Key Insights

The South Korea automotive parts aluminum die casting market is experiencing substantial growth, driven by the nation's dynamic automotive sector and the escalating demand for lightweight, high-strength automotive components. This market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.75%. The market size, valued at 64.87 billion in the base year 2025, is anticipated to see significant expansion. Key growth catalysts include the accelerating adoption of electric vehicles (EVs), which require lighter materials to enhance battery range and operational efficiency. Innovations in die casting technologies, such as high-pressure and semi-solid die casting, are enabling the production of intricate automotive parts with superior precision, thereby improving vehicle performance and safety. The market is segmented by application, with body assembly and engine parts representing prominent segments. Leading industry participants, including Samsree Automotive, BUVO Castings (EU), and GIBBS Die Casting Group, are actively pursuing technological advancements and strategic alliances to expand their market presence. However, market growth may be moderated by fluctuations in aluminum prices and intense competition from both domestic and international manufacturers.

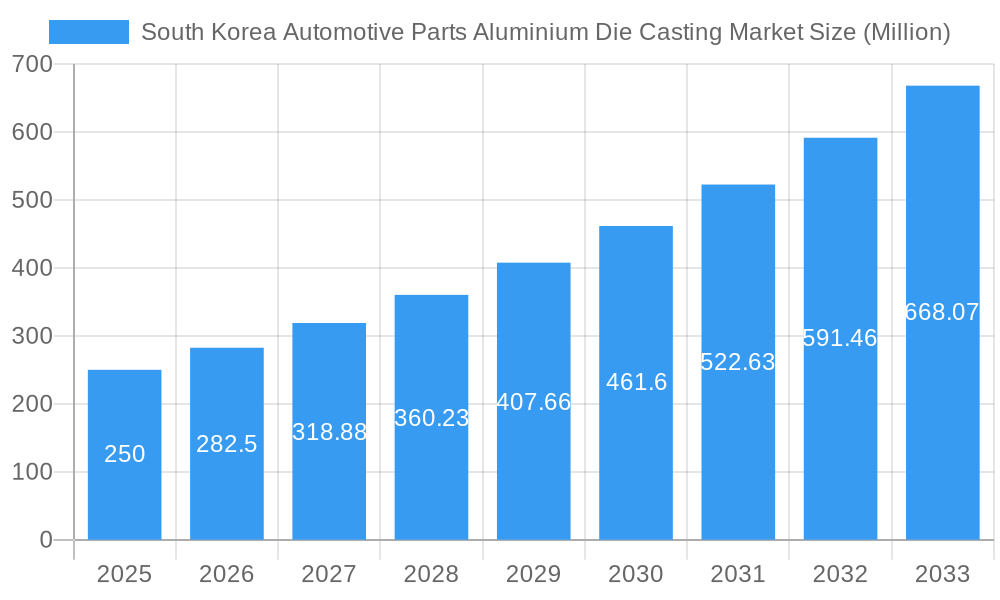

South Korea Automotive Parts Aluminium Die Casting Market Market Size (In Billion)

Looking forward, the South Korea automotive parts aluminum die casting market is poised for continued robust expansion through 2033, fueled by sustained vehicle production and the ongoing EV transition. Increasing stringency in fuel efficiency regulations will further stimulate demand for lightweight automotive components. Growth is expected to be particularly strong in applications utilizing advanced die casting techniques for producing complex, high-precision parts, catering to the evolving demands of modern automotive manufacturing. Competitive pressures are anticipated to intensify as established players scale their operations and new entrants explore opportunities. Strategic imperatives for sustained success in this market will involve a strong focus on technological innovation, cost-efficiency measures, and diversification into emerging application areas.

South Korea Automotive Parts Aluminium Die Casting Market Company Market Share

South Korea Automotive Parts Aluminium Die Casting Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Korea automotive parts aluminium die casting market, offering invaluable insights for stakeholders across the automotive and manufacturing sectors. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is your definitive guide to understanding market dynamics, trends, and future opportunities. High-growth keywords such as "Aluminium Die Casting," "Automotive Parts," "South Korea Market," and "Die Casting Market" are strategically incorporated for enhanced search visibility.

South Korea Automotive Parts Aluminium Die Casting Market Market Dynamics & Concentration

The South Korea automotive parts aluminium die casting market exhibits a moderately concentrated landscape, with key players such as Samsree Automotive, BUVO CASTINGS (EU), and GIBBS DIE CASTING GROUP holding significant market share. The market's dynamics are shaped by several factors:

- Innovation Drivers: Advancements in die casting technologies (e.g., high-pressure die casting, semi-solid die casting) are driving efficiency and improving part quality, leading to increased adoption. The ongoing development of lightweight aluminium alloys further fuels market growth.

- Regulatory Frameworks: Stringent emission regulations and fuel efficiency standards are pushing automakers to adopt lighter weight materials, boosting demand for aluminium die castings. Government incentives for eco-friendly automotive technologies also play a significant role.

- Product Substitutes: Competitive pressure exists from other materials like plastics and steel, particularly for certain applications. However, aluminium's lightweight nature and superior performance characteristics provide a competitive edge in many segments.

- End-User Trends: The growing preference for fuel-efficient and eco-friendly vehicles is a primary driver. The increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) significantly contributes to the market's expansion.

- M&A Activities: The market has witnessed xx M&A deals in the past five years, indicating a trend of consolidation among players seeking economies of scale and enhanced technological capabilities. Market share is estimated to be distributed as follows: Samsree Automotive (xx%), BUVO CASTINGS (EU) (xx%), GIBBS DIE CASTING GROUP (xx%), and others (xx%).

South Korea Automotive Parts Aluminium Die Casting Market Industry Trends & Analysis

The South Korea automotive parts aluminium die casting market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Several factors drive this growth:

The market penetration of aluminium die castings in the automotive industry is currently at approximately xx%. This is driven by the increasing demand for lightweight vehicles, improved fuel efficiency standards, and the adoption of advanced die casting technologies. Technological disruptions, such as the introduction of 3D printing and additive manufacturing, are posing both challenges and opportunities. While these technologies are still in their nascent stages for mass automotive production, they hold the potential to revolutionize the industry in the future. Consumer preferences are shifting towards vehicles with enhanced aesthetics and safety features, fueling the demand for intricate and high-precision die castings. The competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to innovation and price competition. This competitive landscape further strengthens the growth prospects of the market.

Leading Markets & Segments in South Korea Automotive Parts Aluminium Die Casting Market

The pressure die casting segment currently commands the largest market share within the South Korea automotive parts aluminium die casting market. This dominance is attributed to its inherent advantages of cost-effectiveness, high production throughput, and its suitability for manufacturing intricate components in large volumes. The ongoing shift towards electric vehicles (EVs) and the stringent demand for lightweighting across all vehicle types further bolster the importance of this segment.

-

By Production Process Type:

- Pressure Die Casting: Continues to be the workhorse of the industry, offering unparalleled efficiency and cost-effectiveness for mass production of automotive components like engine blocks, transmission housings, and structural parts. Its ability to achieve tight tolerances makes it ideal for critical applications.

- Vacuum Die Casting: This specialized process is experiencing a notable upswing. Driven by the increasing need for defect-free castings, particularly for components subjected to high pressures or requiring exceptional surface integrity (e.g., certain engine components and safety-critical parts), vacuum die casting offers superior mechanical properties and reduced porosity.

- Squeeze Die Casting: This process is recognized for its capability to produce castings with high tensile strength and ductility. It finds crucial applications in manufacturing components that demand superior mechanical performance and dimensional stability, such as certain suspension parts and structural elements where material integrity is paramount.

- Semi-Solid Die Casting: Representing a more advanced and evolving technology, semi-solid die casting is gaining significant traction. Its ability to create complex geometries with fine microstructures, reduced shrinkage porosity, and improved mechanical properties positions it as a key enabler for innovative automotive designs, particularly for intricate and lightweight components in both traditional and electric vehicles.

-

By Application Type:

- Engine Parts: Remains a cornerstone application. The continuous drive for fuel efficiency and performance in internal combustion engines, alongside the evolving requirements for EV powertrains (e.g., battery enclosures, motor housings), ensures sustained demand for aluminium die-cast engine components.

- Transmission Parts: The demand for lighter, more durable, and precisely manufactured transmission components, including housings and gear carriers, significantly drives the growth of this segment. This is particularly relevant as automotive manufacturers seek to optimize driveline efficiency and reduce overall vehicle weight.

- Body Assembly: This segment is witnessing rapid expansion. The increasing adoption of aluminium die castings for structural components, chassis parts, and even large body panels is a direct response to the industry's imperative for vehicle lightweighting, leading to improved fuel economy and enhanced performance.

- Others: This encompassing category includes a diverse range of applications, from interior components like dashboard frames and seat structures to exterior elements such as door handles, mirror housings, and decorative trim. The versatility of aluminium die casting allows for a broad spectrum of uses across the vehicle.

Key drivers fueling the dominance and growth of these segments include:

- Economic Policies & Government Initiatives: Proactive government policies in South Korea, aimed at fostering the automotive industry, promoting the adoption of advanced materials, and incentivizing the production of fuel-efficient and electric vehicles, are providing a strong tailwind for the aluminium die casting market.

- Technological Advancements: Continuous innovation in alloy development, casting technologies, and post-casting treatments are enhancing the performance, durability, and design possibilities of aluminium die-cast parts, making them increasingly attractive for automotive applications.

- Robust Automotive Ecosystem: South Korea's established and highly integrated automotive supply chain, coupled with its advanced manufacturing infrastructure and skilled workforce, provides a fertile ground for the growth and innovation within the automotive parts aluminium die casting sector.

- Sustainability Push: The global emphasis on reducing carbon emissions and improving vehicle sustainability directly benefits aluminium die casting due to its lightweighting capabilities and the high recyclability of aluminium, aligning with the industry's environmental goals.

South Korea Automotive Parts Aluminium Die Casting Market Product Developments

Recent product developments in the South Korea automotive parts aluminium die casting market are sharply focused on enhancing material properties and manufacturing efficiencies. The industry is witnessing the introduction and widespread adoption of high-strength aluminium alloys that offer superior mechanical performance without compromising on weight. Simultaneously, significant advancements are being made in achieving improved surface finishes, reducing the need for secondary operations and enhancing the aesthetic and functional qualities of components. Furthermore, an unwavering focus on enhanced dimensional accuracy through refined tooling and process controls is critical for meeting the increasingly stringent tolerances demanded by modern automotive designs. The integration of sophisticated advanced simulation and modelling techniques (such as Finite Element Analysis - FEA) is revolutionizing casting design, enabling engineers to predict and optimize the casting process, thereby minimizing defects, reducing material wastage, and significantly lowering production costs. These collective advancements are not only elevating the performance and extending the lifespan of automotive components but are also crucial for enabling the creation of more complex, intricate, and lightweight parts essential for next-generation vehicles, especially in the rapidly evolving electric vehicle landscape.

Key Drivers of South Korea Automotive Parts Aluminium Die Casting Market Growth

Several factors contribute to the market's growth:

- Technological advancements in die casting processes and aluminium alloys continuously improve the quality and performance of the castings.

- Stringent government regulations promoting lightweight vehicles drive the demand for aluminium parts.

- Growing demand for electric and hybrid vehicles, which require lightweight components for extended range.

Challenges in the South Korea Automotive Parts Aluminium Die Casting Market Market

Challenges include:

- Fluctuations in raw material prices: Aluminium prices affect production costs.

- Intense competition: Numerous players compete, leading to price pressure.

- Supply chain disruptions: Global events can impact the availability of raw materials and components. This has resulted in xx% increase in production costs in the past year.

Emerging Opportunities in South Korea Automotive Parts Aluminium Die Casting Market

Significant growth potential exists through:

- Strategic partnerships among die casters, automakers, and material suppliers to enhance supply chain efficiency.

- Investment in R&D for advanced die casting technologies and lightweight aluminium alloys.

- Market expansion into new vehicle segments, such as autonomous vehicles and commercial vehicles.

Leading Players in the South Korea Automotive Parts Aluminium Die Casting Market Sector

- Samsree Automotive

- BUVO CASTINGS (EU)

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Pace Industries

- General Motors Company

- Amtek Group

- Kemlows Die Casting Products Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

- Hyundai Motor Company (and its affiliates like Hyundai Mobis)

- Kia Corporation (and its affiliates)

- Doosan Corporation Electro-Materials

- Hankook & Company Co., Ltd. (formerly Hankook Tire & Technology) - for its diversification into automotive components.

- Daesung Industrial Co., Ltd.

Key Milestones in South Korea Automotive Parts Aluminium Die Casting Market Industry

- 2020: Introduction of a new generation of high-strength, lightweight aluminium alloys by leading die casting manufacturers, specifically engineered for enhanced crashworthiness and fuel efficiency in automotive applications.

- 2021: Strategic mergers and acquisitions occur between major players, leading to increased market consolidation and the creation of larger, more vertically integrated entities capable of offering comprehensive solutions.

- 2022: Launch of advanced, highly automated pressure die casting facilities by global automotive suppliers and Tier-1 manufacturers, incorporating Industry 4.0 technologies for greater precision and efficiency in producing complex EV components.

- 2023: The South Korean government introduces enhanced policy frameworks and financial incentives specifically targeting the promotion of lightweight vehicle production and the domestic manufacturing of critical automotive components, including those made via aluminium die casting.

- Ongoing: Significant investments are being made in R&D for innovative aluminium alloys tailored for electric vehicle components, such as battery housings and electric motor parts, alongside the development of more sustainable and energy-efficient die casting processes.

Strategic Outlook for South Korea Automotive Parts Aluminium Die Casting Market Market

The South Korea automotive parts aluminium die casting market is on a trajectory for substantial and sustained growth. This optimistic outlook is primarily fueled by the confluence of accelerating technological advancements in casting processes and materials, the insatiable global and domestic demand for lightweight vehicles (especially electric vehicles), and a supportive ecosystem of government policies and industry initiatives. To effectively navigate and capitalize on this burgeoning market, strategic partnerships, collaborative R&D efforts, and targeted investments will be paramount for all stakeholders. Companies that prioritize innovation in alloy development, process optimization, and the adoption of smart manufacturing technologies will be best positioned to secure significant market share and capitalize on the considerable opportunities that lie ahead. The market is expected to witness significant expansion and increased sophistication in the coming years, presenting compelling prospects for both established industry leaders and agile new entrants aiming to carve out their niche in this dynamic sector.

South Korea Automotive Parts Aluminium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Body Assembly

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Others

South Korea Automotive Parts Aluminium Die Casting Market Segmentation By Geography

- 1. South Korea

South Korea Automotive Parts Aluminium Die Casting Market Regional Market Share

Geographic Coverage of South Korea Automotive Parts Aluminium Die Casting Market

South Korea Automotive Parts Aluminium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. Pressure Die Casting Captures the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Automotive Parts Aluminium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assembly

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsree Automotive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BUVO CASTINGS (EU)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GIBBS DIE CASTING GROUP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CASTWEL AUTOPARTS PVT LTD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pace Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Motors Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amtek Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kemlows Die Casting Products Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Samsree Automotive

List of Figures

- Figure 1: South Korea Automotive Parts Aluminium Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Automotive Parts Aluminium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: South Korea Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: South Korea Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Korea Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: South Korea Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: South Korea Automotive Parts Aluminium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Automotive Parts Aluminium Die Casting Market?

The projected CAGR is approximately 11.75%.

2. Which companies are prominent players in the South Korea Automotive Parts Aluminium Die Casting Market?

Key companies in the market include Samsree Automotive, BUVO CASTINGS (EU), GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Pace Industries, General Motors Company, Amtek Group, Kemlows Die Casting Products Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the South Korea Automotive Parts Aluminium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

Pressure Die Casting Captures the Market.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Automotive Parts Aluminium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Automotive Parts Aluminium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Automotive Parts Aluminium Die Casting Market?

To stay informed about further developments, trends, and reports in the South Korea Automotive Parts Aluminium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence