Key Insights

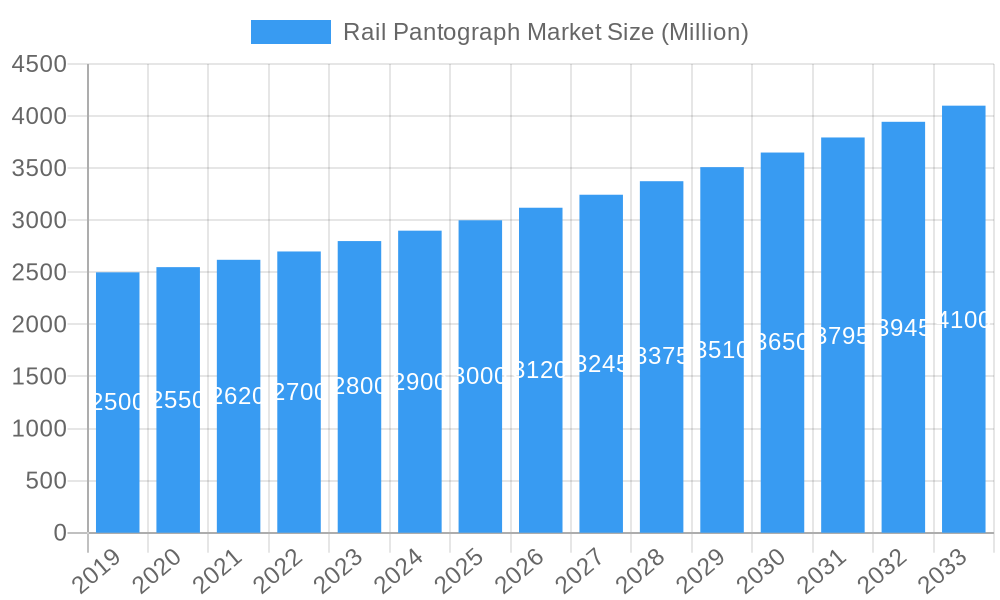

The global Rail Pantograph Market is projected for significant expansion, expected to reach $3771.14 million by 2025. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 12.87% from the base year 2025 through 2033. Key growth factors include the burgeoning demand for high-speed rail, urbanization, the imperative for sustainable transport, and substantial government investments in modernizing rail infrastructure. The proliferation of metro rail systems in emerging economies further fuels market expansion, as pantographs are indispensable for electric traction in urban transit. Technological advancements, such as the development of lightweight, durable, and energy-efficient pantograph designs, alongside the integration of advanced sensors for predictive maintenance, are creating new market opportunities and enhancing operational reliability and safety.

Rail Pantograph Market Market Size (In Billion)

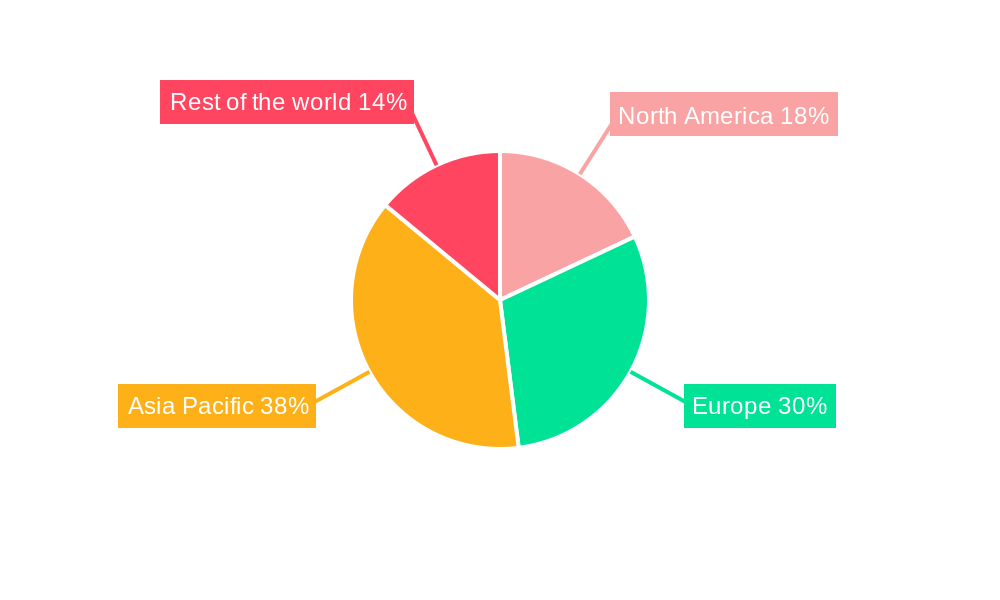

Market segmentation includes Single Arm Pantograph and Double Arm Pantograph by arm type, with Double Arm Pantographs anticipated to lead due to their capacity for higher current collection. By pantograph type, both Diamond Shape and Bow types are widely adopted, influenced by operational speed, current demands, and vehicle design. High-Speed Trains and Metro Trains are dominant segments for pantograph demand, highlighting their critical role in electrified rail transport. The Asia Pacific region, particularly China and India, is expected to lead growth due to extensive investments in high-speed rail and expanding metro networks. Europe, with its established high-speed rail infrastructure and focus on sustainable transport, will remain a key market. Market restraints include high initial infrastructure investment costs and potential supply chain vulnerabilities. Nevertheless, the overarching trend towards electrified and high-speed rail transportation ensures a highly positive market outlook.

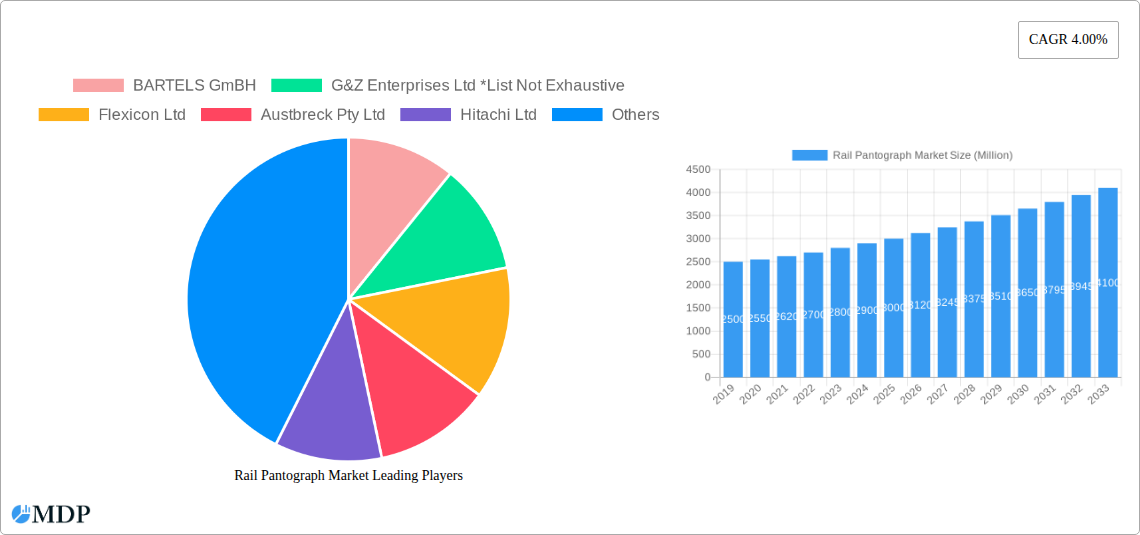

Rail Pantograph Market Company Market Share

Rail Pantograph Market: Comprehensive Analysis & Future Outlook (2019-2033)

Gain unparalleled insights into the global Rail Pantograph Market with this in-depth report, covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025. We delve into critical market dynamics, industry trends, leading segments, product developments, and strategic outlook, providing actionable intelligence for stakeholders seeking to capitalize on the rapidly evolving rail infrastructure landscape. This report is essential for manufacturers, suppliers, rail operators, and investors navigating the complexities of the rail pantograph ecosystem.

Rail Pantograph Market Market Dynamics & Concentration

The Rail Pantograph Market exhibits moderate to high concentration, with key players like Siemens Mobility, Hitachi Ltd, and Alstom SA holding significant market share, estimated at over 60% combined in the historical period. Innovation drivers are primarily focused on enhancing efficiency, reliability, and safety of pantograph systems, driven by the increasing demand for high-speed rail and the modernization of existing rail networks. Regulatory frameworks, particularly those concerning electrical safety standards and interoperability, play a crucial role in shaping market entry and product development. Product substitutes, such as third-rail power collection systems, are largely confined to specific urban transit applications and do not pose a significant threat to pantographs in the broader rail sector. End-user trends indicate a growing preference for lightweight, low-maintenance pantographs with advanced diagnostic capabilities. Merger and acquisition (M&A) activities are expected to increase as larger players seek to consolidate their market position and acquire specialized technologies. The number of significant M&A deals in the past five years is estimated to be around 8-12.

- Market Concentration: Dominated by a few key global players.

- Innovation Drivers: Efficiency, reliability, safety, advanced diagnostics.

- Regulatory Frameworks: Electrical safety, interoperability standards.

- Product Substitutes: Limited impact outside specific applications.

- End-User Trends: Lightweight, low-maintenance, diagnostic-equipped pantographs.

- M&A Activities: Expected to increase for market consolidation and technology acquisition.

Rail Pantograph Market Industry Trends & Analysis

The Rail Pantograph Market is poised for significant growth, driven by the global push for sustainable transportation and massive investments in rail infrastructure expansion and modernization. The Compound Annual Growth Rate (CAGR) is projected to be around 6.5% to 7.5% during the forecast period of 2025-2033. Technological disruptions are at the forefront, with advancements in materials science leading to lighter and more durable pantograph designs, and the integration of sensors for real-time condition monitoring. This trend is exemplified by Ricardo's Pan Mon system, which aims to predict and prevent failures, thereby reducing downtime and maintenance costs. Consumer preferences are increasingly leaning towards pantographs that offer enhanced energy collection efficiency, reduced wear on overhead catenary systems (OCS), and improved aerodynamic performance, especially for high-speed trains. Competitive dynamics are characterized by a blend of established global manufacturers and emerging regional players focusing on niche segments. Market penetration of advanced pantograph technologies is steadily increasing, particularly in developed economies and rapidly developing nations undertaking ambitious rail projects. The market size for rail pantographs is estimated to reach approximately 400 Million USD by 2025, with substantial growth anticipated throughout the forecast period.

- Market Growth Drivers: Sustainable transportation initiatives, infrastructure investments, railway network expansion.

- Technological Disruptions: Advanced materials, integrated sensors, condition monitoring systems, improved aerodynamic designs.

- Consumer Preferences: Energy efficiency, reduced OCS wear, aerodynamic performance, advanced diagnostics.

- Competitive Dynamics: Intense competition between established global players and emerging regional manufacturers.

- Market Penetration: Increasing adoption of advanced pantograph technologies, especially in key markets.

Leading Markets & Segments in Rail Pantograph Market

The Rail Pantograph Market is spearheaded by Asia-Pacific, particularly China, due to its extensive high-speed rail network and ongoing expansion projects. North America and Europe also represent significant markets, driven by the modernization of existing rail lines and the development of new high-speed corridors.

- Dominant Region: Asia-Pacific, led by China.

- Key Countries: China, India, Germany, United States, Japan.

Analysis of segments reveals the following:

Arm Type:

- Single Arm Pantograph: Dominant in metro and light rail applications due to its compact design and lower infrastructure requirements. Expected to see steady growth driven by urban transit expansion.

- Double Arm Pantograph: Predominantly used on freight trains and older mainline routes where higher current collection capacity is required. While facing competition from single-arm designs in some applications, it remains crucial for specific operational needs.

Pantograph Type:

- Diamond Shape Pantograph: Historically prevalent, offering robust current collection. Still widely used on mainline and freight trains, but newer designs are gaining traction.

- Bow Type Pantograph: Increasingly favored for high-speed trains due to its superior aerodynamic properties, lower mechanical stress on the OCS, and smoother current collection at high velocities.

Train Type:

- High Speed Train: The fastest-growing segment, demanding advanced, aerodynamic, and reliable pantographs for speeds exceeding 250 km/h. The Vande Bharat express trains in India are a prime example of this segment's importance.

- Mainline Train: A substantial segment with ongoing demand for efficient and durable pantographs for both passenger and freight services. Modernization projects are driving upgrades.

- Freight Train: Continued demand, with a focus on robustness and capacity to handle the power requirements of long, heavy freight loads.

- Metro Train: Experiencing significant growth due to urbanization and the expansion of urban rapid transit systems. Compact and lightweight designs are key.

Key Drivers for Segment Dominance:

- High Speed Train: Government investment in high-speed rail networks, technological advancements, passenger demand for faster travel.

- Metro Train: Urbanization, population growth, government initiatives for public transport development, need for efficient intra-city connectivity.

- Bow Type Pantograph: Pursuit of higher operational speeds, reduced energy loss, and enhanced passenger comfort in high-speed rail.

- Single Arm Pantograph: Space constraints in urban environments, lower weight, and simplified installation in metro and light rail systems.

The market size for these segments is dynamic, with high-speed trains and metro trains expected to outpace other segments in terms of growth percentage. The overall market value is projected to reach a considerable figure, with estimates suggesting it will exceed 400 Million USD in the near future.

Rail Pantograph Market Product Developments

Recent product developments in the Rail Pantograph Market are centered on lightweight materials such as carbon composite contact strips for reduced wear on overhead catenary systems (OCS) and improved current collection. Smart pantographs with integrated sensors for real-time condition monitoring are also a significant trend, enabling predictive maintenance and reducing operational downtime. Companies are focusing on aerodynamic designs to minimize energy losses and noise pollution, particularly for high-speed applications. These innovations offer competitive advantages by enhancing reliability, reducing maintenance costs, and improving the overall performance and sustainability of rail operations. The market is actively embracing these advancements to meet the evolving demands of modern railway systems.

Key Drivers of Rail Pantograph Market Growth

The Rail Pantograph Market is propelled by several key drivers. The accelerating global investment in high-speed rail networks, driven by the need for efficient and sustainable intercity transportation, is a primary catalyst. Furthermore, the ongoing modernization and electrification of conventional rail lines worldwide contribute significantly to market expansion. Technological advancements in materials science and sensor technology are enabling the development of lighter, more durable, and intelligent pantographs. Regulatory support for cleaner transportation and the increasing adoption of electric trains over diesel alternatives also play a crucial role. The Indian government's initiative to manufacture 400 new generation Vande Bharat express trains underscores the growing demand for advanced electric propulsion systems, where pantographs are integral.

- Global Investments in High-Speed Rail: Facilitating the adoption of advanced pantograph technology.

- Modernization & Electrification of Rail Networks: Driving demand for new and upgraded pantograph systems.

- Technological Advancements: Innovations in materials and sensor integration.

- Government Support for Sustainable Transport: Promoting electric traction and reducing reliance on fossil fuels.

Challenges in the Rail Pantograph Market Market

Despite robust growth, the Rail Pantograph Market faces several challenges. The high initial cost of advanced pantograph systems can be a barrier for some operators, particularly in developing economies. Stringent regulatory compliance and certification processes for new designs can lead to extended development timelines and increased R&D expenses. Fluctuations in raw material prices, especially for specialized composites and metals, can impact manufacturing costs and profitability. Moreover, ensuring the long-term reliability and maintenance efficiency of complex smart pantograph systems requires skilled personnel and a robust support infrastructure, which may not be readily available in all regions.

- High Initial Investment Costs: Can limit adoption, especially for smaller operators.

- Stringent Regulatory Compliance: Leading to longer product development cycles and higher R&D investment.

- Raw Material Price Volatility: Impacting manufacturing costs and profit margins.

- Need for Skilled Maintenance Personnel: Requiring specialized training and infrastructure.

Emerging Opportunities in Rail Pantograph Market

Emerging opportunities within the Rail Pantograph Market are substantial and diverse. The increasing focus on digital rail solutions and the Internet of Things (IoT) presents a significant opportunity for the development and integration of advanced diagnostic and predictive maintenance systems. Strategic partnerships between pantograph manufacturers and rail operators or signaling technology providers can unlock innovative solutions for enhanced operational efficiency and safety. The expansion of freight rail corridors, particularly in emerging economies, offers a significant market for robust and high-capacity pantographs. Furthermore, the growing trend towards decarbonization and the electrification of previously diesel-powered lines present a fertile ground for market growth. Investments in research and development for next-generation pantograph technologies, such as active control systems for improved OCS interaction, will also drive future expansion.

- Digital Rail and IoT Integration: For advanced diagnostics and predictive maintenance.

- Strategic Partnerships: Collaborations for innovative solutions and market penetration.

- Expansion of Freight Rail Corridors: Driving demand for robust and high-capacity systems.

- Decarbonization Initiatives: Accelerating electrification and the demand for pantographs.

Leading Players in the Rail Pantograph Market Sector

- BARTELS GmBH

- G&Z Enterprises Ltd

- Flexicon Ltd

- Austbreck Pty Ltd

- Hitachi Ltd

- Siemens Mobility

- SCHUNK GmbH & Co KG

- Alstom SA

- KONI BV

- Wabtec Corporation

Key Milestones in Rail Pantograph Market Industry

- November 2021: Ricardo completes the roll-out of its Pan Mon pantograph condition monitoring system on selected electrified routes in Scotland, including the East and West Coast main lines, the North Clyde line, and between Edinburgh and Glasgow. This development signifies a crucial step towards predictive maintenance and enhanced operational reliability.

- March 2022: The Indian Government announces a plan to undertake indigenous manufacture of 400 new generation Vande Bharat express trains. This initiative allocates INR 130 crores in the recent budget for 2022-2023. The Vande Bharat series draws energy from over-head equipment through pantographs mounted on coaches, highlighting the critical role of pantographs in modern train designs and emphasizing the drive towards self-reliance in railway manufacturing.

Strategic Outlook for Rail Pantograph Market Market

The strategic outlook for the Rail Pantograph Market is overwhelmingly positive, driven by sustained global investments in railway infrastructure and the accelerating transition towards sustainable transportation. Key growth accelerators include the continued expansion of high-speed rail networks, the electrification of freight and passenger lines, and the increasing adoption of smart technologies for enhanced operational efficiency. Manufacturers focusing on developing lightweight, durable, and intelligent pantographs with integrated diagnostic capabilities are well-positioned to capture market share. Strategic alliances with rail operators and technology providers will be crucial for innovation and market penetration. The market is expected to witness a consistent upward trajectory, fueled by a global commitment to cleaner and more efficient rail travel, with an estimated market size poised to exceed 400 Million USD in the coming years.

Rail Pantograph Market Segmentation

-

1. Arm Type

- 1.1. Single arm Pantograph

- 1.2. Double arm Pantograph

-

2. Pantograph Type

- 2.1. Diamond Shape

- 2.2. Bow type

-

3. Train Type

- 3.1. High Speed train

- 3.2. Mainline Train

- 3.3. Freight Train

- 3.4. Metro Train

Rail Pantograph Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the world

- 4.1. South America

- 4.2. Middle East and Africa

Rail Pantograph Market Regional Market Share

Geographic Coverage of Rail Pantograph Market

Rail Pantograph Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Growing Rail Electrification to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Arm Type

- 5.1.1. Single arm Pantograph

- 5.1.2. Double arm Pantograph

- 5.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 5.2.1. Diamond Shape

- 5.2.2. Bow type

- 5.3. Market Analysis, Insights and Forecast - by Train Type

- 5.3.1. High Speed train

- 5.3.2. Mainline Train

- 5.3.3. Freight Train

- 5.3.4. Metro Train

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the world

- 5.1. Market Analysis, Insights and Forecast - by Arm Type

- 6. North America Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Arm Type

- 6.1.1. Single arm Pantograph

- 6.1.2. Double arm Pantograph

- 6.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 6.2.1. Diamond Shape

- 6.2.2. Bow type

- 6.3. Market Analysis, Insights and Forecast - by Train Type

- 6.3.1. High Speed train

- 6.3.2. Mainline Train

- 6.3.3. Freight Train

- 6.3.4. Metro Train

- 6.1. Market Analysis, Insights and Forecast - by Arm Type

- 7. Europe Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Arm Type

- 7.1.1. Single arm Pantograph

- 7.1.2. Double arm Pantograph

- 7.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 7.2.1. Diamond Shape

- 7.2.2. Bow type

- 7.3. Market Analysis, Insights and Forecast - by Train Type

- 7.3.1. High Speed train

- 7.3.2. Mainline Train

- 7.3.3. Freight Train

- 7.3.4. Metro Train

- 7.1. Market Analysis, Insights and Forecast - by Arm Type

- 8. Asia Pacific Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Arm Type

- 8.1.1. Single arm Pantograph

- 8.1.2. Double arm Pantograph

- 8.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 8.2.1. Diamond Shape

- 8.2.2. Bow type

- 8.3. Market Analysis, Insights and Forecast - by Train Type

- 8.3.1. High Speed train

- 8.3.2. Mainline Train

- 8.3.3. Freight Train

- 8.3.4. Metro Train

- 8.1. Market Analysis, Insights and Forecast - by Arm Type

- 9. Rest of the world Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Arm Type

- 9.1.1. Single arm Pantograph

- 9.1.2. Double arm Pantograph

- 9.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 9.2.1. Diamond Shape

- 9.2.2. Bow type

- 9.3. Market Analysis, Insights and Forecast - by Train Type

- 9.3.1. High Speed train

- 9.3.2. Mainline Train

- 9.3.3. Freight Train

- 9.3.4. Metro Train

- 9.1. Market Analysis, Insights and Forecast - by Arm Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BARTELS GmBH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 G&Z Enterprises Ltd *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flexicon Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Austbreck Pty Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hitachi Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens Mobility

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SCHUNK GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Alstom SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 KONI BV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wabtec Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 BARTELS GmBH

List of Figures

- Figure 1: Global Rail Pantograph Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 3: North America Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 4: North America Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 5: North America Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 6: North America Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 7: North America Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 8: North America Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 11: Europe Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 12: Europe Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 13: Europe Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 14: Europe Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 15: Europe Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 16: Europe Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 19: Asia Pacific Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 20: Asia Pacific Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 21: Asia Pacific Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 22: Asia Pacific Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 23: Asia Pacific Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 24: Asia Pacific Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the world Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 27: Rest of the world Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 28: Rest of the world Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 29: Rest of the world Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 30: Rest of the world Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 31: Rest of the world Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 32: Rest of the world Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the world Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 2: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 3: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 4: Global Rail Pantograph Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 6: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 7: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 8: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 13: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 14: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 15: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 22: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 23: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 24: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: China Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: India Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 31: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 32: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 33: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: South America Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Pantograph Market?

The projected CAGR is approximately 12.87%.

2. Which companies are prominent players in the Rail Pantograph Market?

Key companies in the market include BARTELS GmBH, G&Z Enterprises Ltd *List Not Exhaustive, Flexicon Ltd, Austbreck Pty Ltd, Hitachi Ltd, Siemens Mobility, SCHUNK GmbH & Co KG, Alstom SA, KONI BV, Wabtec Corporation.

3. What are the main segments of the Rail Pantograph Market?

The market segments include Arm Type, Pantograph Type, Train Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3771.14 million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Growing Rail Electrification to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

In March 2022, Indian Government has announced the declaration plan to undertake indigenous manufacture of 400 new generation Vande Bharat express trains by allocating INR 130 crores in the recent budget for year 2022 -2023. Unlike a normal express train which is hauled by a detachable locomotive provided at one end of the train, the Vande Bharat series is provided by electric gear and trains draws it energy from over-head equipment through pantograph mounted on coaches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Pantograph Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Pantograph Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Pantograph Market?

To stay informed about further developments, trends, and reports in the Rail Pantograph Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence