Key Insights

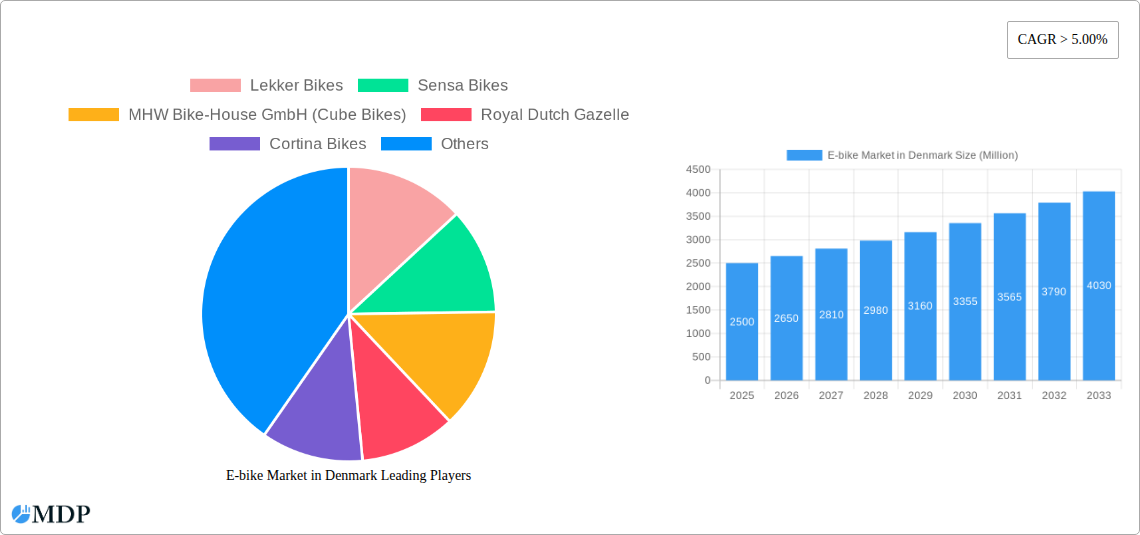

The Denmark e-bike market is projected for significant expansion, expected to reach a market size of 412.6 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.23%. This growth is propelled by increasing environmental awareness, demand for sustainable urban transport, and supportive government policies for cycling infrastructure and e-bike adoption. Denmark's established cycling culture and commitment to green initiatives position it as a key market for e-bike growth. The market features a diverse segmentation. Pedal-assisted e-bikes currently lead, aligning with active commuting preferences. Speed pedelecs are gaining popularity for longer distances, while throttle-assisted models offer effortless mobility. City/urban e-bikes dominate applications, catering to dense urban populations and convenient city travel. Cargo/utility e-bikes are also seeing increased adoption for last-mile delivery and family use as car alternatives.

E-bike Market in Denmark Market Size (In Million)

Technological advancements and evolving consumer preferences further fuel market expansion. The trend towards lighter, more powerful, and longer-lasting lithium-ion batteries addresses range anxiety and enhances user experience. While lead-acid batteries hold a minor share, their influence is diminishing. Initial purchase costs and charging infrastructure development are being mitigated by government incentives, decreasing battery prices, and expanding charging availability in public spaces and workplaces. Key industry players are actively innovating and diversifying product lines to meet the market's varied demands.

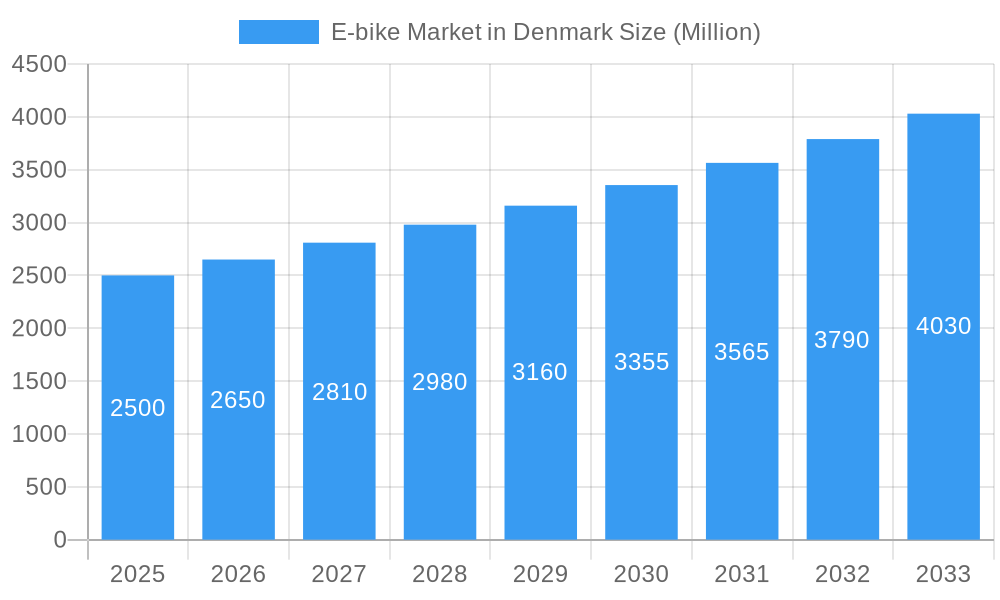

E-bike Market in Denmark Company Market Share

Explore the dynamic Denmark e-bike market. This comprehensive report offers critical insights into market dynamics, industry trends, leading players, and future opportunities for the electric bicycle market in Denmark. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this analysis provides a solid foundation for strategic decision-making for industry stakeholders, investors, and manufacturers. Discover market size estimations, CAGR projections, and detailed segment analysis to navigate the competitive landscape of electric bikes in Denmark.

E-bike Market in Denmark Market Dynamics & Concentration

The e-bike market in Denmark exhibits a moderate concentration, with key players actively vying for market share. Innovation drivers are primarily focused on battery technology, motor efficiency, and smart connectivity features, reflecting the Danish penchant for cutting-edge solutions. Regulatory frameworks, supportive of sustainable transport, continue to foster market growth, encouraging e-bike adoption through subsidies and dedicated infrastructure development. Product substitutes, such as traditional bicycles and public transport, face increasing competition from the growing appeal and versatility of e-bikes. End-user trends lean towards urban commuting, recreational trekking, and increasingly, cargo e-bikes for utility purposes. Mergers and acquisitions (M&A) activities, though not exceptionally high, are indicative of consolidation efforts and strategic partnerships aimed at expanding market reach and technological capabilities. For instance, Cube Bikes (MHW Bike-House GmbH) reintroducing its range through Evans Cycles signifies strategic distribution channel development. The market is characterized by a strong emphasis on quality and performance, with brands like Royal Dutch Gazelle and Koga commanding a premium segment.

- Market Share: While precise figures vary, key players like Giant Manufacturing Co Ltd and Batavus Intercycle Corporation hold significant portions of the Danish e-bike market.

- M&A Deal Counts: The Danish e-bike market has seen a steady, albeit moderate, number of strategic partnerships and smaller acquisitions aimed at enhancing product portfolios and distribution networks.

- Innovation Drivers: Advanced battery management systems, lightweight frame construction, and integrated smart features are key areas of innovation.

E-bike Market in Denmark Industry Trends & Analysis

The e-bike market in Denmark is poised for significant expansion, propelled by a confluence of factors including robust government support for sustainable transportation, increasing environmental consciousness among consumers, and a growing demand for convenient and efficient urban mobility solutions. The market penetration of e-bikes is steadily rising, driven by technological disruptions that have made these vehicles more accessible, powerful, and user-friendly. Consumers in Denmark are increasingly opting for e-bikes as a viable alternative to cars and public transport, particularly for daily commutes and leisure activities. This shift is further fueled by improvements in infrastructure, such as dedicated cycling lanes and charging facilities, making cycling a more attractive and practical choice.

The CAGR for the e-bike market in Denmark is projected to be robust over the forecast period, reflecting sustained demand and supportive market conditions. Technological advancements, particularly in battery technology, are leading to lighter, more powerful, and longer-lasting e-bikes. This enhances their appeal for longer distances and heavier loads. The City/Urban application segment continues to dominate, driven by the need for eco-friendly and time-efficient commuting in densely populated areas. However, the Cargo/Utility segment is witnessing rapid growth, as businesses and individuals explore e-bikes for last-mile delivery and personal transport of goods.

Competitive dynamics are intensifying, with both established international brands and emerging local players introducing innovative products. Companies are focusing on offering a diverse range of e-bikes, catering to various consumer needs and price points. The Danish market's openness to new technologies and its strong cycling culture provide fertile ground for continued innovation and market development. The emphasis on the Pedal Assisted propulsion type remains dominant, offering a balanced riding experience and greater range, while Speed Pedelecs are gaining traction for longer commutes requiring higher speeds. The dominance of Lithium-ion batteries is unchallenged due to their superior energy density, longevity, and faster charging capabilities compared to other battery types.

Leading Markets & Segments in E-bike Market in Denmark

The e-bike market in Denmark is characterized by the strong dominance of the City/Urban application segment. This is primarily driven by the country's progressive urban planning, extensive cycling infrastructure, and a strong societal emphasis on sustainable living. Copenhagen, as a global leader in cycling culture, exemplifies the widespread adoption of e-bikes for daily commuting, errands, and leisure. The Danish government's commitment to reducing carbon emissions and promoting active transportation further bolsters the demand for e-bikes in urban environments.

- Propulsion Type Dominance: The Pedal Assisted propulsion type is the leading segment in the Danish e-bike market. This is attributed to its user-friendly nature, extended range, and the ability to offer a balanced cycling experience that caters to a wide demographic, from casual riders to daily commuters. Speed Pedelecs are also carving out a significant niche, especially for those seeking faster commutes, indicating a growing segment of users prioritizing efficiency and speed. Throttle Assisted models, while present, hold a smaller share compared to pedal-assisted options.

- Application Type Dominance: The City/Urban application type stands out as the most dominant segment. Denmark's well-developed urban infrastructure, including dedicated cycle lanes and bike-friendly policies, makes e-bikes an ideal mode of transport for navigating cities. The increasing adoption of e-bikes for commuting, leisure, and short-distance travel within urban areas fuels this dominance. The Cargo/Utility segment is experiencing substantial growth, reflecting a rising trend in using e-bikes for deliveries and transporting goods, while Trekking e-bikes cater to recreational riders and those exploring longer routes.

- Battery Type Dominance: Lithium-ion Battery technology unequivocally leads the Danish e-bike market. Their superior energy density, lighter weight, longer lifespan, and faster charging capabilities make them the preferred choice for modern e-bikes. The ongoing advancements in lithium-ion technology continue to improve range and performance, further cementing its dominance. While Lead Acid Batteries might be found in some older or very basic models, they are largely phased out due to their limitations in weight, performance, and lifespan. The "Others" category for battery types is minimal in comparison to lithium-ion.

E-bike Market in Denmark Product Developments

Recent product developments in the Denmark e-bike market highlight a strong focus on enhanced performance, user experience, and sustainability. Brands are innovating with lighter, more integrated battery systems and more powerful, efficient motors, catering to the growing demand for both city commuting and recreational riding. The introduction of advanced features such as smart connectivity, GPS tracking, and improved suspension systems are enhancing the competitive edge of e-bikes. For instance, Giant has unveiled its full-suspension Stormguard E+, signaling a push towards premium, all-terrain e-bike options with a price point reflecting advanced technology. The emphasis is on creating e-bikes that offer a seamless blend of technology, comfort, and eco-friendliness, aligning with the Danish consumer's preferences for quality and innovation.

Key Drivers of E-bike Market in Denmark Growth

Several key drivers are fueling the growth of the e-bike market in Denmark. Technological advancements in battery efficiency, motor power, and lightweight materials are making e-bikes more appealing and accessible. Government initiatives and supportive policies, including subsidies and investments in cycling infrastructure, significantly encourage adoption. The growing environmental consciousness among Danish consumers, who are actively seeking sustainable transportation alternatives, is a major catalyst. Furthermore, the rising fuel costs and the need for efficient urban mobility solutions are pushing more individuals and businesses towards e-bikes for commuting and logistics. The increasing popularity of cycling as a recreational activity also contributes to the demand for e-bikes.

Challenges in the E-bike Market in Denmark Market

Despite robust growth, the e-bike market in Denmark faces certain challenges. Regulatory hurdles, although generally supportive, can sometimes create complexities regarding speed limits and classifications of e-bikes, particularly for Speed Pedelecs. Supply chain issues, as highlighted by the temporary pause in the commercial relationship between Cube Bikes and Evans Cycles during the pandemic, can impact product availability and pricing. High upfront costs for premium e-bikes can still be a barrier for some consumers, despite increasing affordability of mid-range options. Competition from alternative modes of transport and the need for ongoing investment in robust charging infrastructure also present ongoing challenges.

Emerging Opportunities in E-bike Market in Denmark

The e-bike market in Denmark presents several emerging opportunities. The continuous advancements in battery technology, promising longer ranges and faster charging, will further boost adoption. Strategic partnerships between e-bike manufacturers and urban mobility platforms can create integrated transportation solutions. The growing demand for cargo and utility e-bikes for last-mile delivery and personal transport opens new avenues for business. Furthermore, the development of smart e-bikes with advanced connectivity features presents opportunities for enhanced user experience and data-driven services. Expansion into the tourism sector with specialized e-bike rental services also holds significant potential.

Leading Players in the E-bike Market in Denmark Sector

- Lekker Bikes

- Sensa Bikes

- MHW Bike-House GmbH (Cube Bikes)

- Royal Dutch Gazelle

- Cortina Bikes

- Giant Manufacturing Co Ltd

- Batavus Intercycle Corporation

- Qwic

- Van Moof B

- Koga

Key Milestones in E-bike Market in Denmark Industry

- November 2022: Giant unveils the Stormguard E+, a full-suspension e-bike, to be available in Europe in 2023 for 7,999 Euros (E+1) and 6,499 Euros (E+2), indicating a move towards premium, high-performance e-bikes.

- August 2022: Evans Cycles reintroduces Cube bikes to all 71 locations, signifying the resumption of strong distribution partnerships after pandemic-induced supply chain disruptions.

- August 2022: Cube's Hybrid One E-Bike is highlighted for offering significant mileage for budget-conscious cyclists, featuring a Bosch electric motor and urban amenities, demonstrating a focus on value and accessibility.

Strategic Outlook for E-bike Market in Denmark Market

The strategic outlook for the Denmark e-bike market remains exceptionally positive. Continued government investment in cycling infrastructure and a strong societal commitment to sustainability will act as persistent growth accelerators. Innovations in battery technology and e-bike design will further enhance user experience and expand the addressable market. Strategic partnerships focused on logistics and urban integration will unlock new revenue streams. The increasing demand for eco-friendly and efficient personal transportation ensures that the e-bike market in Denmark will continue to be a significant and evolving sector. This presents a compelling opportunity for stakeholders to capitalize on the burgeoning demand and contribute to a greener, more mobile future.

E-bike Market in Denmark Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

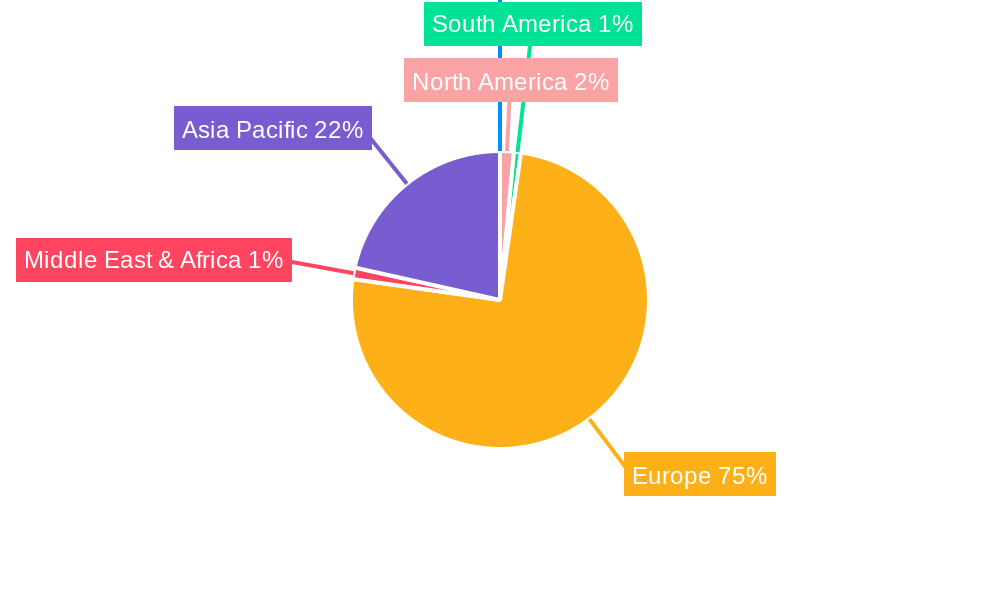

E-bike Market in Denmark Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-bike Market in Denmark Regional Market Share

Geographic Coverage of E-bike Market in Denmark

E-bike Market in Denmark REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Commercial Vehicle Sales to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Interest Rates to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Speed Pedelec

- 6.1.3. Throttle Assisted

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Cargo/Utility

- 6.2.2. City/Urban

- 6.2.3. Trekking

- 6.3. Market Analysis, Insights and Forecast - by Battery Type

- 6.3.1. Lead Acid Battery

- 6.3.2. Lithium-ion Battery

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Speed Pedelec

- 7.1.3. Throttle Assisted

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Cargo/Utility

- 7.2.2. City/Urban

- 7.2.3. Trekking

- 7.3. Market Analysis, Insights and Forecast - by Battery Type

- 7.3.1. Lead Acid Battery

- 7.3.2. Lithium-ion Battery

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Speed Pedelec

- 8.1.3. Throttle Assisted

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Cargo/Utility

- 8.2.2. City/Urban

- 8.2.3. Trekking

- 8.3. Market Analysis, Insights and Forecast - by Battery Type

- 8.3.1. Lead Acid Battery

- 8.3.2. Lithium-ion Battery

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Speed Pedelec

- 9.1.3. Throttle Assisted

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Cargo/Utility

- 9.2.2. City/Urban

- 9.2.3. Trekking

- 9.3. Market Analysis, Insights and Forecast - by Battery Type

- 9.3.1. Lead Acid Battery

- 9.3.2. Lithium-ion Battery

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific E-bike Market in Denmark Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Speed Pedelec

- 10.1.3. Throttle Assisted

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Cargo/Utility

- 10.2.2. City/Urban

- 10.2.3. Trekking

- 10.3. Market Analysis, Insights and Forecast - by Battery Type

- 10.3.1. Lead Acid Battery

- 10.3.2. Lithium-ion Battery

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lekker Bikes

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sensa Bikes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MHW Bike-House GmbH (Cube Bikes)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Royal Dutch Gazelle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cortina Bikes

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Giant Manufacturing Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Batavus Intercycle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qwic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Van Moof B

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Koga

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lekker Bikes

List of Figures

- Figure 1: Global E-bike Market in Denmark Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 3: North America E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 4: North America E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 5: North America E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 7: North America E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 8: North America E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 9: North America E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 11: South America E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: South America E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 13: South America E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: South America E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 15: South America E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 16: South America E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 17: South America E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 19: Europe E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 20: Europe E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 21: Europe E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Europe E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 23: Europe E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 24: Europe E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 25: Europe E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 27: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 28: Middle East & Africa E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 29: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Middle East & Africa E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 31: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 32: Middle East & Africa E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific E-bike Market in Denmark Revenue (million), by Propulsion Type 2025 & 2033

- Figure 35: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 36: Asia Pacific E-bike Market in Denmark Revenue (million), by Application Type 2025 & 2033

- Figure 37: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Application Type 2025 & 2033

- Figure 38: Asia Pacific E-bike Market in Denmark Revenue (million), by Battery Type 2025 & 2033

- Figure 39: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Battery Type 2025 & 2033

- Figure 40: Asia Pacific E-bike Market in Denmark Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific E-bike Market in Denmark Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 4: Global E-bike Market in Denmark Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 8: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 13: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 14: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 15: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 21: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 22: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 34: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 35: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global E-bike Market in Denmark Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 43: Global E-bike Market in Denmark Revenue million Forecast, by Application Type 2020 & 2033

- Table 44: Global E-bike Market in Denmark Revenue million Forecast, by Battery Type 2020 & 2033

- Table 45: Global E-bike Market in Denmark Revenue million Forecast, by Country 2020 & 2033

- Table 46: China E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific E-bike Market in Denmark Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-bike Market in Denmark?

The projected CAGR is approximately 8.23%.

2. Which companies are prominent players in the E-bike Market in Denmark?

Key companies in the market include Lekker Bikes, Sensa Bikes, MHW Bike-House GmbH (Cube Bikes), Royal Dutch Gazelle, Cortina Bikes, Giant Manufacturing Co Ltd, Batavus Intercycle Corporation, Qwic, Van Moof B, Koga.

3. What are the main segments of the E-bike Market in Denmark?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 412.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Commercial Vehicle Sales to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Fluctuations in Interest Rates to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.August 2022: Evans Cycles reintroduces Cube bikes to all 71 locations, During the height of the pandemic, Cube and Evans Cycles put their commercial relationship on pause due to supply chain issues.August 2022: Cube's Hybrid One E-Bike Offers Big Miles For Budget-Minded Cyclists, the Hybrid One packs a Bosch electric motor and urban-focused amenities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-bike Market in Denmark," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-bike Market in Denmark report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-bike Market in Denmark?

To stay informed about further developments, trends, and reports in the E-bike Market in Denmark, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence