Key Insights

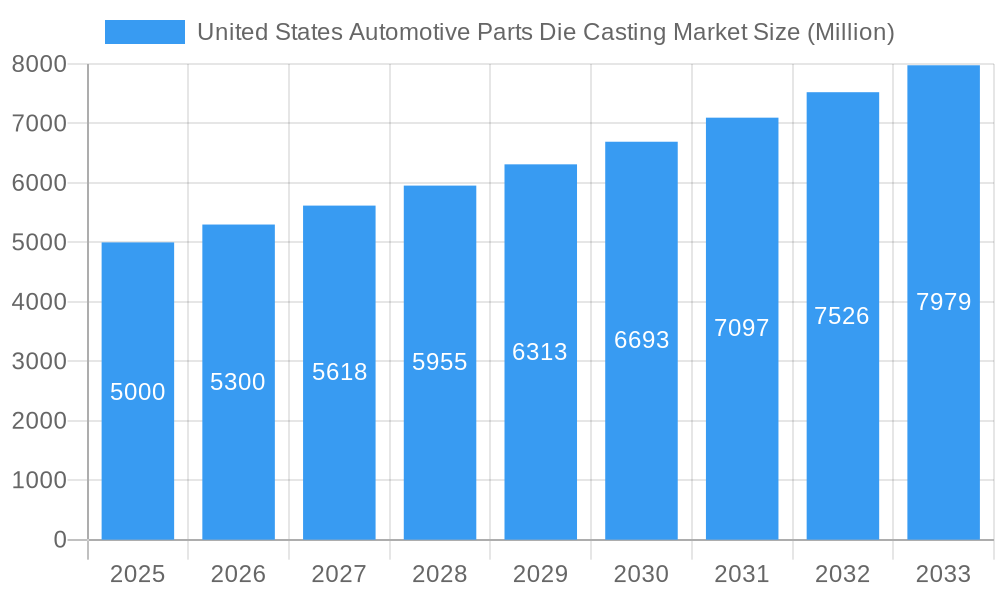

The United States automotive parts die casting market is poised for substantial growth, propelled by the increasing demand for lightweight vehicle components and the accelerating adoption of electric vehicles (EVs). The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.7%, expanding from an estimated market size of 3580.4 million in the base year of 2025. Key growth catalysts include the imperative for enhanced fuel efficiency, improved vehicle performance, and the intricate manufacturing requirements for EV battery casings and motor components. The industry's preference for lightweight yet robust materials such as aluminum, magnesium, and zinc die castings significantly contributes to this expansion. Pressure die casting, favored for its high-volume production capabilities, and the prevalent use of aluminum die castings due to their favorable properties and cost-effectiveness, are notable growth areas. Despite potential challenges such as supply chain disruptions and raw material price volatility, the market outlook remains optimistic, driven by ongoing advancements in die casting technologies and the expanding automotive sector.

United States Automotive Parts Die Casting Market Market Size (In Billion)

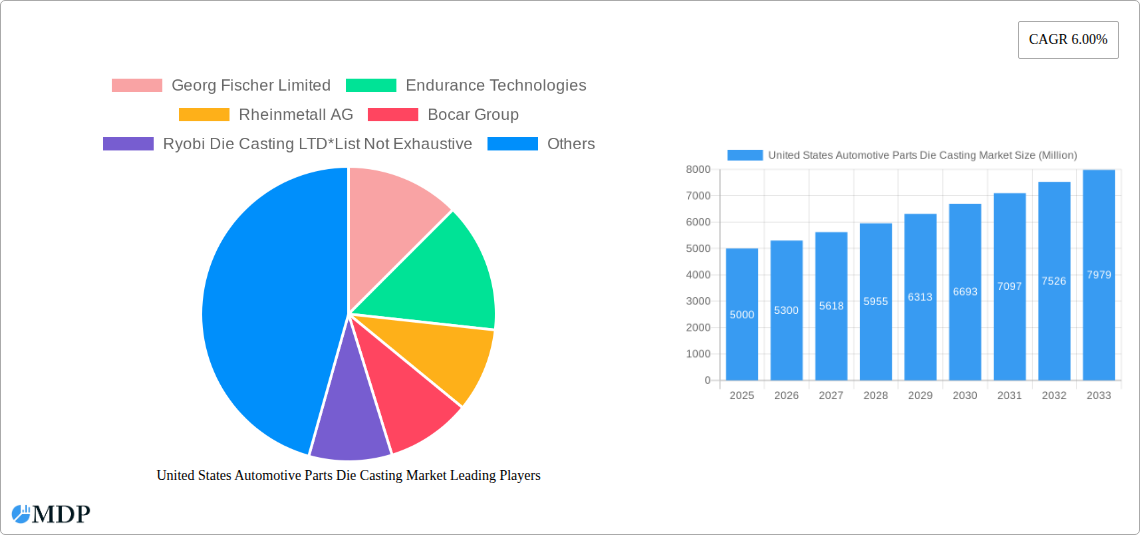

Market segmentation highlights a clear preference for pressure die casting, the dominant process due to its efficiency and scalability, and aluminum, the leading raw material owing to its widespread application in automotive components. Prominent players like Georg Fischer, Endurance Technologies, and Nemak are driving market leadership through technological innovation, strategic collaborations, and geographic expansion. Intense competition necessitates continuous improvements in production efficiency and product quality to align with the evolving needs of the automotive industry. Future market growth hinges on the persistent development of lighter, stronger, and more cost-effective die-casting solutions. Additionally, the increasing integration of Advanced Driver-Assistance Systems (ADAS) and connected car technologies is expected to stimulate demand for sophisticated die-cast components.

United States Automotive Parts Die Casting Market Company Market Share

United States Automotive Parts Die Casting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States automotive parts die casting market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base and estimated year. The report meticulously examines market dynamics, leading players, technological advancements, and emerging opportunities, providing actionable intelligence for navigating this dynamic sector. Expect detailed analysis across key segments including pressure die casting, vacuum die casting, and more, with breakdowns by raw materials such as aluminum, magnesium, and zinc. Key players like Georg Fischer Limited, Endurance Technologies, Rheinmetall AG, and others are profiled, revealing market share, competitive landscapes, and growth strategies.

United States Automotive Parts Die Casting Market Market Dynamics & Concentration

The US automotive parts die casting market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market share of the top five players is estimated at xx% in 2025. Innovation is a key driver, with continuous advancements in die casting processes and materials leading to lighter, stronger, and more cost-effective components. Stringent regulatory frameworks regarding emissions and fuel efficiency are shaping demand for lightweight components, further boosting the market. The market witnesses frequent mergers and acquisitions (M&A) activity, as larger players seek to expand their market presence and consolidate their position. Over the historical period (2019-2024), approximately xx M&A deals were recorded, indicating a dynamic competitive environment. Product substitution from alternative manufacturing methods poses a challenge, although the inherent advantages of die casting, such as high precision and production efficiency, continue to drive its adoption. End-user trends toward electric vehicles (EVs) and hybrid vehicles are creating both opportunities and challenges, demanding adaptations in die casting technologies to accommodate the specific requirements of EV components.

- Market Concentration: Top 5 players hold xx% market share (2025).

- M&A Activity: Approximately xx deals recorded from 2019-2024.

- Key Drivers: Innovation, regulatory compliance, end-user trends.

- Challenges: Product substitution, adaptation to EV technologies.

United States Automotive Parts Die Casting Market Industry Trends & Analysis

The US automotive parts die casting market is projected to witness a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by the increasing demand for lightweight vehicles to enhance fuel efficiency and meet stringent emission norms. Technological advancements, particularly in areas like high-pressure die casting and automation, are enhancing productivity and reducing production costs. Consumer preferences for sophisticated vehicle designs and enhanced safety features are driving the adoption of complex die-cast components. Intense competition among market players is fueling innovation and driving down prices. Market penetration of die-cast components in the automotive sector remains high, with xx% of automotive parts incorporating die casting technology in 2025. Technological disruptions, such as the rise of 3D printing, are presenting challenges, but the cost-effectiveness and scale of die casting continue to secure its dominance.

Leading Markets & Segments in United States Automotive Parts Die Casting Market

The pressure die casting segment dominates the market by process, accounting for approximately xx% of the total market share in 2025. This is due to its high productivity and versatility. Aluminum remains the leading raw material, driven by its lightweight properties and superior casting characteristics. The Midwest region holds a leading position due to its established automotive manufacturing base and well-developed supply chains.

Key Drivers by Segment:

- Pressure Die Casting: High productivity, versatility, cost-effectiveness.

- Aluminum (Raw Material): Lightweight, superior castability, cost-competitiveness.

- Midwest Region: Established automotive manufacturing base, strong supply chain.

Dominance Analysis:

The Midwest’s dominance stems from its concentration of automotive manufacturing facilities, which directly translates into higher demand for die-cast components. This region benefits from well-established infrastructure, skilled labor, and proximity to key automotive suppliers. The pressure die casting segment's prominence reflects its widespread applicability and economic advantages, making it the preferred choice for a wide array of automotive parts. Aluminum's prevalence reflects its optimal balance of performance and cost characteristics for automotive applications.

United States Automotive Parts Die Casting Market Product Developments

Recent product innovations focus on developing lighter, stronger, and more complex die-cast components using advanced materials and processes. High-pressure die casting and thin-wall casting techniques are improving efficiency and reducing material waste. The integration of smart sensors and embedded electronics within die-cast parts is gaining traction, leading to the development of intelligent automotive components. These advancements enable better performance and enhanced functionalities in various automotive applications.

Key Drivers of United States Automotive Parts Die Casting Market Growth

The US automotive parts die casting market growth is fueled by several key factors. Technological advancements leading to improved casting processes and material properties significantly contribute to the overall growth. Stringent fuel economy regulations and emission standards are driving the demand for lighter-weight vehicles, directly impacting the demand for lightweight die-cast components. Furthermore, increasing demand for advanced driver-assistance systems (ADAS) and electric vehicles (EVs) is creating new opportunities for die casting in the production of complex and high-precision parts.

Challenges in the United States Automotive Parts Die Casting Market Market

The market faces challenges such as fluctuating raw material prices, impacting production costs. Supply chain disruptions can lead to production delays and increased expenses. Intense competition among existing players requires continuous innovation to maintain market share. Moreover, stricter environmental regulations necessitate investments in cleaner production technologies and waste management systems, which adds to the cost of production.

Emerging Opportunities in United States Automotive Parts Die Casting Market

The burgeoning EV market presents a significant opportunity, as die casting is crucial for manufacturing key EV components. Advancements in die casting technologies, such as 3D printing of dies and the use of new alloys, are unlocking new possibilities for complex and lightweight designs. Strategic partnerships between die casters and automotive manufacturers are facilitating the development of innovative solutions. Expansion into adjacent markets, such as aerospace and consumer goods, can further drive growth.

Leading Players in the United States Automotive Parts Die Casting Market Sector

- Georg Fischer Limited

- Endurance Technologies

- Rheinmetall AG

- Bocar Group

- Ryobi Die Casting LTD

- Nemak

- Form Technologies Inc.

- Shiloh Industries

- Rockman Industries

Key Milestones in United States Automotive Parts Die Casting Market Industry

- 2020: Introduction of a new high-pressure die casting machine by a leading player, significantly improving production efficiency.

- 2021: Merger between two major die casting companies, creating a larger entity with expanded market reach.

- 2022: Launch of a new lightweight aluminum alloy specifically designed for automotive die casting applications.

- 2023: Implementation of advanced automation systems in several die casting facilities, improving productivity and reducing labor costs.

Strategic Outlook for United States Automotive Parts Die Casting Market Market

The future of the US automotive parts die casting market appears promising, driven by the ongoing shift toward lightweighting and electrification in the automotive industry. Strategic partnerships, technological innovations, and expansion into new market segments will be crucial for success. Companies that can adapt to evolving industry trends and invest in sustainable manufacturing practices are poised to capture significant market share. The focus on improving efficiency, reducing costs, and developing innovative solutions will be essential for long-term growth.

United States Automotive Parts Die Casting Market Segmentation

-

1. Process

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Others

-

2. Raw Material

- 2.1. Aluminium

- 2.2. Magnesium

- 2.3. Zinc

United States Automotive Parts Die Casting Market Segmentation By Geography

- 1. United States

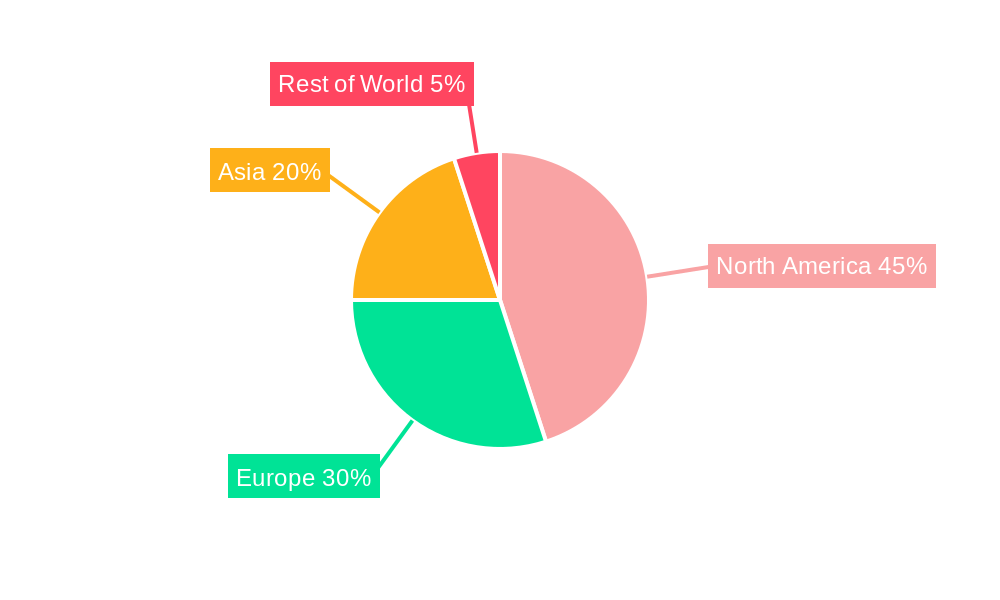

United States Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of United States Automotive Parts Die Casting Market

United States Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. Cost Issues and Resource Inefficiencies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminium

- 5.2.2. Magnesium

- 5.2.3. Zinc

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Georg Fischer Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Endurance Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bocar Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ryobi Die Casting LTD*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Form Technologies In

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiloh Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rockman Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Georg Fischer Limited

List of Figures

- Figure 1: United States Automotive Parts Die Casting Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Automotive Parts Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: United States Automotive Parts Die Casting Market Revenue million Forecast, by Process 2020 & 2033

- Table 2: United States Automotive Parts Die Casting Market Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: United States Automotive Parts Die Casting Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: United States Automotive Parts Die Casting Market Revenue million Forecast, by Process 2020 & 2033

- Table 5: United States Automotive Parts Die Casting Market Revenue million Forecast, by Raw Material 2020 & 2033

- Table 6: United States Automotive Parts Die Casting Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Automotive Parts Die Casting Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the United States Automotive Parts Die Casting Market?

Key companies in the market include Georg Fischer Limited, Endurance Technologies, Rheinmetall AG, Bocar Group, Ryobi Die Casting LTD*List Not Exhaustive, Nemak, Form Technologies In, Shiloh Industries, Rockman Industries.

3. What are the main segments of the United States Automotive Parts Die Casting Market?

The market segments include Process, Raw Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 3580.4 million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

Cost Issues and Resource Inefficiencies.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the United States Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence