Key Insights

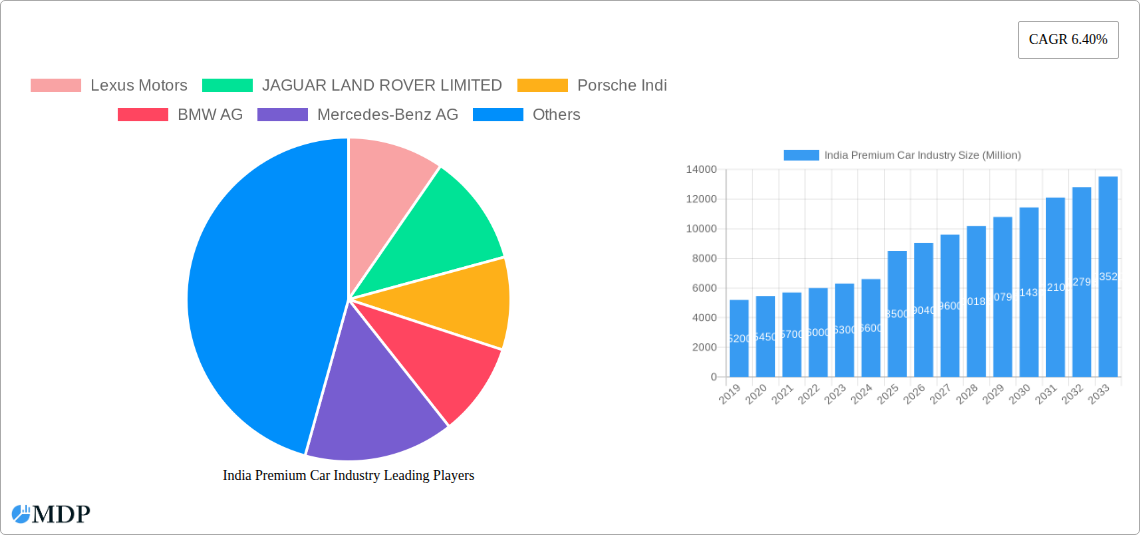

The Indian premium car market is projected for significant expansion, with an estimated market size of $12.1 billion by 2025, driven by a robust CAGR of 7.9% through 2033. This growth is propelled by increasing disposable incomes, a rising aspirational middle class, and a strong demand for sophisticated, feature-rich vehicles. The growing preference for SUVs, particularly among affluent younger consumers, aligns with global trends and is a key growth driver. The accelerating adoption of electric vehicles (EVs) within the premium segment, supported by government initiatives and environmental consciousness, presents a substantial opportunity. Luxury brands are expanding their EV offerings to meet the demand for performance and sustainability.

India Premium Car Industry Market Size (In Billion)

Challenges within the market include the high cost of premium vehicles and dynamic import duties and taxation policies. Intense competition among established luxury manufacturers, characterized by innovation and aggressive marketing, also shapes the landscape. However, the expansion of dealer networks and after-sales services into Tier 2 and Tier 3 cities is vital for deeper market penetration. The market is segmented by vehicle type, with SUVs and Sedans dominating, followed by Hatchbacks. While Internal Combustion Engine (ICE) vehicles remain prevalent, the Electric Vehicle (EV) segment is experiencing rapid growth. Price segments range from INR 20 Lakh - 50 Lakh, INR 50 Lakh - 80 Lakh, and Above INR 80 Lakh, with all showing promising growth. Key global players including BMW AG, Mercedes-Benz AG, Audi AG, and Jaguar Land Rover Limited are introducing advanced technologies and exclusive models to appeal to the discerning Indian consumer.

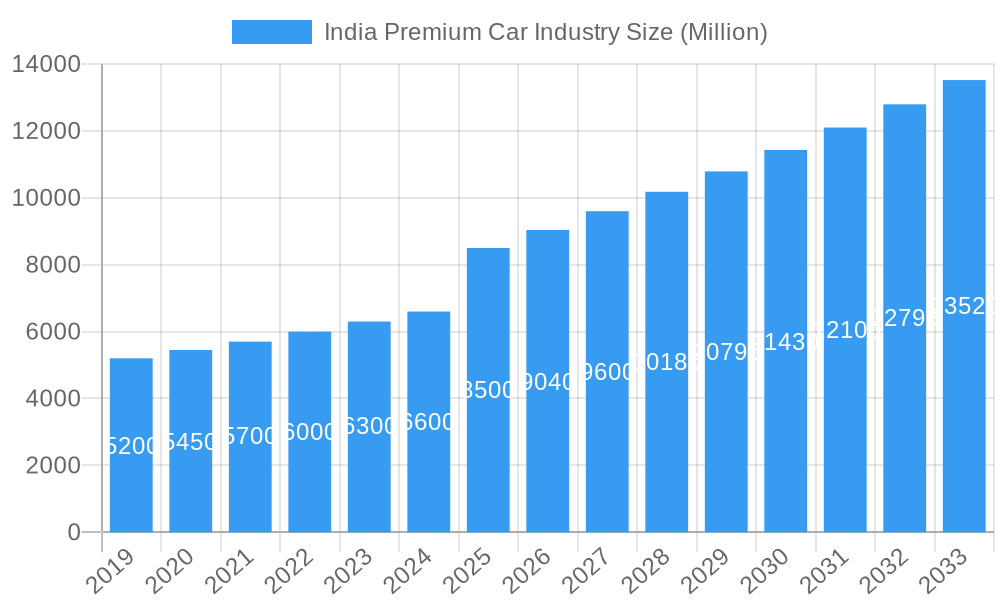

India Premium Car Industry Company Market Share

India Premium Car Industry Market Report: Dynamics, Trends, and Future Outlook (2019-2033)

Unlock critical insights into India's burgeoning premium car market with this comprehensive report. Delve into market dynamics, emerging trends, leading players, and future opportunities shaping the luxury automotive landscape. Essential for manufacturers, dealerships, investors, and policymakers seeking to capitalize on this high-growth sector.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

India Premium Car Industry Market Dynamics & Concentration

The India premium car market exhibits moderate concentration, with a few dominant players like Mercedes-Benz AG, BMW AG, and Audi AG holding significant market share, estimated to be over 60% collectively. Innovation is a key driver, fueled by the constant introduction of new models, advanced technologies (e.g., mild-hybrid, electric powertrains), and enhanced luxury features. Regulatory frameworks, while evolving, are generally supportive of premium segment growth, focusing on emissions standards and safety. Product substitutes are limited within the strict definition of premium, but mainstream brands are increasingly offering feature-rich variants that encroach on entry-level premium segments. End-user trends reveal a growing demand for SUVs, advanced driver-assistance systems (ADAS), and sustainable mobility solutions like electric vehicles. Merger and acquisition (M&A) activities are less prevalent within the established premium players, but strategic partnerships for technology development and market expansion are on the rise. The number of significant M&A deals in the premium segment remains low, with fewer than 5 major transactions over the historical period.

India Premium Car Industry Industry Trends & Analysis

The India premium car industry is experiencing robust growth, driven by a burgeoning affluent population, increasing disposable incomes, and a desire for aspirational mobility. The Compound Annual Growth Rate (CAGR) for the premium car segment is projected to be around 12-15% over the forecast period. Market penetration, while still lower than developed economies, is steadily increasing, with premium car sales expected to reach over 2 Million units by 2033. Technological disruptions are profoundly impacting the market, with a significant shift towards electric vehicles (EVs) and hybrid powertrains. Brands are investing heavily in R&D to offer advanced features, connectivity, and autonomous driving capabilities. Consumer preferences are evolving, with a growing demand for personalized experiences, sustainable luxury, and performance-oriented vehicles. The competitive landscape is intensifying, characterized by aggressive product launches, strategic pricing, and enhanced customer engagement initiatives. Competition is fierce among established German luxury brands, with increasing presence of other global luxury marques.

Leading Markets & Segments in India Premium Car Industry

The SUV segment is the undisputed leader in the India premium car industry, accounting for over 55% of the market share. This dominance is driven by Indian consumer preference for higher ground clearance, spacious interiors, and the perceived prestige associated with SUVs. Within Drive Type, IC Engine vehicles still hold the majority share (approximately 80%), but the Electric segment is rapidly gaining traction with a projected CAGR of over 25%. The Price Range of INR 50 Lakh - 80 Lakh is a significant contributor, capturing a substantial portion of the market as consumers aspire to premium ownership without crossing the ultra-luxury threshold. However, the Above INR 80 Lakh segment, though smaller in volume, represents high-value transactions and brand halo effect.

- Key Drivers for SUV Dominance:

- Indian road infrastructure and varying terrain favouring higher ground clearance.

- Perception of safety and commanding road presence.

- Availability of diverse luxury SUV models across price points.

- Key Drivers for Electric Vehicle Growth:

- Government incentives and tax benefits for EVs.

- Increasing environmental consciousness among affluent buyers.

- Advancements in battery technology and charging infrastructure.

- Dominance of Mid-to-High Price Segments:

- Growing disposable incomes among the Indian middle and upper class.

- Desire for aspirational brands and features.

- Availability of attractive financing options.

India Premium Car Industry Product Developments

The India premium car industry is witnessing rapid product innovation, focusing on electrification, enhanced connectivity, and advanced driver-assistance systems. Manufacturers are introducing mild-hybrid and fully electric variants of their popular models, catering to evolving consumer demands for sustainability and performance. Features like augmented reality-enabled navigation, sophisticated infotainment systems, and AI-powered voice assistants are becoming standard. The competitive advantage lies in offering a superior user experience, cutting-edge technology, and uncompromising luxury. Emphasis is also placed on design aesthetics and personalized customization options.

Key Drivers of India Premium Car Industry Growth

Several factors are propelling the growth of the India premium car industry. Economic Factors such as a rising affluent class and increased disposable incomes are paramount. Technological Advancements in areas like electric mobility, autonomous driving, and connected car features are attracting tech-savvy consumers. Government Initiatives promoting electric vehicle adoption through subsidies and policy support are also playing a crucial role. Furthermore, changing consumer preferences, including a desire for premium branding, enhanced comfort, and aspirational lifestyles, are significant growth accelerators.

Challenges in the India Premium Car Industry Market

Despite its growth, the India premium car industry faces several challenges. High import duties and taxes on completely built units (CBUs) can make premium vehicles significantly more expensive. Developing adequate charging infrastructure for electric premium cars remains a hurdle in many Tier 2 and Tier 3 cities. Intensifying competition among established and emerging players necessitates continuous investment in product development and marketing. Supply chain disruptions, as seen in recent global events, can impact production and availability. The perceived high cost of maintenance and spare parts for luxury vehicles also acts as a restraint for some potential buyers.

Emerging Opportunities in India Premium Car Industry

The India premium car industry is ripe with emerging opportunities. The rapid expansion of the Electric Vehicle (EV) segment presents a massive growth avenue, with manufacturers able to establish early market leadership in sustainable luxury. Strategic partnerships with technology providers for advanced infotainment and autonomous driving features will enhance product offerings. Market expansion into Tier 2 and Tier 3 cities offers untapped potential as wealth distribution grows. The increasing demand for performance-oriented and niche luxury vehicles, such as supercars and ultra-luxury SUVs, opens up specialized market segments. Subscription models and flexible ownership plans could also attract a younger demographic to the premium car market.

Leading Players in the India Premium Car Industry Sector

- Lexus Motors

- JAGUAR LAND ROVER LIMITED

- Porsche Indi

- BMW AG

- Mercedes-Benz AG

- Audi AG

- Volvo AB

- Bentley Motors

- Rolls-Royce Holding PLC

Key Milestones in India Premium Car Industry Industry

- March 2022: Mercedes-Benz India launched the new S-Class sedan under its luxury Maybach brand, with the 2022 Mercedes Maybach S-Class starting at INR 2.5 crore (ex-showroom), available as both locally manufactured and CBU units.

- January 2022 (Launch Year, cited Dec 2021): Aston Martin launched its first-ever SUV in India at INR 3.82 crore, powered by a Mercedes-AMG-sourced 4.0-liter twin-turbo V8 engine.

- November 2021: Audi launched its new luxury SUV for India, the Audi Q5, at a starting price of INR 58.9 lakh, an important model for its SUV sales in the country.

- October 2021: The fifth-generation Jaguar F-Pace with MHV version debuted in India, offered in four trim levels including mild-hybrid options with V6 powertrains.

Strategic Outlook for India Premium Car Industry Market

The strategic outlook for the India premium car industry is exceptionally positive, driven by a confluence of rising affluence, evolving consumer aspirations, and technological advancements. Future market potential is immense, with continued growth expected in both volume and value. Manufacturers should focus on expanding their electric vehicle portfolios, investing in localized manufacturing to mitigate import duties, and enhancing digital customer engagement strategies. Strategic opportunities lie in catering to niche segments, developing advanced driver-assistance systems, and exploring innovative ownership models to broaden market appeal and capture the next wave of luxury car buyers.

India Premium Car Industry Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric

-

3. Price Range

- 3.1. INR 20 Lakh - 50 Lakh

- 3.2. INR 50 Lakh - 80 Lakh

- 3.3. Above INR 80 Lakh

India Premium Car Industry Segmentation By Geography

- 1. India

India Premium Car Industry Regional Market Share

Geographic Coverage of India Premium Car Industry

India Premium Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements In Vehicles Driving Demand; Others

- 3.3. Market Restrains

- 3.3.1. High Scan Tool Costs to Limit Growth; Others

- 3.4. Market Trends

- 3.4.1. Luxury SUVs are Witnessing Rapid Growth in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Premium Car Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Price Range

- 5.3.1. INR 20 Lakh - 50 Lakh

- 5.3.2. INR 50 Lakh - 80 Lakh

- 5.3.3. Above INR 80 Lakh

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lexus Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAGUAR LAND ROVER LIMITED

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Porsche Indi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMW AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mercedes-Benz AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Audi AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bentley Motors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolls-Royce Holding PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lexus Motors

List of Figures

- Figure 1: India Premium Car Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Premium Car Industry Share (%) by Company 2025

List of Tables

- Table 1: India Premium Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: India Premium Car Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: India Premium Car Industry Revenue billion Forecast, by Price Range 2020 & 2033

- Table 4: India Premium Car Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: India Premium Car Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: India Premium Car Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 7: India Premium Car Industry Revenue billion Forecast, by Price Range 2020 & 2033

- Table 8: India Premium Car Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Premium Car Industry?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the India Premium Car Industry?

Key companies in the market include Lexus Motors, JAGUAR LAND ROVER LIMITED, Porsche Indi, BMW AG, Mercedes-Benz AG, Audi AG, Volvo AB, Bentley Motors, Rolls-Royce Holding PLC.

3. What are the main segments of the India Premium Car Industry?

The market segments include Vehicle Type, Drive Type, Price Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements In Vehicles Driving Demand; Others.

6. What are the notable trends driving market growth?

Luxury SUVs are Witnessing Rapid Growth in the Country.

7. Are there any restraints impacting market growth?

High Scan Tool Costs to Limit Growth; Others.

8. Can you provide examples of recent developments in the market?

In March 2022, Mercedes-Benz India launched a new S-Class sedan under its luxury brand, Maybach. The 2022 Mercedes Maybach S-Class is available in India at a starting price of INR 2.5 crore (ex-showroom). The new Maybach S-Class will be available both as locally manufactured units and completely built units (CBU).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Premium Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Premium Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Premium Car Industry?

To stay informed about further developments, trends, and reports in the India Premium Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence