Key Insights

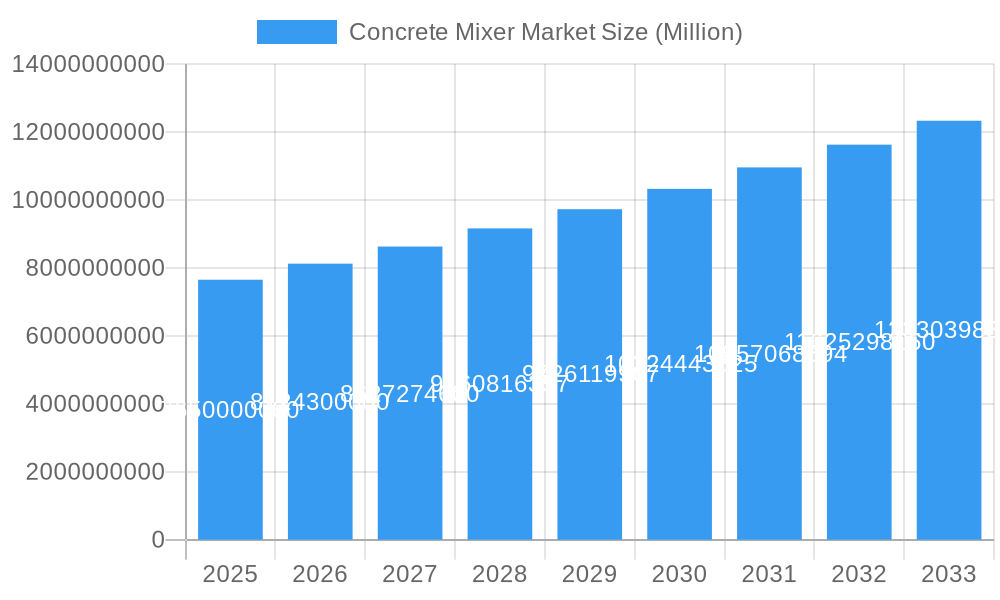

The global concrete mixer market is poised for robust expansion, projected to reach an impressive $7.65 billion in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.2% anticipated between 2025 and 2033, indicating sustained demand and innovation within the sector. Key drivers fueling this upward trajectory include the accelerating pace of urbanization and infrastructure development worldwide, particularly in emerging economies. The rising demand for residential and commercial construction projects, coupled with government initiatives to boost public infrastructure, is creating a significant need for efficient concrete mixing solutions. Mixer trucks and stationary mixing plants are the primary segments, both experiencing substantial demand as the construction industry seeks to optimize production and delivery of concrete on-site and at centralized locations. The increasing focus on technological advancements, such as automated mixing processes and improved fuel efficiency in mobile units, further contributes to market vitality.

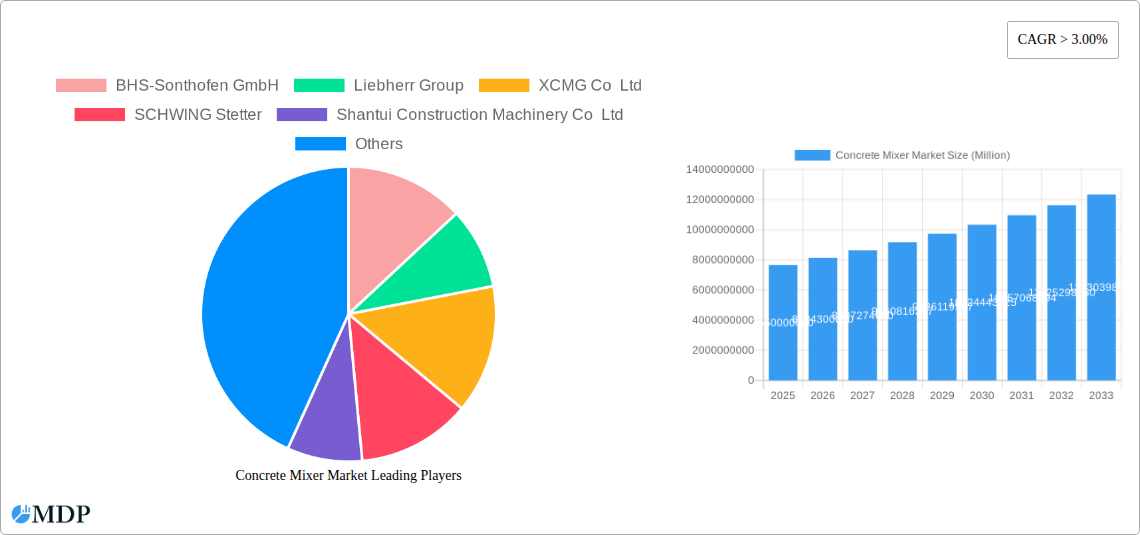

Concrete Mixer Market Market Size (In Billion)

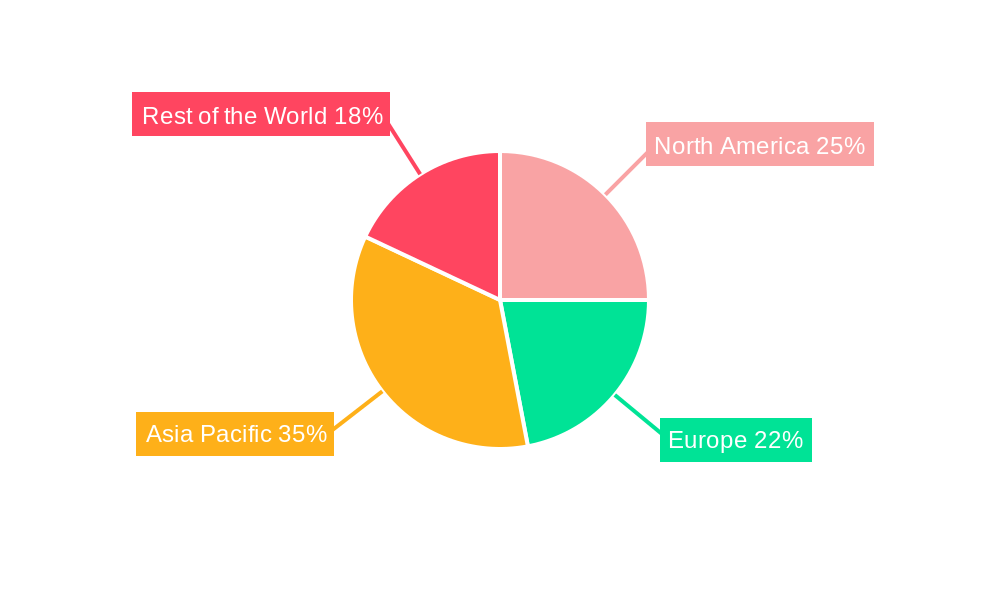

The market is dynamic, with significant regional contributions expected. Asia Pacific, driven by rapid industrialization and large-scale infrastructure projects in countries like India and China, is anticipated to be a major growth engine. North America and Europe, while mature markets, continue to exhibit steady demand driven by renovation, modernization, and specialized construction needs. The market is characterized by the presence of established players like Liebherr Group, XCMG Co Ltd, and SANY Group, who are actively engaged in product innovation and strategic partnerships to capture market share. While the overall outlook is positive, potential restraints such as fluctuating raw material prices and stringent environmental regulations could pose challenges. However, the prevailing trend towards sustainable construction practices and the development of eco-friendly mixing technologies are expected to mitigate these concerns, ensuring a strong and enduring market presence for concrete mixers.

Concrete Mixer Market Company Market Share

Explore the dynamic Concrete Mixer Market with an in-depth analysis spanning 2019-2033. This comprehensive report offers actionable insights into the global concrete mixer industry, forecasting a robust market expansion driven by infrastructure development, technological advancements, and evolving construction practices. Discover the intricate market dynamics, key growth catalysts, prevailing trends, and leading stakeholders shaping the future of concrete mixer trucks and mixing plants. This report is essential for construction equipment manufacturers, raw material suppliers, construction companies, investors, and industry analysts seeking to capitalize on the burgeoning global concrete mixer market.

The market is projected to reach a valuation of $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% from its 2025 base year. Our analysis covers a historical period of 2019-2024 and a detailed forecast period of 2025-2033, providing a complete picture of market evolution.

Concrete Mixer Market Market Dynamics & Concentration

The concrete mixer market is characterized by a moderate level of concentration, with several global players holding significant market share. Key innovation drivers stem from the increasing demand for fuel-efficient and environmentally friendly construction machinery, including advancements in electric and hybrid concrete mixer trucks. Regulatory frameworks, particularly stringent emission standards and safety regulations, are also pushing manufacturers towards adopting cleaner technologies and enhancing product safety. Product substitutes, such as ready-mix concrete suppliers who bypass the need for on-site mixing, present a constant competitive pressure. However, the inherent flexibility and cost-effectiveness of mobile concrete mixers in remote or specialized applications continue to fuel their demand. End-user trends highlight a growing preference for automated and technologically advanced mixers that improve efficiency and reduce labor costs. Mergers and acquisitions (M&A) activities are a significant factor in shaping market concentration, allowing larger entities to expand their product portfolios and geographical reach. The last five years have seen XX M&A deals within the sector, indicating ongoing consolidation. Leading companies like Liebherr Group and SANY Group are actively involved in strategic partnerships and acquisitions to bolster their competitive edge.

Concrete Mixer Market Industry Trends & Analysis

The concrete mixer market is experiencing robust growth, propelled by a confluence of factors including escalating global infrastructure development projects, particularly in emerging economies. The continuous need for new residential, commercial, and industrial construction, coupled with government investments in roads, bridges, and public utilities, directly fuels the demand for concrete mixer trucks and mixing plants. Technological disruptions are a significant trend, with manufacturers heavily investing in research and development to introduce more efficient, automated, and sustainable solutions. The advent of electric concrete mixers and hybrid powertrains is a prime example, addressing environmental concerns and operational cost reductions for end-users. Consumer preferences are shifting towards smart technologies integrated into mixers, offering real-time monitoring, GPS tracking, and improved operational diagnostics. This enhances productivity and reduces downtime. Competitive dynamics are intensifying, with established players and new entrants vying for market dominance. Companies are focusing on product innovation, expanding their distribution networks, and offering comprehensive after-sales services. The market penetration of advanced concrete mixing technologies is steadily increasing, driven by the pursuit of higher quality concrete and optimized construction processes. The overall market size for concrete mixers is expected to witness substantial expansion due to these prevailing trends, with the global construction equipment market serving as a strong underlying driver. The mobile concrete batching plant market is also seeing significant traction due to its flexibility.

Leading Markets & Segments in Concrete Mixer Market

Asia Pacific currently stands as the dominant region in the concrete mixer market, driven by rapid urbanization, massive infrastructure development projects in countries like China and India, and a burgeoning construction sector. Within this region, China commands a significant market share due to its extensive manufacturing capabilities and a vast domestic market for construction equipment.

Key Segment Dominance:

Type:

- Mixer Trucks: This segment holds the lion's share of the market. The increasing demand for on-site concrete production and efficient transportation of mixed concrete to construction sites makes mixer trucks indispensable. Government initiatives promoting housing development and infrastructure upgrades across the globe directly boost the sales of mixer trucks.

- Mixing Plants: While smaller in volume than mixer trucks, the mixing plant segment, particularly mobile concrete batching plants, is experiencing significant growth. Their flexibility and ability to be relocated to different project sites make them highly attractive for large-scale infrastructure projects and in regions with developing construction industries.

Application Type:

- Commercial: This application segment is a major revenue generator, encompassing the construction of office buildings, retail spaces, hotels, and other commercial infrastructure. The sustained growth in global commerce and business expansion fuels continuous demand for concrete mixers in commercial construction.

- Residential: The ongoing global need for housing, coupled with government housing schemes and private sector investments, makes the residential segment a consistent and significant contributor to the concrete mixer market.

- Industry: This segment includes the construction of factories, warehouses, and industrial facilities. While perhaps less prominent than commercial or residential, industrial construction projects often involve large volumes of concrete, thus driving demand for robust and high-capacity concrete mixers.

Economic policies favoring infrastructure spending, such as government stimulus packages and public-private partnerships, are key drivers for the dominance of these segments and regions. The availability of advanced manufacturing facilities and a skilled workforce further solidifies the position of leading markets.

Concrete Mixer Market Product Developments

Recent product developments in the concrete mixer market are heavily focused on sustainability and efficiency. Manufacturers are introducing lighter-weight materials for mixer trucks, such as high-strength aluminum alloys, to improve fuel efficiency and comply with evolving weight regulations. The integration of electric and hybrid powertrains is a significant trend, exemplified by the Putzmeister iONTRON eMixer, which offers an eco-friendly solution for urban construction. Innovations also include advanced transmission systems like Allison Transmission's eGen Power electric axles, designed for seamless integration into electric and hybrid vehicles, enhancing performance and reducing emissions. These developments not only offer competitive advantages through reduced operational costs and environmental impact but also cater to the growing demand for technologically sophisticated and sustainable construction equipment.

Key Drivers of Concrete Mixer Market Growth

The concrete mixer market is propelled by several key drivers. Primarily, the surge in global infrastructure development, including roads, bridges, airports, and public utilities, necessitates a substantial increase in concrete production, directly boosting demand for mixers. Secondly, technological advancements, such as the introduction of lightweight materials, electric powertrains, and smart manufacturing processes, enhance efficiency and sustainability, making these machines more attractive. Thirdly, urbanization trends, particularly in developing economies, are leading to increased demand for residential and commercial construction, further fueling market growth. Lastly, favorable government policies and investments in the construction sector worldwide create a conducive environment for market expansion.

Challenges in the Concrete Mixer Market Market

Despite the positive outlook, the concrete mixer market faces several challenges. Stringent environmental regulations and emission standards require significant investment in research and development to comply, potentially increasing production costs. Volatility in raw material prices, such as steel and other components, can impact manufacturing profitability. Furthermore, the competitive landscape is intense, with established players and emerging manufacturers vying for market share, leading to price pressures. Economic downturns and geopolitical uncertainties can also lead to a slowdown in construction activities, thereby affecting demand for concrete mixers. Supply chain disruptions, as witnessed in recent years, can further impede production and timely delivery.

Emerging Opportunities in Concrete Mixer Market

The concrete mixer market presents numerous emerging opportunities. The growing global focus on sustainable construction practices is driving demand for eco-friendly solutions, such as electric concrete mixers and those utilizing alternative fuels. Technological advancements in automation and IoT integration offer opportunities to develop "smart" mixers with enhanced operational efficiency and predictive maintenance capabilities. The expansion of construction activities in emerging economies, coupled with government initiatives to boost infrastructure, provides significant untapped market potential. Strategic partnerships and collaborations between manufacturers, technology providers, and construction companies can foster innovation and market penetration. The development of specialized concrete mixers for niche applications also represents a growing area of opportunity.

Leading Players in the Concrete Mixer Market Sector

- BHS-Sonthofen GmbH

- Liebherr Group

- XCMG Co Ltd

- SCHWING Stetter

- Shantui Construction Machinery Co Ltd

- Akona Engineering Pvt Ltd

- Anhui Hualing Automobile Group Co Ltd

- SANY Group

- Terex Corporation

- Zoomlion Heavy Industry Science & Technology Co Ltd

Key Milestones in Concrete Mixer Market Industry

- October 2022: Putzmeister announced construction sustainability with its brand-new all-electric concrete mixer, the iONTRON eMixer. This electrically powered mixer, based on a SANY electric chassis with an 8x4 axle configuration and a maximum gross weight of 34 tons, can run for an entire day in urban areas, offering approximately five to six trips and a range of up to 150 kilometers, demonstrating a significant step towards greener construction.

- September 2022: Allison Transmission announced the debut of its new Allison eGen Power electric axles for construction applications like concrete mixers at Bauma 2022. This plug-and-play technology is compatible with many existing truck chassis, speeding up vehicle development projects and featuring integrated electric motors, a two-speed gearbox, an integrated oil cooler, and a pump, suitable for BEV, FCEV, and hybrid applications.

- January 2022: SANY launched a new generation of lightweight mixer trucks designed to meet customer needs. Utilizing high-strength aluminum alloy and non-metal materials with 12 lightweight technologies, these trucks conform to law requirements and are free from annual inspection, showcasing innovation in material science for enhanced efficiency and compliance.

Strategic Outlook for Concrete Mixer Market Market

The strategic outlook for the concrete mixer market is exceptionally promising, driven by a sustained global demand for infrastructure and construction projects. Manufacturers are expected to continue prioritizing innovation in electrification and automation to meet stringent environmental regulations and enhance operational efficiency. Strategic partnerships and collaborations will be crucial for market expansion and technological advancement. The focus on lightweight materials and smart technologies will provide competitive advantages, allowing companies to cater to evolving end-user preferences. Emerging economies will present significant growth opportunities, necessitating localized production and distribution strategies. The integration of digital solutions for monitoring and control will further shape the future of the construction equipment market.

Concrete Mixer Market Segmentation

-

1. Type

- 1.1. Mixer Trucks

- 1.2. Mixing Plants

-

2. Application Type

- 2.1. Residential

- 2.2. Commercial

Concrete Mixer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Concrete Mixer Market Regional Market Share

Geographic Coverage of Concrete Mixer Market

Concrete Mixer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. Residential Construction is Contributing Toward the Concrete Mixer Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Concrete Mixer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mixer Trucks

- 5.1.2. Mixing Plants

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Concrete Mixer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mixer Trucks

- 6.1.2. Mixing Plants

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Concrete Mixer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mixer Trucks

- 7.1.2. Mixing Plants

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Concrete Mixer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mixer Trucks

- 8.1.2. Mixing Plants

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Concrete Mixer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mixer Trucks

- 9.1.2. Mixing Plants

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BHS-Sonthofen GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Liebherr Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 XCMG Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SCHWING Stetter

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Shantui Construction Machinery Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Akona Engineering Pvt Ltd*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anhui Hualing Automobile Group Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SANY Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Terex Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Zoomlion Heavy Industry Science & Technology Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 BHS-Sonthofen GmbH

List of Figures

- Figure 1: Global Concrete Mixer Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Concrete Mixer Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Concrete Mixer Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Concrete Mixer Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 5: North America Concrete Mixer Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Concrete Mixer Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Concrete Mixer Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Concrete Mixer Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Concrete Mixer Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Concrete Mixer Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 11: Europe Concrete Mixer Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Concrete Mixer Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Concrete Mixer Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Concrete Mixer Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Concrete Mixer Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Concrete Mixer Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Concrete Mixer Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Concrete Mixer Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Concrete Mixer Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Concrete Mixer Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World Concrete Mixer Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Concrete Mixer Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 23: Rest of the World Concrete Mixer Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Rest of the World Concrete Mixer Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Concrete Mixer Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Concrete Mixer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Concrete Mixer Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Global Concrete Mixer Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Concrete Mixer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Concrete Mixer Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Global Concrete Mixer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Concrete Mixer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Concrete Mixer Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 12: Global Concrete Mixer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Concrete Mixer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Concrete Mixer Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 19: Global Concrete Mixer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: India Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: China Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: South Korea Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Concrete Mixer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Concrete Mixer Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 27: Global Concrete Mixer Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Brazil Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Mexico Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Concrete Mixer Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Concrete Mixer Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Concrete Mixer Market?

Key companies in the market include BHS-Sonthofen GmbH, Liebherr Group, XCMG Co Ltd, SCHWING Stetter, Shantui Construction Machinery Co Ltd, Akona Engineering Pvt Ltd*List Not Exhaustive, Anhui Hualing Automobile Group Co Ltd, SANY Group, Terex Corporation, Zoomlion Heavy Industry Science & Technology Co Ltd.

3. What are the main segments of the Concrete Mixer Market?

The market segments include Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

Residential Construction is Contributing Toward the Concrete Mixer Market's Growth.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

October 2022 : With its brand-new all-electric concrete mixer, Putzmeister announced construction sustainability. The brand-new iONTRON eMixer is electrically powered and based on a SANY electric chassis. The 8x4 axle configuration permits a maximum gross weight of 34 tons. As a result, the iONTRON eMixer's battery can run for an entire day in urban areas, providing approximately five to six trips and a range of up to 150 kilometers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Concrete Mixer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Concrete Mixer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Concrete Mixer Market?

To stay informed about further developments, trends, and reports in the Concrete Mixer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence