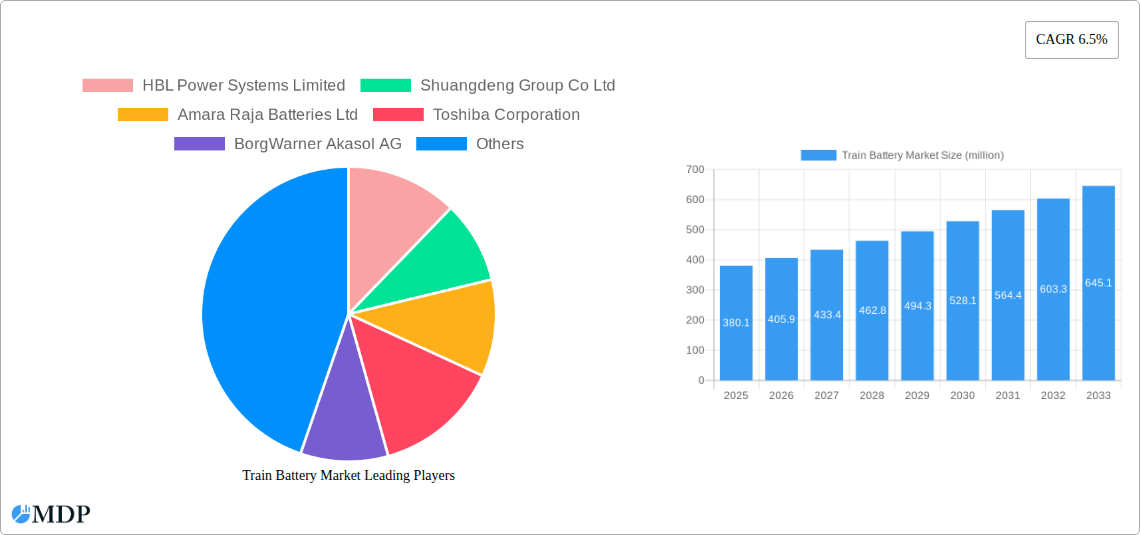

Train Battery Market Company Market Share

Gain unparalleled insights into the train battery market, a critical sector powering the global transition to sustainable and efficient rail transportation. This in-depth report, covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), provides a strategic roadmap for industry stakeholders. Explore key train battery applications, including starter batteries and auxiliary batteries for locomotives, metros, monorails, trams, freight wagons, and passenger coaches. Delve into the evolving landscape of battery types, with a focus on lead acid batteries, nickel cadmium batteries, and the rapidly growing lithium-ion battery segment.

The global train battery market is experiencing significant growth driven by the increasing demand for electrified rail infrastructure and the decarbonization efforts within the transportation sector. This report offers a detailed analysis of market dynamics, trends, leading players, and future opportunities, empowering you to make informed strategic decisions in this dynamic market. We analyze the impact of emerging technologies, regulatory frameworks, and end-user preferences on the trajectory of railway battery solutions.

Train Battery Market Market Dynamics & Concentration

The train battery market exhibits a dynamic and evolving concentration, influenced by technological innovation, stringent regulatory frameworks, and increasing end-user demand for sustainable transport solutions. The market is characterized by a blend of established players and emerging innovators, driving a competitive landscape where product differentiation and cost-effectiveness are paramount. M&A activities are becoming increasingly prevalent as companies seek to expand their technological capabilities and market reach. Leading train battery manufacturers are investing heavily in research and development to enhance battery performance, longevity, and safety. The shift towards electrification and the need for reliable power solutions for modern railway rolling stock are key innovation drivers. The market share distribution among key players is constantly being reshaped by strategic partnerships and product launches.

- Market Concentration: A moderate concentration with key players holding significant market share, but with emerging companies gaining traction.

- Innovation Drivers: Growing demand for electrified railways, advancements in battery technology (especially Li-ion), government initiatives for emission reduction, and the need for enhanced operational efficiency in train power systems.

- Regulatory Frameworks: Stringent emission standards and safety regulations are shaping product development and market entry strategies.

- Product Substitutes: While traditional battery technologies persist, advancements in alternative energy storage solutions and hybrid systems are creating potential substitutes.

- End-User Trends: Increasing preference for energy-efficient and low-emission train operations, coupled with a growing need for reliable auxiliary power for on-board systems.

- M&A Activities: A rising trend of mergers and acquisitions aimed at consolidating market share, acquiring new technologies, and expanding geographical presence. This includes significant investment in train battery solutions.

Train Battery Market Industry Trends & Analysis

The train battery market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is fueled by a confluence of factors, including the global imperative to reduce carbon emissions, stringent government regulations promoting sustainable transportation, and the continuous evolution of battery technology. The increasing adoption of electric and hybrid trains across various rolling stock segments, from locomotives to metro systems, is a primary growth driver. Consumer preferences are shifting towards quieter, cleaner, and more efficient rail travel, further accelerating the demand for advanced train battery solutions. The competitive landscape is intensifying, with established battery manufacturers and new entrants vying for market share through product innovation, strategic partnerships, and aggressive expansion plans. Technological disruptions, particularly in lithium-ion battery chemistry and energy management systems, are revolutionizing the performance and cost-effectiveness of railway batteries. The market penetration of advanced battery technologies is expected to rise significantly as their benefits in terms of energy density, lifespan, and charging speed become more apparent. The ongoing electrification of rail networks worldwide, coupled with investments in modernizing existing fleets, underpins the robust growth trajectory of the train battery market.

Leading Markets & Segments in Train Battery Market

The train battery market is dominated by a few key regions and segments, reflecting the uneven adoption of rail electrification and technological advancements. Asia-Pacific, particularly China and India, is emerging as a powerhouse in this market, driven by massive infrastructure development and government initiatives to electrify extensive rail networks for both passenger and freight transport. North America and Europe are also significant markets, characterized by a strong focus on sustainability, retrofitting existing fleets with advanced battery solutions, and the development of high-speed rail.

Battery Type Dominance:

- Lithium-ion Battery: This segment is experiencing the most rapid growth and is projected to become the dominant battery type in the forecast period. Its high energy density, longer lifespan, and faster charging capabilities make it ideal for modern train battery applications, especially for battery-electric multiple units (BEMUs). Key drivers include technological advancements in battery chemistry, falling production costs, and increasing government support for electrification.

- Lead-Acid Battery: While still holding a significant share, particularly in older rolling stock and for starter battery applications, its dominance is gradually declining due to lower energy density and shorter lifespan compared to Li-ion. However, its cost-effectiveness and established reliability continue to ensure its presence.

- Nickel-Cadmium Battery: This segment is primarily used in specific niche applications where extreme temperature tolerance is required. Its market share is expected to remain stable or see a slight decline.

Application Type Dominance:

- Auxiliary Battery: This segment is expected to witness substantial growth due to the increasing demand for on-board power for passenger amenities, communication systems, and HVAC in modern trains, especially in passenger coaches and metro systems. The rise of smart train technologies further boosts the need for reliable auxiliary power.

- Starter Battery: While essential for locomotives and diesel-electric trains, the demand for starter batteries is expected to see a moderate growth trajectory, influenced by the increasing shift towards fully electric or hybrid powertrains.

Rolling Stock Dominance:

- Metro and Passenger Coaches: These segments are the leading consumers of train batteries, driven by high passenger volumes, frequent stopping patterns, and the ongoing expansion and modernization of urban and suburban rail networks globally. The push for cleaner and more efficient urban transit makes these segments prime areas for battery adoption. The Irish Rail example of purchasing battery-electric multiple units (BEMUs) highlights this trend.

- Locomotive: With the increasing electrification of freight lines and the development of hybrid locomotives, this segment represents a significant and growing market for advanced train battery systems.

- Monorail and Tram: These niche segments are also contributing to market growth, particularly in urban development projects seeking sustainable transportation solutions.

Train Battery Market Product Developments

The train battery market is witnessing a surge in product innovation, focusing on enhancing energy density, improving charging speeds, and extending lifespan for a variety of train battery applications. Manufacturers are heavily investing in lithium-ion battery technologies, exploring new cathode and anode materials to achieve higher performance and reduced costs. Developments include the introduction of advanced battery management systems (BMS) for optimized performance and safety, as well as robust thermal management solutions to ensure reliability in diverse operating conditions. These innovations cater to the growing demand for battery-electric multiple units (BEMUs) and hybrid train solutions, offering extended operational range and reduced reliance on external power sources. Competitive advantages are being built around faster charging capabilities, improved cycle life, and enhanced safety features, directly impacting the operational efficiency and sustainability of railway rolling stock.

Key Drivers of Train Battery Market Growth

The train battery market is propelled by several interconnected growth drivers. The global push for decarbonization and the reduction of greenhouse gas emissions in the transportation sector is a primary catalyst, encouraging the adoption of electric and hybrid trains. Stringent environmental regulations and government incentives for sustainable transport further accelerate this transition, making advanced train battery solutions indispensable. Technological advancements in battery chemistry, particularly the increasing efficiency and decreasing cost of lithium-ion battery technology, are making electric rail a more viable and cost-effective option. Furthermore, the ongoing expansion and modernization of rail infrastructure worldwide, including urban transit systems and freight corridors, necessitates reliable and powerful train battery systems. The growing demand for energy efficiency and improved passenger comfort in rolling stock also contributes significantly to market expansion.

Challenges in the Train Battery Market Market

Despite its strong growth potential, the train battery market faces several significant challenges. High upfront costs associated with the procurement and installation of advanced battery systems, especially lithium-ion battery solutions, can be a deterrent for some railway operators. The need for robust charging infrastructure and integration with existing power grids presents another hurdle, requiring substantial investment and planning. Ensuring the longevity and reliable performance of batteries under extreme operational conditions and fluctuating temperatures remains a critical concern, necessitating advanced thermal management systems. Furthermore, the availability and sustainability of raw materials required for battery production, such as lithium and cobalt, are subject to supply chain volatilities and geopolitical factors, potentially impacting pricing and availability. Regulatory complexities and the need for standardization across different rail networks can also pose barriers to rapid market expansion.

Emerging Opportunities in Train Battery Market

The train battery market is ripe with emerging opportunities, driven by technological breakthroughs and evolving market demands. The continued advancement in battery energy density and charging speed is paving the way for longer-range electric and hybrid trains, reducing the need for catenary infrastructure in certain applications. The development of smart grid integration and bidirectional charging capabilities offers potential for trains to act as mobile energy storage units, supporting grid stability. Strategic partnerships between battery manufacturers, train OEMs, and railway operators are crucial for developing tailored solutions and accelerating market adoption. Furthermore, the growing focus on battery recycling and second-life applications presents a significant opportunity for sustainable battery management throughout the product lifecycle, creating a circular economy within the train battery sector. The expansion of battery-electric multiple units (BEMUs) for regional and commuter lines, as exemplified by the Irish Rail order, represents a substantial growth avenue.

Leading Players in the Train Battery Market Sector

- HBL Power Systems Limited

- Shuangdeng Group Co Ltd

- Amara Raja Batteries Ltd

- Toshiba Corporation

- BorgWarner Akasol AG

- Enersys

- East Penn Manufacturing Company

- Exide Industries Limited

- Hitachi Rail Limited

- GS Yuasa Corporation

Key Milestones in Train Battery Market Industry

- December 2022: The Irish government approved funding for Irish Rail's purchase of 90 new train carriages from Alstom, including 18 modern 5-carriage battery-electric multiple units (BEMUs) at a cost of approximately USD 190.27 million, expected by 2026. This signifies a major step towards adopting advanced battery technology for commuter rail.

- September 2022: Hitachi Rail unveiled a new battery hybrid train at a rail transport fair in Berlin, Germany. This innovative train is designed to cut carbon emissions and fuel usage by 50%, capable of running entirely on battery power at speeds up to 160 km/hr, highlighting significant advancements in train battery technology and hybrid solutions.

Strategic Outlook for Train Battery Market Market

The strategic outlook for the train battery market is exceptionally positive, driven by the undeniable global shift towards sustainable and electrified transportation. Future growth will be significantly accelerated by ongoing innovations in battery chemistries, leading to higher energy densities and faster charging capabilities, thereby expanding the operational range and efficiency of battery-electric multiple units (BEMUs) and hybrid trains. The increasing investment in rail infrastructure modernization and the expansion of urban transit networks worldwide present substantial opportunities for market penetration. Strategic collaborations between train battery manufacturers, rolling stock developers, and railway operators will be crucial for co-creating customized solutions and addressing specific operational needs. Furthermore, the growing emphasis on battery lifecycle management, including recycling and second-life applications, will foster a more sustainable and economically viable market, solidifying the indispensable role of advanced train battery solutions in the future of rail transport.

Train Battery Market Segmentation

-

1. Battery Type

- 1.1. Lead Acid Battery

- 1.2. Nickel Cadmium Battery

- 1.3. Lithium Ion Battery

-

2. Application Type

- 2.1. Starter Battery

- 2.2. Auxiliary Battery

-

3. Rolling Stock

- 3.1. Locomotive

- 3.2. Metro

- 3.3. Monorail

- 3.4. Tram

- 3.5. Freight Wagon

- 3.6. Passenger Coaches

Train Battery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Train Battery Market Regional Market Share

Geographic Coverage of Train Battery Market

Train Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Demand for Auxiliary Battery to Propel Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead Acid Battery

- 5.1.2. Nickel Cadmium Battery

- 5.1.3. Lithium Ion Battery

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Starter Battery

- 5.2.2. Auxiliary Battery

- 5.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 5.3.1. Locomotive

- 5.3.2. Metro

- 5.3.3. Monorail

- 5.3.4. Tram

- 5.3.5. Freight Wagon

- 5.3.6. Passenger Coaches

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. North America Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 6.1.1. Lead Acid Battery

- 6.1.2. Nickel Cadmium Battery

- 6.1.3. Lithium Ion Battery

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Starter Battery

- 6.2.2. Auxiliary Battery

- 6.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 6.3.1. Locomotive

- 6.3.2. Metro

- 6.3.3. Monorail

- 6.3.4. Tram

- 6.3.5. Freight Wagon

- 6.3.6. Passenger Coaches

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 7. Europe Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 7.1.1. Lead Acid Battery

- 7.1.2. Nickel Cadmium Battery

- 7.1.3. Lithium Ion Battery

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Starter Battery

- 7.2.2. Auxiliary Battery

- 7.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 7.3.1. Locomotive

- 7.3.2. Metro

- 7.3.3. Monorail

- 7.3.4. Tram

- 7.3.5. Freight Wagon

- 7.3.6. Passenger Coaches

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 8. Asia Pacific Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 8.1.1. Lead Acid Battery

- 8.1.2. Nickel Cadmium Battery

- 8.1.3. Lithium Ion Battery

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Starter Battery

- 8.2.2. Auxiliary Battery

- 8.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 8.3.1. Locomotive

- 8.3.2. Metro

- 8.3.3. Monorail

- 8.3.4. Tram

- 8.3.5. Freight Wagon

- 8.3.6. Passenger Coaches

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 9. Rest of the World Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 9.1.1. Lead Acid Battery

- 9.1.2. Nickel Cadmium Battery

- 9.1.3. Lithium Ion Battery

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Starter Battery

- 9.2.2. Auxiliary Battery

- 9.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 9.3.1. Locomotive

- 9.3.2. Metro

- 9.3.3. Monorail

- 9.3.4. Tram

- 9.3.5. Freight Wagon

- 9.3.6. Passenger Coaches

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 HBL Power Systems Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shuangdeng Group Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amara Raja Batteries Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toshiba Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BorgWarner Akasol AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Enersys

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 East Penn Manufacturing Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Exide Industries Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hitachi Rail Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GS Yuasa Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 HBL Power Systems Limited

List of Figures

- Figure 1: Global Train Battery Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 3: North America Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 4: North America Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 5: North America Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 7: North America Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 8: North America Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Train Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 11: Europe Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 12: Europe Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 13: Europe Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 15: Europe Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 16: Europe Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Train Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 19: Asia Pacific Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 20: Asia Pacific Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 21: Asia Pacific Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Asia Pacific Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 23: Asia Pacific Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 24: Asia Pacific Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Train Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 27: Rest of the World Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 28: Rest of the World Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 29: Rest of the World Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Rest of the World Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 31: Rest of the World Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 32: Rest of the World Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Train Battery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 4: Global Train Battery Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 6: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 8: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 13: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 14: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 15: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 23: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 24: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 25: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: India Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: China Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Japan Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 32: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 33: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 34: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: South America Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Train Battery Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Train Battery Market?

Key companies in the market include HBL Power Systems Limited, Shuangdeng Group Co Ltd, Amara Raja Batteries Ltd, Toshiba Corporation, BorgWarner Akasol AG, Enersys, East Penn Manufacturing Company, Exide Industries Limited, Hitachi Rail Limited, GS Yuasa Corporation.

3. What are the main segments of the Train Battery Market?

The market segments include Battery Type, Application Type, Rolling Stock.

4. Can you provide details about the market size?

The market size is estimated to be USD 380.1 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Demand for Auxiliary Battery to Propel Market Growth.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

December 2022: The Irish government approved funding for the purchase by Irish Rail of 90 new train carriages from Alstom. They will be used in the Greater Dublin Area and potentially also on the Cork Commuter network. According to Irish Rail, the new purchase means additional capacity on the network, as carriages can be redeployed. The order will consist of 18 modern 5-carriage battery-electric multiple units (BEMUs) at a cost of around 179 million euros (USD 190.27 million). The first units are expected in 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Train Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Train Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Train Battery Market?

To stay informed about further developments, trends, and reports in the Train Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence