Key Insights

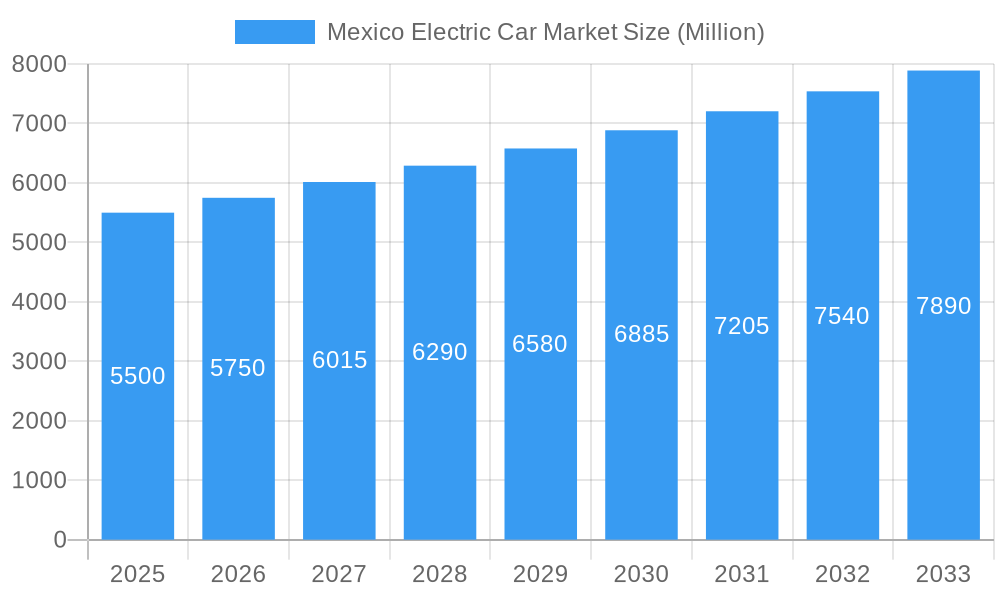

The Mexican electric vehicle market is set for substantial expansion, projected to reach a market size of 1.29 billion by 2033, exhibiting a strong Compound Annual Growth Rate (CAGR) of 28.21% from the base year 2025. This growth is driven by shifting consumer preferences, supportive government policies, and increased automotive industry investments. Growing environmental awareness in Mexico, coupled with government initiatives promoting sustainable transportation, is boosting demand for Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs) across segments like Hatchbacks, MPVs, Sedans, and SUVs.

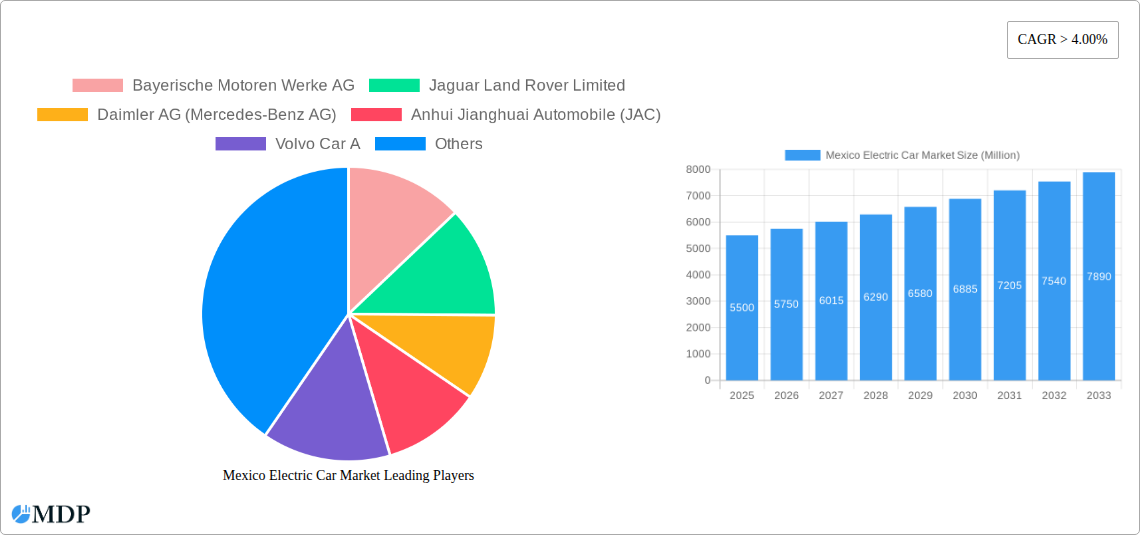

Mexico Electric Car Market Market Size (In Billion)

Key challenges to market growth include the high upfront cost of EVs and the limited charging infrastructure outside major cities, which can cause range anxiety. However, significant investments from global players such as Bayerische Motoren Werke AG, Tesla Inc., and Toyota Motor Corporation are focused on expanding production and developing more affordable models. This increased competition and innovation from both established and emerging manufacturers will help overcome these barriers and drive the Mexican electric car market towards its projected expansion.

Mexico Electric Car Market Company Market Share

Mexico Electric Car Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock critical insights into the rapidly evolving Mexico Electric Car Market. This in-depth report provides a 360-degree view of market dynamics, industry trends, key players, and future projections. With the electric vehicle (EV) revolution gaining momentum globally, Mexico is poised for significant growth, driven by supportive government policies, increasing environmental awareness, and technological advancements. This report is an essential resource for automakers, component suppliers, government agencies, investors, and research institutions seeking to understand and capitalize on the burgeoning opportunities within the Mexican EV landscape.

Key Report Highlights:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Companies Covered: Bayerische Motoren Werke AG, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Anhui Jianghuai Automobile (JAC), Volvo Car A, Kia Corporation, Tesla Inc, Groupe Renault, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd, Ford Motor Company.

Segments Analyzed:

- Vehicle Configuration: Passenger Cars (Hatchback, Multi-purpose Vehicle, Sedan, Sports Utility Vehicle)

- Fuel Category: BEV, FCEV, HEV, PHEV

Mexico Electric Car Market Market Dynamics & Concentration

The Mexico Electric Car Market is characterized by an increasingly dynamic and moderately concentrated landscape. Innovation drivers are primarily focused on battery technology advancements, charging infrastructure expansion, and government incentives aimed at promoting EV adoption. Regulatory frameworks, while still developing, are showing a positive trajectory with policies encouraging local manufacturing and the phasing out of internal combustion engine vehicles. Product substitutes, predominantly traditional gasoline-powered cars, remain a significant competitor, but their market share is gradually eroding. End-user trends indicate a growing demand for sustainable transportation solutions, driven by environmental consciousness and the decreasing total cost of ownership for EVs. Merger and acquisition (M&A) activities, while currently limited, are expected to escalate as the market matures and larger players seek strategic market entry or consolidation. The market concentration is moderately high, with a few key global manufacturers holding significant market share. M&A deal counts are anticipated to increase in the coming years.

Mexico Electric Car Market Industry Trends & Analysis

The Mexico Electric Car Market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is fueled by a confluence of factors, including increasing consumer awareness regarding the environmental benefits of electric vehicles and a growing desire for cost-effective transportation solutions, as electricity prices remain relatively stable compared to fluctuating gasoline costs. Technological disruptions are at the forefront, with continuous improvements in battery energy density, faster charging capabilities, and the development of more affordable EV models. Market penetration of electric vehicles is steadily rising, although it still represents a nascent stage compared to more developed EV markets. This presents a substantial opportunity for early movers and innovative companies. Consumer preferences are shifting towards eco-friendly options, with a growing emphasis on vehicle performance, range, and the availability of charging infrastructure. The competitive dynamics are intensifying, with both established automotive giants and emerging EV manufacturers vying for market dominance. The Mexican government's commitment to sustainability and its potential inclusion in global EV supply chains are also significant growth drivers. The market is seeing an influx of new electric models, catering to diverse consumer needs and price points, further stimulating demand. The estimated CAGR for the Mexico Electric Car Market is XX%.

Leading Markets & Segments in Mexico Electric Car Market

The dominance within the Mexico Electric Car Market is projected to be heavily influenced by the Passenger Cars segment, particularly Sports Utility Vehicles (SUVs). This preference mirrors global trends, where SUVs offer a blend of versatility, space, and perceived safety, making them attractive to a broad demographic. The Battery Electric Vehicle (BEV) sub-segment is expected to lead the fuel category, driven by advancements in battery technology and the increasing availability of charging infrastructure. Economic policies, such as tax incentives for EV purchases and reductions in import duties for electric vehicles and their components, are crucial drivers of dominance in specific segments. The development of public and private charging networks, especially in major urban centers and along key transportation corridors, will be instrumental in accelerating the adoption of BEVs and PHEVs, thereby solidifying their leading position.

Vehicle Configuration Dominance:

- Sports Utility Vehicles (SUVs): Their popularity stems from their perceived practicality, higher driving position, and spacious interiors, aligning with evolving consumer lifestyle needs.

- Sedans: Expected to gain traction with the introduction of more affordable and technologically advanced models.

- Hatchbacks: Likely to appeal to urban dwellers seeking compact and efficient mobility.

- Multi-purpose Vehicles (MPVs): Targeted towards families seeking larger capacity and flexibility.

Fuel Category Dominance:

- BEV (Battery Electric Vehicle): Driven by zero tailpipe emissions, lower running costs, and government support.

- PHEV (Plug-in Hybrid Electric Vehicle): Offer a transitional solution for consumers concerned about range anxiety, benefiting from both electric and gasoline power.

- HEV (Hybrid Electric Vehicle): Continue to hold a significant share due to their established presence and fuel efficiency improvements.

- FCEV (Fuel Cell Electric Vehicle): Currently a niche segment with limited infrastructure, but with potential for future growth.

Mexico Electric Car Market Product Developments

Product development in the Mexico Electric Car Market is witnessing a surge in innovation, with manufacturers focusing on enhancing battery performance, range, and charging speeds. The integration of advanced driver-assistance systems (ADAS) and smart connectivity features is becoming standard, offering a more intuitive and safer driving experience. Competitive advantages are being carved out through unique design aesthetics, robust after-sales service networks, and localized manufacturing strategies. The introduction of more affordable EV models is a key trend, aiming to democratize access to electric mobility for a wider consumer base. Technological advancements in battery management systems and the use of lighter, more sustainable materials are also contributing to improved vehicle efficiency and reduced environmental impact, ensuring market fit and customer appeal.

Key Drivers of Mexico Electric Car Market Growth

The Mexico Electric Car Market is propelled by several key growth drivers. Government initiatives and incentives, such as tax credits and subsidies for EV purchases, play a pivotal role in reducing the upfront cost for consumers. The increasing environmental awareness among the Mexican populace is fostering a demand for sustainable transportation options. Technological advancements in battery technology, leading to longer ranges and faster charging times, are mitigating range anxiety and making EVs more practical. Furthermore, the declining total cost of ownership, owing to lower electricity costs compared to gasoline and reduced maintenance requirements, is a significant economic driver. The expansion of charging infrastructure, both public and private, is crucial for supporting widespread EV adoption.

Challenges in the Mexico Electric Car Market Market

Despite the promising growth trajectory, the Mexico Electric Car Market faces several challenges. The high upfront cost of electric vehicles remains a significant barrier for mass adoption, particularly for lower and middle-income consumers. The availability and accessibility of charging infrastructure are still limited in many regions, especially outside major urban centers, leading to range anxiety. Supply chain issues, including the availability of critical raw materials for battery production and the global semiconductor shortage, can impact production volumes and pricing. Regulatory hurdles and policy inconsistencies can also create uncertainty for investors and consumers. Furthermore, consumer awareness and education regarding the benefits and practicalities of EVs need continuous reinforcement to overcome existing misconceptions and build trust.

Emerging Opportunities in Mexico Electric Car Market

The Mexico Electric Car Market presents numerous emerging opportunities for growth and innovation. The expansion of charging infrastructure, including the development of fast-charging networks and home charging solutions, offers significant business potential. Government support for local EV manufacturing and battery production can attract foreign investment and create a robust domestic supply chain. The increasing demand for electric commercial vehicles and fleet electrification presents a substantial market segment. Technological breakthroughs in battery recycling and second-life applications can address sustainability concerns and create new revenue streams. Strategic partnerships between automotive manufacturers, energy providers, and technology companies can accelerate innovation and market penetration. Furthermore, the development of smart grid integration for EVs can enhance grid stability and offer cost savings to consumers.

Leading Players in the Mexico Electric Car Market Sector

- Bayerische Motoren Werke AG

- Jaguar Land Rover Limited

- Daimler AG (Mercedes-Benz AG)

- Anhui Jianghuai Automobile (JAC)

- Volvo Car A

- Kia Corporation

- Tesla Inc

- Groupe Renault

- Audi AG

- Toyota Motor Corporation

- Honda Motor Co Ltd

- Ford Motor Company

Key Milestones in Mexico Electric Car Market Industry

- December 2023: Ford Mustang Mach-E featured electric all-wheel drive and standard heated seats and a steering wheel, enhancing its appeal in the segment.

- November 2023: JAC Mexico celebrated the opening of its 50th "JAC Store" in Ciudad Juárez, indicating significant network expansion and market presence.

- November 2023: Ford Motors and XX manufacturers entered into a strategic partnership to assist their suppliers in achieving CO2 reduction targets, aligning with Ford's 2050 carbon neutrality goal.

Strategic Outlook for Mexico Electric Car Market Market

The strategic outlook for the Mexico Electric Car Market is highly promising, driven by a sustained push towards electrification. Future growth will be accelerated by continued government support, including potential tax exemptions and infrastructure development investments. The increasing integration of Mexican manufacturing into global EV supply chains will further boost local production and job creation. Innovations in battery technology, leading to more affordable and longer-range EVs, will be critical in unlocking mass market adoption. Strategic partnerships and collaborations will be key to overcoming infrastructure challenges and fostering consumer confidence. The market is poised for significant expansion as a growing number of manufacturers introduce new EV models tailored to the Mexican consumer, creating a competitive environment that benefits buyers with more choices and better value.

Mexico Electric Car Market Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Multi-purpose Vehicle

- 1.1.3. Sedan

- 1.1.4. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Mexico Electric Car Market Segmentation By Geography

- 1. Mexico

Mexico Electric Car Market Regional Market Share

Geographic Coverage of Mexico Electric Car Market

Mexico Electric Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Electric Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Multi-purpose Vehicle

- 5.1.1.3. Sedan

- 5.1.1.4. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jaguar Land Rover Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler AG (Mercedes-Benz AG)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anhui Jianghuai Automobile (JAC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volvo Car A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kia Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesla Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Groupe Renault

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Audi AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Honda Motor Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ford Motor Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Mexico Electric Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Electric Car Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Electric Car Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 2: Mexico Electric Car Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 3: Mexico Electric Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Electric Car Market Revenue billion Forecast, by Vehicle Configuration 2020 & 2033

- Table 5: Mexico Electric Car Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 6: Mexico Electric Car Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Electric Car Market?

The projected CAGR is approximately 28.21%.

2. Which companies are prominent players in the Mexico Electric Car Market?

Key companies in the market include Bayerische Motoren Werke AG, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Anhui Jianghuai Automobile (JAC), Volvo Car A, Kia Corporation, Tesla Inc, Groupe Renault, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd, Ford Motor Company.

3. What are the main segments of the Mexico Electric Car Market?

The market segments include Vehicle Configuration, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

December 2023: Mustang Mach-E has electric all-wheel drive and standard heated seats and a steering wheel.November 2023: In 2022, JAC Mexico opens the "JAC Store" number 50 in Ciudad Juárez.November 2023: Ford motors and manufacturers 2030 have entered into a strategic Partnerships to help its suppliers achieve their CO2 reduction targets in line with Ford Motor Co.'s global objective of becoming carbon neutral by 2050.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Electric Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Electric Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Electric Car Market?

To stay informed about further developments, trends, and reports in the Mexico Electric Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence