Key Insights

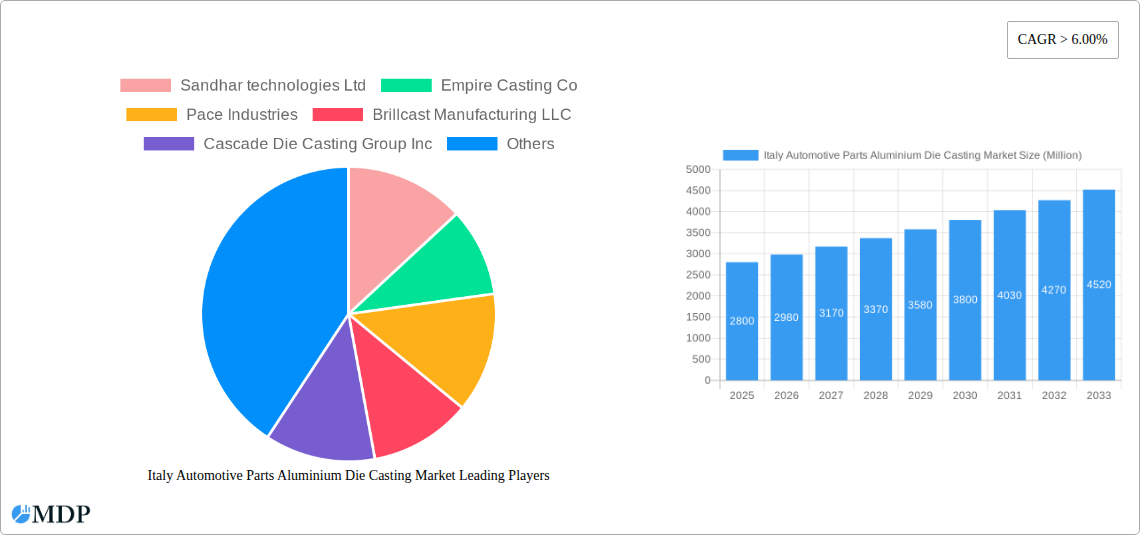

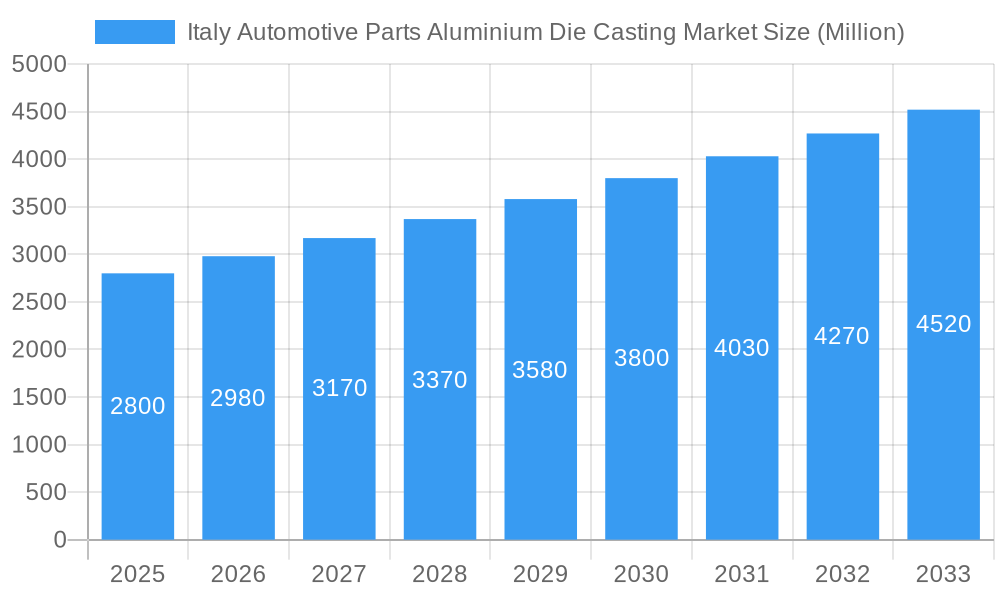

The Italian automotive parts aluminium die casting market is poised for robust growth, projected to reach a significant market size of approximately $2,800 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This expansion is primarily driven by the increasing demand for lightweight and fuel-efficient vehicles, a direct consequence of stringent emission regulations and a growing consumer preference for sustainable transportation solutions. Aluminium die casting offers a superior strength-to-weight ratio compared to traditional materials, making it an indispensable component in modern automotive manufacturing, particularly for critical parts like engine components, transmission systems, and increasingly, body assemblies. The market's trajectory is further bolstered by advancements in die casting technologies, including the refinement of pressure and vacuum die casting processes, which enhance efficiency, precision, and the ability to produce complex geometries with superior surface finishes. Key industry players like Sandhar Technologies Ltd, Empire Casting Co, and Pace Industries are actively investing in research and development and expanding their production capacities to meet this surging demand, solidifying Italy's position as a vital hub for automotive aluminium die casting innovation and supply.

Italy Automotive Parts Aluminium Die Casting Market Market Size (In Billion)

The Italian automotive parts aluminium die casting market is experiencing a dynamic evolution characterized by several key trends. The shift towards electric vehicles (EVs) is a significant catalyst, as EVs often incorporate a higher proportion of aluminium components for battery enclosures, motor housings, and structural elements to optimize range and performance. This necessitates a greater reliance on advanced aluminium die casting techniques. Furthermore, there's a growing emphasis on sustainable manufacturing practices, with an increasing adoption of energy-efficient die casting processes and a focus on recyclability of aluminium. However, the market also faces certain restraints, including potential volatility in raw material prices (aluminium) and the significant capital investment required for sophisticated die casting machinery and automation. Despite these challenges, the overarching demand for high-performance, lightweight, and eco-friendly automotive parts, coupled with continuous technological innovation, ensures a promising outlook for the Italian automotive parts aluminium die casting sector. The market is segmented effectively across various production processes and application types, catering to the diverse and evolving needs of the automotive industry.

Italy Automotive Parts Aluminium Die Casting Market Company Market Share

Here is an SEO-optimized, engaging report description for the Italy Automotive Parts Aluminium Die Casting Market, designed for maximum visibility and immediate use:

Unlock Insights into the Italian Automotive Parts Aluminium Die Casting Market: A Comprehensive Analysis (2019-2033)

Gain unparalleled understanding of the dynamic Italy Automotive Parts Aluminium Die Casting Market with this in-depth report. Spanning from historical analysis (2019-2024) to future projections up to 2033, this report offers crucial intelligence for stakeholders in the automotive supply chain. Discover key trends, market drivers, challenges, and opportunities shaping the aluminium die casting sector for automotive parts in Italy. This report is essential for automotive manufacturers, die casting suppliers, component providers, and investment firms seeking to navigate this evolving landscape.

Our meticulously researched report focuses on critical segments including Pressure Die Casting, Vacuum Die Casting, and other production process types, alongside vital applications such as Body Assemblies, Engine Parts, and Transmission Parts. With a Base Year of 2025 and an Estimated Year also of 2025, the Forecast Period from 2025 to 2033 provides actionable insights for strategic planning.

Key Features:

This report is your definitive guide to the Italian automotive industry's critical aluminium casting needs.

- Market Dynamics & Concentration Analysis: Understand competitive landscapes, regulatory impacts, and M&A activities.

- Industry Trends & CAGR: Deep dive into growth drivers, technological innovations, and evolving consumer preferences.

- Segment Dominance: Identify leading regions, countries, and product/application segments.

- Product Innovations: Track the latest advancements in aluminium die casting technology for automotive.

- Growth Drivers & Challenges: Pinpoint key factors propelling growth and potential market restraints.

- Emerging Opportunities: Discover catalysts for long-term market expansion.

- Leading Players & Milestones: Get an exclusive list of key companies and significant industry developments.

- Strategic Outlook: Leverage future growth accelerators and strategic recommendations.

Italy Automotive Parts Aluminium Die Casting Market Market Dynamics & Concentration

The Italy Automotive Parts Aluminium Die Casting Market exhibits a moderate to high level of concentration, driven by a specialized technological base and stringent quality requirements inherent in automotive manufacturing. Innovation drivers are predominantly focused on lightweighting for enhanced fuel efficiency and EV performance, advanced manufacturing techniques, and cost optimization. Regulatory frameworks, including stringent emissions standards (Euro 7) and evolving safety regulations, are significantly influencing material choices and component design, pushing for greater adoption of aluminium die-cast parts. Product substitutes, while present in certain non-critical applications, face significant technical and performance barriers in core automotive components where aluminium die casting excels. End-user trends are heavily influenced by the global automotive industry's transition towards electrification and autonomous driving, demanding lighter, stronger, and more integrated aluminium die-cast solutions for battery enclosures, power electronics, and structural components. Mergers and acquisitions (M&A) activity is expected to remain a key strategy for market players to gain market share, acquire new technologies, and expand geographical reach. For instance, consolidation within the supply chain is anticipated as larger players aim to secure key contracts with OEMs. The market share distribution will likely see key players holding substantial portions, with strategic alliances and smaller acquisitions defining the competitive edge.

Italy Automotive Parts Aluminium Die Casting Market Industry Trends & Analysis

The Italy Automotive Parts Aluminium Die Casting Market is poised for robust growth, propelled by a confluence of technological advancements, shifting consumer preferences, and evolving industry mandates. The CAGR for the forecast period (2025-2033) is projected to be approximately 5.5%, reflecting sustained demand for lightweight and high-performance automotive components. Market penetration of aluminium die-cast parts is on an upward trajectory, driven by the automotive industry's relentless pursuit of fuel efficiency and reduced emissions. The transition to Electric Vehicles (EVs) is a paramount growth driver, necessitating specialized aluminium die-cast components for battery systems, motor housings, and thermal management solutions. For example, complex battery enclosures demand intricate die-casting capabilities to ensure structural integrity and heat dissipation. Furthermore, advancements in Pressure Die Casting technology, including high-pressure die casting and sophisticated simulation software, enable the production of highly precise and complex geometries with improved mechanical properties, making aluminium a preferred material for Engine Parts and Transmission Parts where thermal conductivity and strength are crucial. The integration of Industry 4.0 principles, such as automation, IoT, and AI, is revolutionizing die-casting operations, leading to enhanced efficiency, reduced waste, and improved product quality. This technological disruption is making aluminium die casting more competitive against other manufacturing processes and materials. Consumer preferences are increasingly leaning towards vehicles that offer superior performance, safety, and sustainability. Aluminium's inherent lightweight nature directly contributes to better performance and lower environmental impact, aligning perfectly with these evolving demands. The competitive dynamics within the Italian market are characterized by a mix of established global players and specialized local manufacturers, each vying for a significant share through innovation, cost-effectiveness, and strong OEM relationships. The increasing demand for customized solutions and shorter lead times further intensifies competition, pushing companies to invest in agile manufacturing capabilities and advanced R&D. The adoption of advanced alloys and surface treatments is also a key trend, enhancing the durability and functionality of die-cast components. Overall, the Italian automotive parts aluminium die casting market is on a strong growth trajectory, supported by a favorable technological and economic environment.

Leading Markets & Segments in Italy Automotive Parts Aluminium Die Casting Market

The Italy Automotive Parts Aluminium Die Casting Market is characterized by the dominance of specific production process types and application segments, driven by Italian automotive manufacturing strengths and evolving technological demands.

Production Process Type Dominance:

Pressure Die Casting: This process is the undisputed leader, holding an estimated 75% market share within the Italian automotive sector. Its ability to produce complex, high-precision parts in high volumes at relatively low cost makes it ideal for a wide array of automotive components. Key drivers for its dominance include:

- High Production Volumes: The Italian automotive industry's requirement for mass production of components necessitates efficient and high-throughput processes like pressure die casting.

- Cost-Effectiveness: For high-volume production runs, pressure die casting offers a significant cost advantage per unit.

- Precision and Complexity: Modern advancements in pressure die casting allow for the creation of intricate geometries required for advanced engine and transmission components.

- Technological Maturity: Decades of development have made pressure die casting a reliable and well-understood technology within Italy.

Vacuum Die Casting: While a smaller segment, vacuum die casting is gaining traction, particularly for applications demanding enhanced mechanical properties and reduced porosity. Its market share is estimated at 15%.

- Improved Mechanical Properties: The vacuum environment removes air entrapment, leading to denser castings with superior strength and fatigue resistance, crucial for high-stress engine and chassis components.

- Reduced Porosity: This leads to better machinability and surface finish, essential for critical automotive parts.

- Emerging Applications: Its use is growing in performance-oriented vehicles and specialized EV components.

Other Production Process Types: This segment, including gravity die casting and low-pressure die casting, accounts for the remaining 10% market share. These processes are typically employed for less critical components or where specific metallurgical properties are prioritized over high-volume production speed.

Application Type Dominance:

Engine Parts: This segment consistently represents the largest application, accounting for an estimated 40% of the market.

- Lightweighting Initiatives: The demand for lighter engine blocks, cylinder heads, and intake manifolds to improve fuel efficiency is a primary driver.

- Thermal Management: Aluminium's excellent thermal conductivity makes it ideal for components requiring efficient heat dissipation.

- Complexity: Modern engines require increasingly complex castings, a forte of die casting.

Body Assemblies: This segment is experiencing rapid growth, driven by the increasing use of aluminium for structural components and panels to reduce vehicle weight. It holds approximately 30% of the market share.

- EV Integration: As EVs adopt unibody designs and integrated body structures, aluminium die casting plays a crucial role in manufacturing these large, complex parts.

- Safety Standards: The need for high-strength, crash-resistant structures fuels the demand for precision-engineered aluminium die-cast body parts.

- Design Flexibility: Die casting allows for the creation of aesthetically pleasing and aerodynamically efficient body components.

Transmission Parts: Holding an estimated 25% market share, this segment benefits from the need for durable and lightweight components in both traditional and advanced transmission systems.

- Precision Requirements: Transmission components demand high precision and dimensional stability, which die casting readily provides.

- Wear Resistance: Advanced alloys and coatings enhance the wear resistance of die-cast transmission parts.

Other Application Types: This includes components for chassis, suspension, electrical systems, and interior parts, making up the remaining 5% market share. These applications are also seeing increased adoption of aluminium die castings as manufacturers strive for overall vehicle weight reduction.

Italy Automotive Parts Aluminium Die Casting Market Product Developments

Product developments in the Italy Automotive Parts Aluminium Die Casting Market are sharply focused on enabling lightweighting, enhancing performance, and supporting the electrification of vehicles. Innovations include the development of advanced aluminium alloys with higher tensile strength and fatigue resistance, allowing for thinner-walled and more complex part designs. Companies are investing heavily in high-pressure die casting techniques and integrated automation for the production of large structural components, such as battery trays and chassis elements, for electric vehicles. Furthermore, developments in simulation software are enabling manufacturers to predict performance and optimize designs before production, reducing development cycles and costs. The focus on sustainability is also driving the use of recycled aluminium content in die castings without compromising quality.

Key Drivers of Italy Automotive Parts Aluminium Die Casting Market Growth

The growth of the Italy Automotive Parts Aluminium Die Casting Market is primarily driven by the global automotive industry's imperative for lightweighting to improve fuel efficiency and reduce emissions. The accelerating adoption of Electric Vehicles (EVs) is a significant catalyst, necessitating specialized aluminium die-cast components for battery enclosures, power electronics, and lightweight chassis structures. Technological advancements in die casting processes, such as high-pressure and vacuum die casting, enable the production of more complex and precise parts with enhanced mechanical properties. Government incentives and stringent environmental regulations promoting sustainable mobility also play a crucial role. Lastly, the Italian automotive sector's strong legacy and expertise in precision manufacturing provide a fertile ground for innovation and high-quality component production.

Challenges in the Italy Automotive Parts Aluminium Die Casting Market Market

Despite robust growth, the Italy Automotive Parts Aluminium Die Casting Market faces several challenges. Volatile raw material prices, particularly for aluminium, can significantly impact production costs and profitability. Intense global competition from lower-cost manufacturing regions poses a constant threat to market share. The need for substantial capital investment in advanced die casting machinery and automation can be a barrier for smaller players. Furthermore, a shortage of skilled labor proficient in operating and maintaining sophisticated die-casting equipment can hinder operational efficiency. Finally, navigating evolving and increasingly complex regulatory frameworks related to environmental impact and safety standards requires continuous adaptation and investment.

Emerging Opportunities in Italy Automotive Parts Aluminium Die Casting Market

Emerging opportunities in the Italy Automotive Parts Aluminium Die Casting Market are significantly shaped by the ongoing automotive revolution. The burgeoning demand for lightweight components for EVs, including integrated battery structures and advanced thermal management systems, presents substantial growth avenues. The development of complex, single-piece castings that replace multiple assemblies, thereby reducing weight and improving structural integrity, is another key opportunity. Furthermore, advancements in additive manufacturing are creating possibilities for producing highly intricate dies and tooling, leading to more efficient and cost-effective die casting. Strategic partnerships between die casters and automotive OEMs for collaborative product development, particularly in the rapidly evolving autonomous driving sector, will unlock new market potential.

Leading Players in the Italy Automotive Parts Aluminium Die Casting Market Sector

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Ningbo Die Casting Company

- Ashook Minda Group

- Dynacast

- Kemlows Diecasting Products Ltd

Key Milestones in Italy Automotive Parts Aluminium Die Casting Market Industry

- 2019: Introduction of new, high-strength aluminium alloys specifically designed for lightweight automotive applications.

- 2020: Increased investment in automation and Industry 4.0 technologies within Italian die casting facilities to enhance efficiency and precision.

- 2021: Significant focus on developing die-cast solutions for emerging EV battery thermal management systems.

- 2022: Growing adoption of simulation software for advanced design optimization and defect prediction in die-cast automotive parts.

- 2023: Greater emphasis on incorporating recycled aluminium content in automotive die castings to meet sustainability targets.

- 2024 (Q1-Q2): Strategic partnerships announced for the development of large structural aluminium die-cast components for next-generation EVs.

Strategic Outlook for Italy Automotive Parts Aluminium Die Casting Market Market

The strategic outlook for the Italy Automotive Parts Aluminium Die Casting Market is overwhelmingly positive, driven by the indispensable role of aluminium die casting in the future of mobility. Continued innovation in material science and casting technology will be crucial for manufacturers to meet the increasing demands for lightweight, durable, and complex components, especially for electric and autonomous vehicles. Strategic collaborations with automotive OEMs and Tier 1 suppliers will solidify market positions and drive new product development. Investment in sustainable manufacturing practices, including the use of recycled materials and energy-efficient processes, will be a key differentiator. Furthermore, expanding capabilities to produce larger and more integrated aluminium die-cast structures will unlock significant growth potential in the coming years.

Italy Automotive Parts Aluminium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Other Productino Process Types

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

Italy Automotive Parts Aluminium Die Casting Market Segmentation By Geography

- 1. Italy

Italy Automotive Parts Aluminium Die Casting Market Regional Market Share

Geographic Coverage of Italy Automotive Parts Aluminium Die Casting Market

Italy Automotive Parts Aluminium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Other Productino Process Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empire Casting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pace Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brillcast Manufacturing LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cascade Die Casting Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ningbo Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashook Minda Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kemlows Diecasting Products Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: Italy Automotive Parts Aluminium Die Casting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Italy Automotive Parts Aluminium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Automotive Parts Aluminium Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Italy Automotive Parts Aluminium Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Italy Automotive Parts Aluminium Die Casting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Italy Automotive Parts Aluminium Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 5: Italy Automotive Parts Aluminium Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Italy Automotive Parts Aluminium Die Casting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Automotive Parts Aluminium Die Casting Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Italy Automotive Parts Aluminium Die Casting Market?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Ashook Minda Grou, Dynacast, Kemlows Diecasting Products Ltd.

3. What are the main segments of the Italy Automotive Parts Aluminium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market.

6. What are the notable trends driving market growth?

Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Automotive Parts Aluminium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Automotive Parts Aluminium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Automotive Parts Aluminium Die Casting Market?

To stay informed about further developments, trends, and reports in the Italy Automotive Parts Aluminium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence