Key Insights

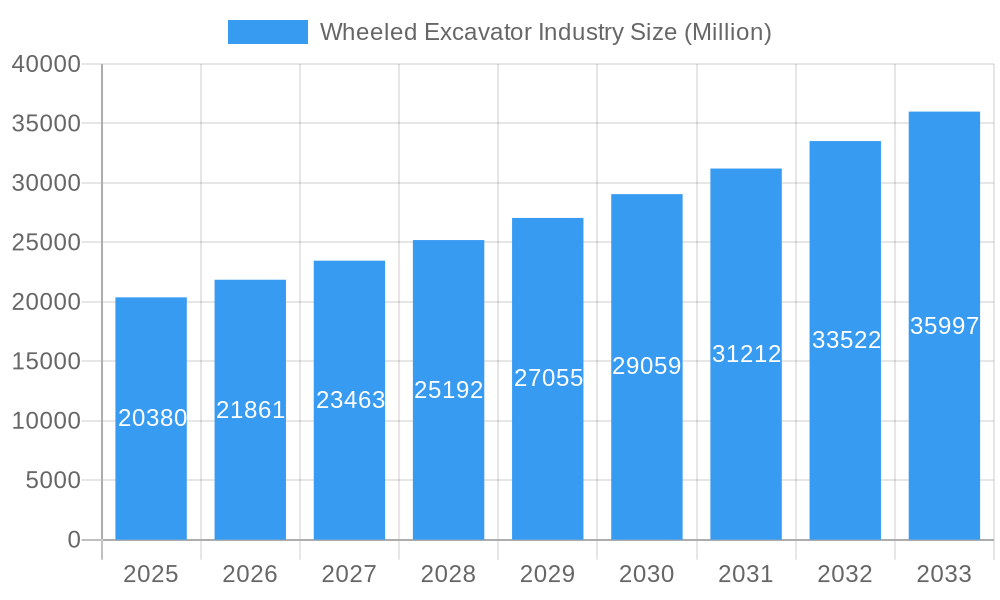

The global wheeled excavator market, valued at $20.38 billion in 2025, is projected to experience robust growth, driven by increasing infrastructure development projects worldwide, particularly in emerging economies. The rising demand for efficient and versatile construction equipment, coupled with the ongoing urbanization and industrialization trends, fuels this market expansion. The shift towards sustainable construction practices is also influencing market dynamics, with a growing adoption of electric and hybrid wheeled excavators. These eco-friendly alternatives reduce carbon emissions and operational costs, making them increasingly attractive to environmentally conscious businesses. Furthermore, technological advancements such as improved hydraulic systems, enhanced operator comfort, and advanced safety features are continuously upgrading the capabilities of wheeled excavators, boosting their appeal to both large and small-scale construction operations. The European market, comprising key regions like Germany, the United Kingdom, Italy, and France, holds a significant share, attributable to the region's well-established construction sector and substantial government investments in infrastructure.

Wheeled Excavator Industry Market Size (In Billion)

The market segmentation reveals a diverse landscape. Hydraulic wheeled excavators currently dominate the drive type segment, although the electric and hybrid segments are expected to witness faster growth in the forecast period (2025-2033) owing to increasing environmental regulations and the drive towards sustainability. Similarly, while excavators hold a larger market share among machinery types, loaders are projected to experience substantial growth driven by their adaptability to diverse construction tasks and increasing demand for smaller, more maneuverable equipment in urban areas. Major players like Kobelco, Deere & Company, Liebherr, Hitachi, and Caterpillar dominate the market, leveraging their established brand reputation, extensive dealer networks, and technological prowess to maintain their competitive edge. However, the increasing involvement of emerging manufacturers is anticipated to intensify competition, ultimately benefiting customers through wider product choices and potentially lower pricing. The projected CAGR of 6.98% suggests continuous market expansion throughout the forecast period (2025-2033), promising lucrative opportunities for industry stakeholders.

Wheeled Excavator Industry Company Market Share

Wheeled Excavator Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global wheeled excavator industry, encompassing market dynamics, trends, leading players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report projects a market value of xx Million by 2033, fueled by robust growth drivers and innovative technological advancements. Discover actionable insights, key market trends, and competitive landscapes to effectively navigate this dynamic industry.

Wheeled Excavator Industry Market Dynamics & Concentration

The global wheeled excavator market is characterized by a moderately concentrated landscape, with several major players holding significant market share. The market size reached xx Million in 2024 and is projected to grow at a CAGR of xx% during the forecast period. This growth is primarily driven by increasing infrastructure development globally, particularly in emerging economies, coupled with the rising adoption of technologically advanced excavators.

- Market Concentration: The top 5 players account for approximately xx% of the global market share in 2024.

- Innovation Drivers: Technological advancements such as electric and hybrid drive systems, improved fuel efficiency, and enhanced safety features are key innovation drivers.

- Regulatory Frameworks: Stringent emission regulations globally are pushing manufacturers towards the development and adoption of cleaner technologies, including electric and hybrid wheeled excavators.

- Product Substitutes: While wheeled excavators offer unique advantages in terms of mobility and versatility, other construction equipment like crawler excavators and loaders pose some degree of substitutability. However, the specific application requirements often dictate the choice of machinery.

- End-User Trends: Construction companies increasingly prioritize fuel efficiency, reduced emissions, and enhanced operator comfort. This drives demand for advanced features in wheeled excavators.

- M&A Activities: The industry has witnessed xx M&A deals in the last five years, indicating a trend towards consolidation and expansion. Many deals involve the acquisition of smaller companies specializing in specific technologies or geographical markets.

Wheeled Excavator Industry Industry Trends & Analysis

The wheeled excavator market is experiencing significant transformation, shaped by several key trends. The market exhibited substantial growth during the historical period (2019-2024), witnessing a CAGR of xx%. This upward trajectory is projected to continue through the forecast period (2025-2033), driven by accelerating infrastructure development and a growing need for efficient construction equipment across diverse sectors. The rising adoption of electric and hybrid models is reshaping the competitive landscape. The increasing preference for eco-friendly technologies, coupled with government regulations promoting sustainable practices, is pushing manufacturers to invest heavily in the development of electric and hybrid excavators. Market penetration of electric wheeled excavators is projected to reach xx% by 2033. Technological disruptions are also pushing the market towards increased automation, advanced operator assistance systems, and improved data analytics capabilities integrated within the machines. This translates into higher efficiency, reduced operational costs, and enhanced safety. These factors are accelerating growth and reshaping the competitive dynamics within the industry.

Leading Markets & Segments in Wheeled Excavator Industry

The European market currently dominates the global wheeled excavator industry, with Germany, the United Kingdom, and France leading the regional landscape. Within the segment breakdown:

- By Machinery Type: Excavators constitute the largest segment, accounting for approximately xx% of the market. Loaders hold a smaller but significant share of around xx%.

- By Drive Type: Hydraulic excavators presently hold the dominant market position. However, the electric and hybrid segments are experiencing rapid growth, driven by environmental concerns and regulatory pressures. Market penetration for electric and hybrid models is expected to increase significantly by 2033.

- By Country:

- Germany: Strong infrastructure spending and a robust construction sector drive demand.

- United Kingdom: Significant investments in infrastructure projects contribute to market growth.

- Italy: A sizable construction industry and ongoing development projects fuel market expansion.

- France: Government initiatives promoting sustainable construction contribute to the adoption of eco-friendly excavators.

- Rest of Europe: Markets across the remaining European countries demonstrate steady growth potential, driven by increasing infrastructure investments.

Key Drivers:

- Robust government infrastructure spending programs.

- Increasing urbanization and construction activities.

- Growing adoption of technologically advanced equipment.

Wheeled Excavator Industry Product Developments

The wheeled excavator industry is experiencing a dynamic period of innovation, with a pronounced shift towards electrification and a relentless pursuit of enhanced operational efficiency. Manufacturers are at the forefront of introducing cutting-edge electric and hybrid models, integrating advanced technologies such as high-capacity lithium-ion battery systems and sophisticated, responsive hydraulic systems. These advancements are not merely technological upgrades; they represent a strategic response to escalating environmental concerns and increasingly stringent regulatory frameworks. Beyond ecological benefits, these developments are engineered to elevate operational performance, promising increased productivity and reduced fuel consumption. The emergence of these next-generation models signifies a broader transition within the construction sector towards more sustainable, environmentally conscious practices. Competitive advantage in this evolving landscape is increasingly defined by the ability to offer a compelling synergy of robust productivity, demonstrably lower emissions, and a superior operator experience, effectively addressing the sophisticated and changing requirements of modern construction enterprises.

Key Drivers of Wheeled Excavator Industry Growth

Several key factors are driving the growth of the wheeled excavator industry. Firstly, substantial government investment in infrastructure development globally fuels demand for construction equipment, including wheeled excavators. Secondly, the ongoing trend toward urbanization and increased construction activities in emerging economies significantly boosts market growth. Thirdly, technological advancements, particularly the development of electric and hybrid models, improve efficiency and reduce environmental impact, furthering industry expansion. Finally, favorable regulatory frameworks in several regions supporting sustainable construction practices also play a crucial role in driving market growth.

Challenges in the Wheeled Excavator Industry Market

The wheeled excavator industry navigates a complex landscape fraught with significant challenges. The imperative to meet increasingly stringent emission regulations compels substantial and ongoing investments in research and development to pioneer cleaner and more sustainable technologies. Concurrently, the global supply chain remains susceptible to disruptions, which can instigate production delays and drive up manufacturing costs. Intense competition, characterized by the presence of established industry giants and the emergence of agile new entrants, exerts considerable pressure on profit margins and the ability to secure and maintain market share. Furthermore, the inherent volatility in raw material prices, coupled with broader global economic uncertainties, introduces substantial risks that can impede consistent industry growth. The cumulative effect of these multifaceted challenges creates a dynamic and often unpredictable environment that impacts profitability, market stability, and the very pace of technological innovation.

Emerging Opportunities in Wheeled Excavator Industry

The future holds significant opportunities for the wheeled excavator industry. Technological breakthroughs in electric and hybrid powertrains, automation, and digitalization will create new market segments and drive innovation. Strategic partnerships and collaborations among manufacturers and technology providers will foster the development of advanced solutions. Expanding into emerging markets with robust construction activities will unlock significant growth potential. These factors are expected to lead to considerable industry growth in the coming years.

Leading Players in the Wheeled Excavator Industry Sector

- Kobelco Construction Machinery Co Ltd

- Deere & Company

- Liebherr-International Deutschland GmbH

- Hitachi Construction Machinery Co Ltd

- Manitou BF SA

- Caterpillar Inc

- Doosan Infracore Co Ltd

- Volvo Construction Equipment

- Komatsu Ltd

- CNH Industrial NV

- Yanmar Construction Equipment Co Ltd

Key Milestones in Wheeled Excavator Industry Industry

- October 2022: Komatsu unveiled its pioneering battery-electric wheel loader at the prominent Bauma 2022 trade fair, signaling a significant step towards electrification.

- November 2022: New Holland Construction bolstered its excavator lineup by launching fifteen new models, notably including two fully electric excavators, underscoring a commitment to zero-emission solutions.

- June 2023: Volvo Construction Equipment introduced its inaugural mid-size electric excavator, the EC230 Electric, expanding its portfolio of sustainable heavy machinery.

- July 2023: Komatsu Europe announced the upcoming release of its PC33E-6, a new 3-ton electric mini excavator, catering to compact and urban construction needs.

- September 2023: Sunward Europe showcased a new 15-ton wheeled excavator at the MATEXPO exhibition, highlighting its growing presence and product development in the European market.

Strategic Outlook for Wheeled Excavator Industry Market

The trajectory for the wheeled excavator industry is exceptionally promising, characterized by robust growth prospects. This optimism is primarily fueled by sustained global investment in infrastructure development, the accelerating adoption of eco-friendly electric and hybrid models, and significant advancements in automation and digitalization technologies. Strategic alliances and dedicated investments in cutting-edge research and development will be paramount in defining the future landscape of the industry. Manufacturers demonstrating agility in adapting to evolving technological paradigms and consistently meeting the increasing demand for sustainable and highly efficient construction equipment will undoubtedly secure a strong position for enduring success. The market is poised for substantial expansion, driven by the relentless pace of technological innovation and a universal global imperative for more efficient and environmentally responsible construction solutions.

Wheeled Excavator Industry Segmentation

-

1. Machinery Type

- 1.1. Excavator

- 1.2. Loader

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric

- 2.3. Hybrid

Wheeled Excavator Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wheeled Excavator Industry Regional Market Share

Geographic Coverage of Wheeled Excavator Industry

Wheeled Excavator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Excavator Holds the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Excavator

- 5.1.2. Loader

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Excavator

- 6.1.2. Loader

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Hydraulic

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. South America Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Excavator

- 7.1.2. Loader

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Hydraulic

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Europe Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Excavator

- 8.1.2. Loader

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Hydraulic

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Middle East & Africa Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Excavator

- 9.1.2. Loader

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Hydraulic

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Asia Pacific Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Excavator

- 10.1.2. Loader

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. Hydraulic

- 10.2.2. Electric

- 10.2.3. Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kobelco Construction Machinery Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Deere & Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liebherr-International Deutschland GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Construction Machinery Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Manitou BF SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caterpillar Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doosan Infracore Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Volvo Construction Equipment*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Komatsu Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CNH Industrial NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yanmar Construction Equipment Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Global Wheeled Excavator Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 3: North America Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 5: North America Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 9: South America Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 10: South America Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 11: South America Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: South America Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 15: Europe Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Europe Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 17: Europe Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Europe Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 21: Middle East & Africa Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 22: Middle East & Africa Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 23: Middle East & Africa Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Middle East & Africa Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 27: Asia Pacific Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Asia Pacific Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 29: Asia Pacific Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 30: Asia Pacific Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Global Wheeled Excavator Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 11: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 12: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 17: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 18: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 29: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 30: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 38: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 39: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wheeled Excavator Industry?

The projected CAGR is approximately 6.98%.

2. Which companies are prominent players in the Wheeled Excavator Industry?

Key companies in the market include Kobelco Construction Machinery Co Ltd, Deere & Company, Liebherr-International Deutschland GmbH, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Caterpillar Inc, Doosan Infracore Co Ltd, Volvo Construction Equipment*List Not Exhaustive, Komatsu Ltd, CNH Industrial NV, Yanmar Construction Equipment Co Ltd.

3. What are the main segments of the Wheeled Excavator Industry?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Excavator Holds the Highest Share.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

September 2023: Sunward Europe unveiled a new 15-ton wheeled excavator at the upcoming MATEXPO exhibition (September 6-10) near their European headquarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wheeled Excavator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wheeled Excavator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wheeled Excavator Industry?

To stay informed about further developments, trends, and reports in the Wheeled Excavator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence