Key Insights

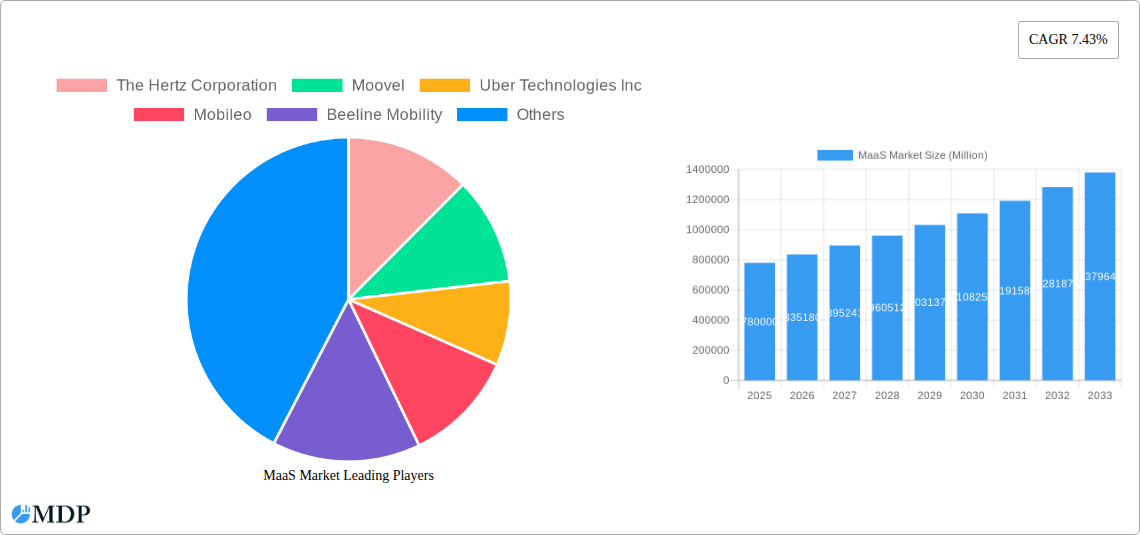

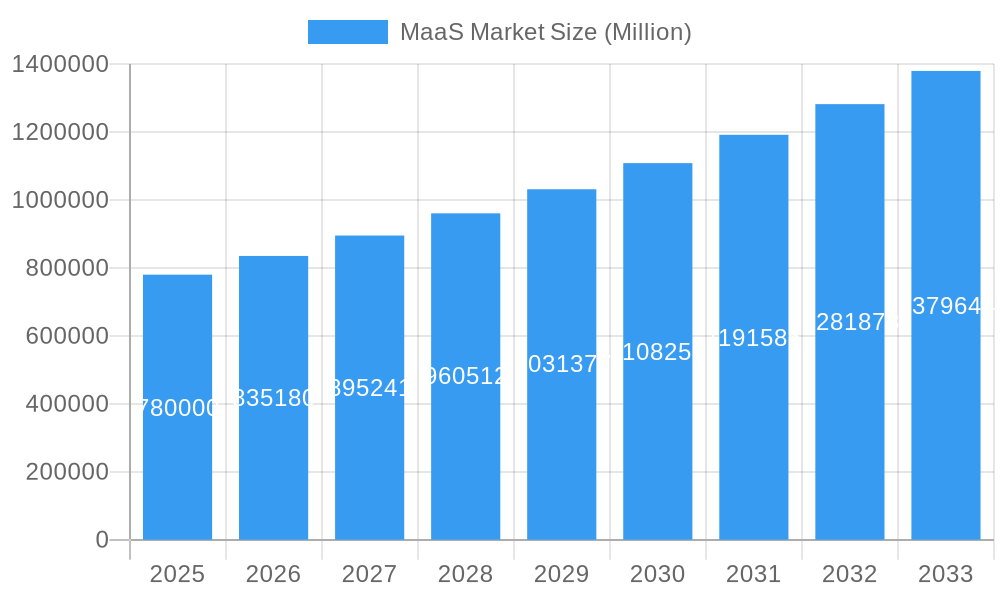

The Mobility as a Service (MaaS) market is poised for significant expansion, projected to reach an estimated market size of $0.78 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.43% anticipated through 2033. This impressive growth trajectory is propelled by several key drivers. Foremost among these is the increasing demand for integrated and seamless transportation solutions that consolidate various mobility options, from public transit to ride-sharing and micro-mobility, into a single platform. The escalating urbanization globally also plays a crucial role, as cities grapple with congestion and environmental concerns, making MaaS an attractive alternative to private vehicle ownership. Furthermore, advancements in digital technologies, including sophisticated AI-powered route optimization, real-time data analytics, and cashless payment systems, are fundamentally transforming the user experience and driving adoption. The growing environmental consciousness among consumers and supportive government initiatives promoting sustainable transport further bolster the market's prospects.

MaaS Market Market Size (In Billion)

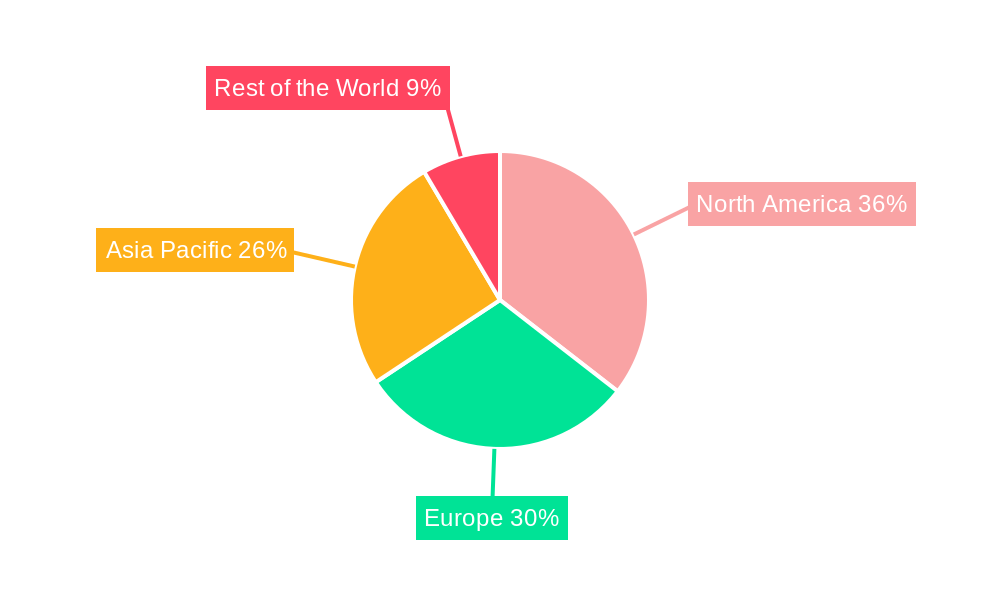

However, the MaaS market is not without its challenges. The primary restraint lies in the complex regulatory landscape and the need for extensive collaboration between diverse stakeholders, including transportation operators, technology providers, and city authorities, to establish interoperable systems. Data privacy and security concerns also present a significant hurdle, requiring robust frameworks to build user trust. Despite these obstacles, the market is witnessing a surge in innovative trends. The integration of autonomous vehicle technology into MaaS platforms is a significant future trend, promising to revolutionize urban mobility. Personalized mobility packages tailored to individual user needs and preferences are also gaining traction. Geographically, North America and Europe are leading the adoption due to established infrastructure and a higher propensity for technology integration, while the Asia Pacific region, particularly China and India, is expected to exhibit the fastest growth driven by rapid urbanization and a large, tech-savvy population.

MaaS Market Company Market Share

This in-depth MaaS Market report provides a definitive analysis of the Mobility as a Service landscape, exploring its transformative impact on transportation. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights for industry leaders, investors, and policymakers. Discover critical data on MaaS market size, MaaS market growth, MaaS market trends, and the intricate dynamics shaping the future of integrated mobility solutions.

With high-traffic keywords like urban mobility, transportation as a service, shared mobility, connected vehicles, and digital transportation, this report ensures maximum visibility. We dissect market concentration, innovation drivers, regulatory frameworks, and end-user trends, providing actionable intelligence on the MaaS ecosystem. Understand the competitive landscape, including key players like The Hertz Corporation, Uber Technologies Inc, Didi Chuxing, and Moovit Inc, and their strategic moves. Whether your focus is on carsharing, micromobility, or public transit integration, this report is your essential guide to navigating the rapidly evolving MaaS market.

MaaS Market Market Dynamics & Concentration

The MaaS market exhibits a dynamic and evolving concentration, characterized by increasing integration and a growing number of partnerships. Innovation drivers are primarily fueled by advancements in digital platforms, data analytics, and the increasing demand for convenient, personalized, and sustainable transportation options. Regulatory frameworks, while still developing in many regions, are crucial for unlocking wider adoption, focusing on data privacy, fare integration, and service accessibility. Product substitutes, such as traditional private vehicle ownership and single-mode transportation services, are gradually being eroded by the comprehensive value proposition of MaaS. End-user trends reveal a strong preference for on-demand services, multimodal journey planning, and cost-effective, seamless travel experiences. Mergers and acquisitions (M&A) activities are on the rise as established players seek to consolidate market share and expand their service offerings. For instance, the acquisition of Bridj Technology Pty Ltd by MaaS Global (Whim) signifies a strategic move to enhance integrated services. We anticipate a continued trend of consolidation and strategic alliances to address the complexity of the MaaS ecosystem and capture a significant share of the estimated \$XX Million market by 2025.

MaaS Market Industry Trends & Analysis

The MaaS market is poised for exponential growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive government initiatives. The estimated Compound Annual Growth Rate (CAGR) for the MaaS market is projected to be XX% from 2025 to 2033, indicating a significant expansion in market penetration. A key growth driver is the increasing adoption of smartphones and the widespread availability of high-speed internet, enabling seamless access to MaaS platforms. Furthermore, the growing urbanization and the associated challenges of traffic congestion, air pollution, and parking scarcity are compelling city planners and residents to embrace integrated mobility solutions.

Technological disruptions, including the advent of electric vehicles (EVs), autonomous driving technologies, and sophisticated data analytics, are revolutionizing how mobility services are offered and consumed. These innovations are paving the way for more efficient, sustainable, and personalized travel experiences. Consumer preferences are shifting towards flexibility, convenience, and cost-effectiveness, with an increasing willingness to subscribe to MaaS packages that bundle various transportation modes. This trend is particularly evident among younger demographics, who are more open to abandoning private car ownership in favor of on-demand, shared mobility options.

The competitive dynamics within the MaaS market are intensifying, with a mix of established transportation giants, tech startups, and mobility service providers vying for market leadership. Companies like Uber Technologies Inc. and Didi Chuxing are expanding their offerings beyond ride-hailing to include multimodal trip planning and integration. Meanwhile, new entrants and specialized players like Moovit Inc. are focusing on specific aspects of the MaaS ecosystem, such as transit planning and ticketing. Strategic partnerships between mobility providers, technology developers, and public transport agencies are becoming crucial for creating comprehensive and user-friendly MaaS solutions. The market penetration of MaaS is expected to reach XX% by 2025, highlighting its growing importance in reshaping urban transportation.

Leading Markets & Segments in MaaS Market

The MaaS market is experiencing robust growth across various regions and segments, with North America and Europe currently leading in adoption and innovation. Economic policies promoting sustainable transportation and smart city initiatives are significant drivers in these leading markets. Infrastructure development, particularly in public transportation networks and the availability of charging stations for electric vehicles, further bolsters the growth of MaaS.

Service Type Dominance:

- Car: The Car segment is a dominant force within the MaaS market, encompassing ride-hailing, carsharing, and ride-pooling services. The convenience and flexibility offered by these services, coupled with advancements in electric and connected car technology, make them highly attractive to consumers. Companies like Uber Technologies Inc., The Hertz Corporation, and Enterprise Holdings Inc. are investing heavily in expanding their car-based MaaS offerings.

- Bus: The Bus segment is crucial for providing cost-effective and accessible public transportation within MaaS frameworks. Integration of bus schedules and ticketing into MaaS platforms is a key focus for improving last-mile connectivity and overall urban mobility.

- Bike: The Bike segment, including traditional bicycles and e-scooters, is rapidly growing, especially in urban environments, due to its sustainability and suitability for short-distance travel. This segment is vital for complementing other modes of transport and addressing the first and last-mile challenges.

Transportation Type Dominance:

- Public: The Public transportation type remains a cornerstone of MaaS, providing the backbone for extensive urban and intercity travel. Seamless integration of public transit options, including trains, trams, and buses, into MaaS platforms is essential for mass adoption and achieving sustainability goals.

- Private: The Private transportation type, encompassing private car usage, carsharing, and ride-hailing, is also a significant contributor. As private mobility services become more integrated into broader MaaS ecosystems, they offer consumers greater choice and personalized travel solutions.

The continued investment in smart city infrastructure, coupled with evolving consumer habits that prioritize convenience and sustainability, will further solidify the dominance of these segments and types within the global MaaS market. The estimated market value for the MaaS market is expected to reach \$XX Billion by 2025, with continued expansion projected.

MaaS Market Product Developments

Product developments in the MaaS market are characterized by a strong emphasis on enhancing user experience and expanding service integration. Innovations include the development of sophisticated multimodal journey planners that incorporate real-time data on traffic, public transport schedules, and micro-mobility availability. Mobile ticketing and payment solutions are becoming increasingly seamless, allowing users to access and pay for various services through a single application. Furthermore, the integration of personalized subscription models and loyalty programs aims to foster customer retention and encourage the adoption of comprehensive MaaS packages. Companies are also focusing on leveraging AI and machine learning to optimize route planning, predict demand, and personalize recommendations, thereby creating a more efficient and user-centric mobility experience. These advancements are critical for the \$XX Million MaaS market.

Key Drivers of MaaS Market Growth

Several key drivers are propelling the growth of the MaaS market.

- Technological Advancements: The proliferation of smartphones, high-speed internet, and advanced data analytics platforms enables the seamless integration and management of diverse mobility services.

- Urbanization and Congestion: Increasing urban populations and resulting traffic congestion are creating a strong demand for efficient and integrated transportation solutions.

- Sustainability Concerns: Growing awareness of environmental issues is driving a shift towards shared mobility, electric vehicles, and public transport, all integral components of MaaS.

- Government Initiatives: Supportive policies and investments in smart city development and sustainable transportation infrastructure by governments worldwide are fostering MaaS adoption.

- Changing Consumer Preferences: A growing preference for convenience, flexibility, and cost-effectiveness over private vehicle ownership is a significant behavioral driver.

These factors are collectively contributing to the expansion of the MaaS market, projected to reach \$XX Billion by 2025.

Challenges in the MaaS Market Market

Despite its immense potential, the MaaS market faces several challenges that can impede its growth.

- Regulatory Fragmentation: Inconsistent regulations across different cities and countries regarding data sharing, fare integration, and service licensing can create significant hurdles for seamless MaaS deployment.

- Interoperability Issues: Achieving true interoperability between different mobility providers, payment systems, and data platforms remains a complex technical challenge.

- User Adoption and Behavioral Change: Convincing consumers to shift from established private vehicle habits to integrated MaaS solutions requires significant effort in education and service demonstration.

- Data Privacy and Security Concerns: Managing sensitive user data while ensuring privacy and security is paramount and requires robust governance frameworks.

- Infrastructure Investment: Significant investment in digital and physical infrastructure, including charging stations and reliable public transport networks, is necessary for widespread MaaS implementation.

These challenges, if not addressed proactively, could limit the pace of growth for the MaaS market.

Emerging Opportunities in MaaS Market

The MaaS market is ripe with emerging opportunities that promise to shape its future trajectory. The increasing deployment of 5G technology will enable real-time data processing and enhanced connectivity, paving the way for more sophisticated and responsive MaaS services. The integration of autonomous vehicles into MaaS platforms presents a revolutionary opportunity to enhance efficiency and accessibility. Furthermore, the development of personalized subscription models and loyalty programs for MaaS users can foster greater customer engagement and loyalty, driving recurring revenue streams. Strategic partnerships between mobility providers, technology companies, and city governments will continue to be a crucial catalyst for market expansion, enabling the creation of holistic and user-centric mobility ecosystems. The growth of the MaaS market is further fueled by the expansion into emerging economies, where the demand for accessible and affordable mobility solutions is high.

Leading Players in the MaaS Market Sector

- The Hertz Corporation

- Moovel

- Uber Technologies Inc

- Mobileo

- Beeline Mobility

- Enterprise Holdings Inc

- Avis Budget Group

- Moovit Inc

- Whim (Maas Global)

- Didi Chuxing

- Bridj Technology Pty Ltd

- Ubigo (via-id)

- Citymapper

Key Milestones in MaaS Market Industry

- February 2023: Uber partnered with financial services firm HSBC to launch a digital payments solution in Egypt, enabling unbanked drivers to receive on-demand cash outs into mobile wallets, enhancing financial inclusion and operational efficiency.

- January 2023: DiDi began collaborating with Jordan Transfer Guidance to integrate taxi dispatch services into the transfer guidance app, covering last-mile routes as part of Jordan's MaaS service and tourism DX business, anticipating tourist return.

- December 2022: Moovit launched a new urban mobility app in Tampa, assisting users in planning multimodal trips (walking, biking, scooting, driving, streetcar, bus) and integrating with HART mobile ticketing, addressing transit access gaps and improving connectivity.

These milestones highlight the continuous innovation and strategic collaborations shaping the MaaS market.

Strategic Outlook for MaaS Market Market

The strategic outlook for the MaaS market is overwhelmingly positive, driven by a clear trajectory towards integrated, sustainable, and user-centric mobility. Future growth accelerators include the continued development and adoption of electric and autonomous vehicle technologies, which will further enhance the efficiency and appeal of MaaS offerings. The increasing focus on data-driven insights and AI-powered personalization will enable mobility providers to offer highly tailored services, meeting the diverse needs of consumers. Strategic partnerships between public transit authorities, private mobility operators, and technology providers will be crucial for creating seamless multimodal journey experiences. As cities worldwide continue to prioritize smart urban development and sustainable transportation, the demand for comprehensive MaaS solutions is expected to surge, solidifying its position as a transformative force in the future of urban mobility, contributing to an estimated \$XX Billion market by 2033.

MaaS Market Segmentation

-

1. Service Type

- 1.1. Car

- 1.2. Bus

- 1.3. Bike

-

2. Transportation Type

- 2.1. Public

- 2.2. Private

MaaS Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

MaaS Market Regional Market Share

Geographic Coverage of MaaS Market

MaaS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Production; Emphasis on Vehicle Comfort and NVH Reduction

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations And Uncertainties

- 3.4. Market Trends

- 3.4.1. Increasing Traffic Congestion Drive the Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MaaS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Car

- 5.1.2. Bus

- 5.1.3. Bike

- 5.2. Market Analysis, Insights and Forecast - by Transportation Type

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America MaaS Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Car

- 6.1.2. Bus

- 6.1.3. Bike

- 6.2. Market Analysis, Insights and Forecast - by Transportation Type

- 6.2.1. Public

- 6.2.2. Private

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe MaaS Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Car

- 7.1.2. Bus

- 7.1.3. Bike

- 7.2. Market Analysis, Insights and Forecast - by Transportation Type

- 7.2.1. Public

- 7.2.2. Private

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific MaaS Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Car

- 8.1.2. Bus

- 8.1.3. Bike

- 8.2. Market Analysis, Insights and Forecast - by Transportation Type

- 8.2.1. Public

- 8.2.2. Private

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of the World MaaS Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Car

- 9.1.2. Bus

- 9.1.3. Bike

- 9.2. Market Analysis, Insights and Forecast - by Transportation Type

- 9.2.1. Public

- 9.2.2. Private

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Hertz Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Moovel

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Uber Technologies Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mobileo

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Beeline Mobility

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Enterprise Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Avis Budget Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Moovit Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Whim (Maas Global)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Didi Chuxing

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bridj Technology Pty Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Ubigo (via-id)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Citymapper

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 The Hertz Corporation

List of Figures

- Figure 1: Global MaaS Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MaaS Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America MaaS Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America MaaS Market Revenue (Million), by Transportation Type 2025 & 2033

- Figure 5: North America MaaS Market Revenue Share (%), by Transportation Type 2025 & 2033

- Figure 6: North America MaaS Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MaaS Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe MaaS Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe MaaS Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe MaaS Market Revenue (Million), by Transportation Type 2025 & 2033

- Figure 11: Europe MaaS Market Revenue Share (%), by Transportation Type 2025 & 2033

- Figure 12: Europe MaaS Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe MaaS Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific MaaS Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific MaaS Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific MaaS Market Revenue (Million), by Transportation Type 2025 & 2033

- Figure 17: Asia Pacific MaaS Market Revenue Share (%), by Transportation Type 2025 & 2033

- Figure 18: Asia Pacific MaaS Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific MaaS Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World MaaS Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Rest of the World MaaS Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Rest of the World MaaS Market Revenue (Million), by Transportation Type 2025 & 2033

- Figure 23: Rest of the World MaaS Market Revenue Share (%), by Transportation Type 2025 & 2033

- Figure 24: Rest of the World MaaS Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World MaaS Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MaaS Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global MaaS Market Revenue Million Forecast, by Transportation Type 2020 & 2033

- Table 3: Global MaaS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MaaS Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global MaaS Market Revenue Million Forecast, by Transportation Type 2020 & 2033

- Table 6: Global MaaS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global MaaS Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global MaaS Market Revenue Million Forecast, by Transportation Type 2020 & 2033

- Table 12: Global MaaS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global MaaS Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global MaaS Market Revenue Million Forecast, by Transportation Type 2020 & 2033

- Table 19: Global MaaS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: China MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global MaaS Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global MaaS Market Revenue Million Forecast, by Transportation Type 2020 & 2033

- Table 27: Global MaaS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South America MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa MaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MaaS Market?

The projected CAGR is approximately 7.43%.

2. Which companies are prominent players in the MaaS Market?

Key companies in the market include The Hertz Corporation, Moovel, Uber Technologies Inc, Mobileo, Beeline Mobility, Enterprise Holdings Inc, Avis Budget Group, Moovit Inc, Whim (Maas Global), Didi Chuxing, Bridj Technology Pty Ltd, Ubigo (via-id), Citymapper.

3. What are the main segments of the MaaS Market?

The market segments include Service Type, Transportation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Production; Emphasis on Vehicle Comfort and NVH Reduction.

6. What are the notable trends driving market growth?

Increasing Traffic Congestion Drive the Demand in the Market.

7. Are there any restraints impacting market growth?

Economic Fluctuations And Uncertainties.

8. Can you provide examples of recent developments in the market?

In February 2023, Uber partnered with financial services firm HSBC to launch a digital payments solution that allows unbanked drivers in Egypt to receive on-demand cash outs into mobile wallets. Through this collaboration, the companies hope to provide Uber platform drivers with access to 100% of their earnings in a timely and convenient manner via HSBC Net's payment solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MaaS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MaaS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MaaS Market?

To stay informed about further developments, trends, and reports in the MaaS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence